Overview

Turnaround management serves as a strategic approach designed to revitalize struggling organizations by tackling operational, financial, and managerial challenges, ultimately restoring profitability and stability. This process is of paramount importance for CFOs, as effective recovery management necessitates thorough assessments, strategic planning, and continuous performance evaluations. These elements are crucial for preventing insolvency and ensuring long-term organizational resilience. By implementing these strategies, organizations can not only navigate their current difficulties but also position themselves for future success.

Introduction

In the dynamic realm of business, organizations frequently find themselves teetering on the edge of decline, contending with financial instability and operational inefficiencies. Turnaround management emerges as a crucial strategy designed to reverse these negative trends, providing a structured methodology to rejuvenate struggling companies.

This comprehensive process entails:

- A meticulous evaluation of existing challenges

- The execution of targeted solutions

- The establishment of sustainable practices to secure long-term success

As competitive pressures escalate and workforce dynamics shift, grasping the complexities of turnaround management becomes imperative for leaders striving to protect their organizations and cultivate resilience in the face of adversity.

Understanding Turnaround Management: Definition and Importance

What is turnaround management? It is a strategic approach designed to revitalize struggling organizations by tackling operational, financial, and managerial challenges. This process begins with a thorough analysis of the company's current state, pinpointing the root causes of its decline, and developing a targeted plan to restore profitability and stability. The importance of recovery management is underscored by its ability to prevent insolvency, protect jobs, and preserve stakeholder value.

In fact, recent studies indicate that 41% of organizations cite competitive pressure as a primary driver for implementing recovery strategies, highlighting the urgency of effective management in today's fast-paced business environment.

For CFOs, mastering recovery management is essential, especially in a landscape where 53% of remote workers report feeling disconnected and nearly 70% experience burnout from digital communication. These factors can exacerbate organizational challenges, making it imperative for financial leaders to adopt proactive measures. Streamlined decision-making processes and real-time analytics are crucial in this context, allowing teams to test hypotheses and make informed decisions quickly.

As Harry Moore points out, 'Human error is a significant risk to cybersecurity,' which can further complicate the recovery process. Effective recovery management not only mitigates risks but also enhances operational efficiency, ultimately leading to sustainable growth.

Ongoing assessment of business performance via real-time analytics allows organizations to modify approaches flexibly, ensuring that insights gained during the recovery process are implemented efficiently. Case studies, such as the statistical analysis of recovery tactics employed by Greek companies during their economic crisis, reveal significant correlations between tailored strategies and successful recovery outcomes. This analysis showed that tailored methods, grounded in particular reasons for decline, are essential for successful recovery efforts.

In summary, turnaround management is not just a reactive measure; it is a crucial element of strategic planning that can significantly influence a company's insolvency rates and overall resilience in an ever-evolving market landscape. By mastering the cash conversion cycle and leveraging data-driven insights, CFOs can enhance business performance and foster lasting relationships that support long-term success. The strategies for mastering the cash conversion cycle are available for $99.00 through Transform Your Small/ Medium Business.

