Introduction

Forensic accounting stands at the intersection of accounting, auditing, and investigative skills, providing a critical service in uncovering financial crimes and anomalies. This discipline is essential for identifying fraud, embezzlement, and other financial misconduct, ensuring transparency and accountability in complex financial transactions. Recent high-profile cases, such as the misreporting of personal expenses as business costs totaling over $7 million, highlight the indispensable role of forensic accountants in the legal arena.

The field is continually evolving, driven by advancements in forensic science and the increasing complexity of financial crimes. The National Institute of Standards and Technology (NIST) emphasizes the need for statistically robust measures to validate forensic techniques, enhancing the accuracy and reliability of investigations. Additionally, the rise of technology and data analytics is transforming fraud detection methods, enabling more sophisticated and timely identification of fraudulent activities.

Forensic accountants, exemplified by experts like Dr. David P. Weber, play a pivotal role in both preventing and investigating financial misconduct. Their expertise not only supports legal proceedings but also fortifies public trust in financial systems. As financial crimes become more intricate, the importance of forensic accounting in maintaining the integrity of financial information and supporting the justice system cannot be overstated.

What is Forensic Accounting?

Forensic accounting is a complex field that combines accounting, auditing, and investigative skills to examine monetary data for legal purposes. This field is indispensable when addressing monetary anomalies, such as fraud, embezzlement, or other economic crimes. Forensic accountants delve into complex financial transactions and records, offering transparency and evidence pivotal in legal disputes or claims.

A stark example of investigative accounting's necessity is a recent case where defendants allegedly defrauded a corporation of over $7 million by misreporting personal expenses as business costs, including luxury cruises and private car services. This case highlights the essential role of investigative accountants in revealing fraud and ensuring offenders are held responsible.

In light of these developments, there's a growing emphasis on enhancing the accuracy and reliability of investigative methods. The National Institute of Standards and Technology (NIST) has highlighted the need for to validate forensic techniques. This advancement is vital for ensuring the integrity of evidence analysis and maintaining public trust in the justice system.

Moreover, reports suggest that more than half of workplace misconduct cases arise from insufficient internal controls. Effective anti-fraud measures are essential to mitigate risks and detect fraudulent activities promptly. The latest information shows that technology and data analysis are becoming more essential in detecting deceit, indicating a move towards more advanced identification techniques.

Dr. David P. Weber, a renowned financial investigator and Certified Fraud Examiner, exemplifies the dedication required in this field. 'His contributions to fraud prevention and investigation have been acknowledged with the Certified Fraud Examiner of the Year Award, emphasizing the significance of expertise and dedication in addressing monetary misconduct.'.

Investigative accounting keeps progressing, propelled by developments in crime science and the growing intricacy of monetary offenses. By adopting rigorous standards and leveraging cutting-edge technology, forensic accountants can enhance their ability to provide critical insights and support legal proceedings effectively.

Key Roles and Responsibilities of Forensic Accountants

Forensic accountants are pivotal in uncovering monetary discrepancies and providing crucial support throughout legal proceedings. Their role extends beyond traditional accounting, blending investigative skills with profound monetary expertise to meticulously gather and analyze data, trace illicit funds, and identify irregularities. By working closely with law enforcement and legal teams, these professionals fortify criminal investigations and litigation efforts. For example, Bhatti's work with the Accounting Management Group at Public Services and Procurement Canada illustrates the substantial influence specialized accountants can exert. She played an important role in the conviction of an Alberta man involved in a large-scale monetary scheme, earning recognition as a 'cautious, reliable, and professional witness' from the judge. This blend of investigative skill and fiscal expertise guarantees that specialized accountants are essential in upholding the integrity of financial data and assisting the justice system. The , comprising members from diverse financial reporting sectors, underscores the significance of collective best practices and research to effectively tackle deception, further stressing the essential role of forensic accountants in maintaining public trust and confidence in financial markets.

