Introduction

Controllers, as financial professionals, play a crucial role in organizations by managing accounting operations, crafting financial statements, and providing strategic guidance. In addition to maintaining accurate financial records, controllers oversee budgeting, forecasting, and compliance with financial regulations. They are not just accounting experts, but strategic partners in steering the business towards its long-term financial goals.

This article explores the different types of controllers, their key functions, and best practices for utilizing their expertise. It also addresses the common challenges faced by controllers and offers solutions to overcome them. As financial landscapes continue to evolve, controllers remain essential in shaping financial strategies and ensuring organizations thrive in dynamic environments.

What is a Controller?

Controllers, as financial professionals, take on a multidimensional role within an organization. Their duties extend beyond maintaining financial records to include crafting comprehensive financial statements such as income statements, balance sheets, and statements of cash flows. These reports are essential, serving as the backbone of , allowing for informed planning and analysis.

A controller's responsibilities encompass the management of all accounting operations, which involves overseeing accounts payable and receivable, as well as ensuring that is both accurate and timely. They also play a pivotal role in developing and enforcing to align with regulatory standards, thereby safeguarding the company's assets through robust internal controls.

Moreover, controllers are instrumental in managing the budgeting and forecasting processes, providing critical support for business planning and strategic guidance. They ensure that a company remains compliant with the ever-evolving financial regulations, which is particularly crucial in dynamic sectors like Web3, where the treatment of digital assets and the definition of fair value pose unique challenges. Automating repetitive tasks and streamlining complex data processing with software solutions are becoming increasingly necessary to address these challenges effectively.

Controllers are indeed more than accounting experts; they are strategic partners in steering the business. They provide insights that influence the company's financial direction and play a key role in . For finance professionals aspiring to move up the ladder, mastering financial intricacies and embracing the comprehensive role of a controller is a fundamental step towards the prestigious CFO position.

Types of Controllers

Controllers play a pivotal role in the of an organization, and their duties are tailored to the size and complexity of the company they serve. Key roles include:

- Financial Controller: Charged with the overarching financial stewardship, this role involves , budgeting, and comprehensive reporting. Financial Controllers ensure the accuracy of financial records, which is fundamental to strategic decision making, and guide the company through regulatory compliance.

- Cost Controller: Specialized in , they scrutinize cost data, devise cost containment strategies, and oversee budget compliance. Embracing a cost-aware culture, the Cost Controller's analyses contribute to long-term savings and operational efficiency, fostering an environment where cost optimization is a collective responsibility.

- Credit Controller: This role focuses on the creditworthiness of the organization, managing customer payments and outstanding debts to ensure liquidity and maintain cash flow. Credit Controllers play a crucial role in upholding financial stability by monitoring and managing credit risks.

- Plant Controller: Typically found in manufacturing settings, they oversee the financial operations of a particular plant or production unit. Their work ensures the alignment of the production facility's financial strategies with the organization's broader financial goals.

The significance of these roles is underscored by recent developments from the , which is proposing enhanced transparency in reporting software costs – a change that affects controllers across various industries. As organizations navigate these evolving financial landscapes, the role of the controller becomes ever more critical in steering companies through the complexities of modern financial management. The effectiveness of a controller is reflected not just in their ability to handle day-to-day accounting operations but also in their strategic contribution to the company's broader financial directives.

How Controllers Work

Financial controllers are pivotal in steering a company towards its by meticulously gathering and scrutinizing financial data. Their expertise is not confined to the finance department alone; they engage with other key divisions such as operations and sales to gauge the fiscal implications of various actions. Armed with sophisticated , controllers track financial metrics, keep a vigilant eye on budget discrepancies, and unearth opportunities for fiscal optimization.

In practice, consider how RetailBank, in partnership with CareDetect, harnessed synthetic data rather than actual customer transactions to evaluate a new product. This innovative approach not only safeguarded customer privacy but also adhered to , showcasing a controller's role in balancing innovation with regulatory compliance. Similarly, the financial controller's role is exemplified in FYNDNA's strategy to modernize banking technologies, ensuring that their scale securely alongside the business.

The realm of controllership extends to safeguarding the accuracy of financial statements. These documents act as a compass for strategic corporate decision-making, and controllers ensure they reflect the true financial health of the organization. They also play a crucial role in maintaining compliance with financial regulations, preserving the integrity and trustworthiness of the business.

