Overview

The primary focus of this article centers on effective bankruptcy planning strategies that CFOs can implement to successfully navigate financial challenges. It underscores the critical importance of proactive measures, such as:

- Cash flow management

- Debt restructuring

- Professional guidance

Collectively, these strategies enhance a company's resilience and position it favorably for recovery during insolvency.

Introduction

In the challenging landscape of small and medium businesses, navigating financial distress can feel overwhelming. However, comprehensive bankruptcy consulting services offer a lifeline, providing tailored strategies that empower organizations to reclaim stability and foster growth. From cash flow management to asset preservation, these services equip CFOs with the tools necessary to address immediate financial concerns while laying the groundwork for sustainable recovery. As businesses confront the complexities of bankruptcy, understanding the multifaceted approach to consulting becomes essential for transforming potential setbacks into opportunities for renewal and resilience.

Transform Your Small/ Medium Business: Comprehensive Bankruptcy Consulting Services

Thorough bankruptcy planning strategies are essential for small to medium enterprises facing economic hardship. These services encompass comprehensive monetary evaluations, operational restructuring, and bankruptcy planning strategies tailored to the unique circumstances of each enterprise. By leveraging expert advice, CFOs can pinpoint critical areas for improvement, optimize operations, and implement effective turnaround strategies that bolster economic stability and foster long-term growth.

Partnering with specialized consulting firms, such as Transform Your Small/Medium Business, equips companies with vital tools and resources to adeptly navigate the complexities of bankruptcy planning strategies. Key offerings include:

- Cash flow management

- Debt restructuring

- Interim management solutions

All meticulously designed to ensure continuity and operational efficiency during challenging periods. Notably, 77% of individuals filing for insolvency cite debt collection as a significant factor in their financial struggles, underscoring the necessity of proactive strategies in advisory services.

Furthermore, exploring alternatives to insolvency, such as negotiating with creditors, can yield more favorable outcomes, allowing owners to safeguard assets and maintain operations. This multifaceted approach not only addresses pressing monetary issues but also incorporates bankruptcy planning strategies to establish a foundation for sustainable recovery and growth. For instance, numerous companies have successfully navigated financial challenges by considering options beyond insolvency, illustrating the effectiveness of comprehensive advisory strategies.

