Introduction

To navigate the complex economic landscape and maintain a competitive edge, businesses must leverage leading indicators. These predictive metrics offer a glimpse into future performance and financial health, empowering CFOs to proactively manage their organizations towards success. Unlike lagging indicators, leading indicators act as a financial foresight tool, allowing decision-makers to anticipate changes and adapt strategies accordingly.

In this article, we will explore the innovative approaches CFOs can implement to uncover disruptive business models, review operational efficiency and supply chain management, and address potential anomalies and emerging market trends. We will also discuss the benefits of incorporating leading indicators into cost accounting frameworks, the characteristics of effective leading indicators, and examples of key metrics to consider. Additionally, we will explore best practices for implementing leading indicators in organizations and common challenges faced, along with their solutions.

By harnessing the power of leading indicators, CFOs can enhance their financial management strategies and drive sustainable growth.

Understanding Leading Indicators

To navigate the complex economic landscape and maintain a competitive edge, it's essential for businesses to leverage leading indicators. These predictive metrics offer a glimpse into future performance and financial health, allowing CFOs to proactively manage and steer their organizations towards success. Unlike lagging indicators, which reflect past achievements, leading indicators act as a financial foresight tool.

They empower decision-makers to anticipate changes and adapt strategies accordingly.

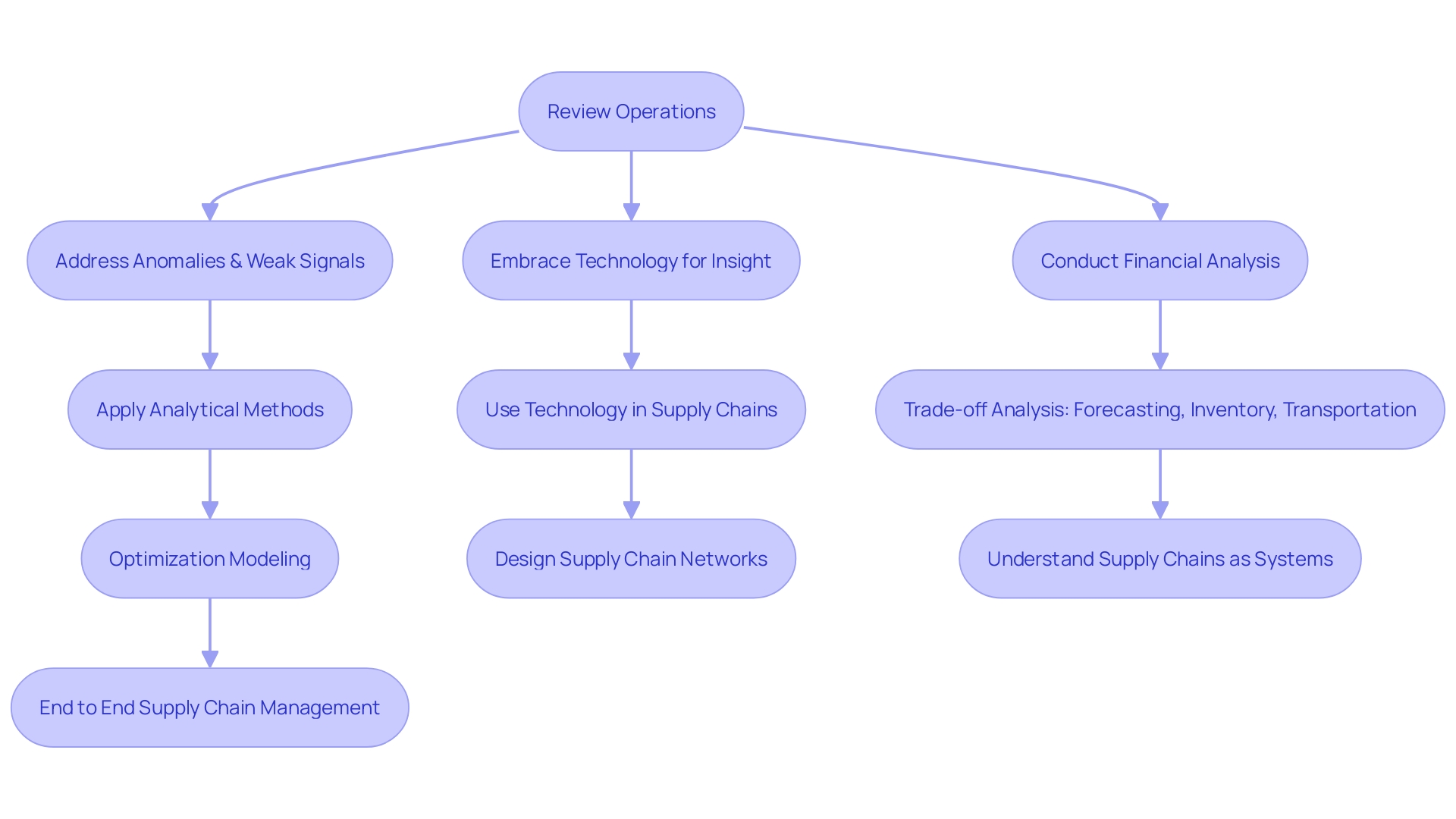

What innovative approaches did we implement, and how effective were they? Operational Efficiency and Supply Chain Management Review your operations and supply chain management. Ask yourself, "How efficient were our operations and supply chain processes?"

