Introduction

In the face of financial distress and operational challenges, businesses often find themselves at a crossroads, needing expert guidance to navigate turbulent waters. Restructuring consulting firms play a pivotal role in this process, offering strategic insights and tailored solutions aimed at stabilizing operations and enhancing financial performance. As organizations seek to emerge stronger and more competitive, understanding how to select the right consulting partner becomes crucial.

This article delves into the essential considerations for engaging a restructuring firm, the structured process of collaboration, and the metrics that define the success of these engagements. By equipping CFOs with practical knowledge, it empowers them to make informed decisions that can lead to transformative outcomes for their organizations.

Understanding Restructuring Consulting Firms: Definition and Purpose

are specialized organizations that help companies in navigating financial distress and operational challenges. Their primary purpose is to provide strategic guidance and actionable solutions that help companies stabilize their operations, improve financial performance, and achieve long-term sustainability.

These firms conduct thorough financial assessments to identify opportunities for cash preservation and liability reduction, ensuring that enterprises can weather crises effectively. By assessing a company's operational efficiency and market position, they create tailored strategies that may involve:

- Cost reductions

- Operational streamlining

- Revenue enhancement initiatives specifically customized for

Moreover, through practical interim leadership, they enable transformational change via established methods like Rapid-30, which permits swift identification of underlying organizational issues and promotes quick execution of solutions.

Collaboration with key stakeholders is essential throughout this process, ensuring that all parties are aligned and invested in the turnaround efforts. The ultimate aim is to assist organizations in emerging from crisis stronger and more competitive in their respective markets, leveraging collaborative strategies and real-time analytics to monitor performance and reinforce strengths.

Choosing the Right Restructuring Consulting Firm: Key Considerations and Top Players

