Introduction

In the intricate world of finance, understanding and managing risk is not just a necessity—it's a strategic imperative. As organizations navigate an ever-evolving landscape marked by market volatility, regulatory scrutiny, and emerging cyber threats, a robust financial risk assessment framework becomes essential.

This article delves into the critical components of financial risk assessment, exploring various types of risks, the assessment process, and the importance of regular evaluations. By employing effective tools and techniques, CFOs can not only safeguard their organizations against potential pitfalls but also unlock opportunities for growth and resilience.

The insights shared here will empower financial leaders to craft proactive strategies that ensure long-term stability and success in a complex financial environment.

Defining Financial Risk Assessment: An Overview

Financial risk assessment meaning is a vital, systematic approach dedicated to identifying, analyzing, and evaluating the potential threats that can negatively impact an organization's financial health. Our Financial Assessment service can reveal opportunities to conserve cash and lower liabilities, forming the backbone of effective oversight. This comprehensive assessment encompasses a variety of challenges, such as market volatility, credit defaults, and operational inefficiencies.

A recent report indicates that:

- 35% of executives prioritize compliance and regulatory challenges as their foremost concern, underscoring the need for focused oversight strategies.

- Statistics indicate that merely 10% of insider threat oversight budgets, averaging $63,383 per incident, are designated for pre-incident activities, emphasizing the economic consequences of insufficient oversight.

By conducting a comprehensive evaluation of potential hazards, entities can formulate effective plans to reduce these threats, thus safeguarding their resources and ensuring long-term viability.

This process is not just a compliance task; it embodies the financial risk assessment meaning that serves as a cornerstone of fiscal oversight, empowering CFOs to make informed decisions and allocate resources efficiently. Furthermore, with the emerging trend of ongoing threat monitoring, as demonstrated by solutions such as those from Secureframe, entities can improve their management frameworks, ensuring that potential dangers are addressed proactively. In an environment where cyber threats remain a top concern, as highlighted by Protiviti—who noted that these threats will continue to be a significant issue in both 2024 and 2034—the importance of thorough evaluations cannot be overstated.

The case study on vendor relationships and breaches, which shows that 98.3% of entities maintain ties with third parties that have experienced a breach in the last two years, further illustrates the critical need for managing third-party risk. Ultimately, comprehensive financial reviews focusing on cash preservation and efficiency are integral to enhancing organizational performance and resilience. For more information on how our Financial Assessment service can benefit your organization, please click the button below.

Exploring Different Types of Financial Risks

Financial uncertainties can be systematically categorized into several distinct types, each with significant implications for organizational stability and strategic planning:

- Market Risk: This includes the possibility of incurring losses due to fluctuations in market prices. Mastering the cash conversion cycle can help reduce this uncertainty by optimizing inventory turnover and receivables oversight, thus enhancing overall business performance through the application of the '20 Strategies for Optimal Business Performance.'

- Credit Risk: This pertains to the potential for loss when a borrower fails to fulfill their repayment obligations. An effective credit management strategy is crucial, especially with the anticipated increase in credit default rates across various industries in 2024. Implementing proactive measures, such as rigorous credit assessments, can help CFOs safeguard their entities against these risks.

- Operational Threat: This type includes dangers originating from internal processes, personnel, systems, or external events, such as fraud or natural disasters. The increasing frequency of cyberattacks—noted by 52% of cybersecurity experts—indicates an urgent requirement for companies to strengthen their operational safety frameworks. By incorporating cash flow management into operational strategies, CFOs can not only reduce losses but also capitalize on opportunities presented by operational efficiencies.

- Liquidity Threat: This threat occurs when an organization cannot fulfill its short-term monetary obligations due to an imbalance between liquid assets and liabilities. A comprehensive grasp of liquidity challenges is crucial for sustaining operational efficiency and economic stability. Enhancing cash reserves through effective cash conversion strategies can significantly reduce this threat.

Recognizing and thoroughly evaluating these challenges is critical for understanding the financial risk assessment meaning necessary to devise effective financial strategies. As Michael Thor, Managing Director at Protiviti, emphasizes,

Effective oversight of uncertainties is not just about avoiding losses; it's about seizing opportunities in a volatile market.

Moreover, sustainability reports from firms in South Korea, monitored from 2011 to 2021, emphasize the significance of organizational responsibility in management practices.

By prioritizing the assessment of the monetary challenges and implementing strategies to improve the cash conversion cycle, CFOs can better position their companies to navigate the complexities of today's economic environment. For a comprehensive approach, think about examining our '20 Strategies for Optimal Business Performance' available for $99.00, which can enable your company to effectively handle these challenges.

