Introduction

Stora Enso, a Finnish paper manufacturer with a rich history dating back to 1288, successfully transformed itself into a sustainable, renewable materials company. This strategic turnaround involved streamlining operations, investing in profitable avenues aligned with environmental consciousness, and pioneering alternatives to plastic and sustainable building products. The story of Stora Enso highlights the critical nature of adaptation and foresight in executing a successful restructuring process.

But Stora Enso is not alone in pursuing a turnaround. Across diverse industries, businesses like Travel Charme Hotels & Resorts and Rivian are integrating technology and sustainability to optimize their core processes and stay competitive. McKinsey & Company's insights further emphasize the need for organizational adjustments and change management to fuel efficient and innovative operations.

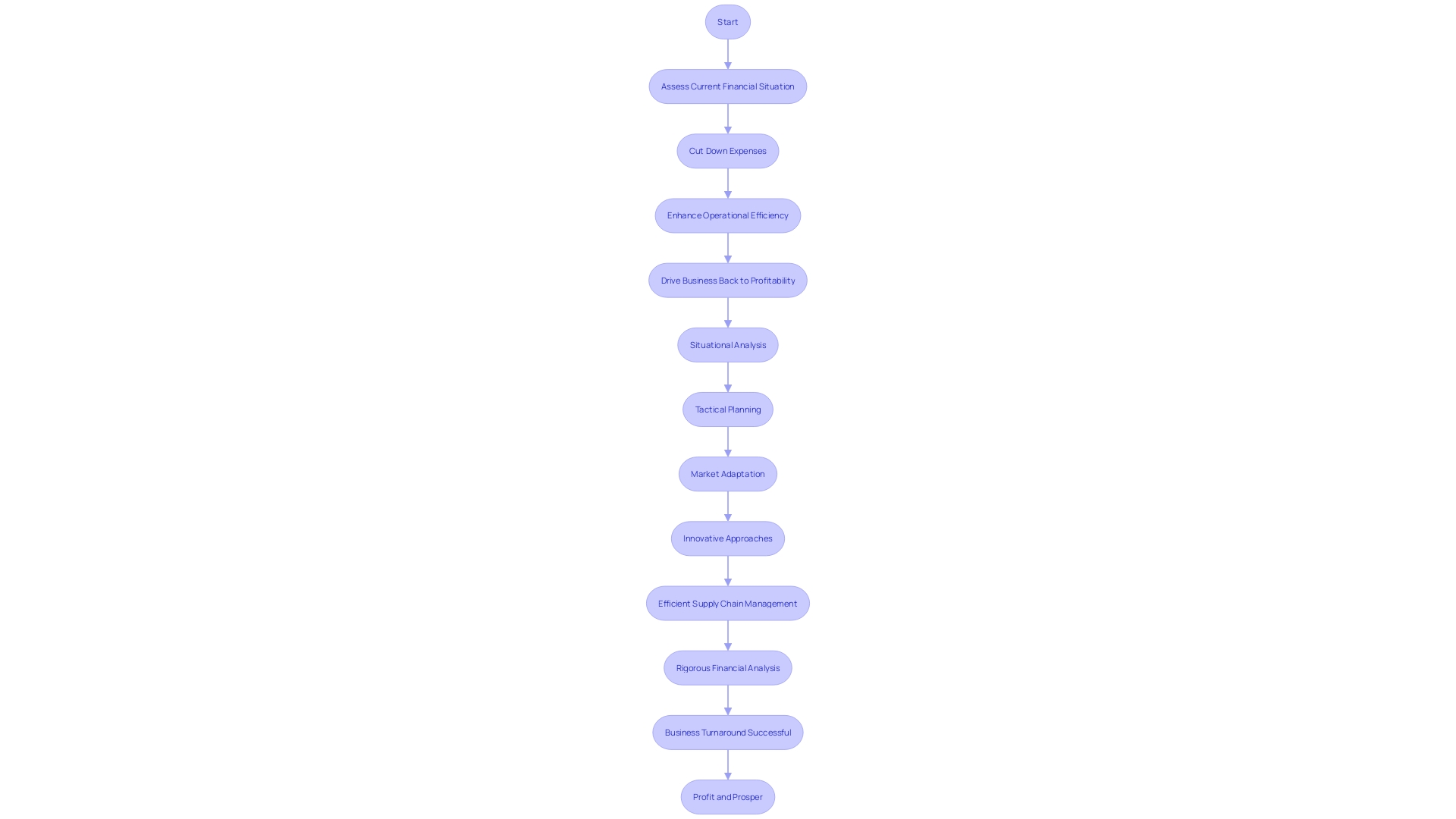

Navigating a business's turnaround is crucial for revitalizing the company, attracting essential capital, and laying the groundwork for sustainable growth. It requires a combination of situational analysis, tactical planning, and a clear understanding of market dynamics. By embracing innovative approaches, efficient supply chain management, and rigorous financial analysis, companies can navigate bankruptcy and restructuring processes and rise above challenging conditions.

The steps involved in a successful turnaround include a thorough assessment, development of a turnaround plan, effective implementation of change, ongoing performance monitoring, and continuous evaluation to foster long-term growth in a turbulent business ecosystem.

What is Turnaround?