Prioritize Cash Flow Management: Key to Successful Bankruptcy Planning

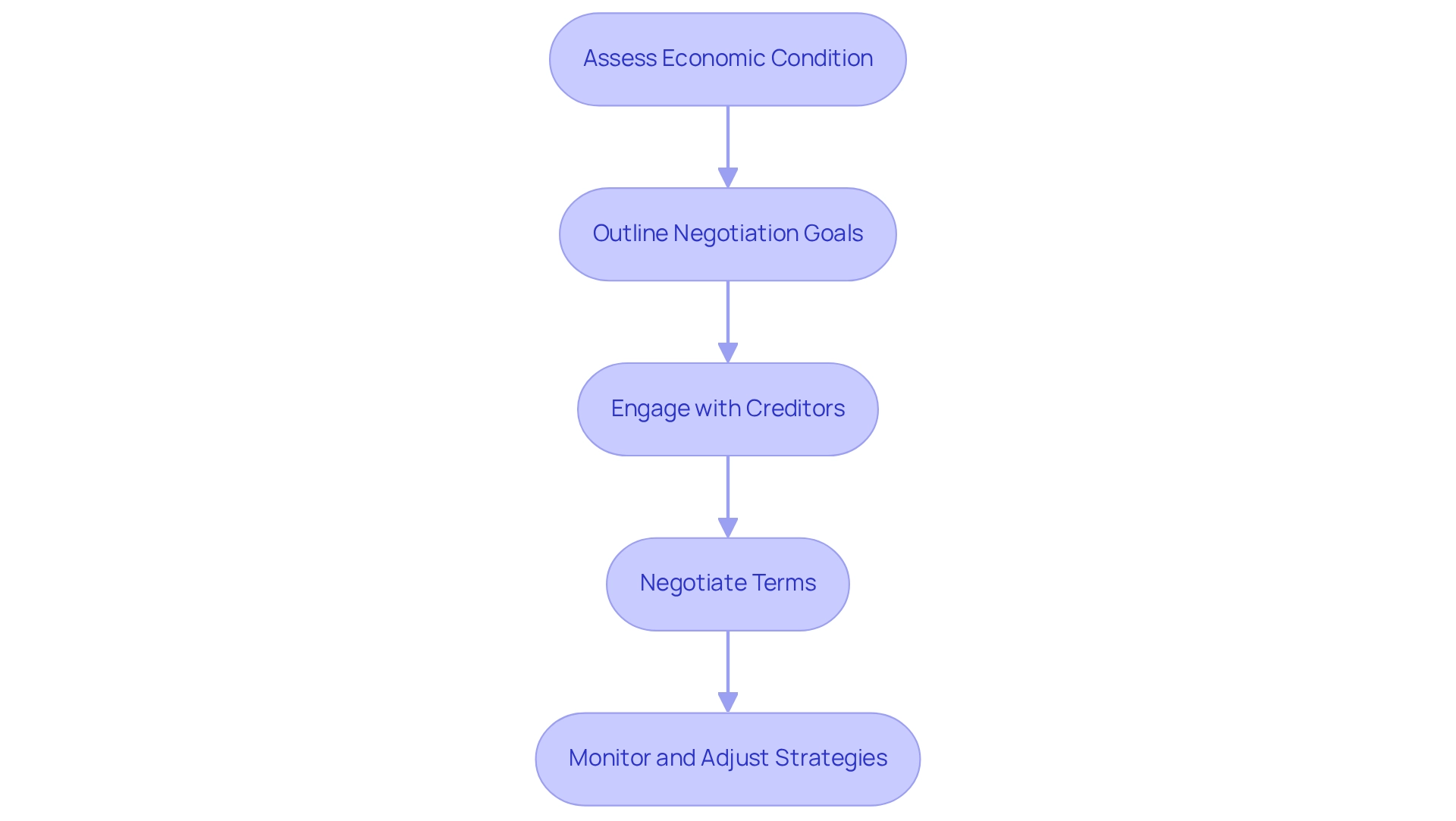

Efficient cash flow management is paramount during insolvency planning, significantly influencing a company's capacity to fulfill its financial obligations. CFOs must prioritize the development of comprehensive cash flow forecasts to identify potential shortfalls and formulate strategies to enhance liquidity. This may involve:

- Negotiating improved payment terms with suppliers

- Expediting receivables

- Curtailing non-essential expenditures

A vigilant approach to cash flow monitoring, bolstered by real-time analytics, empowers enterprises to implement effective bankruptcy planning strategies, ultimately positioning them for a successful recovery. Statistics reveal that 37% of small company owners have contemplated shutting down due to late payment issues, underscoring the urgency of proactive cash flow management.

Furthermore, with 28.8 million small enterprises in the U.S. employing 56.8 million people, the significance of effective cash flow management transcends individual businesses and impacts the broader economy. A case study on the repercussions of inadequate cash flow management illustrates that negative cash flow can lead to substantial operational challenges, reinforcing the notion that cash flow serves as a more precise indicator of economic health than balance sheets or income statements.

By implementing robust cash flow forecasting strategies, utilizing financial management software, and incorporating bankruptcy planning strategies while testing various hypotheses regarding cash flow scenarios, financial leaders can fortify their organizations' resilience during bankruptcy and pave the way for sustainable growth. As 40% of small enterprise owners cite taxes and accounting as the most formidable aspects of running their company, addressing cash flow management becomes increasingly vital in navigating these complexities. The ability to test hypotheses and make swift decisions based on real-time data will further empower financial leaders to operationalize lessons learned and enhance overall business performance.

Renegotiate Loan Terms: A Strategic Approach for CFOs

Chief financial officers must prioritize the renegotiation of loan conditions with creditors as a critical component of their insolvency strategy. This process can involve extending repayment periods, lowering interest rates, or negotiating partial debt forgiveness. By clearly outlining the organization's economic condition and demonstrating a commitment to recovery, CFOs can often secure more favorable terms that alleviate immediate monetary pressures.

