Overview

Bankruptcy recovery strategies for CFOs are pivotal in enhancing financial stability through proactive measures such as:

- Debt restructuring

- Negotiating with creditors

- Seeking additional financing

By implementing these strategies and conducting thorough financial assessments, CFOs can significantly improve liquidity and operational efficiency. Ultimately, this approach reduces the risks associated with bankruptcy and fosters long-term stability.

It is essential for CFOs to recognize that these strategies not only mitigate immediate financial distress but also pave the way for sustainable growth. The commitment to proactive financial management is crucial in navigating the complexities of bankruptcy recovery.

Introduction

In an unpredictable economic landscape, the role of CFOs has never been more critical as they navigate the complexities of financial recovery and stability. Companies facing financial distress must first explore a variety of recovery options before considering bankruptcy, such as:

- Debt restructuring

- Negotiations with creditors

Understanding the nuances between Chapter 7 and Chapter 11 bankruptcy is essential for maintaining operations while formulating a viable repayment plan. As the pressure mounts, proactive financial management strategies become vital for long-term success. This article delves into essential approaches that CFOs can adopt to enhance cash flow management, implement effective recovery strategies, and ensure their organizations remain resilient in the face of economic challenges.

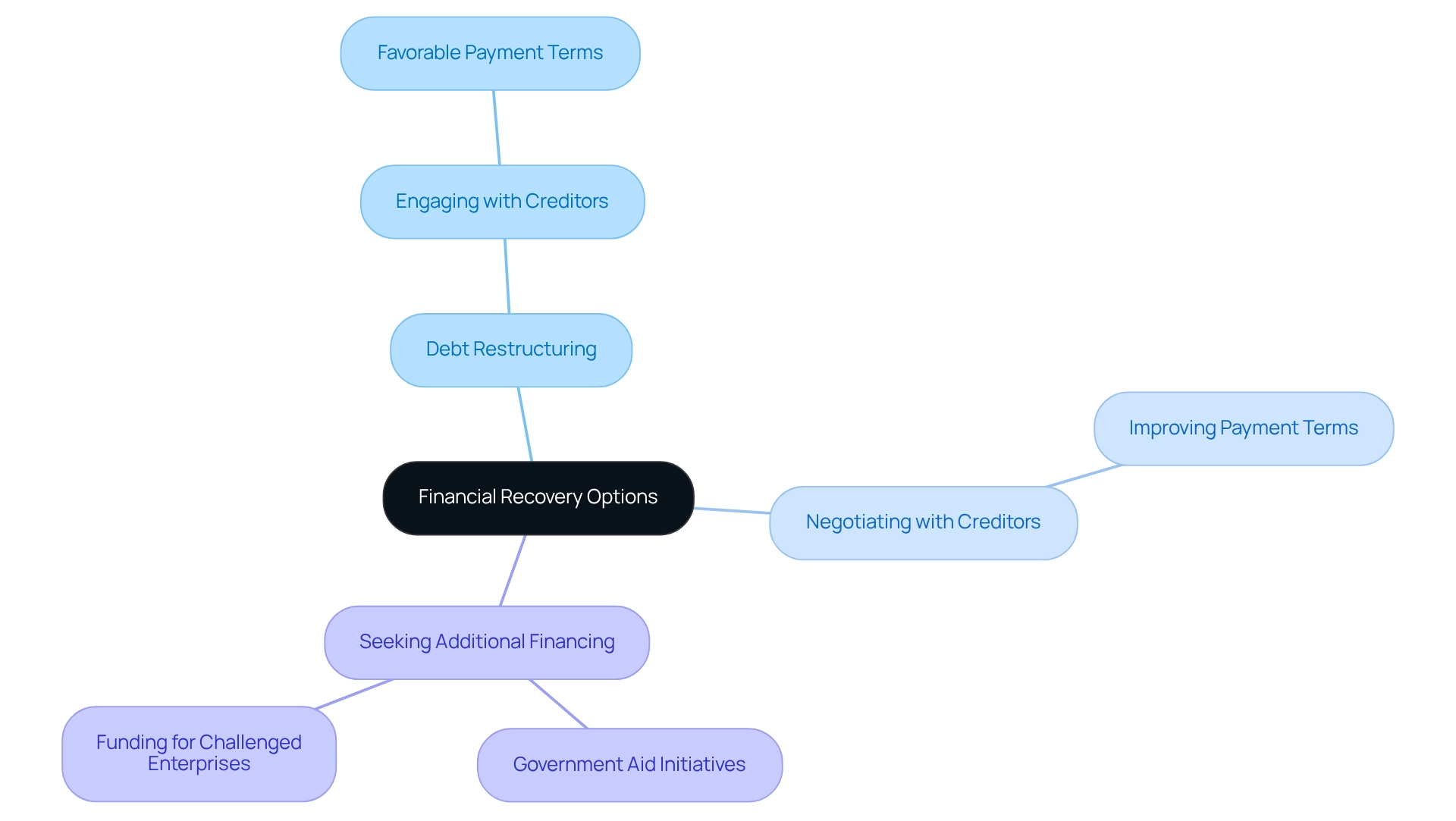

Explore Financial Recovery Options Before Bankruptcy

CFOs must thoroughly assess all options related to funds, including , before considering bankruptcy. Key strategies encompass:

For example, engaging in discussions with creditors can yield more favorable payment terms, alleviating short-term financial flow pressures. Moreover, exploring or funding designed for challenged enterprises can provide crucial monetary support.