Controllers are at the forefront of fiscal management, shaping financial strategies and ensuring that every financial decision aligns with the company's growth and stability. Their comprehensive analysis and strategic insights are indispensable in a world where financial landscapes are constantly evolving, as evidenced by recent developments in technology and finance sectors reported in the news.

Key Functions of Controllers

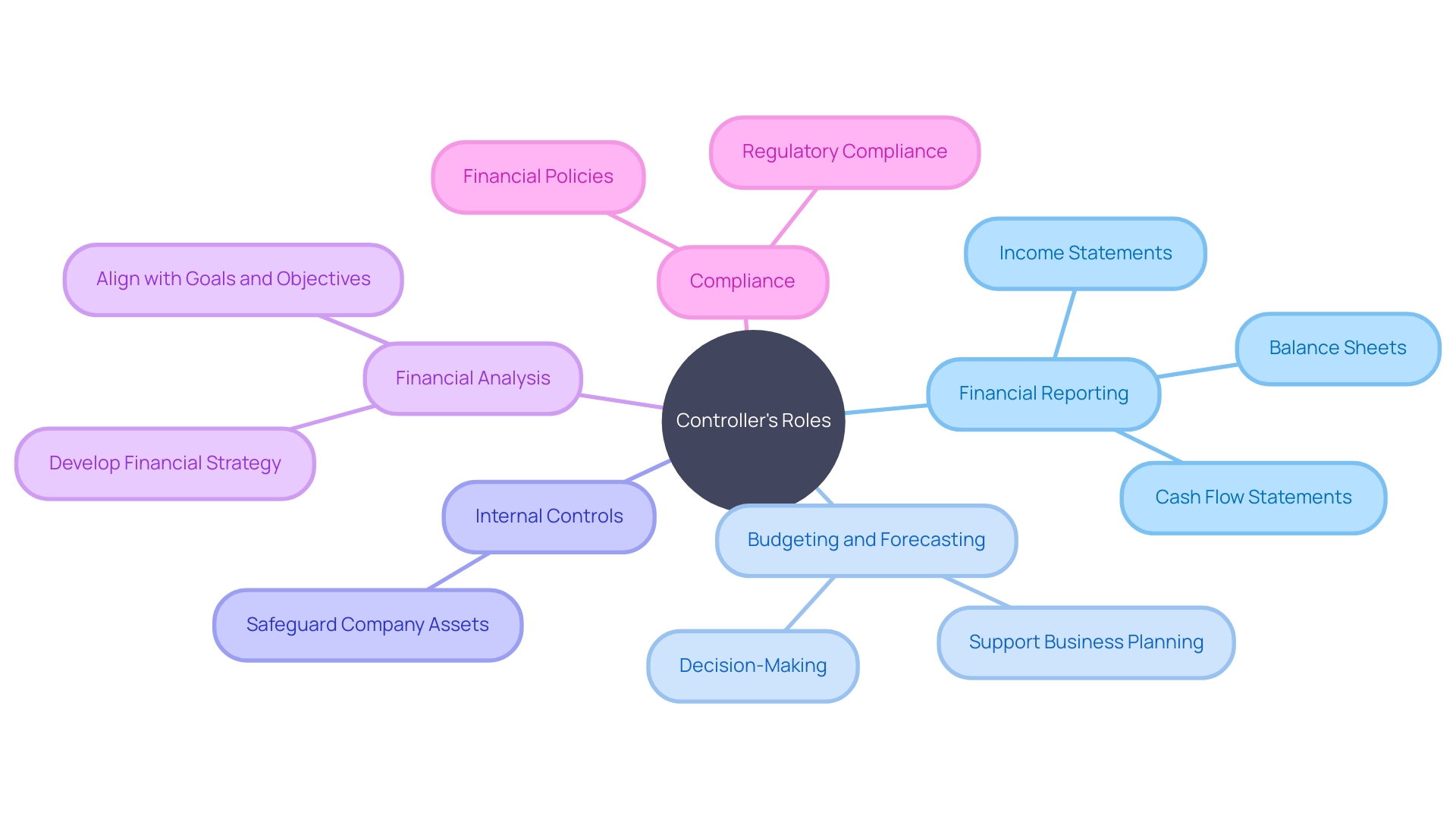

At the heart of an organization's financial health lies the intricate role of controllers, who are pivotal in steering the company's fiscal direction. Their responsibilities encompass a broad range of functions, each serving as a foundational pillar for robust financial management:

- : At its core, financial reporting is about transparency and accuracy. Controllers meticulously compile financial reports, such as balance sheets, income statements, and cash flow statements. These documents are not just statutory requirements but serve as the lifeblood of strategic business decisions, much like the navigational charts guiding a ship through treacherous waters.