For example, successful renegotiation can lead to average reductions in interest rates, significantly easing the burden on cash flow. Moreover, fostering a collaborative relationship with creditors not only aids in managing current liabilities but also sets the stage for future negotiations.

Statistics indicate that proactive engagement in loan term renegotiation is crucial within bankruptcy planning strategies to enhance recovery outcomes, making it an essential approach for CFOs navigating these challenging circumstances. Significantly, Buca di Beppo's recent Chapter 11 filing in August 2024, with reported liabilities between $50 million and $100 million, underscores the economic stakes involved in these negotiations.

Additionally, outstanding debts in Chapter 11 can often be renegotiated into a repayment plan for suppliers, further illustrating the potential benefits of proactive creditor engagement. As emphasized in the case study 'Navigating Bankruptcy: Importance of Early Recognition,' identifying economic distress early enables companies to utilize legal and monetary tools effectively, resulting in successful restructuring and enhanced creditor relations.

A financial advisor noted, 'Building a collaborative relationship with creditors is crucial; it not only helps in managing current liabilities but also fosters trust for future negotiations.'

Furthermore, by utilizing real-time analytics tools, such as dashboards and performance metrics, and sustaining a shortened decision-making cycle, financial leaders can continuously monitor the success of their strategies. This approach ensures that they adapt and respond promptly to changing circumstances, ultimately operationalizing the lessons learned throughout the turnaround process.

Focus on Asset Preservation: Safeguarding Business Value

In the realm of insolvency, CFOs must prioritize asset preservation to sustain the organization's intrinsic value. This entails a thorough assessment of key operational assets, including equipment, inventory, and intellectual property. Effective strategies for safeguarding these assets may involve:

- Restructuring ownership frameworks

- Leveraging asset protection trusts

- Engaging in negotiations with creditors to secure advantageous terms for asset retention

By emphasizing bankruptcy planning strategies that focus on asset preservation, businesses significantly improve their prospects for a successful turnaround, reducing the likelihood of liquidation. Statistics show that companies that adopt strong bankruptcy planning strategies during financial distress can retain an average of 70% of their non-exempt assets, highlighting the significance of proactive planning. Furthermore, the worth of non-exempt assets directly affects the sum paid in Chapter 13 insolvency, emphasizing the economic consequences of efficient asset preservation.