Addressing potential anomalies and weak signals—such as unexplained shifts in financial performance or emerging market trends—can be the key to uncovering disruptive business models ahead of the curve.

Start with four guiding principles. Pay close attention to the peripheries of your industry for early signs of change, emerging markets, or novel consumer behaviors that may indicate a pivot point. Embrace technology for insight, and critically analyze your financial performance by reviewing statements and assessing factors like revenue growth and cost management.

This comprehensive analysis is pivotal for informed decision-making and strategic financial planning.

CFOs should remain vigilant, not just to data confirming existing trends, but to unexpected events that may signal significant shifts. By doing so, they can ensure the consistent application of accounting standards, capture market developments, and maintain the transparency and comparability crucial in today's global business environment.

Benefits of Leading Indicators

Incorporating forward-looking metrics into your cost accounting framework can significantly enhance your company's fiscal health and agility. These predictive indicators serve as an early alert system for potential financial disturbances, giving you the lead time to mitigate issues before they become more severe. They also play a crucial role in pinpointing opportunities for operational improvements, allowing for timely adjustments to enhance efficiency and effectiveness.

Moreover, leading indicators are instrumental in gauging your progress towards financial objectives, enabling you to refine strategies dynamically to achieve desired outcomes.

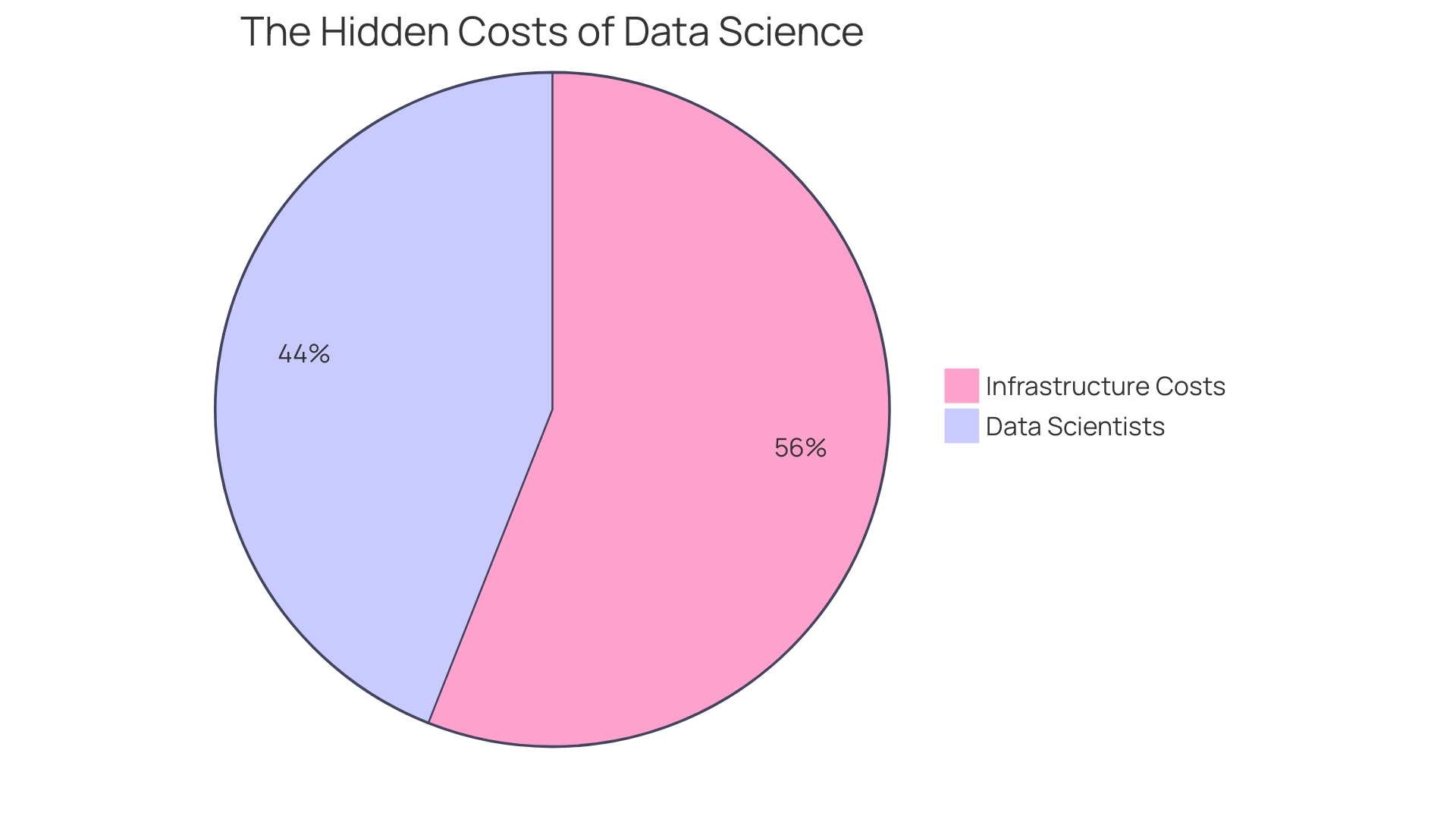

To illustrate, let's consider the implementation of cross-departmental collaboration in cost management. By involving both financial and technology teams, organizations ensure a comprehensive understanding of the cloud consumption model, purchasing options, and billing cycles. This integration of knowledge between finance and technology not only streamlines financial management but also fosters an environment where technology investments are directly correlated with business results.