The Stages of Turnaround Management: A Step-by-Step Guide

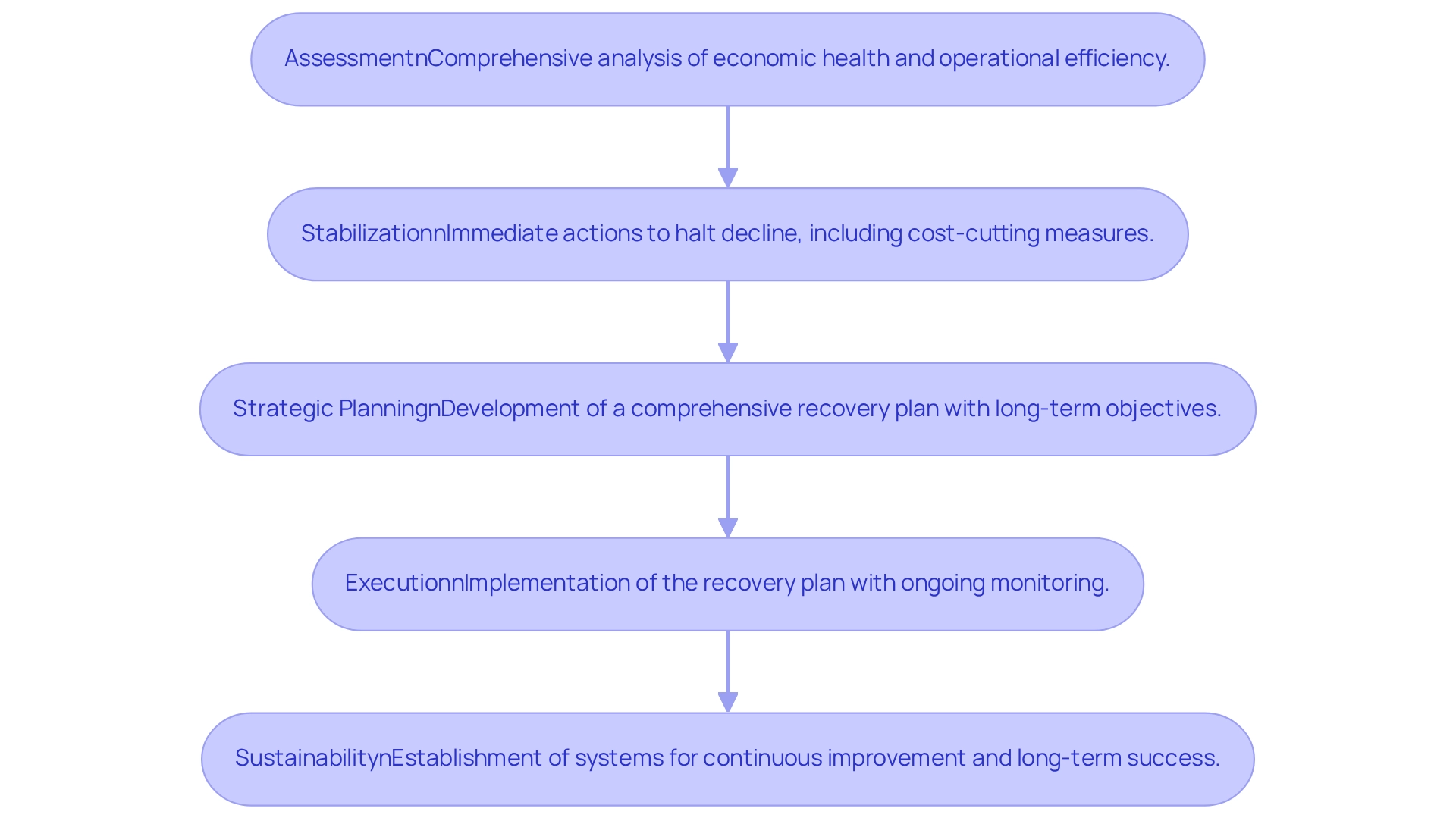

The recovery management process represents a structured approach that encompasses several critical stages, each essential for understanding turnaround management and reversing an organization's decline while fostering sustainable growth. These stages include:

- Assessment - This initial phase involves a comprehensive analysis of the organization's economic health and operational efficiency. Identifying underlying issues that may contribute to current challenges is crucial. As John O. Whitney, a professor of management and specialist in recovery management, emphasizes, understanding the financial landscape is vital for effective recovery.

- Stabilization - Immediate actions are taken to halt further decline, which may include implementing cost-cutting measures and managing cash flow effectively. This stage is vital for creating a stable foundation for future improvements.

- Strategic Planning - In this phase, a comprehensive recovery plan is developed, outlining long-term objectives and the necessary changes to achieve them. This plan serves as a roadmap for the organization’s recovery, incorporating real-time analytics to monitor progress and adjust strategies as needed.

- Execution - The recovery plan is put into action, with ongoing monitoring of progress through a client dashboard that provides real-time business analytics. This allows for quick decision-making and adjustments to ensure alignment with established goals.

- Sustainability - Finally, systems for continuous improvement are established to maintain momentum and ensure long-term success. Each of these stages plays a crucial role in the recovery process, and their effective execution can significantly enhance the likelihood of a successful outcome.

Statistics indicate that organizations that rigorously follow these stages see improved outcomes, with many achieving stabilization within a year. For instance, proposal teams have reduced their average writing time from 34 hours to 24 hours per RFP response, showcasing the effectiveness of structured methodologies. Case studies have indicated that companies adopting a structured approach to recovery management illustrate what turnaround management entails by significantly reducing their average recovery time, demonstrating the effectiveness of this methodology.

