Introduction

In an increasingly volatile business landscape, corporate distress poses a significant threat to organizations, demanding immediate attention and strategic intervention. Understanding the dynamics of financial challenges is crucial for CFOs aiming to navigate their companies through turbulent times. This article delves into the key indicators of distress, effective turnaround strategies, and the metrics that define success in recovery efforts.

By focusing on:

- Operational and financial restructuring

- Management changes

- Cultural transformation

organizations can create a resilient framework for recovery. Moreover, recognizing the impact of micro and macroeconomic factors on turnaround success is essential for crafting targeted strategies. As companies strive for stability, embracing innovative metrics and continuous performance monitoring will not only enhance recovery efforts but also position them for sustainable growth in the future.

Understanding Corporate Distress and Turnaround Dynamics

Corporate distress manifests through significant financial challenges leading to deteriorating performance, liquidity problems, or even insolvency. Recognizing the urgency of these issues is crucial, as early intervention can make the difference between recovery and failure. Key indicators of distress include:

- A noticeable decline in revenues

- An increase in debt levels

- A shrinking market share

Importantly, 79% of UK employees feel close to burnout, severely impacting productivity and overall company performance. For CFOs, grasping these factors is crucial for developing effective recovery strategies. A successful reversal relies on turnaround success metrics that pinpoint critical areas in need of intervention, enabling the development of targeted recovery plans.

Our approach includes identifying underlying issues and implementing a plan that fosters strategic improvement—testing every hypothesis to ensure maximum return on invested capital. We advocate for an expedited decision-making cycle during the turnaround process, enabling your team to take decisive action to safeguard the organization. Additionally, real-time business analytics from our client dashboard allow for continuous monitoring of performance, ensuring that adjustments can be made promptly.

Furthermore, investing in employee well-being is not just a moral imperative; recent statistics reveal that for every £1 invested in mental health initiatives, companies can expect a return of £6.30, highlighting the financial benefits during corporate distress. The rising trend of antidepressant-involved overdose deaths, increasing from 1,749 in 1999 to 5,863 in 2022, underscores the broader implications of financial difficulties on employee mental health. As corporate distress rates increase, it is essential not only to acknowledge these indicators but also to apply strong plans that promote financial recovery and long-term stability, which are vital for assessing turnaround success metrics.

We are dedicated to implementing the lessons learned through the recovery process, fostering strong, lasting relationships that contribute to sustainable improvements.

Key Strategies for Effective Turnaround: Restructuring and Management Changes

To accomplish a successful change, organizations must embrace a broad range of approaches customized to their unique situations. Key components include:

-

Operational Restructuring: This approach focuses on streamlining operations to cut costs and boost efficiency.

Organizations should explore process optimization, enhance supply chain management, and restructure the workforce, all of which can significantly improve performance. Our tailored approach has proven that companies undergoing digital transformations, especially those adopting advanced technologies like AI and IoT, are more likely to achieve successful outcomes despite inherent complexities.

-

Financial Restructuring: A critical aspect involves reevaluating the capital structure to alleviate debt burdens.

This includes negotiating with creditors and refining cash flow management, which can provide the necessary capital for recovery initiatives. Historical data indicates that distressed companies participating in proactive debt management see significantly enhanced financial health, emphasizing the significance of effective financial strategies in recovery situations.

-

Management Changes: Introducing new leadership or restructuring existing management teams can infuse fresh perspectives and accountability into the entity.

Insights from turnaround specialists indicate that success rates are at least twice as likely in entities that run innovative recruiting campaigns to attract top talent, reinforcing the need for strategic management changes to drive turnaround efforts.

-

Cultural Transformation: It’s essential to shift the organizational culture towards resilience, innovation, and performance.

A robust culture fosters an environment conducive to recovery and long-term success, ensuring that all employees are aligned with the entity's strategic goals. Moreover, the timing and arrangement of private sector involvement in crisis management can significantly influence the success of cultural transformation efforts.

-

Interim Management Services: Our interim management solutions offer seasoned leadership during crucial transitions, ensuring that your entity maintains direction and focus while implementing necessary changes.

-

Bankruptcy Case Management: In instances where bankruptcy is unavoidable, our specialized case management services guide entities through the process, helping to mitigate risks and identify opportunities for recovery.

Ultimately, these strategies must be tailored to the unique challenges faced by each entity, creating a roadmap that not only addresses immediate concerns but also positions the company for sustained recovery. Ongoing business performance assessment and real-time analytics are essential in this process, as they enable entities to implement lessons learned during the transformation, ensuring enduring enhancements.

