Overview

This article presents actionable financial recovery action plans tailored for small businesses, enabling them to effectively navigate economic challenges. It underscores the necessity of thorough evaluations, the establishment of SMART goals, and the engagement of turnaround consultants to devise customized strategies. These strategies are designed to foster resilience and promote long-term success.

Supported by compelling case studies and statistical evidence, the article illustrates the tangible benefits of these approaches, encouraging businesses to adopt these measures for sustainable growth.

Introduction

In a landscape where nearly 600,000 businesses close their doors each year, the need for effective financial recovery strategies is more critical than ever. Small and medium-sized enterprises encounter unique challenges that demand tailored solutions to navigate cash flow issues, debt burdens, and operational inefficiencies. By developing comprehensive recovery plans and engaging turnaround consultants, businesses can identify actionable steps to not only survive but thrive in a competitive market.

This article explores essential strategies for:

- Assessing financial damage

- Setting achievable goals

- Discovering new revenue streams

All aimed at fostering resilience and sustainable growth in the face of adversity.

Transform Your Small/ Medium Business: Tailored Financial Recovery Plans

Creating financial recovery action plans requires a thorough evaluation of your enterprise's unique situation, including cash flow obstacles, debt levels, and operational shortcomings. A comprehensive financial review can uncover opportunities to conserve cash and reduce liabilities, which is essential for developing effective financial recovery action plans in collaboration with a turnaround consultant. Their expertise in developing strategies that directly tackle these specific issues ensures the plan is both actionable and measurable. This targeted approach not only facilitates prompt restoration but also lays the groundwork for sustainable long-term success.

With nearly 600,000 enterprises closing each year, the need for a recovery strategy is clear. Engaging a turnaround consultant provides critical insights and strategies for effectively developing financial recovery action plans to address economic challenges, ultimately enhancing organizational resilience and performance.

Our extensive turnaround and restructuring consulting services, including interim management and bankruptcy case management, are designed to support small to medium enterprises in achieving these objectives.

