Overview

The article outlines ten effective strategies to improve cash flow management, emphasizing the necessity for businesses to enhance their financial oversight to ensure stability and growth. It supports this by detailing practical approaches such as utilizing technology for real-time analytics, optimizing inventory management, and establishing early payment incentives, all of which contribute to better liquidity and operational efficiency.

Introduction

In the intricate world of finance, cash flow management emerges as a cornerstone of organizational success. For CFOs, understanding and mastering this essential process is not merely advantageous; it is crucial for sustaining operational viability and ensuring liquidity.

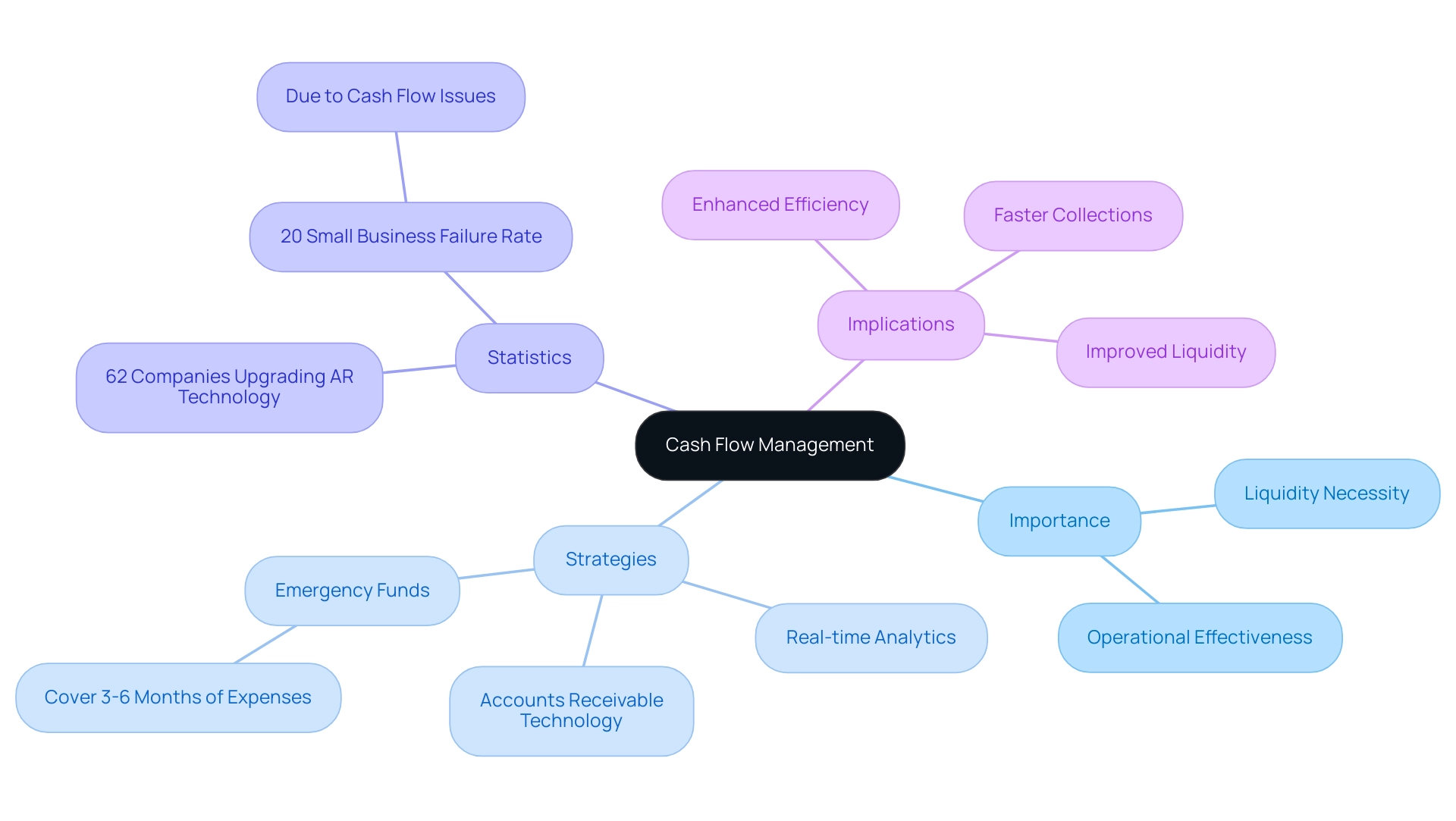

With statistics revealing that a significant percentage of small businesses falter due to cash flow mismanagement, the stakes could not be higher.