Establishing is essential, enabling companies to identify potential deficits early and implement remedial measures. Prioritizing these alternatives is vital for companies to avert the long-term repercussions associated with bankruptcy recovery strategies.

Current statistics reveal that the average recovery for first-lien debt in the retail and consumer products sector stands at 60%. However, as highlighted by Kenny K Tang, average recoveries for first-lien debt have declined from 72% in 2018-2019 to 68% in the six quarters through June 30, 2021, underscoring the significance of effective recovery strategies.

Case studies demonstrate variability in recovery rates; while some companies, like Guitar Center, achieved high recoveries, others, such as JC Penney, encountered significantly lower outcomes. This inconsistency emphasizes the critical need for chief financial officers to implement proactive strategies in recovery preparation.

By leveraging comprehensive turnaround and restructuring consulting services, financial leaders can enhance operational efficiency and streamline decision-making processes, ultimately preserving cash and reducing liabilities.

Understand Chapter 7 and Chapter 11 Bankruptcy Implications

Chief financial officers must distinctly differentiate between Chapter 7 and bankruptcy, as each has unique implications for operations and recovery. Chapter 7 involves the liquidation of a company's assets to fulfill creditor claims, effectively ending the company's operations. Conversely, Chapter 11 facilitates a reorganization of debts, allowing the company to continue its operations while formulating a repayment plan. This distinction is crucial; for example, firms with considerable assets may find Chapter 11 beneficial, as it allows them to maintain operations and possibly restore profitability by implementing . Comprehending the legal and financial consequences of each option is vital for . Chapter 11 can provide a pathway to restructure debts without the immediate pressure of liquidation, which can be vital for maintaining stakeholder relationships and protecting credit ratings. In fact, statistics indicate that enterprises that successfully reorganize under Chapter 11 often emerge stronger, with enhanced operational efficiencies and renewed market focus.

To enhance the effectiveness of the turnaround process, financial leaders should adopt a pragmatic approach to data by testing hypotheses and utilizing real-time analytics to monitor organizational health. This involves continually assessing the success of implemented plans through client dashboards that provide actionable insights. By optimizing decision-making processes, financial leaders can take decisive actions that protect their organizations during challenging times.

Real-world examples illustrate this point: several companies have navigated Chapter 11 successfully, leveraging the process to streamline operations and enhance . As bankruptcy submissions are expected to increase, with predictions indicating an average of more than 11,000 weekly filings by 2026, the significance of comprehending becomes more vital for financial leaders seeking to protect their organizations' futures. In 2018, there were from companies, highlighting the ongoing challenges enterprises face. Looking beyond 2025, the bankruptcy filing trend seems poised to maintain its upward path, highlighting the necessity for financial leaders to be aware of bankruptcy recovery strategies. Moreover, it is essential to acknowledge that individuals encountering significant debt also showcase wider economic pressures, which can affect organizational operations and decision-making.

Implement Proactive Strategies for Long-Term Stability

To achieve long-term economic stability, CFOs must adopt that encompass comprehensive planning, risk management, and . Creating a strong is essential, as it acts as a cushion during economic declines, enabling companies to sustain operations without significant alterations. As emphasized during the 2008 economic crisis, those with were better positioned to endure the storm without drastic changes to their lifestyle. Moreover, mitigates reliance on a single income source, enhancing resilience against market fluctuations.

Investing in technology to improve is essential. Advanced analytics can uncover trends and potential risks, enabling CFOs to make informed, timely adjustments to their strategies. Our team supports a shortened decision-making cycle throughout the turnaround process, allowing for decisive actions that preserve business health. For instance, multinational companies have successfully preserved cash reserves in stable currencies to guard against inflation and currency risks, showcasing the effectiveness of strategic monetary planning. As one expert noted, "Cash reserves play a multifaceted role in providing stability and flexibility during economic uncertainty."

By embedding these practices into the organizational culture, companies can navigate financial challenges more effectively and ensure operational continuity. Continuous monitoring of business performance through our client dashboard, which provides real-time analytics, is vital. This allows for ongoing assessment of cash reserve strategies and operational adjustments. Regular reviews, ideally conducted quarterly or bi-annually, are recommended to adapt to changing economic conditions, reinforcing the importance of flexibility in financial management. Additionally, maintaining fairness and non-discrimination in relationships and operations is vital to fostering a resilient organizational culture.

Actionable Steps for CFOs:

- Create a reserve policy to ensure liquidity during downturns.

