Introduction

In today's rapidly evolving financial landscape, businesses must navigate increasingly complex regulatory environments and make strategic financial decisions that drive growth and efficiency. Accounting advisory services have emerged as a crucial support system, offering expert guidance on financial reporting, risk management, and process optimization. These services go beyond mere compliance, providing tailored solutions that address immediate financial challenges and enhance long-term strategic planning.

With the integration of advanced technologies like automation and AI, accounting advisory services are becoming even more vital, offering deeper insights and improved accuracy. This article delves into the distinct roles of advisory and compliance services, the benefits of engaging accounting advisory services, the challenges in distinguishing between these services, and the future trends shaping the industry. By understanding these elements, CFOs can better leverage these services to ensure their organizations' financial health and sustainable growth.

Definition and Scope of Accounting Advisory

Accounting consulting options provide an extensive array of expert solutions aimed at assisting companies in managing intricate economic environments. These offerings deliver strategic guidance on monetary reporting, adherence to regulatory standards, management of fiscal risks, and enhancement of economic processes. By focusing on areas that require urgent attention and offering customized support plans, these services ensure that organizations can tackle their economic challenges effectively.

For instance, Sage Intacct's advanced functionalities now cater to complex ownership structures, facilitating automatic roll-up consolidation and offering deeper insights to inform data-driven decisions. The enhancements in their platform improve efficiency and accuracy, which is crucial for making swift decisions in dynamic markets like technology and software.

Furthermore, the significance of money management cannot be overstated for small businesses. Effective monetary statements, budgets, cash flows, and forecasts are essential tools for managing finances, as highlighted in recent sessions focusing on the implementation of new accounting standards. These sessions emphasize the need for accurate financial reporting and compliance with evolving regulations.

Practical instances, like the assistance given to Aria Systems, illustrate the importance of accounting guidance in handling rapid expansion. The close collaboration with executives from strategic planning through execution ensures that organizations can thrive even in rapidly changing environments. This practical method, combined with a nurturing and expert manner, renders accounting consulting essential for companies looking to improve their monetary well-being and attain lasting development.

