Introduction

In the dynamic world of finance, effective cash flow management stands as a cornerstone of a business's success. It transcends mere accounting practices, demanding active engagement from leadership, particularly CFOs, to ensure that organizations not only survive but thrive. By mastering the intricacies of cash flow—distinguishing it from profit, leveraging technology, and implementing strategic forecasting—CFOs can unlock the potential for growth and stability.

This article delves into essential practices and innovative strategies that empower finance leaders to navigate the complexities of cash flow, ultimately fostering a resilient financial foundation for their businesses.

Understanding the Fundamentals of Cash Flow Management

Efficient monetary management is crucial for sustaining the financial well-being of any enterprise. It entails carefully monitoring the inflow and outflow of funds, essential for comprehending the basic distinctions between liquidity and profit. While profit represents total earnings, liquidity shows the actual funds available for operations, investments, and growth.

A prevalent misunderstanding among small enterprise owners is that financial oversight is exclusively the accountant's duty; however, it necessitates active participation from all leadership, particularly CFOs. As illustrated in the case study titled 'Understanding Cash Flow Management,' developing cash-flow management strategies is essential for making informed decisions. Our team advocates for a shortened decision-making cycle during the turnaround process, enabling your team to take decisive action to protect your enterprise.

Regular monitoring through real-time analytics via our client dashboard enables businesses to identify trends, anticipate potential shortages, and make informed financial decisions. Essential elements of efficient liquidity oversight consist of:

- Liquidity statements, which act as crucial financial records outlining monetary movements and emphasizing possible deficiencies.

- The monetary balance at the end of the period is $252,500, underscoring the importance of effective financial management strategies.

Comprehending accounts receivable and accounts payable also plays a significant role in managing financial resources effectively. Furthermore, there are two approaches for preparing a flow statement:

- The direct method, which lists actual transactions.

- The indirect method, which adjusts net income for non-cash items and variations in working capital.

As highlighted by industry experts, 'The combination of sources and uses of funds at a given moment determines whether you have a surplus of funds that can be used for future operations and opportunities, or a deficit of resources, which means you are unable to operate without finding more money.'

By mastering these fundamentals, including cash-flow management strategies from 'Mastering the Cash Conversion Cycle: 20 Strategies for Optimal Business Performance,' CFOs can build a robust financial foundation, thereby avoiding the frequent pitfalls that lead to liquidity shortages.