Moreover, a conceptual framework distinguishing recoveries from other business development initiatives based on financial health and time horizon can provide additional context, enhancing the reader's understanding of the topic. At Transform Your Small/Medium Business, we emphasize the importance of 'Test & Measure' and 'Decide & Execute' in our improvement strategies, ensuring that we continuously monitor and adjust our plans while fostering strong relationships with our clients.

Leadership in Turnaround Management: Key Characteristics for Success

Effective leadership is crucial when exploring turnaround management, as the stakes are high and the environment often filled with uncertainty. Successful turnaround leaders exhibit key characteristics such as decisiveness, resilience, and exceptional communication skills. They are adept at making difficult decisions swiftly, often under intense pressure, while ensuring transparency with stakeholders to maintain trust and alignment. This streamlined decision-making process is essential for preserving organizational health and facilitating timely actions that can significantly impact outcomes.

Moreover, these leaders cultivate a culture of collaboration and innovation within their teams. By encouraging team members to share ideas and solutions, they harness collective intelligence, which is vital for overcoming challenges. Ongoing business performance evaluation via real-time analytics, supported by the client dashboard from Transform Your Small/ Medium Business, enables leaders to assess the success of their approaches and implement necessary modifications.

Research shows that companies with diverse leadership teams are 35% more likely to excel over their competitors, emphasizing the significance of varied perspectives in decision-making processes. Insights from successful leaders reveal that effective communication and collaboration are not just advantageous but essential for creating an environment where employees feel valued and engaged. A significant portion of American workers prioritize company culture, with one-third willing to forgo job opportunities if the work environment is unsuitable. This underscores the critical role of leadership in shaping workplace dynamics and enhancing employee retention.

As Lettink observes, Millennials and Gen Zers, comprising almost half of the current global workforce, identify career advancement as their primary work priority, highlighting the necessity for robust leadership to attract and retain younger talent. To execute effective leadership approaches, CFOs ought to consider developing a deployment plan and pilot programs to assess the impact of their initiatives. This practical method can assist in ensuring that leadership initiatives are aligned with organizational objectives and employee requirements, while also putting into action the insights gained from the recovery process to foster strong, enduring relationships.

In summary, embodying these leadership traits not only inspires confidence and commitment among employees but also establishes the foundation for understanding turnaround management to navigate the complexities of recovery. As organizations face increasing pressures, the ability to lead with clarity and purpose becomes paramount in achieving sustainable success.

Financial Assessment and Strategic Planning: Laying the Groundwork for Turnaround Success

A thorough monetary assessment serves as the foundation for any effective turnaround strategy. This process involves a meticulous analysis of monetary statements, cash flow projections, and operational metrics to identify areas needing attention. Upon completing this assessment, strategic planning can commence, concentrating on essential initiatives such as cost reduction, revenue enhancement, and operational efficiency.

By aligning monetary goals with strategic objectives, CFOs can develop a comprehensive roadmap that not only addresses immediate challenges but also positions the organization for long-term, sustainable growth.

Mark, a senior development expert with over 25 years of experience, underscores the vital importance of monetary evaluations in recovery plans, stating, "A thorough monetary analysis is crucial for spotting chances to conserve cash and lessen liabilities."

Research indicates that organizations with robust performance management practices are 4.2 times more likely to outperform their competitors, achieving up to 30% revenue growth and significantly lower attrition rates. This highlights the significance of incorporating monetary evaluations into recovery strategies. Moreover, aligning monetary evaluations with strategic planning enables companies to shift to more adaptable fiscal structures, essential for small to medium-sized enterprises confronting traditional funding challenges.

Typical economic metrics examined during recovery evaluations consist of net income, cash flow, and operational expenses. For instance, a net income margin of 20% is considered strong, while 10% is average, and anything below 5% signals potential issues. By concentrating on these metrics, CFOs can recognize opportunities for enhancement and apply effective recovery plans that yield improved performance and resilience in the face of adversity.

This is additionally backed by the case study titled 'Impact of Effective Performance Management on Business Outcomes,' which emphasizes that firms with robust performance management are 4.2 times more probable to surpass rivals, underscoring the importance of integrating financial evaluations into recovery plans. Furthermore, utilizing AI/ML technologies can transform operations, offering real-time analytics that enable swift decision-making and implementing insights gained during the recovery process.

