Overview

This article highlights the essential insolvency resolution services that CFOs must leverage to manage financial distress effectively and drive recovery within their organizations. It outlines seven critical services, including tailored consulting, operational restructuring, and technology-enabled solutions. These services are vital for navigating insolvency challenges and fostering sustainable growth through strategic planning and robust financial management practices. By employing these strategies, organizations can enhance their resilience and ensure long-term success.

Introduction

In a landscape where financial challenges loom large for small and medium enterprises, the importance of comprehensive insolvency resolution consulting is paramount. As businesses navigate the complexities of financial distress, tailored strategies crafted by expert consultants emerge as a beacon of hope. By delving deep into the financial health, operational efficiency, and market positioning of each organization, these consultants not only facilitate recovery but also lay the groundwork for sustainable growth.

With an alarming rise in bankruptcy filings and a pressing need for effective financial management, organizations must prioritize innovative solutions that address their unique challenges. This article explores multifaceted approaches to insolvency resolution, cash flow management, and operational restructuring, providing insights into how businesses can navigate turbulent waters and emerge resilient in an ever-evolving economic landscape.

Transform Your Small/ Medium Business: Comprehensive Insolvency Resolution Consulting

begin with a meticulous assessment of an organization's economic stability, operational effectiveness, and market positioning. By collaborating closely with enterprise owners, consultants at Transform Your Small/Medium Enterprise craft customized strategies that specifically address the unique challenges faced by each organization. This tailored approach not only facilitates navigation through periods of economic difficulty but also lays the groundwork for sustainable growth and stability. Our comprehensive turnaround and restructuring consulting, coupled with interim management services, empowers businesses to focus on their core operations while we handle the complexities of fiscal assessment and bankruptcy case management.

Recent trends reveal that Chapter 7 filings are prevalent, with weekly Chapter 13 filings estimated between 4,000 and 4,500. This underscores the urgent need for effective insolvency resolution services. As Louie Anderson aptly stated, 'We all think we're going to get out of debt,' reflecting a common sentiment among those facing financial challenges. As enterprises confront these obstacles, the role of expert advisors becomes increasingly vital in fostering resilience and long-term success. The latest data highlights a diverse array of economic hardships across the United States, emphasizing the necessity for comprehensive plans that align with the organization's commitment to helping enterprises achieve sustainable growth.