Evaluate Financial Damage: Assessing Your Business's Current Situation

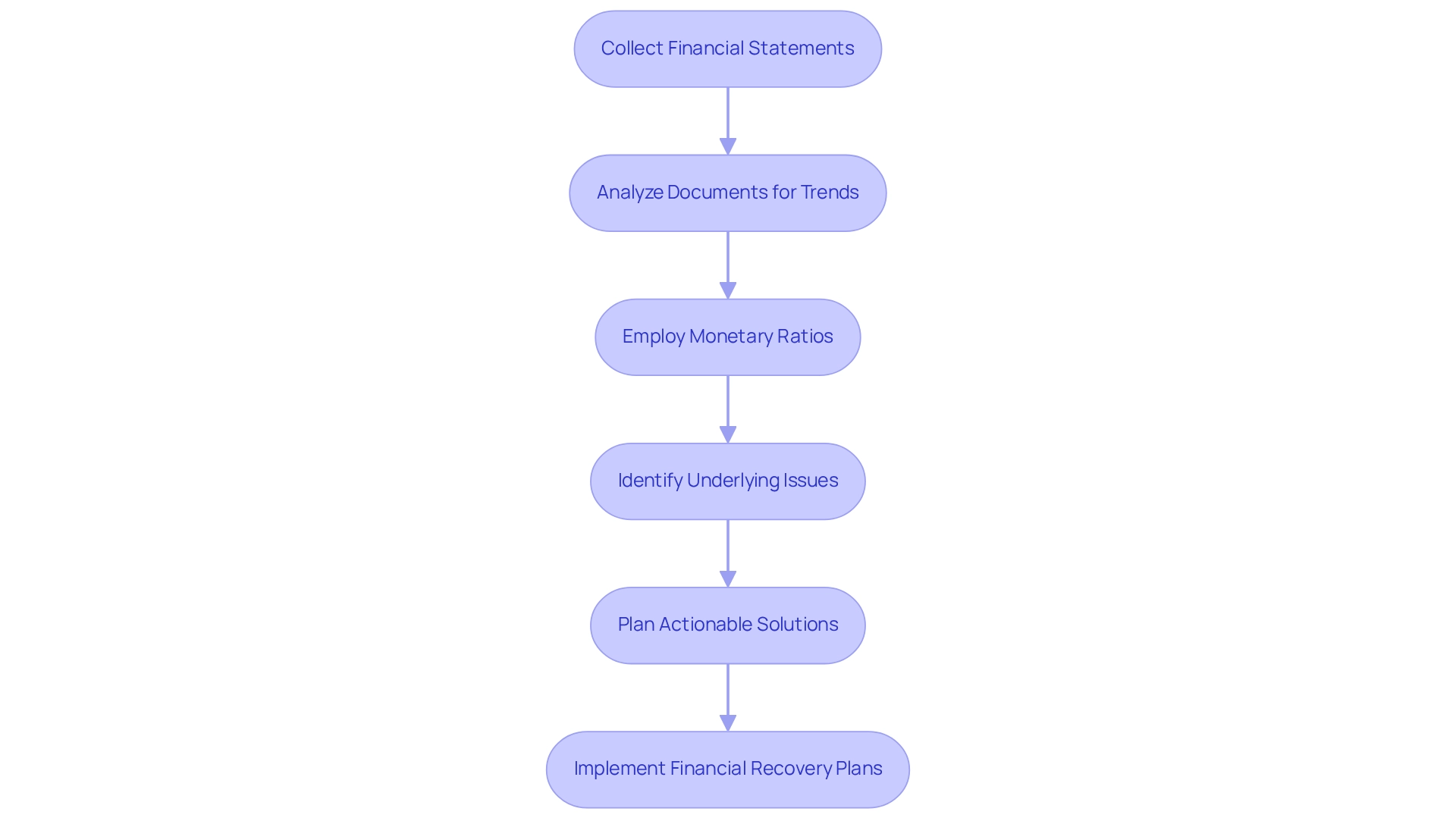

To effectively assess monetary damage in small enterprises, it is crucial to begin by collecting essential fiscal statements, such as balance sheets and cash flow reports. Analyzing these documents allows for the identification of trends in revenue, expenses, and profitability. Moreover, employing monetary ratios can further enhance this evaluation by providing insights into liquidity and solvency. This examination not only highlights areas of economic hardship but also serves as a foundation for developing financial recovery action plans.

Economic analysts underscore the significance of these statements in evaluating overall organizational health, as they reveal critical insights into operational efficiency and fiscal stability. By adopting a structured approach that includes identifying underlying issues and planning actionable solutions, CFOs can streamline their decision-making processes.

Case studies illustrate that companies proactively evaluating their economic losses and utilizing real-time analytics are better positioned to implement effective financial recovery action plans. By leveraging expert insights and focusing on statement analysis, CFOs can pinpoint actionable measures to mitigate harm and foster sustainable growth.