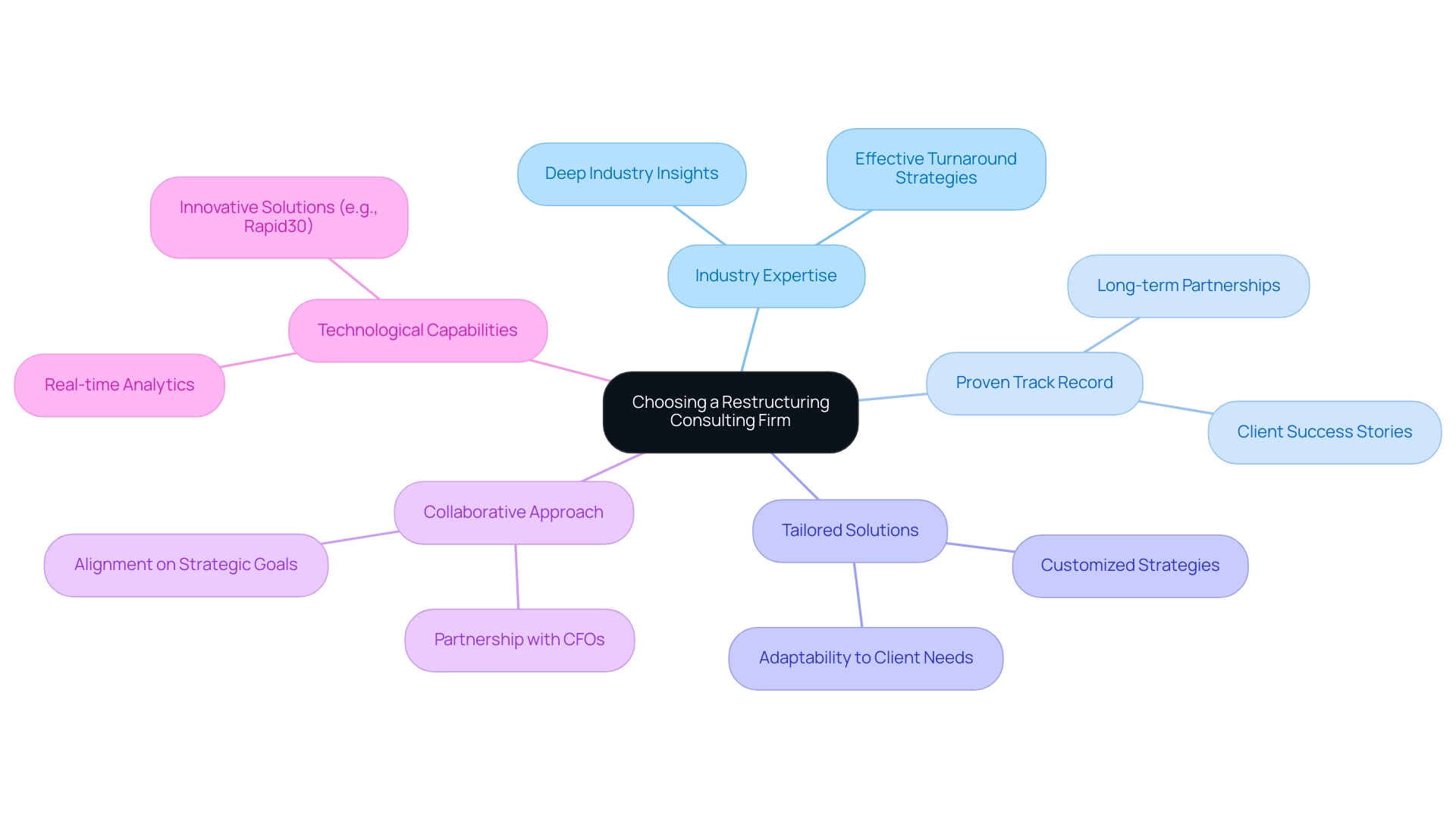

When choosing a consulting firm for reorganization, businesses should consider several critical factors:

- Industry expertise

- A proven track record

- The ability to deliver [tailored solutions

Leading firms](https://factmr.com/report/corporate-restructuring-advisory-market) like AlixPartners, FTI Consulting, and Deloitte are renowned for and effective turnaround strategies. It's essential for companies to evaluate a firm's collaborative approach, ensuring they can closely partner with internal stakeholders, particularly CFOs, to align on strategic goals and priorities.

Additionally, evaluating the firm's technological capabilities is essential, as the use of real-time analytics greatly improves decision-making and performance monitoring during the restructuring. For instance, the SMB team's innovative 'Rapid30' plan exemplifies how testing hypotheses and quick decision-making can lead to transformative outcomes, showcasing client satisfaction and professional success.

The SMB team is also deeply committed to operationalizing the lessons learned throughout the turnaround phase, ensuring that clients not only recover but thrive long-term. As one client remarked, 'SMB assisted my family venture through our most challenging time.' Since completing SMB's turnaround process, we were able to grow our operations debt-free and focus on what we do best: serving our customers.

By thoroughly considering these factors, companies can select a partner that not only understands their unique challenges but is also dedicated to operationalizing lessons learned for sustained growth and relationship-building.

The Process of Engaging a Restructuring Consulting Firm

Engaging a consulting firm for reorganization involves a series of strategic steps crucial for success, beginning with to align key stakeholders and understand the client's unique challenges beyond mere numbers. This initial consultation sets the stage for a detailed assessment phase, where consultants rigorously analyze financial data, operational processes, and market conditions.

Industry insights indicate that financial reorganization is the most desired service, commanding over 30% of the corporate reorganization market share. As mentioned by S. N. Jha, Principal Consultant, financial reorganization includes:

- Contingency planning

- Distressed M&A planning

- Tax & legal adjustments, among others.

Following this analysis, a customized reorganization strategy is devised, focusing on:

- Cost-cutting measures

- Operational enhancements

- Revenue generation initiatives.

A critical aspect of this process is the 'Test & Measure' phase, where hypotheses are rigorously tested to maximize return on investment, ensuring that strategies are data-driven and effective. Recent mergers and acquisitions within the advisory landscape—such as Armanino LLP’s acquisition of Holtzman Partners and Deloitte Consulting’s acquisition of BIAS Corporation—highlight the industry's dynamism.

Once the strategy is established, the firm collaborates closely with the client's leadership team to implement changes efficiently, utilizing real-time analytics through a client dashboard that continually evaluates business health. The 'Update & Adjust' phase is vital, as it allows for ongoing monitoring and necessary adjustments based on performance metrics.

The typical duration of consulting projects spans several months, offering CFOs clarity regarding the engagement timeline. Throughout this process, maintaining open communication and fostering collaboration with the client's leadership is essential for successful outcomes.

With expected to attain a value of US$ 44.5 billion by 2033, the need for skilled reorganization services is projected to increase, especially as companies navigate through increasingly intricate commercial environments. Our commitment extends beyond immediate results, focusing on operationalizing lessons learned to build strong, lasting relationships.