Furthermore, in the realm of operational efficiency, reports highlight an increasing trend in companies investing in technologies like AI to not only maintain discipline in expenses but also to drive future productivity. This is especially relevant in sectors such as software, professional services, health care services, and financial services, where firms are actively seeking ways to protect margins in anticipation of a stable economic trajectory.

In practice, the strategic use of leading indicators, combined with a clear understanding of dynamic financial management and technological advances, can result in significant savings and improved organizational efficiency. For instance, one case study revealed that reassessing cost management practices and addressing anti-patterns led to a long-term reduction of expenses by over 30% by the third year. Such real-world examples underscore the value of proactive financial strategies in achieving sustainable cost optimization.

Characteristics of Effective Leading Indicators

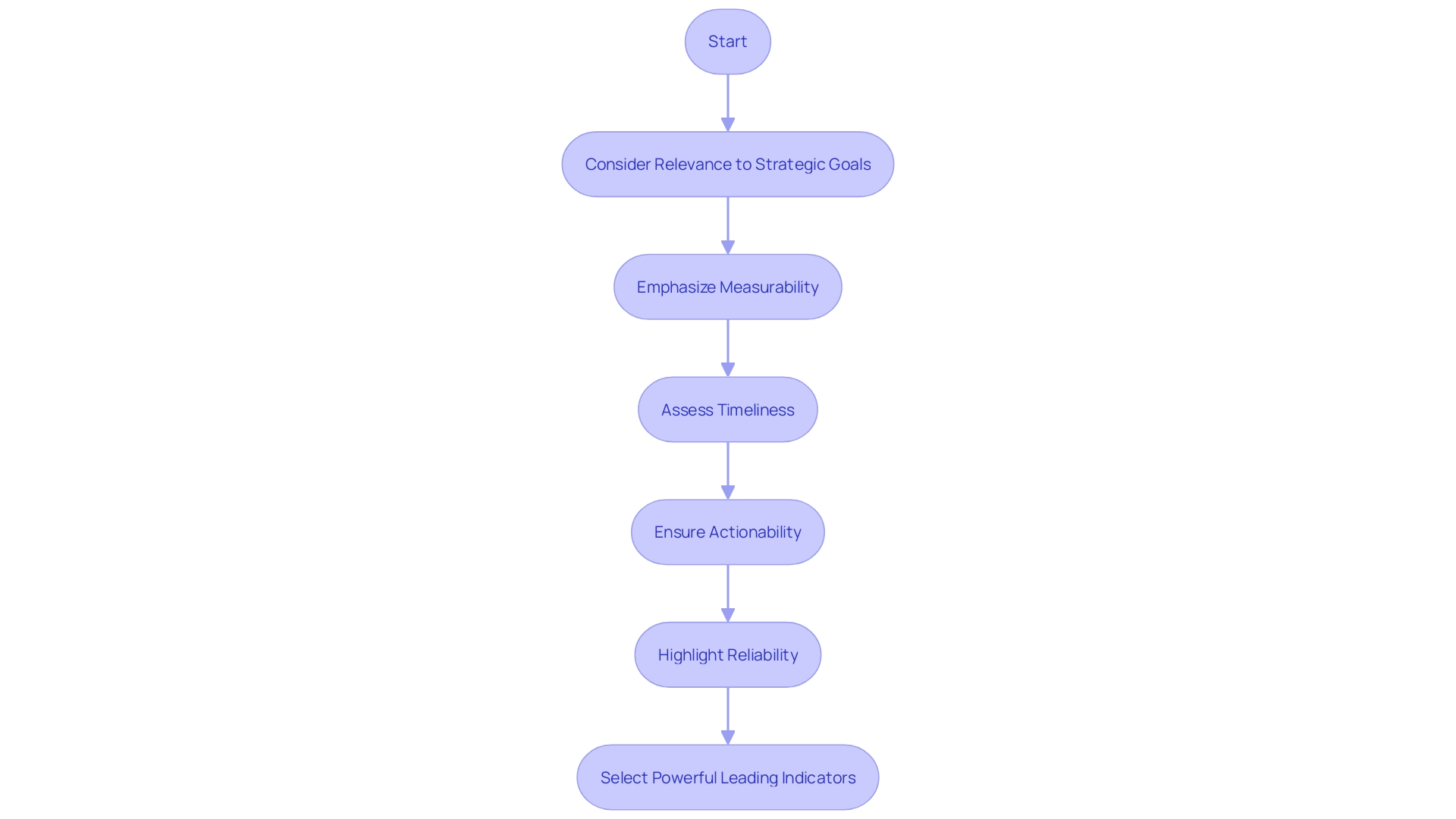

When integrating leading indicators into cost accounting practices, it's pivotal to select metrics that not only align with strategic objectives but can also be effectively acted upon. Here are key attributes to consider for powerful leading indicators:

-

Relevance: A leading indicator must have a clear connection to the strategic goals. For example, for a new product's success, a leading indicator might be daily user engagement patterns, as seen in the synergy between swipes and clicks in a mobile app.

