Overview

The financial crime risk assessment methodology serves as a systematic approach that organizations employ to evaluate and mitigate risks associated with monetary crimes, including fraud and money laundering. This methodology necessitates a thorough examination of various factors, such as operational practices and transaction patterns, to identify vulnerabilities and ensure compliance with regulatory standards. Ultimately, this rigorous process safeguards organizations from substantial financial losses and reputational damage, underscoring its critical importance in today’s financial landscape.

Introduction

In a world where financial crimes are increasingly sophisticated, organizations face immense pressure to safeguard their assets and reputations. The process of financial crime risk assessment has evolved beyond a mere regulatory checkbox; it is now a critical strategy for identifying vulnerabilities and mitigating risks associated with fraud, money laundering, and other illicit activities.

As businesses navigate a constantly changing landscape marked by rising compliance costs and complex regulations, understanding the methodologies and technologies that underpin effective risk assessments is essential.

This article delves into the current state of financial crime risk assessment, exploring key methodologies, types of financial crimes, and practical applications that can help organizations bolster their defenses against these pervasive threats.

Understanding Financial Crime Risk Assessment

The financial crime risk assessment methodology is a critical and systematic process that organizations implement to assess the risks associated with monetary crimes. It involves identifying, analyzing, and mitigating threats linked to offenses such as fraud, money laundering, and terrorist financing. By following this methodology, organizations conduct a thorough examination of various factors, including operational practices, customer demographics, and transaction patterns, to identify vulnerabilities that criminals may exploit. Transform Your Small/ Medium Business offers comprehensive evaluations that can help identify opportunities to conserve cash and reduce liabilities, which is essential for maintaining economic stability in challenging times.

As we look toward 2025, the landscape of monetary misconduct risk evaluation is evolving rapidly. The market for financial crime risk assessment methodology is projected to grow by 6.7% annually. A recent study by Forrester Consulting, which surveyed 1,181 senior decision-makers at monetary institutions, revealed that 99% of these organizations in the U.S. and Canada have experienced rising compliance costs, totaling an alarming $61 billion. This data underscores the urgent need for organizations to adopt a strategic financial crime risk assessment methodology that balances cost reduction with compliance efficiency.

The 'True Cost of Financial Crime Compliance Study' highlights the challenges faced by mid and large-sized institutions in reducing expenses while adhering to increasing regulations. Industry leaders emphasize the importance of robust strategies in financial crime risk assessment methodology. Ade O'Connor, Sr Manager of International Media Relations, asserts, "Organizations must leverage new technologies and compliance tools to enhance operational efficiency while maintaining a strong focus on customer experience." Effective applications of the financial crime risk assessment methodology demonstrate that organizations can manage costs while ensuring compliance with evolving regulations.

The impact of economic offenses on businesses is significant, with evidence indicating that such illicit activities can lead to substantial financial losses and reputational damage. For instance, compliance costs related to monetary misconduct have increased for 99% of banking entities, highlighting the pressing need for effective threat evaluations. By conducting thorough assessments using a financial crime risk assessment methodology, companies can develop proactive strategies to safeguard against potential risks, ensuring compliance with regulatory standards and enhancing overall security.

This comprehensive approach not only protects the organization but also builds trust and confidence among stakeholders, ultimately contributing to cash preservation and liability reduction.

Key Methodologies in Financial Crime Risk Assessment

In the field of financial crime evaluation, the financial crime risk assessment methodology encompasses two primary approaches: qualitative and quantitative. Qualitative evaluations hinge on personal judgments, leveraging expert insight and experience to identify potential threats. This method frequently involves interviews and surveys, enabling organizations to capture nuanced insights that numerical data alone may overlook.

Conversely, quantitative evaluations employ numerical information and statistical analysis to assess danger levels, providing a more objective measure of potential threats.