This article delves into the fundamental concepts of cash flow management, practical strategies for enhancement, and the pivotal role of forecasting and technology in optimizing financial health. By adopting a proactive approach and leveraging innovative tools, CFOs can navigate the complexities of cash flow dynamics, ensuring their organizations are well-positioned to seize growth opportunities while mitigating risks.

Understanding Cash Flow Management: Key Concepts and Importance

The handling of finances is the structured procedure of observing, evaluating, and enhancing the disparity between income and expenditures. For CFOs, mastering this process is not just beneficial; it is essential for ensuring liquidity and operational effectiveness. Efficient management of funds is crucial for companies to implement strategies to improve cash flow management, fulfill monetary commitments, compensate staff punctually, and capitalize on expansion opportunities.

According to the U.S. Small Business Administration, 20% of small enterprises fail within their first year, often due to financial flow issues, which underscores the critical importance of employing strategies to improve cash flow management. By implementing streamlined decision-making processes, including a shortened decision-making cycle during turnaround situations, CFOs can enable decisive actions that preserve business viability. Utilizing a client dashboard to maintain emergency funds that cover at least three to six months of operating expenses is a proactive strategy that further secures a company’s financial health.

This stability not only protects against insolvency but also positions businesses to invest confidently in future projects. Recent statistics indicate that 62% of companies intend to enhance their accounts receivable technology, acknowledging the importance of effective AR oversight. This upgrade is anticipated to result in enhanced efficiency, quicker collections, and better liquidity, highlighting the importance of strategies to improve cash flow management as a strategic necessity.

Moreover, employing real-time analytics via client dashboards enables CFOs to consistently track the effectiveness of financial strategies, particularly assisting in recognizing patterns and making informed choices, thus facilitating strategies to improve cash flow management and enhancing operational stability. Please note that UMB is not responsible for third-party content or privacy policies.

Practical Strategies for Enhancing Cash Flow Management

- Implement Early Payment Discounts: Encourage customers to settle invoices ahead of schedule by offering attractive discounts for early payments. This approach not only enhances financial resources but also incorporates strategies to improve cash flow management while encouraging stronger connections with your clients. Research indicates that customers are four to five times more likely to complete a purchase when incentivized, which underscores the effectiveness of this approach. As emphasized by the Wall Street Journal, incentives such as early payment discounts can greatly impact consumer behavior, rendering them a potent resource in financial management.

- Optimize Inventory Management: Regularly evaluate your inventory levels to prevent the pitfalls of overstocking and understocking. Implementing just-in-time inventory methods can greatly reduce holding expenses and free up funds, enabling more flexible financial oversight. Strategies such as cycle counting and demand forecasting can enhance your inventory accuracy and efficiency.

- Utilize Technology for Immediate Analytics: Invest in financial management software to achieve real-time insight into your monetary resources. Automating invoicing and payment reminders not only streamlines your processes but also reduces delays in revenue collection. Sophisticated instruments can offer insights that assist in recognizing trends and forecasting future revenues, facilitating a reduced decision-making cycle essential for business recovery. Utilizing a client dashboard allows for continuous monitoring of business health, ensuring timely adjustments can be made as needed.

- Negotiate Better Payment Terms: Engage with suppliers to negotiate extended payment terms. This flexibility enables you to coordinate expenditures with revenues, which is one of the effective strategies to improve cash flow management. Building strong supplier relationships can facilitate these negotiations, ultimately enhancing your operational efficiency.

- Conduct Financial Forecasting: Regularly estimate your liquidity to preemptively identify potential shortfalls. This proactive strategy incorporates strategies to improve cash flow management, allowing you to make informed decisions and take corrective actions before economic issues arise, ensuring a smoother operational flow.

- Diversify Revenue Streams: Seek out new revenue channels to enhance financial flow. Whether launching innovative products, services, or entering unexplored markets, diversification can reduce risks and improve economic resilience.

