Introduction

Pro Forma Financial Statements: Navigating the Path to Financial Rejuvenation

Pro forma financial statements serve as indispensable tools for businesses navigating the complexities of restructuring, providing a strategic forecast of a company's financial health. These forward-looking documents rely on specific assumptions to estimate financial outlooks, enabling companies to steer through hypothetical restructuring strategies. From managing expectations post-merger to evaluating financial feasibility in new markets, pro forma statements have played a crucial role in the success stories of companies like Fresenius Medical Care, Bird, and WeWork.

In this article, we delve into the world of pro forma financial statements, exploring their types and key considerations. We will discuss why these statements are essential for businesses undergoing restructuring and how to create accurate pro forma income statements, cash flow statements, and balance sheets. Additionally, we will examine common uses of pro forma statements and highlight potential pitfalls and best practices.

Crafting pro forma financial statements demands meticulous attention to critical elements such as market conditions, industry trends, historical financial performance, and the anticipated effects of the restructuring. By adhering to best practices of clarity and transparency, CFOs can create financial statements that not only withstand scrutiny but also serve as reliable blueprints for the company's financial future.

Join us as we unravel the power of pro forma financial statements and discover how they can guide businesses towards financial rejuvenation and sustained growth.

Understanding Pro Forma Financial Statements

Pro forma financial statements serve as navigational beacons during the stormy process of restructuring, particularly in the choppy waters of bankruptcy. These forward-looking documents rely on specific assumptions to provide an estimated financial outlook, enabling companies to steer through various hypothetical restructuring strategies. For instance, in the case of Fresenius Medical Care, pro forma statements were key in managing expectations post-merger, accounting for risks such as market changes and litigation uncertainties.

Similarly, Bird's expansion into the micromobility sector relied on pro forma projections to evaluate financial feasibility in new markets. And notably, WeWork's successful emergence from Chapter 11 was underpinned by careful financial reevaluation and the use of pro forma statements to ensure a return to profitability. These statements are not mere financial conjectures; they are indispensable tools for businesses to map out a path to financial rejuvenation, ensuring they make decisions that align with their strategic financial goals.

