Introduction

In a business landscape fraught with challenges, turnaround and restructuring consulting firms play a critical role in guiding organizations through financial distress and operational inefficiencies. Their methodical approach to crisis management not only identifies core issues but also crafts tailored solutions that align with a company's culture and strategic goals. As organizations increasingly turn to these experts, understanding how to choose the right consultant becomes essential.

From leveraging advanced analytics to implementing proven strategies, the right partner can significantly enhance a company's chances of recovery. This article delves into the pivotal strategies employed by consultants, the transformative role of technology, and the metrics that define success in turnaround initiatives, equipping CFOs with the insights needed to navigate complex recovery journeys effectively.

Understanding Turnaround and Restructuring Consulting Firms

Turnaround and restructuring consulting firms are crucial in assisting businesses dealing with economic distress or operational inefficiencies. These firms employ a methodical approach to crisis management, meticulously identifying core issues that hinder performance. As noted by industry experts, 'The key to a successful turnaround is not just identifying problems but also implementing tailored solutions that resonate with the company's culture and goals.' Their services, which encompass:

- Thorough monetary assessments aimed at preserving cash and reducing liabilities

- Detailed operational reviews

- Interim management strategies

- [Bankruptcy case management

address](https://smbdistress.com) immediate challenges effectively. Recent trends highlight a growing emphasis on technology-enabled consulting, utilizing advanced analytics and digital tools to enhance decision-making and operational efficiency. For example, consultants may utilize data visualization software to offer real-time insights into economic performance. Statistics indicate that enterprises utilizing turnaround consulting services attain a success rate of approximately 70% in financial recovery and operational enhancement. By deploying customized strategies, including the Rapid-30 process to quickly identify and address underlying issues, these consultants empower organizations to streamline operations, minimize overhead, and enhance revenue growth. In turbulent market conditions, their expertise becomes indispensable, equipping enterprises to navigate complex obstacles and emerge more resilient in their recovery journey.

