Overview

Turnaround management services represent strategic frameworks aimed at revitalizing struggling businesses. By identifying the root causes of underperformance, these services implement focused recovery strategies designed to restore profitability and sustainability. Such approaches are crucial for CFOs navigating financial distress. They leverage thorough financial evaluations, operational optimizations, and technology-driven insights to foster organizational resilience and enhance market competitiveness. This underscores the necessity of adopting turnaround management services in today’s challenging economic landscape.

Introduction

In a world where businesses frequently face unexpected hurdles, turnaround management services stand out as a beacon of hope for struggling organizations. These services offer a structured framework designed to analyze and rejuvenate underperforming companies, concentrating on critical areas such as:

- Financial health

- Operational efficiency

- Market positioning

By implementing targeted strategies, businesses can not only reclaim profitability but also secure long-term sustainability. As industries evolve and confront new challenges, understanding the nuances of turnaround management becomes essential for CFOs and decision-makers aiming to navigate financial distress effectively.

This article explores the key components, common challenges, and strategic approaches that characterize successful turnaround management, emphasizing the importance of leveraging technology and expert insights to foster recovery and growth in an increasingly competitive landscape.

Understanding Turnaround Management Services

Turnaround management services represent a strategic framework designed to rejuvenate struggling businesses. These services begin with a comprehensive examination of a company's operations, economic health, and market positioning to unveil the root causes of underperformance. The primary objective is to implement focused strategies that not only restore profitability but also ensure long-term sustainability.

Key elements of recovery management encompass:

- Thorough financial evaluations

- Reorganizing financial commitments

- Maximizing operational efficiencies

- Enhancing leadership effectiveness

- Providing temporary management services alongside bankruptcy case oversight

Notably, companies that embrace customer-centric approaches are reported to be 60% more profitable than those that neglect customer engagement. This underscores the critical importance of understanding customer needs in the change process.

As Steve Jobs astutely pointed out, organizations must thoroughly comprehend their clients to anticipate their requirements and deliver tailored experiences.

Recent trends in 2025 indicate a growing emphasis on technology-driven consulting, empowering companies to leverage real-time analytics for informed decision-making and continuous performance assessment. Successful case studies illustrate how organizations have revitalized their operations through effective restructuring. For instance, the case study titled 'Understanding Customers for Proactive Experiences' highlights the necessity of knowing customers to achieve true customer centricity.

By gathering feedback and mapping the customer journey, companies can anticipate needs and provide tailored experiences, ultimately resulting in improved financial outcomes.

Expert opinions stress the significance of turnaround management services for struggling enterprises. Industry leaders assert that grasping the nuances of turnaround management equips CFOs to adeptly navigate the complexities of financial distress. As Arianna Huffington noted, we often mistakenly believe that success stems from the quantity of time invested at work, rather than the quality of that time.

By adopting recovery strategies, organizations can not only rebound from setbacks but also enhance their overall profitability and market competitiveness. Transform Your Small/Medium Business is committed to collaborating with clients to ensure a successful recovery process.

Common Challenges Leading to Turnaround Management Needs

Companies frequently encounter a range of challenges that necessitate the engagement of turnaround management services. Key issues encompass declining sales, rising operational costs, cash flow shortages, and heightened market competition. For instance, a retail company may witness a substantial decline in foot traffic due to shifting consumer preferences, leading to reduced revenues.

Moreover, detrimental leadership decisions—such as overexpansion or insufficient financial planning—can exacerbate these challenges.

Statistics indicate that 4.1% of supervisors recognize that modifying top leadership should be a crucial strategy in addressing these obstacles. This highlights the importance of early detection of distress signals, as it facilitates the swift engagement of turnaround management services before situations escalate into crises. As Markus C. Slevogt notes, 'Using a qualitative and phenomenological method, this study reveals the lived experiences of these managers, examining the nuances and intricacies of their recovery journeys.'

This perspective underscores the necessity of understanding managerial experiences during recovery processes.