- Reduce Overhead Costs: Undertake a comprehensive review of operating expenses to pinpoint areas for cost reduction. By optimizing processes without sacrificing quality, businesses can implement strategies to improve cash flow management, releasing considerable funds for essential functions and promoting a more flexible economic environment.

- Strengthen Collections Processes: Enhance your accounts receivable procedures to ensure efficiency. Regular follow-ups on unpaid invoices can be part of strategies to improve cash flow management by effectively reducing days sales outstanding (DSO) and enhancing flow dynamics. Consider implementing automated reminders to streamline this process.

- Establish a Fund Reserve: Create a fund reserve to serve as a buffer during downturns. This reserve can safeguard your business against unexpected expenses, ensuring continuity without disrupting operations.

- Engage Financial Consultants: Don’t hesitate to seek the expertise of consultants. Their perspectives on revenue management strategies customized to your unique business requirements can be extremely beneficial, especially in maneuvering through intricate financial environments. By utilizing their knowledge, you can guarantee optimal financial management and strategic growth.

- Case Study - Coupa Pay and EPD Integration: Consider the integration of early payment discounts with payment processes as demonstrated by Coupa Pay. This all-in-one solution enhances supplier participation and optimizes working capital through automated supplier engagement and onboarding. The integration allows for prompt payments and better control over discounting processes, ultimately benefiting both buyers and suppliers.

The Role of Cash Flow Forecasting in Financial Planning

Financial forecasting is an essential process for anticipating future monetary inflows and outflows, allowing organizations to recognize possible shortfalls or surpluses. By leveraging historical data and current market trends, businesses can craft precise forecasts that serve as a foundation for informed financial strategies. Routine financial projections enable CFOs to identify seasonal variations, plan for major expenses, and ensure sufficient liquidity for operational needs.

Key components such as accounts payable and accounts receivable play crucial roles in this process, alongside advancements like AP automation, which streamline these functions and enhance forecasting accuracy. Significantly, recent discoveries indicate that companies are three times more likely to miss liquidity forecast targets than revenue guidance targets, with about 80% of revenue guidance reports falling within 10% of their stated objectives. This stark contrast highlights the necessity of robust forecasting processes to master the conversion cycle.

Particular strategies to improve cash flow management for mastering the conversion cycle include:

- Optimizing inventory turnover

- Reducing receivables days

- Extending payables days

All of which contribute to enhanced liquidity oversight. For instance, a national health services company enhanced its financial forecasting accuracy and borrowing timing with the assistance of an EY team, which created a future state operating model and a transition plan for improved communication between finance and operational teams. This proactive strategy ultimately decreased forecasting variances by $450 million to $535 million and led to savings of up to $6 million, highlighting the tangible advantages of efficient resource oversight.

Such insights not only allow organizations to make timely adjustments but also sustain financial health, particularly during challenging economic conditions. As Christina Ross, CFO and CEO of Cube, aptly states, 'Get out of the data entry weeds and into the strategy'—a call for CFOs to prioritize strategic foresight and operationalize turnaround lessons over routine tasks, ensuring streamlined decision-making and continuous performance monitoring through real-time analytics. Moreover, applying these strategies to improve cash flow management may entail expenses, such as the $99.00 charge for particular tools or consultations that can further enhance financial oversight efforts.

Improving Accounts Receivable Management

Effective accounts receivable management begins with the establishment of clear credit policies that delineate payment terms and conditions. This foundational step is crucial, as statistics indicate that any practice with more than four times the average monthly charges in its accounts receivable balance faces a significant collection challenge. A systematic invoicing process is essential for ensuring timely billing and mitigating the risk of late payments.