Measuring the Success of Restructuring Consulting Engagements

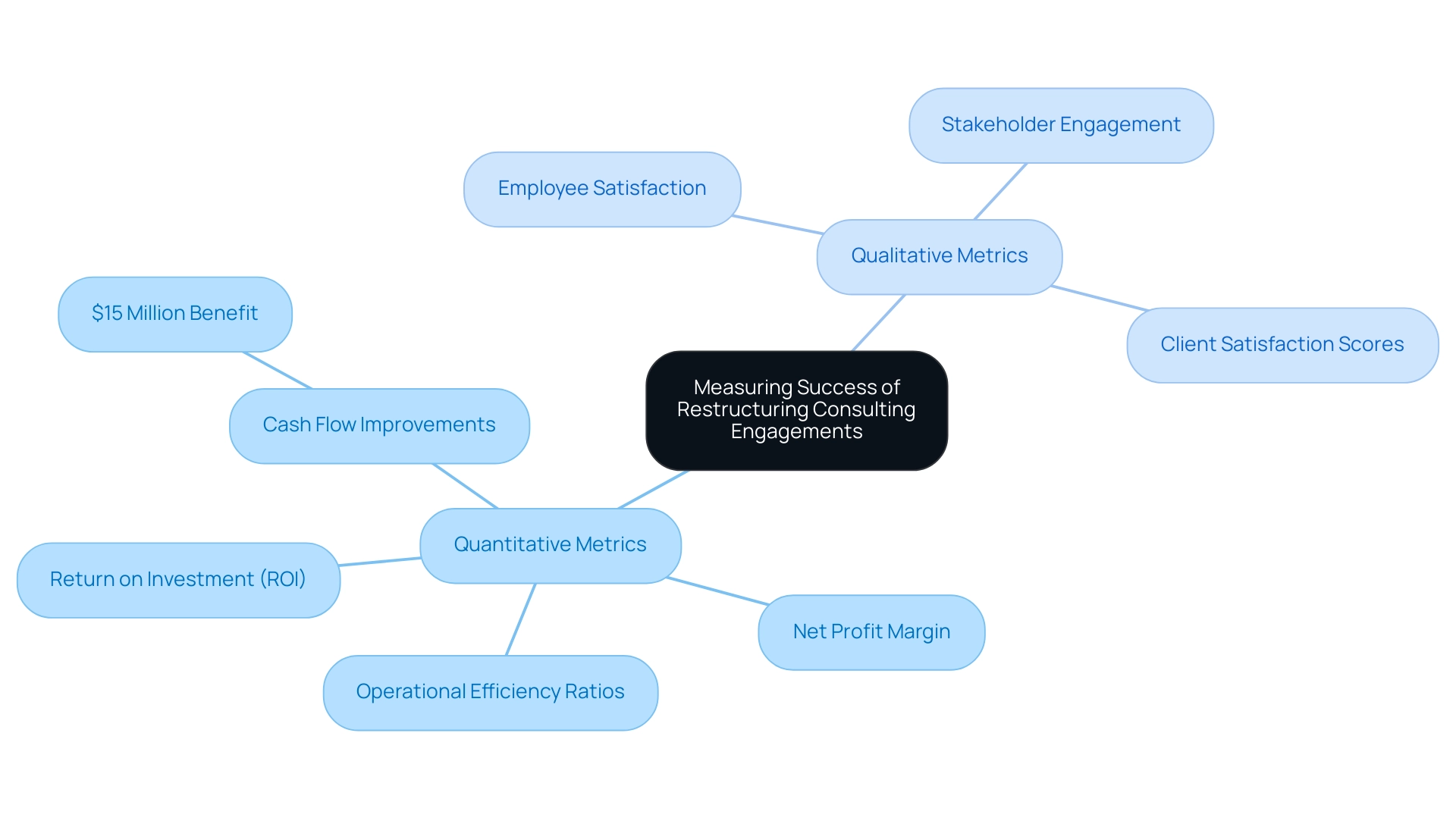

To effectively measure the success of a restructuring consulting engagement, it is crucial for organizations to establish definitive performance metrics at the outset. This process should be collaborative, involving all stakeholders to identify underlying issues that need addressing. Key indicators of success should encompass both quantitative and qualitative aspects.

Quantitative metrics might include significant improvements in cash flow, as evidenced by companies that have realized up to $15 million in benefits through streamlined operations and clarified functional delivery. Our pragmatic approach includes utilizing real-time business analytics through a client dashboard to continually diagnose business health and support decision-making cycles.

