Introduction

In the realm of financial leadership, mastering cash flow management is not just a necessity—it's a strategic imperative. As businesses navigate an increasingly complex economic landscape, the ability to monitor, analyze, and optimize cash flow can mean the difference between thriving and merely surviving.

This article delves into the critical components of effective cash flow management, including:

-

Understanding key concepts:

- Operating cash flow

- Free cash flow

-

Implementing best practices that enhance financial stability.

With a focus on actionable strategies, technology integration, and proactive forecasting, CFOs will discover how to overcome common cash flow challenges and position their organizations for sustainable growth.

The insights provided here are designed to empower financial leaders to take decisive action, ensuring their companies remain resilient and competitive in today's dynamic market.

Understanding Cash Flow Management: Key Concepts and Importance

Effective cash flow management strategies are crucial for guaranteeing the financial stability and expansion of an enterprise. It encompasses the careful procedure of observing, examining, and enhancing effective cash flow management strategies for the net funds that circulate in and out over a specific time period. Understanding the essential principles of liquidity management is vital:

- Liquidity: This denotes the actual funds produced and used by the enterprise. A favorable monetary movement suggests a rise in a company’s liquid resources, whereas negative monetary movement denotes a reduction, which can threaten operational viability.

- Operating Monetary Movement: This metric captures the funds generated from the core daily activities of the enterprise. It is essential for maintaining operational activities and ensuring liquidity.

- Free Funds Flow: This signifies the funds available after accounting for capital expenditures, providing insights into the company's ability to invest in growth opportunities and distribute dividends.

Grasping these concepts enables CFOs to develop effective cash flow management strategies that enhance financial health. According to a study by U.S. Bank, 82% of small enterprises fail due to financial mismanagement, with overspending being a crucial factor. Moreover, companies that implement effective cash flow management strategies through monthly financial assessments experience an impressive 80% survival rate, in contrast to only 36% for those that evaluate annually.

A case study titled 'Impact of Financial Flow Reviews' highlights that enterprises that implement effective cash flow management strategies by frequently reviewing their financial flow have a significantly higher survival rate, reinforcing the importance of regular evaluations. Additionally, by mastering the cash conversion cycle and implementing effective cash flow management strategies, CFOs can improve their organizational performance. Our team advocates for a reduced decision-making cycle during the turnaround process, enabling your team to take decisive action to safeguard your enterprise.

With continual monitoring through our client dashboard that provides real-time analytics, organizations can diagnose their financial health effectively. In a setting where 34% of small enterprises indicate a rise in liquidity requirements, and with the opportunity to save up to 20 hours a week by merging various financial management tools onto a single platform, emphasizing effective cash flow management strategies becomes essential for enduring success. Discover our 20 strategies for maximum organizational performance, crafted to offer practical insights and improve your financial management.

For just $99.00, you can access these strategies and transform your business approach. Get Started Now to manage your finances and ensure sustainable growth.

