Overview

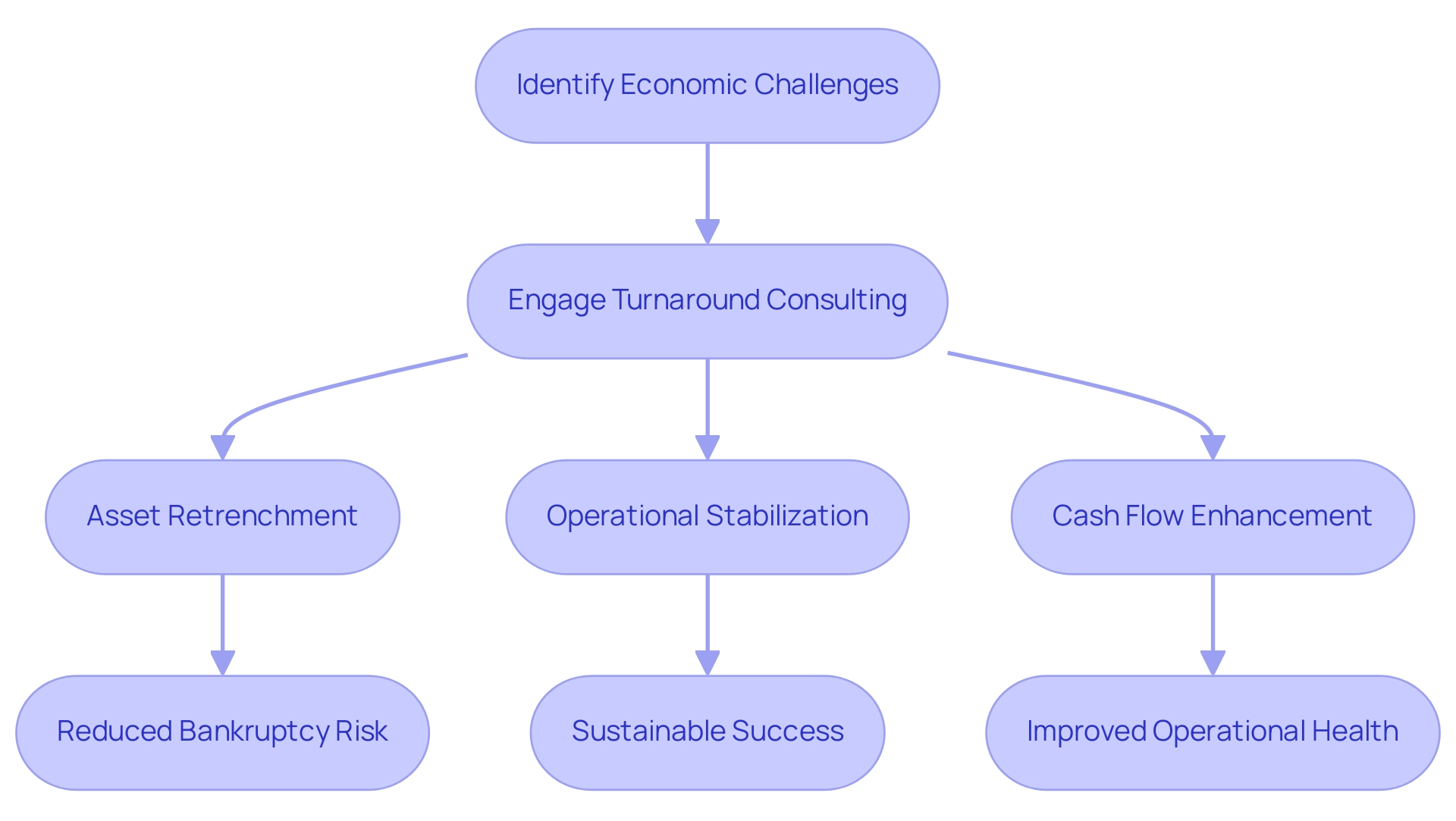

Turnaround and restructuring consulting is crucial for organizations grappling with economic challenges. It offers tailored strategies designed to stabilize operations, enhance cash flow, and foster sustainable growth. This article highlights the significance of expert-led recovery efforts, illustrated by successful case studies such as Party City's emergence from bankruptcy. Such examples demonstrate how effective consulting can substantially improve financial health and operational efficiency. Organizations must recognize the value of these services and consider engaging with professionals who can guide them through recovery.

