Introduction

In the realm of corporate finance, turnaround management emerges as a vital lifeline for organizations facing the storm of financial distress and operational inefficiencies. As businesses navigate turbulent waters, the strategic implementation of a robust turnaround framework becomes paramount. This article delves into the intricacies of turnaround management, outlining essential elements that drive successful transformations.

From comprehensive financial assessments to empowering leadership and stakeholder engagement, the discussion emphasizes actionable strategies that CFOs can adopt to stabilize their organizations and chart a course for sustainable growth.

With a focus on overcoming common challenges and measuring success through key performance indicators, this guide equips financial leaders with the insights needed to not only survive but thrive in the face of adversity.

Defining Turnaround Management: An Overview

The turnaround management framework is a strategic discipline designed to revitalize organizations grappling with financial distress or operational inefficiencies. It encompasses a systematic approach that begins with the 'Identify & Plan' phase, where our team will diagnose underlying business issues and collaboratively create actionable plans to mitigate weaknesses and leverage strengths. This procedure is particularly critical for small to medium-sized enterprises (SMEs), which often face resource constraints in navigating crises.

The primary objectives of recovery management include:

- Stabilizing cash flow

- Minimizing liabilities

- Fostering a foundation for sustainable growth

By adhering to a turnaround management framework, organizations can effectively identify core issues, develop actionable plans, and implement transformations that pave the way for long-term success.

A key aspect of this discipline is the commitment to operationalizing the lessons learned through the recovery process, ensuring strong, lasting relationships with stakeholders. Our team is dedicated to streamlining decision-making cycles, enabling CFOs to take decisive action and preserve their businesses. Continuous performance monitoring is facilitated through real-time analytics, which are made accessible via a client dashboard, allowing for ongoing assessment of business health.

Moreover, we adopt a 'Test & Measure' approach, pragmatically testing every hypothesis to maximize returns on invested capital during the recovery process. Notably, recovery acquisitions account for approximately half of all M&A deals, a trend expected to rise during economic downturns, emphasizing the need for CFOs to be proactive in their strategic planning. A compelling example of effective management during a crisis can be seen in the case study titled 'COVID-19 Demand Shock Response,' where a company faced a demand shock due to the pandemic.

They conducted scenario evaluations to forecast future demand and cash generation, implementing 11 actions to conserve cash, which were deemed sufficient to weather the storm and prepare for business redevelopment. In 2024, the emphasis on developing robust business plans—including comprehensive market analysis, profit margin assessments, and financial projections—will be essential for enhancing survival rates, especially in the first year post-intervention. As Schulz aptly stated, 'Starting a business is incredibly difficult, and the odds are stacked against you in so many ways,' emphasizing the necessity for effective recovery strategies.