- : The foresight of controllers is essential in the budgeting and forecasting process. They collaborate closely with department heads to sculpt budgets, juxtapose actual performance against budgeted figures, and crystalize future financial projections. Their expertise ensures that the company's financial sails are set to catch the winds of opportunity and navigate through the storms of uncertainty.

- : Safeguarding an organization's assets is a task of utmost importance. Controllers institute robust internal control procedures, acting as the gatekeepers who defend against risks and ensure adherence to financial regulations—a role highlighted by the challenges faced by Toyota's Woven Planet venture, where a deviation from disciplined zone management led to setbacks.

- Financial Analysis: Sharp analytical skills allow controllers to dissect financial data, identifying underlying trends, potential risks, and emerging opportunities. Their analytical prowess turns raw data into actionable insights, much like decoding a complex cipher to reveal strategic directives.

- Compliance: Controllers are the vanguards of compliance. They diligently ensure that the organization aligns with accounting standards, tax laws, and financial regulations. Their continuous vigilance on regulatory changes is crucial for implementing necessary adaptations to maintain compliance, echoing the sentiments of Geoffrey Moore regarding the importance of feedback mechanisms in dynamic systems.

In an environment where financial landscapes are rapidly shifting, much like the evolution of DeFi protocols scrutinized by global financial regulators, controllers' roles are more vital than ever. They not only manage the financial backbone of a company but also act as strategic advisors, ensuring the organization is well-positioned to thrive in a future as dynamic as the envisioned by industry giants.

