Introduction

Management accounts are essential financial reports that provide a comprehensive view of a company's operational health and guide strategic decision-making. Unlike statutory accounts, which fulfill external legal requirements, management accounts serve as an internal compass for businesses. These reports offer a granular breakdown of revenues, expenses, cash flows, and other key financial metrics, enabling leaders to navigate through complex financial landscapes.

In today's fast-paced business environment, where agility is paramount, the timely and precise insights provided by management accounts are invaluable. They not only showcase a company's financial acumen but also reflect its commitment to transparency and strategic growth. By informing investment decisions and offering a real-time view of financial performance, management accounts empower businesses to make informed decisions that align with their long-term objectives and operational needs.

With their various components, management accounts remain an indispensable tool for companies to navigate the complex financial terrain and foster sustainable growth and stability.

What Are Management Accounts?

Management accounts are bespoke financial reports crafted to shed light on a company's operational health and guide pivotal strategic decisions. While statutory accounts satisfy external legal requirements, management accounts serve as an internal compass for steering a business towards its goals. Assembling management accounts, akin to a trifecta of engineering, product, and UX teams working in unison, blends diverse expertise to generate actionable insights. These reports often include a granular breakdown of revenues, expenses, cash flows, and other key financial metrics.

The importance of management accounts is underscored by the fact that, much like how Toyota's Woven Planet initiative required a clear vision and structured approach, businesses too need clarity and discipline in their financial strategies. A study revealing that over 6000 researchers lacked support with data sharing echoes the need for robust management frameworks, which management accounts provide. They enable businesses to navigate through complex financial landscapes, akin to the way Dr. Aamir Hussain at De Montfort University developed a suite of support materials to foster a research data management community with limited resources.

In today's fast-paced business environment, where the National Living Wage is set to increase, and innovative projects like the first transatlantic green fuel flight are taking off, the agility provided by timely and precise management accounts is invaluable. These reports are not only a testament to a company's financial acumen but are also a reflection of its commitment to transparency and strategic growth. They inform investment decisions, similar to how companies integrate alternative data, which involves overcoming cultural challenges and stakeholder resistance over a span of two to three years, as per statistics on alternative data integration in the investment process.

Ultimately, management accounts are a powerful tool in the arsenal of any business, enabling leaders to 'decide, not fight' their financial challenges, as George C. Marshall famously advised. They offer a comprehensive, real-time view of financial performance, which is essential for making informed decisions that align with the company's long-term objectives and operational needs.

Key Components of Management Accounts

Management accounts serve as the backbone for a company's financial analysis and strategic planning. These accounts consist of essential components that together paint a comprehensive picture of the business's fiscal well-being. The Income Statement is the financial narrative of the company over a period, detailing revenue and expenses and culminating in the net profit or loss. The Balance Sheet, on the other hand, is akin to a financial photograph, capturing the state of the company's assets, liabilities, and shareholders' equity at a specific moment in time.

A crucial tool for understanding a company's solvency is the Cash Flow Statement. It meticulously records the cash moving in and out, offering insights into the company's liquidity and cash reserves. This statement is especially pertinent considering that a recent IASB study highlighted the diverse methodologies companies employ when reporting financial performance, emphasizing the need for standardized practices.

Moreover, a company's pulse can be measured through Key Performance Indicators (KPIs). These quantifiable metrics shed light on the company's operational efficacy, such as sales growth and profitability. KPIs act as navigational beacons, guiding businesses towards their strategic objectives and enabling them to benchmark their performance against industry standards. According to recent statistics, embracing KPIs and other data-driven insights is crucial for businesses to maintain a competitive edge and secure long-term success.

As the financial landscape evolves, it becomes increasingly important for businesses to adopt tools and practices that offer clarity and precision in financial reporting. For instance, software startups and small businesses may find nuanced differences in account naming conventions based on their structure, as seen in the YNAB budgeting approach, which mandates a job for every dollar, reflecting the importance of specificity in financial management.

