Introduction

In an increasingly complex financial landscape, organizations must proactively navigate a myriad of risks that threaten their stability and growth. Financial risk assessment emerges as a crucial strategy, enabling CFOs to identify, analyze, and mitigate potential threats that could derail their operations. This comprehensive approach not only encompasses traditional risks like market volatility and credit exposure but also addresses the evolving challenges posed by cybersecurity and operational disruptions.

By implementing targeted strategies to optimize the cash conversion cycle, organizations can enhance their resilience and performance. With the right tools and techniques at their disposal, CFOs can transform risk management from a reactive measure into a proactive framework that safeguards assets and drives strategic success.

This article delves into the essential components of financial risk assessment, offering actionable insights and practical steps to empower organizations in their quest for long-term sustainability.

Defining Financial Risk Assessment: An Overview

What is financial risk assessment? It is an essential, systematic approach aimed at identifying, analyzing, and evaluating potential financial threats that may jeopardize an organization’s financial stability. This comprehensive process encompasses both quantitative and qualitative factors, including:

- Market volatility

- Credit exposure

- Liquidity challenges

- Operational uncertainties

In the context of mastering the cash conversion cycle, CFOs can implement 20 focused strategies designed to enhance business performance while reducing uncertainties. These strategies may include:

- Optimizing inventory turnover

- Improving receivables collection

- Managing payables effectively

As the environment of monetary threats changes—particularly with the increase of remote work, which has resulted in security breaches in 20% of entities during the pandemic—grasping these dangers becomes increasingly essential. Cybersecurity threats are diverse, with various types of attacks such as:

- Phishing

- Malware

- Social engineering

- Ransomware

- DDoS attacks

According to Cybersecurity Ventures, 'global spending on cybersecurity products and services is predicted to reach $1.75 trillion cumulatively for the five-year period from 2021 to 2025.' By conducting a comprehensive evaluation to understand what is financial risk assessment and incorporating strategies for enhancing the cash conversion cycle, organizations can proactively identify weaknesses and develop strategic measures to reduce these threats, ultimately strengthening their asset protection and ensuring long-term sustainability. Such evaluations not only strengthen economic wellbeing but also improve overall organizational effectiveness, enabling companies to navigate uncertainties with increased assurance.

The thorough manual priced at $99.00 provides detailed insights into these strategies, equipping CFOs with the resources needed for effective monetary management.

The Importance of Financial Risk Assessment in Business Strategy

Financial uncertainty evaluation plays a crucial part in influencing business strategy and decision-making. By effectively identifying possible monetary threats, organizations can grasp what is financial risk assessment and implement preemptive measures that reduce dangers, significantly enhancing their resilience amid market fluctuations. Our approach supports a streamlined decision-making cycle, enabling CFOs to take decisive action while continually monitoring business health through real-time analytics.

We are committed to developing strong, lasting relationships with our clients, ensuring that their needs are met throughout the turnaround process. Studies show that companies conducting thorough evaluations of uncertainties see significant enhancements in economic performance, as these evaluations enable improved resource distribution and compliance with regulatory requirements. For example, Client B recently asked for a review of their monetary controls, operations, equity, and uncertainties during a major transition between owners, which emphasizes what is financial risk assessment and the essential need for comprehensive monetary vulnerability evaluation during crucial moments.

Becky Todd, the Western Washington Practice Manager for CFO Selections, highlights that both new and established businesses will gain from a monetary evaluation conducted regularly. This proactive method allows CFOs to synchronize their monetary strategies with wider business goals, ensuring that all choices are guided by a comprehensive understanding of the company’s tolerance for uncertainty. Additionally, we focus on identifying underlying business issues and testing hypotheses to ensure maximum return on invested capital.

A practical illustration of what is financial risk assessment can be found in a recent case study titled 'Conducting a Business Financial Risk Evaluation,' which demonstrated how companies utilizing monetary evaluations identified specific threat levels, prioritized them, and crafted strategies to effectively navigate economic uncertainties. This process not only bolstered compliance but also empowered organizations to enhance their operational resilience against potential losses, ultimately driving strategic success. Moreover, data indicate that firms participating in regular monetary evaluations report a 20% rise in performance metrics, highlighting the concrete advantages of this proactive strategy.