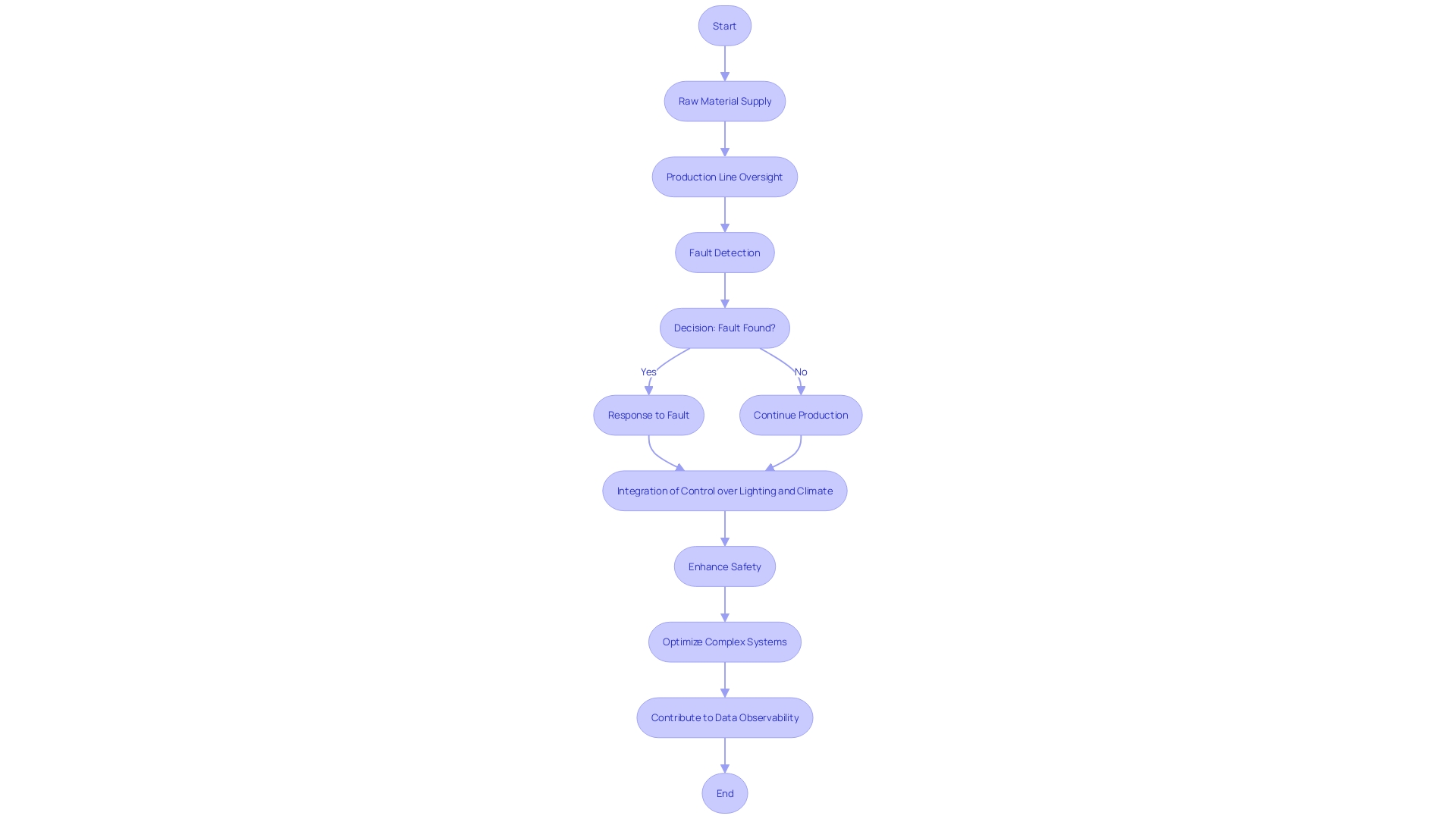

Examples of Controllers in Different Systems

Industrial control panels are indispensable in various sectors, and bolstering efficiency. In the manufacturing realm, these panels are the nerve center for production lines, meticulously overseeing tasks from mixing to assembly. Their prowess extends to ensuring a seamless supply of raw materials, thereby curtailing downtime and maintaining production momentum.

The pharmaceutical industry, too, capitalizes on these panels, harnessing their precision to mitigate errors and .

Taking a cue from Building Management Systems (BMS), which integrate control over lighting and climate in expansive structures, industrial control panels similarly unify oversight in manufacturing environments. They serve a pivotal role in fault detection and , akin to BMS frameworks that promptly address malfunctions such as power outages or heating issues.

Meanwhile, the energy sector, particularly data centers, is under scrutiny for its high power consumption. With and the risk of becoming 'stranded assets,' data centers are eyeing building efficiency upgrades, as underscored in a World Economic Forum report.

The observability of control panels, as defined by Rudolf E. Kálmán, is crucial. It is the ability to deduce a system's internal states from its outputs, a principle that's gained traction in software engineering, thanks in part to pioneers like Charity Majors. Observability grants insight into operations, informing decision-making and operational adjustments.

In summary, from manufacturing to energy management, industrial control panels are pivotal. They not only streamline processes and [enhance safety](https://blog.smbdistress.com/10-essential-stakeholder-management-behavioural-interview-questions) but also contribute to data observability, a key component in modern management systems. Their role in various industries is a testament to their versatility and the value they add in controlling and optimizing complex systems.

Best Practices for Using Controllers

Elevating the effectiveness of controllers within an organization hinges on several key strategies. First and foremost, it is critical to delineate their roles and responsibilities with precision to promote a clear understanding of their duties and accountability. Equipping them with the necessary resources, including sophisticated and tools, is essential for their success in executing their roles.

Moreover, fostering a culture of collaboration is beneficial, creating synergy between controllers and other departments, which is instrumental in acquiring accurate financial data and comprehending the fiscal implications of various organizational activities. For instance, when Dunelm Group plc experienced significant growth, they understood the importance of adapting their organizational structure and software architecture to reflect this expansion, particularly for their high-revenue-generating digital platform. Similarly, controllers must be adaptable and collaborative to meet the evolving needs of a scaling enterprise.

Professional development should be an ongoing endeavor for controllers, equipping them with the latest knowledge in accounting standards, regulations, and financial management practices. This is exemplified by the platform engineering trend, as seen at companies like Amazon, where continuous learning and adherence to governance are crucial for managing the software delivery process and maintaining numerous compliance certifications.

Regular reporting and analysis are indispensable for ensuring the provision of accurate and timely , which are vital for informed decision-making. This need for regular and robust reporting is echoed in the practices of organizations like Siemens Digital Industries, which emphasizes the of the entire value chain for increased productivity and flexibility.

Ultimately, these best practices are not merely theoretical but are grounded in the real-world experiences of organizations striving for excellence in their respective industries. By embracing these strategies, controllers can significantly contribute to the and strategic goals of their organizations.

Common Challenges and Solutions

Financial controllers navigate a labyrinth of , with the complexity of financial data presenting one of the most formidable obstacles. In the financial services sector, the integration of artificial intelligence (AI) with banking has transformed traditional practices, streamlining the aggregation and analysis of financial information. For instance, relationship managers in private banking now leverage AI to amalgamate and condense data across fragmented infrastructures, significantly reducing the manual effort previously required.

