Introduction

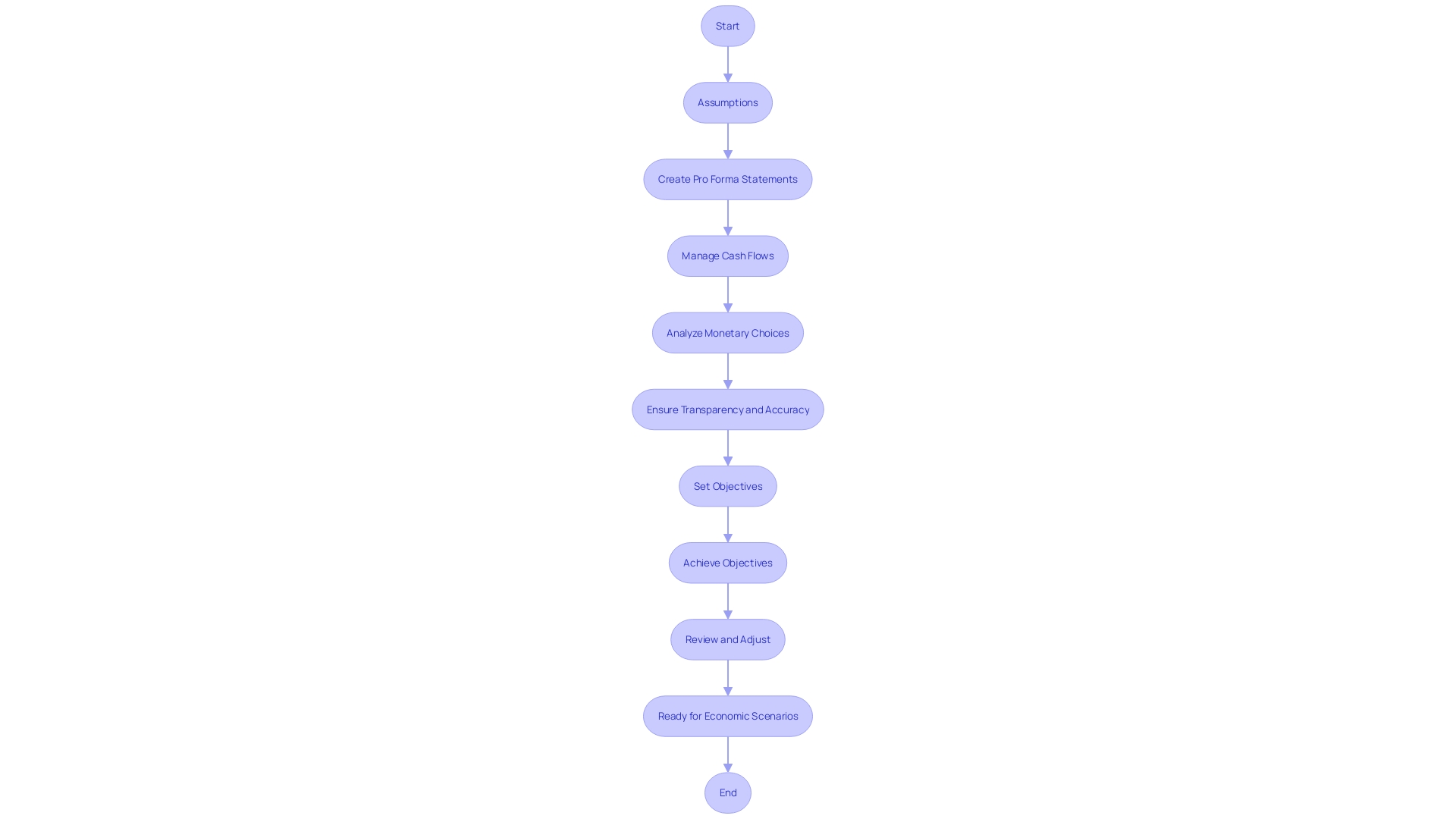

Pro forma financial statements serve as a financial crystal ball, providing a glimpse into a company's potential future economic activities. By incorporating assumptions about upcoming changes, whether they're related to operational shifts, market dynamics, or capital structure alterations, these statements enable businesses to forecast their financial health and readiness for various scenarios. In the evolving landscape of financial technology, such as the integration of AI in banking for hyper-personalized services, it's crucial to anticipate and adapt to new trends.

A staggering 61% of banking customers now expect personalized recommendations, underscoring the importance of forward-looking financial planning. Moreover, the corporate world has taken notice of the power of pro forma statements. For instance, a bank's interim report reflected a pivot in managing a sub-portfolio of bonds, indicative of changing business models and the pursuit of capital stability.