Organizations often adopt a hybrid strategy, integrating both methodologies within their financial crime risk assessment framework to develop a comprehensive vulnerability profile that addresses the full spectrum of potential weaknesses. This amalgamation not only enhances the accuracy of evaluations but also aligns with industry best practices.

Frameworks such as the Basel Committee's guidelines and the Financial Action Task Force (FATF) recommendations serve as essential resources for organizations conducting these evaluations. These structured approaches ensure compliance with global standards, facilitating robust management strategies. As we approach 2025, the latest methods in crime evaluation underscore the importance of real-time data analysis and advanced forecasting techniques, which are crucial for effective fraud detection and prevention.

The integration of Business Intelligence (BI) technology in finance provides real-time insights, advanced forecasting, and improved fraud detection, rendering it indispensable for competitive operations in the economic sector.

Current trends reveal a growing reliance on technology-driven solutions that enhance the efficiency and effectiveness of evaluations. As Rachel Mader aptly notes, 'The combination of qualitative and quantitative approaches is essential for a comprehensive understanding of monetary threats.' Additionally, the case study on 'Mapping Self-Organization in the Arts' highlights the importance of documentation and data management in assessment, illustrating how organized data can refine evaluation processes.

By embracing these methodologies and frameworks, organizations can adeptly navigate the complexities of financial misconduct challenges, ultimately safeguarding their operations and ensuring compliance with a financial crime risk assessment methodology in an increasingly regulated environment.