Types of Pro Forma Financial Statements

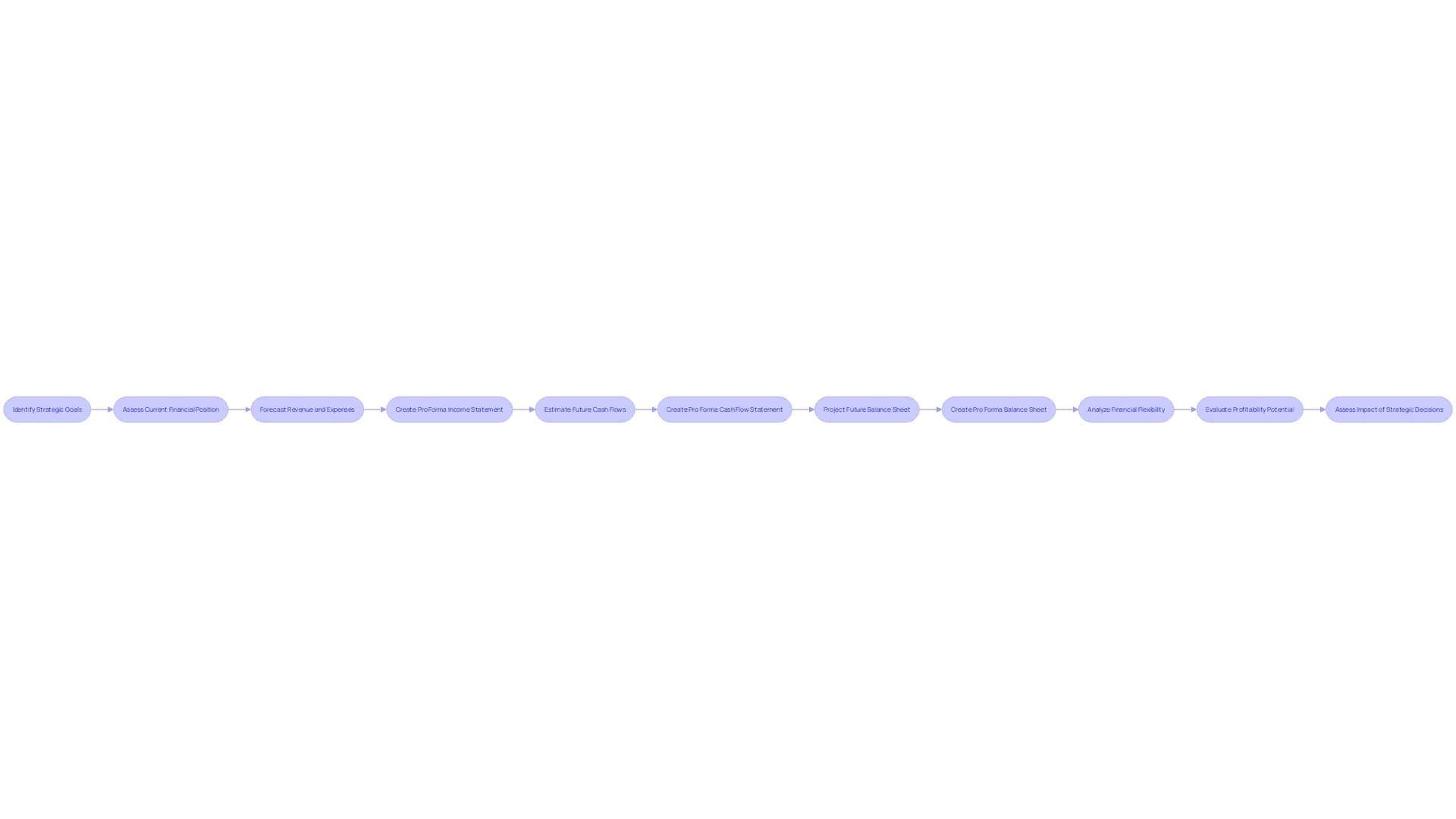

Pro forma financial statements are the lynchpin of informed financial forecasting and strategic planning. The pro forma income statement, for instance, isn't merely a speculative look at potential revenue and expenses; it's a detailed projection that can guide a company through future financial landscapes. By unveiling potential profitability, it serves as a beacon for decision-making.

Moving on to the pro forma cash flow statement, its significance cannot be overstated. This statement is a roadmap of all financial transactions, charting cash inflows from operations and investments, and cash outflows covering ongoing business expenditures. A keen analysis of this statement reveals a company's ability to generate sufficient operational cash versus its dependency on external funding sources, a critical factor in assessing both liquidity and financial dexterity.

Lastly, the pro forma balance sheet offers a snapshot of a company's financial equilibrium at a future point in time. It reflects anticipated changes in assets, liabilities, and equity, providing a forward-looking perspective on the company's financial solidity. This statement is essential for evaluating the potential impact of strategic decisions on the company's financial structure.

Accurate pro forma statements are foundational for any business, especially when navigating financial complexities. As noted in the insights from the Cato Institute and the practices of successful business leaders like those at Cabletron Systems, the ability to forecast and analyze financial outcomes is integral to effective governance and sustained growth. Furthermore, contemporary events, such as SAP's significant financial settlements, underscore the importance of maintaining transparent and accurate financial reporting, as mandated by regulatory bodies like the DOJ and the SEC.

In essence, pro forma financial statements are not just about numbers on a page; they encapsulate the financial narrative of a company, allowing stakeholders to visualize the future with clarity and prepare for it with confidence.

Why Do You Need Pro Forma Financial Statements?

Crafting pro forma financial statements is a pivotal step in the restructuring process, providing a strategic forecast of a company's financial health. These statements are instrumental in predicting future cash flows and gauging the likely outcomes of various restructuring scenarios on the company's profitability and solvency. Lenders and investors, in pursuit of a transparent picture of the company's financial future, often require these documents.

They provide a standardized framework that facilitates comparison and informed decision-making. A clear example of the practical use of pro forma statements can be seen in the case of Cano Health, Inc., which presented its financial projections to effectively communicate its strategy for debt reduction, liquidity enhancement, and long-term viability during its Chapter 11 proceedings. This forward-looking approach is critical for companies to align their restructuring efforts with stakeholders' expectations and to navigate the complexities of financial reorganization with confidence.

Creating a Pro Forma Income Statement

Crafting a pro forma income statement is more than a mere financial exercise; it's a strategic tool that encapsulates a company's vision for growth and sustainability. This forward-looking document hinges on well-informed assumptions about future sales, cost structure, and other pivotal factors. For instance, a founder transitioning from tech giant to startup learned through hard-won experience that setting realistic yet ambitious income goals, such as a 25% to 100% increase, can be instrumental to success.

Similarly, the culinary concept of "prix fixe" inspired an accountant to curate technology solutions for clients, providing a fixed-price selection that enhanced business efficiency. These anecdotes underscore the importance of tailored strategies in financial projections.

Companies need to delve deep into their operational blueprint, analyzing the main components of their income statement such as operating expenses, which encompass the essential costs of running a business but aren't directly tied to the production or delivery of goods and services. It's crucial to understand that even though various enterprises reported operating profits in over nine different ways according to an IASB study, the essence of such financial statements remains constant: to illuminate the pathway to profitability.

Adopting the Profit First approach, which prioritizes profit by allocating a predetermined percentage of income to it before any expenses, can revolutionize an entrepreneur's financial strategy. This paradigm shift is complemented by a keen understanding of the distinction between cash flow and profit. Cash flow, the lifeblood of a business, represents the in and out movement of cash, and maintaining its steadiness is vital to prevent crippling shortages.

To effectively implement these principles, begin with a thorough analysis of your business's financial health. Evaluate revenue streams, expenses, and cash flow patterns to establish realistic profit allocations and goals. With these insights, create segregated bank accounts for profit, owner's pay, taxes, and operating expenses, ensuring that each dollar earned is judiciously utilized.