Key Differences Between Advisory and Compliance Services

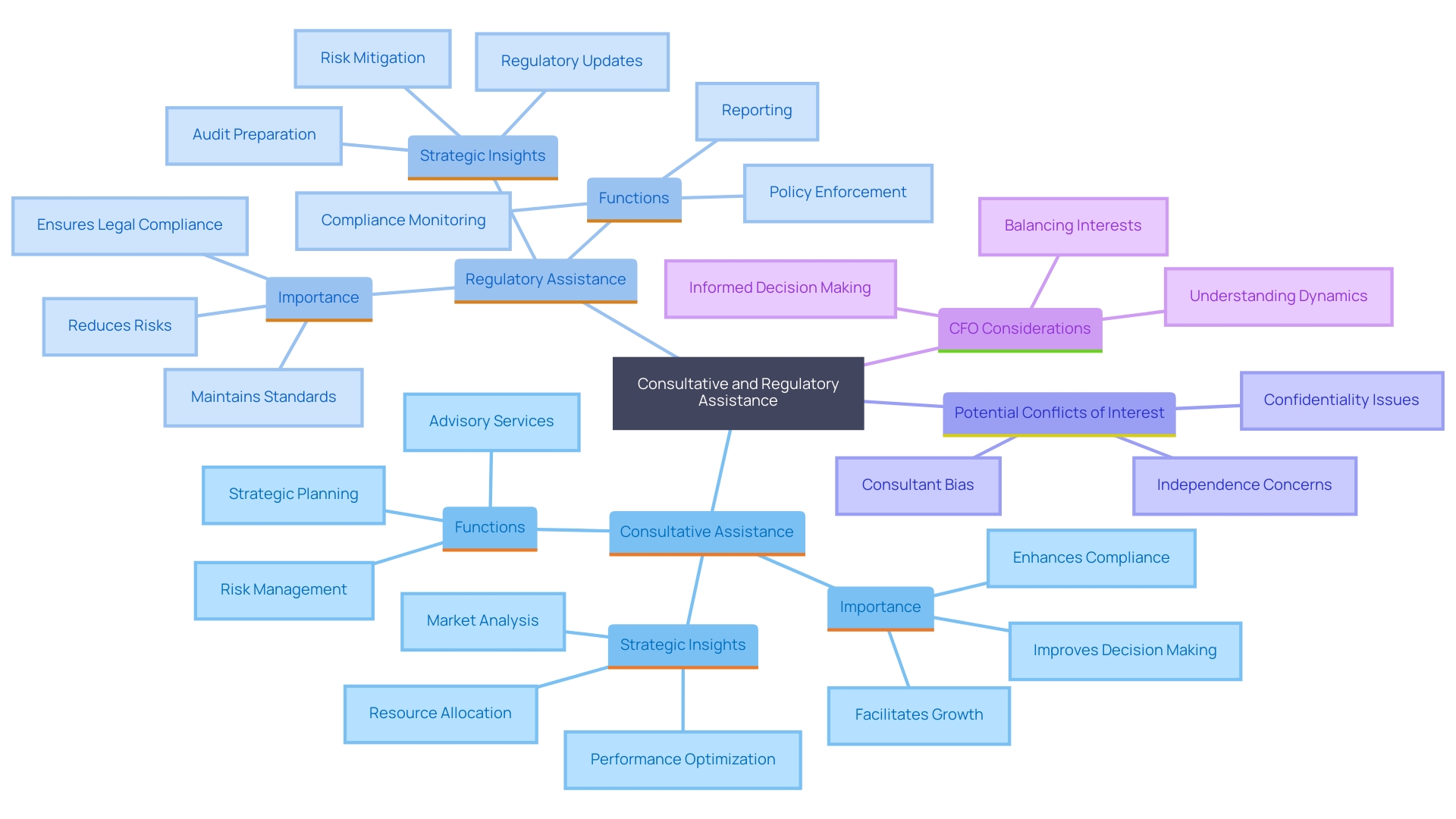

Although both consultative and regulatory assistance are essential in the economic framework, they fulfill different functions. Adherence support is crucial for guaranteeing that a company follows economic regulations and standards, including tax laws and audit requirements. This is particularly important given the increasing complexity and stringency of regulatory compliance, as seen with the Financial Accounting Standards Board’s ongoing focus on professional skepticism and audit quality.

Conversely, consultative assistance provides strategic insights that aid organizations in reaching their financial objectives, improving operational efficiency, and making informed choices. This distinction is vital for CFOs when choosing the suitable offerings for their organization. For instance, collaboration between compliance and business leaders can significantly impact key strategic objectives, such as differentiating client experience and investing in fast-evolving areas.

Based on information from more than 17,000 U.S. companies, two out of every five companies have at least one conflict of interest, frequently associated with consulting. The most common conflicts arise when firms act as insurance agents or are affiliated with them, potentially leading clients toward high-commission products over more cost-effective options. Thus, grasping these differences and possible conflicts is essential for CFOs to maneuver through the economic environment efficiently and select the appropriate mix of compliance and consultancy options for their organizations.