Introduction

In a world where businesses frequently confront the formidable challenge of financial distress, turnaround and restructuring consulting stands as a beacon of hope. This specialized field provides a vital lifeline to small and medium enterprises struggling with operational inefficiencies and cash flow issues, delivering the expertise necessary to navigate complex financial landscapes. Through comprehensive assessments and the implementation of targeted strategies, consultants not only facilitate organizational recovery but also position these businesses for sustainable growth.

As the business landscape continues to evolve, the importance of these consulting services becomes increasingly evident, highlighting the necessity for customized solutions that tackle the unique challenges encountered by various industries. From crisis management to operational enhancement, the restructuring journey can transform struggling businesses into resilient entities poised to thrive in the face of adversity.

Understanding Turnaround and Restructuring Consulting

encompasses a range of specialized services designed to assist small to medium enterprises in overcoming economic distress and operational inefficiencies. This consulting approach initiates with a thorough monetary assessment of the organization's current state, pinpointing critical issues that hinder performance while identifying opportunities to preserve cash and reduce liabilities. The process involves executing focused strategies aimed at restoring profitability and stability, which may include monetary analysis, operational improvements, and tactical planning tailored to the unique challenges each business faces, alongside bankruptcy case management.

Understanding turnaround and restructuring consulting is crucial, particularly for businesses grappling with economic challenges. In 2023, Party City successfully emerged from bankruptcy, eliminating $1 billion in debt, illustrating the potential for recovery through effective restructuring strategies. Such outcomes underscore the vital role that expert consulting plays in navigating complex economic landscapes.

Furthermore, the recognition of Transform Your Small/Medium Business as the Corporate Restructuring Financial Advisory Firm of the Year in China for 2023 emphasizes the authority and effectiveness of these consulting services. Recent trends in 2025 indicate a growing reliance on private equity and credit providers, enabling struggling companies to restructure discreetly. This shift allows management teams to engage in proactive liability management, potentially averting Chapter 11 filings. As companies adapt to evolving market conditions, the demand for innovative and adaptable monetary solutions continues to escalate.

Significantly, the demand for office space is expected to remain subdued compared to pre-COVID-19 levels, prompting some owners to consider transforming underutilized office assets, which adds complexity to the current commercial environment.

Expert opinions highlight the importance of adopting an activist investor mindset when evaluating operational strategies. This perspective can unveil both opportunities and shortcomings, guiding organizations toward more effective operational frameworks. Moreover, the effectiveness of recovery consulting is evidenced by improved recovery rates, with many firms reporting notable enhancements in financial health post-engagement.

The client engagement process commences with a comprehensive review of operations to align key stakeholders and gain a deeper understanding of the situation beyond the numbers. Our team will identify underlying organizational issues and collaborate to create a plan that encompasses decisive actions and cooperative approaches to mitigate weaknesses and empower the organization to reinvest in key strengths. Companies that have embraced turnaround and restructuring consulting have not only stabilized their operations but have also positioned themselves for sustainable growth.

As the landscape evolves, leveraging expert insights and tailored strategies will remain essential for enterprises striving to thrive in challenging environments.

The Importance of Turnaround and Restructuring Services

In 2025, understanding turnaround and restructuring consulting is essential for companies facing economic challenges. These specialized consulting services equip organizations with the expertise necessary to navigate complex economic landscapes, stabilize operations, and enhance cash flow. By identifying and addressing underlying issues, businesses can significantly reduce the risk of bankruptcy. Studies indicate that approximately 70% of companies engaging consulting services successfully avoid insolvency, raising the question of how turnaround and restructuring consulting benefits Chief Financial Officers.

These services not only facilitate immediate monetary recovery but also lay the groundwork for sustainable long-term success. A notable case study illustrates this: through an asset retrenchment approach, a firm identified underperforming areas and strategically disposed of obsolete assets. This method maintained cash flow while facilitating reinvestment in more effective resources, ultimately improving overall organizational performance.

The impact of turnaround and restructuring consulting extends beyond simple financial recovery; it is essential for ensuring stability. By implementing effective strategies tailored to the unique challenges faced by each organization, these services help maintain operational continuity and foster resilience in turbulent times. The SMB team exemplifies this transformative approach through their 'Rapid30' plan, which has garnered positive testimonials from clients who have experienced significant improvements in their operational health within a short timeframe.