For a comprehensive approach, the Business Valuation Report priced at $3,500.00 provides expert guidance from Peter Griscom, M.S., David Bates, CFP, CPA, and Chase Hudson, MBA, Lean Six Sigma Black Belt, ensuring that companies can effectively navigate their recovery strategies.

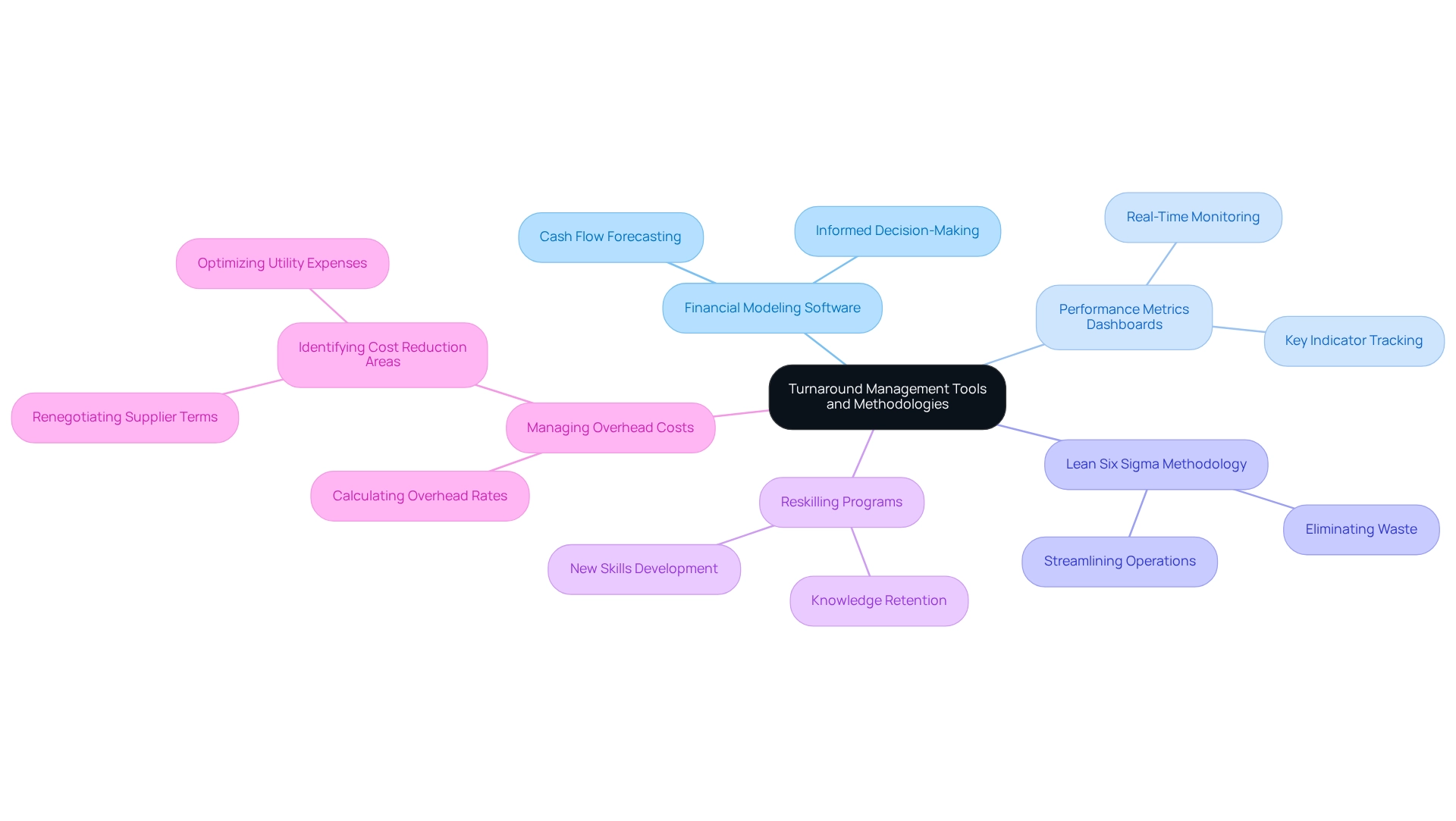

Tools and Methodologies for Effective Turnaround Management

Effective turnaround management is defined by a variety of tools and methodologies designed to optimize decision-making and enhance operational efficiency. Financial modeling software plays a crucial role in cash flow forecasting, allowing companies to anticipate financial challenges and make informed decisions. Performance metrics dashboards provide real-time monitoring of key indicators, enabling CFOs to track progress and adjust strategies promptly.