The Financial Risk Assessment Process: Steps and Methodologies

The procedure of monetary assessment is vital for organizations, as understanding the financial risk assessment meaning helps protect their performance from possible threats. It typically unfolds through the following steps:

-

Risk Recognition: This initial phase involves identifying potential threats that could negatively impact economic performance.

With 52% of surveyed cybersecurity experts indicating a rise in attacks compared to the prior year (Business Wire), the significance of comprehensive threat identification cannot be overstated. Furthermore, the inability to utilize rigorous data analytics for market intelligence is recognized as a new challenge in 2034, highlighting the evolving nature of financial threats. Collaborative planning among team members is essential during this phase to ensure comprehensive identification of underlying business issues.

-

Risk Analysis: Here, the likelihood and potential impact of identified risks are evaluated. This frequently utilizes both quantitative and qualitative approaches, enabling entities to leverage advanced analytical tools that handle large volumes of data, derive meaningful insights, and enhance decision-making processes.

Our team advocates for a shortened decision-making cycle throughout the turnaround process, which enables your entity to take decisive actions to preserve business health.

-

Threat Assessment: In this step, potential issues are prioritized based on their importance relative to the organization’s objectives, ensuring that critical dangers are addressed first.

Continuous monitoring through a client dashboard provides real-time business analytics that allows for the ongoing diagnosis of business health, facilitating relationship-building and operationalizing lessons learned during turnarounds.

-

Risk Management: Organizations create strategies to mitigate, transfer, accept, or eliminate threats.

This may involve the adoption of innovative hazard oversight frameworks, similar to those observed in successful case studies like the Financial Intermediation Platform, which achieved 98% model accuracy in its secure, interactive B2B environment. Furthermore, having over 100 in-house employees at DATAFOREST enhances organizational capacity to manage these financial challenges effectively.

Monitoring and Review: Continuous assessment of the threat environment and the effectiveness of management strategies is vital. This continuous procedure enables entities to adjust to new challenges, including the rising issue of insufficient data analytics for market intelligence anticipated for 2034. By employing pragmatic approaches to data testing and measurement, including testing every hypothesis, entities can deliver maximum return on invested capital in both the short and long term.

By following these systematic steps, entities can create a strong structure for handling monetary challenges, which enhances their understanding of financial risk assessment meaning and improves their adaptability and strategic stance in a progressively intricate market environment.