As Dr. Harry Moore MBE, the Head of Europe and Global Head of Change and Transformation at NMS Consulting, emphasizes, expert-led recovery consulting is vital for organizations aiming to thrive amidst adversity. Additionally, the commitment to real-time analytics and operationalizing lessons learned ensures that businesses can continuously monitor their performance and build strong, lasting relationships with . This underscores the importance of consulting services in managing acquisitions and data integration, making it a vital investment for any organization aspiring to thrive in challenging conditions.

Key Strategies in Turnaround and Restructuring Consulting

Key strategies in encompass several critical areas:

- Financial Assessment: A comprehensive analysis of financial statements is essential to pinpoint cash flow challenges and identify potential cost-saving opportunities. Effective assessment techniques involve scrutinizing key performance indicators and market-driven performance metrics, such as market share and brand equity, to gauge an organization's economic health and competitive standing. Mastering the cash conversion cycle is a crucial approach, as it directly impacts liquidity and operational efficiency, allowing businesses to reinvest in key strengths. The approaches for mastering the cash conversion cycle are available for $99.00, providing valuable insights for organizations looking to enhance their financial performance.

- Operational Improvements: Streamlining processes is vital for enhancing efficiency and minimizing waste, which is often a focus of turnaround and restructuring consulting. Case studies have shown that companies leveraging emerging technologies like AI and cloud computing can achieve significant operational excellence. Moreover, emerging technologies are transforming corporate restructuring, enhancing operational excellence and planning development. Real-time analytics play a crucial role in this process, enabling quick decision-making and the testing of hypotheses to ensure that strategies are effective and adaptable.

- Stakeholder Engagement: Effective communication with stakeholders is crucial for ensuring alignment and garnering support for the recovery plan, especially when discussing turnaround and restructuring consulting. Engaging stakeholders early in the process fosters trust and collaboration, which are essential for successful implementation. Dedication to implementing lessons from the recovery process helps build strong, lasting relationships with stakeholders, ensuring their continued support.

Developing a clear roadmap for recovery is fundamental to turnaround and restructuring consulting. This plan should outline both short-term and long-term objectives, ensuring that all team members understand their roles in the recovery process. Expert insights suggest that a well-defined plan increases the likelihood of success, with many turnaround initiatives reporting improved outcomes when guided by a structured approach. As Second Wind emphasizes, "That’s why Second Wind doesn’t charge hourly fees. Zero."

In 2025, the emphasis on these strategies is more pronounced, as organizations seek to navigate complex market dynamics and operational challenges. By adopting best practices in financial assessment and operational improvement, businesses can position themselves for sustainable growth and resilience in the face of adversity.

Challenges in Turnaround Situations and How Consulting Helps

Common challenges in turnaround situations often impede progress and can significantly affect a company's recovery trajectory—central to the essence of turnaround and restructuring consulting. Key issues include:

- Resistance to Change: A prevalent barrier, employee reluctance to embrace new processes or strategies can stall initiatives. Statistics indicate that up to 70% of change initiatives fail due to this resistance, underscoring the need for effective change management strategies. Consulting services from Transform Your Small/Medium Business play a crucial role in mitigating this resistance by implementing structured change management processes that engage employees and foster acceptance. By operationalizing lessons learned from previous turnaround efforts, organizations can create a culture that embraces change.

- Cash Flow Constraints: Limited liquidity is a critical concern that can obstruct the implementation of necessary changes. Organizations facing cash flow issues may struggle to invest in essential resources or technologies that facilitate transformation. Utilizing real-time analytics through our client dashboard helps businesses monitor their cash conversion cycle and identify areas for improvement, ensuring effective resource allocation.

- Stakeholder Conflicts: Differing priorities among stakeholders can complicate decision-making processes. As Norman Augustine, retired CEO of Lockheed-Martin, noted, "Imagine 50 percent of your volume tied to one account—and that account takes a long strike or begins to face financial problems of its own." When stakeholders are not aligned, it can lead to delays and inefficiencies, further exacerbating the challenges faced by the organization.

Consulting services from Transform Your Small/Medium Business are essential in understanding turnaround and restructuring consulting to mitigate these challenges. By providing objective assessments, consultants can identify underlying issues and facilitate open communication among stakeholders. They develop actionable plans that not only address the root causes of distress but also foster a culture of collaboration and engagement.