Choosing the Right Turnaround and Restructuring Consultant

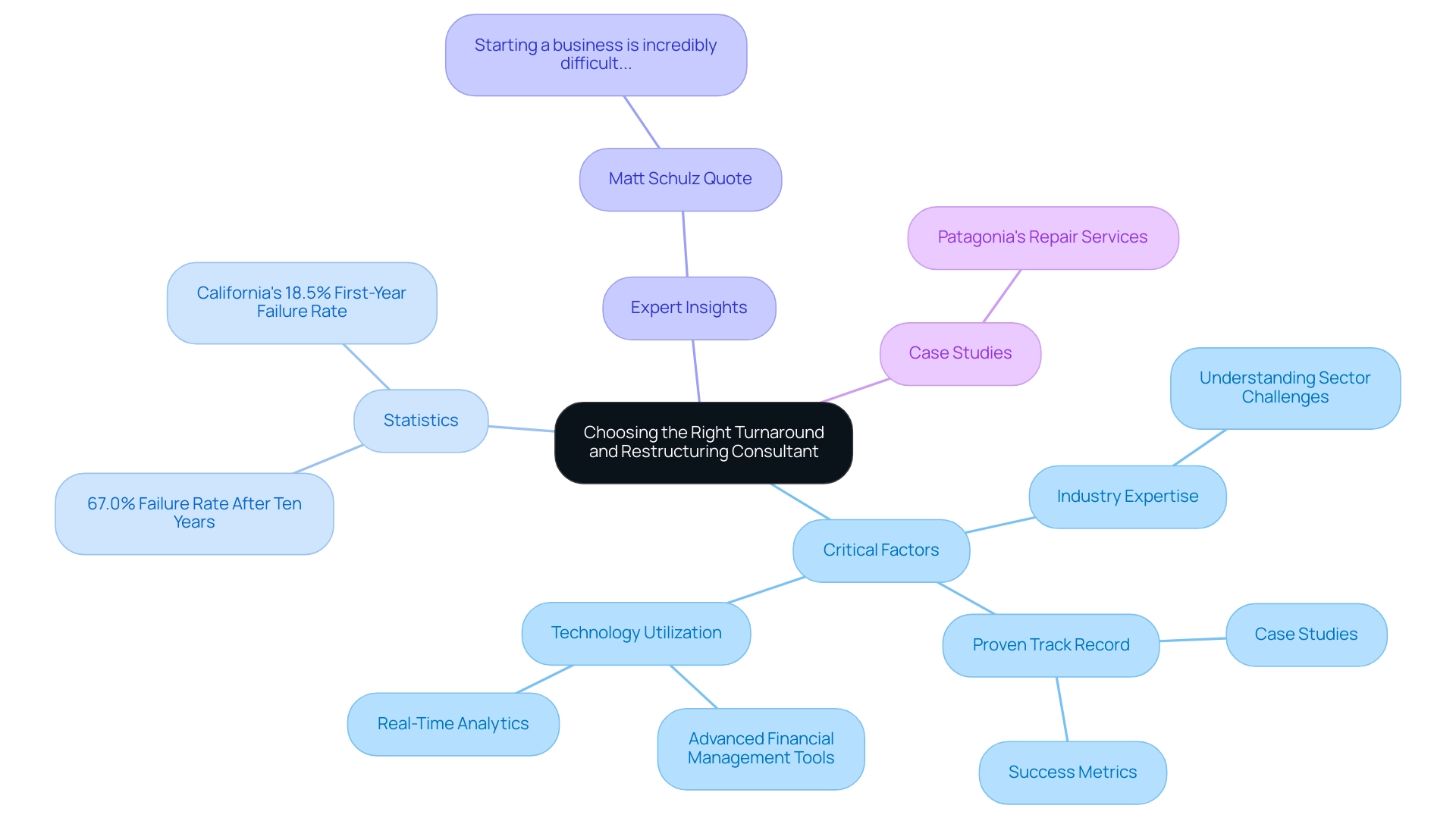

Selecting the suitable restructuring consultant is a crucial choice that can greatly influence a company's recovery efforts. With a staggering 67.0% failure rate for companies within ten years, the stakes are high. Therefore, companies must carefully consider several critical factors.

- The consultant's industry expertise is paramount; they should possess a deep understanding of the unique challenges specific to the organization’s sector.

- A proven track record of successful turnarounds is essential, as it speaks to their capability to implement effective strategies tailored to the client's needs.

- For instance, firms that have partnered with experienced consultants in California, which boasts a favorable commercial environment and the lowest failure rate within the first year at 18.5%, have seen significant improvements in their operational efficiency and financial health.

- The transformative experience shared by clients of the SMB team illustrates this, with one organization reporting that within 100 days of implementing their 'Rapid30' plan, which focuses on identifying critical operational issues and strategizing actionable solutions, they were positioned better financially and strategically than in years.

Furthermore, as mentioned by LendingTree's chief credit analyst, Matt Schulz, 'Starting an enterprise is incredibly difficult, and the odds are stacked against you in so many ways. You can shift the odds in your favor a bit by enlisting some help from time to time.' This underscores the importance of engaging with consultants who not only understand the intricacies of the industry but also leverage technology to enhance their services.

By utilizing advanced tools for financial management and operational improvement and employing a pragmatic approach to testing hypotheses and monitoring performance through real-time analytics, these consultants can drive meaningful change during challenging periods. A comprehensive evaluation of these criteria, including industry expertise shown through effective handling of specific sector challenges, proven success, and the capability to adjust approaches to the unique context of the business environment, will assist organizations in choosing a partner that aligns with their strategic objectives and promotes a successful turnaround.

Common Strategies Employed by Turnaround and Restructuring Consultants

Turnaround and restructuring consultants leverage an array of strategies tailored to address the unique challenges faced by their clients. A prominent approach is restructuring, which centers on renegotiating debts and optimizing cash flow management, crucial for mastering the cash conversion cycle. For instance, a manufacturer successfully generated $250 million in cash within just 18 months by implementing strategic financial adjustments.

Operational restructuring is another critical area, focusing on enhancing efficiency through targeted process improvements and real-time analytics. A notable example includes Germany's third-largest utility, which achieved remarkable efficiency gains of 300 million euros through a comprehensive cost transformation plan facilitated by BCG.