This strategic move, informed by pro forma insights, underscores how financial instruments like RILAs, influenced by market indices, necessitate transparency and comprehensive disclosure to investors. Such amendments and investor-focused approaches are becoming the norm, as seen in the recent Consolidated Appropriations Act. A pro forma financial statement isn't just a tool for prediction; it's a framework for setting and achieving financial objectives.

It helps delineate short-term, medium-term, and long-term goals, each with specific timelines and financial targets. This aids in managing cash flows effectively, scrutinizing whether the cash influx comes from robust operations or is a result of external borrowing, and assessing the overall financial agility of the company.

Understanding Pro Forma Financial Statements

serve as a monetary crystal ball, offering a glimpse into a company's potential future economic activities. By incorporating assumptions about upcoming changes, whether they're related to operational shifts, market dynamics, or capital structure alterations, these statements enable businesses to forecast their economic health and readiness for various scenarios.

In the changing landscape of finance technology, such as the integration of AI in banking for hyper-personalized services, it's important to anticipate and adapt to new trends. An astounding 61% of banking customers now anticipate personalized recommendations, emphasizing the significance of forward-looking money management.

Additionally, the business industry has recognized the influence of pro forma documents. For instance, a bank's interim report reflected a pivot in managing a sub-portfolio of bonds, indicative of changing business models and the pursuit of capital stability. This calculated action, guided by projected insights, highlights how monetary instruments like RILAs, influenced by market indices, require transparency and thorough disclosure to investors. Such amendments and investor-focused approaches are becoming the norm, as seen in the recent Consolidated Appropriations Act.

A pro forma statement isn't just a tool for prediction; it's a framework for setting and achieving objectives. It helps define short-term, medium-term, and long-term goals, each with specific timelines and monetary targets. This aids in managing , scrutinizing whether the cash influx comes from robust operations or is a result of external borrowing, and assessing the overall agility of the organization.

The document of modifications in equity, or the document of retained earnings, further clarifies how , covering aspects from net profits to dividend distribution. These documents, regulated by strict reporting criteria, provide transparency and accuracy, guaranteeing that stakeholders have a clear understanding of an organization's monetary path.

Purpose and Importance of Pro Forma Financial Statements

Pro forma documents are not just administrative paperwork; they are . They play a critical role for companies contemplating new ventures or strategic shifts. By simulating potential economic outcomes, these expressions assist businesses in , acquisitions, and investments. This foresight is key to mitigating risks and maximizing returns, a fundamental aspect of . For businesses seeking investment or loans, are essential. They act as evidence of a company's strength and future prospects, which is exactly what investors and lenders examine. Omar Choucair of Trintech emphasizes the significance of precise reporting, which starts with clean books that reflect up-to-date costs. Internally, these declarations align closely with budgeting and monetary planning processes. They offer an organized method to establish monetary objectives and create a viable route to attain them, guaranteeing that monetary operations are in alignment with the organization's overarching fiscal strategy. Furthermore, the insights gained from analyzing cash flow reports, such as those revealed by ARK Investment Management LLC's financial reporting, can be instrumental in determining the sufficiency of operational cash generation versus the need for external financing. These insights contribute to a thorough comprehension of an organization's fiscal well-being and operational effectiveness.