Regularly revisiting and adjusting these allocations based on financial performance keeps the business aligned with its strategic objectives, paving the way for long-term success.

Creating a Pro Forma Cash Flow Statement

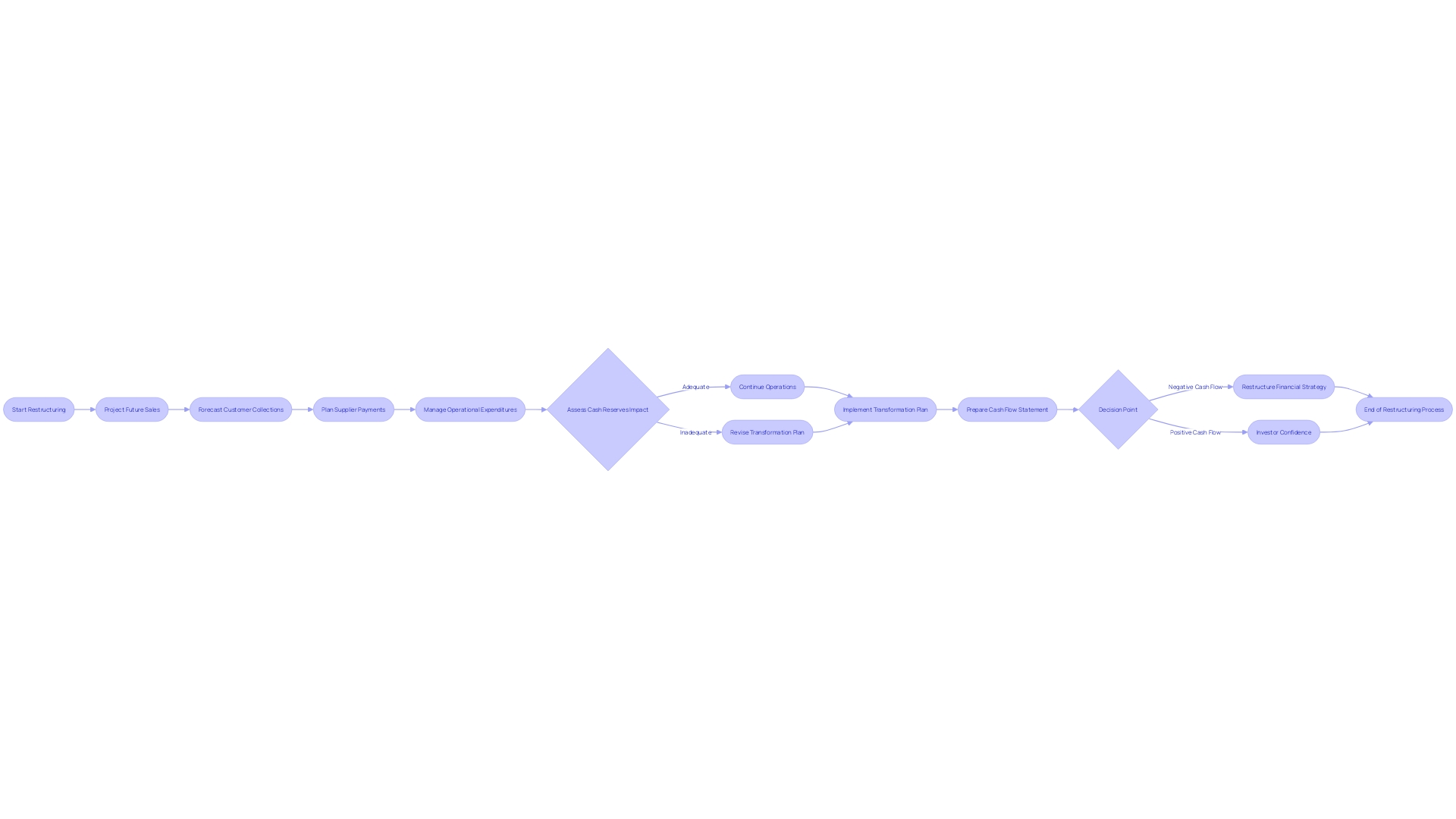

A pro forma cash flow statement stands as a pivotal tool for companies navigating the complexities of restructuring. This forward-looking document meticulously projects future cash movements by incorporating expected sales, customer collections, supplier payments, and other operational expenditures, offering a clear picture of anticipated liquidity. It's an essential asset for decision-makers, as it provides insights into the impact of the restructuring on the company's cash reserves.

For instance, when Fresenius Medical Care merged with National Medical Care, the integration of product and service businesses required careful cash flow management to navigate the uncertainties and risks inherent in the process, including legislation changes and exchange rate fluctuations. Similarly, Cano Health's restructuring through Chapter 11 proceedings necessitated acute awareness of cash flow to maintain operations and implement their Transformation Plan effectively, underscored by a $150 million debtor-in-possession financing.