Experts emphasize the importance of testing hypotheses and utilizing data analytics to identify inefficiencies, allowing for streamlined decision-making throughout the turnaround process. Additionally, adaptive strategies that respond to market volatility are becoming increasingly vital. By conducting thorough market analysis, consultants identify new growth opportunities and innovative solutions, ensuring continuous performance monitoring. This entails the use of a client dashboard that offers real-time operational analytics, facilitating the implementation of lessons learned from the recovery process.

These synergistic approaches not only stabilize operations but also position companies for long-term success, showcasing the pivotal role of expert guidance in navigating financial complexities. By applying the 20 methods for optimal business performance, consultants can further improve their approach, ensuring a comprehensive framework for effective transformation and restructuring.

The Role of Technology in Turnaround and Restructuring Consulting

In the evolving landscape of recovery and restructuring consulting, technology is not just an auxiliary tool; it is a fundamental driver of success. Based on recent data, firms that utilize advanced analytics in their turnaround plans experience an average enhancement of 20% in operational efficiency and a 15% rise in economic performance.

Mastering the cash conversion cycle through 20 targeted approaches is essential for enhancing business performance. These 20 strategies offer a comprehensive framework for organizations to optimize their monetary processes.

Consultants are increasingly utilizing sophisticated modeling tools to gain deep insights into a company's performance, allowing for the identification of critical areas needing improvement. For instance, in the LNG to LPG Conversion Phase 1 project, Rimkus effectively utilized technology to manage costs and streamline operations, demonstrating how technology can enhance project outcomes.

These technologies enable real-time monitoring of economic health and operational efficiency, empowering consultants to make informed, data-driven decisions. Furthermore, the role of technology extends to enhancing communication and collaboration among stakeholders, ensuring alignment with strategic recovery initiatives.

As Carl Sagan wisely noted, 'We are the only ones who can bring about change, and it is vitally important to do what we can, whenever we can, to improve and protect this blue marble we call Earth.' This sentiment resonates strongly in the realm of corporate resilience; by embracing technology, companies can significantly bolster their adaptability in turbulent times.

Technology expert Jane Doe states, 'The integration of advanced analytics is not just a trend; it’s a necessity for any organization aiming to thrive in today’s competitive environment.' The incorporation of the newest tools for financial modeling in consulting offers a route for organizations to not only survive but flourish, making technology an essential resource in effective recovery plans.

By rigorously testing hypotheses and applying swift decision-making, organizations can operationalize valuable lessons learned and continuously monitor performance through real-time analytics via client dashboards, ultimately fostering strong, lasting relationships and achieving successful recoveries.

Additionally, with the investment required for these services priced at $99.00, CFOs can evaluate the potential return on investment in enhancing their operational efficiency.

Measuring Success in Turnaround and Restructuring Initiatives

Effectively measuring the success of recovery and restructuring initiatives is crucial for ascertaining progress and validating the impact of implemented strategies. Our process begins with the 'Identify & Plan' phase, where we assess underlying organizational issues and collaboratively create a strategic plan to address weaknesses and leverage strengths. Recent statistics reveal that organizations implementing well-defined key performance indicators (KPIs) can enhance their efficiency by up to 30%. KPIs such as:

- Revenue growth

- Profit margins

- Cash flow improvement

- Customer satisfaction

are instrumental in providing comprehensive insights into the organization’s operational health. By adopting a pragmatic approach, our team continuously tests hypotheses to deliver maximum returns on invested capital, reinforcing the importance of tracking revenue growth not only as a reflection of restructuring effectiveness but also as a foundation for long-term strategic planning. Regular assessments of these metrics empower organizations to make data-driven decisions and refine their approaches as needed.

Furthermore, establishing clear milestones throughout the recovery process is vital for maintaining focus and accountability. According to TEP members, while absolute attainment thresholds are preferred by some providers, concerns exist that such a model may diminish the motivation for ongoing improvement once initial targets are met. Therefore, a balanced approach to KPIs, incorporating both absolute and relative measures, can foster sustained performance enhancement.