-

Measurability: Quantifiable metrics are necessary to objectively assess progress. As the New York Federal Reserve emphasizes, maintaining a competitive banking system involves measurable standards for industry and payment services.

-

Timeliness: Indicators must provide prompt insights to inform proactive strategies. The dynamic nature of financial reporting, with different companies using varied methods to calculate operating profit, underscores the need for up-to-date and adaptable metrics.

-

Actionability: The insights from leading indicators should prompt specific actions. This could involve tracking the on-time delivery record of teams or assessing value creation for customers, thereby influencing immediate decision-making.

-

Reliability: Dependable data sources and methodologies form the bedrock of reliable indicators. This is mirrored in the historical evolution of accounting, from the Mesopotamians tracking crops and herds to the modern-day consistent application of IFRS Accounting Standards.

By focusing on these characteristics, cost accountants can ensure their leading indicators are not only reflective of performance but also instrumental in driving strategic decisions and enhancing overall financial management.

Examples of Leading Indicators

Optimizing financial health through cost accounting extends beyond mere number-crunching; it involves strategic analysis of various indicators that can forecast business performance. Let's delve into some pivotal metrics:

-

Sales Pipeline: By scrutinizing both the quantity and caliber of leads in the sales pipeline, CFOs can derive valuable predictions on potential revenue expansion. This is crucial for financial planning and aligns with the Rule of X, advocating for growth while being cost-conscious.

-

Customer Satisfaction: Metrics on customer satisfaction serve as harbingers of customer loyalty and retention. Consistent application of standards, as emphasized at the World Standard-setters Conference, underpins the reliability of such metrics.

-

Employee Training: The proportion of employees completing training programs is an insight into future enhancements in productivity and performance. This factor is grounded in the long-standing tradition of balancing operational costs with strategic investments in human capital, as discussed in historical contexts by luminaries like James O McKinsey.

-

Cost Variance: Diving into cost variance analysis not only illuminates potential savings but also exposes areas prone to cost overruns, offering a chance for preemptive measures.

-

Inventory Turnover: The speed at which inventory moves reflects both demand levels and supply chain efficiency. As the Mesopotamians and Luca Pacioli laid the groundwork for systematic financial tracking, modern CFOs can leverage similar principles to gauge operational health.

These indicators, when analyzed thoughtfully, allow businesses to navigate the complex terrain of financial management with foresight and precision.