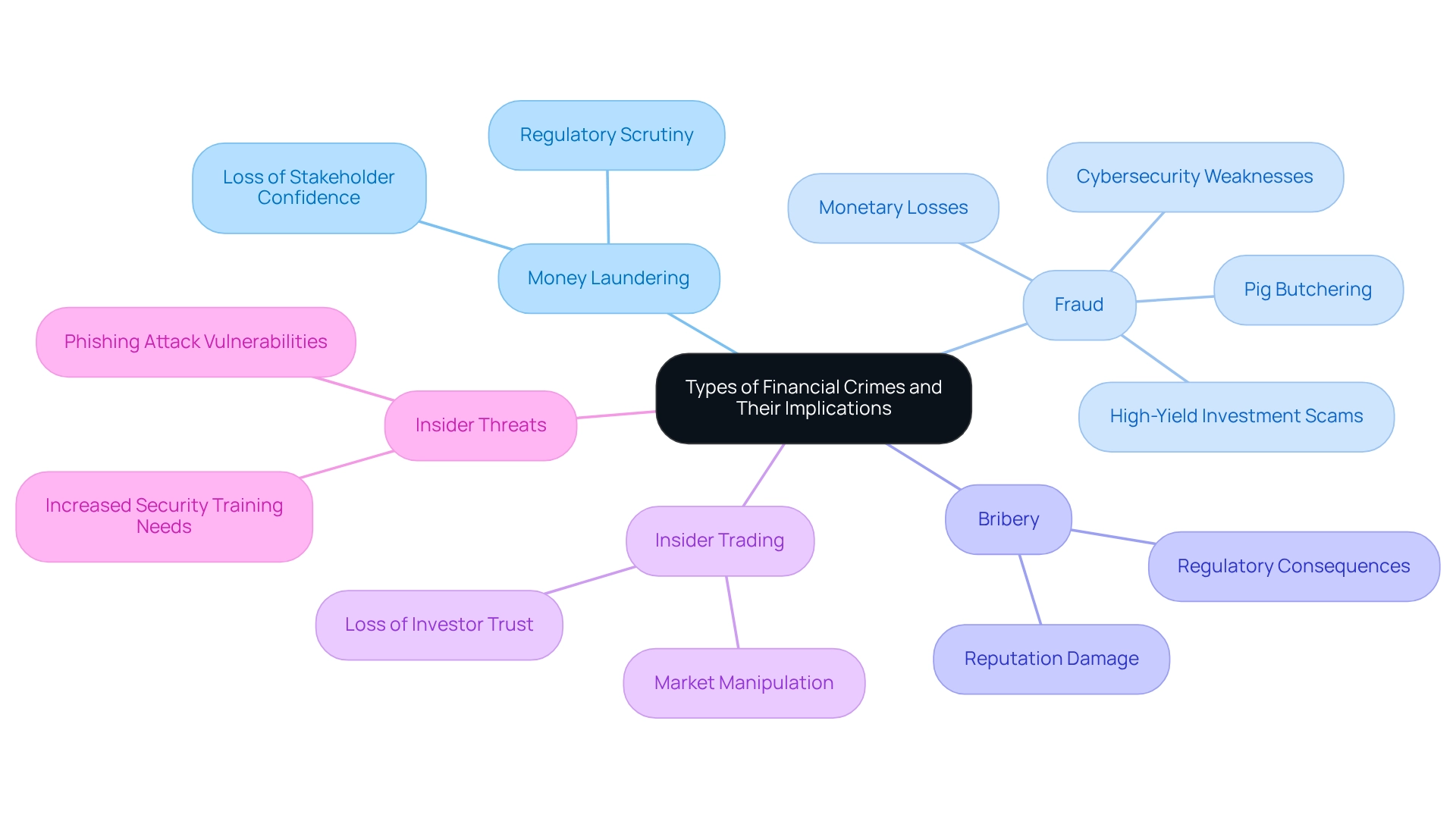

Types of Financial Crimes and Their Implications

Financial offenses encompass a diverse array of illicit activities, including money laundering, fraud, bribery, and insider trading, each presenting distinct risks and implications for organizations. Money laundering, for instance, not only enables additional criminal activities but also undermines the integrity of economic systems, potentially resulting in regulatory scrutiny and loss of stakeholder confidence. In 2025, the occurrence of monetary offenses remains alarming, with high-yield investment scams and sophisticated fraud schemes, such as 'pig butchering,' emerging as the most successful types of deception, often leveraging artificial intelligence to mislead victims.

Moreover, the threat of data breaches is significant; statistics indicate that in 2022, 2 internet users had their data leaked every second. This highlights the urgent need for organizations to bolster their cybersecurity measures. Fraud can lead to substantial monetary losses, with companies reporting an average loss of 5% of their yearly revenue due to deceptive practices.

Additionally, insider threats have become increasingly concerning. A staggering 83% of businesses reported experiencing at least one insider attack in 2024, emphasizing the critical need for comprehensive security training and awareness programs. Phishing attacks, which remain the most prevalent cyber threat, often result in more serious assaults, highlighting the necessity of tackling these weaknesses.

The consequences of economic offenses extend beyond individual entities, affecting market stability and public confidence in monetary institutions. As organizations address these challenges, comprehending the categories of monetary offenses and their related dangers is crucial for prioritizing evaluations and creating focused strategies to reduce possible threats within the financial crime risk assessment methodology. As the ransomware group Conti stated, the severity of these attacks necessitates urgent attention.

By tackling these issues proactively, companies can protect their operations and foster a more secure economic environment.