In conclusion, management accounts, with their various components, remain an indispensable tool for companies to navigate the complex financial terrain and make informed decisions that foster sustainable growth and stability.

Why Are Management Accounts Important?

Management accounts are essential tools that provide a clear picture of a company's financial health, influencing strategic decision-making at the highest levels. They serve several vital functions:

-

Performance Evaluation: By enabling a comparison of actual financial performance against budgets and forecasts, management accounts pinpoint areas needing improvement. This close scrutiny allows for timely adjustments to be made, aligning performance with business objectives.

-

Planning and Forecasting: Armed with a comprehensive analysis of past financial data and observable trends, businesses can craft realistic budgets, set achievable financial targets, and map out forward-thinking strategies. This foresight is pivotal for navigating the evolving business landscape.

-

Cash Flow Management: A robust understanding of cash flows is imperative for any business's longevity. Management accounts shed light on the intricacies of cash inflows and outflows, offering a foundation for solid cash flow planning and preemptive management.

-

Informed Decision-Making: The financial insights provided by management accounts are invaluable when evaluating the economic impact of various options. They empower management to select the most beneficial and profitable strategies.

In the dynamic world of business, where uncertainties like those faced by the Californian utilities in managing wildfire risks or the ambitious software projects like Toyota's Woven Planet can lead to significant economic repercussions, having a rigorous accounting framework is more crucial than ever. Furthermore, as CFOs become more involved in operations to boost efficiency and growth, the insights from management accounts become a lighthouse guiding through the complexities of financial decision-making.

Even as the landscape shifts—be it through innovative green technologies, evolving wage standards, or the need for enhanced research data management—management accounts remain the steadfast tool that helps businesses adapt and thrive. They not only facilitate the day-to-day financial operations but also enable businesses to anticipate and prepare for the future, ensuring that they are not just reactive but proactive in their financial stewardship.

How to Prepare Management Accounts

To craft management accounts that truly serve an organization's decision-making needs, a meticulous and tailored approach is key. Here's a refined strategy for developing these vital financial tools:

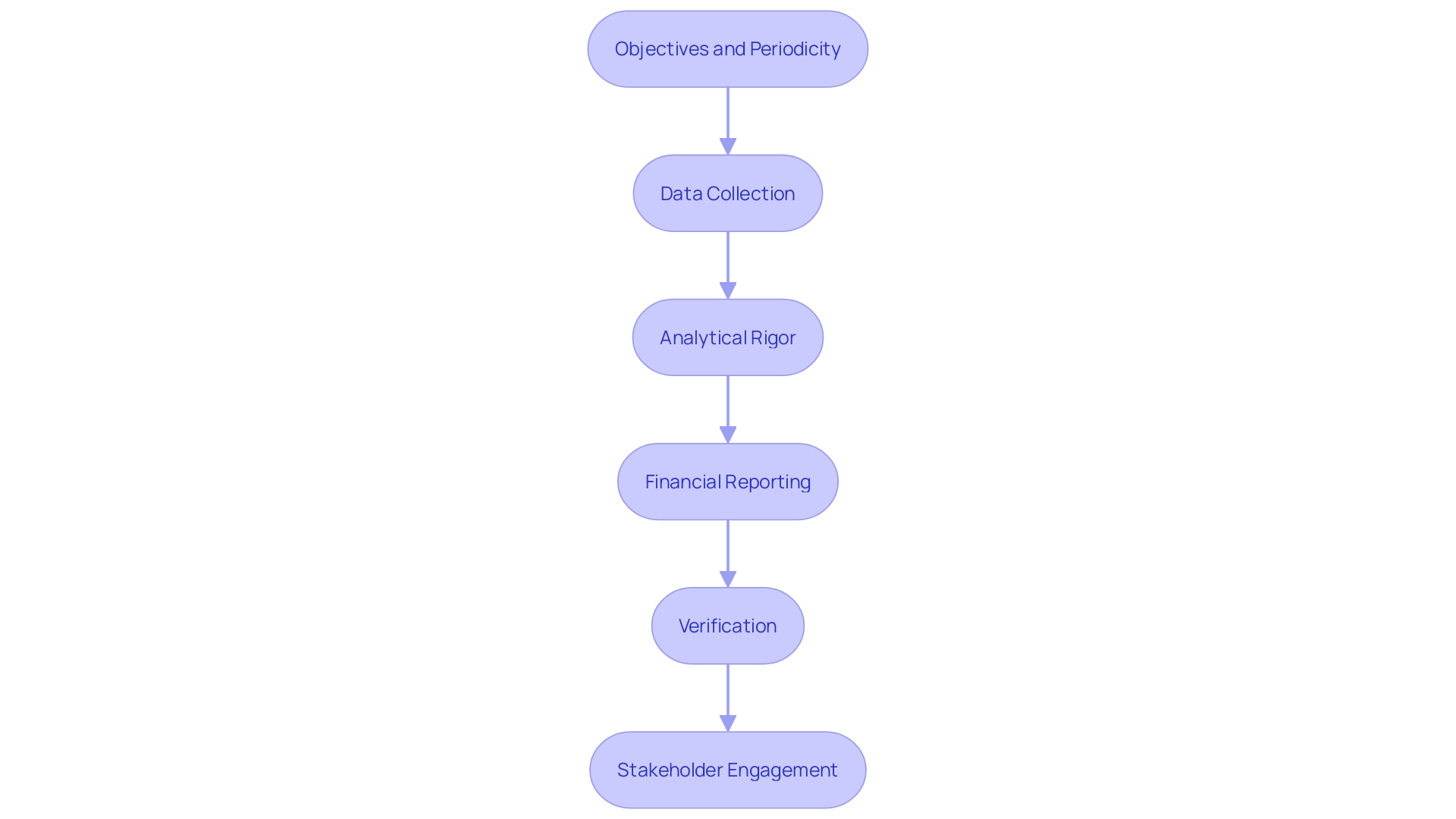

-

Objectives and Periodicity: Begin by pinpointing the exact purposes your management accounts will serve. Whether it's tracking monthly progress or providing quarterly insights, choose a reporting frequency that supports your strategic decision-making process.

-

Data Collection: Assemble all pertinent financial information—sales, expenditures, assets, obligations, and cash flow. This step is foundational; ensure the precision of your data by cross-verifying it with corroborating documents.

-

Analytical Rigor: Delve into the numbers to unearth trends, anomalies, and pivotal data points. This might involve juxtaposing actuals against budgets, evaluating financial ratios, or gauging segmental performance.

-

Financial Reporting: Synthesize the analyzed data into financial statements: the income statement, balance sheet, and cash flow statement. Don't hesitate to include supplementary reports or KPIs that sharpen the management's strategic vision.

-

Verification: Scrutinize your management accounts for thoroughness and accuracy. Confirm that the figures are in harmony with the broader financial records and backup documents.

-

Stakeholder Engagement: Communicate your findings to the stakeholders it concerns—CFOs, executives, department leaders. Present the insights succinctly, emphasizing the principal conclusions and suggesting clear, actionable next steps.

Incorporating these steps will help ensure that your management accounts are not only accurate but also resonate with the strategic needs of your business.

Common Elements Included in Management Accounts

Management accounts are bespoke financial snapshots that help businesses make informed decisions. Tailored to the specific needs of an industry or company, these reports typically include:

- Sales and Revenue: Indicating the success of sales initiatives and market demand, sales and revenue figures are pivotal for gauging financial performance.

- Cost of Goods Sold (COGS): COGS details the direct costs of producing goods or services, such as materials and labor, providing insight into the production efficiency.