Implementing Leading Indicators in Your Organization

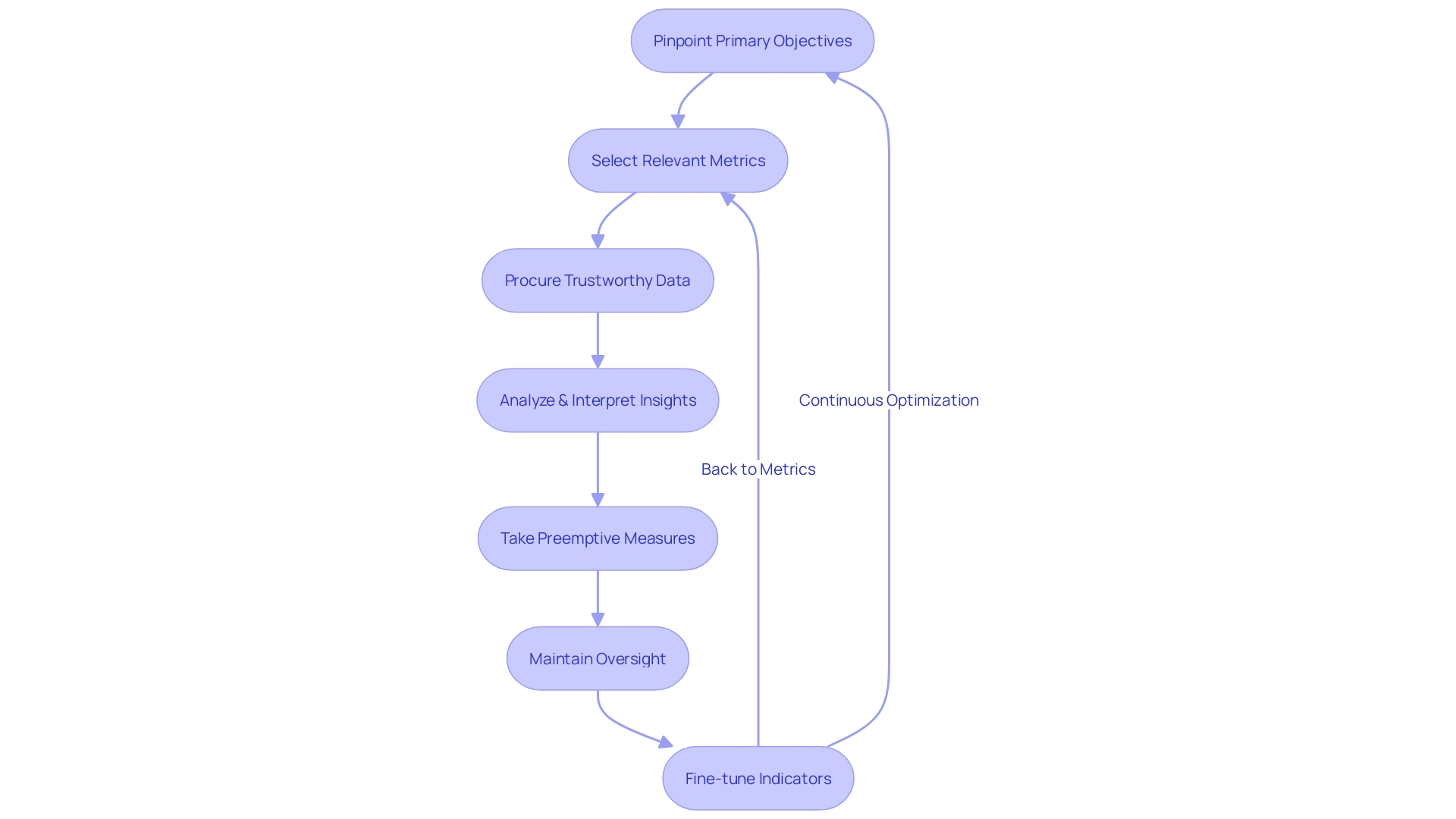

Enhancing your cost accounting practices with leading indicators involves a strategic approach to achieve cost optimization and financial management. Begin by pinpointing your primary objectives that you wish to evaluate and foster through these indicators. Next, select pertinent metrics that correspond with your goals and can be quantified effectively.

It's essential to procure data from trustworthy sources, ensuring its precision and uniformity.

Delve into data analysis to extract significant insights, and interpret these findings to guide your decision-making process. Utilizing the insights, take preemptive measures to encourage favorable outcomes. Lastly, maintain vigilant oversight of these indicators, fine-tuning them as necessary to enhance performance.

Substantiating these steps, consider the IDP case study within the Cost Optimization pillar of the Well-Architected Framework, which highlights the continuous nature of cost optimization across a workload's lifecycle. Similarly, AT&T's transformation, prompted by the need to address inefficiencies, serves as a prime example of the importance of evolving cost management strategies.

In light of the Financial Accounting Standards Board's recent vote to update reporting requirements for software costs, it's evident that modernizing accounting practices is crucial. This reflects the ongoing changes in financial accounting, where cost accounting offers a focused classification of costs to manage and control them effectively, as opposed to the broader financial transaction records.

Remember that cost accounting systems have been successfully applied across various industries, such as steel production, where standard cost accounting helps identify discrepancies between expected and actual costs. Embracing these principles can lead to substantial long-term savings and enhanced organizational efficiency, avoiding common pitfalls and focusing on productivity improvements.