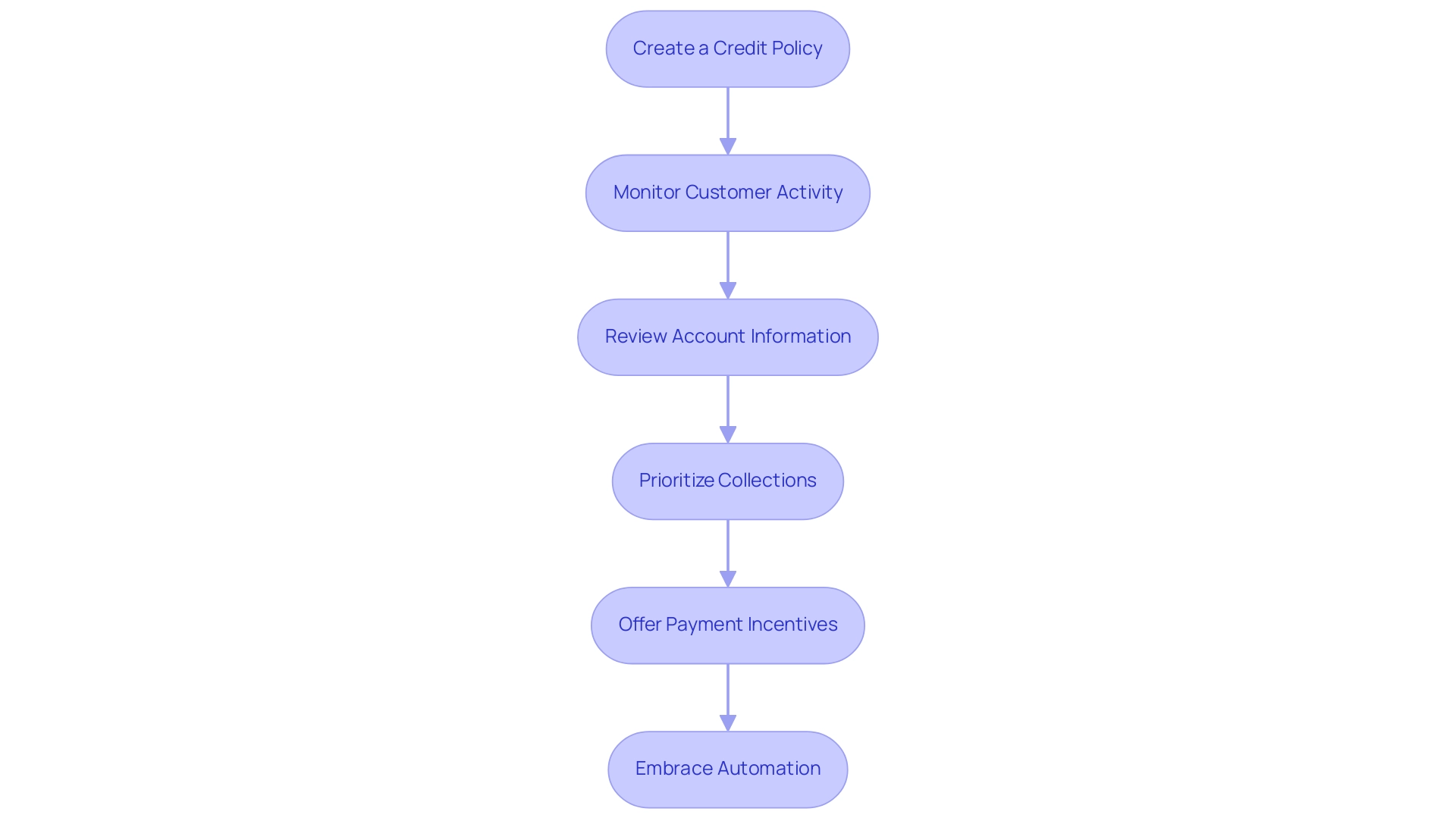

Regularly reviewing accounts receivable aging reports helps identify overdue accounts, allowing for prioritized collection efforts. A case study titled 'Improving Accounts Receivable Practices' highlights that organizations facing challenges with manual processes in their AR departments can enhance their practices by:

- Creating a credit policy

- Monitoring customer activity

- Reviewing account information

- Prioritizing collections

- Offering payment incentives

- Embracing automation

Furthermore, implementing robust payment processing practices, including the use of third-party services and adherence to PCI-DSS compliance, ensures secure handling of payment information, ultimately safeguarding your business.

Establishing robust connections with clients is similarly significant; it promotes easier communication about payments, improving financial movement. To maximize revenue inflows, consider implementing automated reminders and follow-ups to notify customers about upcoming or overdue payments. As Katherine Gustafson observes, 'Establishing clear credit policies is not merely a best practice; it's vital for sustaining healthy financial movement.'

By adopting these best practices and integrating the 20 strategies to improve cash flow management, businesses can significantly enhance their accounts receivable processes and economic outcomes in 2024.

