Introduction

Understanding the Cost of Goods Sold Formula

Cost of Goods Sold (COGS) is a pivotal financial figure that represents the direct costs tied to the creation of products or services a business sells. It encompasses expenses such as the price of raw materials, labor wages for production staff, and other outlays that are directly linked to the manufacturing process. A deeper comprehension of COGS is essential for dissecting and steering your company's financial health.

Direct costs are the cornerstones of COGS, affecting everything from small business dealings to large-scale operations. They fluctuate with production levels and include material costs and direct labor. A greater understanding of COGS can offer insights into operational efficiency and profitability, as showcased by the swift rise of software companies like Monday.com.

These companies focus on streamlining their growth to maximize free cash flow, which then translates into a robust cash reserve and enhanced shareholder value.

Establishing a firm grasp on gross margins and their components is crucial, given their significant impact on long-term profitability. For businesses in dynamic sectors like software, where customer success factors heavily into gross margins, understanding these figures is even more critical. This understanding helps to avoid poor benchmarking and valuations while ensuring a company's growth is both sustainable and profitable.

By delving into the intricacies of COGS, businesses can unlock the potential for financial optimization and strategic decision-making.

Understanding the Cost of Goods Sold Formula

Cost of Goods Sold (COGS) is a pivotal financial figure that represents the direct costs tied to the creation of products or services a business sells. It encompasses expenses such as the price of raw materials, labor wages for production staff, and other outlays that are directly linked to the manufacturing process. A deeper comprehension of COGS is essential for dissecting and steering your company's financial health.

Direct costs are the cornerstones of COGS, affecting everything from small business dealings to large scale operations. They fluctuate with production levels and include material costs and direct labor. For instance, in a car manufacturing business, steel costs and assembly line labor are direct costs. These are precisely tracked and included in COGS on financial statements.

A greater understanding of COGS can offer insights into operational efficiency and profitability, as showcased by the swift rise of software companies like Monday.com. These companies focus on streamlining their growth to maximize free cash flow, which then translates into a robust cash reserve and enhanced shareholder value. Notably, during high-growth phases, investors may prioritize revenue over gross margins; however, the real substance lies in a company's capacity to sustainably generate cash flow over time.

Establishing a firm grasp on gross margins and their components is crucial, given their significant impact on long-term profitability. For businesses in dynamic sectors like software, where customer success factors heavily into gross margins, understanding these figures is even more critical. This understanding helps to avoid poor benchmarking and valuations while ensuring a company's growth is both sustainable and profitable.

Components of COGS: Direct and Indirect Costs

Understanding the nuances of Cost of Goods Sold (COGS) is essential for financial optimization. COGS is not just a singular figure but an amalgamation of direct and indirect costs. Direct costs, such as raw materials and labor directly involved in production, are straightforward and vary depending on production levels. These costs are easily traceable to a specific product, making them critical for accurate financial reporting and inventory management.

On the other hand, indirect costs, like factory overhead and administrative expenses, may not be directly linked to production but play a crucial role in the overall cost structure. They include utilities, rent, and salaries of non-production staff. While these costs are more challenging to allocate to a single product, they still affect the bottom line and require careful consideration to maintain profitability.

Recent research employs machine learning to analyze complex cost structures, including indirect costs, offering innovative ways to streamline operations and reduce expenses. For instance, machine learning techniques can predict and allocate costs more accurately, leading to a more efficient pricing strategy and inventory management.

Additionally, case studies of industries such as utilities in California, where indirect costs like safety standards and wildfire risk mitigation are significant, illustrate the importance of understanding all facets of COGS. These studies emphasize the impact of external factors and the necessity for businesses to adapt and manage these costs proactively.

In practice, COGS is a dynamic figure influenced by various factors, including market conditions and regulatory changes. The evolving nature of these costs means that businesses must stay informed and agile to remain competitive. By dissecting COGS into its components and utilizing cutting-edge research and case studies, companies can better navigate the complexities of cost management and enhance their financial strategies.

