Introduction

In an unpredictable economic landscape, maintaining a steady cash flow is paramount for organizational resilience and growth. Cash flow stabilization strategies are not merely reactive measures; they are proactive frameworks that empower businesses to navigate financial challenges effectively.

By adopting robust methodologies such as:

- precise cash flow forecasting

- optimizing accounts receivable

- leveraging technology

CFOs can ensure their organizations remain agile and prepared for whatever comes their way.

This article delves into essential techniques, the role of technology, common challenges, and metrics for success, providing a comprehensive guide for financial leaders dedicated to securing their companies' financial futures.

With actionable insights and real-world examples, organizations can transform their cash flow management approaches and thrive amidst uncertainty.

Defining Cash Flow Stabilization Strategies and Their Importance

Cash flow stabilization strategies include the approaches that organizations implement to sustain a consistent and reliable monetary stream, both in receipts and expenditures. These cash flow stabilization strategies are essential for protecting economic health, particularly during periods of economic uncertainty or downturns. By applying cash flow stabilization strategies, companies can prevent possible liquidity emergencies, guaranteeing they fulfill financial responsibilities, capitalize on growth prospects, and maintain operational stability.

Our approach emphasizes streamlined decision-making and real-time analytics, equipping CFOs with the tools needed to monitor performance continuously and make informed decisions. We are committed to operationalizing lessons learned from past experiences, utilizing specific frameworks and methodologies that enhance our decision-making processes. Project Manager provides valuable resources and guides, such as financial forecasting tools and scenario analysis templates, that can assist in the development and execution of these strategies, offering a practical framework for managing monetary challenges.

Furthermore, real-world case studies illustrate how companies have effectively handled liquidity during economic downturns, highlighting the significance of cash flow stabilization strategies and proactive actions. As Helen Keller aptly stated, 'Character cannot be developed in ease and quiet. Only through experience of trial and suffering can the soul be strengthened, ambition inspired, and success achieved.'

This highlights the core of resilience; financial management is not merely a reactive approach but a proactive strategy that prepares organizations to face challenges directly and ensure their financial future. Taking action, as highlighted in recent news, is essential for effective financial management, enabling organizations to react quickly to shifting economic conditions.

Techniques for Effective Cash Flow Stabilization

To effectively stabilize financial resources, businesses can implement several strategic techniques:

-

Financial Flow Forecasting: Regularly predicting monetary inflows and outflows is crucial. Precise financial forecasting enables organizations to foresee shortfalls, facilitating proactive planning for expenditures and investments through cash flow stabilization strategies. According to industry data, enterprises that participate in accurate monetary forecasting experience significantly enhanced financial stability, with accuracy rates soaring to 85% when utilizing advanced forecasting tools.

-

Streamlining Accounts Receivable: Efficient invoicing processes and clearly defined payment terms are essential for reducing the time taken to collect payments. Implementing strategies such as providing discounts for early payments not only encourages timely transactions but also improves liquidity. Shlomo Halberstam from Bottom Line Concepts LLC highlights the significance of sustaining sufficient financial reserves, stating,

Another important factor is assessing any risk and keeping adequate monetary reserves in the organization or a captive insurance entity to ensure that the funds are accessible when required.

This underscores the critical role of cash flow stabilization strategies and effective accounts receivable management in securing liquidity.

-

Inventory Management: Maintaining optimal inventory levels is essential to prevent funds from being tied up in excess stock. By implementing just-in-time inventory methods as cash flow stabilization strategies, companies can match stock with real sales, which enhances liquidity and lowers holding expenses. This strategic approach aids in reducing wastage and enhancing financial availability.

-

Expense Control: Regular reviews of operational expenses can reveal opportunities for cost reduction. Methods like renegotiating agreements with vendors or pinpointing superfluous overhead expenses can greatly improve liquidity. Monitoring expenses closely enables companies to uphold a more robust financial position by implementing cash flow stabilization strategies, which also simplify decision-making processes.

-

Diversifying Revenue Streams: Developing new products or services can act as extra sources of income, thereby improving financial stability. Companies ought to proactively investigate possibilities to broaden their market presence or innovate their products, implementing cash flow stabilization strategies to lessen risks linked to dependence on a singular revenue source. Furthermore, it is essential to comprehend frequent errors in financial statements, such as the absence of reconciliation with income statements and overlooking non-monetary values. These mistakes can result in misguided monetary choices.

A tangible illustration of efficient liquidity management can be observed in the case of XYZ healthcare company, which reported $4,000,000 in EBIT after subtracting overhead expenses. This statistic emphasizes the economic advantages of effective liquidity management techniques. Moreover, grasping net working capital—determined by deducting current liabilities from current assets—can offer insight into an organization's short-term economic condition, aiding in pinpointing possible liquidity challenges and facilitating informed choices.