To effectively tackle these challenges, organizations must embrace a pragmatic approach to data, utilizing turnaround management services to test hypotheses and optimize returns on invested capital. Transform Your Small/ Medium Business fosters a streamlined decision-making cycle throughout the recovery process, empowering CFOs to take decisive actions to safeguard their organizations. Additionally, we continuously monitor the effectiveness of our strategies through a client dashboard that provides real-time business analytics, facilitating ongoing evaluation of business health.

The theoretical framework for implementing recovery strategies during economic downturns emphasizes the need for companies to adapt to challenging economic conditions. Recognizing these common challenges and understanding the indicators of economic distress can enable CFOs to act decisively, ensuring their organizations are well-equipped to navigate turbulent times and achieve sustainable growth.

A notable case study is Marvel's transformation following its bankruptcy in 1996, which was a result of years of mismanagement and economic instability. Initially regarded as a lost cause, Marvel successfully licensed its characters for films and diversified into movies and merchandise, ultimately evolving into a global entertainment powerhouse. This shift culminated in a $4 billion acquisition by Disney, illustrating the potential for recovery through strategic oversight and innovation.

Key Strategies in Turnaround Management

Key strategies in turnaround management services encompass fiscal restructuring, operational optimization, and leadership realignment, all bolstered by streamlined decision-making and real-time analytics. Financial restructuring typically involves renegotiating debts, enhancing cash flow oversight, and reallocating resources to more profitable segments. This approach is vital, as successful financial restructuring can markedly improve a company's recovery prospects; studies indicate that organizations implementing these strategies achieve success rates exceeding 70% in stabilizing their financial health.

Operational optimization stands as another critical component, concentrating on streamlining processes, minimizing waste, and enhancing productivity. For example, a manufacturing firm facing operational inefficiencies may adopt lean manufacturing principles, which have demonstrated the ability to reduce costs by up to 30% while concurrently improving output quality. The integration of real-time business analytics empowers organizations to continually monitor their operational success, facilitating timely adjustments that enhance performance.

Leadership realignment often necessitates changes in management to infuse fresh perspectives and expertise into the organization. This shift can be pivotal in propelling the recovery process, as effective leadership is essential for implementing and sustaining change. By applying the lessons learned throughout the recovery process, organizations can cultivate strong, lasting relationships that further bolster recovery efforts.

Incorporating these strategies enables CFOs to adeptly navigate their organizations through challenging times, ultimately steering them toward recovery via turnaround management services. The recovery process is characterized by a progression from low-risk measures to more radical actions as the risk of decline escalates, aiming to restore performance and ensure long-term viability. As highlighted in the case study 'Phases of Turnaround and Recovery,' this progression is crucial for identifying management actions that impact profits.

Moreover, it is imperative for CFOs to uphold core profit-generating elements during the recovery process, ensuring that the foundation of the business remains intact while implementing necessary changes. As Leigh Steinberg wisely stated, 'The only thing certain about any negotiation is that it will lead to another negotiation,' underscoring the significance of negotiation in the economic restructuring phase.