Benefits of Accounting Advisory Services for Businesses

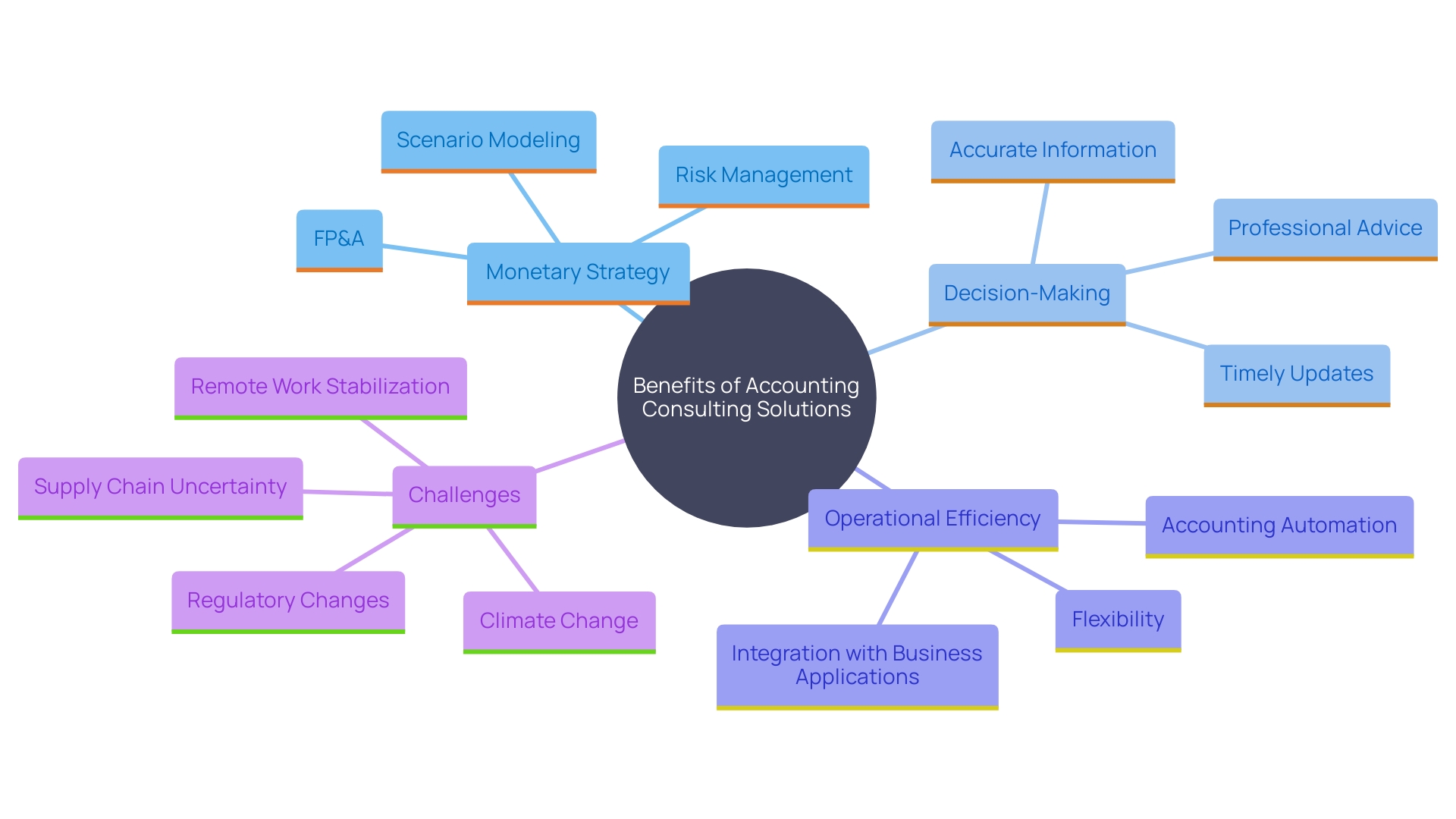

Participating in accounting consulting solutions provides many advantages to companies, such as better monetary strategy, improved decision-making abilities, and heightened operational efficiency. By leveraging expert advice, organizations can identify cost-saving opportunities, streamline processes, and enhance their overall financial performance. This is particularly crucial in an environment where rules and regulations continue to become more complicated, with an average of 399 changes to the Tax Code each year, as reported by the National Taxpayers Union Foundation.

Additionally, accounting advisory services provide valuable insights into market trends and competitive positioning, aiding in long-term strategic planning. For example, incorporating finance planning and analysis (FP&A) into accounting automation can help organizations plan, stay flexible, manage risk, and model scenarios to ensure growth targets are met, especially in industries affected by regulatory changes or supply chain uncertainties.