Leveraging Technology for Effective Cash Flow Management

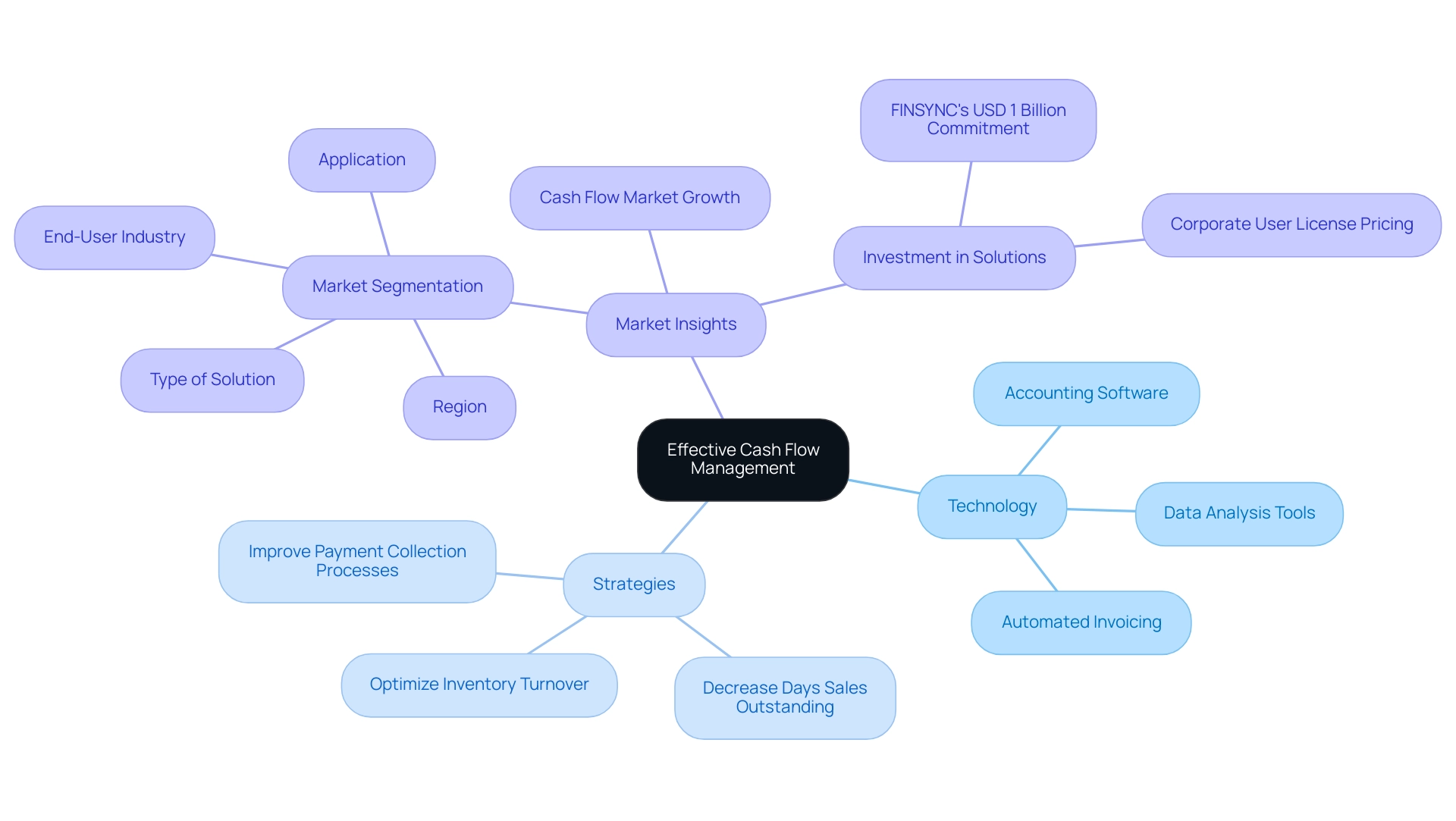

In the present digital environment, utilizing technology is essential for enhancing financial management. Mastering the financial conversion cycle involves implementing sophisticated accounting software and automated invoicing systems as powerful allies in minimizing manual errors and streamlining operations. Particular tactics like optimizing inventory turnover, decreasing days sales outstanding, and improving payment collection processes are essential cash-flow management strategies that can significantly enhance financial liquidity.

By automating routine procedures like invoicing and payment reminders, companies can ensure prompt payments, which is essential for effective cash-flow management strategies and maintaining a healthy financial status. Moreover, sophisticated data analysis tools provide important perspectives on financial trends, enabling CFOs to make educated monetary choices concerning expenditures and investments. Significantly, recent progress in accounting applications particularly tailored for small enterprises has revolutionized liquidity oversight, as evidenced by FINSYNC's investment of USD 1 billion to improve financing and revenue solutions.

This expansion in the liquidity market, valued at USD 3,450 for the Corporate User License, reflects rising demand for efficient financial management solutions. The market segmentation by type of solution, application, end-user industry, and region highlights the variety of tools available for CFOs. As stated by ORACLE, 'MarkWide Research is a trusted partner that provides us with the market insights we need to make informed decisions.'

This feeling emphasizes the importance for CFOs to utilize these technological advancements and implement cash-flow management strategies for improved business performance and effective management of financial challenges. Understanding the investment associated with these solutions is essential for CFOs to make informed decisions.