The significance of the cash flow statement is also highlighted by its impact on investors' confidence. As per the observations around financial restatements and internal control weaknesses, investors rely on this statement to assess a company's capacity to generate net positive cash flows and fulfill financial obligations. The cash flow statement's division into operating, investing, and financing activities provides a transparent view of the company's financial health, enabling investors and management alike to understand the firm’s cash flow dynamics.

In practice, a positive operating cash flow signifies a firm's proficiency in generating sufficient cash through its core business operations, which is vital for sustainable growth. This component of the cash flow statement accounts for cash inflows from sales and outflows for goods production, labor, and other operational costs. As a CFO, ensuring the accuracy and reliability of this statement is crucial, not only to navigate the immediate challenges of restructuring but also to maintain a robust financial strategy that supports the long-term vitality of the business.

Creating a Pro Forma Balance Sheet

A well-constructed pro forma balance sheet is an indispensable tool for companies undergoing restructuring. It does more than merely list assets, liabilities, and shareholders' equity; it serves as a strategic compass, pointing toward financial health and solvency. Insightful analysis of this forward-looking statement can illuminate the effectiveness of restructuring efforts, guiding decisions that shape a company's future trajectory.

In the wake of TBC Bank's agile transformation, which streamlined operations and embraced digital innovation, the value of a dynamic balance sheet became apparent. By distilling complex financial data into a digestible format, TBC Bank could swiftly respond to the evolving market, enhancing customer experience while nurturing growth.

Similarly, the case of Kraft Heinz demonstrates the need for meticulous brand asset management on the balance sheet. The company's significant write-down sparked conversations about the shifting tides in the food industry, underscoring the balance sheet's role in reflecting a company's adaptive strategies and the potential for market repositioning.

Omar Choucair of Trintech emphasizes the bedrock importance of accurate financial statements, advocating for accounting software tailored to the business's needs. Such precision is crucial, as the balance sheet is a foundational report used by business owners, investors, and lenders alike to appraise a company's performance and creditworthiness.

Ultimately, a company's aim should be to maximize value, as articulated eloquently in our industry's discourse. A forward-thinking balance sheet, therefore, is not just a financial document but a roadmap for sustainable growth and long-term success.