Key Elements of a Turnaround Management Framework

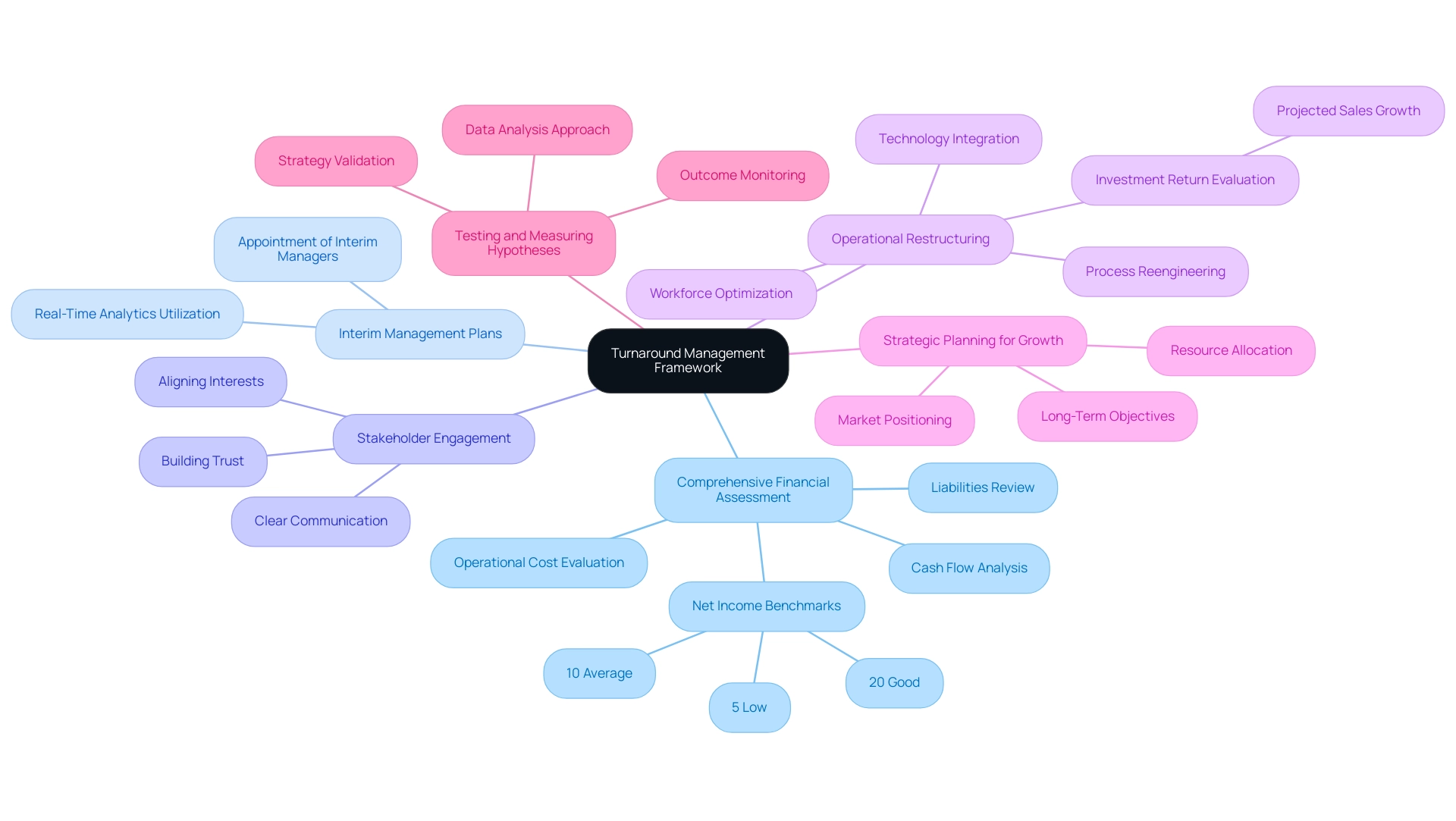

A successful turnaround management framework is built on several pivotal elements that guide organizations through the recovery process:

- Comprehensive Financial Assessment: A meticulous analysis of the organization’s financial health is fundamental. This involves a thorough review of cash flow, liabilities, and operational costs to pinpoint areas ripe for improvement. By identifying inefficiencies—often a significant cause of financial distress, as noted by corporate finance expert Umer Khalid, who states, "Operational inefficiencies are often a significant cause of financial distress"—companies can preserve cash and curtail unnecessary expenditures. Additionally, understanding net income benchmarks is crucial; a net income of 20% is considered good, 10% average, and 5% low. Establishing this financial context creates a solid foundation for recovery.

- Interim Management Plans: Crafting actionable interim management plans is crucial for implementing immediate changes while ensuring operational continuity. This often entails appointing seasoned interim managers who possess the expertise to guide recovery efforts effectively. The success rates of such interim management strategies in recovery scenarios highlight their importance in driving quick and decisive action, leveraging real-time analytics for informed decision-making.

