Introduction

Fraudulent actions in the business world can have devastating consequences, from financial damage to loss of trust among clients and legal repercussions. To protect your enterprise, it is crucial to embrace robust fraud prevention measures.

This article will provide an overview of fraud in business, including types of fraudulent activities, common scams and schemes, healthcare fraud, and practical steps for protecting your business from fraud. By implementing these strategies, you can fortify your defenses and ensure the long-term safeguarding of your financial resources.

Overview of Fraud in Business

Fraudulent actions in the business world are not limited to the theft of office supplies or fudging expense reports. These deceptive maneuvers are executed with the intent to unjustly profit, often resulting in substantial financial damage, loss of trust among clients and partners, and even attracting legal consequences. To effectively shield an enterprise against these malpractices, it's crucial to embrace robust fraud prevention measures.

Foremost among them is safeguarding sensitive information. In a digital era where data breaches can instantly compromise your identity, it's imperative to store information securely, using measures like encrypted cloud services. Accessibility from any internet-enabled device adds layers of both convenience and protection.

Staying informed is equally important. Notably, the domain of insurance fraud, which the Coalition Against Insurance Fraud (CAIF) recognizes as a 'major league crime,' encompasses a multitude of deceitful tactics. Awareness and understanding of such schemes are fundamental to preemptively recognize and counteract any suspicious activities threatening to destabilize the company's financial standing.

Types of Fraudulent Activities

To safeguard fiscal integrity, companies must be alert to various fraudulent schemes. Embezzlement, one such malfeasance, involves an individual diverting assets for personal enrichment, often through manipulation of financial records.

Identity Theft is another serious concern, where wrongdoers exploit personal details to arrange fraudulent transactions or attain credit unlawfully. Moreover, Financial Statement Fraud undermines corporate trust with deliberate misinformation in financial reporting, such as overinflated revenues or concealed liabilities, misleading stakeholders from investors to creditors.

Corruption, too, erodes ethical standards, as officials exploit their positions for undue advantage, accepting bribes or participating in illicit dealings. Lastly, Asset Misappropriation represents unauthorized commandeering of organizational resources, ranging from pilferage of physical goods to the sophisticated misstatements in inventory ledgers. Vigilance and strong anti-fraud controls are essential for organizations to thwart these deceptive acts and preserve the straightforward simplicity expected of a robust business model.