Types of Pro Forma Financial Statements

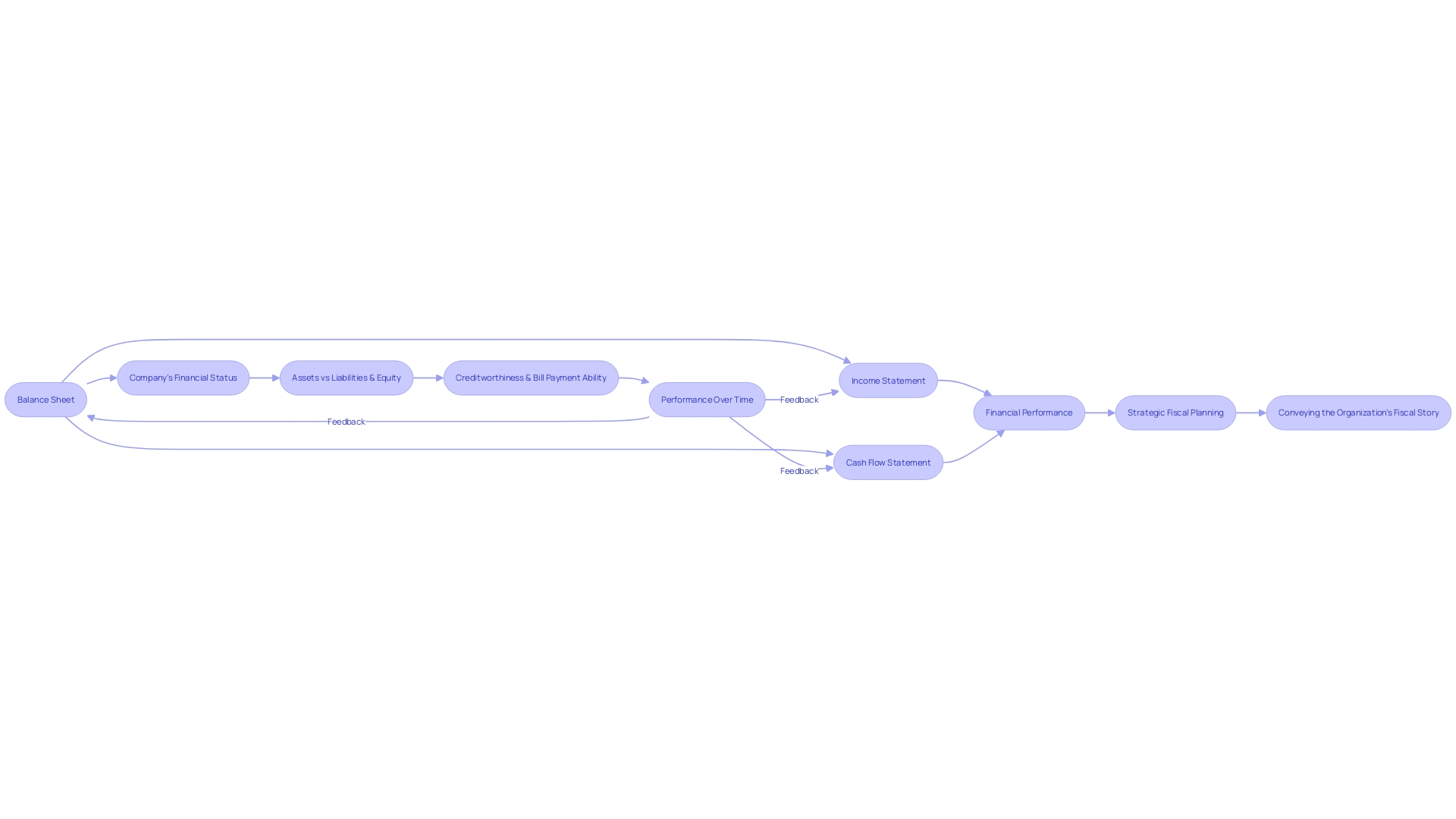

The pro forma statements include the balance sheet, income statement, and cash flow statement. Each offers a distinct outlook on the organization's economic well-being and operational achievement. The balance sheet illustrates what the anticipated is expected to be at a future date, taking into account projected changes in assets, liabilities, and equity. Conversely, the predicts future revenues, costs, and net income during a specific period, providing a projection of profitability. The is crucial for assessing the anticipated cash movements, which is vital for liquidity and cash management strategies.

The importance of these statements is underlined by real-world cases. For example, Equinix's alleged manipulation of operating expenses and capital expenditures to enhance reported profitability emphasizes the importance of precise reporting. Meanwhile, the industry is shifting towards more transparent disclosures about money matters, as shown by the Sec's proposed amendments for Rivals, aiming to provide investors with clear, essential information.

These declarations are interconnected, showing the basic accounting equation where Assets = Equity + Liabilities. Modifications in the balance sheet have an impact on the income record and cash flow document, providing hints about the monetary dynamics of an organization. For CFOs, comprehending and precisely predicting these documents is not only about adherence, but also about strategic fiscal planning and conveying an organization's fiscal story to stakeholders and investors.

Components of Pro Forma Financial Statements

Assembling involves combining different components to depict a prognostic representation of a company's economic path. At the core of these assertions are , which are not mere guesses but educated estimations based on market analysis, historical performance, and anticipated growth. They map out the expected income streams, an essential gauge of business vitality.

Concurrently, are meticulously crafted to encompass all foreseeable costs necessary to keep the business operational. These encompass day-to-day operational costs, salaries to retain talent, marketing to fuel growth, and the inevitable overheads. Collectively, these estimates constitute a vital component of the narrative, unveiling the expense of business ambitions.

However, it's the that bring depth to pro forma statements. They are the strategic pivots - the introduction of innovative products, ventures into new markets, or shifts in pricing strategies - each carrying implications. These adjustments acknowledge that business is not static and that strategic decisions directly influence economic outcomes.