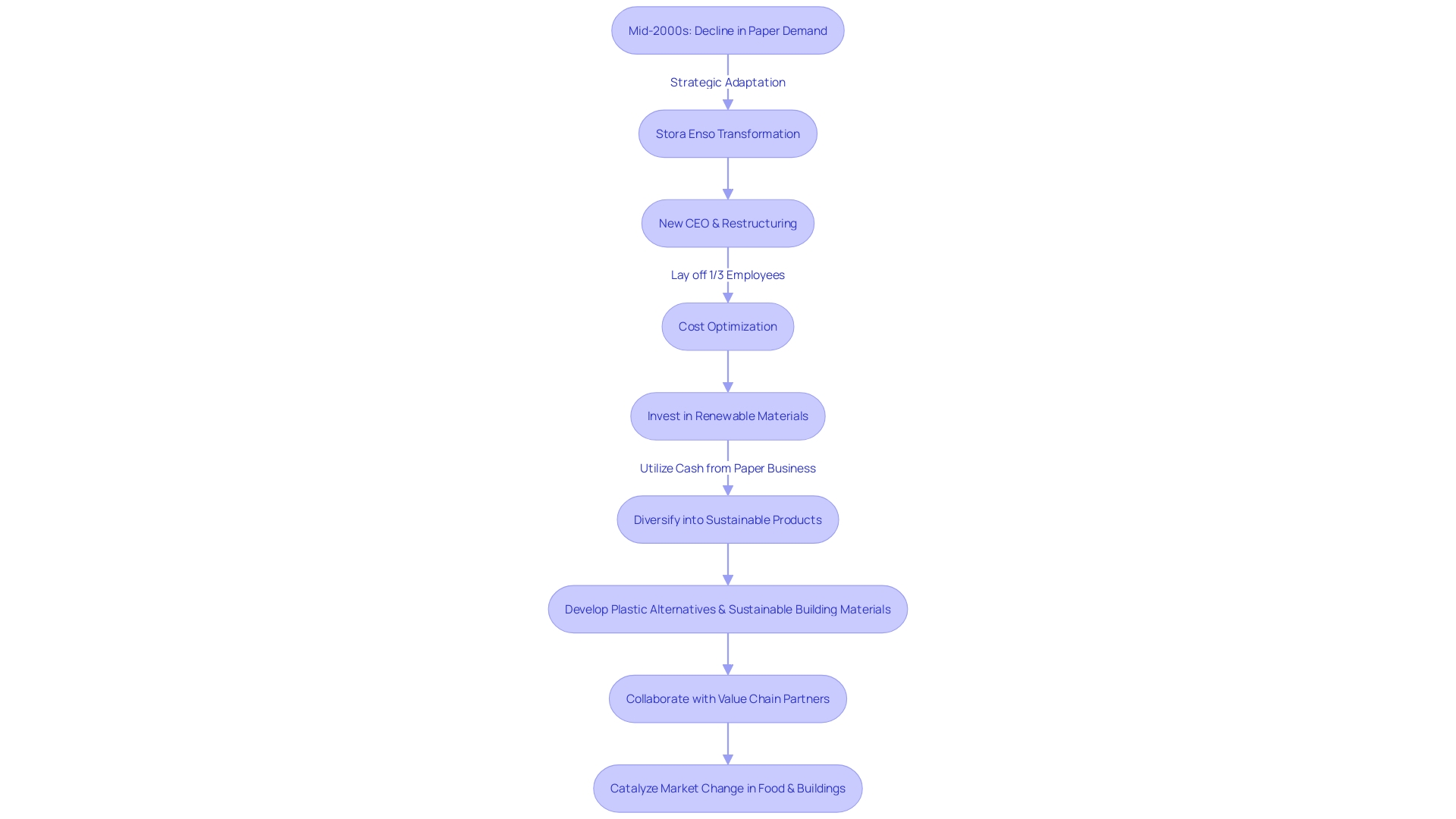

Stora Enso's transformation from a traditional paper manufacturer to a sustainable, renewable materials company exemplifies a strategic turnaround in practice. The Finnish company, steeped in history since 1288, responded proactively to the decline of global paper demand by investing in burgeoning sectors like renewable materials. Stora Enso, facing dwindling paper sales – which plummeted from 12% to a mere 4% within two decades – embarked on an ambitious overhaul.

They streamlined operatively by reducing the workforce by a third, and strategically invested generated paper business revenues into profitable avenues aligned with the rise of environmental consciousness.

The enterprise now pioneers alternatives to plastic drinkware and develops sustainable building products, working closely with value chain partners to reshape food and construction markets. These moves mirror the broader financial and operational changes seen across industries embracing sustainability. It corresponds with the 2023 trends highlighting decarbonization, finance's role in sustainability, and the growing influence of artificial intelligence and ESG metrics in corporate operations.

Stora Enso's proactive steps to shift its focus and align with these global trends of sustainability and renewable resources emphasize the critical nature of adaptation and foresight in executing a successful restructuring process.

Types of Turnaround

Across diverse industries, businesses confront the necessity to adapt and reinvent themselves. The Travel Charme Hotels & Resorts, for instance, illustrate how the hospitality sector can integrate technology to fine-tune operations and elevate the guest experience. To maintain their standing as a sought-after destination in Germany and Austria, the resort has been focusing on perfecting their operational efficiency, a type of operational turnaround strategy which is critical when a company needs to optimize its core processes to stay competitive.