For instance, a case study titled " illustrates how organizations that actively solicit employee feedback can enhance retention rates and create a more engaged workforce. This approach addresses resistance to change and empowers employees, making them essential to the recovery process.

In 2025, as businesses navigate increasingly complex environments, the importance of consulting in overcoming these challenges cannot be overstated. Businesses are classified according to recovery approach outcomes into four categories: non-recoverable, short-term survival, sustained survival, and sustained recovery. By leveraging expert insights and customized approaches, organizations can effectively address resistance to change, optimize cash flow management, and align stakeholder interests, which is essential for understanding turnaround and restructuring consulting.

Moreover, the industrial sector is encountering substantial losses from rising costs, while the trading sector is seeing decreases in sales and profit margins, emphasizing the need for effective recovery strategies.

Financial Assessment and Operational Analysis: The Backbone of Consulting

To grasp the essence of turnaround and restructuring consulting, it is essential to acknowledge that financial assessments and operational analyses form the cornerstone of informed decision-making. These evaluations encompass several critical components:

- Reviewing Financial Statements: of balance sheets, income statements, and cash flow statements is crucial for uncovering trends and pinpointing issues that may impede financial performance. This process not only highlights areas of concern but also identifies opportunities for improvement, empowering businesses to make data-driven decisions. The insights derived from these evaluations are vital for developing a comprehensive Business Valuation Report, which serves as a strategic tool for understanding the company's worth and guiding turnaround efforts.

- Benchmarking Performance: By comparing financial metrics against industry standards, organizations can evaluate their competitiveness and operational efficiency. This benchmarking process is particularly important given recent statistics indicating a -16% change in gross profit from 2021 to 2022, emphasizing the urgent need for strategic adjustments to enhance profitability. Leveraging AI/ML strategies can further streamline decision-making and provide real-time analytics, enabling CFOs to monitor performance continuously.

- Operational Audits: Conducting comprehensive assessments of processes and workflows allows organizations to identify inefficiencies and areas ripe for improvement. Implementing operational analysis techniques can lead to significant enhancements in productivity and cost savings, which are pivotal for recovery. Continuous business performance monitoring through real-time analytics enables organizations to effectively operationalize recovery lessons, fostering a culture of ongoing improvement.

These analyses not only furnish the necessary data to formulate effective turnaround strategies but also empower organizations to navigate challenges with assurance. For example, a case study involving SaaS companies illustrates how precise reporting aids in assessing tax liabilities, ensuring compliance, and ultimately enhancing economic health. By categorizing expenditures and providing insights into economic performance, these companies can manage their tax obligations more effectively.

In 2025, comprehending turnaround and restructuring consulting is paramount, especially regarding the significance of economic evaluation. As companies face increasingly complex challenges, utilizing diagnostics will assist management in focusing on the appropriate performance measures, resulting in improved profitability and sustainable growth. Neil Wainwright, CEO of Cira Apps, remarked that "partnering with Consero helped establish an efficient and cost-effective finance function within his first 90 days in-seat," underscoring the transformative impact of effective assessments.

Moreover, CFOs seeking actionable strategies can benefit from the organization’s free guide for managing indirect spend and can subscribe to their email newsletter for ongoing updates. Expert opinions underscore that understanding turnaround and restructuring consulting is essential for initiating transformational change, making these evaluations indispensable for any organization aiming to recover and thrive.

Services Offered by Turnaround and Restructuring Consultants

offers a comprehensive suite of services through turnaround and restructuring consulting, designed to assist organizations in navigating challenging economic landscapes. Key offerings include:

- Crisis Management: Our consultants provide immediate support to stabilize operations and address urgent financial issues, ensuring that businesses can quickly regain their footing during turbulent times.

- Interim Management: By offering seasoned leadership, recovery consultants guide organizations through the intricacies of the process. This role is crucial, as studies indicate that effective interim management significantly enhances turnaround success rates, enabling organizations to implement necessary changes swiftly and efficiently. As noted by James, an Associate in the Loan Restructuring Team, "Yes, they would see it as a valuable experience, and you could probably move into IB directly from there as long as you have a decent amount of deal experience."