Set Short-Term Financial Goals: Creating Immediate Action Steps

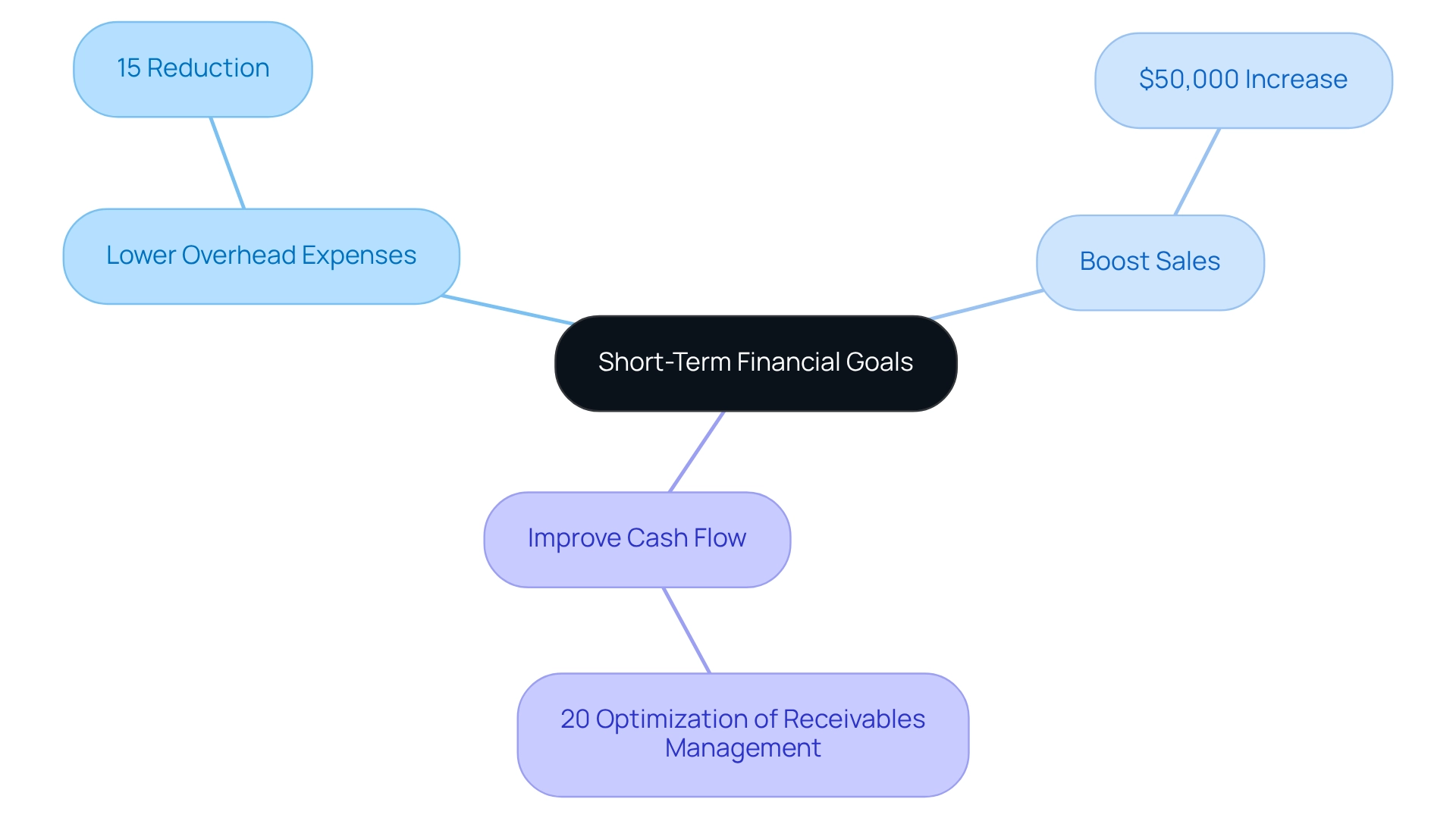

Setting specific, measurable, achievable, relevant, and time-bound (SMART) objectives is crucial for small enterprises aiming for financial recovery action plans in the upcoming quarter. For instance, a company might establish an objective to:

- Lower overhead expenses by 15%

- Boost sales by $50,000

- Improve cash flow by optimizing receivables management by 20%

Frequent assessments of these objectives are essential to uphold their significance and implement necessary modifications. Research indicates that businesses implementing structured financial objectives, such as SMART criteria, can achieve significant improvements in performance, with many realizing profit margins between 25% and 40%. By embracing these organized objectives, CFOs can establish prompt financial recovery action plans that not only tackle existing challenges but also lay the groundwork for enduring growth.

Moreover, integrating streamlined decision-making processes and real-time analytics can enhance the effectiveness of these goals, allowing for continuous monitoring and adjustment based on performance metrics. This approach not only applies lessons learned but also cultivates strong relationships through ongoing engagement with performance data. Additionally, focusing on the cash conversion cycle can provide actionable insights, such as optimizing inventory turnover and accelerating receivables collection, which are essential strategies for enhancing cash flow and profitability.

