Introduction

In today's competitive business landscape, CFOs face numerous challenges that can impact the financial health of their organizations. From lack of financial planning and management to insufficient cash flow and poor market understanding, these obstacles can derail even the most well-established companies. This article explores three key reasons why CFOs must address these challenges head-on and provides practical advice and solutions to help them navigate through financial turbulence.

By understanding the importance of robust financial planning, mastering cash flow management, and staying ahead of market dynamics, CFOs can steer their organizations towards long-term success.

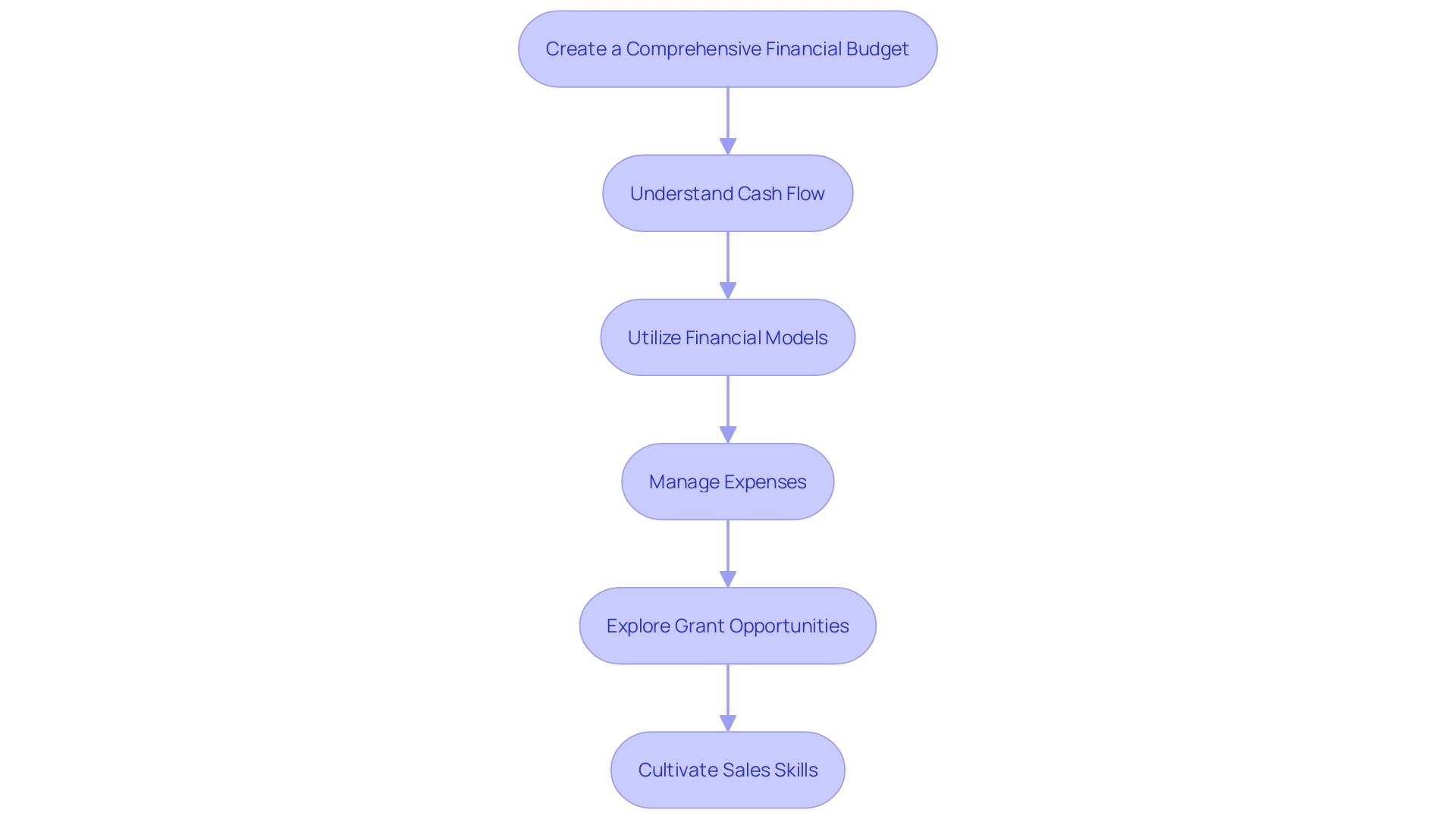

Reason 1: Lack of Financial Planning and Management

Creating a robust financial plan is not just a nice-to-have; it's a bedrock necessity for any thriving business. It's the difference between navigating through financial turbulence or being capsized by it. A comprehensive financial plan empowers businesses to allocate resources with precision, control cash flow with foresight, and make strategic decisions with confidence.

Without it, companies are often caught off guard by unmonitored expenses, unchecked revenue, or cost overruns, leading to a precarious financial position or even failure.

