Overview

The stakeholder management training course in Birmingham is vital for CFOs, as it equips them with essential skills for navigating complex stakeholder relationships and enhancing organizational communication strategies. This training fosters emotional intelligence and conflict resolution abilities, which are crucial for maintaining trust and collaboration among diverse stakeholders. Consequently, these competencies lead to improved financial outcomes and bolster organizational resilience.

Introduction

Stakeholder management is not merely an ancillary skill for Chief Financial Officers; it is a fundamental component that shapes the financial landscape of an organization. As CFOs navigate the diverse interests of investors, employees, and regulatory bodies, mastering the art of stakeholder engagement becomes essential for driving strategic success and enhancing financial outcomes.

However, a critical question arises: what are the implications when financial leaders neglect this vital aspect of their role? This article delves into the profound implications of stakeholder management training for CFOs, highlighting its benefits, the risks associated with inadequate engagement, and the transformative impact it can have on organizational resilience and leadership effectiveness.

Understand the Critical Role of Stakeholder Management for CFOs

Stakeholder management is integral to a CFO's responsibilities, significantly impacting the financial health and strategic trajectory of an organization. Chief Financial Officers must navigate the interests of diverse stakeholders, including:

- Investors

- Employees

- Customers

- Regulatory bodies

By understanding the needs and expectations of these groups, financial executives can enhance financial planning and risk management.

For instance, active participation with investors enables financial leaders to align monetary strategies with shareholder expectations, fostering trust and enhancing investment confidence. Moreover, effective management of involved parties promotes collaboration across departments, ensuring that financial decisions are informed by a comprehensive understanding of organizational dynamics. This holistic approach not only mitigates risks but positions the CFO as a strategic partner in driving business success.

The incorporation of real-time analytics and ongoing performance oversight allows financial leaders to make informed choices quickly, adjusting strategies based on present data to enhance participant involvement. Research shows that companies with robust participant involvement are 30% more likely to thrive with new products, while projects with clearly outlined participant strategies attain an 83% success rate. Therefore, emphasizing the involvement of interested parties, backed by efficient decision-making and immediate insights, is crucial for financial leaders seeking to improve both financial outcomes and organizational resilience.

Furthermore, by recognizing and strategizing together, financial leaders can adopt a practical method for data testing. This guarantees that engagement strategies are consistently improved and in harmony with organizational objectives.