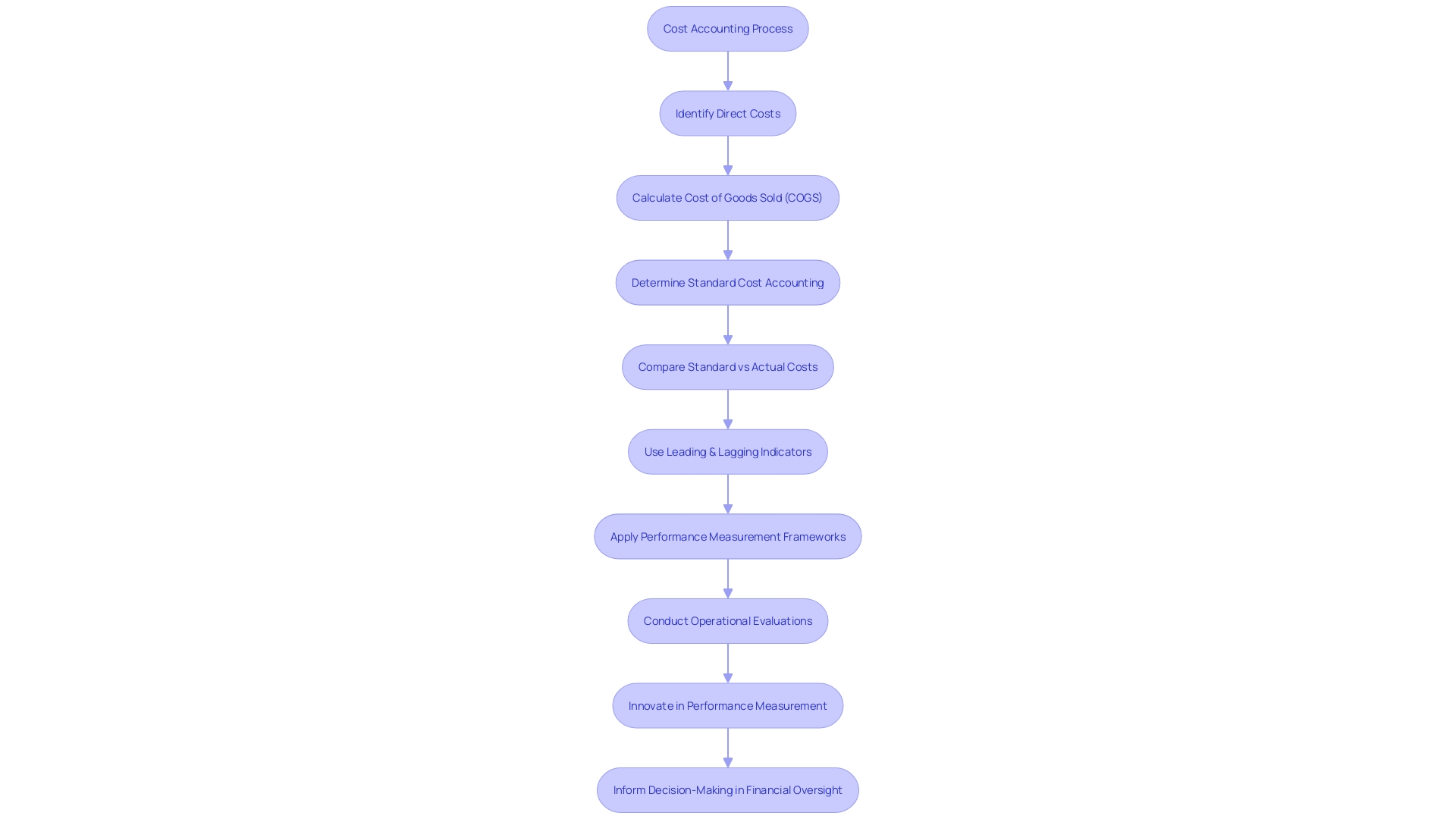

Combining Leading and Lagging Indicators for Comprehensive Performance Measurement

In the realm of financial oversight, CFOs are tasked with steering their organizations through the complexities of economic performance, leveraging both leading and lagging indicators. Leading indicators, akin to a compass, guide proactive strategic maneuvers, while lagging indicators serve as the historical ledger, chronicling outcomes and trends. The art and science of cost accounting necessitate an intricate dance between these two metrics.

By meticulously synthesizing leading indicators with their lagging counterparts, CFOs can sculpt a comprehensive tableau of their enterprise's fiscal vitality. This dual-lens approach empowers them to make astute, evidence-based decisions. As research has proliferated across sectors—from academia's scrutiny of performance measurement to the dynamic shifts in healthcare consulting—CFOs can draw on these diverse insights to refine their cost accounting practices.

A recent wave of literature underscores the necessity for robust performance measurement frameworks that transcend mere efficiency, urging a pivot towards effectiveness and practical implementation. This echoes the sentiment from the field of operations and supply chain management, which calls for dynamic, rather than static, performance measurement systems that can adapt to rapid organizational changes.

The financial consulting arena has seen an uptick in engagements aimed at boosting fiscal performance, with clients reaping the fruits of enhanced efficiency and cost reductions. This mirrors the necessity for CFOs to seek operational evaluations that not only increase revenue but also judiciously manage expenditures.

In an era where the academic maturity of performance measurement is questioned and the call for empirical verification of theoretical foundations grows louder, CFOs can no longer rely on antiquated frameworks. Innovations in performance measurement, including the examination of intangible assets and the measurement of performance across supply chains, beckon a new chapter in cost accounting—one that is dynamically aligned with the holistic health of an organization and responsive to the ever-evolving economic landscape.