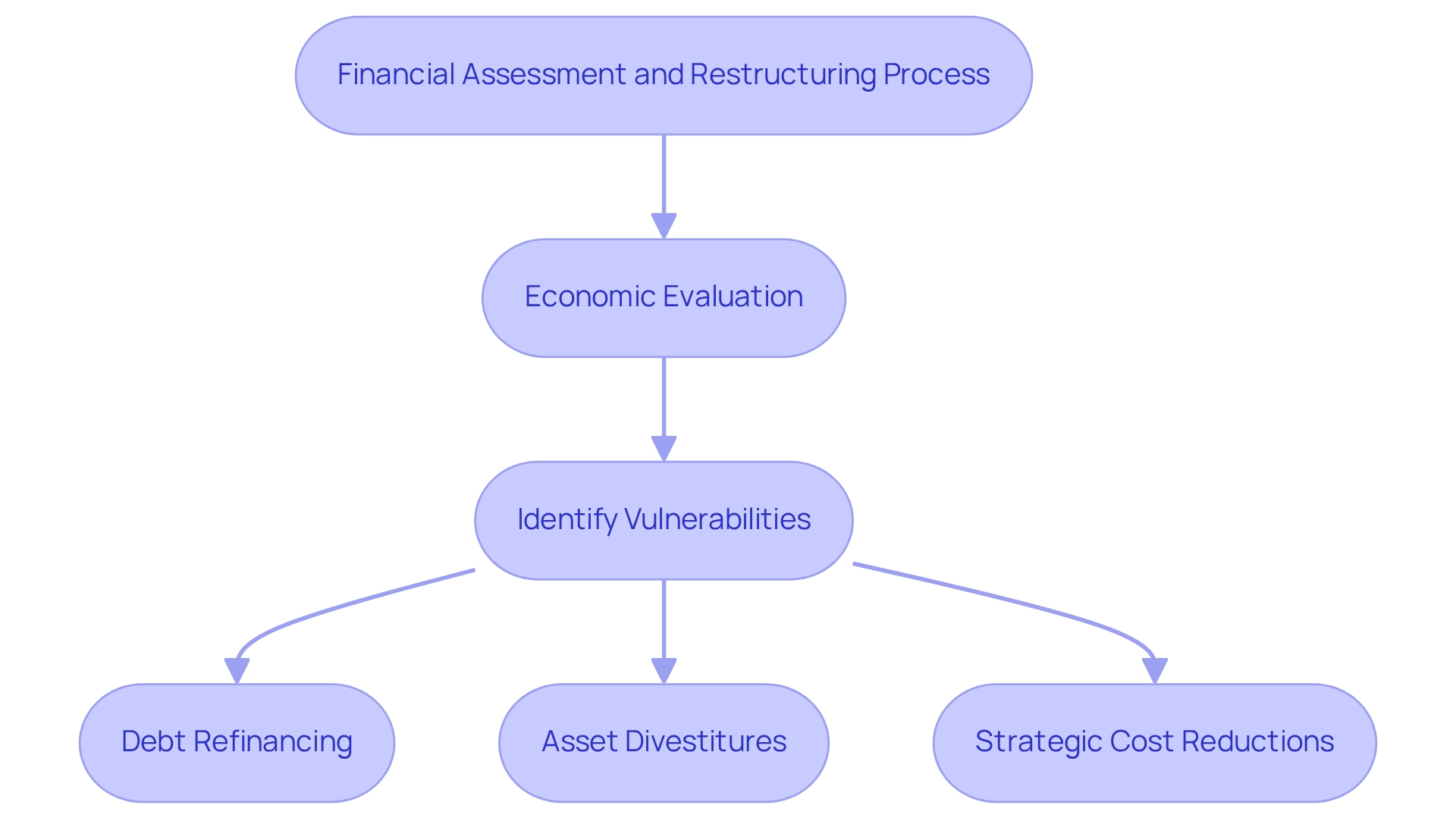

Financial Assessment and Restructuring in Turnaround Management

Economic evaluation serves as the cornerstone of effective turnaround management, offering a comprehensive perspective on a company's fiscal health and operational sustainability. This process entails a meticulous analysis of monetary statements, cash flow forecasts, and key performance indicators to identify vulnerabilities. Recognizing these weaknesses is essential, as it lays the groundwork for targeted restructuring initiatives, which may include:

- Debt refinancing

- Asset divestitures

- Strategic cost reductions

A recent case study involving a leading aerospace supplier exemplifies how a well-structured reorganization strategy enabled the company to navigate significant market disruptions caused by new entrants. By focusing on economic evaluation, the supplier successfully adjusted its operations and maintained competitiveness in a challenging environment, ultimately achieving a more resilient market position.

CFOs can leverage restructuring to enhance cash flow by implementing strategies such as extending payment terms on existing debt. This tactic not only alleviates immediate liquidity pressures but also positions the company for long-term stability. Recent statistics reveal that businesses prioritizing monetary assessment during turnaround efforts experience a higher success rate in debt restructuring, with many realizing substantial improvements in liquidity and operational efficiency.

In fact, studies indicate that companies effectively employing economic assessment can see success rates in debt restructuring increase by over 30%.

Current trends in monetary evaluation practices highlight the integration of emerging technologies, particularly AI and machine learning, which are transforming corporate restructuring strategies. By harnessing advanced analytics and real-time data, CFOs can make informed decisions that drive transformational change within their organizations. As Jim Schoen, Principal at FRC Group, asserts, "This is truly a service that benefits the consulting industry and associated clients."