- Operating Expenses: Spanning from rent to marketing, these are the costs necessary for daily business operations and can affect the company's operational efficiency.

- Gross Profit Margin: This metric, calculated by subtracting COGS from revenue and dividing by revenue, reflects the profitability from core business activities.

- Net Profit or Loss: The bottom line after all expenses reveals the business's overall profitability and financial health.

- Cash Flow: The cash flow statement, covering operating, investing, and financing activities, is essential for assessing liquidity and cash reserves.

To effectively manage these accounts, it is critical to have robust accounting software and a solid understanding of financial principles. As noted by industry experts, including Omar Choucair of Trintech, clean and updated books are the foundation of reliable financial statements. Moreover, the integration of digital applications can greatly enhance the accuracy and reliability of these financial reports.

The importance of understanding and managing these financial components cannot be overstated. As revenue has evolved into a term that signifies the collective effort of product, marketing, sales, and customer success teams, it is clear that an integrated approach is key to driving growth. This holistic perspective aligns with the sentiments expressed at the CEO Summit, emphasizing that growth stems from the collaborative efforts of the entire organization.

Furthermore, the data produced by a company's people, systems, and processes is a testament to its performance. As one quote suggests, numbers reflect the willingness of customers to pay for value and the efficiency of the systems that serve them. These metrics, devoid of emotional bias, present the actual performance of the business.

In a broader context, the role of accurate financial reporting is highlighted by trends in industries like insurance, where despite a global demand increase, the industry has faced a decline over the past five years. Efficient risk management services that insurance operators provide underscore the significance of safeguarding against potential losses, further showcasing the essential nature of precise financial analysis and management.

Difference Between Management and Statutory Accounts

Distinguishing between management accounts and statutory accounts is crucial for internal analysis and external reporting. Management accounts, crafted for internal decision-making, are produced frequently—monthly or quarterly—to reflect real-time financial health and guide managerial choices. They delve into finer financial details and may include Key Performance Indicators (KPIs) and non-financial metrics.

On the other hand, statutory accounts serve a legal purpose, addressing external stakeholders such as investors and regulatory bodies, and are compiled annually. These obey strict reporting standards to ensure transparency and consistency.

The depth of management accounts allows for tailored insight, often integrating various reports and data analyses, while statutory accounts present a standardized financial snapshot. The legal obligations that govern statutory accounts ensure external stakeholders rely on verified information, unlike the more flexible and internally focused management accounts that can be customized to suit specific organizational needs.

Benefits of Using Management Accounts

Management accounts serve as a cornerstone for solid business decision-making, offering a range of advantages that propel a company's growth and efficiency. For instance, they furnish businesses with timely and accurate financial data crucial for making informed strategic decisions, such as pinpointing areas ripe for improvement or assessing the fiscal outcomes of various paths. This allows companies to navigate towards enhanced profitability and expansion with confidence.

A key benefit of management accounts is their role in bolstering financial planning. By studying historical data and identifying trends, these accounts contribute to setting realistic budgets, forecasting future performance, and judiciously allocating resources. This analytical approach informs more strategic planning and helps in steering the business towards its financial targets.

Moreover, management accounts are instrumental in the early detection of potential issues, enabling businesses to act swiftly and avert adverse effects. By keeping a close watch on key performance indicators and financial metrics, management is equipped to undertake proactive steps to mitigate challenges.

Accountability is another area where management accounts play a pivotal role. They enable the tracking of individual, team, and departmental performance against the organization's broader goals and objectives. This regular review helps ensure that all parts of the business are contributing effectively to the collective aims.

Lastly, management accounts facilitate communication across various stakeholders by providing a unified financial framework. This common language aids in aligning discussions around financial performance, goals, and strategies, fostering a united vision throughout the company.