Redo Your Budget: Aligning Financial Plans with Current Needs

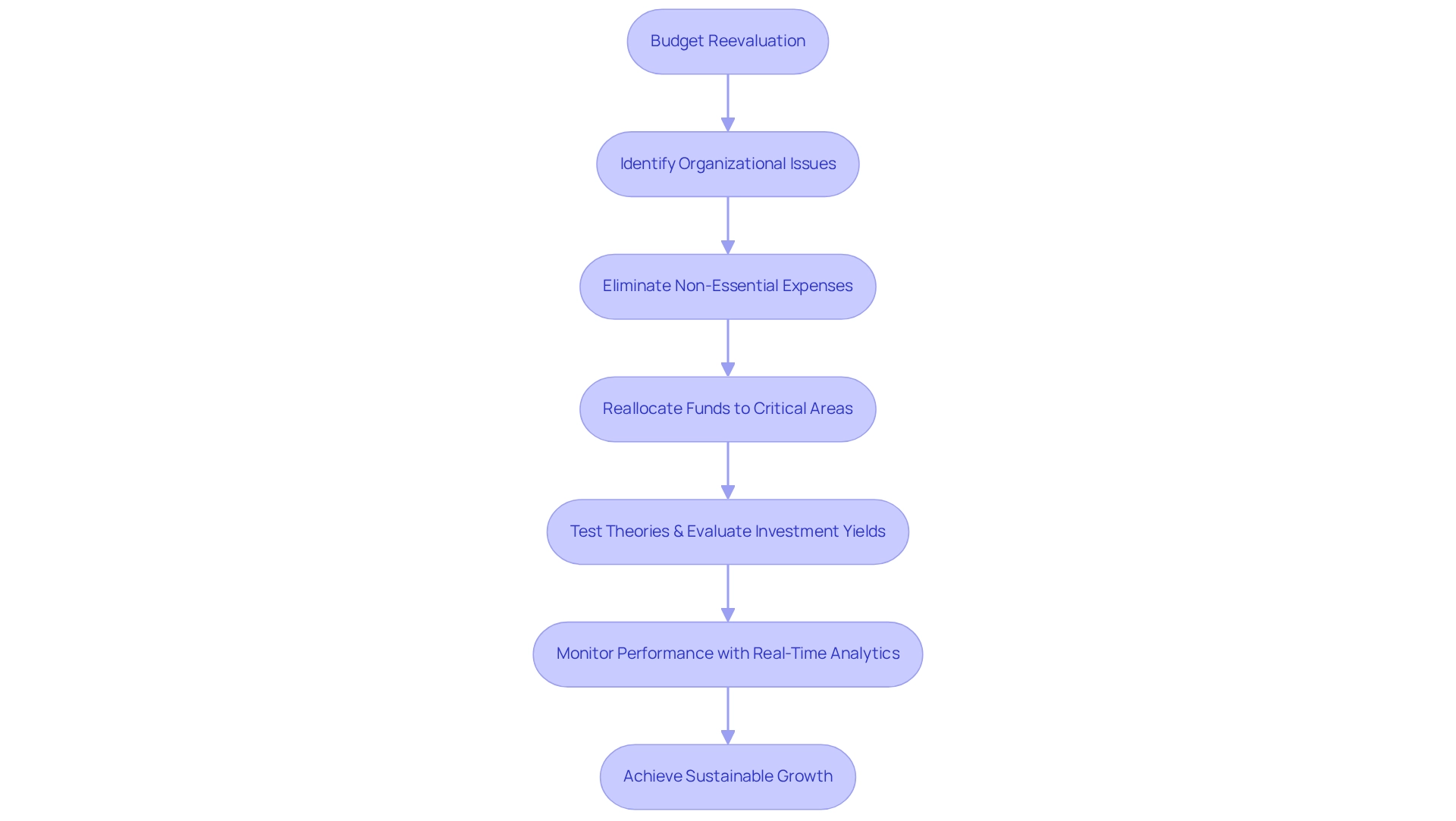

To effectively navigate monetary challenges, it is essential to reassess all income and expense categories within your budget. Begin by identifying underlying organizational issues and non-essential expenses that can be eliminated. This enables the reallocation of those funds to critical areas such as marketing initiatives or debt repayment strategies. By leveraging historical information alongside current market conditions, you can create a budget that accurately reflects your organization's evolving economic landscape.

Our strategy emphasizes the importance of testing theories and evaluating investment yields to ensure that every financial decision is data-driven. For instance, enterprises in the healthcare and social assistance sectors have demonstrated remarkable resilience, underscoring the necessity of adaptability in budget management. This resilience is highlighted by the actual surplus of $64 billion reported in September 2024, illustrating the economic context within which these industries operate. Through strategic resource reallocation and continuous performance monitoring via real-time analytics, these sectors have maintained high survival rates, even amid economic fluctuations. Furthermore, statistics reveal that many small enterprises have successfully revised their budgets to align with immediate needs, resulting in improved financial outcomes. In fact, a recent analysis indicated that companies that proactively adjust their budgets can enhance their cash flow and reduce liabilities, ultimately fostering sustainable growth. This aligns with the broader goal of achieving lasting success, which is crucial for all enterprises, especially during challenging times.