- Economic Restructuring: Our consultants assist in negotiating debts, refinancing, and restructuring capital to create a more sustainable economic framework. This service is essential for enterprises seeking to alleviate monetary pressures and enhance cash flow. A thorough financial review can identify opportunities to preserve cash and reduce liabilities, which is vital for long-term stability. Notably, Dr. Harry Moore's strategies have preserved approximately 135 UK companies, underscoring the effectiveness of recovery consulting.

- Bankruptcy Case Management: Transform Your Small/Medium Business provides specialized services to manage bankruptcy cases, ensuring clients navigate the complexities of the process with expert guidance and support.

- Operational Improvement: Through targeted process enhancements, our consultants drive efficiency and reduce costs, ultimately positioning businesses for long-term success. Implementing these improvements can lead to substantial savings and increased operational effectiveness.

In 2025, the landscape of consulting for recovery continues to evolve, focusing on technology-enabled solutions that streamline operations and enhance decision-making. The combination of data analytics and RFP software has been shown to enhance content storage by 51% and conserve time by 50%, critical factors for organizations seeking to refine their strategies. Furthermore, case studies reveal that small and midsize companies (SMCs) maintain a steady RFP win rate of 42%, despite facing increasing competition from larger enterprises.

This underscores the importance of tailored consulting services that address the unique challenges faced by SMBs in crisis situations.

Overall, understanding turnaround and restructuring consulting is essential for organizations striving to overcome obstacles and achieve sustainable growth, particularly in times of crisis, as demonstrated by the expertise of consultants at Transform Your Small/Medium Enterprise. The transformative experience with the SMB team, highlighted by the 'Rapid30' plan, showcases client satisfaction and professional success, emphasizing the importance of decisive action and collaborative approaches for stabilizing economic positions and improving operations.