- Stakeholder Engagement: Actively involving key stakeholders—employees, creditors, and suppliers—in the recovery effort is essential for securing their support. Clear communication nurtures trust and aligns interests towards common goals, which is essential for the success of recovery initiatives. Establishing strong connections through consistent interaction boosts dedication to the turnaround effort.

- Operational Restructuring: Enhancing operational efficiency is paramount to reducing costs and improving productivity. This may involve process reengineering, workforce optimization, and integrating new technologies. Companies must assess the expected return on investments from these initiatives against projected sales growth, as illustrated in the case study titled "Considerations for Investment Decisions." This evaluation ensures that capital expenditures align with the company's financial health and strategic goals, facilitating continuous performance monitoring.

- Strategic Planning for Growth: After achieving stabilization, organizations must pivot towards a strategic growth plan that delineates long-term objectives, market positioning, and resource allocation. This proactive approach ensures that the change is not merely a temporary fix but a sustainable pathway to future success. By implementing insights gained during the recovery phase, businesses can improve their strategic flexibility and resilience.

- Testing and Measuring Hypotheses: A critical aspect of the recovery process involves the systematic testing and measuring of hypotheses to maximize returns on invested capital. Organizations should adopt a pragmatic approach to data analysis, ensuring that decisions are driven by evidence and that outcomes are continuously monitored. This not only helps in validating strategies but also in making necessary adjustments to optimize performance.

By concentrating on these essential components, businesses can create a strong turnaround management framework that not only addresses immediate challenges but also lays the foundation for lasting growth and resilience.

The Role of Leadership in Turnaround Management

Effective leadership is crucial in change management, establishing the atmosphere for the whole entity and impacting its direction during difficult periods. Leaders must embody resilience, decisiveness, and transparency to inspire confidence among stakeholders. In the context of a recovery, leaders should concentrate on several key areas:

- Vision and Direction: A clearly articulated vision for the future is crucial for aligning the organization around common goals. Clear communication of the recovery strategy, like the innovative 'Rapid30' plan carried out by the SMB team, guarantees that all staff comprehend their roles in the initiative, promoting a sense of collective purpose. Clients have reported significant improvements in their business positions, with some experiencing up to a 30% increase in revenue within 100 days of implementing this structured approach.

- Empowering Teams: Actively involving employees in the recovery process cultivates a sense of ownership and accountability. Leaders should promote collaboration and innovation, enabling teams to present ideas and solutions that can propel the entity forward. The success stories from SMB clients highlight how empowering teams leads to impactful results in just a matter of weeks, with many teams reporting enhanced productivity and morale.

- Monitoring Progress: Regular assessment of the effectiveness of turnaround strategies is vital. Leaders need to establish key performance indicators (KPIs) to track progress and make necessary adjustments to the plan in response to real-time data. SMB's client dashboard exemplifies a successful tool for continuous monitoring, providing entities with real-time analytics on key metrics such as cash flow, operational efficiency, and employee engagement, enabling them to adapt swiftly and maintain a focus on performance.

- Building a Culture of Accountability: Creating a culture where team members are held accountable for their performance fosters responsibility and drives results. Leaders must exemplify accountability to reinforce its importance throughout the entity, thereby enhancing overall effectiveness. This method not only enhances financial well-being but also fortifies connections among the workforce.

The influence of effective leadership within the turnaround management framework cannot be overstated. Research indicates that effective leadership training can lead to a 25% increase in organizational outcomes, underscoring the necessity for leaders to develop their skills constantly. Furthermore, a notable 66% of managers and 71% of C-suite executives indicate a readiness to contemplate transitioning to another entity that promotes their wellbeing, emphasizing the vital role of leadership in staff retention and morale during difficult periods.

Moreover, intentional leadership, demonstrated by the transformative experiences of SMB clients, aligns business success with social and environmental causes, resonating especially well with younger generations who prioritize making a positive impact through their work. By embodying these essential leadership qualities, entities can navigate the complexities of the turnaround management framework more effectively and achieve their desired outcomes.