Additionally, the Business Valuation Report, priced at $3,500.00, offers essential insights and expert guidance from our team, including Peter Griscom M.S., David Bates CFP, CPA, and Chase Hudson, MBA, Lean Six Sigma Black Belt. This report underscores our commitment to transforming operations with AI/ML, ensuring that CFOs possess the necessary tools for successful change. Ultimately, by emphasizing economic evaluation and reorganization, CFOs can establish a solid foundation for a successful recovery, fostering sustainable growth and resilience in the face of adversity.

The Role of Technology in Turnaround Management

In today's dynamic business environment, technology is indispensable for effective recovery strategies, equipping organizations with tools that significantly enhance data analysis, optimize operations, and foster improved communication. Mastering the cash conversion cycle through advanced analytics empowers organizations to identify inefficiencies and accurately forecast financial outcomes, which leads to more strategic decision-making. Furthermore, project management software is critical in facilitating collaboration among teams, ensuring that initiatives are executed with precision and efficiency.

As companies increasingly adopt digital solutions, it is imperative for CFOs to harness technology for effective recovery strategies. The integration of these tools not only bolsters immediate recovery efforts but also positions organizations for sustainable growth and resilience against future challenges. Statistics reveal that companies employing advanced analytics in their recovery processes experience notable improvements in operational efficiency and financial performance, underscoring the necessity of embracing these innovations.

Indeed, organizations that neglect to leverage data risk falling behind in today's competitive landscape, as highlighted by Ernest Dimnet.

Moreover, continuous business performance evaluation through real-time analytics is crucial for applying lessons learned during the recovery process. Case studies illustrate how organizations have adeptly utilized technology to enhance their recovery efforts. The human element in data analytics, emphasized by Hilary Mason, underscores that while technology is vital, the intuition and insight of skilled professionals are equally important in interpreting data effectively.

This fusion of sophisticated tools and human expertise ultimately drives successful outcomes in organizational recovery. As Warren Buffett wisely stated, "It takes 20 years to build a reputation and five minutes to ruin it." This perspective accentuates the importance of maintaining a strong reputation during recovery efforts, further highlighting the critical role of technology and analytics in achieving lasting success.

Benefits of Turnaround Management Services for Businesses

Engaging turnaround management services provide substantial benefits for companies in distress, significantly enhancing financial stability and operational efficiency while strengthening market positioning. Organizations that have successfully implemented recovery strategies frequently report notable improvements in profitability, with some studies indicating that firms can see profit margins increase by as much as 20% within the first year of intervention. Furthermore, these services often lead to considerable cost savings, as companies optimize their operations and eliminate inefficiencies.

A key aspect of recovery oversight is its ability to cultivate a culture of accountability and innovation. Teams are motivated to adopt new practices and technologies, creating an environment where adaptability becomes a core competency. This aligns with Charles Darwin's principle, which emphasizes that the survival of organizations depends on their capacity to adapt to changing circumstances.

For instance, companies utilizing turnaround management services, such as those implementing the SMB team's 'Rapid30' plan, have effectively navigated economic challenges, achieving both stability and growth. One client noted, "Within 100 days of meeting the SMB team, my company was in a better position financially and strategically than it had been in years." This testimonial illustrates the importance of fostering adaptability for survival and growth in demanding environments.

Additionally, the strategic integration of digital tools, like automatic savings transfers, can further enhance financial management, enabling organizations to conserve cash and minimize liabilities effectively. Employing digital nudging techniques can aid organizations in managing their finances more efficiently. Given that the national unemployment rate hovers around 3.9%, the imperative for companies to improve their operations and financial health has never been more critical.

The strategies employed by the SMB team, including 'Test & Measure,' 'Decide & Execute,' and 'Update & Adjust,' ensure a systematic approach to recovery. By consistently monitoring the success of their initiatives and teams through real-time analytics, they can accurately assess business health and make informed decisions.

As St. Francis de Sales wisely advised, "Have patience with all things, but chiefly have patience with yourself. Do not lose courage in considering your imperfections but instantly set about remedying them; every day begin the task anew." By recognizing these advantages, CFOs can champion the integration of turnaround management services from Transform Your Small/Medium Business as a strategic necessity, ensuring their organizations are well-equipped to thrive in an increasingly competitive landscape.