Types of Cases Handled by Forensic Accountants

Forensic accountants address a broad spectrum of cases, from deception inquiries and anti-money laundering compliance to bankruptcy proceedings and litigation support. The complexity of these cases has increased, with the emphasizing that over half of occupational misconducts are due to inadequate internal controls. Recent information indicates that the average fraud case stays unnoticed for 12 months, with 53% of cases during the pandemic featuring at least one pandemic-related factor. This highlights the importance of customized investigative methods that utilize cutting-edge technology and analysis to reveal economic wrongdoing. In divorce situations involving disputed asset valuations or corporate inquiries into monetary discrepancies, investigative accountants play a vital role in uncovering the truth behind economic data and ensuring adherence to legal and regulatory standards.

The Process of Conducting a Forensic Accounting Investigation

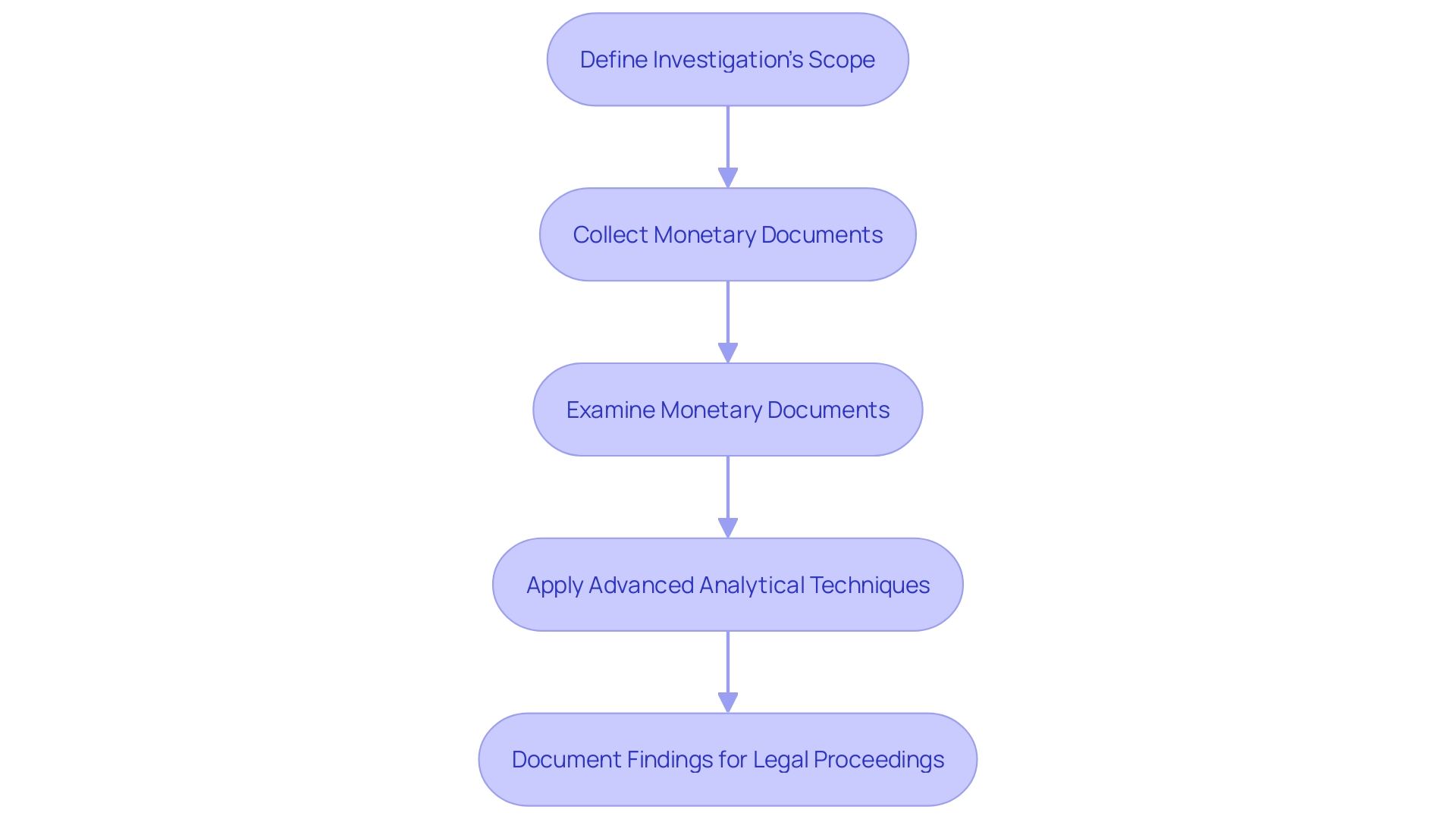

Conducting a forensic accounting investigation requires a meticulous and structured approach. It starts with clearly defining the investigation's scope, ensuring all pertinent aspects are covered. Forensic accountants collect pertinent monetary documents, examining them thoroughly to identify any irregularities or fraudulent activities. 'Advanced analytical techniques, including AI and information analysis, are employed to enhance the accuracy and efficiency of these investigations, as seen in the recent advancements highlighted in the report on monetary statement fraud detection.'. The findings from these analyses are meticulously documented in detailed reports, which are crucial for legal proceedings. This process not only strengthens the validity and reliability of forensic evidence but also ensures that justice is served, as evidenced by like the Wirecard scandal and the investigation of Jian Wen's property acquisition using unverified bitcoin.

Tools and Techniques Used in Forensic Accounting

Forensic accountants utilize advanced technology and sophisticated techniques to scrutinize financial information meticulously. Instruments such as analysis software, visual analytics, and specialized databases are crucial in identifying discrepancies. By employing ratio analysis, trend analysis, and forensic data mining, these professionals can detect patterns indicating fraudulent behavior. 'The 2024 Anti-Cheat Technology Benchmarking Report highlights the growing adoption of AI and generative AI, which significantly enhance the accuracy and efficiency of .'. Real-world examples, like the Wirecard scandal, highlight the significance of these tools in revealing intricate monetary deception. As fraud detection research has increased by roughly 20% annually from 2011 to 2020, it is evident that technology plays a vital role in contemporary investigative accounting.