To establish this financial bulwark, begin with meticulous budgeting and financial planning. This process is pivotal to achieving and maintaining financial stability. By meticulously analyzing your financial status and recognizing all sources of income and expenditures, you set the stage for an effective budget, one that not only guides current spending but also shapes future financial scenarios.

Moreover, a dynamic approach to budgeting—where you revise and adapt your financial plan in response to market shifts, industry trends, and evolving customer needs—can keep your business aligned with its objectives, fostering enduring financial health.

Equally important is mastering cash flow management. It's the art of ensuring that the timing and amount of money flowing in and out of the business are in sync, thus avoiding financial shortfalls that could jeopardize day-to-day operations. Regular forecasting of cash inflows and outflows gives you a clearer picture of your financial landscape, enabling you to navigate it with greater agility.

In essence, financial planning is the compass that steers your business towards wealth—a strategic, step-by-step journey that doesn't have to be daunting. In fact, the simplicity and prioritization of this process are often underscored by financial experts, emphasizing the importance of understanding your financial circumstances, setting clear goals, and continuously monitoring your progress.

Indeed, the initial consultation with a financial professional can often be the first step towards this clarity—many offer a free first discussion to help you start on the right foot. Remember, the goal is not just to create a financial plan but to become financially literate, turning the complex into the manageable and the overwhelming into the achievable.

Reason 2: Insufficient Cash Flow

A robust cash flow is the lifeblood of any thriving business, yet many firms find themselves grappling with financial instability due to poor cash flow management. The ability to balance money coming in with money going out is pivotal for day-to-day operations, such as covering expenses, capitalizing on growth opportunities, and fulfilling financial commitments. When cash flow turns negative, it can trigger a perilous chain reaction: difficulties in bill payments, payroll challenges, and a lack of capital for essential investments, which may ultimately steer a business towards the brink of bankruptcy.

To proactively manage and enhance cash flow, firms must diligently monitor their financial inflows and outflows. It's imperative to understand the significance of comprehensive financial statement reviews, including cash flow statements, income statements, and balance sheets. Dr. Sharon H. Porter from Vision & Purpose Lifestyle Magazine and Media emphasizes the importance of leaders knowing their numbers, as it is fundamental to the future success of their business.

Furthermore, developing a strategic approach to allocating funds is crucial. This includes investments that yield a substantial return, allowing businesses to thrive even in challenging times. Tracking key performance indicators (KPIs) is also essential, as Peter Drucker famously stated, "What gets measured gets managed."

By keeping a close eye on metrics like gross profit margin, operating expenses, and debt levels, businesses can pinpoint areas to improve cash flow.

A study by Intuit highlights common pitfalls leading to cash flow issues, such as slow-paying customers and high fixed costs. Tackling these issues head-on can prevent the cash flow gaps that endanger a company's financial health. Additionally, embracing strategies like break-even analysis can clarify the sales needed to cover costs and achieve profitability.

In today's dynamic business landscape, cash flow management is not merely about survival but about building a foundation for long-term, sustainable success. As such, businesses must adopt a strategic and analytical approach to cash flow, ensuring they can navigate through any financial challenges that may arise.