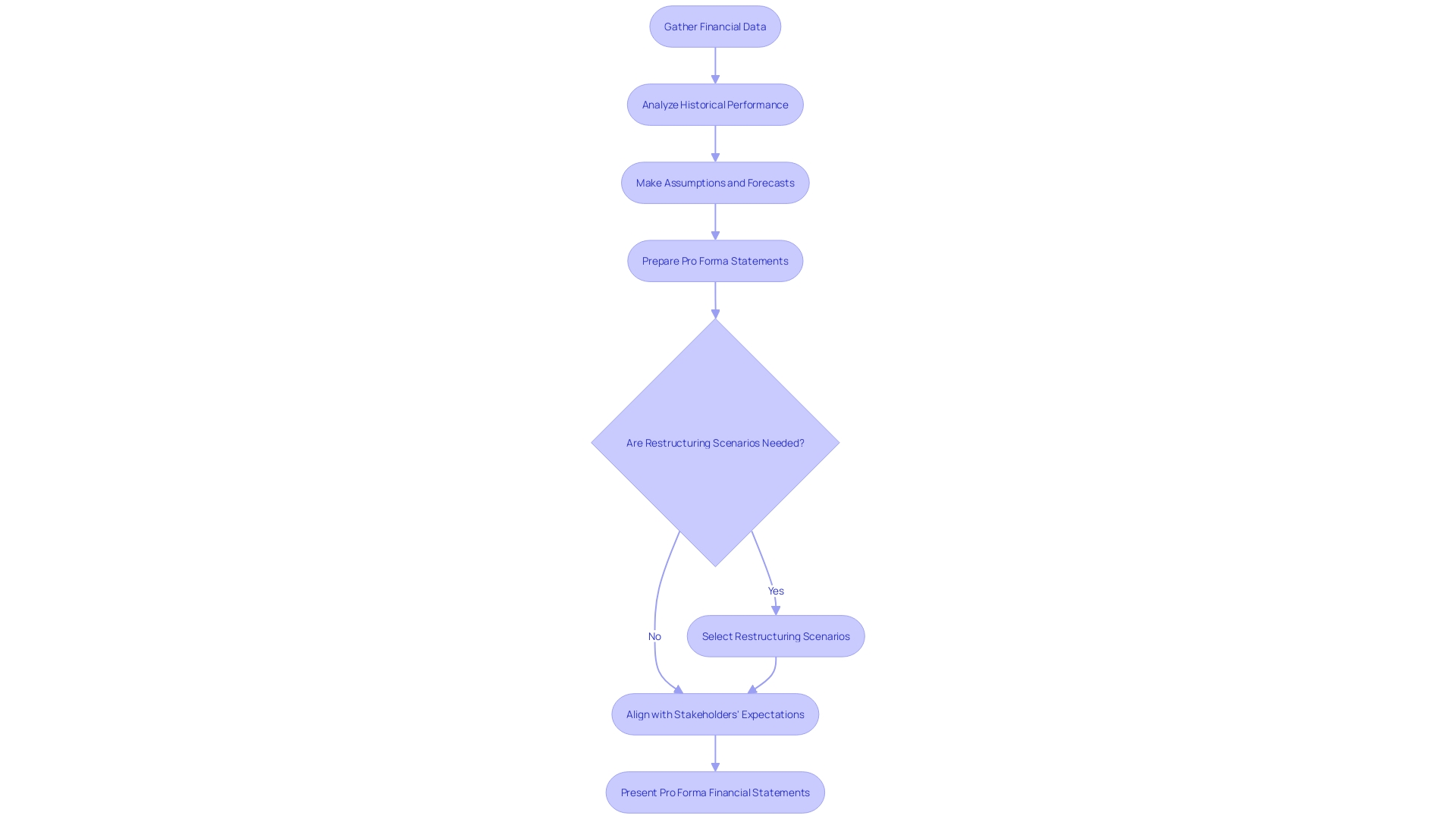

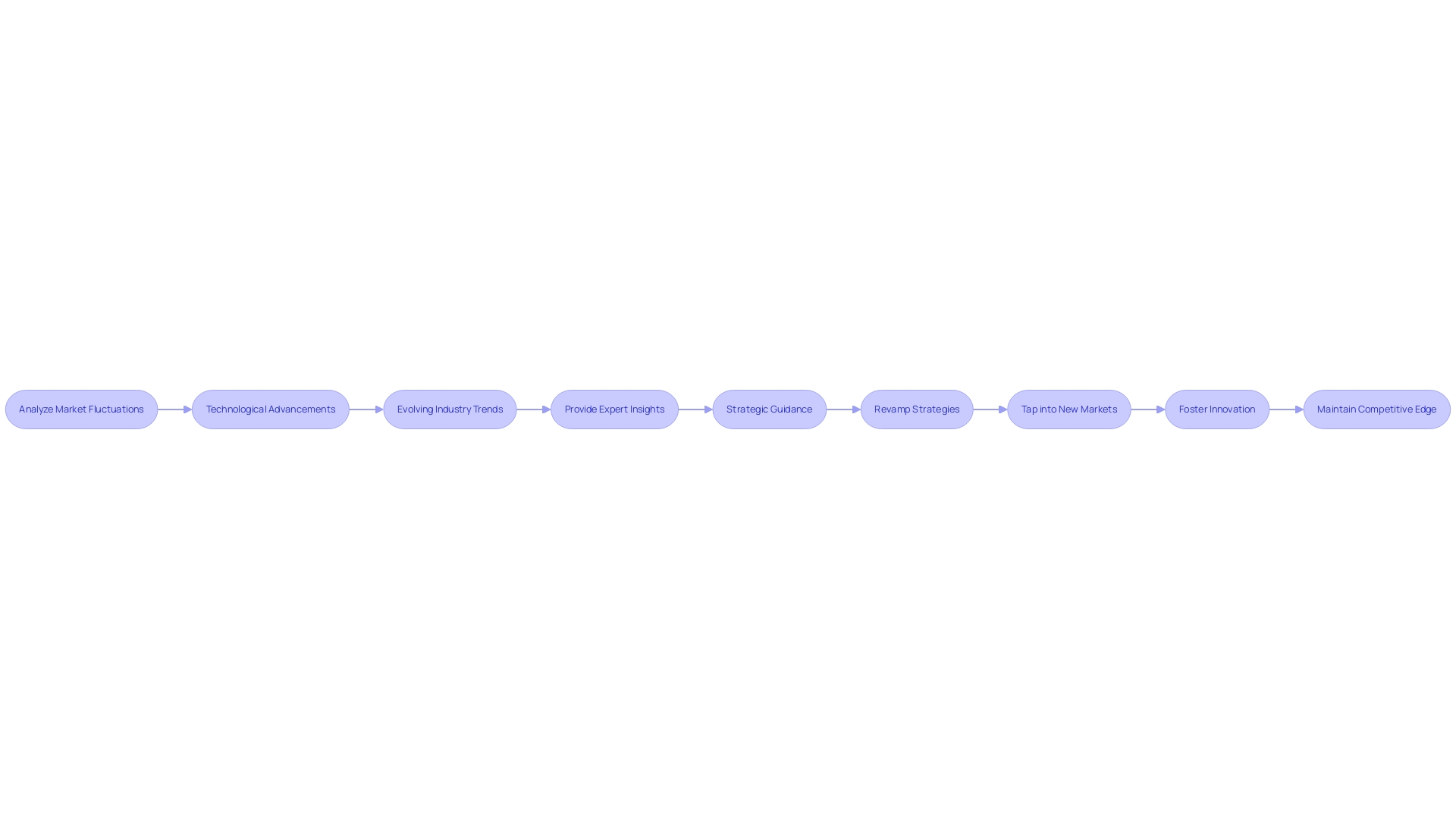

Key Considerations and Assumptions

Crafting pro forma financial statements demands meticulous attention to various critical elements to ensure they reflect a realistic picture of the company's potential post-restructuring. These elements include market conditions, industry trends, historical financial performance, and the anticipated effects of the restructuring. It's not just about making assumptions; it's about substantiating them with concrete data and justifiable scenarios that resonate with the reality of the business environment.