Similarly, Rivian, the American electric vehicle manufacturer, demonstrates strategic turnaround by steadfastly pursuing net-zero emissions by 2040. This underlines the pivot towards sustainability not just in production but across their entire supply chain as an innovative strategic shift responding to environmental concerns. Companies like Rivian are setting a precedent for financial turnaround strategies by reassessing their goals in context with global sustainability trends, a move that is proving not just ethically sound, but financially viable as market demands shift towards greener products.

In light of these evolving business landscapes, McKinsey & Company's insights become particularly relevant, suggesting profound shifts to product and platform operating models that transcend mere structural changes. By committing to organizational adjustments at the process, performance, and talent levels, companies can energize and gear up their teams for efficient and innovative operation.

Adopting lessons from cases like the Startup Genome report, which notes that 70% of startups fail due to misjudged scaling efforts, organizations can augment their turnaround strategies with a disciplined focus on change management. It's about aligning transformative efforts with a genuine market need, ensuring the commitment is not only to technology and processes but, crucially, to the people driving them. Through this multi-faceted approach combining operational, financial, and strategic turnaround strategies, timely adaptation, and rigorous execution, companies can navigate rough terrains and emerge robustly positioned for future challenges.

Importance of Turnaround

Navigating a business's turnaround is a multifaceted task; it's about revitalizing the company by addressing intrinsic problems, cutting down unnecessary expenses, enhancing operational efficiency, and driving the business back to profitability. A carefully executed turnaround strategy not only brings back the confidence of stakeholders and injects new life into the company's financial vein by attracting essential capital but also lays the groundwork for sustainable growth and success in the long term.

For instance, consider the situation of a well-placed hotel struggling to amplify its food and beverage sales. The turnaround directive here encompassed leveraging its prime location to attract diners, a move informed by a clear understanding of the market led by experienced strategists such as John Young. This case exemplifies the profound impact that strategically informed decisions have on a business's ability to turnaround.