Evaluating Turnaround Success: Metrics and Outcomes

To effectively assess the success of a turnaround, entities must analyze both quantitative and qualitative turnaround success metrics. Key indicators include:

- Financial Performance: This encompasses revenue growth, profit margins, and improvements in cash flow, which are critical for assessing the overall health of the organization post-turnaround.

The transformative 'Rapid30' plan implemented by the SMB team has been pivotal in positioning companies for financial recovery, enabling them to achieve significant growth and stability.

- Operational Efficiency: Measurement of reductions in operational costs and enhancements in productivity provides insight into how well resources are being utilized. Notably, 73% of executive leaders believe that remote workers are a greater security risk than in-house employees, highlighting the need for careful management of remote operations to ensure efficiency and security.

Continuous business performance monitoring through real-time analytics, facilitated by our client dashboard, is essential to identify areas for improvement and operationalize lessons learned. The dashboard offers features such as real-time data tracking and performance metrics that empower organizations to make informed decisions swiftly.

- Market Position: Assessing changes in market share and customer satisfaction aids in measuring the success of the recovery plan in attracting and retaining clients.

The positive feedback from clients who have experienced transformative support from SMB underlines the value of a focused approach to market engagement. For instance, clients have reported improvements in customer retention rates, which directly correlate to the strategies implemented through the 'Rapid30' plan.

- Stakeholder Engagement: Assessing employee morale and engagement levels acts as a crucial indicator of the internal culture and well-being of the entity, reflecting the effectiveness of leadership during the recovery process.

Testimonials from satisfied clients illustrate how improving internal dynamics can lead to a more resilient workforce. A case study on candidate experience shows that enhancing this aspect can improve overall perceptions of the employer and attract better talent, crucial during recovery.

A recent report highlights that companies transitioning to remote work have reported greater retention rates, indicating the importance of adapting to employee needs during recovery and operationalizing lessons learned from the recovery process. Regularly reviewing turnaround success metrics not only ensures that entities remain on track but also facilitates timely adjustments, enhancing the likelihood of sustained financial performance improvements. As Erik van Vulpen notes,

Candidate job satisfaction is an excellent way to track whether the expectations set during the recruiting procedure match reality.

This underscores the importance of aligning internal metrics with broader organizational goals. By concentrating on these metrics, CFOs can gain valuable insights into the effectiveness of their recovery strategies.

The Role of Context in Turnaround Success: Micro and Macroeconomic Factors

The success of turnaround management is intricately linked to a multitude of micro and macroeconomic factors that organizations cannot afford to overlook:

- Microeconomic Factors: Key elements such as industry competition, customer behavior, and supply chain dynamics play pivotal roles in shaping an organization's market positioning. A comprehensive grasp of these elements allows companies to customize their approaches effectively, thereby improving their odds of recovery. For instance, insights from Wölfl et al. (2009) illustrate how product market reforms in OECD countries have improved sector efficiencies, providing valuable lessons for CFOs in navigating similar landscapes. As highlighted by Heyman, Norbäck, and Persson, "more than half of the overall increase in productivity in the business sector originated from new firms," emphasizing the critical nature of fostering innovation and new business models. Moreover, by testing hypotheses through real-time analytics, organizations can make informed adjustments to their plans, ensuring relevance in a competitive marketplace.

- Macroeconomic Factors: Economic conditions at a broader level—such as overall economic growth, interest rates, and shifts in regulatory frameworks—can have profound effects on corporate turnaround efforts. Organizations must stay flexible and responsive to these macroeconomic trends, modifying their recovery plans as necessary. Recent reports underscore the importance of land policies and institutions in fostering equitable growth in regions like Sub-Saharan Africa, where female participation in the economy stands at 65.2%. This highlights the need for strategic alignment with macroeconomic conditions, particularly in addressing the unique challenges faced by these economies. Ongoing observation using a client dashboard for real-time analytics can aid prompt decision-making, ensuring that entities are well-prepared to react to shifting conditions. The client dashboard is essential for assessing organizational health and directing changes to approaches based on real-time data.

By recognizing and meticulously analyzing these contextual factors, organizations can implement effective turnaround strategies that improve their turnaround success metrics while addressing both internal challenges and external pressures. The interplay between micro and macroeconomic elements is not merely a theoretical construct; it is a practical framework that can drive significant improvements in organizational performance. Specifically, lessons from Sweden's industrial reorganization reveal that micro-based reform programs can lead to notable advancements in business sector efficiency, especially in countries close to the technological and institutional frontier.

CFOs can utilize these insights to implement comparable approaches that correspond with their operational contexts, ensuring sustainable recovery and growth while applying the lessons learned throughout the recovery process. This includes a commitment to testing hypotheses regularly to maximize return on invested capital and enhance decision-making cycles.