To achieve this, one must adhere to the best practices of clarity and transparency. This involves clearly stating and justifying the assumptions used to construct the model. For instance, when considering market conditions, it's vital to analyze current trends and make informed projections.

Using data sources that are both current and relevant to the industry can significantly enhance the accuracy of these projections. Furthermore, regular updates to the assumptions based on real-time market feedback can provide a dynamic and more precise model.

As one delves into industry trends, it becomes apparent that a single sector may be influenced by a handful of pivotal companies or events. Taking lessons from cases like the California utilities and their approach to wildfire risk, CFOs can appreciate the importance of considering sector-specific risks and the actions of major players within their industry.

Historical financial data serves as the backbone of any pro forma statement, offering essential insights into the company's financial trajectory. An IASB study highlighted the variability in reporting, with over 60 companies presenting their operating profit in at least nine different ways. This illustrates the critical need for consistency and adherence to recognized standards when utilizing historical data to inform future financial projections.

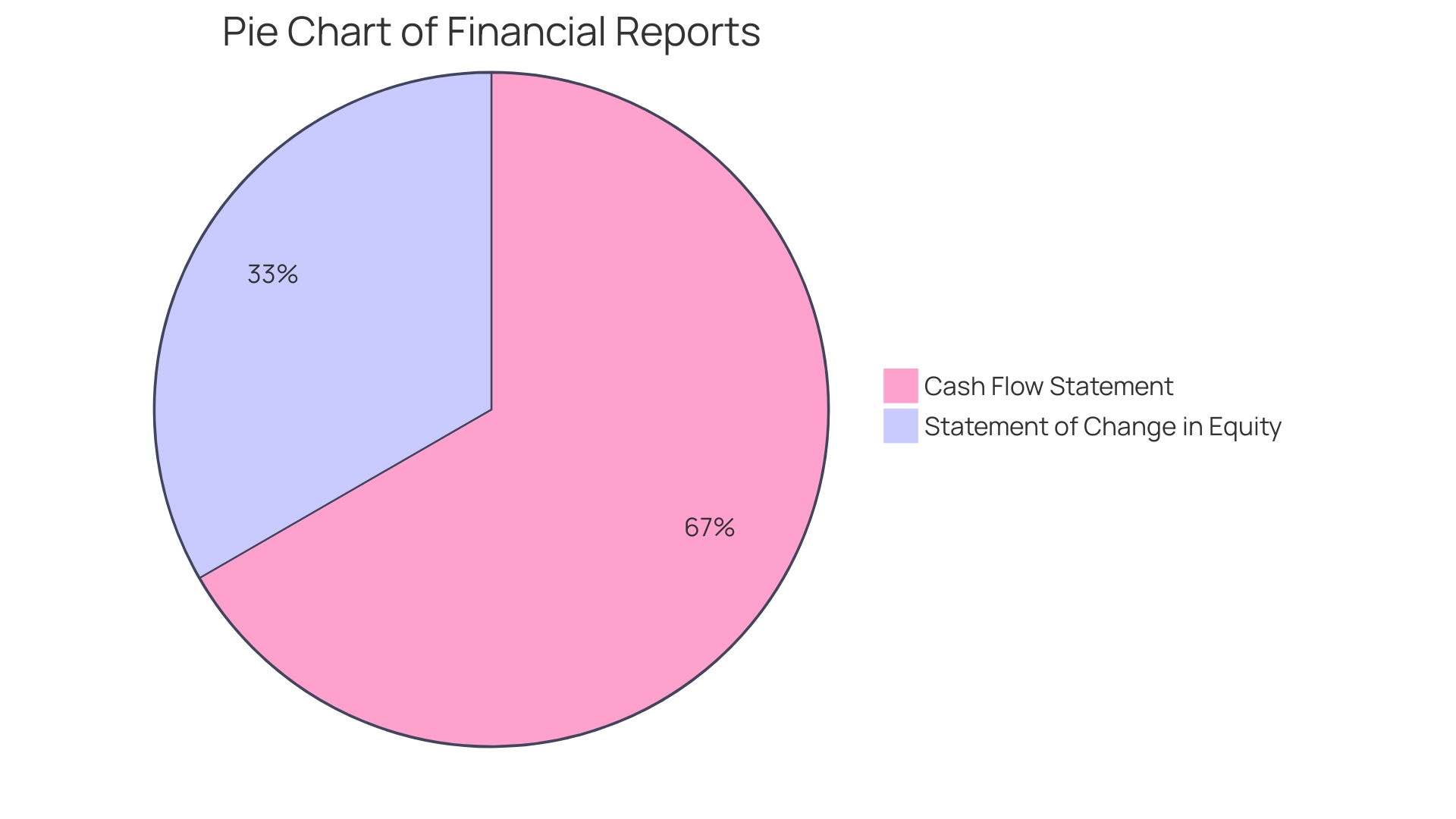

The potential impact of the restructuring process on the financial statements cannot be ignored. It’s essential to consider how changes in operations, cost structures, and strategic direction will influence financial outcomes. Here, a thorough understanding of the cash flow statement and the statement of changes in equity is imperative.