Exploring Different Types of Financial Risks

Organizations face various monetary challenges that can greatly affect their performance. These include:

- Market Risk: This encompasses the potential for losses stemming from fluctuations in market prices, such as interest rates and stock prices, which can adversely affect both revenue and asset values.

- Credit Exposure: This threat occurs when borrowers do not meet their repayment commitments, resulting in possible losses on loans and other monetary products.

- Liquidity Challenge: Organizations encounter liquidity challenges when they cannot meet short-term obligations due to a disparity between their liquid assets and liabilities, which can jeopardize operational stability.

- Operational Hazard: This type of hazard originates from internal processes, people, and systems, including potential fraud and system failures that can disrupt business continuity.

Understanding what is financial risk assessment is crucial for comprehending these hazards and developing effective mitigation strategies. For additional details on monetary hazards, please consult the resource available at NCEI. Identifying and handling these challenges is essential for companies to sustain economic stability and guarantee long-term success.

Steps Involved in Conducting a Financial Risk Assessment

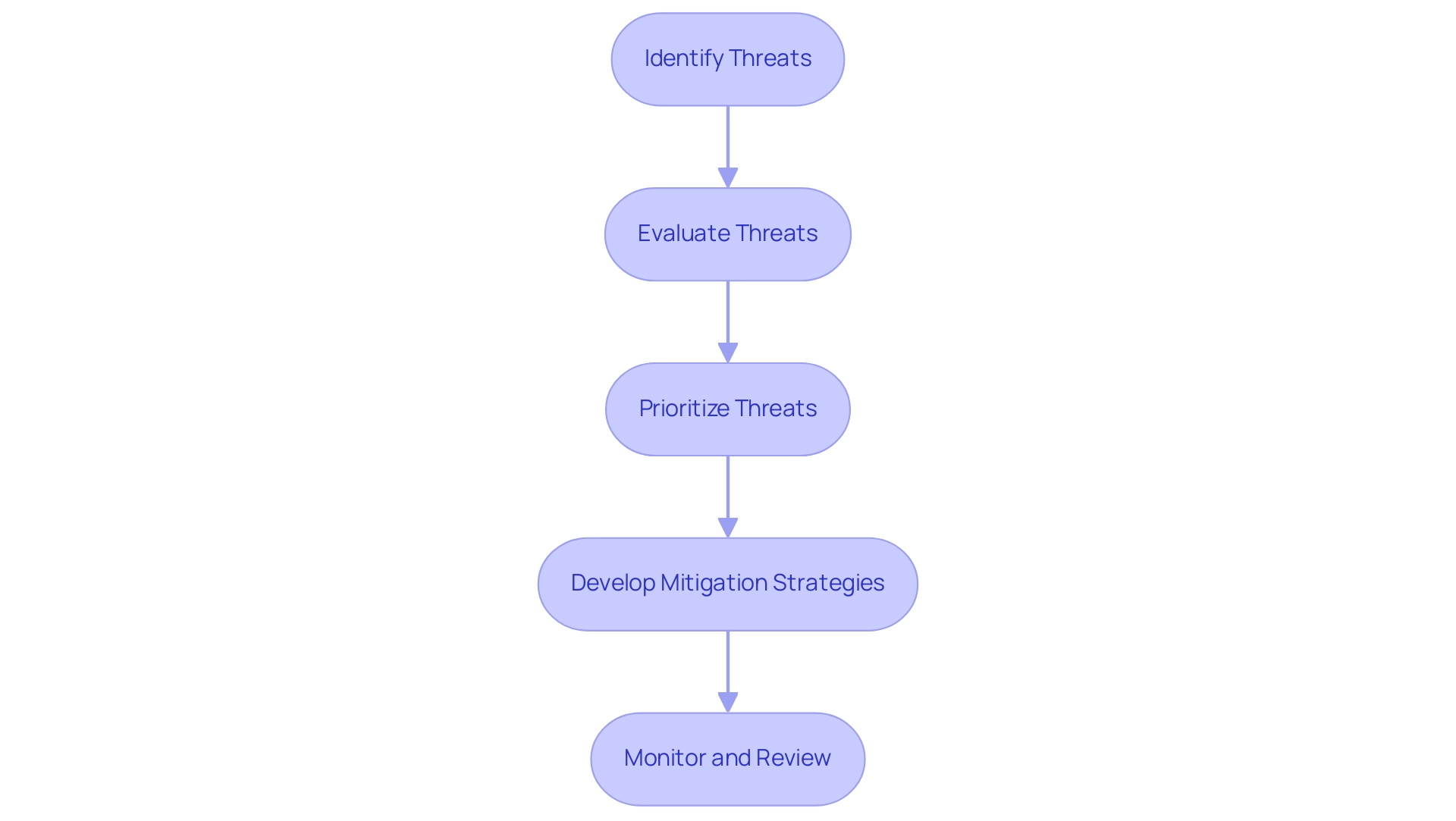

Carrying out a monetary threat evaluation is essential, and this process is what is financial risk assessment, involving several crucial steps to protect your organization’s economic well-being. Here’s a structured approach:

-

Identify Threats: Start by collecting detailed information to determine possible monetary hazards.

This encompasses understanding the landscape of prevalent cyber threats, such as phishing, whaling, malware, social engineering, ransomware, and DDoS attacks, which can severely affect economic stability. For instance, in 2023, an AT&T breach exposed approximately 9 million customers' personal details, illustrating the severe consequences of financial threats related to cybersecurity.

-

Evaluate Threats: After threats are recognized, assess the probability of each happening and the possible effect on your entity.

This assessment should consider the evolving nature of cyber threats, with global spending on cybersecurity expected to reach $1.75 trillion from 2021 to 2025, indicating the high stakes involved.

-

Prioritize Threats: Rank the identified threats based on their significance and the potential consequences for your organization.

This prioritization is vital for effective resource allocation and focuses on addressing the most critical vulnerabilities first.

-

Develop Mitigation Strategies: Formulate action plans tailored to the highest-priority threats.