Practical Strategies for Improving Cash Flow

To improve liquidity, CFOs can adopt a range of efficient cash-flow management strategies that not only stabilize financial well-being but also facilitate growth. Efficient cash-flow management strategies ensure that businesses can cover operational costs and invest in growth opportunities. Here are key methods to consider:

-

Automate Invoicing: Leveraging invoicing software allows for the automation of billing processes and payment reminders. This significantly reduces the delays often linked to manual invoicing, thereby speeding up revenue inflow. Kit Morris, Content Marketing Manager for The Access Group APAC and Fathom, emphasizes that,

Cash forecasting allows you to anticipate future liquidity needs and prepare for various scenarios.

This predictive capability is especially crucial when taking into account seasonal fluctuations in revenue, allowing companies to strategize appropriately.

-

Negotiate Payment Terms: Engaging suppliers in discussions to extend payment terms can lead to favorable arrangements. This flexibility in cash-flow management strategies enables companies to manage their expenditures without facing penalties, which is crucial for sustaining liquidity in difficult periods.

Recent studies indicate that businesses that successfully negotiate payment terms can significantly enhance their cash-flow management strategies and improve their flow of funds outcomes.

-

Offer Discounts for Early Payments: Encouraging customers to pay their invoices prior to the due date with discounts can improve financial inflow. This strategy not only enhances immediate funds availability but also promotes stronger customer relationships.

-

Regularly Review Expenses: Conducting frequent audits of expenses is crucial for identifying areas where cost reductions can be made. By utilizing cash-flow management strategies to trim unnecessary expenditures, companies can free up funds that can be redirected towards growth initiatives.

-

Implement a Financial Reserve: Establishing a financial reserve provides a safety net for unexpected expenses or resource shortfalls. This proactive approach ensures that enterprises are better equipped to handle financial fluctuations without compromising operational stability.

-

Master the Cash Conversion Cycle: Comprehending and enhancing the conversion cycle is essential for improving liquidity. By efficiently overseeing cash-flow management strategies that transform stock into funds, companies can improve liquidity and guarantee they possess the resources required for operational requirements.

The case study titled 'Challenges in Financial Analysis' emphasizes typical problems such as misunderstandings of liquidity versus profit and the effect of seasonal fluctuations. By acknowledging these challenges, CFOs can carry out more precise liquidity evaluations and enhance their cash-flow management strategies. Additionally, utilizing a client dashboard for real-time analytics enables CFOs to monitor organizational health continuously, facilitating swift decision-making and operationalizing lessons learned throughout the turnaround process.

By employing these approaches, organizations can cultivate a more robust and predictable revenue environment, essential for navigating the complexities of both enterprise and personal finance. This approach embodies a commitment to testing hypotheses, facilitating quick decision-making, and utilizing real-time analytics to operationalize the lessons learned throughout the turnaround process.

The Importance of Cash Flow Forecasting and Planning

Efficient cash-flow management strategies are crucial for anticipating future monetary inflows and outflows, utilizing historical data while taking into account expected changes in the operational environment. For small enterprises aiming to succeed in 2024, developing monthly financial forecasts is essential. This proactive strategy not only identifies possible funding shortfalls but also utilizes cash-flow management strategies to enable companies to plan their expenditures, investments, and financing requirements effectively.

As Dashmeet Kaur wisely points out,

Employ historical analysis, sales, revenue, and expense forecasting, along with accounts receivable and payable assessment, and working capital oversight for effective projections.

Moreover, integrating real-time analytics through advanced tools and software, including our client dashboard, significantly enhances the accuracy of these forecasts, which is crucial for effective cash-flow management strategies and offers valuable insights that inform strategic planning. This ensures that companies remain agile and responsive to market dynamics.

With our team's commitment to operationalizing lessons learned during turnaround processes, organizations can access real-time insights via the client dashboard that mitigate risks and improve compliance, allowing treasury departments to focus on strategic initiatives. For example, a recent case study showed how digital transformation in treasury operations streamlined processes and improved financial management, offering real-time insights and lowering expenses. By adopting such comprehensive forecasting techniques, small enterprises can confidently navigate their financial futures, mastering their conversion cycle for optimal performance.

Building Strong Relationships to Enhance Cash Flow

Establishing robust relationships with vendors and customers is paramount for implementing effective cash-flow management strategies. Effective communication not only facilitates more favorable payment terms but also encourages customers to adhere to their payment schedules, which are essential for implementing cash-flow management strategies. As one client pointed out, 'Within 100 days of meeting the SMB team, my company was in a better position financially and strategically than it had been in years.'