Moreover, the thorough examination of market dynamics and emerging trends through market research reports can assist organizations in making informed choices. These insights, combined with the knowledge offered by accounting consulting, enable businesses to manage the intricacies of today’s economic environment efficiently, ensuring continued growth and achievement.

Challenges in Differentiating Advisory from Compliance Services

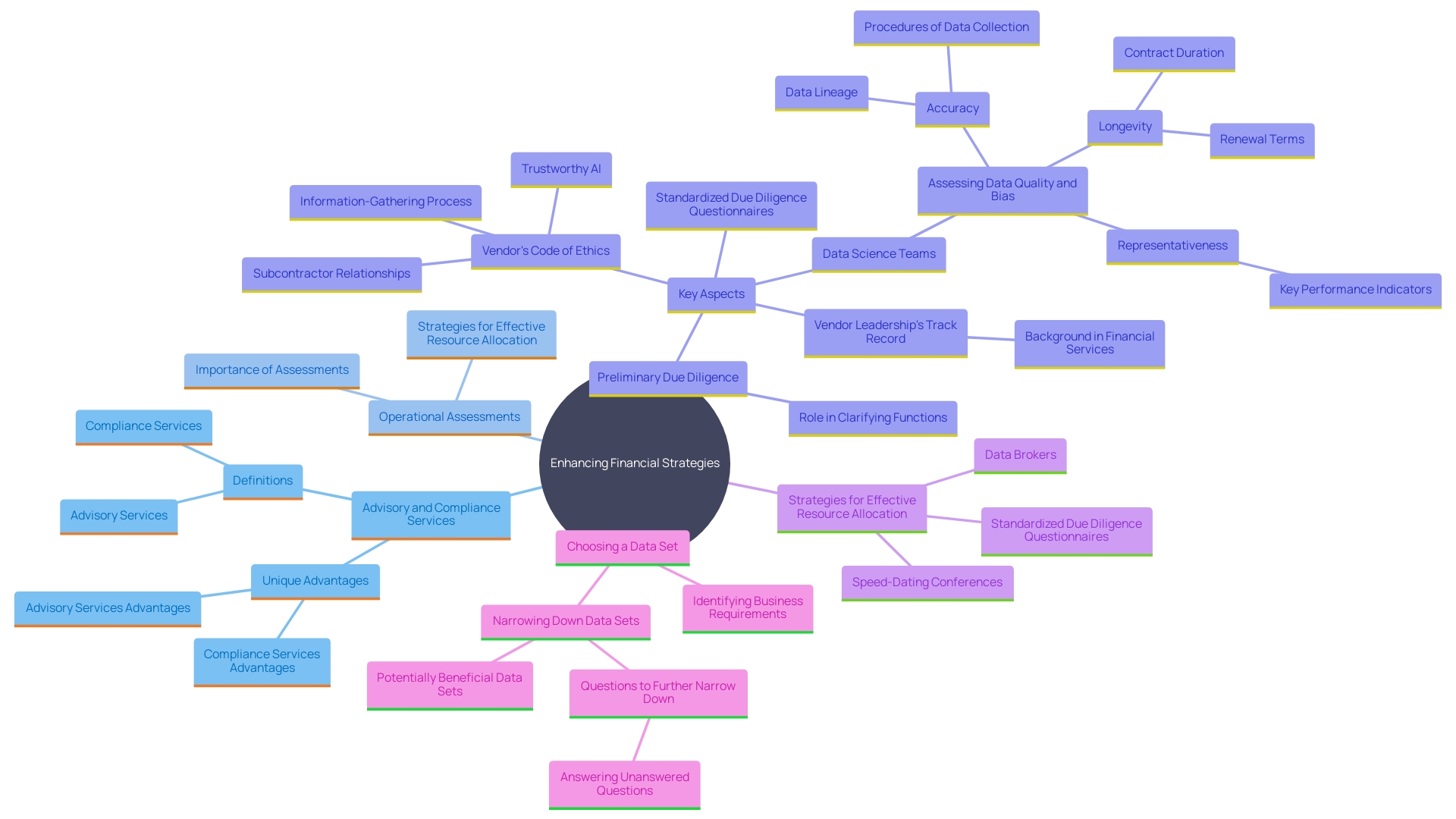

Organizations often grapple with the challenge of distinguishing between advisory and compliance services. This confusion can result in misallocation of resources and ineffective financial strategies. To address this, businesses need to clearly define their objectives and assess their specific needs. Carrying out a comprehensive operational assessment can aid in resource distribution and scenario evaluation, ensuring that both guidance and compliance functions are effectively utilized.

Informing stakeholders about the unique functions and advantages of each offering is also essential. For example, consulting assistance can provide strategic perspectives that enhance economic performance enhancements, like those noted in a recent KLAS study, which discovered a 56% rise in economic performance improvement engagements. On the other hand, compliance solutions ensure adherence to regulations, protecting the organization from legal and financial risks.

'Furthermore, preliminary due diligence, such as assessing vendor ethics and leadership's history, can further clarify the functions of consulting and compliance. This process not only aids in comprehending the regulatory environment but also guarantees that the selected offerings align with the company’s long-term objectives. By applying these strategies, organizations can enhance the worth gained from both consultative and compliance offerings, promoting sustainable financial growth.