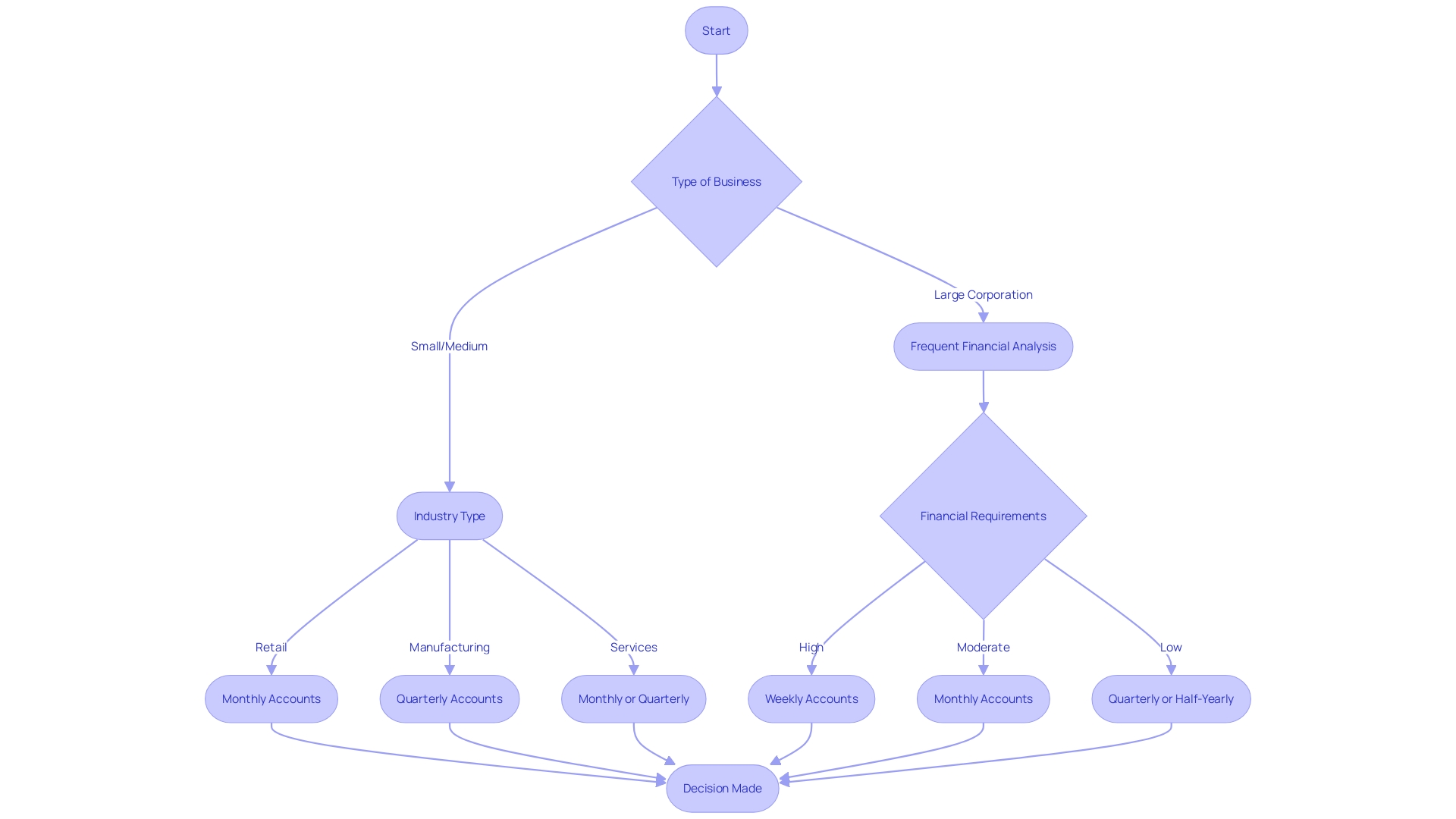

Frequency of Preparing Management Accounts

Determining how frequently to prepare management accounts is paramount for businesses to maintain financial health and make informed decisions. Regularly updated management accounts enable close monitoring of financial performance and progress toward objectives. Monthly accounts are advantageous for their up-to-date insights, facilitating timely adjustments to business strategies.