In conclusion, a comprehensive budget reevaluation not only identifies areas for expense reduction but also positions your business to seize opportunities for improvement and growth within a tough economic climate. By applying lessons learned from past decisions and maintaining a focus on real-time analytics, CFOs can steer their organizations toward a more robust economic future.

Follow a Revised Budget: Ensuring Compliance with New Financial Strategies

Establishing a robust system for monitoring expenses in relation to a revised budget is crucial for the implementation of financial recovery action plans. By implementing accounting software, organizations can achieve real-time oversight of expenditures and generate detailed reports that highlight variances.

Our team strongly advocates for an expedited decision-making cycle during the turnaround process, empowering your team to take decisive action to protect your organization. Regularly reviewing these reports with your team fosters alignment with the budgetary strategy and facilitates timely adjustments.

Notably, 50% of organizations allocate 6-10% of their revenue to compliance costs, underscoring the critical need for effective expense tracking. Furthermore, as 62% of compliance officers dedicate 1 to 7 hours each week to tracking regulatory developments, leveraging technology can significantly boost compliance efficiency.

The importance of compliance is further illustrated by a case study on ESG adherence, which reveals that 91% of corporate leaders believe their organization has a responsibility to address ESG issues, with 76% of consumers willing to withdraw support from companies that neglect these concerns. This underscores the vital role compliance plays in safeguarding organizational reputation and consumer trust.

Additionally, Rick Stevenson noted that the global average cost of a data breach in 2024 was $4.88 million, highlighting the economic ramifications of non-compliance. By prioritizing adherence to financial strategies and continuously monitoring organizational health through real-time analytics, companies can develop and implement financial recovery action plans to protect their resources while enhancing overall performance.