An example of this is the hospitality sector, where profit and loss (P&L) records function as a monetary guide. They emphasize the significance of not only top-line outcomes but also the bottom-line consequences, unveiling the true economic well-being of an establishment. In the realm of cloud services, a leading provider's expansive vision to open new data centers globally is a strategic move with significant cost, management, and capacity planning considerations - all of which must be reflected in pro forma statements.

Recent advancements in finance, such as a bank's transition in its bond management strategy, highlight the dynamic nature of planning and the need for stability in capital. Similarly, the legal sector's dependence on current intelligence and the insurance industry's shift towards more transparent annuity products through the Consolidated Appropriations Act, 2023, both emphasize the changing landscape and the need for precise reporting.

According to Omar Choucair from Trintech, the basis of dependable books is accurate records that show present expenses. This is achieved through tailored accounting software and a keen analytical approach to monthly reports. Indeed, accurate reporting of finances is not just about adhering to generally accepted accounting principles (GAAP); it also involves strategic capitalization of costs to portray a robust economic condition.

In summation, pro forma statements are not static documents but dynamic tools that enable strategic foresight. They require a blend of historical data, market analysis, and strategic adjustments to provide a transparent and forward-looking view of a company's financial health.

Conclusion

To sum up, pro forma financial statements are essential tools for businesses to anticipate and adapt to the changing financial landscape. By incorporating assumptions about upcoming changes, these statements enable companies to forecast their financial health and readiness for various scenarios. They serve as frameworks for setting and achieving financial objectives, helping businesses manage cash flows effectively and assess their overall financial agility.

The importance of pro forma statements is evident in the corporate world, with examples like a bank's pivot in managing a sub-portfolio of bonds, informed by pro forma insights. Transparency and comprehensive disclosure to investors are becoming the norm, as seen in recent regulations like the Consolidated Appropriations Act. Pro forma financial statements are indispensable for businesses seeking investment or loans, as they demonstrate financial robustness and future prospects.

These statements encompass the pro forma balance sheet, income statement, and cash flow statement, providing different perspectives on the company's financial health and operational performance. CFOs must understand and accurately project these statements to comply with regulations, strategically plan finances, and communicate the company's financial narrative.

Creating pro forma financial statements involves revenue forecasts, expense estimates, and strategic assumptions and adjustments. Accurate financial reporting is crucial, starting with clean books that reflect up-to-date costs. By utilizing these statements effectively, businesses can navigate the changing financial landscape and achieve their financial objectives.

Frequently Asked Questions

What are pro forma financial statements?

Pro forma financial statements are projected financial documents that provide insights into a company's potential future economic activities by incorporating assumptions about upcoming changes in operations, market conditions, or capital structure.

Why are pro forma financial statements important?

They are critical for strategic planning as they assist businesses in forecasting the impact of new projects, acquisitions, and investments. They help mitigate risks and maximize returns, making them essential for companies seeking investment or loans.

What types of pro forma financial statements exist?

The main types include: Pro Forma Balance Sheet, which projects the company's anticipated financial position at a future date; Pro Forma Income Statement, which predicts future revenues, costs, and net income to provide a projection of profitability; and Pro Forma Cash Flow Statement, which assesses expected cash movements, crucial for liquidity and cash management.

How do pro forma financial statements aid in cash flow management?

They help in managing cash flows effectively by assessing whether cash inflow stems from strong operations or external borrowing, enabling a clear understanding of the organization's financial agility.

What components make up pro forma financial statements?

Key components include: Revenue Forecasts, which are educated estimations based on market analysis and historical performance; Expense Estimates, which are detailed projections of all operational costs necessary for running the business; and Assumptions and Adjustments, which are strategic changes that impact economic outcomes, such as new product launches or market expansions.

How do pro forma statements relate to each other?

Pro forma statements are interconnected, reflecting the basic accounting equation: Assets = Equity + Liabilities. Changes in the balance sheet affect the income statement and cash flow statement, providing a comprehensive view of the company's financial dynamics.

What are the regulatory aspects of pro forma financial statements?

These statements are subject to strict reporting criteria to ensure transparency and accuracy, allowing stakeholders to understand the organization's financial trajectory effectively.

Can you give an example of pro forma financial statements in practice?

A notable case is Equinix, which faced scrutiny for allegedly manipulating operating expenses to enhance reported profitability. This highlights the need for precise reporting in pro forma statements.

How can companies ensure the reliability of their pro forma financial statements?

Companies can ensure reliability by maintaining accurate records that reflect current expenses and utilizing tailored accounting software for analytical reporting. This adherence to robust accounting practices is essential for portraying a strong financial condition.