Common Challenges in Turnaround Management

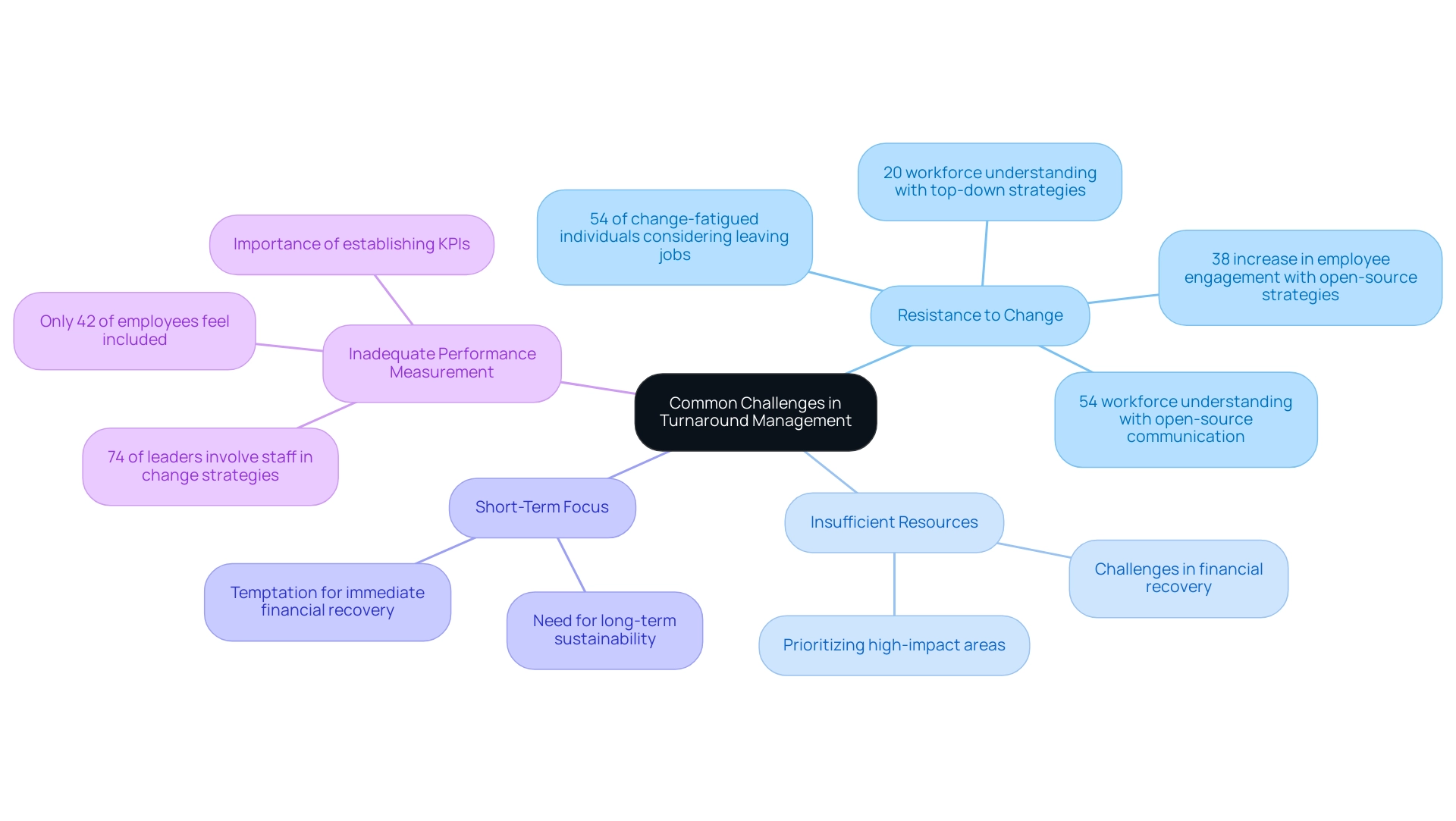

The turnaround management framework offers the potential for substantial organizational improvements, yet it is fraught with challenges that must be navigated effectively. Key obstacles include:

-

Resistance to Change: A major obstacle in numerous organizations is staff opposition, frequently motivated by anxieties concerning job security and unease with new methods.