Why COGS is Significant for Your Business Finances

Understanding and managing the Cost of Goods Sold (COGS) is a lever for enhancing profitability that savvy businesses cannot afford to overlook. COGS encapsulates the direct costs tied to the production of goods sold by a company, such as raw materials and labor. A well-managed COGS not only carves out opportunities for cost reduction but also empowers businesses to set strategic pricing and evaluate their financial well-being with greater precision.

- For instance, a car manufacturer's direct costs would include the steel used and the wages of assembly line workers, both of which are pivotal to calculating COGS.

- In the realm of software, where gross margins are under intense scrutiny, COGS plays a vital role in long-term profitability. It's not just about the revenue a company generates, but the quality of that revenue, which is often reflected in the gross margins. Companies like Monday.com have exemplified efficient growth by becoming free cash flow positive promptly, underscoring the importance of a solid grasp on COGS and its impact on overall financial health.

A focused approach to COGS management can yield a robust profit margin, a key indicator of financial health for any business. The profit margin measures what percentage of sales has turned into profits, which varies across industries. Therefore, companies are encouraged to pursue expert guidance or industry data to identify their optimal profit margins.

As the Deloitte Center for Health Solutions' 2024 survey indicates, health care CFOs are shifting priorities from cost-cutting to other concerns such as the economy and cybersecurity, suggesting a nuanced approach to profitability that extends beyond mere cost reduction strategies.

Case studies, such as IFCO Systems' collaboration with Rackspace Technology, demonstrate how leveraging expertise in cloud solutions can streamline operations and reduce operational costs. Similarly, Chess.com's global digital platform shows that strategic infrastructure investments can expand audience reach while maintaining cost-efficiency.

In summary, COGS is a critical financial metric that, when effectively managed, can significantly bolster a company's profit margins and contribute to a sound financial strategy.

Operating Expenses vs. COGS: Key Differences

Understanding the interplay between operating expenses and Cost of Goods Sold (COGS) is a pivotal aspect of financial health for a business. Operating expenses encompass the outlay necessary to maintain the day-to-day functions of a company—expenses like salaries, utilities, and marketing. These are distinct from COGS, which are the direct costs tied to the creation of products or services, such as raw materials and direct labor.

A business must maintain operating costs at a manageable level relative to incoming revenue to ensure profitability. Operating expenses, combined with COGS, provide a comprehensive view of the total operational expenditure. For instance, embracing technology such as artificial intelligence or online systems can streamline operations and reduce costs over time, despite potential initial investments. A tool like BILL Spend & Expense Management can exemplify cost savings by automating tasks that traditionally require manual labor, such as data entry and paper invoice processing.

Recent studies, such as the one led by PwC in collaboration with the World Economic Forum, stress the importance of energy efficiency in reducing operational costs without compromising economic output. The report suggests that by implementing energy-efficient measures, businesses could significantly lower their energy demands, aligning with global initiatives like the Paris Agreement and the COP28 pledge.

Moreover, cost accounting practices, especially in diverse industries, aid in tracking and managing expenses. For instance, standard cost accounting compares actual costs to standard expected costs under normal conditions, highlighting variances that can signal opportunities for cost savings.

In the software industry, companies like Monday.com have demonstrated the value of efficient growth. The emphasis on gross margins and free cash flow has been a key factor in their strategy, as each dollar of revenue is scrutinized for its contribution to profitability.

To sum up, the distinction between operating expenses and COGS is more than an accounting technicality; it's a strategic tool for businesses to optimize their financial performance. By carefully managing direct costs and operational expenditures, companies can enhance their bottom line and remain competitive in the evolving marketplace.