These documents not only shed light on the company's financial health and operational efficiency but also highlight the shifts in equity, reflecting the decisions that impact shareholder value.

In summary, the creation of pro forma financial statements is a strategic exercise that requires a clear articulation of assumptions, a firm grasp of market and industry dynamics, meticulous analysis of historical data, and a forward-looking view of the company's restructuring outcomes. By integrating these factors with precision and clarity, CFOs can craft financial statements that not only withstand scrutiny but also serve as a reliable blueprint for the company's financial future.

Common Uses of Pro Forma Statements

In the intricate landscape of business restructuring, pro forma financial statements are not merely projections but strategic tools that convey the potential financial trajectory to key stakeholders. They offer a foundation for assessing various restructuring strategies, such as those employed by Fresenius Medical Care, which has seen exponential growth through strategic mergers and acquisitions. These forward-looking statements are essential for monitoring the restructuring progress and gauging the effectiveness of strategies applied.

For instance, Cano Health, Inc. utilized pro forma statements in its Restructuring Support Agreement to successfully navigate Chapter 11 proceedings, showcasing a commitment to reducing debt and enhancing liquidity. Similarly, WeWork's confirmed Plan of Reorganization, which emerged from meticulous restructuring efforts, is a testament to the vital role pro forma statements play in communicating financial resilience and operational overhaul to creditors and investors.

These statements encapsulate the financial health of a company, detailing cash movements and equity changes, critical for stakeholders to assess operational efficiency and shareholder value. As Omar Choucair of Trintech highlights, the accuracy and reliability of financial statements are paramount, requiring clean books and a deep understanding of the monthly reports.

Moreover, the journey of integrating alternative data into financial decision-making, which can span years, underscores the evolution of financial reporting. As organizations like Pros Holdings Inc explore strategic options amidst profitability challenges, the transparency and insight provided by pro forma financial statements become even more valuable. They serve as a beacon, guiding companies through the uncertainty of restructuring toward a stable and prosperous future.

Potential Pitfalls and Best Practices

Pro forma financial statements can be powerful forecasting tools when used responsibly. Meticulous attention to detail and critical analysis are paramount, as overly positive projections can lead to misguided business decisions. A comprehensive cash flow statement, for instance, is indispensable for evaluating whether a business is self-sufficient or dependent on external funding.

It also offers transparency into how effectively a company is using its cash, which is a strong indicator of financial stability and operational competence.

The statement of changes in equity, or the statement of retained earnings, reveals shifts in a company's equity, encompassing net profits or losses and dividend distributions, thereby influencing shareholder value. Likewise, a robust financial report that includes the balance sheet and the income statement is key to comprehensively assessing a company's short-term and long-term financial posture. These documents, regulated by stringent accounting standards, are essential for ensuring the veracity of financial information.