For entities seeking a compromise between frequency and resources, quarterly accounts are beneficial. They offer a more extensive perspective on financial health and afford the opportunity for deeper analysis, which is crucial for long-term planning and course corrections.

Businesses with predictable operations might consider half-yearly accounts adequate, as they provide sufficient information for strategic decision-making without the need for more frequent updates. However, it's not a one-size-fits-all approach. Industries with rapid changes or businesses with complex structures might need more frequent reviews, such as weekly or even daily management accounts, to keep a firm grasp on their financial standing.

A case in point is how a startup, particularly a software-based one or an entity with a unique structure like a single-member LLC, may have specific accounting needs that dictate the frequency of their management account updates. Accurate account categorization and understanding the nature of financial transactions are essential in such cases.

Recent insights from Andreas Barckow on the improvements in financial performance reporting illuminate the variability in operating profit reporting among companies, underscoring the need for standardized practices. Consistency in management accounts preparation aligns with these new requirements and enhances comparability, a boon for stakeholders making critical financial assessments.

To lay a robust accounting foundation, small business owners must engage in activities like opening a dedicated business bank account, choosing an appropriate accounting method, setting up a chart of accounts, and establishing a fiscal year. These steps are vital for clarity in financial transactions and ensure compliance with tax requirements.

Compiling historical data, which may include revenue, operating costs, profit margins, and liabilities, is also critical for creating a solid financial forecast. This historical perspective aids in identifying trends and informing future financial strategies.

Expert opinions, such as the insights from Ibbotson & Kaplan on asset allocation's role in portfolio variability, further emphasize the importance of understanding financial nuances. These practices and insights combined help businesses, regardless of size, maintain financial agility and resilience, allowing CFOs to steer their companies towards stability and growth effectively.

Can Small Businesses Benefit from Management Accounts?

Management accounts are not just for large corporations; they are a potent tool for small businesses too. These accounts shine a light on financial performance, revealing both strengths and opportunities for improvement. Here's how they can be instrumental for small businesses:

-

Financial Clarity: Management accounts provide an unobstructed view of financial health, enabling business owners to make informed decisions. Just as Non-stop dogwear leveraged clear insights to grow from a small local brand to a global presence, small businesses can use management accounts to steer their strategic direction.

-

Cash Flow Oversight: Monitoring cash flow is pivotal for the vitality of small businesses. These accounts help track the movement of money, forecast potential shortfalls, and encourage proactive measures to maintain liquidity. This is akin to utilizing a cash management tool that ensures funds are available and safeguarded, as is essential for short-term financial needs.

-

Strategic Budgeting and Planning: With management accounts, small businesses can construct realistic budgets, establish financial targets, and devise robust business plans. This level of planning is essential for resource allocation and future growth, similar to how educational publishers like Twinkl use precise scheduling to optimize time and resources.

-

Proactive Issue Identification: Regular reviews of management accounts allow for the early detection of problems, enabling swift corrective action. This proactive approach minimizes risks and fortifies the business against potential setbacks, ensuring a smoother path to success.

-

Transparency with Stakeholders: Sharing management accounts with stakeholders, such as investors or lenders, can build trust through transparency. It's a demonstration of the business's financial stability and potential, much like a prix fixe menu that offers a curated selection at a fixed price, ensuring clear expectations are set.

Amidst a landscape where 33.2 million small businesses operate in the United States, accounting practices that enhance financial understanding and control are invaluable. Management accounts are a linchpin in this process, enabling small businesses to navigate the complexities of finance with confidence and clarity.

