Overview

Financial restructuring consulting services provide specialized advisory support to organizations facing financial difficulties, helping them reorganize their financial structures and optimize cash flow for improved stability and growth. The article illustrates this by detailing the comprehensive process these consultants follow, which includes assessing economic conditions, negotiating with creditors, and implementing operational changes to address monetary challenges effectively.

Introduction

In the face of escalating financial challenges, organizations increasingly turn to financial restructuring consulting services as a lifeline. With bankruptcies rising significantly and the economic landscape evolving rapidly, businesses must navigate these turbulent waters with strategic foresight.

Financial restructuring consultants play a pivotal role in this journey, offering specialized expertise to help companies:

- Reorganize their financial structures

- Optimize cash flow

- Enhance overall health

Through comprehensive assessments and targeted interventions, these professionals guide organizations in addressing immediate financial concerns while laying a foundation for long-term resilience.

As companies grapple with declining revenues and operational inefficiencies, understanding the key functions and benefits of engaging these consultants becomes essential for achieving stability and sustainable growth.

Defining Financial Restructuring Consulting Services

Financial restructuring consulting services encompass specialized advisory support tailored for small to medium organizations grappling with monetary challenges. In 2023, the economic landscape has experienced a notable 68% rise in bankruptcies compared to the previous year, signaling a return to normalized levels post-stimulus. These financial restructuring consulting services are designed to assist organizations in reorganizing their financial structures, optimizing cash flow, and ultimately enhancing overall financial health.

Our comprehensive assessments focus on critical areas for improvement, including:

- Cash preservation

- Risk mitigation strategies

These strategies help businesses save money and grow revenues. This may involve:

- Negotiating with creditors

- Reorganizing debt

- Implementing operational changes that stabilize the organization and pave the way for recovery

Utilizing our Rapid-30 process, we provide interim management services that offer hands-on executive leadership for crisis resolution and transformational change, enabling quick and effective decision-making.

Effective communication is paramount, especially when data insights are inconclusive, as managing stakeholder expectations can be particularly challenging during the restructuring process. Furthermore, enhancing alignment between IT architecture and support teams is essential, as operational changes may be required to support the new economic strategies. By adopting these measures, organizations not only tackle immediate monetary concerns but also create a foundation for long-term resilience and success, supported by real-time analytics that facilitate continuous performance monitoring and operationalizing valuable lessons learned.

Key Functions and Activities of Financial Restructuring Consultants

In today's economic environment, characterized by one of the highest rates of issuer defaults in the past two decades, financial restructuring consulting services have become more crucial than ever. These specialists participate in crucial activities that involve:

- Performing thorough economic assessments

- Formulating focused recovery strategies

- Executing operational enhancements customized to the distinct challenges of each enterprise

They meticulously evaluate statements, cash flow projections, and prevailing market conditions to identify critical areas of concern.

Moreover, financial restructuring consulting services aid discussions with crucial stakeholders—like creditors and investors—to efficiently reorganize debt responsibilities and master the cash conversion cycle through 20 strategic improvements for optimal performance. This process frequently entails developing temporary management strategies that offer a guide for organizations, enabling them to maneuver through the intricacies of reorganization while reducing interruptions to their operations. The initial steps of the client engagement process include:

- Observing and evaluating the current organizational situation

- Identifying underlying issues

- Planning strategic interventions

In 2022, U.S. companies allocated a staggering US$ 8.4 billion to corporate reorganization, solidifying its status as the largest market of its kind globally. This investment underscores the necessity for clear communication and realistic expectation management, particularly when dealing with inconclusive data insights that can cloud stakeholder perceptions. As highlighted in the case study 'Managing Stakeholder Expectations with Inconclusive Data Insights,' both clear communication and setting realistic expectations are essential for management in such scenarios.

The commitment to operationalizing lessons learned from the turnaround process further reinforces strong, lasting relationships with stakeholders. As the landscape evolves, the ability to adapt turnaround strategies and align monetary objectives remains paramount in steering organizations towards stability and growth. As one consultant in reorganization observed, 'The key to successful reorganization lies not only in the figures but also in how we convey and handle the expectations of all parties involved.