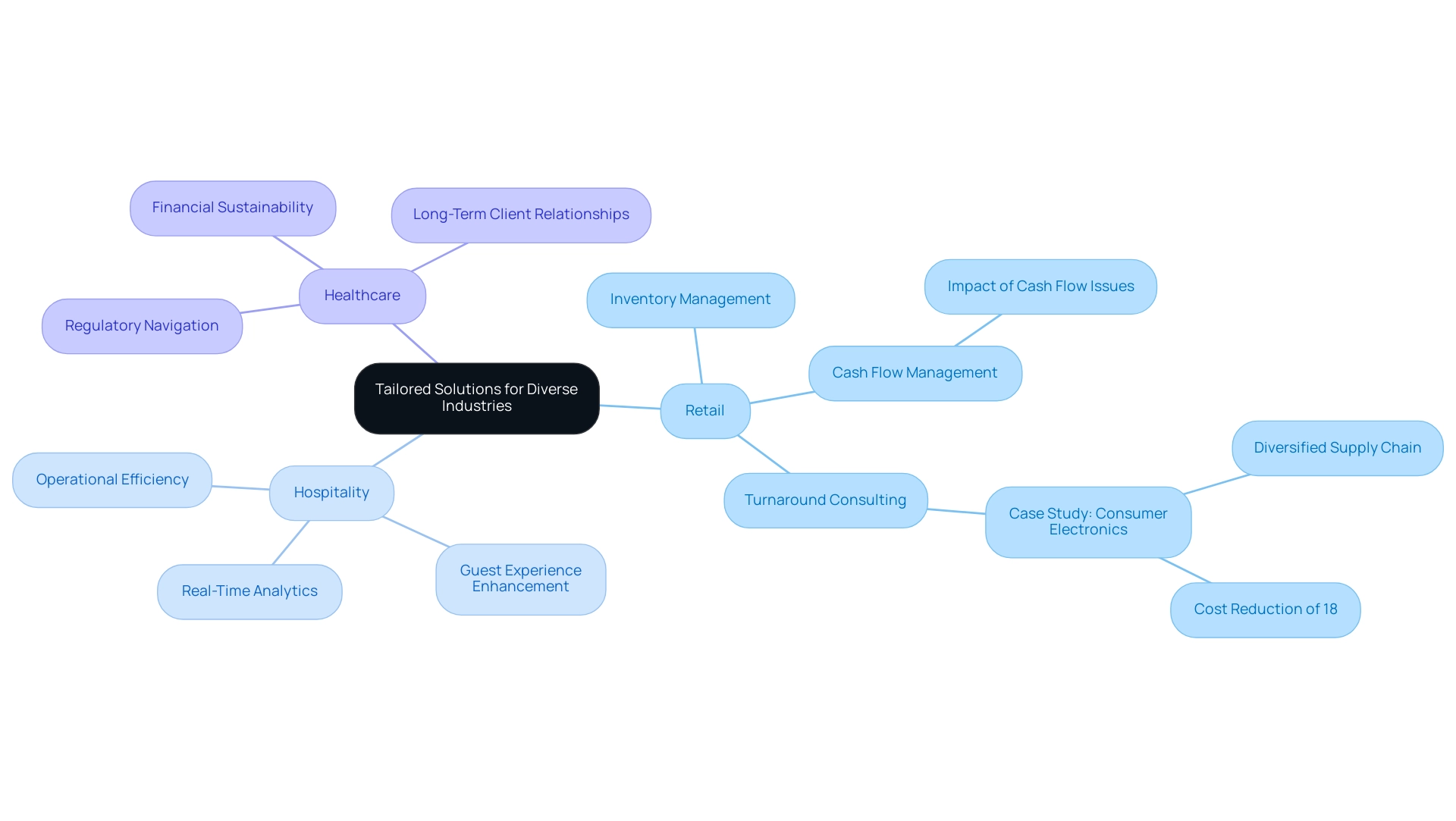

Tailored Solutions for Diverse Industries

Consulting services are inherently specialized, designed to address the distinct needs of various industries. For instance, in Retail, strategies focus on optimizing inventory management and enhancing customer engagement to drive sales and improve profitability. Considering that 82% of small enterprises fail due to cash flow issues, effective cash flow management is critical in this sector.

Organizations with strong economic plans outperformed their counterparts during recessions by an average of 30%. This statistic highlights the importance of turnaround and restructuring consulting, as well as the significance of solid monetary practices. Our approach emphasizes testing hypotheses to identify the most effective methods, enabling quick decision-making that preserves business health.

In the Hospitality sector, the emphasis is on operational efficiency and elevating the guest experience, which are vital for maintaining competitiveness in a crowded market. Tailored solutions can lead to significant improvements in service delivery and customer satisfaction. By utilizing real-time analytics through our client dashboard, we continually monitor the success of our plans, allowing for timely updates and adjustments that enhance operational practices and streamline costs.

In Healthcare, consultants work to navigate complex regulatory environments while ensuring financial sustainability, essential for long-term viability. Our dedication to implementing lessons learned from the recovery process cultivates robust, enduring connections with clients, guaranteeing that approaches are not only executed but also improved over time.

By tailoring solutions, consultants can effectively address the distinct challenges encountered by each sector, resulting in more successful outcomes. For instance, in the retail sector, turnaround and restructuring consulting has proven effective in rejuvenating underperforming enterprises by applying creative methods that align with current market trends. A case study of a consumer electronics company illustrates this: faced with escalating tariffs on components imported from Asia, helped diversify its supply chain, resulting in a cost reduction of 18% and improved production timelines.

Similarly, in hospitality, targeted consulting has resulted in enhanced operational practices that not only improve guest experiences but also streamline costs, ultimately fostering sustainable growth.

Your Essential Checklist for Choosing a Consulting Partner

When selecting a partner for turnaround and restructuring consulting, it is crucial to utilize a comprehensive checklist that addresses key factors influencing the success of the partnership:

- Experience and Expertise: Assess the consultant's proven track record within your specific industry. A collaborator with pertinent experience is more likely to comprehend the unique challenges your enterprise encounters, greatly improving the effectiveness of their plans. For instance, the gross revenue of Grant Thornton in the U.S. from 2012 to 2023 underscores the financial implications of , highlighting the importance of choosing a partner with a strong background.

- Approach and Methodology: Gain insight into their strategies for navigating financial distress. A consultant's methodology should be adaptable and tailored to your organization's needs, ensuring they can implement solutions that are both practical and impactful. Transform Your Small/Medium Company employs a comprehensive review process to identify underlying issues and collaboratively create a strategic plan, exemplified by their 'Rapid30' plan, which has successfully transformed client enterprises within a short timeframe.