Successful case studies demonstrate that companies utilizing bankruptcy planning strategies not only manage financial distress more effectively but also emerge with a stronger operational foundation, prepared for future growth. As demonstrated in the case study 'Bankruptcy as a New Beginning,' financial failure can be positioned as a strategic instrument for recovery, encouraging enterprises to perceive it as a chance for a fresh start. Moreover, maintaining adequate insurance coverage is crucial for protecting personal assets from litigation, a key consideration for financial executives. As mentioned by Sheriff Sole, 'In reality, insolvency can be a strategic choice for both individuals and enterprises seeking a fresh financial start.'

By utilizing real-time business analytics via client dashboards, financial leaders can continually oversee the effectiveness of their asset preservation strategies, enabling prompt updates and modifications. Lastly, recent changes in insolvency law favor retirement plans while complicating the homestead exemption, which necessitates careful bankruptcy planning strategies for effective asset protection. By incorporating these factors, financial leaders can create a stronger strategy for asset protection during insolvency.

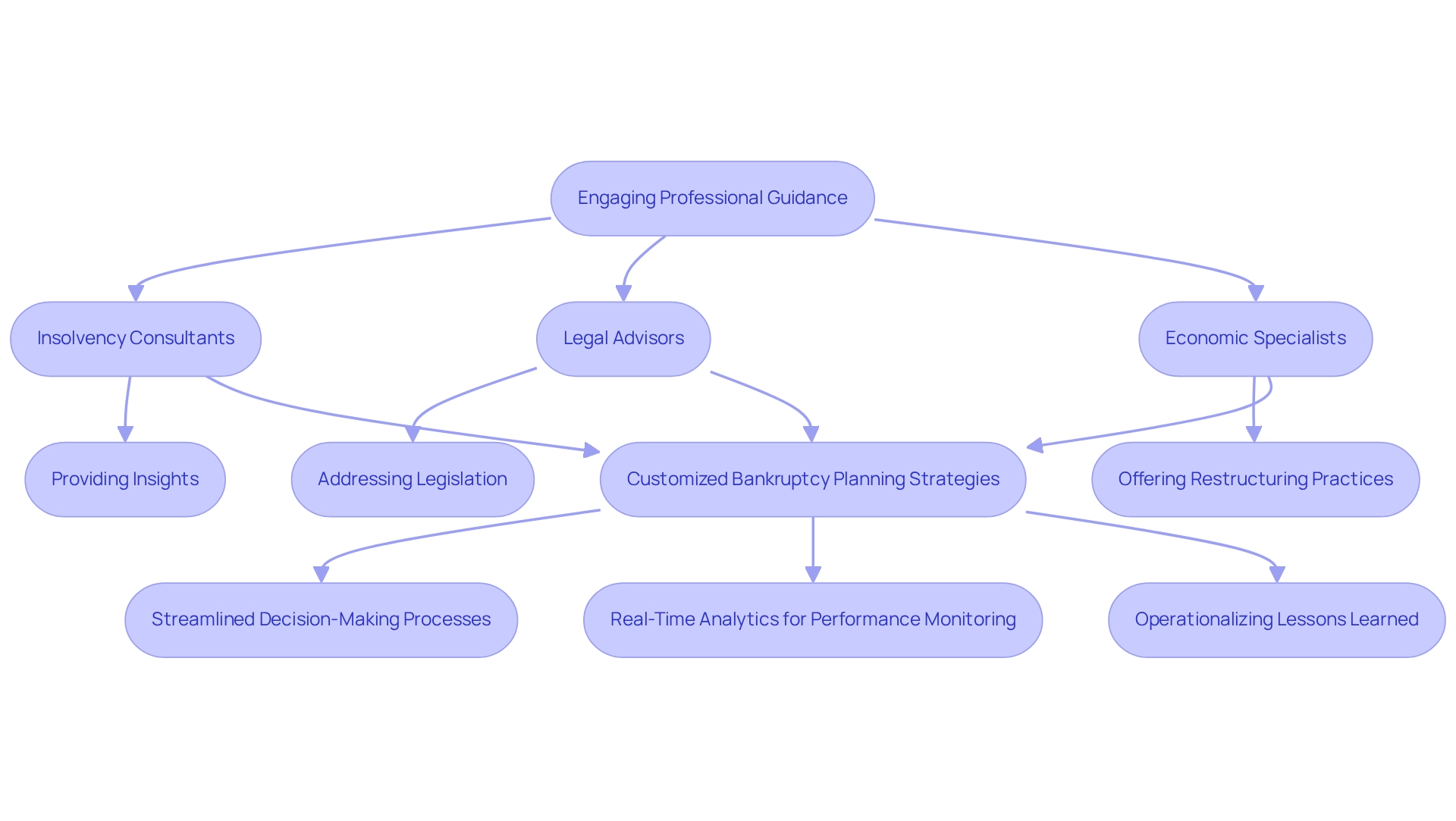

Leverage Professional Guidance: Enhancing Bankruptcy Strategies

CFOs can significantly enhance their decision-making processes and strategies by leveraging professional guidance on bankruptcy planning strategies during financial distress. Involving seasoned insolvency consultants, legal advisors, and economic specialists provides invaluable insights into bankruptcy planning strategies and the intricacies of insolvency legislation and effective restructuring practices.