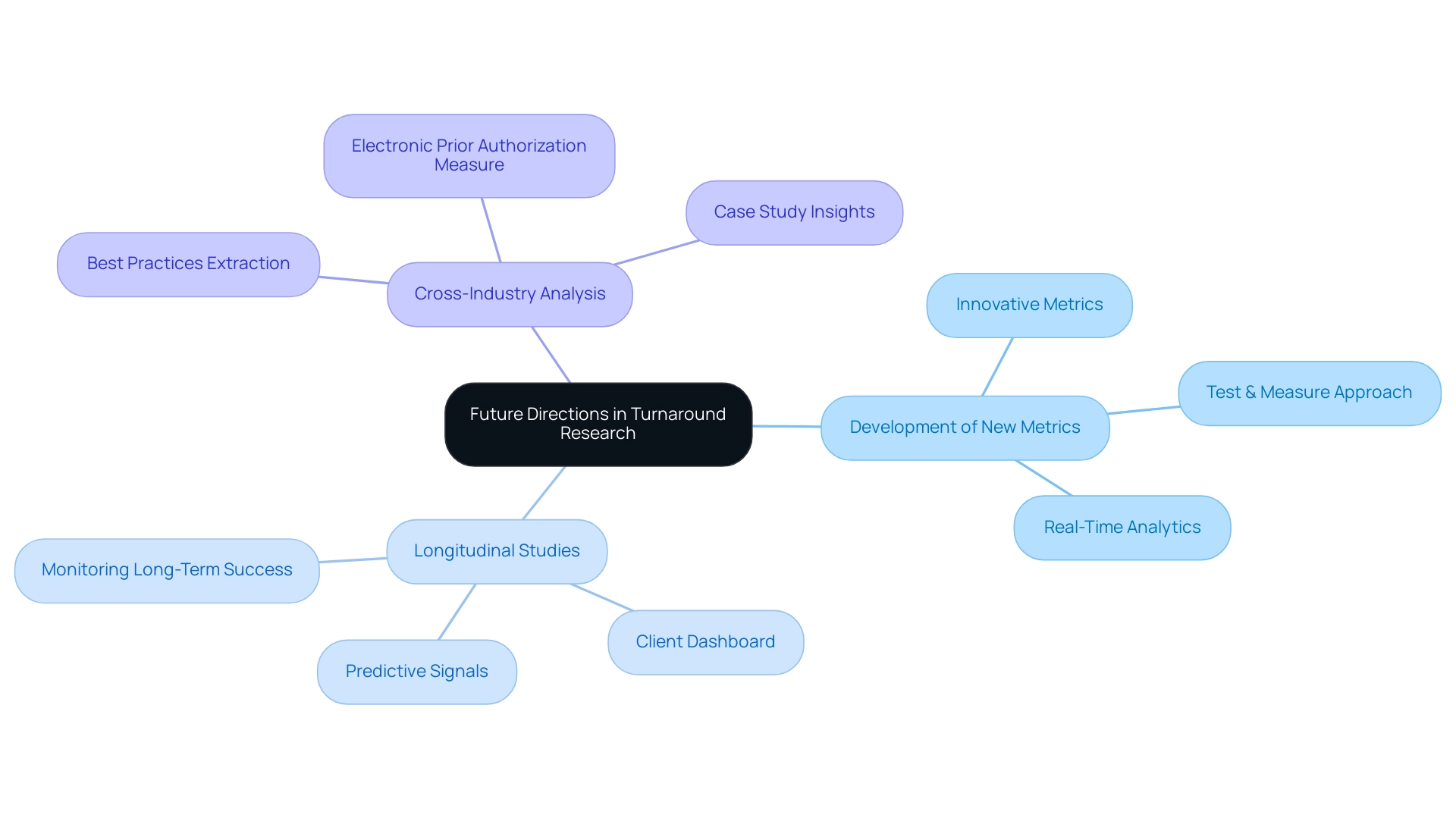

Future Directions in Turnaround Research: Addressing Gaps in Success Metrics

As consulting continues to evolve, it is crucial for Chief Financial Officers to tackle existing gaps in turnaround success metrics and research methodologies that can hinder effective recovery strategies. For instance, the introduction of the Electronic Prior Authorization measure in 2027 highlights the importance of adopting new metrics in healthcare and can serve as a model for other industries. Future directions should encompass several key areas:

- Development of New Metrics: Crafting innovative metrics that accurately capture the intricacies of contemporary business environments and the nuances of various recovery scenarios is vital. These turnaround success metrics should not only quantify financial performance but also assess operational resilience and stakeholder engagement, reinforcing the need for real-time analytics in decision-making processes. The 'Test & Measure' approach will facilitate this by allowing entities to systematically evaluate their strategies.