Update and Revise Your Budget Regularly: Adapting to Changing Circumstances

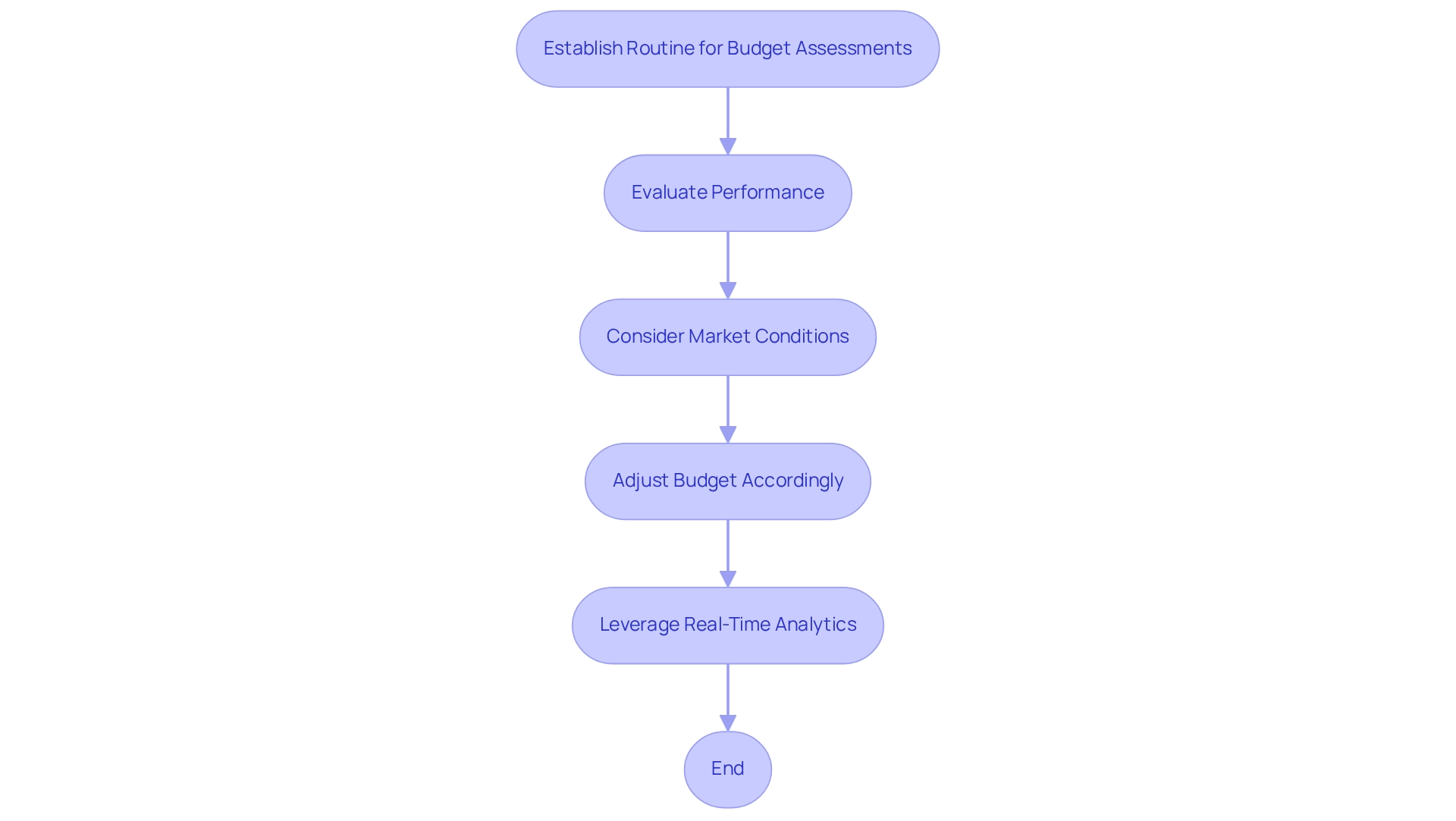

Establish a routine for budget assessments, ideally on a monthly or quarterly basis, to evaluate performance against predetermined monetary objectives. These reviews must consider fluctuations in market conditions, sales forecasts, and operational expenses. By adjusting the budget to reflect these dynamics, organizations can ensure it remains a vital tool for informed economic decision-making.

Our team strongly advocates for an expedited decision-making cycle during the turnaround process, empowering CFOs and their teams to take decisive action to uphold organizational health. Regular budget evaluations not only uncover discrepancies between actual outcomes and forecasts but also enable leaders to leverage real-time analytics through our client dashboard for continuous performance monitoring.

Furthermore, operationalizing lessons learned during turnarounds within budget reviews can significantly enhance adaptability and foster innovation. Case studies reveal that companies consistently assessing their budgets, supported by real-time analytics, are better equipped to navigate economic fluctuations, ultimately leading to improved monetary health and growth.

Indeed, statistics indicate that small enterprises conducting regular budget evaluations are more likely to successfully adapt to changing market conditions, underscoring the critical importance of this practice.

Pad Your Income: Exploring Additional Revenue Streams

Identifying and developing new revenue streams is essential for small enterprises aiming to enhance financial stability. This can involve diversifying product lines, entering new markets, or utilizing existing assets to generate additional income. For instance, retail companies can benefit from launching an online sales platform, which not only expands their reach but also addresses the increasing demand for e-commerce. Additionally, subscription services can create a steady income flow by offering regular customers exclusive products or discounts.

Statistics show that small enterprises have been crucial in job creation, representing 62.7% of all new positions since 1995. This underscores their vital role in the economy and highlights the necessity for financial recovery action plans that explore new revenue opportunities. Furthermore, a significant trend among SaaS companies indicates that 61% plan to adopt usage-based pricing models in 2023, reflecting a shift towards flexible pricing strategies that align with customer consumption. This approach not only enhances customer satisfaction but also opens new avenues for revenue generation.

Nick Johnson, a senior director at Salesforce, emphasizes the importance of adapting to the evolving market landscape: "Companies must adapt to the changing landscape of consumer information access." This insight underscores the necessity for small enterprises to explore additional revenue streams to thrive in a competitive environment. Business strategists further stress the importance of incorporating financial recovery action plans that diversify income sources to mitigate risks and capitalize on emerging opportunities. By leveraging technology and real-time analytics, businesses can identify trends and customer preferences, enabling them to tailor their offerings effectively.