According to recent data, 54% of change-fatigued individuals are contemplating leaving their jobs, highlighting the critical need for effective communication. Involving staff in the change process can alleviate these fears, fostering a sense of ownership and responsibility. Organizations that implement changes through a transparent, open-source strategy have seen a 38% increase in employee engagement and a 19% rise in discretionary effort.

In fact, while only 20% of the workforce understands changes implemented through top-down strategies, 54% achieve understanding through open-source communication, underscoring the latter's effectiveness.

-

Insufficient Resources: Financially troubled entities often struggle with restricted resources, which can impede recovery efforts. By prioritizing initiatives and focusing on high-impact areas, firms can maximize their existing resources.

This strategic allocation becomes crucial when navigating financial recovery.

-

Short-Term Focus: The temptation to prioritize immediate financial recovery often overshadows the need for long-term sustainability. A balanced approach that aligns short-term actions with strategic long-term planning is vital for enduring success.

This dual focus ensures that organizations do not compromise future stability for quick fixes.

-

Inadequate Performance Measurement: The absence of clear performance metrics can obscure the effectiveness of recovery strategies. Establishing key performance indicators (KPIs) and conducting regular reviews are essential practices for monitoring progress and ensuring alignment with organizational goals.

Notably, while 74% of leaders claim to involve staff in developing change strategies, only 42% of individuals feel genuinely included, indicating a significant gap in engagement that needs to be addressed. This difference emphasizes the significance of authentic employee engagement in the change initiative, a sector frequently overlooked because of ineffective communication and insufficient leadership backing.

By actively identifying and tackling these obstacles, companies can utilize the turnaround management framework alongside efficient decision-making and immediate analytics to improve their recovery strategies. Utilizing a client dashboard for continuous monitoring allows teams to diagnose business health effectively and operationalize the lessons learned throughout the recovery process. The commitment to operationalizing these lessons ensures that entities not only learn from their experiences but also integrate these insights into their ongoing operations.

This method ultimately places entities favorably to manage the intricacies of recovery management, guiding toward successful results.

Measuring Success in Turnaround Management

Measuring success within a turnaround management framework necessitates a thorough evaluation of both financial and operational metrics, critical for CFOs to gauge effectiveness. Key performance indicators (KPIs) that should be prioritized include:

- Financial Metrics: Evaluating key indicators such as enhancements in cash flow, profit margins, and debt-to-equity ratios is essential for understanding the entity's financial health post-turnaround.

Establishing clear, achievable targets for each KPI within the turnaround management framework serves as a benchmark for performance evaluation, ensuring that progress can be effectively tracked and assessed.

- Operational Efficiency: Metrics that track productivity, cost reductions, and enhancements are vital for evaluating the effectiveness of operational changes implemented during the turnaround. This approach enables organizations to recognize effective strategies and areas requiring additional improvement while simplifying decision-making methods within the turnaround management framework that boost overall performance.

- Staff Engagement: Monitoring attendance and punctuality KPIs provides insights into staff engagement and performance. Moreover, assessing staff satisfaction and engagement levels can signify the effectiveness of leadership and communication initiatives during the recovery process. Notably, the Employee Churn Rate, calculated as the percentage of departing employees divided by total employees, multiplied by 100, is a key statistic that reflects organizational stability.

- Market Position: Examining changes in market share and customer feedback after the implementation of recovery strategies is essential. Understanding market dynamics, as highlighted in the case study on success in international markets, illustrates that a responsive approach through real-time analytics, supported by our client dashboard, is essential for long-term viability. Businesses must adapt to various market dynamics to thrive in international settings.