These professionals play a crucial role in developing comprehensive bankruptcy planning strategies that address immediate financial challenges and set the stage for long-term recovery. Moreover, the economic environment has changed, with growing debt burdens and inflation leading to heightened insolvency filings, as shown by the 11.7% increase in business failures for the 12-month period ending January 31, 2025. This context highlights the urgency for financial leaders to seek expert guidance.

As stated by the Consumer Bankruptcy Project, the profile of those declaring insolvency has transformed, with notable growth in specific age categories, emphasizing the evolving characteristics of economic hardship. By working together with these experts, financial leaders can guarantee their organizations are strategically aligned for success following financial distress, ultimately resulting in enhanced financial stability and operational strength.

To maximize the benefits of engaging insolvency advisors in 2025, financial leaders should concentrate on creating customized bankruptcy planning strategies that address their distinct challenges, ensuring they utilize the complete range of expertise accessible to them. This includes:

- Utilizing streamlined decision-making processes

- Real-time analytics for performance monitoring

- Operationalizing lessons learned throughout the turnaround process

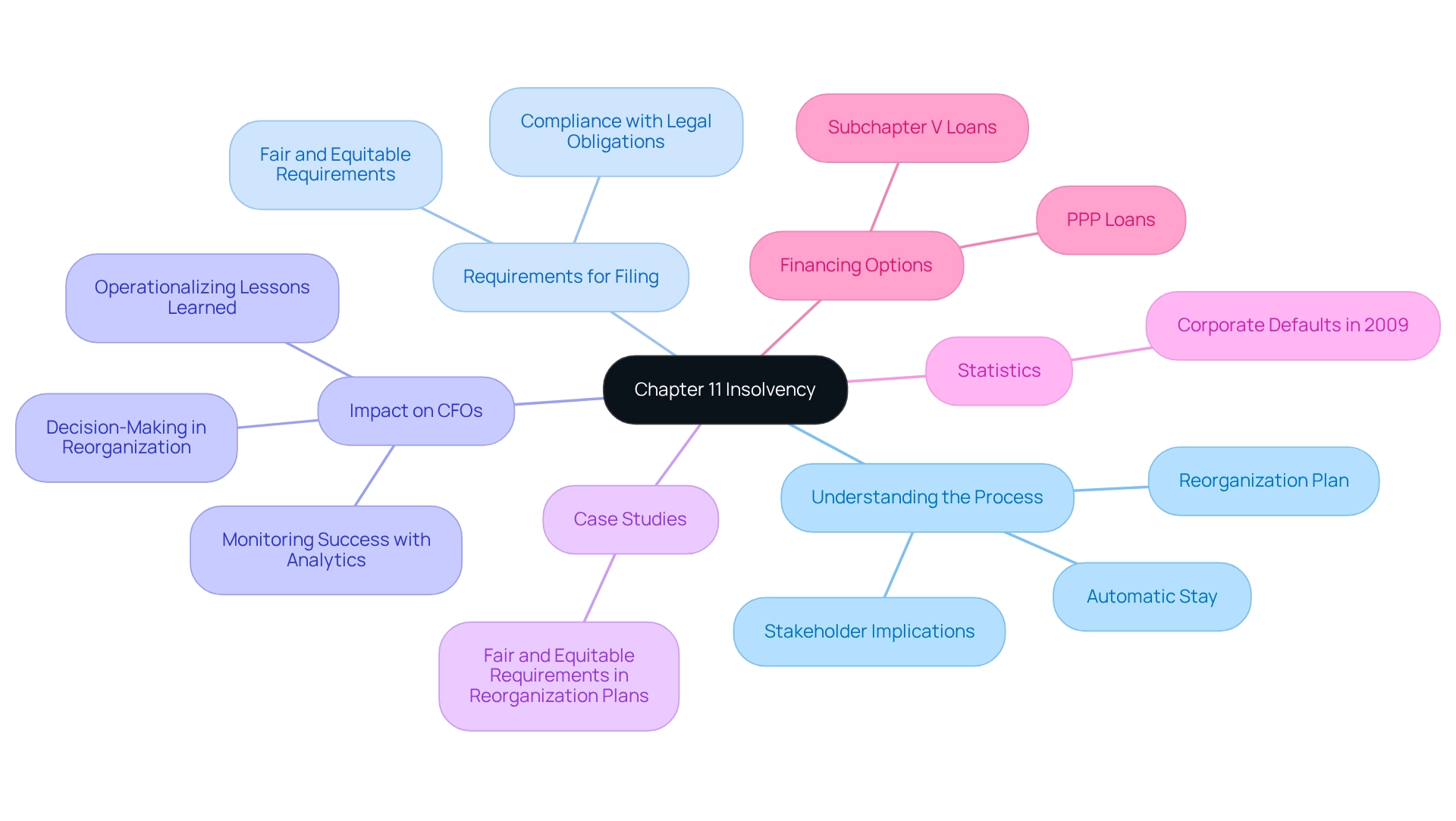

Understand Chapter 11: Essential Knowledge for CFOs

CFOs must grasp the complexities of Chapter 11 insolvency, a critical mechanism that enables businesses to reorganize their debts while maintaining operations. This process initiates an automatic stay on creditor actions, granting companies essential breathing room to formulate a viable reorganization plan. Understanding the requirements for filing is crucial, as it entails navigating the intricacies of the court and addressing the implications for various stakeholders.

A notable case study highlights the fair and equitable requirements in reorganization plans, emphasizing that debtors must repay secured debts over time, ensuring fairness in the repayment process. This requirement directly impacts CFO decision-making, necessitating careful planning to meet these obligations while restructuring.

Moreover, current statistics reveal that in 2009, during the economic downturn, there were 201 corporate defaults worldwide by mid-year, underscoring the significance of effective bankruptcy planning strategies. Additionally, CFOs should consider financing options available under Subchapter V, which allows debtors to obtain loans administered by the Small Business Administration, including PPP loans, pending SBA approval.

As Tony F., a client, remarked, "With creditors getting ready to try to garnish my wages and repossess needful property, I was in a true financial emergency. San Diego Bankruptcy Attorney explained to me how a skeletal filing, for an emergency bankruptcy could help by getting the ball rolling and automatically creating a 'stay' to prevent creditor actions."

This foundational knowledge is vital for financial leaders to adeptly manage the reorganization process and ensure compliance with legal obligations, ultimately positioning their companies for sustainable recovery. To enhance this process, financial executives can leverage real-time business analytics through client dashboards, allowing them to continually monitor the success of their plans and make informed decisions quickly. By testing hypotheses throughout the recovery process, financial executives can refine their strategies and enhance outcomes.

Furthermore, operationalizing lessons learned from previous experiences can significantly improve the effectiveness of their strategies. It is also significant to note that the insolvency court can address or dismiss a Chapter 11 case for cause, including failure to demonstrate effective reorganization, which underscores the necessity for financial executives to present a solid plan to avoid such outcomes.