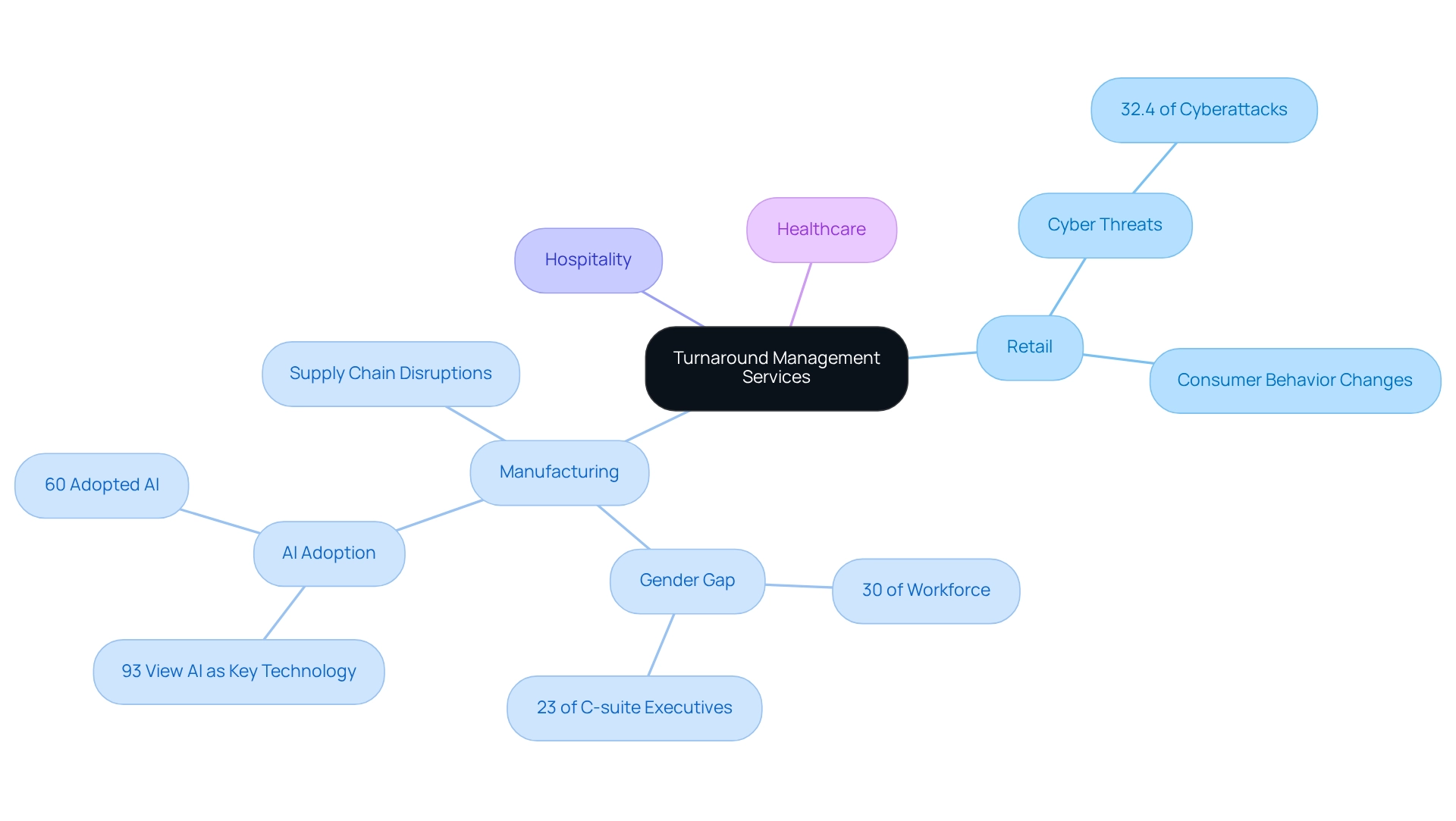

Industries That Benefit from Turnaround Management Services

Turnaround management services are crucial across various sectors, including retail, manufacturing, hospitality, and healthcare, each presenting distinct challenges that may require specialized interventions. The retail sector, for instance, is particularly susceptible to shifts in consumer behavior and cyber threats, with 32.4% of cyberattacks targeting this industry. Conversely, manufacturing firms frequently contend with supply chain disruptions and a notable gender gap, as women represent only 30% of the workforce and 23% of C-suite executives in this field.