- Diversify revenue streams to reduce dependency on a single source.

- Invest in advanced analytics tools for better forecasting and risk assessment.

- Utilize the client dashboard for real-time performance monitoring and adjustments.

- Conduct regular fiscal reviews to adapt strategies as needed.

Conduct Thorough Financial Assessments for Cash Preservation

CFOs must prioritize thorough evaluations to uncover opportunities for implementing . This procedure entails a detailed examination of , balance sheets, and income statements to identify inefficiencies. For instance, a meticulous review of accounts receivable processes can highlight strategies to accelerate collections, such as offering early payment discounts or enforcing stricter credit policies. Moreover, examining vendor contracts may reveal potential savings through renegotiation. Routine monetary health assessments are crucial for proactively tackling . By setting key performance indicators (KPIs) centered on fund management, CFOs can closely track monetary performance, enabling informed choices that improve liquidity and reduce liabilities.

In 2024, it is anticipated that 62% of businesses will enhance their , indicating a rising awareness of the necessity for efficient flow management. Additionally, small and medium-sized enterprises in the UK are collectively owed an average of £27,214 in late payments, underscoring the essential nature of optimizing accounts receivable to enhance . A survey conducted by the American Institute of CPAs revealed that 72% of financial executives employing effective liquidity management strategies felt 'very prepared' for economic volatility, in contrast to only 31% of those utilizing . Applying these strategies not only enhances liquidity but also prepares companies for sustainable growth.

Furthermore, by adopting a pragmatic approach to data and testing hypotheses, CFOs can refine their strategies to deliver maximum return on invested capital. However, they should be cautious of typical traps, such as neglecting to regularly update financial flow forecasts or failing to communicate effectively with stakeholders about financial management strategies. For example, a business that enforced stringent credit policies and frequently assessed its [financial flow statements](https://numberanalytics.com/blog/top-5-strategies-optimize-cash-flow-predictive-analysis) experienced a notable decrease in late payments, which directly aided its enhanced financial well-being. By learning from such examples and operationalizing the lessons learned, CFOs can better navigate the complexities of cash flow management.

Conclusion

In navigating the complexities of financial recovery, CFOs play a pivotal role in exploring various strategies before considering bankruptcy. By prioritizing options such as:

- Debt restructuring

- Negotiating with creditors

- Seeking additional financing

organizations can alleviate cash flow pressures and potentially avoid the long-term consequences of bankruptcy. The importance of effective cash flow management cannot be overstated, as it allows CFOs to identify inefficiencies and implement corrective measures proactively.

Understanding the distinctions between Chapter 7 and Chapter 11 bankruptcy is essential for informed decision-making. While Chapter 7 leads to asset liquidation and business termination, Chapter 11 offers a pathway for debt reorganization, enabling companies to continue operations while formulating a repayment strategy. This knowledge empowers CFOs to choose the most suitable course of action, ensuring the preservation of stakeholder relationships and credit ratings.

Long-term stability hinges on proactive financial management strategies. Establishing cash reserves, diversifying revenue streams, and investing in technology for improved financial reporting are critical steps toward resilience. Regular assessments and the use of real-time analytics facilitate informed decision-making, allowing organizations to adapt to changing economic conditions effectively.

Ultimately, thorough financial assessments focused on cash preservation are vital. By analyzing cash flow statements and implementing strategies for accounts receivable optimization, CFOs can enhance liquidity and minimize liabilities. As the economic landscape continues to evolve, adopting these comprehensive approaches will be essential for organizations aiming not only to survive but thrive amidst financial challenges.

Frequently Asked Questions

What should CFOs assess before considering bankruptcy?

CFOs must thoroughly assess all options related to funds, including bankruptcy recovery strategies, before considering bankruptcy.

What are some key strategies for bankruptcy recovery?

Key strategies for bankruptcy recovery include debt restructuring, negotiating with creditors, and seeking additional financing.

How can negotiating with creditors help a company?

Engaging in discussions with creditors can yield more favorable payment terms, alleviating short-term financial flow pressures.

What role does government aid play in financial recovery?

Exploring government aid initiatives or funding designed for challenged enterprises can provide crucial monetary support during financial difficulties.

Why is financial flow management important for companies?

Establishing a robust financial flow management approach is essential for identifying potential deficits early and implementing remedial measures to avoid bankruptcy.

What are the current recovery statistics for first-lien debt in the retail sector?

The average recovery for first-lien debt in the retail and consumer products sector stands at 60%, with a decline from 72% in 2018-2019 to 68% in the six quarters through June 30, 2021.

What do case studies reveal about recovery rates?

Case studies show variability in recovery rates; some companies, like Guitar Center, achieved high recoveries, while others, such as JC Penney, encountered significantly lower outcomes.

How can CFOs prepare for recovery effectively?

CFOs can implement proactive strategies in recovery preparation and leverage comprehensive turnaround and restructuring consulting services to enhance operational efficiency and streamline decision-making processes.