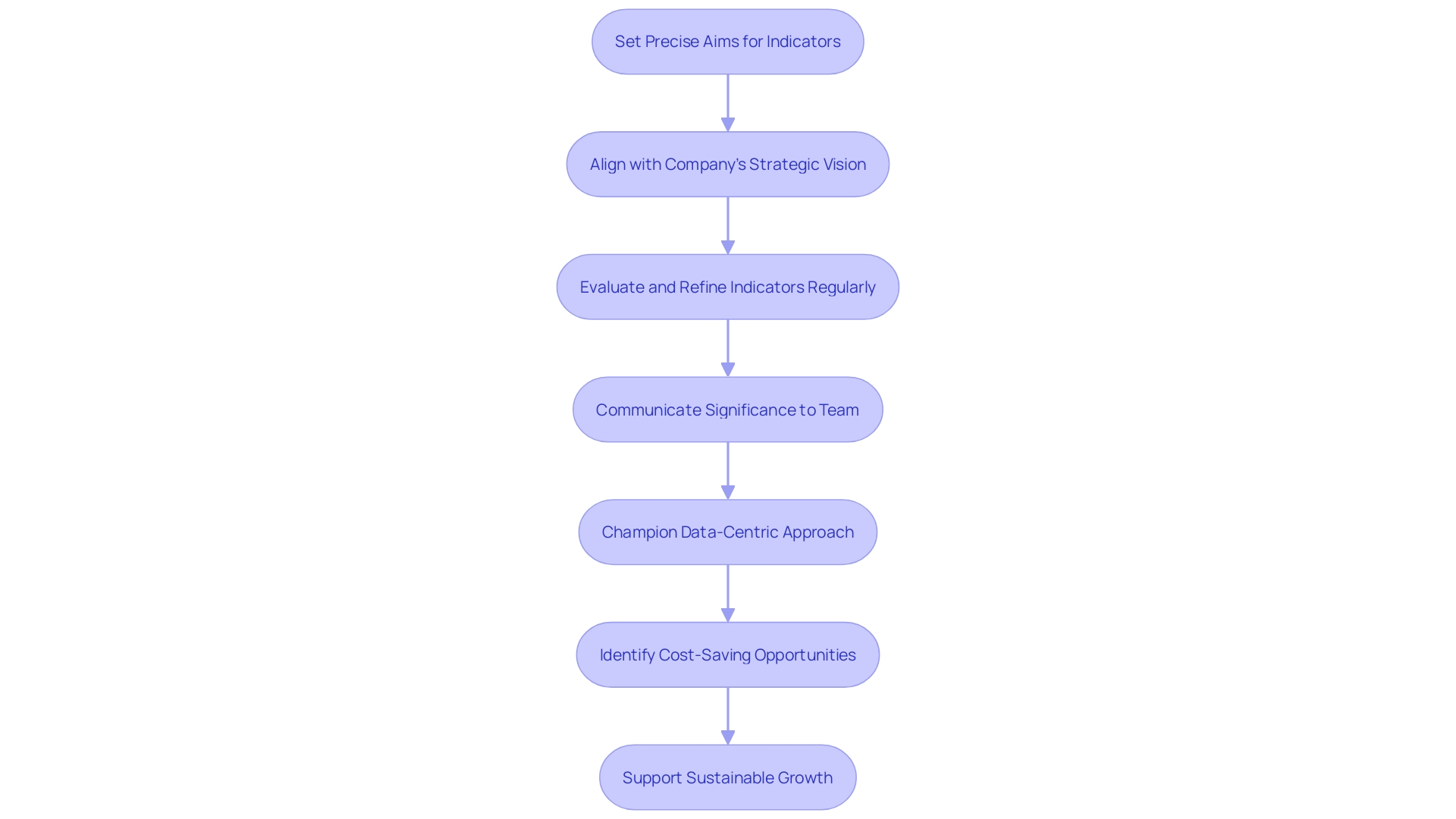

Best Practices for Using Leading Indicators

To harness the full potential of leading indicators in cost accounting, it's vital to integrate them seamlessly into your company’s financial strategies. Start by setting precise aims for what you hope to achieve with these indicators. This could range from sharpening budget forecasts to enhancing operational efficiency.

Next, ensure these indicators are in sync with your company's strategic vision. This harmonization helps to steer your operations in the desired direction. Be vigilant—regularly evaluate and refine these indicators to maintain their relevance and potency in an ever-evolving market landscape.

Communication is key. Make sure that your team understands the significance of these indicators. Provide comprehensive training to empower them with the knowledge to interpret and leverage this valuable data effectively.

Lastly, champion a data-centric approach within your organization. This mindset fosters informed decision-making and cultivates an environment where data is the cornerstone of strategic planning.

By adopting such practices, you’re not just managing numbers; you’re weaving cost accounting into the very fabric of your business, enabling you to pinpoint cost-saving opportunities and drive sustainable growth.