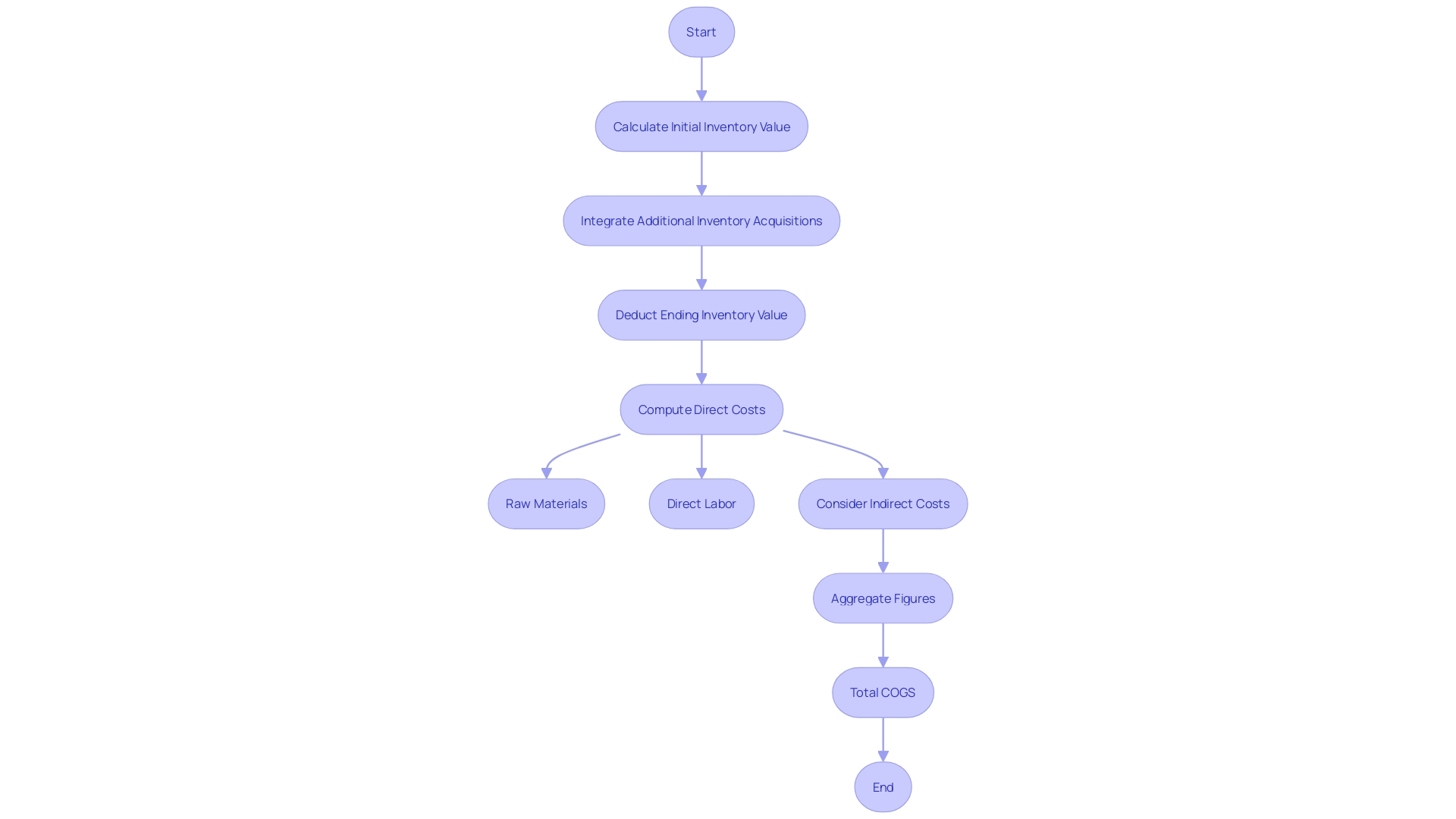

Calculating COGS: Step-by-Step Guide

To accurately determine the Cost of Goods Sold (COGS), one must execute a meticulous process, step by step. Begin with ascertaining the value of your initial inventory at the inception of the accounting period. Then, integrate the cost of any additional inventory acquisitions made throughout the period. Following this, deduce the ending inventory value from the aggregate sum. It's crucial to precisely compute the direct costs tied to the goods or services produced within the period, considering raw materials, direct labor, and other pertinent outlays.

When considering direct costs, remember that these are expenses directly attributable to the production of goods or services and may fluctuate with production levels. For example, in a car manufacturing firm, the cost of steel and the wages for assembly line workers are direct costs and are integral components of COGS.