As Steve Shepley, Vice Chair and US Industrial Products & Construction Sector Leader, articulates, "With more than 26 years of experience in the industrial products space, he understands and has insight into the trends that can impact highly engineered product manufacturing companies and help drive performance improvements, such as through the use of advanced techniques and technologies." This perspective underscores the necessity for customized turnaround management services that not only enhance operational efficiency but also empower companies to capitalize on emerging opportunities in a rapidly evolving market landscape.

Understanding these sector-specific challenges enables CFOs to devise focused recovery strategies that effectively address the unique needs of their organizations, including the implementation of turnaround management services. By leveraging real-time analytics and streamlined decision-making processes, CFOs can swiftly identify underlying issues and enact solutions that maximize returns on investment. For example, in the retail industry, the implementation of a secure payment gateway is vital for maintaining PCI DSS compliance, thereby mitigating payment data fraud risks and safeguarding sensitive information.

Furthermore, sectors such as manufacturing are increasingly acknowledging the significance of advanced technologies, with 93% of companies regarding AI as a crucial tool for driving growth and innovation. This highlights the importance of Transform Your Small/Medium Enterprise's technology-enabled consulting services, designed to assist organizations in navigating these challenges and seizing new opportunities while consistently monitoring performance and applying lessons learned.

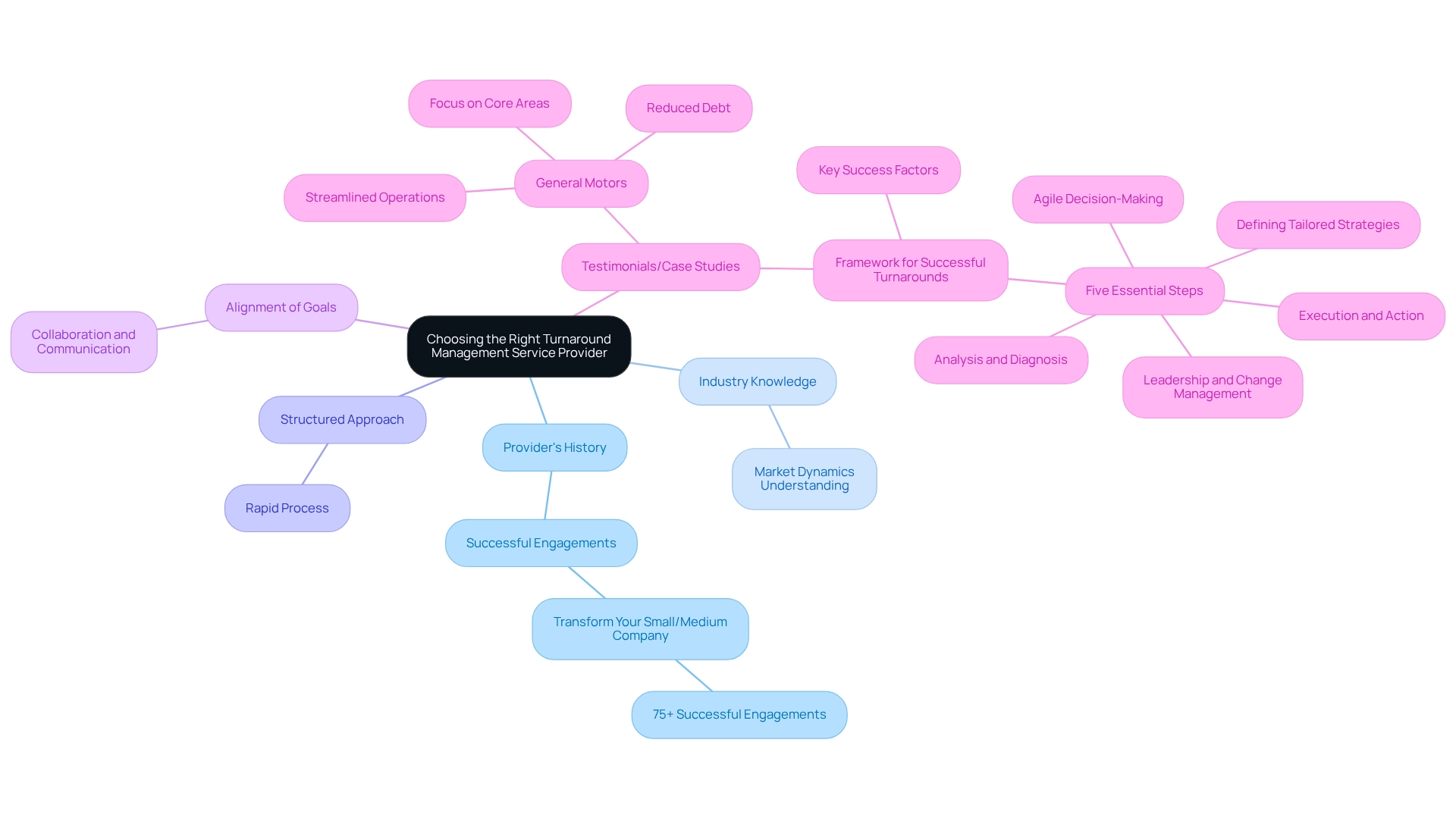

Choosing the Right Turnaround Management Service Provider

Choosing the appropriate provider of turnaround management services is crucial for the success of any revitalization initiative. CFOs must evaluate several key factors to ensure they partner with a firm that provides turnaround management services to effectively address their unique challenges. A provider's history is essential; firms such as Transform Your Small/Medium Company, with more than 75 successful engagements in recovery consulting, can provide invaluable insights and strategies customized for small to medium enterprises.

Industry knowledge plays a vital role, as consultants acquainted with specific market dynamics can adjust their approaches to meet the detailed needs of the organization. Transform Your Small/ Medium Enterprise specializes in comprehensive recovery and restructuring consulting services, which include turnaround management services, financial evaluation, and interim management, ensuring that companies can streamline operations and enhance their financial positions.