- Longitudinal Studies: Implementing comprehensive studies that monitor the long-term success of improvement initiatives is essential. By recognizing patterns and predictive signals, entities can improve their forecasting abilities and adjust their approaches accordingly, ensuring ongoing performance tracking through tools like the client dashboard, which offers real-time business analytics.

- Cross-Industry Analysis: Investigating successful recovery strategies across diverse industries can yield valuable insights. For example, the case study titled 'Electronic Prior Authorization Measure for MIPS' illustrates how new measures are being integrated into performance categories, requiring eligible clinicians and hospitals to attest to electronic prior authorization requests. This analysis can help extract best practices and applicable lessons, providing a broader perspective on effective strategies.

By engaging with ongoing research and remaining adaptable to new findings, organizations will be better positioned to refine their strategies based on turnaround success metrics. Streamlined decision-making, as emphasized by the 'Decide & Execute' principle, and operationalizing lessons learned will ultimately boost overall success rates in financial recovery, as highlighted by recent developments like the addition of the Electronic Prior Authorization measure to the MIPS Promoting Interoperability performance category.

Conclusion

In navigating the complexities of corporate distress, organizations must prioritize a multifaceted approach to recovery. Recognizing the key indicators of financial challenges, such as declining revenues and increasing debt, is essential for CFOs to initiate timely interventions. By implementing targeted strategies—including operational and financial restructuring, management changes, and cultural transformation—companies can effectively address the root causes of distress and set the stage for a successful turnaround.

Moreover, continuous performance monitoring through innovative metrics and real-time analytics empowers organizations to make informed decisions, ensuring they remain agile in a rapidly changing business landscape. The interplay of micro and macroeconomic factors further emphasizes the importance of contextual awareness in strategy formulation. Understanding market dynamics and broader economic conditions allows CFOs to tailor their recovery plans, enhancing their potential for sustainable growth.

Ultimately, the journey through corporate distress requires not only a commitment to immediate recovery but also a long-term vision for resilience and adaptability. By operationalizing lessons learned and embracing a culture of continuous improvement, organizations can emerge stronger, better positioned to thrive in future challenges. The proactive steps taken today will lay the groundwork for enduring success and stability in an increasingly volatile environment.

Frequently Asked Questions

What is corporate distress and how does it manifest?

Corporate distress refers to significant financial challenges that lead to deteriorating performance, liquidity problems, or insolvency. Key indicators include a noticeable decline in revenues, an increase in debt levels, and a shrinking market share.

Why is early intervention important in corporate distress?

Early intervention is crucial because it can make the difference between recovery and failure, allowing organizations to address issues before they escalate.

What percentage of UK employees feel close to burnout, and how does this impact companies?

79% of UK employees feel close to burnout, which severely impacts productivity and overall company performance.

What are the key components of effective recovery strategies for CFOs?

Key components include operational restructuring, financial restructuring, management changes, cultural transformation, interim management services, and bankruptcy case management.

How does operational restructuring improve performance?

Operational restructuring focuses on streamlining operations to cut costs and boost efficiency, including process optimization and enhancing supply chain management.

What role does financial restructuring play in recovery?

Financial restructuring involves reevaluating the capital structure to alleviate debt burdens, which can provide necessary capital for recovery initiatives.

How can management changes influence turnaround success?

Introducing new leadership or restructuring management teams can bring fresh perspectives and accountability, significantly increasing the likelihood of successful recovery.

Why is cultural transformation important during a turnaround?

Cultural transformation fosters resilience, innovation, and performance, ensuring that employees align with the organization's strategic goals, which is vital for recovery.

What is the significance of investing in employee well-being during corporate distress?

Investing in mental health initiatives can yield significant financial returns, with companies expecting a £6.30 return for every £1 invested, highlighting the importance of employee well-being.

What are the key turnaround success metrics to assess recovery?

Key metrics include financial performance (revenue growth, profit margins), operational efficiency (cost reductions, productivity), market position (market share, customer satisfaction), and stakeholder engagement (employee morale).

How can organizations use real-time analytics in their recovery process?

Real-time analytics allow organizations to continuously monitor performance and make timely adjustments, ensuring that recovery strategies remain effective and aligned with changing conditions.

What are the microeconomic and macroeconomic factors affecting turnaround management?

Microeconomic factors include industry competition and customer behavior, while macroeconomic factors encompass overall economic growth and regulatory changes. Both types of factors influence recovery strategies and outcomes.

What future directions should organizations consider for turnaround success metrics?

Organizations should focus on developing new metrics, conducting longitudinal studies to monitor long-term success, and performing cross-industry analyses to extract best practices and insights.