Ultimately, success is defined by the entity’s ability to sustain growth and stability over time through an effective turnaround management framework. Consistently assessing performance in relation to long-term goals guarantees that the change is not simply a temporary solution but a strategic route to lasting success. As R. Turner emphasizes in 'Managing Through KPIs: A Practical Guide for Turnaround Organizations,' leveraging KPIs effectively is vital for measuring turnaround efficacy.

By adopting a comprehensive approach to measuring success, organizations can not only hold themselves accountable for their turnaround efforts but also make informed decisions that catalyze future growth, supported by real-time analytics, continuous performance monitoring, and a pragmatic 'Test & Measure' strategy.

Conclusion

Navigating the complexities of turnaround management is crucial for organizations facing financial distress and operational challenges. By employing a structured framework that emphasizes:

- Comprehensive financial assessments

- Interim management plans

- Stakeholder engagement

businesses can identify core issues and implement effective strategies for recovery. The importance of operational restructuring and the development of a strategic growth plan cannot be overstated, as these elements lay the groundwork for sustainable success.

Leadership plays a pivotal role in guiding organizations through these turbulent times. By fostering a clear vision, empowering teams, and maintaining open lines of communication, leaders can inspire confidence and drive engagement among stakeholders. This commitment to accountability and continuous monitoring ensures that turnaround efforts are not only effective but also adaptable to changing circumstances.

However, the journey is fraught with challenges, including:

- Resistance to change

- Resource limitations

Acknowledging these obstacles and strategically addressing them through transparent communication and prioritization of high-impact initiatives is essential. By leveraging real-time analytics and establishing key performance indicators, organizations can effectively measure their success and make informed adjustments to their turnaround strategies.

Ultimately, the goal of turnaround management is to transform crises into opportunities for lasting growth and resilience. By embracing the principles outlined in this guide, CFOs can lead their organizations through adversity, ensuring that they not only survive but thrive in the long run. The time to act is now—implementing these strategies can set the stage for a brighter, more sustainable future.

Frequently Asked Questions

What is the turnaround management framework?

The turnaround management framework is a strategic discipline designed to revitalize organizations facing financial distress or operational inefficiencies. It involves a systematic approach to diagnose underlying business issues and create actionable plans for recovery.

What are the primary objectives of recovery management?

The primary objectives of recovery management include stabilizing cash flow, minimizing liabilities, and fostering a foundation for sustainable growth.

Why is the turnaround management framework particularly important for SMEs?

The framework is particularly critical for small to medium-sized enterprises (SMEs) because they often face resource constraints when navigating crises.

What are the key elements of a successful turnaround management framework?

Key elements include: 1. Comprehensive financial assessment 2. Interim management plans 3. Stakeholder engagement 4. Operational restructuring 5. Strategic planning for growth 6. Testing and measuring hypotheses.

How does a comprehensive financial assessment contribute to recovery?

A comprehensive financial assessment involves analyzing the organization’s financial health to identify inefficiencies and areas for improvement, which helps preserve cash and reduce unnecessary expenditures.

What role do interim management plans play in the recovery process?

Interim management plans are crucial for implementing immediate changes while ensuring operational continuity, often involving seasoned interim managers to guide recovery efforts effectively.

Why is stakeholder engagement important in turnaround management?

Engaging key stakeholders—such as employees, creditors, and suppliers—is essential for securing support, nurturing trust, and aligning interests towards common recovery goals.

What does operational restructuring involve?

Operational restructuring involves enhancing efficiency by reengineering processes, optimizing the workforce, and integrating new technologies to reduce costs and improve productivity.

How should organizations approach strategic planning for growth after stabilization?

Organizations should pivot towards a strategic growth plan that outlines long-term objectives, market positioning, and resource allocation, ensuring that changes are sustainable and not just temporary fixes.

What is the significance of testing and measuring hypotheses in the recovery process?

Testing and measuring hypotheses helps organizations maximize returns on invested capital by ensuring decisions are evidence-based and outcomes are continuously monitored for necessary adjustments.