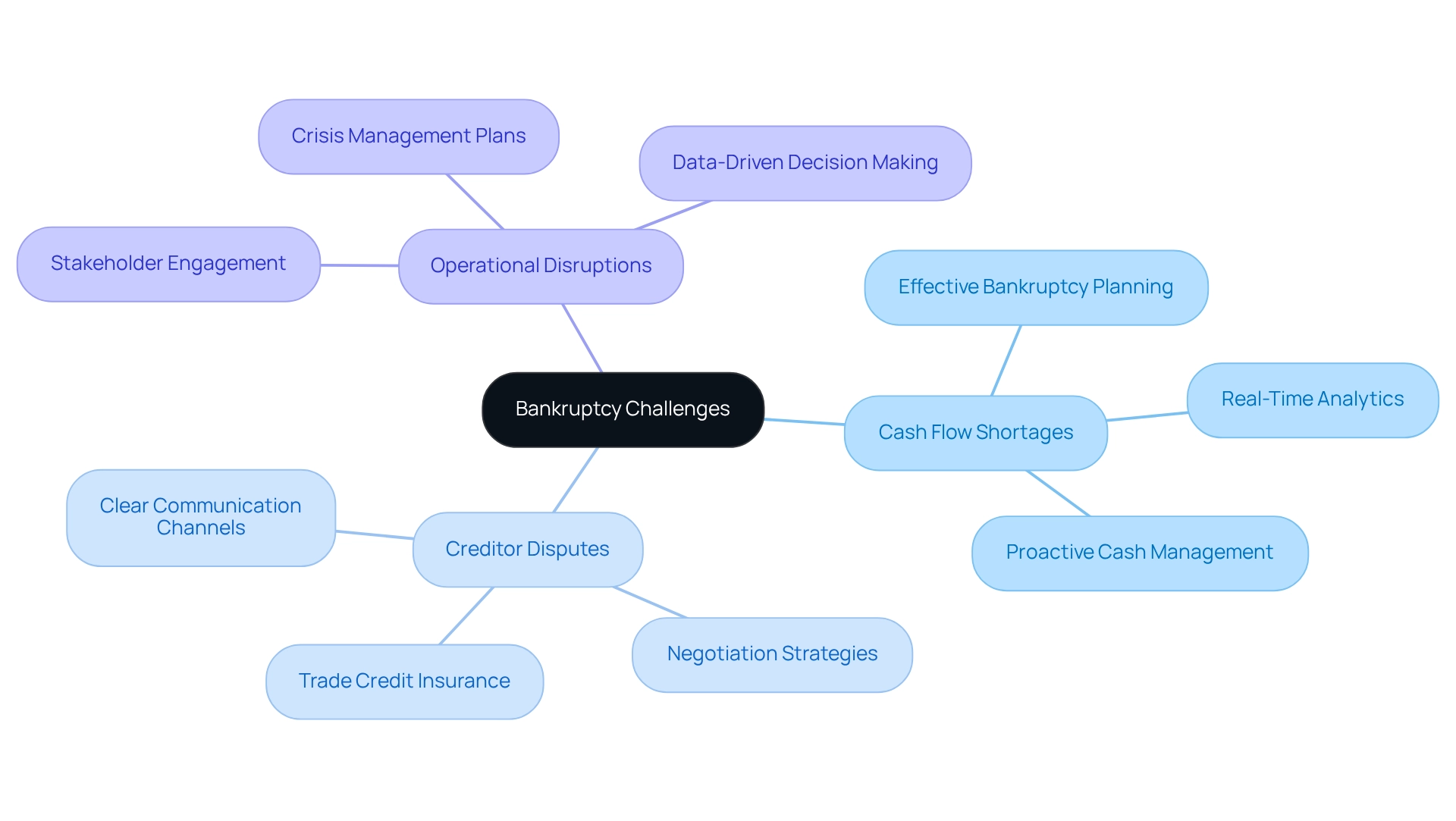

Identify Common Challenges: Navigating Bankruptcy Risks

Chief financial officers must recognize the prevalent challenges encountered during insolvency, such as cash flow shortages, creditor disputes, and operational disruptions, and consider bankruptcy planning strategies to address them. A significant statistic from a study of U.S. domestic companies listed on NYSE, AMEX, and NASDAQ from 1980 to 2021 reveals that organizations experiencing cash flow shortages are more likely to face adverse insolvency outcomes, highlighting the importance of effective bankruptcy planning strategies. This underscores the critical necessity for effective bankruptcy planning strategies in cash management.

By identifying these risks early, CFOs can utilize bankruptcy planning strategies to take proactive measures in mitigating their effects. Establishing clear communication channels with stakeholders is vital, as it fosters transparency and trust, pivotal elements in negotiations with creditors. Additionally, implementing bankruptcy planning strategies for cash flow management can help ensure that the business remains solvent throughout the insolvency process.

Compliance with bankruptcy regulations is another essential consideration; a thorough understanding of bankruptcy planning strategies can help avert costly missteps. Insights from the case study titled "Cash Flow Dynamics in Volatile Economic Climate" illustrate that companies enhancing their cash flow dynamics in turbulent economic conditions often achieve superior financial results. Supporting this, a pragmatic approach to data—by testing hypotheses—can yield maximum returns on invested capital, while real-time business analytics tools, such as dashboards and performance metrics, can continuously assess business health.

Consequently, a comprehensive understanding of these challenges is crucial for effectively navigating bankruptcy planning strategies and minimizing potential obstacles. Furthermore, considering bankruptcy planning strategies, including trade credit insurance, may offer an additional layer of protection for clients nearing bankruptcy. By operationalizing lessons learned from past experiences, financial leaders can refine their strategies and enhance decision-making processes during critical periods.

Recognize Benefits of Bankruptcy: Opportunities for Recovery

Bankruptcy planning strategies, often viewed in a negative light, can actually provide significant advantages that CFOs should capitalize on. It offers a unique opportunity to implement bankruptcy planning strategies to:

- Restructure debts

- Renegotiate contracts

- Eliminate unprofitable operations

Ultimately, this results in a more sustainable financial framework. In 2025, approximately 70% of businesses successfully restructure their debts during financial distress, demonstrating its effectiveness as a recovery strategy. David Pinkston, a lawyer specializing in bankruptcy planning strategies, emphasizes, 'Insolvency should not be perceived as a failure but as a strategic instrument that can aid recovery and promote long-term growth.'

By embracing bankruptcy planning strategies in this context, financial leaders can harness their potential to drive transformational change, enabling firms to emerge stronger and more resilient. Furthermore, by adopting a practical approach to data, CFOs can assess hypotheses and utilize real-time analytics through our client dashboard to monitor organizational health throughout the insolvency process. This facilitates quicker decision-making, ensuring that actions taken are informed and effective.

Additionally, creditors can recover debts without resorting to a debt collection agency by following specific steps, further illustrating the economic advantages of effectively managing insolvency. The case of FirstMerit Bank, N.A. v. Antioch Bowling Lanes, Inc. exemplifies how insolvency law can lead to favorable outcomes, reinforcing the notion that such legal processes can serve as beneficial methods for businesses seeking recovery.