Identifying Risk Factors in Financial Crime

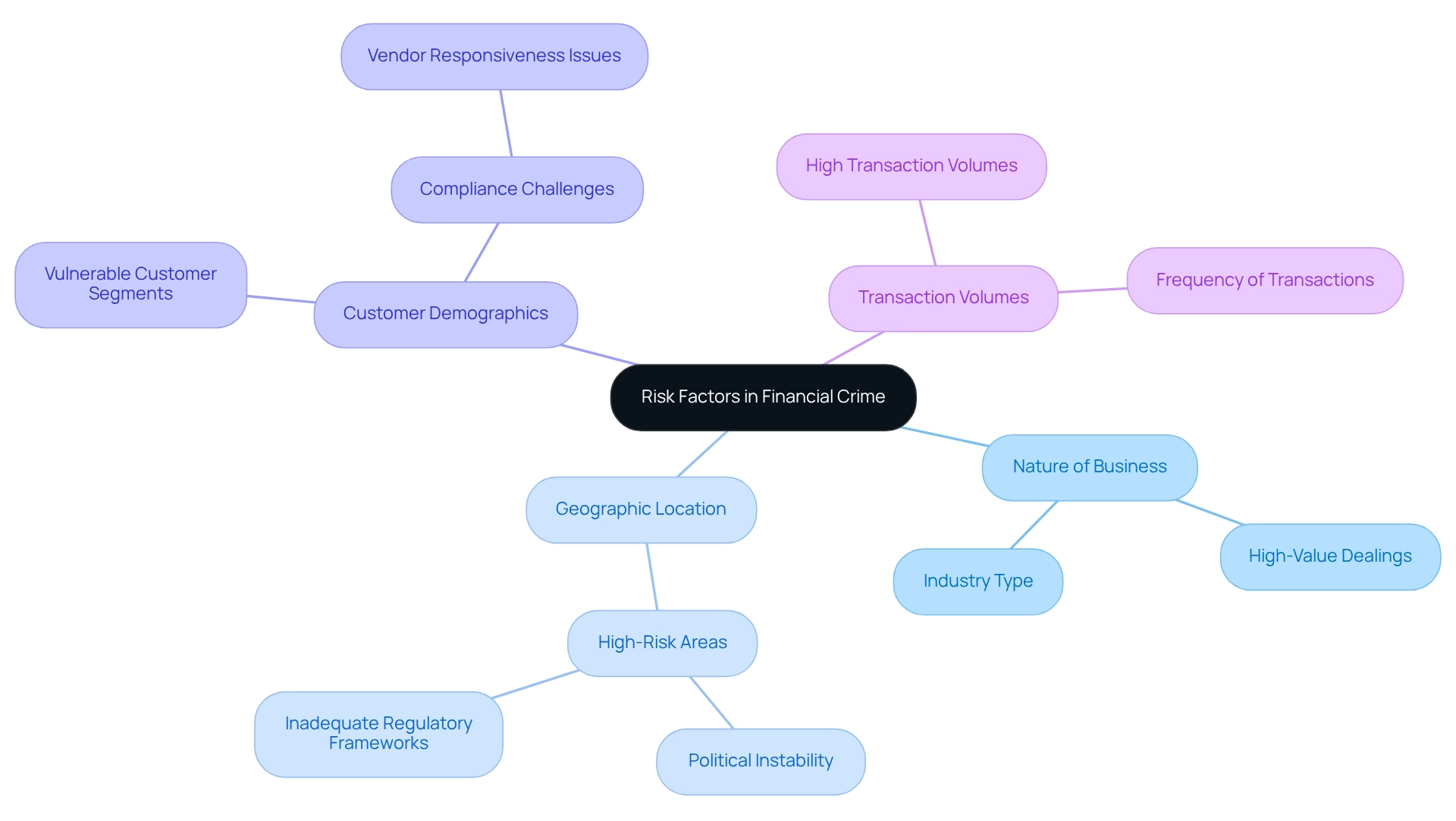

Recognizing threat factors in monetary offenses necessitates a comprehensive examination of various aspects that contribute to an entity's susceptibility through a financial crime risk assessment methodology. Key threat elements include:

- The nature of the business

- Geographic location

- Customer demographics

- Transaction volumes

For instance, companies operating in high-risk areas or engaged in high-value dealings are often more vulnerable to illicit activities.

In 2025, it is crucial to acknowledge that specific geographic regions are categorized as high-risk due to factors such as political instability or inadequate regulatory frameworks, significantly increasing the likelihood of monetary offenses.

Moreover, internal factors play a pivotal role in shaping an organization's vulnerability profile. Employee training, the prevailing compliance culture, and the effectiveness of existing controls are essential components that can either mitigate or exacerbate vulnerabilities. A recent study revealed that 58% of compliance teams encounter challenges in assessing vendor responsiveness, underscoring the difficulties associated with managing third-party risks and ensuring that external partners adhere to compliance standards.