By utilizing these methods alongside real-time analytics from our client dashboard and efficient decision-making processes, enterprises can create a strong framework for effective liquidity management. This not only ensures agility in responding to economic challenges but also positions them for sustainable growth, all while supporting a shortened decision-making cycle that is critical for timely action.

The Role of Technology in Cash Flow Stabilization

The incorporation of technology is transforming revenue stabilization by implementing cash flow stabilization strategies, which provide companies with resources that greatly improve visibility and control over their monetary processes. Solutions such as accounting software, flow management platforms, and financial forecasting tools automate invoicing, track expenses in real-time, and generate precise flow forecasts. For instance, platforms such as QuickBooks and Xero enable organizations to effortlessly track their financial positions, while advanced analytics tools uncover trends that guide strategic decision-making.

As Sahar Salama, CEO and Founder of TPAY Mobile, emphasizes, 'Cash is inefficient, expensive to manage, hard to track by both private and public agents, and requires an individual to travel to wherever their payment needs to be made.' This emphasizes the urgency of adopting cashless solutions for enhanced efficiency in mastering the currency conversion cycle. Furthermore, with 53% of businesses either already accepting or planning to offer crypto payment options in their online checkout, the landscape of financial management is evolving rapidly.

Thought leaders like Grant Cardone advocate for using debt strategically to leverage investments, reinforcing the idea that technology can complement financial strategies. A relevant case study is Grant Cardone's counsel against utilizing debt for unproductive reasons, where he stresses using debt to invest in opportunities that enhance income. By adopting these technological advancements and electronic solutions, companies can optimize operations, reduce manual mistakes, and make informed decisions—essential factors that support cash flow stabilization strategies and ongoing performance evaluation.

Moreover, applying the '20 Strategies for Optimal Business Performance' can further improve these processes, ensuring that companies not only enhance overall performance but also implement cash flow stabilization strategies to stabilize their finances. Pricing considerations for these tools are also essential, as investing in the right technology can lead to significant returns in efficiency and control.

Common Challenges in Implementing Cash Flow Stabilization Strategies

Implementing effective monetary stabilization strategies is essential for organizational success; however, it frequently poses a series of challenges that CFOs must navigate. These obstacles include:

-

Resistance to Change: Employees and stakeholders frequently exhibit resistance to new processes or technologies.

This reluctance can significantly hinder the effective execution of financial strategies, as buy-in is essential for success.

-

Flawed Predictions: The effects of erroneous monetary projections are profound.

Such discrepancies can lead to misguided monetary decisions, exacerbating cash flow issues instead of resolving them.

-

Lack of Financial Literacy: A prevalent issue within many organizations is the insufficient financial literacy among staff.

This gap can hinder the effective implementation of financial strategies, making focused training and education essential for improving understanding and skills.

-

Economic Uncertainty: External factors such as market fluctuations and economic declines can also negatively impact liquidity.

Such uncertainties create additional challenges in maintaining stability, even when strong monetary strategies are in place.

-

Short-Term Focus: Many organizations fall prey to prioritizing short-term economic gains over long-term stability.

This attitude can result in the disregard of crucial liquidity stabilization efforts, ultimately jeopardizing economic well-being.

-

Project Management: Effective project oversight is essential during the execution of monetary strategies, as it aids in coordinating efforts and resources efficiently, tackling resistance to change and ensuring that all stakeholders are aligned with the economic objectives.

The necessity for streamlined decision-making and real-time analytics cannot be emphasized enough. By consistently tracking organizational performance through client dashboards, CFOs can quickly assess economic health, making informed adjustments as needed.

These dashboards play a crucial role in operationalizing lessons learned, fostering relationship-building and ongoing improvement.

As a compelling illustration, consider the statistic that IBM was spending at least 100 times more on R&D than Apple when Apple launched the Mac.

This emphasizes the significance of strategic investment in liquidity management, where prioritizing resources can result in substantial benefits.

By recognizing and tackling these challenges, companies can proactively formulate cash flow stabilization strategies to enhance their liquidity management practices and reduce risks, paving the way for stronger economic outcomes in 2024 and beyond.

For instance, leveraging the expertise of software implementation partners, as shown in the case study titled 'Leveraging Software Implementation Partner's Experience,' can provide valuable insights and support during the transition to new systems.

Their knowledge can assist in addressing employee issues and enable a more seamless incorporation of new tools, ensuring that organizations are well-prepared to handle financial resources effectively.

Furthermore, performing a swift yet thorough examination of financial operations is crucial for recognizing opportunities to conserve funds and lessen liabilities.