Contexts and Scenarios for Engaging Restructuring Consulting Services

Engaging financial restructuring consulting services is essential during critical situations like bankruptcy, liquidity crises, or significant operational challenges. Our team will identify underlying operational issues and work collaboratively to create a plan to mitigate weaknesses and allow the organization to reinvest in key strengths. A study involving 407 financially distressed SMEs in France reveals that enterprises often seek financial restructuring consulting services when they are faced with declining revenues, escalating debt levels, or operational inefficiencies threatening their viability.

Our approach emphasizes streamlined decision-making supported by real-time analytics, allowing organizations to test hypotheses and monitor organizational health continuously. For instance, the case study named 'Turnaround Strategy' illustrates how thorough capital, equity, and business model overhaul can rejuvenate a corporate entity, although determining success can be intricate in formal insolvency processes. Moreover, in mergers and acquisitions, consulting on reorganization is essential for aligning monetary strategies and ensuring smooth transitions.

A notable discovery from PwC's 2023 Employee Wellness Survey suggests that 73% of economically stressed employees are more inclined to be drawn to employers who prioritize their monetary well-being. This statistic highlights the need for organizations to utilize financial restructuring consulting services proactively, ensuring not only their economic stability but also the well-being of their workforce. Furthermore, mandatory segment disclosure enhances market efficiency by increasing information volume, improving shareholder monitoring, and reducing agency conflicts, reiterating the importance of financial restructuring consulting services during turbulent times.

Our pragmatic approach to data ensures we test every hypothesis to deliver maximum return on invested capital in both the short and long term, while also supporting a shortened decision-making cycle throughout the turnaround process.

Benefits of Financial Restructuring Consulting for Businesses

Utilizing expert financial restructuring consulting services can provide organizations with significant advantages, including improved cash flow, enhanced financial stability, and heightened operational efficiency. In the context of an increasingly complex commercial landscape driven by globalization, technological advancements, and evolving regulations, it becomes essential for organizations to adapt strategically. Our structured client engagement process begins with a comprehensive review to align key stakeholders, ensuring that we understand your organization beyond the numbers.

This initial phase is crucial for identifying underlying issues and developing a plan to mitigate weaknesses while reinforcing key strengths. Furthermore, we emphasize the 'Update & Adjust' aspect by continually monitoring success through our client dashboard, which provides real-time analytics to diagnose your organization's health. By supporting a streamlined decision-making cycle throughout the turnaround process, we empower your team to take decisive action swiftly, preserving your organization with actionable insights.

This proactive approach not only preserves cash but also reduces overall liabilities. Companies that effectively implement these strategies often emerge from periods of economic distress with robust, sustainable business models that facilitate long-term growth and profitability. Furthermore, these consulting services enhance stakeholder confidence; as Brian from M&I notes, 'elite and local boutiques are instrumental in providing the necessary financial acumen during transitions.'

Handling inconclusive data insights is essential, as effective management strategies can meet stakeholder expectations and align with organizational changes. Statistics indicate that smaller and more rural healthcare providers are at the greatest risk of default and reorganization, highlighting the necessity for financial restructuring consulting services in these sectors. By implementing lessons learned and utilizing external expertise, organizations show a commitment to tackling monetary challenges responsibly, ultimately resulting in a more resilient organizational framework.