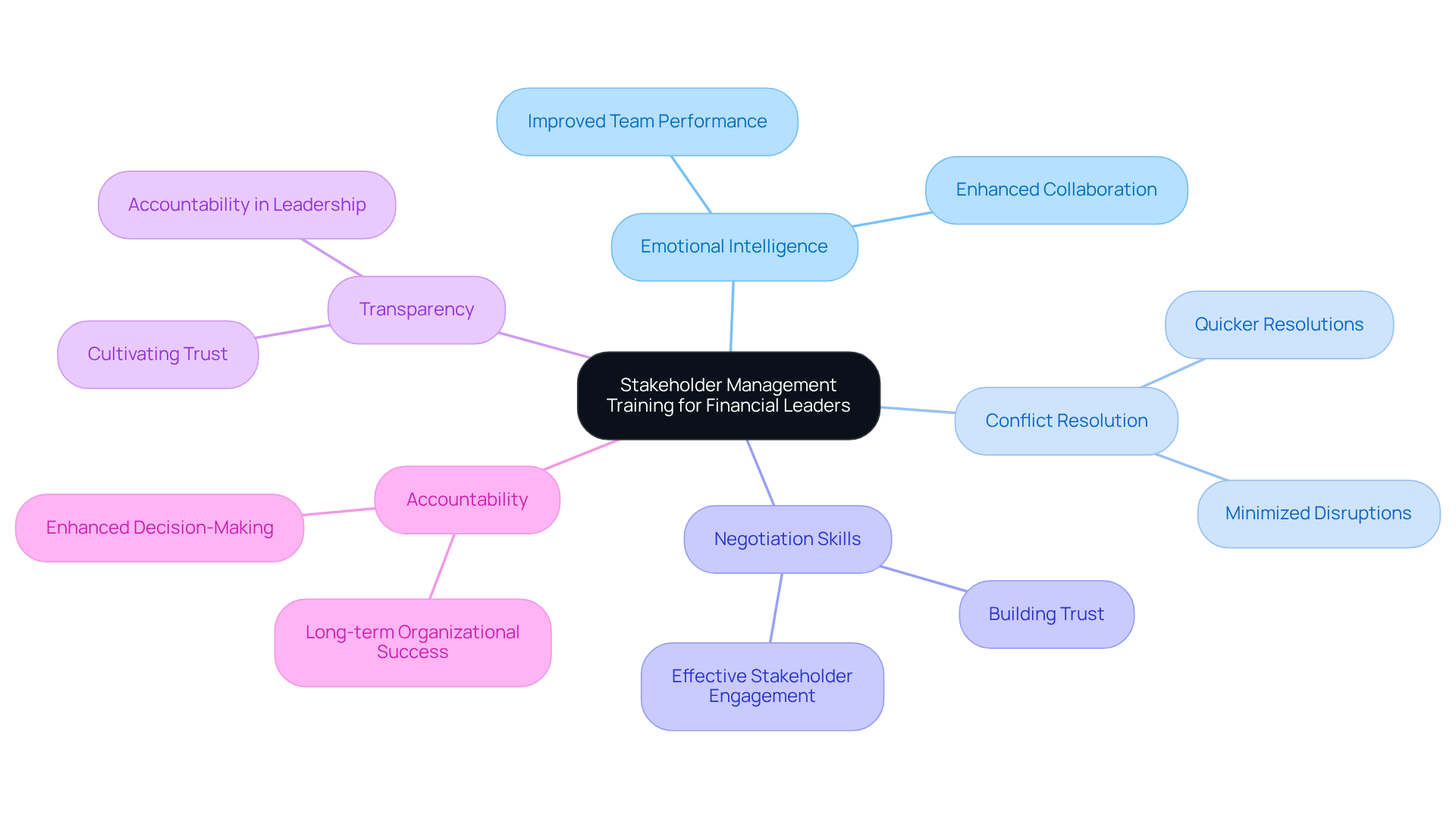

Explore the Benefits of Stakeholder Management Training for Financial Leaders

The stakeholder management training course Birmingham equips financial officers with vital skills to navigate complex relationships and enhance communication strategies. One of the primary benefits of this program is the development of emotional intelligence, empowering CFOs to effectively understand and address the concerns of various stakeholders.

These programs typically incorporate techniques for conflict resolution and negotiation, which are crucial for sustaining positive relationships during challenging periods. For instance, a CFO adept in managing interests can skillfully resolve disagreements with investors or board members, leading to faster resolutions and minimizing disruptions to business operations.

Furthermore, these development programs underscore the importance of transparency and accountability, cultivating a culture of trust that is essential for long-term organizational success. Research indicates that leaders with high emotional intelligence can boost team performance by as much as 50%, while teams exhibiting elevated emotional intelligence collaborate 30% more effectively. This underscores the in interactions with stakeholders.

As the role of chief financial officers evolves, it is imperative to prioritize emotional intelligence through a stakeholder management training course Birmingham to enhance leadership effectiveness and advance organizational goals.