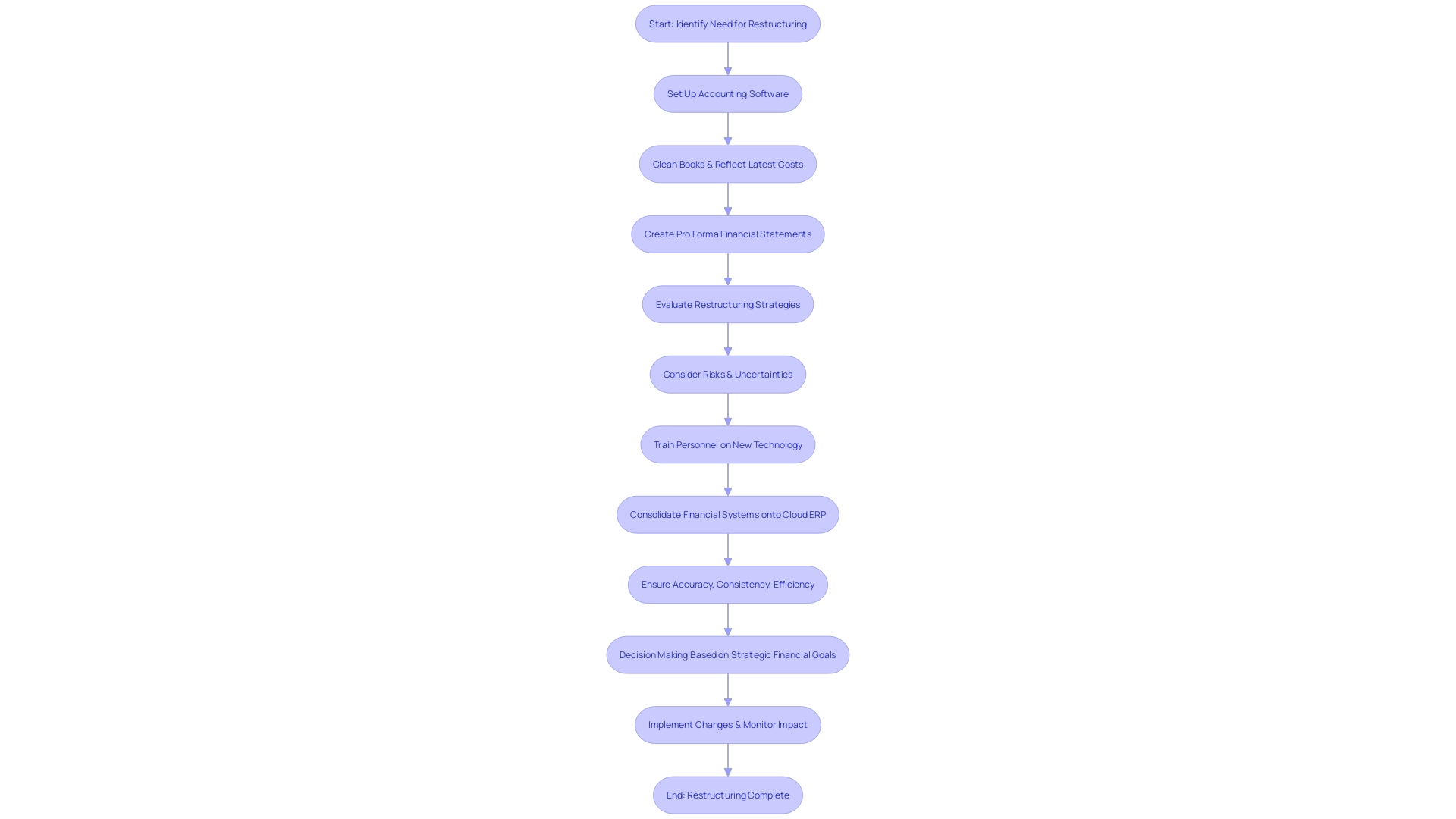

Expert insights emphasize the importance of clean and updated books and the utilization of accounting software tailored to an organization's needs. In the digital age, leveraging technology such as automation is recommended for enhancing accuracy and compliance in financial reporting. Training staff to adeptly handle these tools is equally crucial.

Automation streamlines reporting processes, reducing human error and facilitating timely and precise financial disclosures.

Cross-verification is a recommended practice to further bolster the reliability of financial statements. This practice helps negate inaccuracies and ensure that financial reports reflect the true state of affairs. By embracing these practices, organizations can foster trust in their financial reporting, which is the bedrock of sound financial planning and decision-making.

Case Studies and Examples

Pro forma financial statements are essential tools for businesses undergoing restructuring, providing a hypothetical view of the company's financial position. These statements can help businesses anticipate results and align their restructuring strategies for optimal outcomes. For instance, Fresenius Medical Care's success following its merger highlights the power of strategic growth and proactive planning.

The company's organic growth and acquisitions led to a sevenfold increase in revenue and patient numbers, and a fivefold growth in employee count. Similarly, Cano Health's prearranged Chapter 11 proceedings and WeWork's confirmed Plan of Reorganization exemplify how well-devised restructuring plans can lead to revitalized liquidity, reduced costs, and sustainable profitability. These examples underscore the critical role that pro forma statements play in facilitating successful restructuring by enabling businesses to forecast and navigate financial uncertainties with confidence.

Conclusion

Pro forma financial statements are crucial tools for businesses undergoing restructuring. They provide a strategic forecast of a company's financial health, relying on specific assumptions to estimate future outlooks. Crafting accurate pro forma statements requires meticulous attention to critical elements such as market conditions, industry trends, historical performance, and the anticipated effects of restructuring.

These statements serve as the foundation for informed financial forecasting and strategic planning. The pro forma income statement, cash flow statement, and balance sheet offer valuable insights into a company's future financial landscape. They guide decision-making, evaluate feasibility, and assess the impact of strategic choices on the company's financial structure.

Creating pro forma financial statements is a pivotal step in the restructuring process. They enable companies to predict cash flows, gauge outcomes, and align strategies with stakeholders' expectations. Lenders and investors often require these statements for a transparent view of the company's financial future.

The pro forma income statement is not just a financial exercise; it's a strategic tool that encapsulates a company's growth vision. Analyzing expenses and adopting effective financial strategies can drive success.

The pro forma cash flow statement is crucial for navigating restructuring complexities. It projects cash movements, offering insights into liquidity and the impact on reserves. Positive operating cash flow signifies proficiency in generating cash through core operations.

A well-prepared pro forma balance sheet serves as a strategic compass, reflecting changes in assets, liabilities, and equity. It provides a forward-looking perspective on financial solidity and allows companies to respond to market changes.

Crafting pro forma statements demands adherence to best practices of clarity and transparency. These statements are strategic tools that convey potential financial trajectories, facilitating successful restructuring and guiding companies towards stability and growth.

In conclusion, pro forma financial statements are essential for businesses undergoing restructuring. By creating accurate and transparent statements, companies can navigate complexities, align strategies, and pave the way for financial rejuvenation and growth.