Role of Accountants in Preparing Management Accounts

Accounting is an essential practice in any business, large or small, acting as the foundation of a firm's financial health. The process goes beyond simple transaction recording, as accountants analyze, interpret, and report financial data, which culminates in the creation of management accounts. These accounts are indispensable tools for decision-making, as they provide a comprehensive view of a company's financial status through well-articulated financial statements.

Accountants have a multifaceted role in preparing these crucial documents. They start by meticulously collecting and verifying financial data, ensuring that every figure is accurate and supported by documentation. This step is crucial for maintaining the integrity of financial reports.

With the data in hand, accountants delve deep into financial analysis. They scrutinize trends and patterns, calculate ratios, and benchmark performance, turning raw numbers into actionable business intelligence. Their expertise in interpreting financial data is pivotal in crafting strategies that drive a company forward.

The preparation of management accounts is another area where accountants shine. They craft financial statements, including cash flow statements that trace the movement of money, balance sheets that reveal a company's assets and liabilities, and income statements that highlight revenue and expenses. These statements, derived from bookkeeping records, are presented with clarity to inform and empower management's decision-making process.

Compliance is non-negotiable in accounting, and professionals in the field are vigilant about adhering to the latest accounting standards and regulations. Their commitment to upholding these standards ensures the credibility and reliability of the financial reports they produce.

Lastly, accountants serve as strategic advisors. Drawing on their analysis, they offer recommendations and guide management through the financial implications of various strategies, ultimately supporting informed and strategic decision-making for the business.

As the economic landscape evolves, with factors such as inflation and interest rates influencing the business world, accounting practices must also adapt. With technology playing an increasing role in creating resilience within the sector, accountants are at the forefront of navigating these changes, ensuring their firms—and their clients—remain profitable and competitive in challenging times.

Accounting's importance is magnified when considering the pivotal role it plays in guiding businesses through financial decisions. It's a discipline that is inherently about people, where clear and relevant communication is as important as the figures themselves. As the industry continues to strive for diversity and equality at the leadership level, the value of accounting in a business's success cannot be understated.

Conclusion

Management accounts are essential financial reports that provide a comprehensive view of a company's operational health and guide strategic decision-making. They offer a granular breakdown of key financial metrics, enabling leaders to navigate through complex landscapes and make informed decisions aligned with their objectives. The timely insights they provide are invaluable in today's fast-paced business environment.

The key components of management accounts, such as the Income Statement, Balance Sheet, Cash Flow Statement, and Key Performance Indicators (KPIs), serve as the backbone of financial analysis and planning. They offer a comprehensive picture of the business's fiscal well-being, allowing leaders to evaluate performance, plan and forecast, manage cash flow, and make informed decisions.

Management accounts play a vital role in driving business success by providing a clear picture of financial health and influencing strategic decision-making. They enable proactive issue identification, resource allocation, and effective communication with stakeholders. In a dynamic business landscape, management accounts serve as a lighthouse, guiding businesses through financial decision-making and helping them adapt and thrive.

To craft effective management accounts, a meticulous approach is essential. This involves setting clear objectives, collecting accurate financial data, conducting rigorous analysis, synthesizing the data into financial statements, verifying accuracy, and engaging stakeholders. By following this strategy, companies can ensure that their management accounts align with their needs and facilitate informed decision-making.

Management accounts are not limited to large corporations; they are also a powerful tool for small businesses. They provide financial clarity, cash flow oversight, strategic planning, proactive issue identification, and transparency. In a landscape where small businesses play a significant role, management accounts help them navigate finance with confidence.

Accountants play a crucial role in preparing management accounts. They collect and verify financial data, analyze and interpret the data, craft financial statements, ensure compliance, and serve as strategic advisors. Their expertise and commitment to integrity are instrumental in guiding businesses through financial decisions.

In conclusion, management accounts are a powerful tool for businesses to make informed decisions, drive growth, and ensure financial stability. With their comprehensive view of financial health, management accounts empower leaders to navigate complex landscapes and align strategies with objectives.