This situation highlights the pressing need for organizations to enhance their oversight of third-party relationships to mitigate potential risks. Current insights indicate that organizations must leverage technology and best practices to improve compliance efficiency. With an alarming average of 97 cyber offense victims per hour—equating to a victim every 37 seconds—the necessity for robust monetary threat evaluations has never been more critical. Furthermore, in 2022, the UK mobilized an initial £6.35 million package to protect against cyber attacks, illustrating the growing recognition of the need for proactive measures in the face of evolving threats.

By comprehending and addressing these danger elements, organizations can refine their financial crime risk assessment methodology to bolster their protections and enhance their overall security stance, ultimately safeguarding their assets and reputation.

The Role of Compliance in Risk Assessment

Adherence is crucial in evaluating potential threats; organizations must navigate a complex landscape of regulatory structures, including the Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) rules. These regulations necessitate the execution of thorough evaluation procedures based on financial crime risk assessment methodology, aimed at identifying and mitigating potential monetary misconduct threats efficiently. As Beazley states, "Regardless of sector, there’s no question that uncertainty and compliance practices are crucial to operating a company in our current environment."

Beyond merely avoiding legal penalties, robust compliance practices significantly enhance an organization's reputation and foster trust among customers and stakeholders. By integrating a financial crime risk assessment methodology into their evaluation practices, organizations not only shield themselves from financial crimes but also ensure they meet their legal obligations.

As the regulatory environment evolves—particularly with the anticipated launch of the European Anti-Money Laundering Authority (AMLA) in mid-2025, alongside updates from the FATF and FinCEN—organizations must remain vigilant and adaptable. Recent statistics indicate that 34% of organizations delegate at least some of their compliance functions, underscoring the growing recognition of compliance's role in effectively managing uncertainties. Instruments like Zluri's access review solution exemplify how technology can streamline compliance procedures, further embedding them into evaluation methodologies.

Case studies demonstrate that organizations effectively incorporating compliance into their evaluations not only enhance their operational resilience but also improve overall efficiency by employing a financial crime risk assessment methodology to combat financial misconduct. Understanding the leading causes of data breaches, such as weak passwords and insider threats, is essential for developing robust data access practices that safeguard sensitive information. In this context, compliance transcends mere regulatory requirement; it emerges as a strategic imperative that drives sustainable growth and operational integrity.

Practical Applications of Financial Crime Risk Assessment

The financial crime risk assessment methodology is essential for evaluating financial crime threats across various industries, including banking, insurance, and retail. In the banking sector, these evaluations are crucial for identifying potential threats related to money laundering and terrorist financing. By meticulously analyzing transaction patterns and customer profiles, banks can pinpoint high-risk clients and implement enhanced due diligence measures, thereby safeguarding their operations and ensuring compliance with regulatory standards.

In the retail industry, companies leverage evaluations to combat various types of fraud, such as payment fraud and return fraud. By employing sophisticated methodologies, retailers can proactively identify and mitigate potential threats, protecting their assets and maintaining customer trust. For instance, predictive analytics has emerged as a vital tool in this process, enabling retailers to analyze historical and real-time data to anticipate fraudulent activities before they escalate.

This approach mirrors the use of predictive analytics in healthcare, which employs similar data to forecast events like patient readmissions.

Statistics indicate that retail fraud detection is advancing, with organizations reporting a significant reduction in losses due to improved evaluation practices. By 2025, the integration of advanced data analytics and machine learning is expected to further enhance these evaluations, allowing retailers to adapt to evolving fraud patterns more effectively. Upcoming advancements in monetary uncertainty management will incorporate new data analytics limitations and soft computing tactics for higher-dimensional analysis, underscoring the evolving nature of vulnerability evaluation methodologies.