Moreover, mastering the cash conversion cycle is essential for optimizing cash flow and profitability. Implementing strategies from 'Mastering the Cash Conversion Cycle: 20 Strategies for Optimal Business Performance' that streamline decision-making and operationalize lessons learned can significantly improve economic performance. Case studies illustrate successful implementations of new revenue strategies. For instance, a retail business that embraced an online sales platform experienced a notable rise in revenue, showcasing the effect of innovative product offerings on economic performance. Additionally, the shift towards usage-based pricing has allowed many companies to enhance flexibility in their pricing models, which can significantly reduce operational costs. As companies navigate the complexities of the market, exploring additional revenue streams can lead to sustainable growth and enhanced resilience.

Set New Financial Goals: Planning for Sustainable Growth

Setting clear long-term financial objectives is crucial for aligning your vision with actionable results. These goals should encompass targets for revenue growth, profit margins, and market share, serving as a roadmap for sustainable success. Effective communication of these objectives across the organization fosters a collective commitment to achieving them.

For instance, research indicates that only 25% of small enterprises survive for 15 years or longer, underscoring the essential need for strategic planning. Furthermore, expert insights suggest that small businesses should aim for an average revenue growth target of 5% to 10% annually to remain competitive. CFOs emphasize the importance of articulating monetary objectives within their teams, as this clarity enhances accountability and motivation.

As Ramit Sethi wisely remarked, 'You don't have to be wealthy to be a philanthropist, just as you don't have to be wealthy to invest,' highlighting the importance of planning at all levels. Real-world examples illustrate how businesses that prioritize sustainable growth planning during revitalization not only stabilize but also flourish.

A notable case study revealed that companies implementing financial recovery action plans, including mastering the cash conversion cycle, experienced significant improvements in their operational efficiency and profitability. Moreover, with 56% of small-business owners indicating that cybersecurity threats impact their operations, it is essential to consider these challenges when establishing economic objectives.

By establishing and conveying long-term economic objectives, organizations can navigate challenges more effectively and position themselves for lasting success. Additionally, the statistic showing a 22.1% decline in employees within the other services sector further highlights the current economic difficulties faced by small enterprises, making strategic monetary planning even more essential.

To support these efforts, Transform Your Small/Medium Company offers a comprehensive guide on 'Mastering the Cash Conversion Cycle' for $99.00, which includes 20 strategies for optimal performance, providing actionable insights for CFOs to enhance their planning.

Implement Financial Recovery Solutions: Utilizing Effective Strategies

To effectively navigate economic recovery, small businesses must consider a range of solutions, such as:

- Debt restructuring

- Cost-cutting measures

- Exploring additional financing options

Collaborating with investment consultants, like those from Transform Your Small/Medium Business, provides valuable insights into tailored strategies for specific situations. Our comprehensive turnaround and restructuring consulting services focus on detailed monetary assessments, including bankruptcy case management, which help identify opportunities to preserve cash and reduce liabilities. Notably, studies on debt restructuring success rates reveal that companies implementing these strategies often achieve a success rate exceeding 70%.

Systematic implementation of these solutions is vital; organizations should regularly monitor their effectiveness and be prepared to make necessary adjustments. This proactive approach not only addresses immediate financial challenges but also establishes a foundation for long-term sustainability. Our temporary management services offer practical executive guidance for crisis resolution and transformational change, enabling organizations to adapt swiftly to evolving circumstances.

Case studies underscore the importance of resilience in recovery. For example, companies that developed robust coping strategies and support networks managed setbacks while remaining focused on their objectives. This aligns with the findings from the case study titled 'Building Resilience in Recovery,' which emphasizes that resilience is crucial for both leaders and individuals facing challenges in recovery. As financial consultant Louie Anderson aptly noted, 'We all think we're going to get out of debt,' reflecting the widespread aspiration for financial stability among small enterprises.

By prioritizing debt restructuring and leveraging expert guidance from Transform Your Small/Medium Business, small businesses can enhance their chances of achieving a fulfilling and significant turnaround, ultimately paving the way for a more resilient future.

Stay Motivated: Maintaining Momentum During Financial Recovery

Encouraging open dialogue within your team is essential during the healing process. Regularly discussing progress and challenges not only builds trust but also fosters collaboration. Celebrating small wins can significantly boost morale, keeping the team focused on overarching goals. Implementing structured check-ins and team-building activities, such as brainstorming sessions or collaborative projects, reinforces unity and purpose—essential elements for navigating financial recovery action plans.