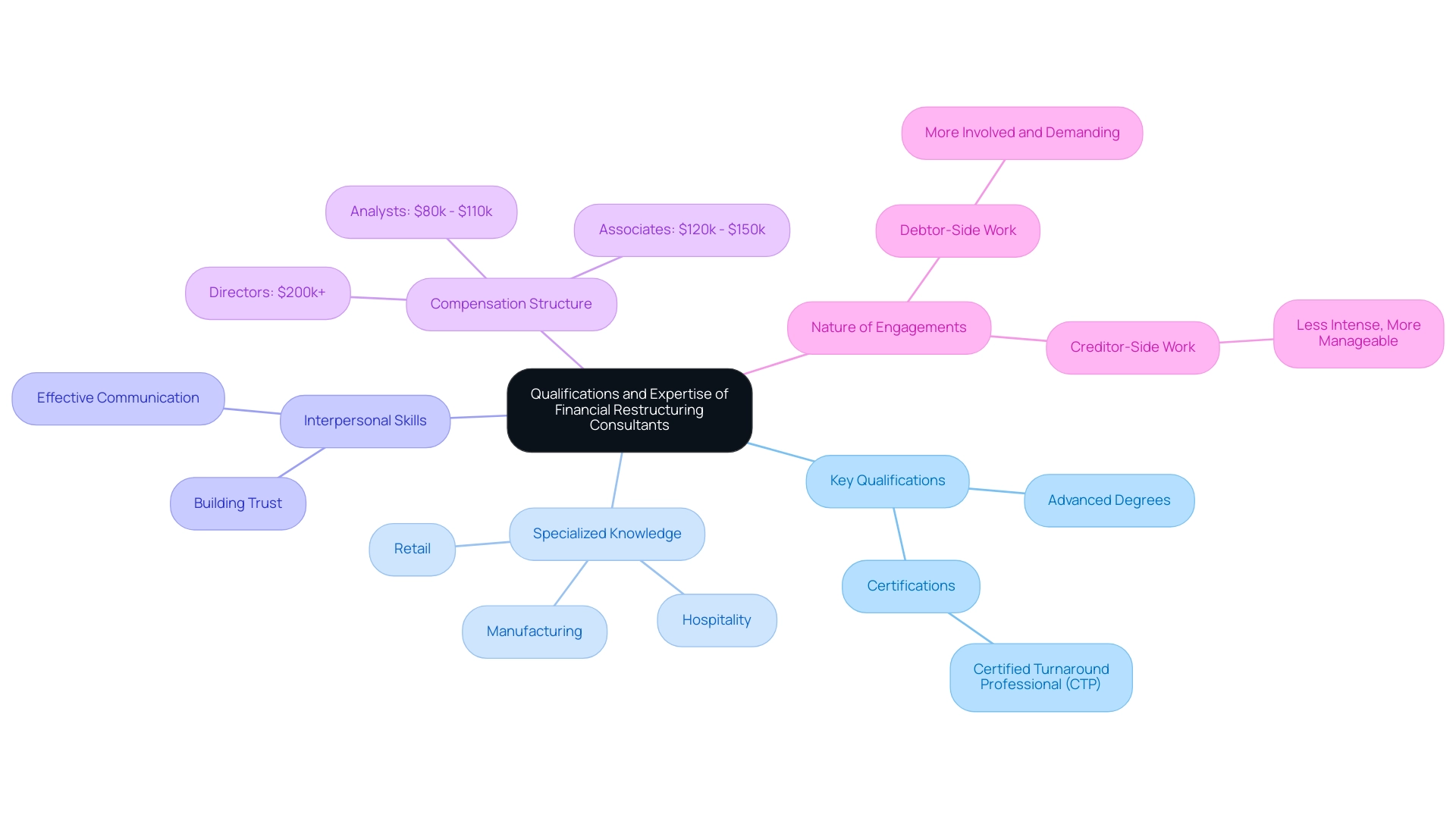

Qualifications and Expertise of Financial Restructuring Consultants

Financial restructuring consulting services provided by specialists are essential assets in turnaround situations, equipped with a unique mix of financial expertise, industry knowledge, and practical experience. Key qualifications for these professionals typically encompass:

- Advanced degrees in finance or management

- Professional certifications such as the Certified Turnaround Professional (CTP)

This certification signifies a professional's commitment to the field and enhances their credibility within the industry.

Notably, individuals like Peter Griscom, M.S., a leading business integration and turnaround expert in manufacturing and technology, and Jason Collyer, recognized as one of the Top 100 COOs with expertise in defense, aviation entrepreneurship, and supply chain transformation, exemplify the caliber of professionals sought in this field. Jason Collyer has notably spearheaded important initiatives that improved operational efficiencies and generated substantial revenue growth in intricate environments.