Case studies illustrate the successful implementation of the financial crime risk assessment methodology in banking. For example, organizations utilizing artificial intelligence and machine learning algorithms have demonstrated improved prediction capabilities, surpassing traditional statistical methods. These advancements facilitate the processing of large volumes of unstructured data, enabling banks to stay ahead of emerging threats.

The case study titled 'Artificial Intelligence and Risk Prediction' exemplifies how these technologies can enhance prediction capabilities in banking.

Expert insights underscore the importance of the financial crime risk assessment methodology in evaluations within both the retail and insurance sectors. Industry leaders, such as Dr. T. Sree Kala, advocate for a proactive strategy in managing uncertainties, asserting that effective evaluations of monetary threats not only protect organizations but also enhance their overall operational efficiency. As the landscape of monetary misconduct continues to evolve, the demand for robust evaluation techniques will only increase, making it imperative for organizations to remain informed and adaptable.

Overall, these services are designed to assist businesses in overcoming challenges and achieving sustainable growth.

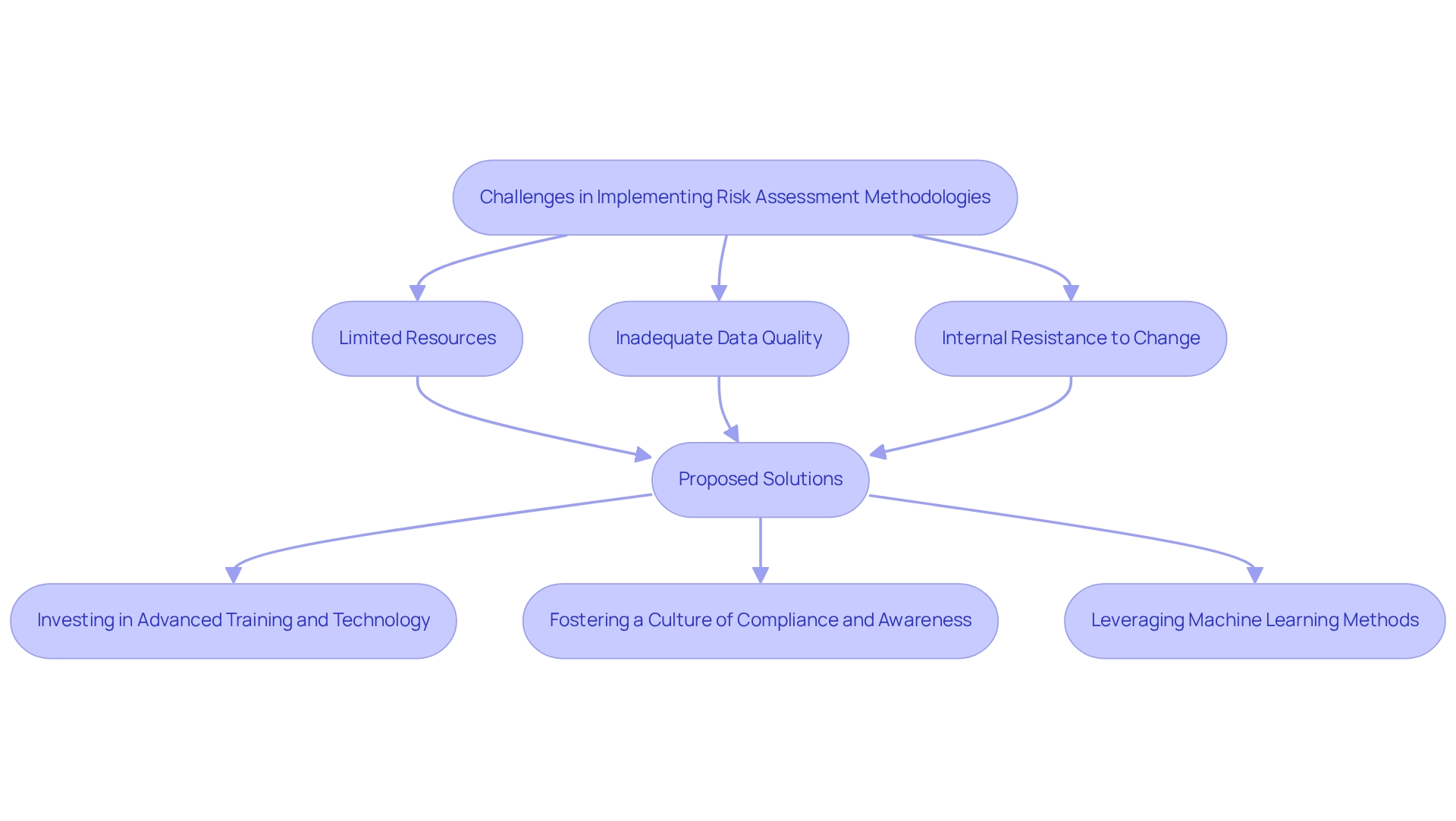

Challenges in Implementing Risk Assessment Methodologies

Applying a financial crime risk assessment methodology to evaluate monetary misconduct presents considerable challenges for organizations, particularly in 2025. Key obstacles include:

- Limited resources

- Inadequate data quality

- Internal resistance to change

The evolving landscape of monetary offenses necessitates that organizations implement robust evaluation procedures grounded in a financial crime risk assessment methodology, consistently enhancing these processes to proactively address emerging threats.

Statistics reveal that organizations often struggle with resource allocation for monetary misconduct assessments, with many indicating that up to 40% of their compliance budgets are dedicated to these initiatives. As Matt Michaud, Global Head of Financial Crime Compliance, asserts, "As the cost of financial crime compliance rises for organizations across the U.S. and Canada, organizations must take a strategic approach to financial crime compliance." To effectively navigate these challenges, it is crucial to invest in advanced training and technology.