The Importance of Regular Financial Risk Assessments

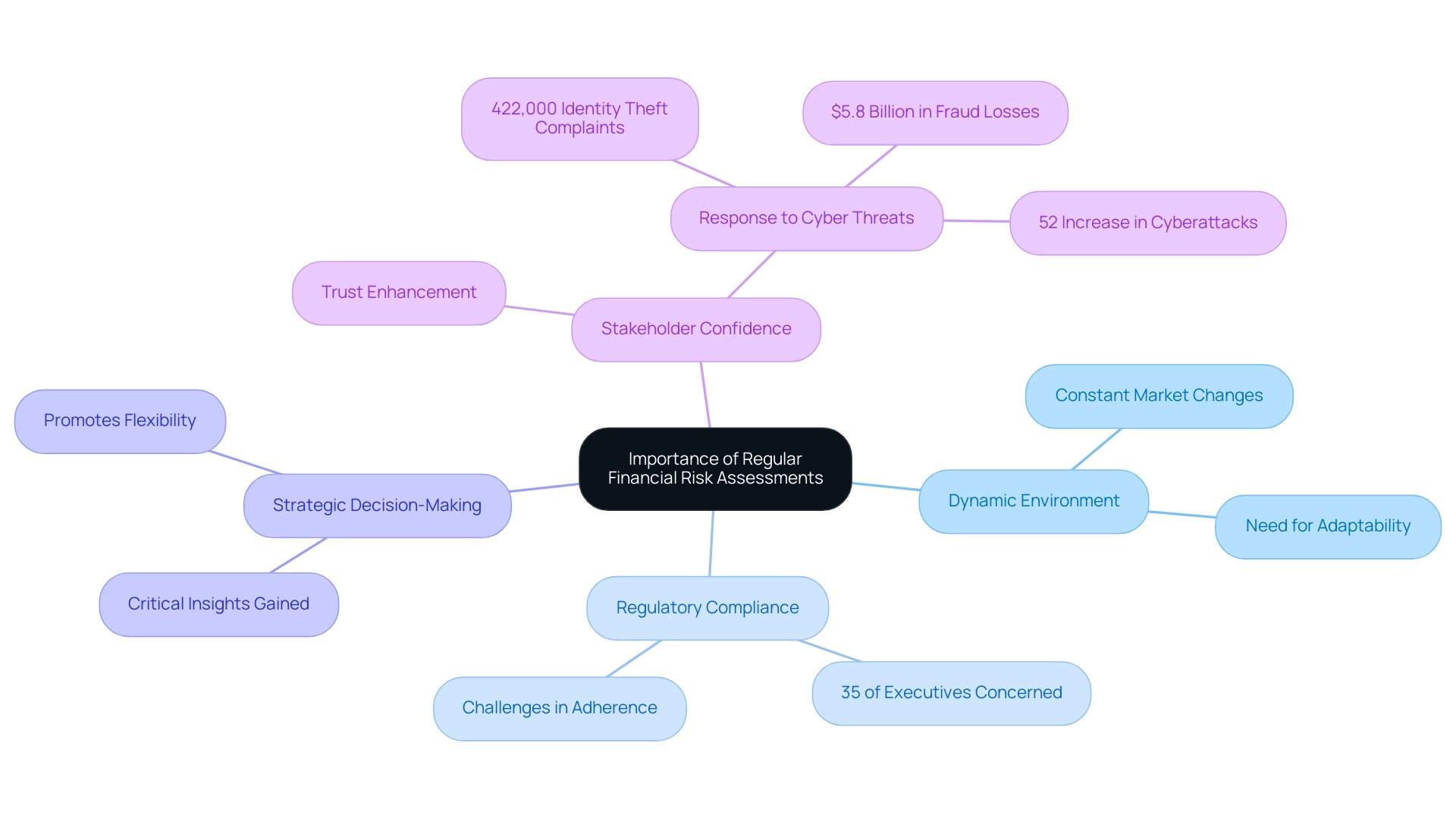

Performing routine evaluations to understand financial risk assessment meaning is essential for entities traversing today's intricate environment. Here are the key reasons for prioritizing these evaluations:

- Dynamic Environment: Financial markets and business conditions are in a constant state of flux. The International Monetary Fund (IMF) stresses that adaptability is essential; therefore, regular evaluations are required to recognize and address new challenges that emerge from these changes.

- Regulatory Compliance: With increasingly strict financial regulations, entities face the challenge of ensuring compliance. Secureframe reports that 35% of compliance executives cite adherence and regulatory challenges as their top concerns. Regular evaluations of potential challenges are essential to meet these requirements effectively, particularly as entities strive to understand the financial risk assessment meaning while navigating the complexities of regulatory landscapes.

- Strategic Decision-Making: Ongoing assessments yield critical insights that help clarify the financial risk assessment meaning in guiding strategic decisions. They allow entities to react swiftly to changing situations, promoting flexibility and knowledgeable decision-making.

- Stakeholder Confidence: Showing a dedication to strong economic oversight through regular evaluations enhances trust among stakeholders. Investors and clients are more inclined to trust entities that emphasize threat reduction approaches. Furthermore, with over 422,000 identity theft complaints reported in 2022 and fraud losses exceeding $5.8 billion, the need for vigilance in economic risk management is underscored. Furthermore, as emphasized in a recent case study, 52% of cybersecurity experts reported encountering more attacks compared to the previous year, indicating a rising trend in cyber threats faced by entities. By embracing these evaluations, entities not only enhance their resilience but also position themselves to adapt effectively in a rapidly changing economic environment.

Tools and Techniques for Effective Financial Risk Management

Efficient monetary hazard management is essential for entities seeking to maneuver through uncertainties in today's dynamic market. Key tools and techniques to bolster this capability include:

- Risk Assessment Software: Advanced tools such as RiskMetrics and @RISK are essential for quantifying and modeling risks. These solutions provide organizations with valuable insights into potential financial impacts, enabling informed decision-making. Significantly, recent statistics reveal that 92% of leaders in security are closely monitoring cyber developments, underscoring the necessity of robust software solutions in addressing emerging threats. Furthermore, IBM Security Guardium plays a crucial role in managing data challenges by monitoring vulnerabilities and providing real-time activity insights, enhancing organizational security and supporting real-time analytics for performance monitoring.

- Scenario Analysis: This analytical technique evaluates various potential outcomes by simulating different scenarios and their impacts on economic performance. By understanding how risks could evolve, organizations can better prepare for volatility. Experts emphasize the effectiveness of scenario analysis in identifying vulnerabilities and informing strategic responses, which is essential for quick decision-making in turnaround situations.

- Stress Testing: Organizations simulate adverse conditions to assess their resilience to extreme economic stress. This proactive approach helps identify weaknesses in economic health and provides insights on necessary adjustments to maintain stability under pressure, contributing to the overall goal of operationalizing lessons learned from past experiences.