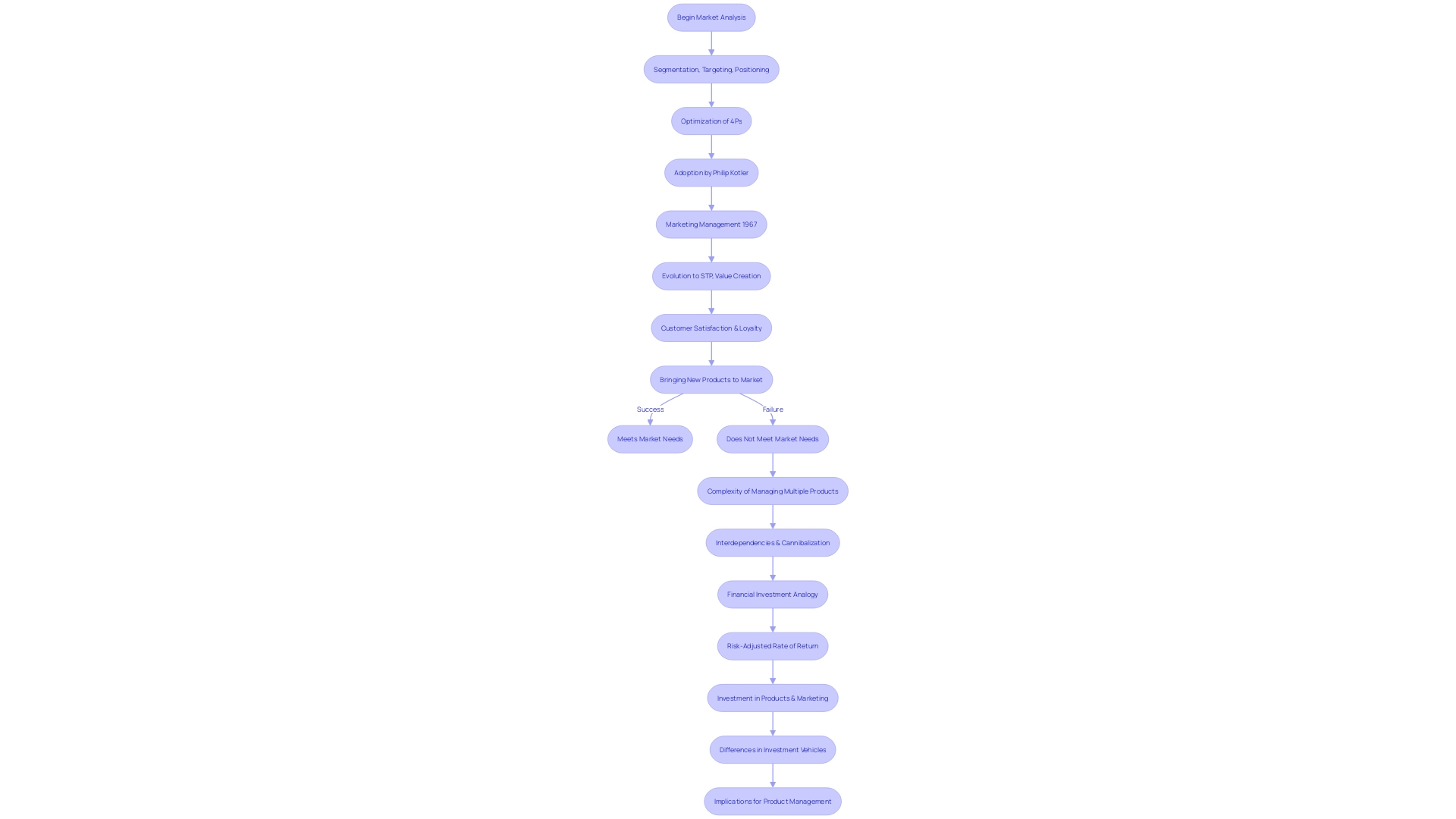

Reason 3: Poor Market Understanding and Competition

Understanding market dynamics is crucial for a business's survival, especially in a landscape where investment heavyweights might hold stakes in competing giants, such as Coca-Cola and Pepsi. Common ownership and the interplay of competitive forces shape the battlefield in unexpected ways. It's not just the economic theory that profits draw competition; in reality, the competitive advantage period (CAP) for a business is a complex interplay of invested capital returns, industry change rates, and company-specific factors.

This CAP doesn't follow a linear depreciation with increased competition, contrary to theoretical expectations.

Firms with generic products, traditionally competing on price, find themselves in a race that converges their returns to the cost of capital over time. Yet, the real-world scenario often deviates from this model. For instance, the market's reaction to the write-down of Kraft Heinz's brand assets raised questions about the sustainability of 'Big Food' brands and the effectiveness of their competitive strategies.

Moreover, the allure of 'Banana Stand Businesses'—firms with products consumers love—can lead to significant capital loss if not managed well, echoing the importance of understanding customer preferences and trends. Companies that navigate these complexities by continuously innovating and adapting to market demands can maintain their market share and financial health. Analyzing industry-specific data, such as the rise in concentration within Canada's most concentrated industries from 2000 to 2020, underscores the importance of vigilance and agility in business strategies.

As competition intensifies and the landscape evolves, firms must refine their strategic approaches, ensuring they resonate with market needs and withstand the competitive storm.

Conclusion

In conclusion, CFOs must address three key challenges to ensure the financial health and long-term success of their organizations. The first challenge is the lack of financial planning and management. By creating a robust financial plan, CFOs can allocate resources effectively, control cash flow, and make strategic decisions with confidence.

Meticulous budgeting and continuous adaptation of the financial plan to market shifts are crucial for maintaining financial stability.

The second challenge is insufficient cash flow management. CFOs must diligently monitor financial inflows and outflows to balance money coming in and going out. Comprehensive financial statement reviews, tracking key performance indicators, and addressing common pitfalls can help enhance cash flow.

By adopting a strategic and analytical approach to cash flow, CFOs can build a foundation for long-term success.

The third challenge is poor market understanding and competition. CFOs need to understand market dynamics and adapt their strategies accordingly. Market forces and interplay among competitors shape the business landscape in unexpected ways.

By continuously innovating, adapting to market demands, and analyzing industry-specific data, CFOs can maintain market share and financial health.

To navigate these challenges, CFOs should take practical steps such as consulting with financial professionals, becoming financially literate, and understanding the significance of comprehensive financial statements. It is crucial for CFOs to take action and implement these solutions to steer their organizations towards financial success.

By addressing these challenges head-on, CFOs can ensure the financial stability, growth, and long-term success of their organizations.