By cultivating an atmosphere of trust and rapport, organizations can enhance sales and customer loyalty. Regular check-ins with key stakeholders are essential; they allow for mutual understanding of expectations and needs, thereby reinforcing these relationships. Moreover, as evidenced by the transformative experiences shared by clients of the SMB team, such as the successful 'Rapid30' plan, a focused approach to financial assessments can help businesses navigate challenges.

The SMB team's comprehensive reviews emphasize fund preservation and efficiency, enabling clients to reduce liabilities and uncover hidden value. In fact, healthcare systems are increasingly acknowledging the significance of automation in revenue cycle operations (RCM), with potential dollar savings estimated at $22 billion from fully electronic transactions. Notably, the average cost-to-collect (C2C) has decreased by 0.23% due to RCM automation, highlighting its significant impact.

As leaders require a 'hard ROI' for substantial investments, it is evident that prioritizing relationships and ensuring open lines of communication can create a supportive ecosystem that greatly enhances financial management strategies. By utilizing cash-flow management strategies such as detailed financial reviews and cash flow forecasting, businesses can better position themselves for sustainable growth.

Conclusion

Effective cash flow management is not merely a financial task but a strategic imperative that can determine the success of a business. Understanding the distinctions between cash flow and profit is crucial, as is the active involvement of CFOs in overseeing cash management practices. By leveraging technology and employing automated systems, organizations can significantly reduce errors and streamline operations, ensuring timely payments and improving cash flow visibility.

Implementing practical strategies, such as:

- Negotiating favorable payment terms

- Automating invoicing

- Building cash reserves

empowers CFOs to navigate financial challenges with confidence. Furthermore, effective cash flow forecasting allows businesses to anticipate future needs, making informed decisions that align with strategic objectives.

Ultimately, fostering strong relationships with vendors and customers enhances cash flow dynamics, creating a supportive ecosystem that benefits all parties involved. By embracing these practices, CFOs can cultivate a resilient financial foundation that not only stabilizes current operations but also positions the organization for sustained growth and success. The time for proactive cash flow management is now—seize the opportunity to transform financial strategies and drive your business forward.

Frequently Asked Questions

Why is efficient monetary management important for enterprises?

Efficient monetary management is crucial for sustaining financial well-being, as it involves carefully monitoring the inflow and outflow of funds, which helps in understanding the differences between liquidity and profit.

What is the difference between liquidity and profit?

Profit represents total earnings, while liquidity indicates the actual funds available for operations, investments, and growth.

Who is responsible for financial oversight in a business?

Financial oversight requires active participation from all leadership, particularly CFOs, rather than being solely the accountant's duty.

What are liquidity statements, and why are they important?

Liquidity statements are crucial financial records that outline monetary movements and emphasize possible deficiencies, helping businesses understand their financial health.

What are the two methods for preparing a cash flow statement?

The two methods are the direct method, which lists actual transactions, and the indirect method, which adjusts net income for non-cash items and variations in working capital.

How can technology enhance financial management?

Technology, such as sophisticated accounting software and automated invoicing systems, minimizes manual errors and streamlines operations, improving cash-flow management.

What are some effective cash-flow management strategies?

Effective strategies include automating invoicing, negotiating payment terms, offering discounts for early payments, regularly reviewing expenses, implementing a financial reserve, and mastering the cash conversion cycle.

Why is cash forecasting important for businesses?

Cash forecasting allows businesses to anticipate future liquidity needs and prepare for various scenarios, especially important during seasonal fluctuations in revenue.

How can establishing relationships with vendors and customers improve cash flow management?

Strong relationships facilitate more favorable payment terms and encourage customers to adhere to payment schedules, which are essential for effective cash-flow management.

What role does real-time analytics play in cash-flow management?

Real-time analytics through advanced tools and software enhance the accuracy of financial forecasts, allowing businesses to remain agile and responsive to market dynamics.