Measuring the Success of Cash Flow Stabilization Strategies

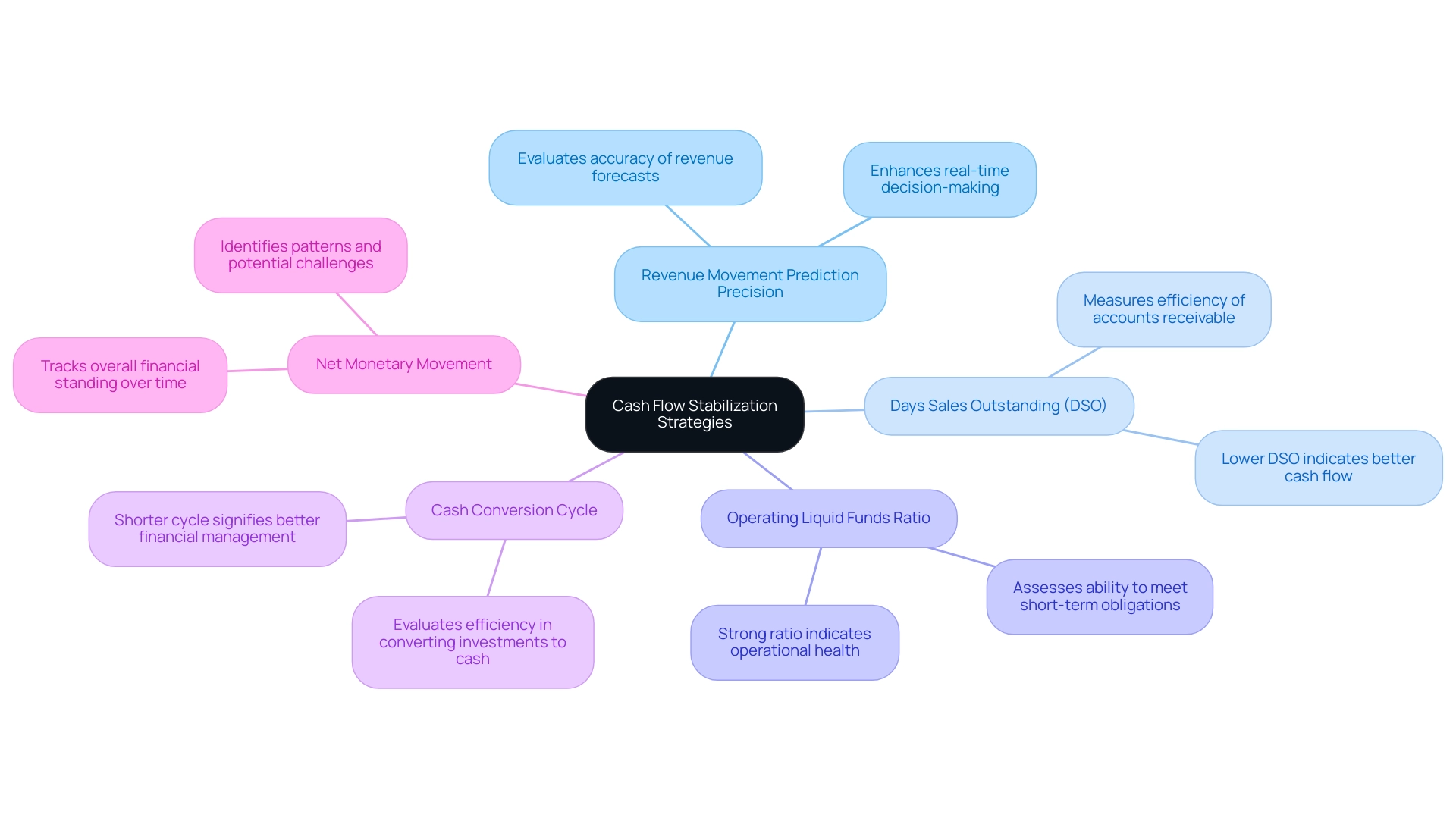

To effectively assess the success of cash flow stabilization strategies, companies must establish well-defined metrics and key performance indicators (KPIs). Among these, the following indicators are crucial:

- Revenue Movement Prediction Precision: This metric evaluates the correspondence between actual monetary movements and predictions, providing insights into the efficacy of revenue management strategies. Accurate forecasting allows businesses to anticipate future challenges and adjust accordingly, enhancing real-time decision-making.

- Days Sales Outstanding (DSO): DSO measures the average duration required to collect payment after a sale, providing valuable insights into the efficiency of accounts receivable processes. A lower DSO indicates a more efficient revenue collection process, which is essential for cash flow stabilization strategies that sustain a healthy financial circulation.

- Operating Liquid Funds Ratio: By comparing operating liquid resources to current liabilities, this ratio assesses a company's capacity to fulfill short-term commitments. A strong ratio indicates solid operational health and financial management.

- Cash Conversion Cycle: This metric evaluates the duration it takes for a business to convert its investments in inventory and resources into real monetary flows from sales. A shorter cycle signifies better efficiency in financial management, indicating that the company can quickly reinvest funds into growth opportunities. This is a key strategy for mastering cash flow stabilization strategies within the financial conversion cycle.