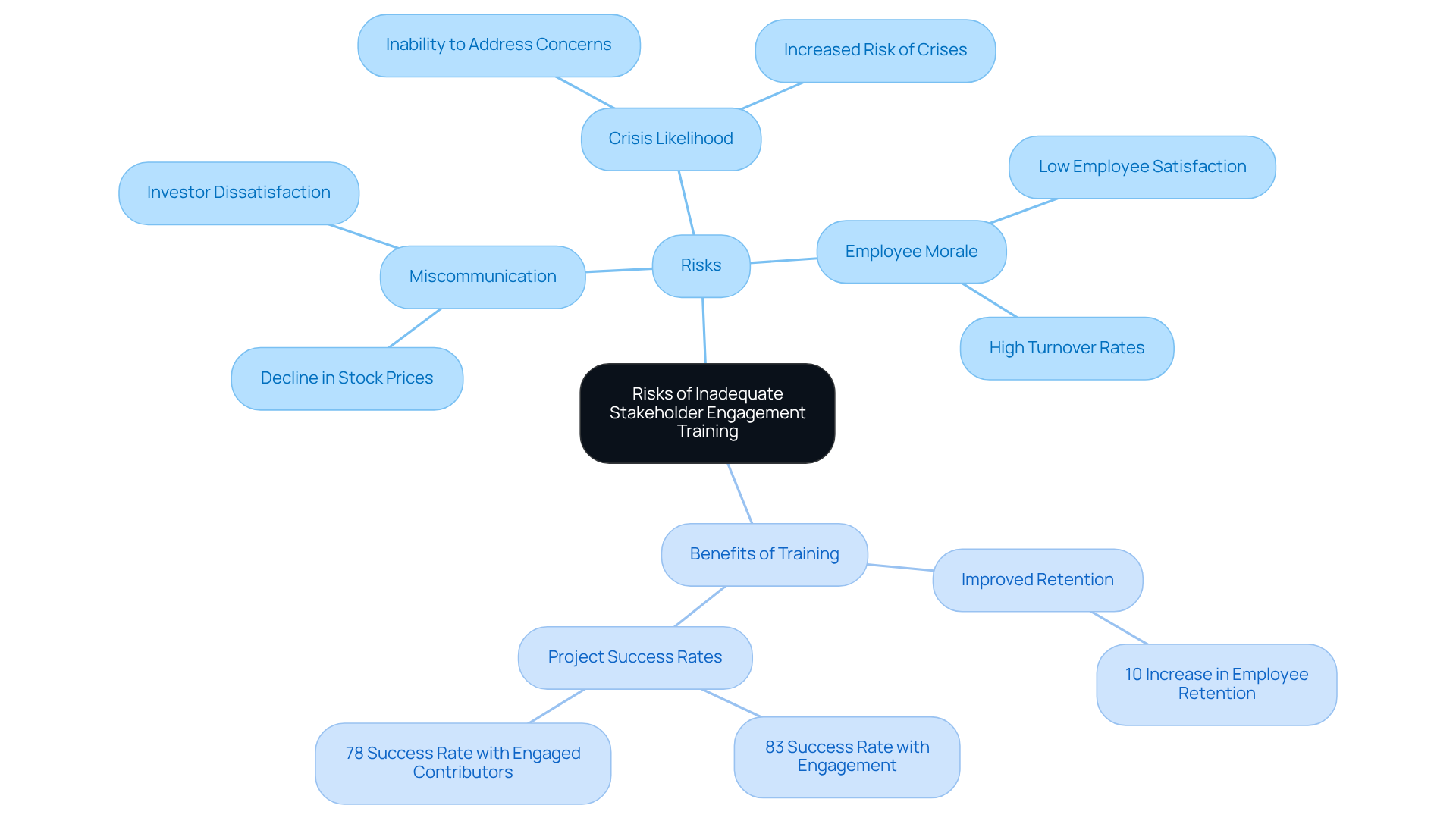

Recognize the Risks of Inadequate Stakeholder Engagement Training

Ignoring engagement development poses significant risks for CFOs and their companies. A primary concern is miscommunication, which can lead to misunderstandings and conflicts among involved parties. For instance, a CFO who struggles to articulate financial strategies may encounter investor dissatisfaction, potentially resulting in a decline in stock prices.

Moreover, inadequate preparation can hinder a CFO's ability to proactively recognize and address concerns from interested parties, elevating the likelihood of crises that could have been averted. Organizations that overlook the importance of participant involvement often benefit from a stakeholder management training course Birmingham, as it can help prevent low employee morale and high turnover rates by making staff feel valued and connected to the company's objectives.

Studies indicate that establishing trust with interested parties can lead to a 10% improvement in employee retention within the technology sector, emphasizing the direct correlation between stakeholder involvement and employee satisfaction. Ultimately, ineffective management of involved parties can severely undermine an organization's reputation and financial stability.

Research shows that initiatives with succeed 83% of the time, and 78% of projects thrive with engaged contributors, compared to merely 40% with lower involvement. This underscores the necessity of investing in a stakeholder management training course Birmingham to promote effective communication and collaboration.

As Maureen O'Connell, former CFO, observes, the role of a CFO is evolving from finance operations expert to corporate strategist, making effective stakeholder engagement more critical than ever.

Conclusion

Stakeholder management training is essential for CFOs, equipping them with the necessary skills to navigate complex relationships and enhance communication within their organizations. By understanding the diverse interests of stakeholders—such as investors, employees, and regulatory bodies—CFOs can significantly influence financial planning and risk management, ultimately driving organizational success. This training fosters emotional intelligence and enables financial leaders to resolve conflicts effectively, ensuring that stakeholder concerns are addressed promptly and transparently.

The importance of stakeholder management training is emphasized through various insights. The ability to engage stakeholders effectively can lead to improved team performance, higher employee retention, and greater overall organizational resilience. Furthermore, the risks associated with inadequate training, such as miscommunication and diminished trust, highlight the consequences of neglecting this critical aspect of financial leadership. As the role of CFOs evolves into that of strategic partners, the need for robust stakeholder engagement becomes increasingly vital.

Investing in stakeholder management training is not merely a professional development opportunity but a strategic necessity for CFOs aiming to enhance their effectiveness and contribute to their organization's long-term goals. By prioritizing this training, financial leaders can cultivate a culture of collaboration and trust, ultimately positioning their organizations for sustainable success in a competitive landscape. Embracing the principles of stakeholder engagement will benefit individual CFOs and strengthen the financial health and reputation of their organizations as a whole.

Frequently Asked Questions

What is the importance of stakeholder management for CFOs?

Stakeholder management is critical for CFOs as it significantly impacts the financial health and strategic direction of an organization. It helps CFOs navigate the interests of various stakeholders, including investors, employees, customers, and regulatory bodies.

How does understanding stakeholder needs benefit CFOs?

By understanding the needs and expectations of stakeholders, CFOs can enhance financial planning and risk management, align monetary strategies with shareholder expectations, and foster trust, which enhances investment confidence.

What role does stakeholder management play in collaboration across departments?

Effective stakeholder management promotes collaboration across departments, ensuring that financial decisions are informed by a comprehensive understanding of organizational dynamics, which helps mitigate risks.

How does real-time analytics contribute to stakeholder management?

Real-time analytics and ongoing performance oversight enable CFOs to make informed decisions quickly, allowing them to adjust strategies based on current data and enhance stakeholder involvement.

What are the success rates of projects with clear stakeholder strategies?

Research indicates that projects with clearly outlined stakeholder strategies attain an 83% success rate, and companies with robust stakeholder involvement are 30% more likely to succeed with new products.

How can CFOs improve engagement strategies with stakeholders?

CFOs can improve engagement strategies by recognizing fundamental business challenges and strategizing together with stakeholders, ensuring that engagement strategies are continuously enhanced and aligned with organizational objectives.