Our team advocates for an expedited decision-making cycle during the turnaround process, enabling your team to take decisive action to safeguard your organization. Furthermore, we continually monitor the success of our plans through a client dashboard that provides real-time business analytics, allowing for continuous diagnosis of your business health.

Research indicates that engaged employees are 87% less likely to leave their organization, underscoring the importance of maintaining motivation. Moreover, disengaged employees cost organizations billions in lost productivity each year, illustrating the economic impact of low engagement. Effective communication can lead to a 33% reduction in stress-related absences, as noted by Matter, further enhancing productivity.

Consider incorporating financial incentives, as 57% of U.S. employees report that bonuses or commissions motivate them to perform better. The case study titled 'Financial Incentives and Employee Motivation' illustrates how well-structured incentive programs can significantly boost motivation.

By prioritizing communication and motivation—especially given that global employee engagement remained low at 23% in 2024—small businesses can significantly improve their chances of successful financial recovery action plans.

Conclusion

In a world where small and medium-sized enterprises face unprecedented challenges, implementing effective financial recovery strategies is paramount for survival and growth. By undertaking a thorough assessment of financial damage, businesses can gain valuable insights into their current situation, allowing for the identification of key areas that need attention. Setting SMART goals creates a roadmap for immediate action, empowering businesses to tackle current financial issues while positioning themselves for sustainable success.

Moreover, the importance of revising budgets and aligning them with evolving business needs cannot be overstated. Regular budget reviews ensure that organizations can adapt to market fluctuations and operational changes, ultimately enhancing their financial health. Additionally, exploring new revenue streams is essential for fostering resilience; diversification not only mitigates risk but also opens doors to new opportunities for growth.

As businesses implement these strategies, maintaining motivation and open communication within teams is vital. Celebrating small victories and fostering collaboration can significantly enhance morale, driving collective efforts toward recovery. By prioritizing these comprehensive financial recovery solutions, small and medium-sized enterprises can not only navigate immediate challenges but also build a robust foundation for long-term success in an ever-competitive landscape. The time to act is now; the future of business resilience depends on the proactive steps taken today.

Frequently Asked Questions

What is involved in creating financial recovery action plans?

Creating financial recovery action plans requires a thorough evaluation of an enterprise's unique situation, including cash flow obstacles, debt levels, and operational shortcomings. A comprehensive financial review can help uncover opportunities to conserve cash and reduce liabilities.

How can a turnaround consultant assist in financial recovery?

A turnaround consultant provides expertise in developing strategies that specifically address issues related to financial recovery, ensuring that the plans are actionable and measurable, which facilitates prompt restoration and lays the groundwork for long-term success.

Why is a recovery strategy important for businesses?

With nearly 600,000 enterprises closing each year, a recovery strategy is essential for addressing economic challenges and enhancing organizational resilience and performance.

What services do turnaround and restructuring consulting firms offer?

They offer extensive services including interim management and bankruptcy case management, specifically designed to support small to medium enterprises in achieving financial recovery objectives.

What fiscal statements are essential for assessing monetary damage in small enterprises?

Essential fiscal statements include balance sheets and cash flow reports, which help identify trends in revenue, expenses, and profitability.

How can monetary ratios enhance the evaluation of financial health?

Monetary ratios provide insights into liquidity and solvency, highlighting areas of economic hardship and serving as a foundation for developing financial recovery action plans.

What is the significance of setting SMART objectives for financial recovery?

Setting specific, measurable, achievable, relevant, and time-bound (SMART) objectives is crucial for small enterprises as it helps them establish clear goals for financial recovery, such as lowering overhead expenses or boosting sales.

How often should financial objectives be assessed?

Frequent assessments of financial objectives are essential to maintain their relevance and implement necessary modifications.

What impact can structured financial objectives have on performance?

Research indicates that businesses implementing structured financial objectives can achieve significant improvements in performance, with many realizing profit margins between 25% and 40%.

What strategies can enhance cash flow and profitability?

Strategies such as optimizing inventory turnover and accelerating receivables collection are essential for enhancing cash flow and profitability.