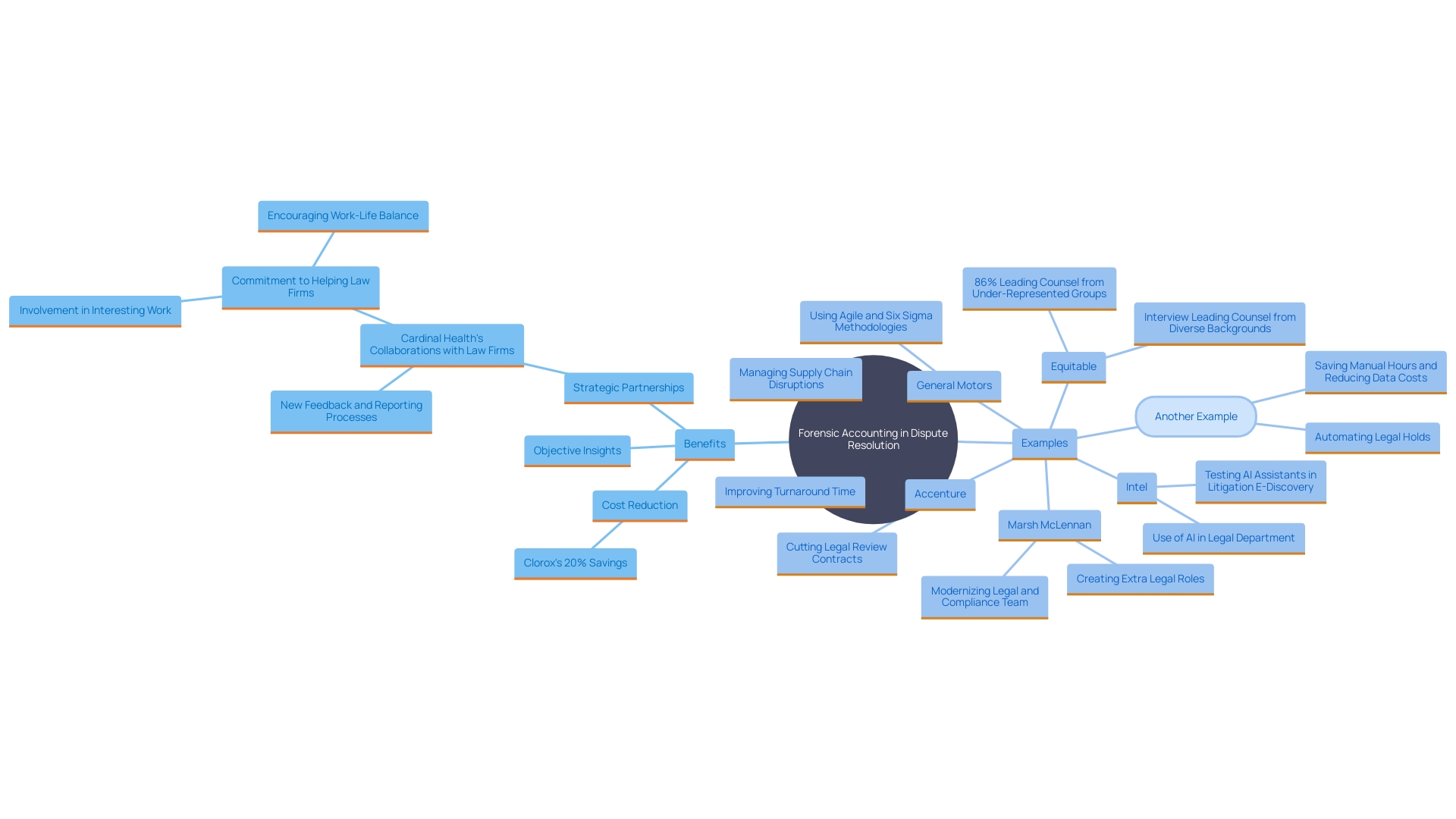

The Value of Forensic Accounting in Dispute Resolution

Forensic accounting plays a crucial role in dispute resolution by providing objective insights into complex monetary matters. This expertise not only aids courts in understanding the intricate details of cases but also promotes outside of court, conserving time and resources for all parties involved. For instance, Clorox's legal team implemented real-time dashboards to manage legal spend, achieving a 20% cost reduction while handling more complex cases. Similarly, Cardinal Health's strategic partnerships with law firms demonstrate how data-driven approaches can streamline legal processes. Such advances illustrate how investigative accounting can lead to significant savings and enhanced efficiency in legal disputes.