For instance, the integration of machine learning methods, as demonstrated in a recent case study utilizing Data Envelopment Analysis (DEA), has shown promise in predicting current threat levels and enhancing control measures. This approach effectively combines traditional techniques with innovative data analysis, resulting in improved outcomes in managing uncertainties.

Moreover, fostering a culture of compliance and awareness is essential to mitigate resistance within the organization. By ensuring that all staff understand the significance of monetary misconduct evaluations, organizations can cultivate an environment conducive to proactive threat management. The need for clear information systems for efficient credit evaluation further underscores the importance of these analyses.

Expert opinions emphasize that a strategic financial crime risk assessment methodology for addressing monetary misconduct is vital, especially as the costs associated with these initiatives continue to rise. Organizations that adeptly navigate these challenges not only bolster their compliance posture but also position themselves for sustainable growth in an increasingly complex regulatory environment. Furthermore, the accuracy of the XG boost model, which ranges from 91% to 96%, highlights the potential benefits of leveraging advanced technology in evaluations.

Future Trends in Financial Crime Risk Assessment

The future of evaluating monetary misconduct risks is on the brink of significant transformation, driven by the integration of artificial intelligence (AI), machine learning (ML) technologies, and a comprehensive financial crime risk assessment methodology. Experts like Peter Griscom, David Bates, and Chase Hudson emphasize that these innovations are set to enhance the financial crime risk assessment process, improving both the precision and efficiency of evaluations through automated data analysis and the identification of patterns indicative of potential monetary offenses. As we approach 2025, statistics reveal that organizations leveraging AI and ML can expect a notable increase in accuracy for identifying potential issues, with some studies indicating enhancements of up to 30% in detecting fraudulent activities.

Moreover, the evolving regulatory landscape necessitates that organizations continually adapt their compliance strategies to remain resilient against emerging threats. This adaptability is crucial as public-private partnerships expand, facilitating real-time sharing of information regarding monetary wrongdoing and fostering a collaborative approach to managing vulnerabilities. For instance, enhanced cross-border cooperation is becoming increasingly vital as financial systems globalize, underscoring the need for improved coordination among jurisdictions and the establishment of consolidated sanctions databases.