Leveraging Technology for Enhanced Cash Flow Management

Technology acts as a crucial factor in mastering liquidity supervision, providing CFOs with strong tools and strategies to improve cash flow management, enhancing oversight and decision-making. The incorporation of cloud-based fiscal oversight software allows organizations to utilize real-time information, which is essential for informed monetary decisions that can significantly impact liquidity oversight. For instance, using real-time dashboards and alerts can effectively track liquidity performance and related risks, with studies showing that organizations utilizing these tools can attain a significant decrease in financial variability by as much as 30%.

Furthermore, automation tools significantly boost operational efficiency by streamlining essential tasks such as invoicing, payment processing, and reconciliation, minimizing manual errors and conserving valuable time. Industry insights indicate that such automation can result in a significant improvement in resource management efficiency, enabling businesses to respond swiftly to economic challenges. These features align directly with the 20 Strategies for Optimal Business Performance, particularly in enhancing decision-making processes and operationalizing lessons learned.

However, it is essential to address ongoing challenges, including data privacy concerns and the necessity for skilled personnel in advanced technologies, which underscores the importance of strategic implementation. Furthermore, utilizing data analytics offers leaders in finance essential insights into liquidity trends, which can aid in developing strategies to improve cash flow management and recognizing areas for possible enhancement. As Rick Johnson, a finance and accounting professional, emphasizes, 'With a proven track record, I help businesses confidently achieve their goals.'

Moreover, analyzing case studies from leading tech companies highlights significant environmental impacts stemming from their monetary practices, reinforcing the need for enhanced sustainability measures. By adopting these technological developments and implementing strategies to improve cash flow management, CFOs can significantly enhance the effectiveness and durability of their financial resource strategies.

Establishing a Cash Flow Management Team

Creating a dedicated revenue management group is essential for improving an organization’s fiscal oversight. This specialized team plays a crucial role in monitoring financial flow metrics, analyzing trends, and executing strategies to improve cash flow management. A comprehensive evaluation of resources can assist in discovering chances to conserve funds and lessen obligations, which is essential in today’s dynamic business landscape.

Businesses with dedicated financial teams are more likely to achieve better oversight, resulting in improved operational efficiency. By centralizing financial management, organizations can prioritize liquidity across all departments, enhancing communication between finance, sales, and operations. This collaborative method not only encourages openness but also guarantees that financial movement remains a focal point for decision-making.

Regular meetings to assess financial performance are essential. These sessions allow teams to adjust strategies proactively in response to market fluctuations and internal changes. In reality, 77.7% of accountants for small enterprises offer additional value through financial guidance, highlighting the significance of having specialists available.

As highlighted in our monetary evaluations, effective strategies to improve cash flow management, such as:

- Providing early payment incentives

- Implementing stringent credit policies

as outlined in the case study titled 'Accelerating Collections from Receivables,' can enhance liquidity stability by speeding up collections from receivables. By emphasizing the creation of a revenue oversight group and concentrating on thorough monetary assessments, organizations prepare themselves for enhanced economic resilience and operational achievement. To learn more about how our assessment services can benefit your organization, click here to get started.

The Importance of Financial Compliance in Cash Flow Management

Effective cash flow oversight relies greatly on upholding compliance while also adopting streamlined decision-making and real-time analytics. CFOs must prioritize adherence to relevant regulations and reporting standards, as failure to do so can lead to substantial penalties and operational disruptions. Our team supports a shortened decision-making cycle throughout the turnaround process, allowing your team to take decisive action to preserve your business through our 'Decide & Execute' framework.

As María de la Nieves López García states, 'The data used in this study is taken from China Stock Market and Accounting Research (CSMAR) database,' underscoring the importance of reliable data in compliance efforts. Implementing regular audits and compliance checks serves as a proactive strategy, allowing organizations to identify potential issues before they escalate. Keeping up with regulatory changes is just as crucial; for example, grasping the sustainable growth rate (SGR)—the maximum growth a company can reach without taking on more debt—can guide strategic monetary decisions.