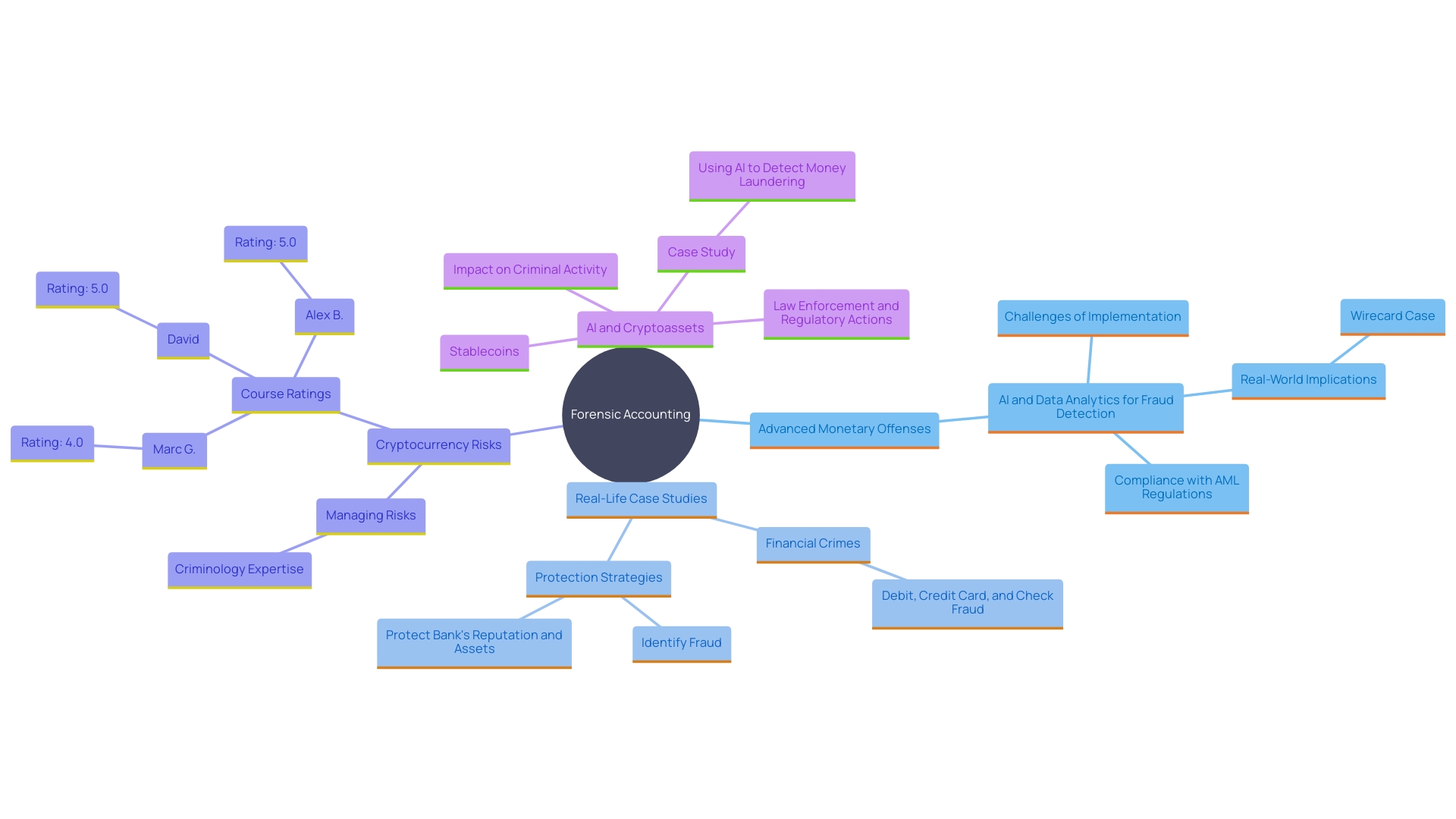

Emerging Trends in Forensic Accounting

As monetary offenses grow more advanced, forensic accounting is swiftly adapting to tackle these challenges. A notable trend is the increased application of (AI) to detect anomalies in financial information, significantly improving accuracy and efficiency in identifying illicit activities. For example, the 2024 Anti-Fraud Technology Benchmarking Report, created in collaboration with SAS, emphasizes the increasing use of AI and generative AI, case management tools, and biometrics to tackle deception. This report aids organizations in assessing the effectiveness of their anti-fraud technology toolkits and planning future technology-related budgets and resources.

AI's role in fraud detection is underscored by the need for enhanced security measures. AI tools can quickly identify patterns and anomalies in large datasets, notifying the appropriate personnel and aiding in both detection and prevention. However, integrating AI into forensic accounting isn't without its challenges. Concerns around accuracy and reliability, data privacy, and the cost of implementation are significant hurdles.

Real-world examples, like the downfall of Wirecard in 2020, demonstrate the serious effect of accounting deception. Wirecard's insolvency, triggered by the revelation of missing EUR 1.9 billion, underscores the necessity of advanced fraud detection technologies. The complexity and volume of monetary data in modern businesses make traditional analysis methods inadequate, further emphasizing the need for sophisticated tools like AI.

Additionally, there is a growing emphasis on compliance with anti-money laundering (AML) regulations. Forensic accountants play a crucial role in risk management strategies, ensuring organizations adhere to these regulations. The ever-evolving landscape of financial crimes necessitates continuous advancements in forensic accounting practices to safeguard against emerging threats.