Effective Strategies for Managing Cash Flow: Best Practices and Techniques

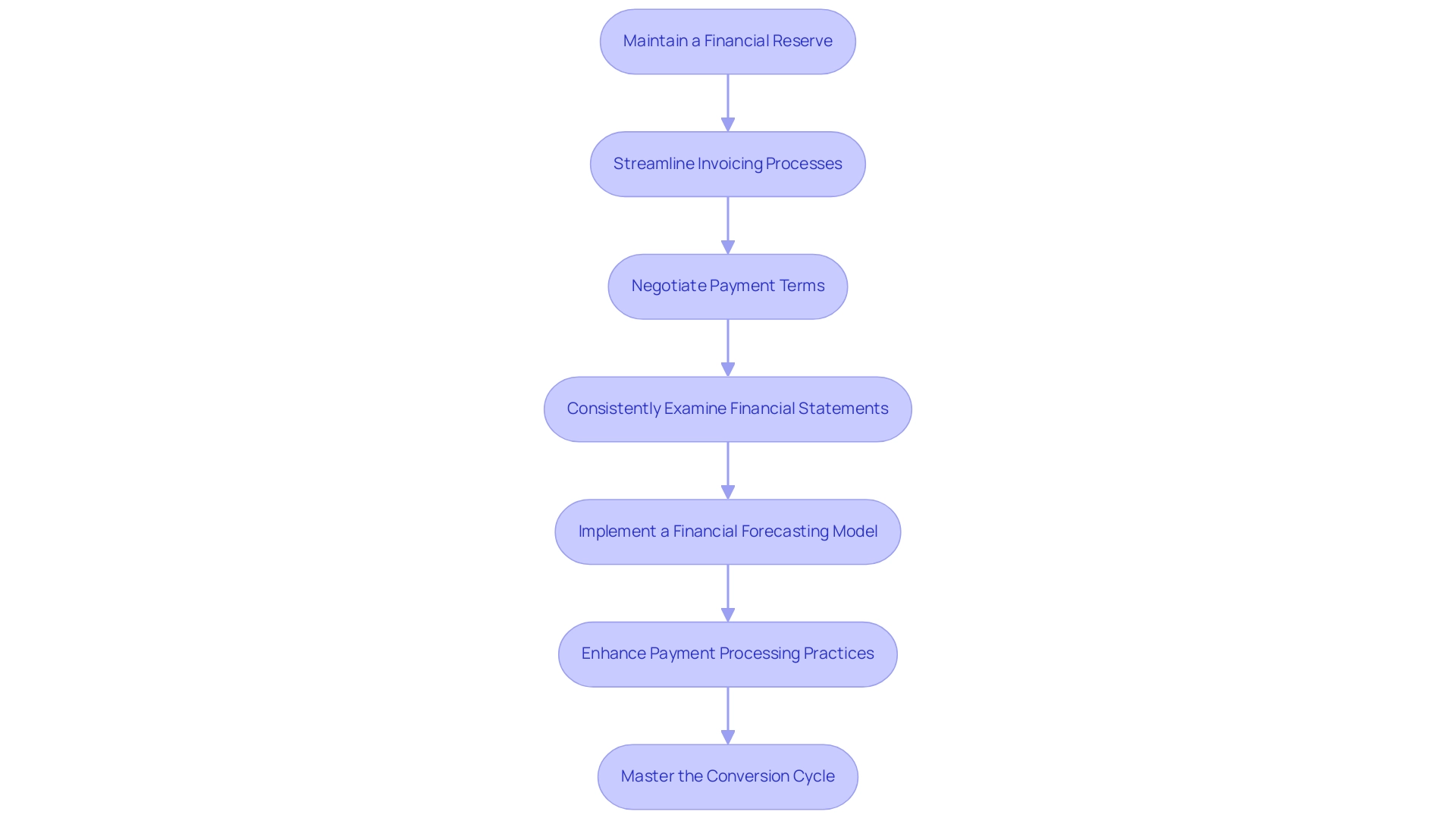

To ensure strong financial management, consider adopting the following best practices:

- Maintain a Financial Reserve: It's essential to set aside a portion of your funds as a buffer against unexpected expenses or economic downturns. This practice enhances business resilience and stability.

- Streamline Invoicing Processes: Implement automated invoicing systems to facilitate timely billing and enhance revenue inflow. Considering that payment terms in Western Europe currently average 52 days, often stressing liquidity, automating these processes is essential. In fact, according to recent research, over 37% of small company owners have contemplated terminating their operations in the last year due to issues with late payments, highlighting the urgency of addressing these challenges.

- Negotiate Payment Terms: Actively engage with suppliers to extend payment terms while encouraging customers to pay promptly. This dual approach enhances your financial cycle and can significantly increase liquidity by implementing effective cash flow management strategies.

- Consistently Examine Financial Statements: Perform weekly or monthly evaluations of financial statements to identify trends and implement necessary strategic adjustments. Companies that regularly assess their financial resources show an impressive 80% survival rate, in contrast to only 36% for those who evaluate annually.

- Implement a Financial Forecasting Model: Create a forecasting model that uses historical data to estimate future monetary movements. This proactive measure empowers informed financial decision-making and assists in navigating potential funding shortfalls.

- Enhance Payment Processing Practices: Incorporate third-party services that comply with PCI-DSS standards to ensure secure handling of payment information. This not only safeguards sensitive information but also fosters trust with your clients, further aiding your financial goals.

- Master the Conversion Cycle: Implement strategies such as reducing inventory holding times and accelerating accounts receivable collections to optimize your conversion cycle. By concentrating on these sectors, companies can greatly enhance liquidity and overall economic performance by implementing effective cash flow management strategies.

By comprehending the global environment of B2B transactions and utilizing these methods, you can guarantee that your organization sustains adequate liquidity to fulfill operational requirements and accomplish strategic goals, thus improving overall economic well-being.

The Role of Cash Flow Forecasting in Financial Planning

Financial forecasting is an essential procedure that predicts future monetary inflows and outflows over a designated timeframe. Its importance in financial planning can be divided into several key areas:

- Identifying Shortfalls: Effective forecasting enables businesses to anticipate potential shortages, empowering them to take proactive measures to mitigate risks before they escalate.

- Guiding Investment Decisions: With a clear understanding of future availability, organizations can make informed investment choices and strategically plan for expansions, ensuring that capital is allocated wisely.