A firm with an ROE of 10.26% and a dividend payout ratio of 45% illustrates this with an SGR of 5.64%, highlighting the balance between growth and compliance. Continuous monitoring through our client dashboard provides real-time business analytics, enhancing your ability to diagnose business health and operationalize turnaround lessons effectively. Additionally, the case study titled 'Mixed Evidence on Working Capital Management' reveals that existing literature presents varying evidence regarding the impact of working capital management on firm performance, suggesting that companies need to make informed and specific choices to enhance their performance.

The median size of Chinese firms being 20.71 underscores the relevance of compliance for businesses of varying scales. By prioritizing financial compliance alongside strategies to improve cash flow management and adopting an 'Update & Adjust' approach, organizations not only protect their cash flow but also reinforce operational stability, ultimately bolstering their long-term financial health.

Conclusion

Mastering cash flow management is essential for CFOs seeking to ensure their organizations thrive in an increasingly competitive landscape. The article outlines the critical components of effective cash flow management, emphasizing the importance of:

- Understanding cash flow dynamics

- Implementing practical strategies

- Leveraging technology for enhanced financial oversight

By adopting proactive measures such as:

- Establishing early payment discounts

- Optimizing inventory management

- Conducting regular cash flow forecasting

organizations can significantly improve their liquidity and operational efficiency.

Furthermore, the integration of advanced technology plays a pivotal role in streamlining cash flow processes. Real-time analytics and automated systems empower CFOs to make informed decisions swiftly, reducing cash flow variability and enhancing strategic planning. By fostering a dedicated cash flow management team, businesses can ensure consistent monitoring and adaptability to market fluctuations, ultimately reinforcing their financial resilience.

In conclusion, the effective management of cash flow is not just about maintaining liquidity; it is about positioning the organization for sustainable growth. By embracing these strategies and prioritizing financial compliance, CFOs can create a robust financial framework that not only safeguards against potential downturns but also capitalizes on growth opportunities. Now is the time to take decisive action, harness innovative tools, and implement best practices to secure a prosperous future for the organization.

Frequently Asked Questions

What is the importance of managing finances for CFOs?

For CFOs, managing finances is essential for ensuring liquidity and operational effectiveness, allowing companies to implement strategies that improve cash flow management, meet monetary commitments, pay staff on time, and seize expansion opportunities.

What are some common reasons for small business failures related to finances?

According to the U.S. Small Business Administration, 20% of small enterprises fail within their first year, often due to issues with cash flow management.

How can CFOs improve cash flow management during turnaround situations?

CFOs can streamline decision-making processes and shorten the decision-making cycle to enable decisive actions that preserve business viability.

What proactive strategy can CFOs employ to secure a company’s financial health?

Utilizing a client dashboard to maintain emergency funds that cover at least three to six months of operating expenses is a proactive strategy that helps secure financial health.

What is the significance of enhancing accounts receivable technology?

Recent statistics indicate that 62% of companies intend to enhance their accounts receivable technology to improve efficiency, speed up collections, and better liquidity.

How does real-time analytics aid CFOs in managing finances?

Real-time analytics via client dashboards allow CFOs to track the effectiveness of financial strategies, recognize patterns, and make informed decisions that enhance operational stability.

What are some strategies to improve cash flow management?

Strategies include implementing early payment discounts, optimizing inventory management, utilizing technology for immediate analytics, negotiating better payment terms, conducting financial forecasting, diversifying revenue streams, reducing overhead costs, strengthening collections processes, establishing a fund reserve, and engaging financial consultants.

How can early payment discounts benefit cash flow management?

Early payment discounts encourage customers to pay invoices ahead of schedule, enhancing financial resources and fostering stronger client relationships.

What role does inventory management play in cash flow?

Regular evaluation of inventory levels prevents overstocking and understocking, reducing holding expenses and freeing up funds for better financial oversight.

Why is financial forecasting important for businesses?

Conducting regular financial forecasting helps businesses identify potential liquidity shortfalls early, allowing for informed decisions and corrective actions to ensure smoother operations.

How can diversifying revenue streams improve financial flow?

Seeking new revenue channels through innovative products, services, or markets can reduce risks and enhance economic resilience.

What is the benefit of establishing a fund reserve?

A fund reserve serves as a financial buffer during downturns, safeguarding the business against unexpected expenses and ensuring operational continuity.

How can financial consultants assist businesses?

Financial consultants provide tailored expertise on revenue management strategies, helping businesses navigate complex financial environments and optimize financial management.