Moreover, understanding the provider's approach is essential. Companies that use a structured framework—like the Rapid process employed by Transform Your Small/ Medium Business—can significantly improve the response process. This structured approach not only facilitates a comprehensive understanding of the contextual realities but also ensures that the actions taken are appropriate for halting decline and fostering recovery.

The study also emphasizes that improved response times allow companies to manage more orders and finish more projects, creating increased revenue streams.

CFOs should also take into account the alignment of the provider's goals with their own organizational objectives. Interacting with companies that emphasize collaboration and communication, such as Transform Your Small/Medium Business, can lead to more effective problem-solving and a smoother execution of turnaround management services. As demonstrated by successful case studies, including General Motors, by streamlining operations, reducing debt, and focusing on core business areas, companies can successfully restructure themselves and return to profitability.

Transform Your Small/ Medium Business tailors its approach by closely analyzing each client's specific challenges and customizing solutions that align with their strategic goals.

By making informed choices based on these criteria, CFOs can secure the expertise necessary for turnaround management services to navigate complex recovery scenarios, ultimately driving sustainable growth and operational efficiency. Additionally, the similarities between recovery strategy and the entrepreneurial process emphasize the need for innovative thinking during crises, further underscoring the importance of selecting the right partner. By referencing the framework for successful transformations, CFOs can gain practical insights that empower them to initiate recovery processes with a deep understanding of contextual realities.

Testimonials from satisfied clients further reinforce the effectiveness of Transform Your Small/ Medium Business's approach, showcasing the tangible benefits experienced by businesses that have engaged their services.

Key Takeaways for CFOs on Turnaround Management Services

CFOs play a pivotal role in steering successful turnaround management services initiatives. A crucial takeaway is the importance of early identification of distress signals, which can be essential in preventing deeper economic crises. A recent report reveals that nearly half of UK workers are 'running on empty,' with burnout and work-related stress costing the UK economy £28 billion. This underscores the urgency for CFOs to recognize distress signals promptly.