This should encompass contingency plans to alleviate the effects of these threats should they arise. For example, entities that have implemented robust cybersecurity measures have seen significant reductions in incident impact, as highlighted in the case study on cybercrime statistics, which emphasizes the diversity and evolution of cybersecurity threats.

-

Monitor and Review: Establish a system for continuous monitoring of the effectiveness of management strategies.

Frequent assessments are essential to adjust to new challenges as they arise, ensuring your entity stays robust against an ever-changing threat environment. By diligently following these steps, CFOs can significantly improve their entity's ability to manage monetary uncertainties effectively, which relates directly to understanding what is financial risk assessment to safeguard both assets and reputation.

Tools and Techniques for Effective Financial Risk Assessment

A strong evaluation of monetary uncertainties relates to what is financial risk assessment, which is essential for companies and can be greatly enhanced through the use of advanced tools and methods. Key components include:

- Risk Assessment Software: Tools such as RiskWatch and Resolver streamline the risk identification and analysis process, allowing for more efficient and accurate evaluations.

- Modeling: Utilizing software such as Excel or dedicated platforms to create models allows organizations to simulate different scenarios and evaluate their potential effects. This technique is essential as it enables CFOs to visualize the economic landscape under various circumstances.

- Scenario Analysis: Implementing scenario planning techniques is essential for evaluating potential future events and understanding the monetary implications. This proactive approach helps entities to explore what is financial risk assessment for a range of possibilities.

- Stress Testing: Performing thorough stress evaluations to ascertain how monetary uncertainties could affect the entity during extreme conditions is essential. This method helps in identifying vulnerabilities and developing contingency plans.

- Data Analytics in Audit Activities: Data analytics can be utilized in various audit tasks, including planning, sampling, documentation, and fraud detection, enhancing the overall evaluation process.

By leveraging these innovative tools and techniques, CFOs can improve their financial evaluation processes, making informed decisions that align with the organization’s strategic goals. As Alan Anderson, CPA, CGMA, founder of ACCOUNTability Plus, emphasizes,

I foresee auditors taking outliers identified by data analytics at the data or transaction level, determining if they are appropriate or inappropriate, and then moving them into a Gen AI program that would continuously monitor the area where the outlier occurred.