Common performance metrics used in reorganization projects include:

- Return on investment (ROI)

- Net profit margin

- Operational efficiency ratios

While reductions in operational costs and increases in revenue serve as vital indicators of successful initiatives. Recent metrics for evaluating advisory effectiveness, such as client satisfaction scores and project completion rates, have also emerged as essential tools in measuring success.

Qualitative measures such as employee satisfaction and stakeholder engagement play a pivotal role in evaluating the overall effectiveness of organizational changes. Expert opinions indicate that a balanced scorecard method, which merges both financial and non-financial metrics, can offer a comprehensive perspective on performance in advisory engagements.

Regular evaluations and adjustments based on these metrics not only ensure strategies align with the company's evolving objectives but also enhance market competitiveness. A notable example is a government organization that implemented , leading to improved financial sustainability. This case highlights the importance of both structured performance evaluations and operationalizing lessons learned during the turnaround process, reinforcing our commitment to continuous improvement and achieving successful outcomes in restructuring consulting engagements.

Conclusion

Navigating the complexities of financial distress and operational challenges requires a strategic partnership with a restructuring consulting firm. Understanding the definition and purpose of these firms is essential, as they provide the necessary expertise to stabilize operations and enhance financial performance. By conducting thorough assessments and developing tailored strategies, these firms empower organizations to emerge from crises stronger and more competitive.

Choosing the right consulting partner hinges on critical considerations such as industry expertise, a proven track record, and the ability to deliver customized solutions. Leading firms excel in collaborative approaches, ensuring alignment with internal stakeholders and leveraging technology for real-time analytics. This partnership fosters a proactive environment that not only addresses immediate challenges but also sets the foundation for long-term growth.

The engagement process is structured and methodical, beginning with a comprehensive review and culminating in a tailored restructuring strategy. Success hinges on continuous monitoring and adaptation, allowing organizations to respond swiftly to changing circumstances. By establishing clear performance metrics from the outset, businesses can gauge the effectiveness of their restructuring efforts and make data-driven decisions.

Ultimately, engaging a restructuring consulting firm is not merely about overcoming current challenges; it’s about building a resilient organization capable of thriving in an evolving market landscape. By prioritizing strategic partnerships and focusing on measurable outcomes, CFOs can drive transformative change that positions their companies for sustainable success.

Frequently Asked Questions

What is the main purpose of restructuring consulting firms?

Restructuring consulting firms help companies navigate financial distress and operational challenges by providing strategic guidance and actionable solutions to stabilize operations, improve financial performance, and achieve long-term sustainability.

What strategies do restructuring consulting firms typically employ?

They conduct thorough financial assessments to identify opportunities for cash preservation and liability reduction, and create tailored strategies that may involve cost reductions, operational streamlining, and revenue enhancement initiatives, particularly for small to medium enterprises.

How do these firms facilitate transformational change?

They enable transformational change through practical interim leadership and established methods like Rapid-30, which allows for the swift identification of organizational issues and quick execution of solutions.

Why is collaboration with key stakeholders important in the restructuring process?

Collaboration ensures that all parties are aligned and invested in the turnaround efforts, which is essential for successfully emerging from a crisis stronger and more competitive in the market.

What factors should businesses consider when choosing a consulting firm for reorganization?

Businesses should consider industry expertise, a proven track record, the ability to deliver tailored solutions, and the firm's technological capabilities, particularly in utilizing real-time analytics for decision-making.

What is the significance of the 'Test & Measure' phase in the reorganization process?

The 'Test & Measure' phase involves rigorously testing hypotheses to maximize return on investment, ensuring that strategies are data-driven and effective.

How long do typical consulting projects last, and what is their focus?

Consulting projects typically span several months, focusing on comprehensive business reviews, detailed assessments, customized reorganization strategies, and ongoing monitoring through real-time analytics.

What are some key performance metrics used to measure the success of restructuring engagements?

Key metrics include return on investment (ROI), net profit margin, operational efficiency ratios, client satisfaction scores, and project completion rates, along with qualitative measures such as employee satisfaction and stakeholder engagement.

How can organizations ensure their restructuring strategies remain effective over time?

Organizations can ensure effectiveness by establishing definitive performance metrics at the outset, conducting regular evaluations and adjustments based on these metrics, and operationalizing lessons learned during the turnaround process.