Comprehensive financial assessments are vital, enabling CFOs to identify underlying issues and opportunities for improvement. By adopting a pragmatic approach to data, CFOs can test hypotheses and leverage technology to enhance recovery efforts, providing real-time analytics that facilitate informed decision-making.

As Cory Jones remarked, "I also like to take off on adventures worldwide," a sentiment that mirrors the adventurous yet calculated approach CFOs must adopt in navigating their organizations through turbulent times. Understanding the unique challenges specific to their industry empowers CFOs to select the most suitable service providers, ensuring tailored solutions that address their organization’s needs. By embracing strategies such as continuous performance monitoring and operationalizing lessons learned, CFOs can not only guide their organizations through challenging periods but also lay the groundwork for sustainable growth and resilience.

Case studies on CFOs leading successful turnaround management services further illustrate the effectiveness of these strategies, showcasing how early recognition of distress signals and strategic decision-making can lead to positive outcomes.

Conclusion

Engaging turnaround management services can transform struggling businesses, offering a structured approach to recovery that encompasses financial assessment, operational optimization, and strategic leadership realignment. By identifying the root causes of underperformance and implementing targeted strategies, organizations can not only restore profitability but also enhance their long-term sustainability. Moreover, the critical role of technology in this process cannot be overstated, as it enables real-time analytics and informed decision-making, ensuring that challenges are addressed promptly and effectively.

CFOs play a pivotal role in steering these initiatives, with early recognition of distress signals being essential to avert deeper financial crises. By embracing a pragmatic, data-driven approach and selecting the right service providers, organizations can tailor their turnaround strategies to meet specific industry challenges. Successful case studies underscore the positive outcomes that can arise from these efforts, illustrating the potential for recovery and growth even in the most challenging environments.

Ultimately, the integration of turnaround management services is not just about overcoming immediate hurdles; it’s about cultivating a culture of adaptability and innovation within the organization. As businesses continue to navigate an increasingly competitive landscape, leveraging these services will be vital for achieving sustainable growth and resilience in the face of future challenges.

Frequently Asked Questions

What are turnaround management services?

Turnaround management services are a strategic framework aimed at rejuvenating struggling businesses through a comprehensive examination of operations, economic health, and market positioning to identify the root causes of underperformance.

What is the primary objective of turnaround management services?

The primary objective is to implement focused strategies that restore profitability and ensure long-term sustainability for the business.

What key elements are involved in recovery management?

Key elements include thorough financial evaluations, reorganizing financial commitments, maximizing operational efficiencies, enhancing leadership effectiveness, and providing temporary management services alongside bankruptcy case oversight.

How important is understanding customer needs in turnaround management?

Understanding customer needs is critical, as companies that adopt customer-centric approaches are reported to be 60% more profitable than those that do not engage with customers effectively.

What recent trends are influencing turnaround management services?

A growing emphasis on technology-driven consulting is enabling companies to leverage real-time analytics for informed decision-making and continuous performance assessment.

What challenges might lead a company to seek turnaround management services?

Companies may face challenges such as declining sales, rising operational costs, cash flow shortages, and increased market competition, which can necessitate the engagement of turnaround management services.

Why is early detection of distress signals important for companies?

Early detection of distress signals allows for the swift engagement of turnaround management services before issues escalate into crises, enabling more effective recovery efforts.

What strategies are crucial in turnaround management?

Key strategies include fiscal restructuring, operational optimization, and leadership realignment, all supported by streamlined decision-making and real-time analytics.

How does financial restructuring contribute to recovery?

Financial restructuring involves renegotiating debts and reallocating resources, which can significantly improve a company's recovery prospects, with success rates exceeding 70% for organizations that implement these strategies.

What role does leadership play in the turnaround process?

Effective leadership is essential for implementing and sustaining change during the recovery process, often requiring changes in management to bring fresh perspectives and expertise.

Can you provide an example of a successful recovery through turnaround management?

An example is Marvel's transformation after its bankruptcy in 1996, where it successfully licensed its characters and diversified into movies and merchandise, leading to a $4 billion acquisition by Disney.