Conclusion

Forensic accounting plays a vital role in the modern financial landscape, addressing the complexities of fraud and financial misconduct with precision and expertise. By merging accounting, auditing, and investigative skills, forensic accountants provide essential insights into financial anomalies, supporting legal proceedings and ensuring accountability. The increasing sophistication of financial crimes necessitates the adoption of advanced technologies and data analytics, which enhance the accuracy and efficiency of fraud detection efforts.

The responsibilities of forensic accountants extend beyond traditional auditing roles, as they collaborate closely with law enforcement and legal teams to investigate and resolve financial discrepancies. Their contributions are instrumental in various contexts, including fraud investigations, bankruptcy proceedings, and asset valuations in divorce cases. The evolving nature of financial crimes, highlighted by recent data indicating that many fraud cases remain undetected for extended periods, underscores the importance of deploying tailored investigative techniques and robust internal controls.

Emerging trends in forensic accounting, particularly the integration of artificial intelligence and data analytics, are set to redefine the field. These technologies not only improve fraud detection capabilities but also streamline dispute resolution processes, ultimately enhancing efficiency and reducing legal costs. As organizations continue to face sophisticated threats, the proactive engagement of forensic accountants in risk management and compliance will be crucial in preserving the integrity of financial systems.

In conclusion, the indispensable role of forensic accounting in uncovering financial misconduct and supporting the justice system cannot be overstated. The ongoing evolution of this field, driven by technological advancements and a commitment to rigorous investigation standards, is essential for safeguarding public trust in financial markets and ensuring accountability in complex financial transactions.

Frequently Asked Questions

What is forensic accounting?

Forensic accounting is a specialized field that combines accounting, auditing, and investigative skills to analyze monetary data for legal purposes. It is crucial in identifying financial irregularities such as fraud and embezzlement.

Why is forensic accounting important?

Forensic accounting provides transparency and evidence vital in legal disputes. It helps uncover monetary anomalies, ensuring that offenders are held accountable for their actions.

Can you provide an example of forensic accounting in action?

A notable example involved defendants who allegedly defrauded a corporation of over $7 million by misreporting personal expenses as business costs, which included luxury items. This case demonstrates the essential role forensic accountants play in revealing fraud.

What advancements are being made in forensic accounting methods?

There is a growing focus on enhancing the accuracy and reliability of investigative methods. The National Institute of Standards and Technology (NIST) has emphasized the need for statistically robust measures to validate forensic techniques.

How do forensic accountants detect fraud?

Forensic accountants utilize advanced technology and analytical techniques, including AI and data analysis, to identify discrepancies and patterns that suggest fraudulent behavior.

What types of cases do forensic accountants handle?

Forensic accountants deal with a wide range of cases, including fraud investigations, anti-money laundering compliance, bankruptcy proceedings, and litigation support.

What is the significance of internal controls in preventing fraud?

Reports indicate that over half of workplace misconduct cases arise from insufficient internal controls, highlighting the importance of effective anti-fraud measures to mitigate risks and detect fraudulent activities promptly.

How do forensic accountants collaborate with law enforcement?

Forensic accountants work closely with law enforcement and legal teams to strengthen criminal investigations and legal proceedings, providing critical insights and expertise in financial matters.

What is the role of technology in forensic accounting?

Technology, including analysis software and AI, plays a vital role in modern forensic accounting by enhancing the efficiency and accuracy of fraud detection efforts.

How does forensic accounting contribute to dispute resolution?

Forensic accountants provide objective insights that aid courts in understanding complex monetary issues and can promote efficient settlements outside of court, saving time and resources.

What challenges does forensic accounting face with the integration of AI?

Challenges include concerns about accuracy and reliability, data privacy, and the costs of implementing AI technology in the forensic accounting process.

How is forensic accounting evolving in response to financial crimes?

Forensic accounting is adapting to increasing complexities in financial crimes by employing advanced data analytics and AI tools, which improve the ability to detect and prevent fraud effectively.

Why is compliance with anti-money laundering regulations important for forensic accountants?

Forensic accountants play a crucial role in developing risk management strategies to ensure organizations comply with anti-money laundering regulations, thus safeguarding against emerging financial threats.