For small and medium enterprises (SMEs), the heightened focus on data privacy and security will significantly influence how they conduct evaluations of monetary misconduct. Businesses must strike a careful balance between effective threat management and adherence to privacy regulations, ensuring their strategies not only protect against financial offenses but also respect the confidentiality of sensitive information. As organizations navigate these complexities, the role of AI and ML will be crucial in developing robust, compliant, and efficient financial crime risk assessment methodologies.

Transform Your Small/Medium Business is dedicated to assisting SMBs through this transformative journey.

Conclusion

In summary, financial crime risk assessment has evolved into a crucial strategy for organizations aiming to protect their assets and reputation in an increasingly complex regulatory environment. The methodologies employed—both qualitative and quantitative—provide a comprehensive framework for identifying vulnerabilities associated with various financial crimes, such as fraud, money laundering, and insider trading. By integrating advanced technologies and adhering to international compliance standards, organizations can enhance their risk assessment processes, ensuring resilience against emerging threats.

The implications of financial crimes extend beyond individual organizations, impacting market stability and public trust in financial systems. As businesses confront rising compliance costs and evolving threats, understanding the types of financial crimes and their associated risks becomes imperative. Proactive risk assessments not only safeguard operations but also foster trust among stakeholders, ultimately contributing to a more secure financial environment.

Looking ahead, the integration of artificial intelligence and machine learning technologies promises to revolutionize financial crime risk assessments by automating data analysis and improving accuracy in identifying fraudulent activities. As organizations adapt to these advancements and the changing regulatory landscape, a commitment to robust risk assessment methodologies will be essential for sustainable growth and operational integrity. In this dynamic landscape, the proactive management of financial crime risks will be a defining factor for organizations striving to maintain their competitive edge while ensuring compliance and security.

Frequently Asked Questions

What is the financial crime risk assessment methodology?

The financial crime risk assessment methodology is a systematic process organizations use to assess risks associated with monetary crimes, including fraud, money laundering, and terrorist financing. It involves identifying, analyzing, and mitigating threats by examining various factors such as operational practices, customer demographics, and transaction patterns.

Why is financial crime risk assessment important for organizations?

It helps organizations identify vulnerabilities that criminals may exploit, reduces compliance costs, enhances operational efficiency, and ensures adherence to regulatory standards, ultimately protecting against financial losses and reputational damage.

What are the projected growth trends for financial crime risk assessment methodology by 2025?

The market for financial crime risk assessment methodology is projected to grow by 6.7% annually as organizations increasingly recognize the need for effective compliance strategies.

What challenges do organizations face in financial crime compliance?

Organizations, particularly mid and large-sized institutions, face rising compliance costs, which have reached $61 billion for 99% of banking entities. Balancing cost reduction with compliance efficiency is a significant challenge.

What are the two primary approaches in financial crime risk assessment?

The two primary approaches are qualitative evaluations, which rely on expert judgment and insights, and quantitative evaluations, which use numerical data and statistical analysis to assess risk levels.

How do organizations typically implement financial crime risk assessment methodologies?

Organizations often adopt a hybrid strategy, integrating both qualitative and quantitative approaches to create a comprehensive vulnerability profile that addresses a wide range of potential weaknesses.

What frameworks guide organizations in conducting financial crime risk assessments?

Frameworks such as the Basel Committee's guidelines and the Financial Action Task Force (FATF) recommendations serve as essential resources for ensuring compliance with global standards in financial crime risk assessments.

What role does technology play in financial crime risk assessments?

Technology, particularly Business Intelligence (BI), provides real-time insights, advanced forecasting, and improved fraud detection, making it indispensable for enhancing the efficiency and effectiveness of evaluations in the financial sector.

How can organizations safeguard against financial misconduct?

By conducting thorough assessments using the financial crime risk assessment methodology and embracing both qualitative and quantitative approaches, organizations can develop proactive strategies to mitigate potential risks and ensure compliance with regulations.