- Communication Skills: Evaluate their ability to engage with stakeholders at all levels. Effective communication is essential for fostering collaboration and ensuring that all parties are aligned throughout the restructuring process. As John Smith, Senior Channel Sales Manager at Introhive, noted, prioritizing follow-ups with ecosystem qualified leads is crucial for stakeholder engagement, which aligns with this criterion.

- References and Case Studies: Request detailed examples of past successes with businesses similar to yours. Reviewing case studies can provide valuable insights into the consultant's capabilities and the outcomes they have achieved, helping you gauge their potential effectiveness. The testimonial from a pleased client of Transform Your Small/Medium Business emphasizes how the SMB team swiftly identified problems and executed the 'Rapid30' plan, resulting in significant enhancements in economic and strategic positioning within just 100 days.

- Cultural Fit: Ensure that the consultant's values and goals align with those of your organization. A strong cultural fit can facilitate smoother collaboration and enhance the likelihood of successful implementation of strategies. The example of Run offering free services to businesses in Ukraine during financial distress serves as a reminder of the importance of support and alignment in challenging times.

This checklist serves as a vital tool in guiding your selection process, ultimately leading to a more fruitful partnership that can drive your organization toward recovery and growth. Successful consulting partnerships often hinge on these criteria, as evidenced by various case studies that illustrate turnaround and restructuring consulting, emphasizing the importance of strategic alignment and effective communication in achieving desired outcomes.

Conclusion

Turnaround and restructuring consulting stands as a vital asset for businesses grappling with financial distress and operational hurdles. Through meticulous financial assessments and the implementation of customized strategies, consultants empower organizations to reclaim stability and strategically position themselves for future growth. The documented achievements of companies such as Party City, alongside the recognition of consulting firms, underscore the transformative potential of expert guidance in navigating intricate financial landscapes.

As the business environment evolves, the demand for innovative and adaptable solutions becomes paramount. The strategies discussed, ranging from crisis management to stakeholder engagement, exemplify how consulting services can tackle unique industry challenges and cultivate resilience. Embracing these services not only aids immediate recovery but also lays the groundwork for sustainable success.

In conclusion, collaborating with a seasoned turnaround consultant can significantly bolster a company's capacity to navigate adversity. By leveraging expert insights and tailored strategies, organizations can adeptly manage financial distress, streamline operations, and ultimately thrive in a competitive marketplace. As businesses gear up for the future, investing in turnaround consulting represents a strategic initiative towards resilience and long-term viability.

Frequently Asked Questions

What is turnaround and restructuring consulting?

Turnaround and restructuring consulting involves specialized services aimed at helping small to medium enterprises overcome economic distress and operational inefficiencies through monetary assessments, strategic planning, and operational improvements.

How does the consulting process begin?

The process starts with a thorough monetary assessment of the organization’s current state to identify critical issues and opportunities for cash preservation and liability reduction.

What strategies are implemented in turnaround and restructuring consulting?

Strategies may include monetary analysis, operational improvements, tactical planning, and bankruptcy case management, all tailored to the unique challenges each business faces.

Can you provide an example of a successful restructuring case?

In 2023, Party City emerged from bankruptcy by eliminating $1 billion in debt, showcasing the potential for recovery through effective restructuring strategies.

What recognition has Transform Your Small/Medium Business received?

Transform Your Small/Medium Business was recognized as the Corporate Restructuring Financial Advisory Firm of the Year in China for 2023, highlighting the effectiveness of its consulting services.

What trends are influencing the demand for turnaround consulting?

A growing reliance on private equity and credit providers is allowing struggling companies to restructure discreetly, which helps management teams engage in proactive liability management.

How does turnaround consulting help prevent bankruptcy?

By identifying and addressing underlying issues, turnaround consulting significantly reduces the risk of bankruptcy, with studies indicating that approximately 70% of companies engaging these services successfully avoid insolvency.

What is the 'Rapid30' plan mentioned in the article?

The 'Rapid30' plan is a transformative approach employed by the SMB team that has received positive testimonials from clients due to significant improvements in operational health within a short timeframe.

Why is expert-led recovery consulting important?

Expert-led recovery consulting is vital for organizations aiming to thrive amidst adversity, as it ensures stability and fosters resilience by implementing effective strategies tailored to each organization’s challenges.

How do consulting services contribute to long-term success?

Consulting services not only facilitate immediate monetary recovery but also establish a foundation for sustainable long-term success by maintaining operational continuity and fostering strong relationships with consulting partners.