It underscores that situational analysis and tactical planning are integral to rejuvenating a business's performance.

In the broader economic landscape, variations in financial performance reminiscent of the experiences of new ventures like Build My Burgers point towards the undulating nature of business fortunes and the need for agility in response to market dynamics. This eatery's initial success, drawing in significant revenue and an engaged customer base, echoes the tangible outcomes of a focused and dynamic approach to business. Additionally, data from places like the Erie Regional Chamber and Growth Partnership spotlight the importance of acknowledging economic trends and adapting in kind.

In essence, enterprise value is at the heart of ascertaining a business's worth, informed by a blend of EBITDA, Free Cash Flow, revenue, alongside industry specifics. Yet, it's the Quality of Earnings report that refines this understanding, presenting a transparent and normalized view of business cash flow, crucial for revealing a business's authentic financial stature. As we peel back the layers of financial health, operational efficiency, and market adaptation, the narrative is clear—innovative approaches, efficient supply chain management, and rigorous financial analysis are the cornerstones of an effectual turnaround and paramount for any business aiming to rise above challenging conditions and navigate through the intricacies of the bankruptcy and restructuring processes.

Steps Involved in a Turnaround

Navigating through corporate bankruptcy involves a strategic restructuring process that transcends the traditional 'unfreeze-change-refreeze' model and embraces transformation as a continuous evolution. It starts with a thorough assessment and diagnosis of the company's challenges, forging a path forward based on a deep understanding of the market and competitive landscape. The development of a turnaround plan comes next, incorporating insights from successful business practices such as leveraging location for retail or identifying profitable market segments in healthcare.

Implementing change effectively demands an attentive ear to feedback from both customers and internal teams, ensuring agility and responsiveness. This stage often involves deploying new content strategies or business models to tap into identified growth areas. Performance monitoring is a dynamic, ongoing activity, guiding adjustments to refine the implementation process and responding proactively to market signals.

The ultimate goal is to achieve a stable footing in a turbulent business ecosystem, fostering sustainable growth. This involves continuous evaluation and strategic pivots as indicated by market trends and organizational performance, an approach echoed by thought leaders who stress the importance of perpetual transformation.

Successful navigation of bankruptcy not only protects the financial health of a business but also preserves the livelihoods and dreams of those it employs and serves. Each step in this meticulous process, from initial assessment to long-term growth, plays a crucial role in revitalizing an organization's future.

Conclusion

In conclusion, successful turnaround strategies are crucial for revitalizing businesses and navigating through challenging conditions. Companies like Stora Enso, Travel Charme Hotels & Resorts, and Rivian exemplify the importance of adapting to market dynamics and embracing sustainability, technology, and efficiency.

Stora Enso's transformation into a sustainable materials company demonstrates the critical nature of adaptation and foresight in executing a successful restructuring process. By investing in environmentally conscious avenues, such as alternatives to plastic and sustainable building products, they have positioned themselves as pioneers in their industry.

Similarly, Travel Charme Hotels & Resorts and Rivian have integrated technology and sustainability to optimize their core processes and stay competitive. These companies have set a precedent for financial turnaround strategies that align with global sustainability trends, focusing on operational efficiency and pursuing net-zero emissions.

To achieve a successful turnaround, companies should focus on strategic, financial, and operational strategies. This involves a thorough assessment, development of a turnaround plan, effective implementation of change, ongoing performance monitoring, and continuous evaluation. By embracing innovation, efficient supply chain management, and rigorous financial analysis, businesses can navigate through bankruptcy and restructuring processes.

Ultimately, a successful turnaround not only revitalizes a company and attracts essential capital but also lays the groundwork for sustainable growth. By remaining agile and responsive to market trends, organizations can position themselves for long-term success.

In summary, the success stories of Stora Enso, Travel Charme Hotels & Resorts, and Rivian, along with the guidance provided by McKinsey & Company, emphasize the importance of turnaround strategies. By driving innovation, efficiency, and sustainability, businesses can navigate through challenging conditions and thrive in today's ever-changing business landscape.