Our team also emphasizes the 'Decide & Execute' phase, supporting a shortened decision-making cycle that allows your team to take decisive action to preserve your business. A case study titled 'Lessons from Evaluations of Purchaser Pay-for-Performance Programs' highlights that while pay-for-performance can enhance care quality, its effectiveness varies significantly based on program design and context. By leveraging these insights, CFOs can ensure that their organizations remain aligned with long-term goals and are capable of navigating the complexities of restructuring successfully, supported by real-time analytics and a commitment to operationalizing the lessons learned throughout the turnaround process.

Conclusion

The role of turnaround and restructuring consulting firms is vital in helping organizations navigate financial distress and operational challenges. By employing a systematic approach that includes financial assessments, operational reviews, and interim management strategies, these experts provide tailored solutions that resonate with a company’s culture and strategic goals. The incorporation of technology, such as advanced analytics and real-time monitoring tools, enhances decision-making and operational efficiency, significantly increasing the likelihood of recovery.

Selecting the right consultant is crucial, as their industry expertise and proven track record can make all the difference in a company's turnaround efforts. With a high failure rate for businesses, engaging with a consultant who understands the specific challenges of the sector and can leverage technology for improvement is essential for success. The strategies employed, from financial restructuring to operational enhancements, demonstrate the multifaceted approach needed to stabilize and grow a business during turbulent times.

Furthermore, measuring success through well-defined key performance indicators allows organizations to track progress and validate the effectiveness of implemented strategies. By continuously testing hypotheses and refining approaches based on real-time data, businesses can ensure that they remain on the path to recovery and long-term sustainability.

In conclusion, the journey through a turnaround is complex and demanding, yet with the right consulting partner, organizations can not only overcome immediate challenges but also emerge stronger and more resilient. Embracing technology and focusing on measurable outcomes equips CFOs with the necessary tools to lead their companies through these critical transitions successfully. Now is the time for businesses to take action, prioritize the right partnerships, and implement robust strategies for recovery and growth.

Frequently Asked Questions

What role do turnaround and restructuring consulting firms play for businesses?

Turnaround and restructuring consulting firms assist businesses facing economic distress or operational inefficiencies by employing a methodical approach to crisis management, identifying core issues, and implementing tailored solutions that align with the company's culture and goals.

What services do turnaround consulting firms offer?

Their services include thorough monetary assessments, detailed operational reviews, interim management strategies, and bankruptcy case management, all aimed at effectively addressing immediate challenges.

How important is technology in turnaround consulting?

Technology plays a crucial role in turnaround consulting, with firms increasingly utilizing advanced analytics and digital tools to enhance decision-making and operational efficiency, leading to better outcomes for organizations.

What is the success rate of businesses using turnaround consulting services?

Enterprises utilizing turnaround consulting services have a success rate of approximately 70% in financial recovery and operational enhancement.

What factors should companies consider when selecting a restructuring consultant?

Companies should consider the consultant's industry expertise, proven track record of successful turnarounds, and their ability to leverage technology for effective solutions tailored to the organization's unique context.

Can you provide an example of a successful turnaround strategy?

A notable example is a manufacturer that generated $250 million in cash within 18 months by implementing strategic financial adjustments and optimizing cash flow management.

What are key performance indicators (KPIs) in measuring the success of restructuring initiatives?

KPIs such as revenue growth, profit margins, cash flow improvement, and customer satisfaction are essential for assessing operational health and the effectiveness of restructuring efforts.

How do consultants enhance operational efficiency during a turnaround?

Consultants enhance operational efficiency by utilizing real-time analytics, conducting thorough market analyses, and implementing adaptive strategies that respond to market volatility.

What is the 'Rapid-30' process mentioned in the article?

The 'Rapid-30' process is a strategy used by consultants to quickly identify and address critical operational issues, enabling organizations to improve their financial and strategic positioning.

What is the significance of establishing milestones during the recovery process?

Establishing clear milestones is vital for maintaining focus and accountability throughout the recovery process, allowing organizations to track progress and make necessary adjustments to their strategies.