Compliance remains a critical concern, with financial institutions needing to maintain a panoramic view of customer data to meet KYC and AML regulations. The emergence of technology platforms has been instrumental in dissolving persistent data silos, which are often the byproduct of divergent systems and departmental boundaries. These platforms enable a continuous orchestration of data, transforming it through business-approved logic for instant analysis and operationalization.

Accuracy and timeliness in are critical, and yet, industry studies reveal that 90% of spreadsheets with over 150 rows contain errors. The shift towards a more harmonized regulatory environment, as advocated by Quinn Perrott, Co-CEO of Traction FinTech, suggests a trend towards shared data among global regulators, potentially simplifying compliance and reducing implementation costs.

Handling stakeholder expectations involves transparent communication, which is facilitated by high-quality, segmented data sets. As the global data market is projected to reach nearly $78 billion by 2025, robust data management and interaction strategies become indispensable for finance teams. These strategies are the linchpin for in a comprehensible manner, ensuring that stakeholders' expectations are not only managed but exceeded.

Conclusion

In conclusion, controllers are financial professionals who play a crucial role in organizations. They go beyond maintaining financial records and act as strategic partners in steering the business towards its long-term financial goals. Controllers oversee accounting operations, craft financial statements, and provide strategic guidance.

They also manage budgeting, forecasting, and compliance with financial regulations.

There are different types of controllers, each with specific roles tailored to the company's size and complexity. Financial controllers ensure accurate records and guide compliance. Cost controllers focus on cost management, credit controllers manage payments and debts, and plant controllers oversee financial operations in production units.

Controllers meticulously gather and scrutinize financial data, track metrics, and ensure accurate financial statements. They also maintain compliance and preserve business integrity. Key functions of controllers include financial reporting, budgeting and forecasting, internal controls, financial analysis, and compliance.

Controllers face challenges such as managing complex data, ensuring compliance, and maintaining accuracy. Solutions involve leveraging technology, adopting harmonized regulations, and implementing robust data management strategies.

Overall, controllers are essential for organizations. By embracing best practices and overcoming challenges, they significantly contribute to financial health and strategic goals. Controllers shape financial strategies, ensure compliance, and provide valuable guidance.

Their expertise is vital in navigating evolving financial landscapes. Controllers are indispensable partners in steering organizations towards success.

Frequently Asked Questions

What is a controller in a financial context?

A controller is a financial professional who oversees all accounting operations, creates financial statements, manages budgeting and forecasting processes, and ensures regulatory compliance. They play a crucial role in strategic decision-making and safeguarding a company's assets.

What are the main types of controllers?

The main types of controllers include Financial Controllers, Cost Controllers, Credit Controllers, and Plant Controllers. Each type specializes in different aspects of financial management tailored to the company's needs.

What are the key functions of a controller?

Key functions of a controller include compiling financial reports, managing budgeting and forecasting, establishing internal controls, conducting financial analysis, and ensuring compliance with financial regulations.

Can you give examples of controllers in different systems?

Controllers are found in various sectors, such as manufacturing, where they oversee production line operations, and in the pharmaceutical industry, where they ensure precision and safety. They are also similar to Building Management Systems (BMS) in that they help manage and optimize complex systems.

What are some best practices for using controllers?

Best practices include clearly defining their roles and responsibilities, providing the necessary resources, fostering a culture of collaboration, encouraging ongoing professional development, and maintaining regular reporting and analysis.

What common challenges do controllers face?

Controllers face challenges like managing complex financial data, ensuring compliance with regulations such as KYC and AML, maintaining accuracy in financial reporting, and handling stakeholder expectations with clear communication.

How do controllers contribute to strategic decision-making?

Controllers provide comprehensive financial statements and analyses that serve as the backbone for strategic planning and enable informed decision-making at various organizational levels.

Why is the role of a controller critical in modern financial management?

Controllers are critical due to their ability to navigate the complexities of financial regulations and technology, ensuring that companies remain compliant and financially stable in a dynamic economic environment.

What is the significance of financial reporting in a controller's role?

Financial reporting is essential for transparency and accuracy in presenting a company's financial health, which guides strategic business decisions and regulatory compliance.

How does a controller ensure a company remains compliant with financial regulations?

Controllers monitor regulatory changes and implement necessary adaptations in the company's financial policies and procedures to maintain compliance and uphold the integrity of the business.