Common Scams and Schemes

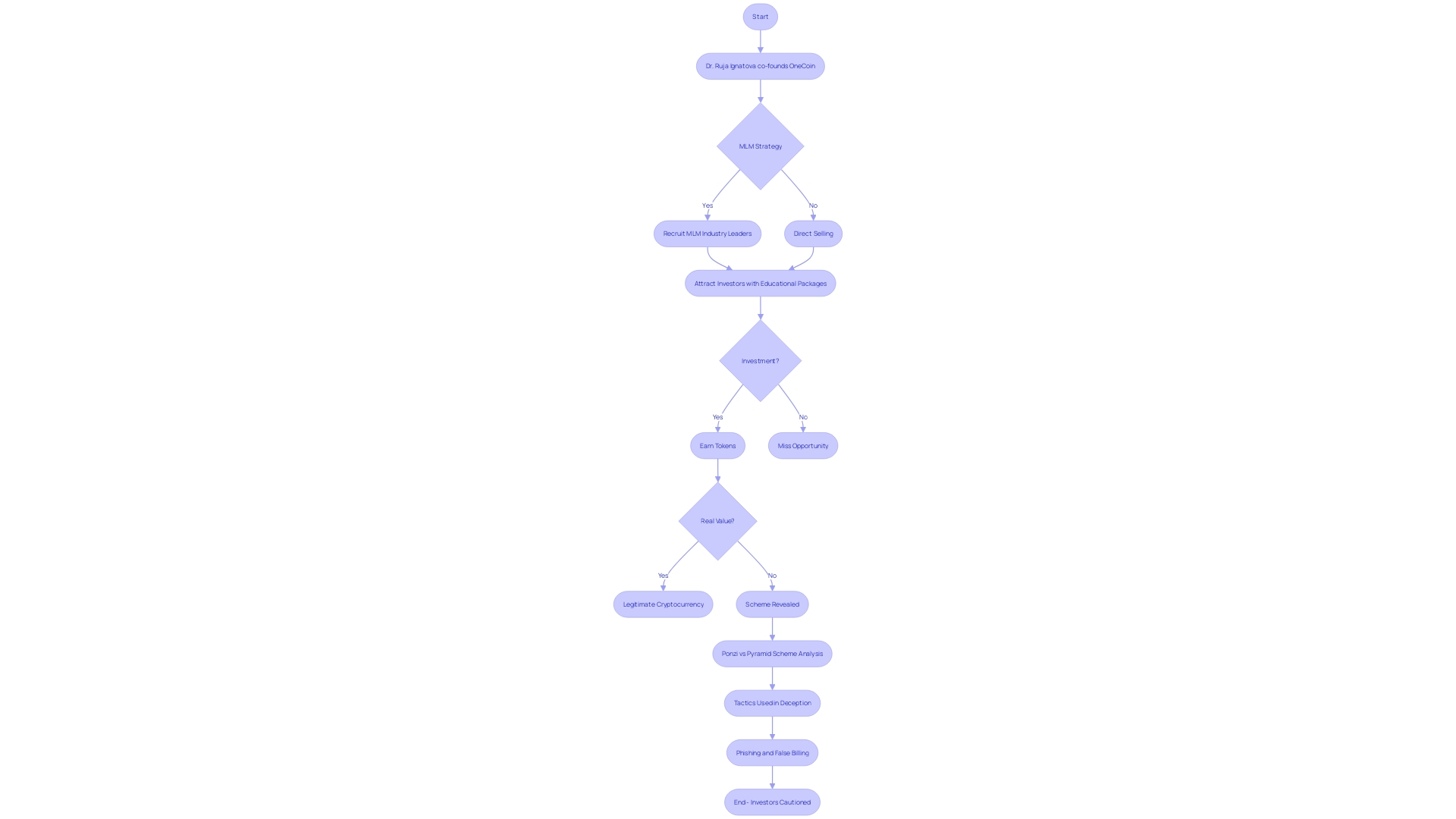

Con artists masterfully engineer an array of deceptions to part the unwary from their money. A profound example of this was the OneCoin cryptocurrency debacle spearheaded by Dr. Ruja Ignatova. Dr. Ignatova, with her extensive academic background and linguistic prowess, drew in expert investors by presenting OneCoin as a revolutionary opportunity.

Counterintuitively, the blatant complexity and confusion surrounding OneCoin's business model did not deter its rampant success. With Dr. Ignatova at the helm and Sebastian Greenwood, an MLM connoisseur, as her co-founder, OneCoin's multifaceted scheme captivated over three million individuals. It epitomized a critical red flag in fraudulent ventures – a business strategy that, rather than bearing the hallmark simplicity of legitimate models, thrived in ambiguity and obfuscation.

This very complexity should have been a warning to investors, as a genuine business' model of profitability is typically straightforward. OneCoin's multi-level marketing (MLM) strategy, though, was a masquerade to disguise the scheme's empty promises. Ponzi and pyramid schemes, beware the subtle differ; one feeds on new investor cash, while the other on recruitment fervor.

Phishing too, with its deceit and guile, entices unsuspecting souls, while false billing preys on overworked accountants to fulfill its dreadful goals. These sophisticated frauds all share a common thread – exploiting trust and complexity, they lead countless to financial dread. Vigilance and education are the armor against these chameleons of crime, with OneCoin's tale as a stern reminder to scrutinize each investment's paradigm.

Healthcare Fraud

Healthcare fraud involves fraudulent activities within the healthcare industry, such as insurance fraud, billing for services not provided, or billing for unnecessary procedures. Healthcare fraud can result in increased healthcare costs, compromised patient care, and financial losses for both insurance providers and individuals. It is crucial for healthcare organizations to implement stringent controls and regularly audit their billing processes to prevent and detect healthcare fraud.