- Enhancing Budgeting Processes: Accurate forecasts significantly improve budgeting accuracy, allowing for more efficient resource allocation and financial management.

To create a robust forecast, start by analyzing historical data while accounting for seasonal fluctuations and considering upcoming financial commitments. The Axiom™ Flow Forecaster exemplifies cutting-edge technology in this area, showcasing how it enhances financial projections at an unprecedented level through the use of AI algorithms for data analysis and automated data collection. This tool processes millions of records efficiently, leading to a 50% reduction in idle cash and a 70% increase in forecasting productivity, thereby improving accuracy in net interest margin planning and seamlessly integrating with budgeting processes.

Its capacity to perform scenario analysis and develop personalized forecasting models enables CFOs to customize strategies effectively. As mentioned by a VP and Director of Financial Planning & Analysis, cash movements were a total guess before we began using Axiom. We now have a high level of confidence in the numbers.

This highlights the transformative effect that mastering the currency conversion cycle through effective forecasting can have on a company's financial strategy. Moreover, the Axiom™ Financial Forecasting Tool is offered for $99.00, positioning it as a worthwhile investment for CFOs aiming to enhance their effective cash flow management strategies. Beyond utilizing the Axiom tool, it is essential to consider the broader strategies for optimal organizational performance, including effective cash flow management strategies, effective inventory management, receivables optimization, and strategic financing options, all of which contribute to mastering the conversion cycle.

Leveraging Technology for Enhanced Cash Flow Management

In the quickly changing digital environment, the incorporation of technology has become crucial for efficient financial management. Here are key strategies for CFOs to consider:

- Thorough Economic Evaluations: Conducting comprehensive economic reviews, as part of our Assessment service, can help identify opportunities to preserve funds and reduce liabilities, enabling businesses to uncover value and streamline costs.

- Automation Tools: Leveraging software solutions like QuickBooks and Xero can streamline invoicing and payment reminders, significantly minimizing the time spent on manual accounting processes.

- Revenue Management Software: Utilizing dedicated platforms such as Float or Cashflow Manager provides CFOs with the ability to visualize financial movement more effectively, enabling real-time performance tracking and informed decision-making.

- Mobile Banking Applications: By adopting mobile banking solutions, leaders in finance can oversee liquidity dynamics anytime, ensuring they have immediate access to crucial economic data, which is vital for timely decision-making.

- Data Analytics: Implementing analytics tools enables businesses to examine past revenue patterns, uncovering insights that can promote enhancements and improve forecasting precision.

The influence of comprehensive financial evaluations and automation on monetary efficiency cannot be exaggerated; organizations employing these technologies are not only boosting operational effectiveness but also liberating valuable time for strategic planning. As an example, employees using Generative AI for administrative tasks report an impressive time savings of 1.75 hours per day, showcasing the transformative potential of these innovations. Moreover, with digital payments comprising 25% of the FinTech market, the importance of technology in monetary management is evident.

A practical illustration of this can be seen with Roomorama, an online booking platform for short-term vacation rentals that allows hosts to easily list their properties and connect with travelers globally, exemplifying how technology can enhance cash flow management. By embracing these technological advancements and continuously monitoring performance through real-time analytics, CFOs can shift their focus from routine tasks to driving growth while navigating the evolving job landscape in FinTech. Additionally, our team supports a shortened decision-making cycle throughout the turnaround process, allowing your team to take decisive action to preserve your business.

Overcoming Common Cash Flow Challenges: Solutions and Strategies

Efficient monetary management is essential for any organization, and several typical challenges can obstruct financial stability. Addressing these issues proactively can result in enhanced liquidity and long-term success.

- Delayed Payments from Clients: To tackle the considerable problem of delayed payments, which is anticipated to impact 60% of invoices in the Security, Compliance & Identity sector due to lengthy project approval processes, it is crucial to implement strict credit policies. Regular follow-ups with reminders can keep payment timelines clear, while offering discounts for early payments can incentivize promptness. As mentioned, 'We address a company’s losses from deceitful or intentional illegal actions of employees, contractors, and offenders,' emphasizing the significance of managing financial risks efficiently. Furthermore, an efficient decision-making process allows your team to quickly tackle overdue payments and strengthen financial stability. Utilizing a client dashboard for real-time analytics can further enhance this process by providing insights into payment trends and customer behavior.

- Unexpected Expenses: Organizations must be prepared for unforeseen costs that can disrupt cash flow. Creating a contingency fund is crucial, as it offers a monetary buffer. Additionally, continually monitoring the budget through real-time analytics allows CFOs to identify areas where costs can be cut, minimizing the impact of unexpected expenses and facilitating agile responses to financial challenges. The client dashboard plays an essential role here, allowing CFOs to visualize budgetary information and make informed choices swiftly.