This insight emphasizes the transformative potential of combining data analytics with traditional evaluation methodologies.

Moreover, Moody's has secured the #1 overall ranking in the Chartis RiskTech100® for the third consecutive year, showcasing its leadership in the industry. The case study titled 'Innovating with Purpose' illustrates how Moody's is leveraging cutting-edge technology and top talent to drive innovation in risk management and compliance. This commitment to innovation positions Moody's as a frontrunner in the field, highlighting the advantages of combining advanced technology with expert insights.

Conclusion

Financial risk assessment is not merely a procedural task; it is an integral component of strategic business management. By identifying, analyzing, and mitigating various financial risks—from market fluctuations to cybersecurity threats—organizations can significantly enhance their operational resilience. The steps outlined in this article, such as:

- Identifying and prioritizing risks

- Developing tailored mitigation strategies

- Employing advanced tools

provide a structured approach for CFOs to navigate an increasingly complex financial landscape.

Moreover, the proactive nature of financial risk assessment empowers organizations to align their financial strategies with broader business objectives. As demonstrated through case studies and statistical evidence, firms that engage in regular risk assessments report improved financial performance and compliance. This underscores the tangible benefits of integrating financial risk evaluation into the organizational framework.

In conclusion, embracing financial risk assessment as a core strategy not only protects assets but also drives long-term sustainability and success. By leveraging the insights and tools discussed, CFOs can transform their risk management practices, ensuring that their organizations remain robust and competitive in the face of evolving financial challenges. Now is the time to act decisively and make financial risk assessment a priority for future growth and stability.

Frequently Asked Questions

What is financial risk assessment?

Financial risk assessment is a systematic approach aimed at identifying, analyzing, and evaluating potential financial threats that may jeopardize an organization’s financial stability. It includes both quantitative and qualitative factors such as market volatility, credit exposure, liquidity challenges, and operational uncertainties.

Why is financial risk assessment important for organizations?

Financial risk assessment is crucial as it helps organizations identify possible monetary threats and implement preemptive measures to reduce risks, enhancing their resilience amid market fluctuations. It supports informed decision-making and improves overall organizational effectiveness.

What are some strategies CFOs can implement to enhance business performance?

CFOs can implement strategies such as optimizing inventory turnover, improving receivables collection, and managing payables effectively to enhance business performance while reducing uncertainties.

What types of cybersecurity threats should organizations be aware of?

Organizations should be aware of various cybersecurity threats, including phishing, malware, social engineering, ransomware, and DDoS attacks, which can significantly impact financial stability.

How does market risk affect organizations?

Market risk encompasses potential losses stemming from fluctuations in market prices, such as interest rates and stock prices, which can adversely affect both revenue and asset values.

What steps are involved in conducting a financial risk assessment?

The steps involved in conducting a financial risk assessment include: 1. Identifying threats by collecting detailed information. 2. Evaluating the probability and potential impact of each threat. 3. Prioritizing threats based on their significance. 4. Developing mitigation strategies tailored to high-priority threats. 5. Monitoring and reviewing the effectiveness of management strategies.

How can advanced tools and methods enhance financial risk assessment?

Advanced tools and methods such as risk assessment software, modeling, scenario analysis, stress testing, and data analytics can streamline the risk identification and analysis process, enabling more efficient and accurate evaluations.

What is the expected global spending on cybersecurity from 2021 to 2025?

Global spending on cybersecurity products and services is predicted to reach $1.75 trillion cumulatively for the five-year period from 2021 to 2025.

What are the benefits of regular financial evaluations for companies?

Companies conducting regular financial evaluations report significant enhancements in economic performance, improved resource distribution, and better compliance with regulatory requirements, leading to a 20% rise in performance metrics.

How does financial risk assessment contribute to long-term sustainability?

By conducting thorough financial risk assessments, organizations can proactively identify weaknesses and develop strategic measures to reduce threats, ultimately strengthening asset protection and ensuring long-term sustainability.