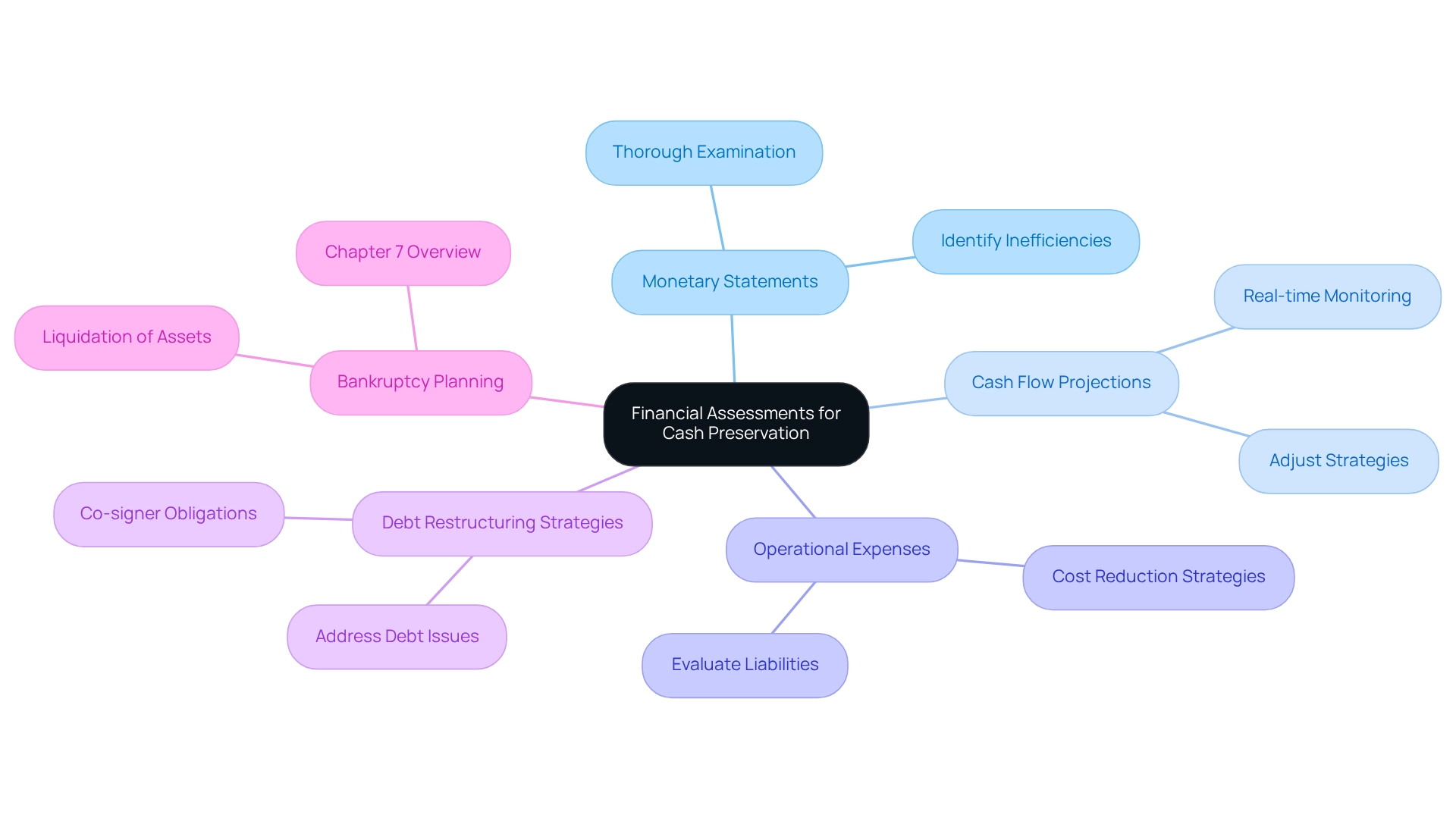

Conduct Thorough Financial Assessments: Preserving Cash and Reducing Liabilities

Chief financial officers must prioritize thorough assessments of funds to effectively maintain cash and reduce obligations during insolvency processes. This process includes a meticulous examination of monetary statements, cash flow projections, and operational expenses to identify inefficiencies and possible areas for enhancement. In 2018, there were 475,575 total insolvency filings, with 13,678 of those being corporate filings, highlighting the critical environment financial officers must navigate. By gaining a clear understanding of the company's economic landscape, CFOs can implement informed strategies for cost reduction, debt restructuring, and optimal resource allocation. This proactive strategy, particularly focusing on bankruptcy planning strategies, is essential for preserving liquidity, allowing the business to manage financial distress effectively while setting it up for future expansion.

Successful examples of cash preservation strategies during economic distress demonstrate that thorough assessments can lead to significant improvements in cash flow and overall monetary health. As Nathan Bennett, a Holistic Debt Advisor, states, 'Our commitment is to walk beside you, helping to lift the weight off your shoulders by turning what seems like an insurmountable challenge into a manageable plan.' Furthermore, grasping the consequences of co-signers being legally required to repay loans if the main borrower files for insolvency is essential for evaluating liabilities. With 77% of filers citing debt collection as a contributor to their bankruptcy, addressing underlying debt issues during financial assessments becomes even more essential.

To enhance decision-making, financial leaders should adopt a pragmatic approach to data, testing hypotheses to deliver maximum return on invested capital. By utilizing real-time business analytics through client dashboards, they can continually monitor the success of their plans and operationalize lessons learned, ensuring a streamlined decision-making process that supports effective turnaround strategies. This includes regularly updating and adjusting strategies based on the insights gained from continuous monitoring, thereby reinforcing the 'Decide & Execute' and 'Update & Adjust' themes in their operational framework.