- Inventory Management Issues: Effective inventory management is crucial to sustaining a healthy financial status. By examining sales trends, CFOs can optimize inventory levels and modify orders to meet demand, thus decreasing surplus stock that ties up funds. Incorporating real-time performance monitoring ensures that inventory decisions are data-driven and responsive to market dynamics. The client dashboard can offer valuable insights into inventory turnover rates and sales predictions, assisting in more precise inventory management.

A significant instance of efficient financial management is Allianz Trade, which received the EcoVadis Silver Medal for Excellent Sustainable Action. This recognition demonstrates their commitment to sustainability and advanced management systems, placing them in the top 15% of companies assessed by EcoVadis. By recognizing these challenges and implementing the recommended strategies, CFOs can significantly enhance their organizations' cash flow management capabilities, ensuring financial resilience and stability in the face of evolving market conditions.

The integration of a shortened decision-making cycle and real-time analytics through tools like the client dashboard can further empower CFOs to navigate these challenges effectively.

Conclusion

Mastering cash flow management is a pivotal aspect of financial leadership that cannot be overlooked. By understanding key concepts such as operating cash flow and free cash flow, CFOs can make informed decisions that directly impact their organization’s financial health. The data underscores the necessity of regular cash flow reviews, revealing that businesses that actively engage in these assessments enjoy significantly higher survival rates.

Implementing best practices, such as:

- Maintaining cash reserves

- Streamlining invoicing processes

enhances the resilience of organizations in the face of economic uncertainties. The integration of technology, from cash flow management software to mobile banking applications, empowers CFOs to not only monitor their cash flow more effectively but also to make timely and strategic decisions that drive growth.

Finally, addressing common cash flow challenges head-on—whether through:

- Improved payment processing

- Inventory management

- Proactive forecasting

positions businesses for sustained success. By embracing these strategies, financial leaders can ensure their organizations remain agile, competitive, and prepared for the challenges of an evolving market landscape. Taking action now can create a robust financial foundation that supports both immediate stability and long-term growth.

Frequently Asked Questions

What is the importance of effective cash flow management strategies?

Effective cash flow management strategies are crucial for ensuring the financial stability and expansion of an enterprise by monitoring, analyzing, and enhancing the net funds that flow in and out over a specific time period.

What does liquidity mean in the context of cash flow management?

Liquidity refers to the actual funds produced and used by the enterprise. A favorable monetary movement indicates an increase in liquid resources, while negative monetary movement signifies a reduction that can threaten operational viability.

What is operating monetary movement?

Operating monetary movement captures the funds generated from the core daily activities of the enterprise, which is essential for maintaining operational activities and ensuring liquidity.

What is free funds flow?

Free funds flow signifies the funds available after accounting for capital expenditures, providing insights into the company's ability to invest in growth opportunities and distribute dividends.

How does financial mismanagement affect small enterprises?

According to a study by U.S. Bank, 82% of small enterprises fail due to financial mismanagement, with overspending being a crucial factor.

What is the survival rate of companies that implement effective cash flow management strategies?

Companies that conduct monthly financial assessments experience an impressive 80% survival rate, compared to only 36% for those that evaluate annually.

What role does the cash conversion cycle play in cash flow management?

Mastering the cash conversion cycle allows CFOs to improve organizational performance by optimizing the flow of cash through the business.

How can organizations monitor their financial health effectively?

Organizations can use client dashboards that provide real-time analytics to diagnose their financial health effectively.

What are some best practices for strong financial management?

Best practices include maintaining a financial reserve, streamlining invoicing processes, negotiating payment terms, consistently examining financial statements, implementing a financial forecasting model, enhancing payment processing practices, and mastering the conversion cycle.

Why is it essential to automate invoicing processes?

Automating invoicing processes facilitates timely billing and enhances revenue inflow, which is critical given that payment terms in Western Europe currently average 52 days, stressing liquidity.

How can companies improve their liquidity through payment terms?

Companies can improve liquidity by negotiating extended payment terms with suppliers while encouraging customers to pay promptly.

What is the benefit of regularly examining financial statements?

Regular evaluations of financial statements help identify trends and implement necessary strategic adjustments, significantly increasing the survival rate of companies.

What is the purpose of a financial forecasting model?

A financial forecasting model uses historical data to estimate future monetary movements, empowering informed financial decision-making and helping navigate potential funding shortfalls.

How can companies enhance their payment processing practices?

Companies can enhance payment processing by incorporating third-party services that comply with PCI-DSS standards, ensuring secure handling of payment information and fostering trust with clients.