Moreover, don't overlook indirect costs that also play a role in the total COGS. Upon gathering all these figures, aggregate them to arrive at the total COGS. This figure is pivotal for businesses, as it reflects the direct costs of producing the goods sold and is instrumental in pricing and inventory control decisions.

In the context of cost accounting, it's insightful to note that there are various methodologies applied across different industries. For instance, standard cost accounting involves costs based on typical operating conditions, and discrepancies between standard and actual costs are scrutinized. Understanding these nuances is essential for a comprehensive grasp of COGS and broader financial accounting, which encompasses a record of all monetary transactions, including Balance Sheets, Cash Flow Statements, and Income Statements.

Strategies to Reduce COGS

To bolster your company's profit margins, it is essential to minimize the Cost of Goods Sold (COGS). Here are some practical strategies:

-

Bulk Purchases: Strike deals for bulk purchases to unlock discounts and lower prices. This approach can lead to significant savings on raw materials or inventory.

-

Alternative Materials: Assess and utilize alternative materials that maintain quality while reducing costs, effectively decreasing production expenses.

-

Supplier Relationships: Foster robust relationships with suppliers to secure favorable terms, such as extended payment options or bulk-buy discounts.

-

Automation: Embrace automation to enhance production efficiency and cut labor expenses.

-

Inventory Optimization: Utilize advanced inventory management systems to avoid surplus stock and lower carrying costs.

-

Offshore Production: Consider relocating manufacturing processes offshore to capitalize on reduced labor and production expenses.

-

Waste Reduction: Identify and eradicate waste in manufacturing processes and inventory to curtail needless expenditures.

-

Lean and Agile Practices: Apply lean and agile methodologies to streamline operations and diminish waste across the supply chain.

-

Continuous Negotiation: Persistently engage with suppliers to attain the best pricing and terms.

Managing operational costs wisely is not just about immediate savings; it's about long-term sustainability and competitive edge. By implementing these strategies, businesses can thrive in a demanding economic landscape.

Conclusion

Understanding and effectively managing COGS is crucial for businesses to optimize financial performance. It encompasses direct costs like raw materials and labor, as well as indirect costs that impact the bottom line. By delving into the intricacies of COGS, businesses can unlock financial optimization and strategic decision-making.

A firm grasp on gross margins and their components is essential for long-term profitability. This understanding is particularly critical in dynamic sectors like software, where customer success heavily influences gross margins. It ensures sustainable and profitable growth while avoiding poor benchmarking and valuations.

COGS is an amalgamation of direct and indirect costs. Direct costs are easily traceable to a specific product and crucial for accurate financial reporting. Indirect costs, though not directly linked to production, impact the bottom line.

Utilizing machine learning techniques can accurately allocate these costs, leading to efficient pricing strategies and inventory management.

Effectively managing COGS is a lever for enhancing profitability. It enables businesses to set strategic pricing, evaluate financial well-being accurately, and achieve robust profit margins. Understanding the interplay between operating expenses and COGS is essential for optimizing financial performance.

Strategies such as embracing technology, implementing energy-efficient measures, and leveraging cost accounting practices reduce operational costs and enhance the bottom line.

Calculating COGS requires a meticulous step-by-step process, considering factors like inventory values and direct and indirect costs. Different industries may apply various methodologies, such as standard cost accounting. A comprehensive grasp of COGS and broader financial accounting is essential for accurate financial reporting.

To minimize COGS and bolster profit margins, businesses can employ practical strategies like bulk purchases, alternative materials, fostering supplier relationships, automation, inventory optimization, offshore production, waste reduction, lean and agile practices, and continuous negotiation. These strategies promote long-term sustainability and a competitive edge.

In conclusion, understanding and effectively managing COGS is crucial for financial optimization and strategic decision-making. It offers opportunities for cost reduction, strategic pricing, and evaluation of financial well-being. By implementing practical strategies and following a meticulous process, businesses can enhance profitability, build a robust financial strategy, and thrive in a competitive marketplace.