Future Trends and Opportunities in Accounting Advisory

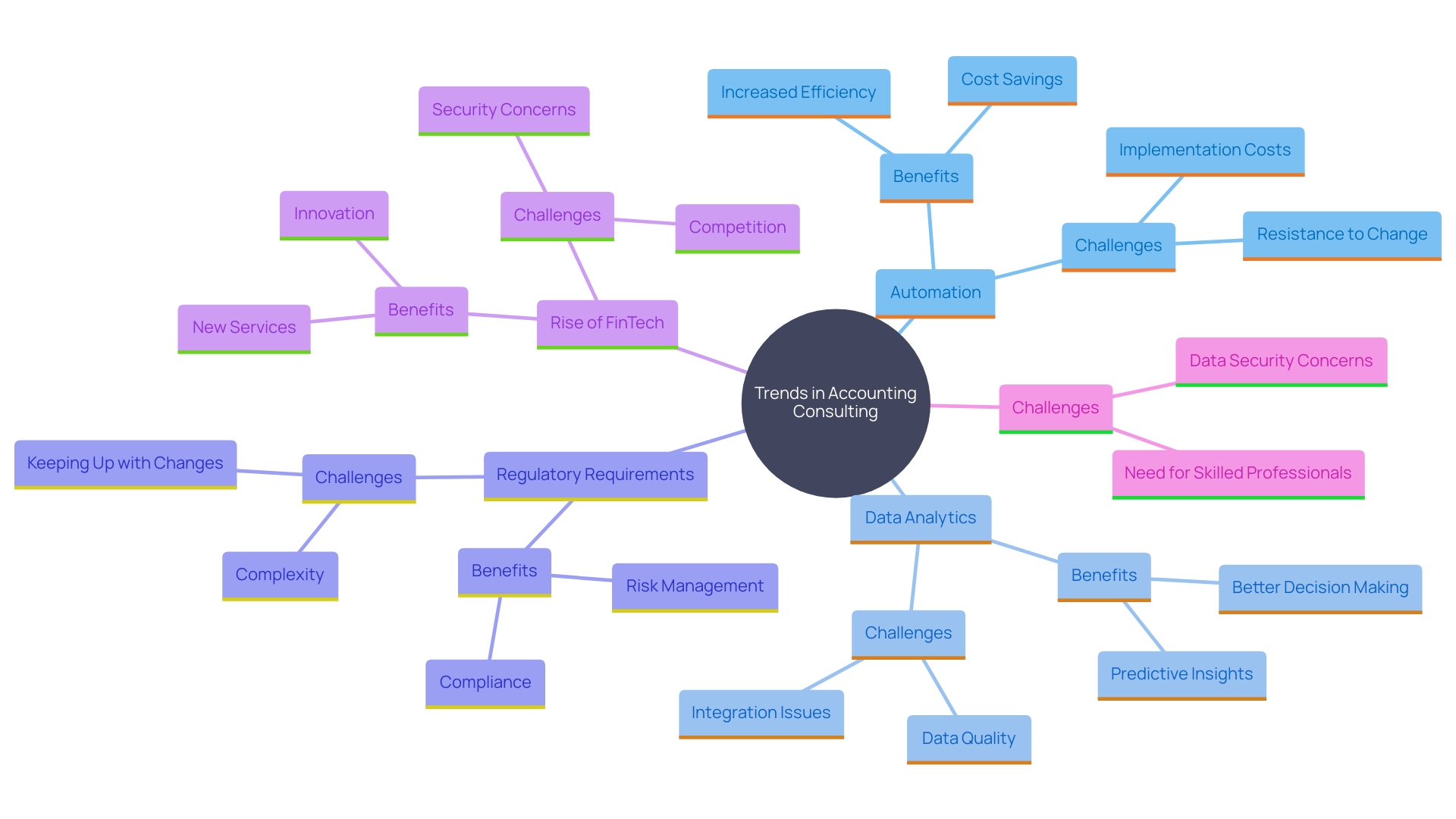

The field of accounting consulting is changing quickly because of progress in technology and shifting market conditions. Trends such as automation, data analytics, and enhanced regulatory requirements are reshaping how advisory services are delivered. The rise of FinTech firms is revolutionizing financial management and investment decisions, making it essential for organizations to adapt. According to a 2005 study by the American Bar Association, the number of words in the Tax Code had more than tripled over the preceding 30 years, with an average of 399 changes enacted annually by Congress. This complexity underscores the need for businesses to stay informed and compliant.

Automation and AI, including analytics-based automation and large language models, are increasingly being adopted to handle repetitive tasks, freeing up staff for higher-level strategic decision-making. Cloud-based accounting solutions with embedded AI are replacing desktop and managed service offerings, providing greater flexibility and agility. This shift is particularly important for financial planning and analysis (FP&A), which integrates with line-of-business applications to support scenario modeling and risk management in uncertain times.

Furthermore, the demand for predictive analytics is increasing, assisting organizations in addressing intricate challenges and enhancing performance. The BFSI sector's embrace of Big Data technologies enhances decision-making, risk management, and operational efficiency. However, data security concerns and a shortage of skilled professionals remain significant challenges.

Staying ahead of these trends is crucial for businesses aiming to enhance their advisory capabilities. As John Epperson, Managing Principal of Financial Services, has noted, the market is poised for significant changes, and companies must be prepared to adapt to ensure growth and success.

Conclusion

Engaging with accounting advisory services is essential for businesses striving to navigate the complexities of today’s financial landscape. These services not only provide strategic guidance on financial reporting and risk management but also enhance operational efficiency through tailored solutions. The integration of advanced technologies, such as automation and AI, further amplifies the effectiveness of these services, enabling organizations to make informed, data-driven decisions.

Understanding the distinction between advisory and compliance services is crucial for CFOs. While compliance services ensure adherence to regulatory standards, advisory services focus on strategic insights that drive growth and improve financial performance. This differentiation allows businesses to allocate resources effectively, maximizing the benefits derived from both service types.

As the industry continues to evolve, staying informed about future trends and opportunities is vital. Embracing advancements in technology and data analytics will empower organizations to enhance their advisory capabilities, thereby positioning themselves for sustained growth and success. By leveraging expert guidance and embracing innovative solutions, businesses can navigate the complexities of the financial landscape with confidence.