This real-time analytics feature is essential for assessing organizational health and ensuring that choices are data-driven, ultimately safeguarding the company during critical recovery stages.

Methodologies such as Lean Six Sigma are particularly valuable in this context, as they focus on streamlining operations and eliminating waste, which can significantly reduce overhead costs. A compelling case study on managing overhead costs demonstrates how companies can enhance economic performance by calculating overhead rates and pinpointing areas for cost reduction, such as renegotiating supplier terms or optimizing utility expenses. This practical application of methodologies illustrates the essence of turnaround management by emphasizing the significance of having the appropriate tools available to test hypotheses and implement lessons learned from the recovery process.

Furthermore, the efficacy of these tools is underscored by data showing that organizations utilizing robust financial modeling software in recovery situations experience significant enhancements in their recovery results. Additionally, as Doug McElhaney notes, "To retain knowledge while also ensuring the business has the new skills and capabilities necessary to compete, many organizations will design and implement reskilling programs." This highlights the essential function of reskilling in ensuring that recovery plans are effective and sustainable.

By leveraging these resources, CFOs can not only improve their recovery strategies but also prepare their organizations for sustainable growth in the long term. Moreover, it is vital to acknowledge that dissatisfied customers online can inform 6,000 friends, illustrating the broader implications of management on customer experience and business reputation.

Continuous Improvement: Monitoring Progress and Ensuring Sustainability

Ongoing enhancement is vital in recovery management, serving as a foundation for lasting success. CFOs must prioritize the establishment of key performance indicators (KPIs) to effectively monitor progress against recovery objectives. By conducting regular evaluations of both financial and operational performance, organizations can identify areas that require modification, ensuring their recovery strategies remain adaptable to changing market dynamics.

The significance of continuous improvement is underscored by the fact that organizations leveraging real-time data analytics can significantly reduce turnaround times for market research—from weeks to mere days. This agility not only improves decision-making but also positions organizations to swiftly capitalize on emerging opportunities. As one expert observed, "Continuous enhancement is no longer optional—it’s crucial for organizations that wish to succeed in a rapidly changing world."

Fostering a culture of continuous improvement empowers organizations to stabilize and thrive in the long term. As challenges and opportunities evolve, a commitment to ongoing enhancement allows businesses to adapt effectively, ensuring they remain competitive in a rapidly changing landscape. Insights from CFOs reveal that establishing clear KPIs is essential for monitoring progress, as these metrics provide a tangible framework for evaluating success and driving accountability.

The transformative experience with the SMB team, particularly through their 'Rapid30' plan, illustrates the effectiveness of applying lessons learned during the recovery process. A client shared, "Within 100 days of meeting the SMB team, my business was in a better position financially and strategically than it had been in years," highlighting the impact of their approach. Integrating case studies that showcase successful continuous improvement initiatives in management of change can further demonstrate the transformative impact of this approach.

For instance, organizations that have implemented customized dashboards and predictive analytics, such as those seen in the Sales Insights Dashboard Customization case study, have experienced marked improvements in performance management and sales forecasting accuracy. This illustrates the importance of customized solutions in reaching improvement objectives. Moreover, addressing the gap in learning opportunities can boost employee engagement and motivation, further aiding in successful recovery efforts.

The client dashboard supplied by the SMB team offers real-time analytics, ensuring continuous monitoring of organizational health and facilitating timely adjustments to strategies.

Case Studies in Turnaround Management: Learning from Success Stories

Analyzing case studies of successful management recovery provides a comprehensive understanding of turnaround management, offering essential insights for CFOs navigating challenging business environments. The turnaround of Apple in the late 1990s exemplifies how strategic leadership and a commitment to innovation can revitalize a struggling company. Under Steve Jobs' guidance, Apple refocused on product quality and design, ultimately achieving a remarkable resurgence in market share and profitability.

Similarly, the restructuring of General Motors post-bankruptcy in 2009 underscores the critical need for financial discipline and operational efficiency. GM's recovery entailed a thorough overhaul of its business model, emphasizing cost reduction, streamlining operations, and investing in new technologies. This strategic pivot not only stabilized the company but also positioned it for sustainable growth in a competitive automotive market.