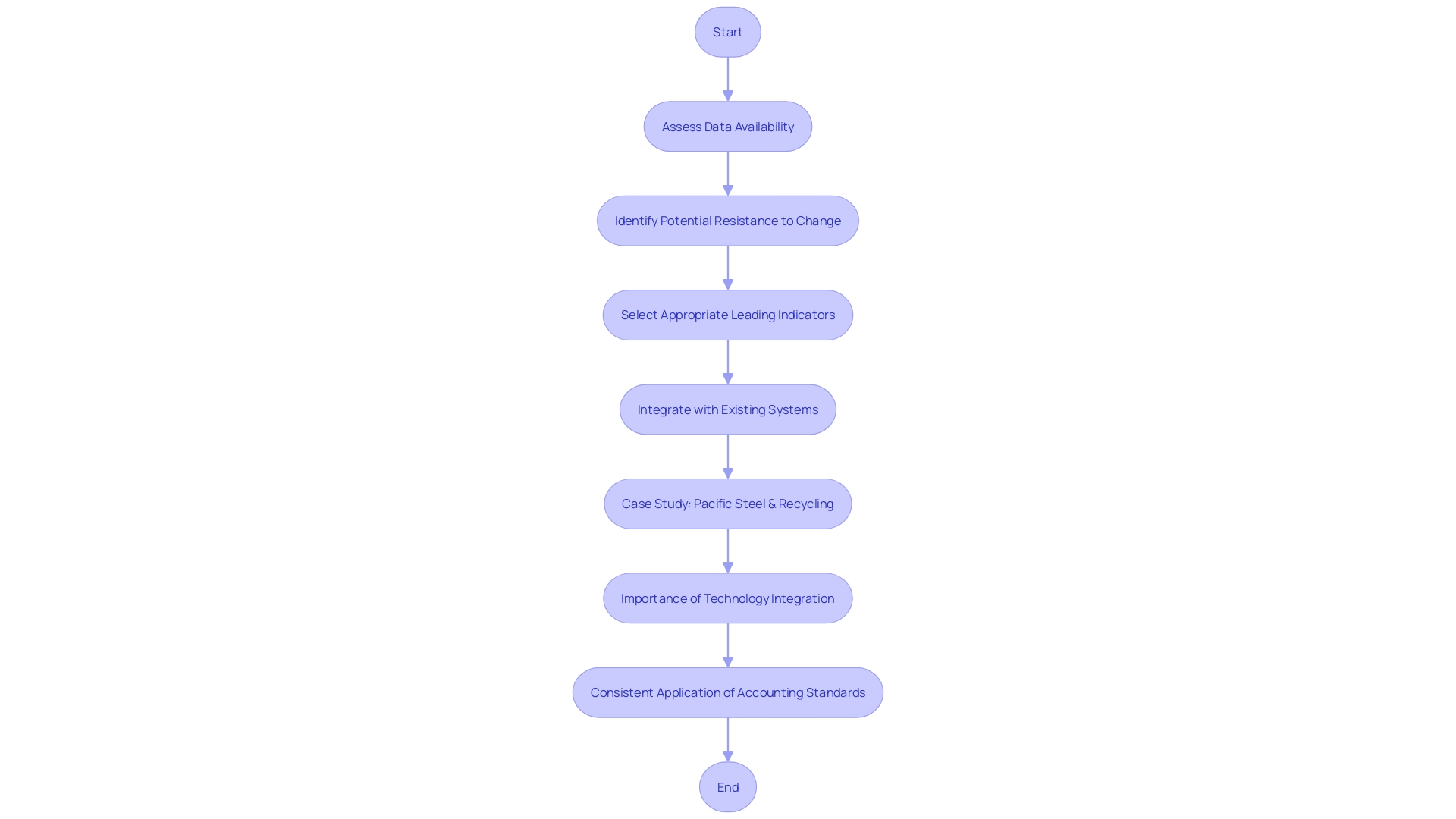

Common Challenges and Solutions in Implementing Leading Indicators

Implementing leading indicators in your cost accounting framework is pivotal for proactive financial management. However, it's not without its hurdles:

-

Data Availability: It's crucial to have accurate and reliable data for measuring leading indicators. This is where robust data management practices come into play, ensuring data integrity and accessibility.

-

Resistance to Change: Change is often met with resistance. A successful transition to a new system requires comprehensive change management strategies. These not only facilitate smoother adoption but also promote a culture that values proactive metrics.

-

Selecting the Right Metrics: The essence of leading indicators lies in their relevance and impact. Involving stakeholders in the selection process can garner support and ensure the metrics chosen are aligned with the company's strategic goals.

-

Integration with Existing Systems: Seamless integration of new indicators with existing cost accounting systems is essential for coherence. Working alongside IT departments can bridge gaps between new initiatives and legacy systems, ensuring a unified approach.

The case of Pacific Steel & Recycling is a testament to the power of transparent data and effective change management. By severing ties with traditional networks and adopting a reference-based pricing system, the company was able to dramatically cut healthcare costs, thanks to a deep dive into insurance claims data and an open dialogue with employees.

Furthermore, as businesses prepare for economic recovery, the integration of technology and forecasting tools is paramount to streamline efficiency and agility. A centralized approach to these integrations can prevent redundancies and support cost-effective operations, much like how health systems can manage clinical engineering costs by standardizing processes across the organization.

Keynes's perspective on asset pricing highlights the subjective nature of value, resonating with the need for businesses to deploy leading indicators that reflect future financial health rather than just historical data. As the 22nd World Standard-setters Conference emphasized, the consistent application of accounting standards is critical, and by extension, so is the consistency of leading indicators in cost accounting.

Ultimately, decision-making in high-pressure environments necessitates a balance between speed and data integrity, as shown in the Statistics Under Pressure initiative. Just as compromises are made to inform policy, so must they be in cost accounting to ensure timely and effective financial strategies.

Conclusion

In conclusion, leveraging leading indicators is crucial for businesses to navigate the complex economic landscape and maintain a competitive edge. These predictive metrics offer a glimpse into future performance and financial health, empowering CFOs to proactively manage their organizations towards success.

Throughout this article, we explored innovative approaches for CFOs to uncover disruptive business models, review operational efficiency and supply chain management, and address potential anomalies and emerging market trends. By incorporating leading indicators into cost accounting frameworks, CFOs can enhance fiscal health, identify opportunities for improvement, and track progress towards financial objectives.

Effective leading indicators possess key attributes such as relevance, measurability, timeliness, actionability, and reliability. CFOs must select metrics that align with strategic goals and can drive informed decision-making and overall financial management.

We provided examples of leading indicators, such as sales pipeline, customer satisfaction, employee training, cost variance, and inventory turnover. These metrics, when analyzed thoughtfully, provide valuable insights for navigating financial management with foresight and precision.

Implementing leading indicators requires setting precise aims, aligning indicators with strategic vision, regularly evaluating and refining metrics, and fostering a data-centric approach. By adopting these best practices, CFOs can integrate leading indicators seamlessly into their financial strategies and drive sustainable growth.

In summary, by combining leading and lagging indicators, CFOs can gain a comprehensive understanding of their enterprise's fiscal vitality. This dual-lens approach enables them to make evidence-based decisions and navigate the complexities of the economic landscape. By harnessing the power of leading indicators, CFOs can enhance financial management strategies and drive sustainable growth for their organizations.