Protecting Your Business from Fraud

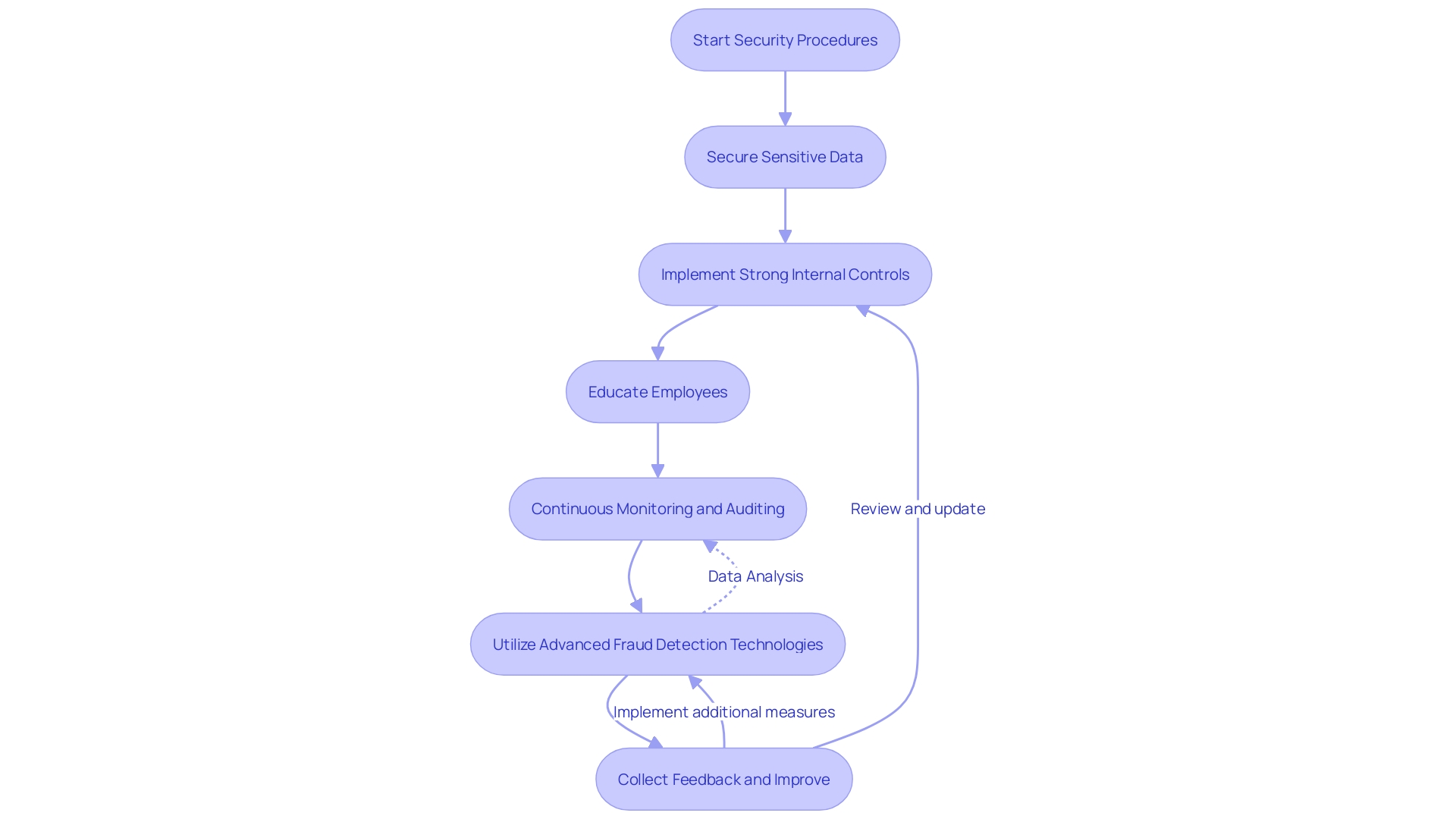

Creating a robust shield against fraud is an imperative for every organization, ensuring financial assets are safeguarded and integrity maintained. Key elements of an effective fraud prevention framework include the following:

1.

Securing Sensitive Data: A principal defense against fraud, particularly identity theft, involves proper data management. Aligning with modern practices, organizations should transition sensitive data to encrypted cloud storage solutions, providing both security and accessibility.

This measure not only secures critical information from unauthorized access but also assures data integrity across multiple platforms. 2.

Strong Internal Controls: Rigorous internal protocols, such as separating financial responsibilities among employees, detailed background verifications, and systematic audits, are critical. These internal controls are instrumental in creating barriers to fraudulent activities and ensuring transparency within the financial and operational workflows.

- Educational Programs for Employees: Empowering employees with knowledge on fraud detection contributes to a vigilant organizational culture.

Comprehensive training programs should cover aspects like phishing recognition, procedures for reporting suspicious actions, and the ramifications of participating in fraudulent behavior. 4.

Continuous Monitoring and Regular Auditing: The essence of fraud detection lies in the vigilant oversight of transactions and corporate relationships. Implementing habitual internal reviews and engaging unbiased external audit services play a pivotal role in identifying potential irregularities and shortcomings in the control environment. 5. Advanced Fraud Detection Technologies: Another layer of defense can be added with sophisticated fraud detection systems. By leveraging cutting-edge technologies, organizations can systematically screen financial data for irregular patterns or transactions, massively reducing the window of opportunity for fraud to occur. It's worth noting that Member States manage over 85 percent of EU expenditure and collect the EU's own resources, as reported in OLAF’s 35th Annual Report on the protection of the EU's financial interests. Proactive approaches in fraud prevention and routine compliance checks are vital for maintaining the sanctity of financial interests on such a grand scale. By integrating these strategies, organizations can fortify their defenses against fraud and ensure the long-term safeguarding of their financial resources.

Conclusion

In conclusion, fraud in the business world can have serious consequences, from financial damage to loss of trust among clients and partners. To protect your enterprise, it is crucial to embrace robust fraud prevention measures. Safeguarding sensitive information and staying informed are key aspects of fraud prevention.

Types of fraudulent activities include embezzlement, identity theft, financial statement fraud, corruption, and asset misappropriation. To counteract these deceptive acts, companies must maintain strong anti-fraud controls and vigilance. Common scams and schemes, such as Ponzi and pyramid schemes, phishing, and false billing, exploit trust and complexity.

Healthcare fraud is a significant concern in the healthcare industry and requires stringent controls and regular auditing of billing processes. To protect your business from fraud, key elements of an effective fraud prevention framework include securing sensitive data, implementing strong internal controls, providing educational programs for employees, conducting continuous monitoring and regular auditing, and using advanced fraud detection technologies. By integrating these strategies, organizations can fortify their defenses against fraud and ensure the long-term safeguarding of their financial resources.