By examining these success narratives, CFOs can gain significant insights into effective recovery strategies, particularly the importance of testing hypotheses and making swift decisions based on real-time analytics. For instance, during the economic crisis from 2010 to 2016, 29.6% of companies reported being extremely negatively affected, while 25.8% reported mostly negative effects, totaling 74.3% negatively impacted. This statistic highlights the necessity of proactive measures in crisis management and the imperative for robust internal controls and strategic foresight.

Furthermore, insights from the case study titled 'Recovery Approach in Turbulent Economic Environments' provide effective tactics for implementing recovery plans, emphasizing the need for proper planning and execution. By incorporating insights from these case studies, CFOs can implement tailored strategies that enhance their organizations' resilience and adaptability, ultimately leading to improved performance and long-term success. As Mark Bridges emphasizes, understanding various management frameworks is crucial for navigating these challenges, particularly in operationalizing the lessons learned in turnaround management.

Conclusion

In the ever-evolving landscape of business, turnaround management emerges as a critical strategy for revitalizing struggling organizations. By meticulously assessing existing challenges, implementing targeted solutions, and establishing sustainable practices, companies can navigate their way back to stability and growth. The structured stages of turnaround management—assessment, stabilization, strategic planning, execution, and sustainability—provide a comprehensive roadmap for organizations aiming to reverse decline and secure long-term success.

Leadership plays a pivotal role in this process. Effective leaders possess the decisiveness, resilience, and communication skills necessary to inspire teams and foster a collaborative culture. By prioritizing transparency and engagement, leaders can build trust among stakeholders and motivate employees to contribute to the turnaround effort. Furthermore, a thorough financial assessment and strategic planning serve as the groundwork for successful turnaround initiatives, enabling organizations to align their financial health with operational goals.

Continuous improvement is essential for sustaining progress post-turnaround. By setting key performance indicators and leveraging real-time analytics, organizations can adapt to changing market dynamics and ensure their strategies remain effective. The insights gained from successful case studies, such as Apple and General Motors, highlight the importance of innovation, financial discipline, and strategic foresight in overcoming adversity.

Ultimately, mastering turnaround management equips leaders with the tools and methodologies necessary to navigate challenges and foster resilience. As businesses face increasing competitive pressures and operational complexities, embracing the principles of turnaround management will be crucial in safeguarding their future and achieving lasting success.

Frequently Asked Questions

What is turnaround management?

Turnaround management is a strategic approach aimed at revitalizing struggling organizations by addressing operational, financial, and managerial challenges. It involves analyzing the company's current state, identifying the root causes of its decline, and creating a targeted plan to restore profitability and stability.

Why is recovery management important?

Recovery management is crucial as it helps prevent insolvency, protects jobs, and preserves stakeholder value. It is especially relevant in a competitive business environment, where organizations face pressures that necessitate effective management strategies.

What are the key stages in the recovery management process?

The recovery management process consists of five key stages: 1. Assessment - Analyzing the organization’s economic health and operational efficiency. 2. Stabilization - Taking immediate actions to halt further decline, such as cost-cutting measures. 3. Strategic Planning - Developing a comprehensive recovery plan with long-term objectives. 4. Execution - Implementing the recovery plan with ongoing monitoring through real-time analytics. 5. Sustainability - Establishing systems for continuous improvement to maintain success.

How does real-time analytics contribute to turnaround management?

Real-time analytics allows organizations to monitor progress, make informed decisions quickly, and adjust strategies as needed throughout the recovery process. This data-driven approach enhances operational efficiency and supports effective recovery management.

What evidence supports the effectiveness of structured recovery management?

Studies indicate that organizations that rigorously follow the structured stages of recovery management often achieve stabilization within a year. Case studies show that companies employing structured methodologies significantly reduce their average recovery time and improve overall outcomes.

How can CFOs enhance recovery management in their organizations?

CFOs can enhance recovery management by mastering the cash conversion cycle, leveraging data-driven insights, and adopting streamlined decision-making processes. This proactive approach is essential in addressing challenges, especially in a remote work environment where employees may feel disconnected.

What role does human error play in recovery management?

Human error poses a significant risk to cybersecurity and can complicate the recovery process. Effective recovery management aims to mitigate such risks while enhancing operational efficiency to foster sustainable growth.