- Net Monetary Movement: Tracking net monetary movement over time offers companies a thorough perspective of their financial standing and helps in recognizing patterns or possible challenges. Routine examination of this metric can emphasize the overall efficiency of financial strategies, reinforcing the necessity for ongoing performance assessment.

In the context of these metrics, it is essential to remember that "a satisfied customer is the best business strategy of all." This emphasizes the link between effective financial management and customer satisfaction, as timely and efficient monetary processes can enhance customer experiences. Additionally, Grant Cardone advises against using debt for non-productive purposes, emphasizing the importance of leveraging debt for investments that generate income.

His case study on productive debt demonstrates the distinction between utilizing debt to increase wealth versus wasteful spending, reinforcing the concept that comprehending monetary metrics can lead to improved economic choices.

By consistently reviewing these metrics and utilizing real-time business analytics from dashboards, which support a shortened decision-making cycle, CFOs and financial leaders can implement cash flow stabilization strategies to make informed decisions, adjust strategies as necessary, and ultimately achieve enhanced cash flow stability while building strong relationships through operational lessons learned.

Conclusion

In navigating the complexities of cash flow stabilization, organizations must embrace a multifaceted approach that combines:

- Strategic techniques

- Technological integration

- A keen awareness of common challenges

By implementing:

- Precise cash flow forecasting

- Streamlining accounts receivable

- Maintaining optimal inventory levels

Businesses can significantly enhance their financial resilience. Coupled with diligent expense control and diversification of revenue streams, these strategies create a robust framework for ensuring steady cash flow.

The role of technology cannot be overstated; leveraging advanced financial tools not only automates processes but also provides invaluable insights through real-time analytics. This empowers CFOs to make informed decisions swiftly, adapting to the dynamic economic landscape. However, it is crucial to recognize and address the common challenges that may impede progress, such as:

- Resistance to change

- The pitfalls of inaccurate forecasting

By fostering a culture of financial literacy and emphasizing long-term stability, organizations can overcome these obstacles and secure their financial futures.

Finally, measuring success through well-defined metrics such as:

- Cash flow forecast accuracy

- Operating cash flow ratios

is essential. These indicators not only reflect the effectiveness of cash flow management practices but also guide organizations in making strategic adjustments as needed. As businesses continue to refine their cash flow stabilization strategies, they position themselves not just to survive economic uncertainty but to thrive and capitalize on growth opportunities. The time to act is now—embracing these strategies will lead to a stronger, more resilient financial foundation for the future.

Frequently Asked Questions

What are cash flow stabilization strategies?

Cash flow stabilization strategies are approaches organizations implement to maintain a consistent and reliable monetary stream in both receipts and expenditures, essential for protecting economic health, particularly during economic downturns.

Why are cash flow stabilization strategies important?

These strategies help prevent liquidity emergencies, ensuring companies can meet financial obligations, seize growth opportunities, and maintain operational stability during uncertain economic times.

How can companies forecast financial flows effectively?

Companies can implement financial flow forecasting, which involves regularly predicting monetary inflows and outflows to foresee shortfalls and plan expenditures and investments proactively.

What role does accounts receivable management play in cash flow stabilization?

Streamlining accounts receivable through efficient invoicing and defined payment terms can reduce the time taken to collect payments, improving liquidity and ensuring adequate financial reserves.

How does inventory management contribute to cash flow stabilization?

Maintaining optimal inventory levels prevents funds from being tied up in excess stock. Implementing just-in-time inventory methods aligns stock with real sales, enhancing liquidity and reducing holding costs.

What are some techniques for controlling expenses?

Companies can regularly review operational expenses to identify cost reduction opportunities, such as renegotiating vendor agreements or eliminating unnecessary overhead, thereby improving liquidity.

Why is diversifying revenue streams important?

Developing new products or services can provide additional income sources, improving financial stability and reducing reliance on a single revenue stream.

What challenges do organizations face when implementing cash flow stabilization strategies?

Challenges include resistance to change, flawed predictions, lack of financial literacy, economic uncertainty, short-term focus, and the need for effective project management.

How can technology aid in cash flow stabilization?

Technology, such as accounting software and financial forecasting tools, enhances visibility and control over monetary processes, automating invoicing, tracking expenses, and generating accurate forecasts.

What metrics should companies use to assess the success of their cash flow stabilization strategies?

Key metrics include revenue movement prediction precision, Days Sales Outstanding (DSO), operating liquid funds ratio, cash conversion cycle, and net monetary movement.

How does effective financial management relate to customer satisfaction?

Effective financial management, which includes timely and efficient monetary processes, can enhance customer experiences, linking customer satisfaction to strong financial practices.