Develop Strategic Recovery Plans: A Roadmap for Bankruptcy Navigation

Chief financial officers must develop strategic recovery strategies that outline clear goals and actionable measures for managing insolvency effectively. These plans should encompass defined timelines, key performance indicators (KPIs), and contingency measures to tackle potential challenges. Establishing a structured approach ensures that all stakeholders remain aligned and focused on recovery goals. This comprehensive roadmap not only facilitates informed decision-making during bankruptcy but also integrates bankruptcy planning strategies to lay the groundwork for sustainable growth in the post-recovery phase.

By adopting a pragmatic approach to data, CFOs can test hypotheses to maximize return on invested capital, ensuring that decisions are based on real-time analytics. Utilizing tools such as dashboards and performance metrics can enhance this process. With almost 600,000 enterprises shutting down each year in the U.S., the necessity for efficient recovery plans cannot be emphasized enough. In fact, in 2015, 52 percent of industry leaders indicated plans to allocate more resources to continuity and disaster recovery solutions, highlighting a trend towards prioritizing recovery measures, including bankruptcy planning strategies.

Furthermore, organizations that implement strategic recovery plans often experience significantly improved outcomes, underscoring the importance of proactive planning. The prevalence of ransomware attacks, which affected 59% of organizations in 2023-2024, further illustrates the urgent need for enhanced cybersecurity measures and recovery plans. By continually monitoring the success of their plans through real-time business analytics, CFOs can adjust strategies as needed and operationalize lessons learned, ultimately developing tailored recovery strategies that enhance operational resilience and drive long-term success.

Conclusion

Comprehensive bankruptcy consulting services are essential for small and medium businesses grappling with financial distress. By delivering tailored strategies that include financial assessments, cash flow management, asset preservation, and loan renegotiation, these services empower CFOs to adeptly navigate the complexities of bankruptcy. The significance of collaborating with specialized consultants cannot be overstated, as they provide organizations with the essential tools to tackle immediate challenges while fostering long-term recovery.

Effective cash flow management emerges as a critical component of successful bankruptcy planning. By emphasizing precise forecasting and proactive strategies, businesses can alleviate the risks tied to cash shortages and operational interruptions. Furthermore, a deep understanding of Chapter 11 bankruptcy enables CFOs to utilize this framework for debt reorganization and operational continuity, ultimately positioning their companies for enduring recovery.

Recognizing the potential advantages of bankruptcy as a strategic instrument for restructuring and eliminating unprofitable operations is crucial. By reframing bankruptcy not as a setback but as a chance for renewal, CFOs can unlock transformative changes that bolster resilience and operational strength. Comprehensive financial assessments and strategic recovery plans further bolster this journey, ensuring businesses are well-prepared to navigate challenges and seize growth opportunities.

In conclusion, the multifaceted approach to bankruptcy consulting offers a roadmap for small and medium businesses to regain stability and flourish post-distress. By embracing expert guidance, prioritizing cash flow, and implementing robust recovery strategies, organizations can effectively transform setbacks into opportunities, paving the way for a more prosperous future.

Frequently Asked Questions

What are bankruptcy planning strategies, and why are they important for small to medium enterprises?

Bankruptcy planning strategies involve comprehensive monetary evaluations, operational restructuring, and tailored planning to address the unique circumstances of each enterprise. They are essential for small to medium enterprises facing economic hardship as they help identify critical areas for improvement, optimize operations, and implement effective turnaround strategies.

What services are included in bankruptcy planning strategies?

Key services include cash flow management, debt restructuring, and interim management solutions. These offerings are designed to ensure continuity and operational efficiency during challenging financial periods.

How does cash flow management influence bankruptcy planning?

Efficient cash flow management is crucial during insolvency planning, as it significantly affects a company's ability to meet financial obligations. Developing comprehensive cash flow forecasts helps identify potential shortfalls and formulate strategies to enhance liquidity.

What are some strategies for improving cash flow during bankruptcy planning?

Strategies include negotiating improved payment terms with suppliers, expediting receivables, and reducing non-essential expenditures. A vigilant approach to cash flow monitoring, supported by real-time analytics, empowers enterprises to implement effective bankruptcy planning strategies.

Why is renegotiating loan conditions with creditors important in bankruptcy planning?

Renegotiating loan conditions can lead to extending repayment periods, lowering interest rates, or negotiating partial debt forgiveness. This helps alleviate immediate monetary pressures and can result in more favorable terms that enhance recovery outcomes.

What role do specialized consulting firms play in bankruptcy planning?

Specialized consulting firms provide vital tools and resources that help companies navigate the complexities of bankruptcy planning, offering expert advice and support to ensure effective strategies are implemented.

What alternatives to insolvency should businesses consider?

Businesses should explore alternatives such as negotiating with creditors, which can yield more favorable outcomes and help safeguard assets while maintaining operations.

How can real-time analytics support bankruptcy planning strategies?

Real-time analytics tools, such as dashboards and performance metrics, allow financial leaders to continuously monitor the success of their strategies, adapt to changing circumstances, and make informed decisions during the turnaround process.