- Hedging Strategies: Using monetary tools like options and futures enables companies to reduce uncertainties linked to market changes. Implementing these strategies effectively can safeguard against unforeseen economic shifts, further enhancing the agility of decision-making processes.

- Client Dashboard: Our client dashboard offers real-time business analytics, enabling entities to continuously track their economic health and make informed decisions based on current data. This tool is crucial for operationalizing lessons learned and ensuring that strategies remain effective over time.

As Drata aptly states, "I selected Data for this list because of its innovative approach to security compliance oversight," highlighting the importance of leveraging innovative tools in addressing threats. Furthermore, the case study on cybersecurity education illustrates the necessity of preparing future professionals in the field, emphasizing that a typical requirement includes a bachelor's degree in computer and information technology or related fields. Public four-year universities charged an average of $9,375 in tuition for in-state students during the 2020-21 academic year, showcasing the investment in education needed to address cybersecurity challenges.

By leveraging these tools and techniques, including real-time analytics and operationalizing insights from previous strategies, entities can significantly enhance their understanding of financial risk assessment meaning and management capabilities, positioning themselves for success in an increasingly complex financial landscape. Additionally, by testing hypotheses through data-driven approaches, organizations can ensure that their strategies are both pragmatic and effective.

Conclusion

In the realm of finance, a robust financial risk assessment framework is not merely beneficial; it is essential for organizational success. This article has outlined the critical components of financial risk assessment, emphasizing the importance of identifying and categorizing various types of risks, such as:

- Market risks

- Credit risks

- Operational risks

- Liquidity risks

By understanding these risks, CFOs can develop targeted strategies that not only mitigate potential losses but also capitalize on opportunities that arise in a volatile market.

The assessment process itself is pivotal, comprising systematic steps from risk identification to monitoring and review. Each stage plays a crucial role in ensuring that organizations can adapt to the ever-changing financial landscape. Regular evaluations are vital, as they empower organizations to remain compliant with regulations, foster stakeholder confidence, and enhance strategic decision-making.

Moreover, effective tools and techniques for financial risk management—such as:

- Risk assessment software

- Scenario analysis

- Stress testing

are indispensable in navigating uncertainties. By leveraging these resources, organizations can gain valuable insights and maintain resilience against emerging threats.

Ultimately, prioritizing financial risk assessment is a strategic imperative that enables organizations to safeguard their assets and position themselves for long-term stability and growth. As the financial environment continues to evolve, embracing these practices will not only protect against risks but also unlock pathways to sustainable success. Taking decisive action today will lay the foundation for a stronger financial future.

Frequently Asked Questions

What is financial risk assessment?

Financial risk assessment is a systematic approach to identifying, analyzing, and evaluating potential threats that can negatively impact an organization's financial health. It helps in revealing opportunities to conserve cash and lower liabilities.

Why is financial risk assessment important for organizations?

It is crucial as it forms the backbone of effective oversight, enabling organizations to develop plans to mitigate risks, safeguard resources, and ensure long-term viability.

What types of financial uncertainties are there?

Financial uncertainties can be categorized into four types: Market Risk - Losses due to market price fluctuations; Credit Risk - Losses when borrowers fail to meet repayment obligations; Operational Threat - Risks from internal processes or external events, including cyberattacks; Liquidity Threat - Inability to meet short-term monetary obligations.

What are some statistics related to financial risk management?

A report indicates that 35% of executives prioritize compliance and regulatory challenges, and only 10% of insider threat oversight budgets are allocated for pre-incident activities, highlighting the economic consequences of insufficient oversight.

How can organizations mitigate market risk?

Organizations can mitigate market risk by mastering the cash conversion cycle, optimizing inventory turnover, and improving receivables oversight.

What measures can be taken to manage credit risk?

Implementing a robust credit management strategy, including rigorous credit assessments, is crucial to safeguard against potential increases in credit default rates.

What strategies can help address operational threats?

Strengthening operational safety frameworks and incorporating cash flow management into operational strategies can help reduce losses and capitalize on operational efficiencies.

How can liquidity threats be managed?

Organizations can enhance their cash reserves through effective cash conversion strategies to ensure they can meet short-term monetary obligations.

What is the significance of ongoing threat monitoring?

Ongoing threat monitoring helps organizations proactively manage potential dangers, particularly in an environment where cyber threats are a major concern.

How can CFOs better position their companies to navigate financial challenges?

By prioritizing the assessment of monetary challenges and implementing strategies to improve the cash conversion cycle, CFOs can enhance their companies' resilience in a volatile economic environment.