A proven history of successful financial restructuring consulting services sets apart leading advisors, demonstrating their capability to navigate complex economic landscapes. Effective advisors often bring specialized knowledge tailored to specific sectors, including:

- Retail

- Hospitality

- Manufacturing

This allows them to confront industry-specific challenges with targeted strategies. For example, a specialist with retail experience may better grasp consumer behavior nuances and supply chain disruptions, offering actionable insights that facilitate recovery.

Interpersonal skills are also essential for advisors, as they often interact with clients who may be distrustful or hostile due to their economic situations. Establishing trust and rapport can significantly influence the success of organizational changes. Additionally, understanding the nature of engagements is vital; debtor-side work tends to be more demanding and involved compared to creditor-side work, which may offer a more manageable lifestyle but still requires strong analytical skills.

This distinction can affect the choice of advisors based on the particular requirements of the organization.

By choosing advisors who have these essential qualifications and specialized knowledge, organizations greatly enhance their chances for successful economic recovery through financial restructuring consulting services in an increasingly competitive market. Furthermore, compensation for consultants at various levels reflects the investment businesses make in securing top talent for their restructuring efforts:

- Analysts earning $80k - $110k

- Associates earning $120k - $150k

- Directors earning $200k+

This compensation structure underscores the importance of hiring experienced professionals to navigate the complexities of financial recovery.

Conclusion

Navigating financial challenges requires a proactive approach, and engaging financial restructuring consulting services can be a game-changer for organizations facing adversity. These specialized consultants provide critical expertise to help businesses reorganize their financial structures, optimize cash flow, and enhance overall health. By conducting thorough assessments and implementing targeted interventions, they empower companies to address immediate concerns while establishing a foundation for long-term resilience.

The benefits of consulting services extend beyond immediate financial stabilization. They facilitate the development of tailored turnaround strategies, improve operational efficiencies, and foster stakeholder confidence. In an environment where bankruptcies are on the rise, the strategic insights offered by these experts are invaluable. Their ability to communicate effectively and manage expectations is essential for navigating the complexities of restructuring, ensuring that all parties remain aligned and informed throughout the process.

Ultimately, the value of financial restructuring consultants lies in their capacity to transform challenges into opportunities for growth. By leveraging their expertise, organizations can emerge stronger, more agile, and better equipped to thrive in an increasingly competitive landscape. Engaging these professionals not only serves to mitigate financial distress but also positions businesses for sustainable success in the future. Taking decisive action today can pave the way for a more secure and prosperous tomorrow.

Frequently Asked Questions

What are financial restructuring consulting services?

Financial restructuring consulting services provide specialized advisory support for small to medium organizations facing monetary challenges, helping them reorganize their financial structures, optimize cash flow, and enhance overall financial health.

Why have financial restructuring consulting services become more crucial in 2023?

In 2023, there has been a notable 68% rise in bankruptcies compared to the previous year, indicating a return to normalized levels post-stimulus, which has increased the demand for financial restructuring consulting services.

What key areas do financial restructuring consulting services focus on?

They focus on cash preservation and risk mitigation strategies, which help businesses save money and grow revenues.

What strategies might be implemented during financial restructuring?

Strategies may include negotiating with creditors, reorganizing debt, and implementing operational changes to stabilize the organization and facilitate recovery.

What is the Rapid-30 process?

The Rapid-30 process provides interim management services that offer hands-on executive leadership for crisis resolution and transformational change, enabling quick and effective decision-making.

How important is communication during the restructuring process?

Effective communication is crucial, particularly when data insights are inconclusive, as it helps manage stakeholder expectations during the restructuring process.

What initial steps are involved in the client engagement process for restructuring?

The initial steps include observing and evaluating the current organizational situation, identifying underlying issues, and planning strategic interventions.

How much did U.S. companies invest in corporate reorganization in 2022?

In 2022, U.S. companies allocated US$ 8.4 billion to corporate reorganization, highlighting the necessity for clear communication and realistic expectation management.

What is the significance of operationalizing lessons learned from the turnaround process?

Operationalizing lessons learned reinforces strong, lasting relationships with stakeholders and helps organizations adapt turnaround strategies to align monetary objectives for stability and growth.