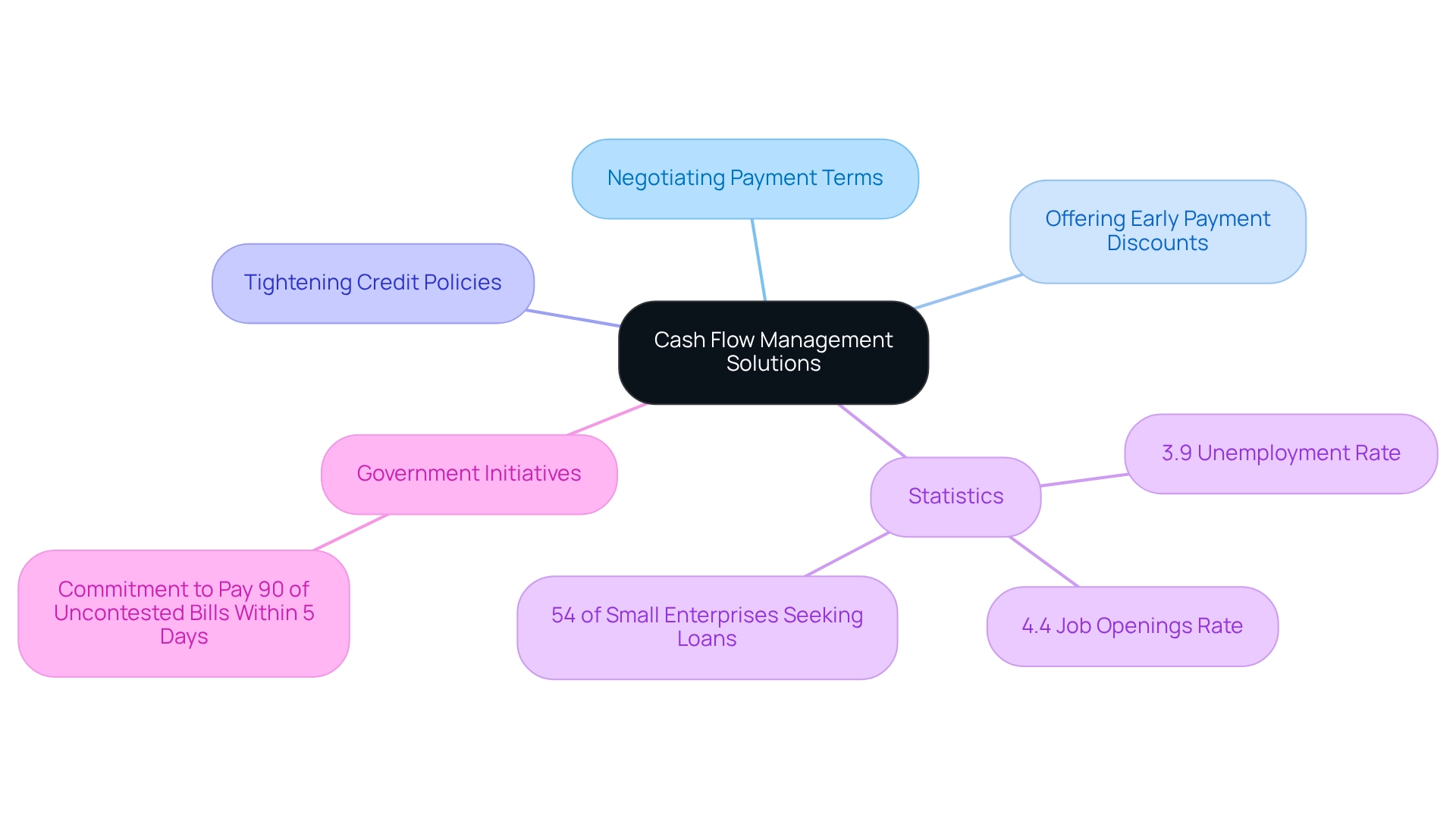

Cash Flow Management Solutions: Strategies for Financial Stability

Effective cash flow management is vital for sustaining economic stability, particularly in today's economic landscape, where the unemployment rate stands at 3.9 percent and the job openings rate is at 4.4 percent. Implementing robust solutions involves accurately forecasting cash needs, optimizing receivables, and controlling expenses. Strategies such as:

- Negotiating favorable payment terms with suppliers

- Offering discounts for early payments

- Tightening credit policies

can lead to significant cash flow improvements. By mastering the cash conversion cycle through organized approaches, including the 20 Methods for Optimal Organizational Performance, companies can improve their overall performance.

Consistent cash flow examination, backed by real-time analytics, allows CFOs to foresee possible deficits and make knowledgeable choices that protect their financial well-being. In reality, small enterprises that implement organized cash flow management techniques can experience average enhancements of up to 20% in their cash flow situations. Moreover, the dependence on outside funding is clear, as 54% of sought a loan or line of credit in 2018, emphasizing the significance of effective cash flow practices.

Additionally, government initiatives aimed at supporting small businesses, such as the commitment to pay 90% of uncontested bills within five days, can further enhance cash flow, enabling firms to maintain operations and invest in growth. As CFOs face these challenges, utilizing effective cash flow management approaches, along with streamlined decision-making processes and real-time analytics, will be crucial for attaining sustainable growth.

Financial Assessment Services: Identify Opportunities for Cost Reduction

Financial Assessment Services: Identify Opportunities for Cost Reduction

Financial assessment services deliver a thorough analysis of a company's financial statements, operational processes, and market conditions. By pinpointing inefficiencies and avoidable expenses, businesses can implement targeted cost-cutting measures that enhance their cash conversion cycle. These strategies may involve:

- Renegotiating contracts

- Streamlining operations

- Eliminating redundant processes

For example, organizations utilizing advanced spend management solutions have attained complete visibility of their spending, facilitating informed decision-making and proactive identification of cost-saving opportunities. In 2025, have become indispensable, with statistics revealing that companies employing these assessments can achieve significant enhancements in profitability and cash flow, accompanied by a notable Return on Investment (ROI) from their initiatives.

By mastering the cash conversion cycle through 20 techniques for optimal performance, companies can bolster their operational efficiency and profitability. Expert insights underscore that a comprehensive examination of monetary statements is vital for uncovering inefficiencies, ultimately leading to effective cost-reduction strategies. As Jean Chatzky aptly states, "By definition, saving for anything requires us not to get things now so that we can get bigger ones later."

By leveraging these insights, companies can not only improve their operational efficiency but also position themselves for sustainable growth. The pricing for these financial assessment services is set at $99.00, representing a valuable investment for CFOs aiming to enhance their company's financial health.

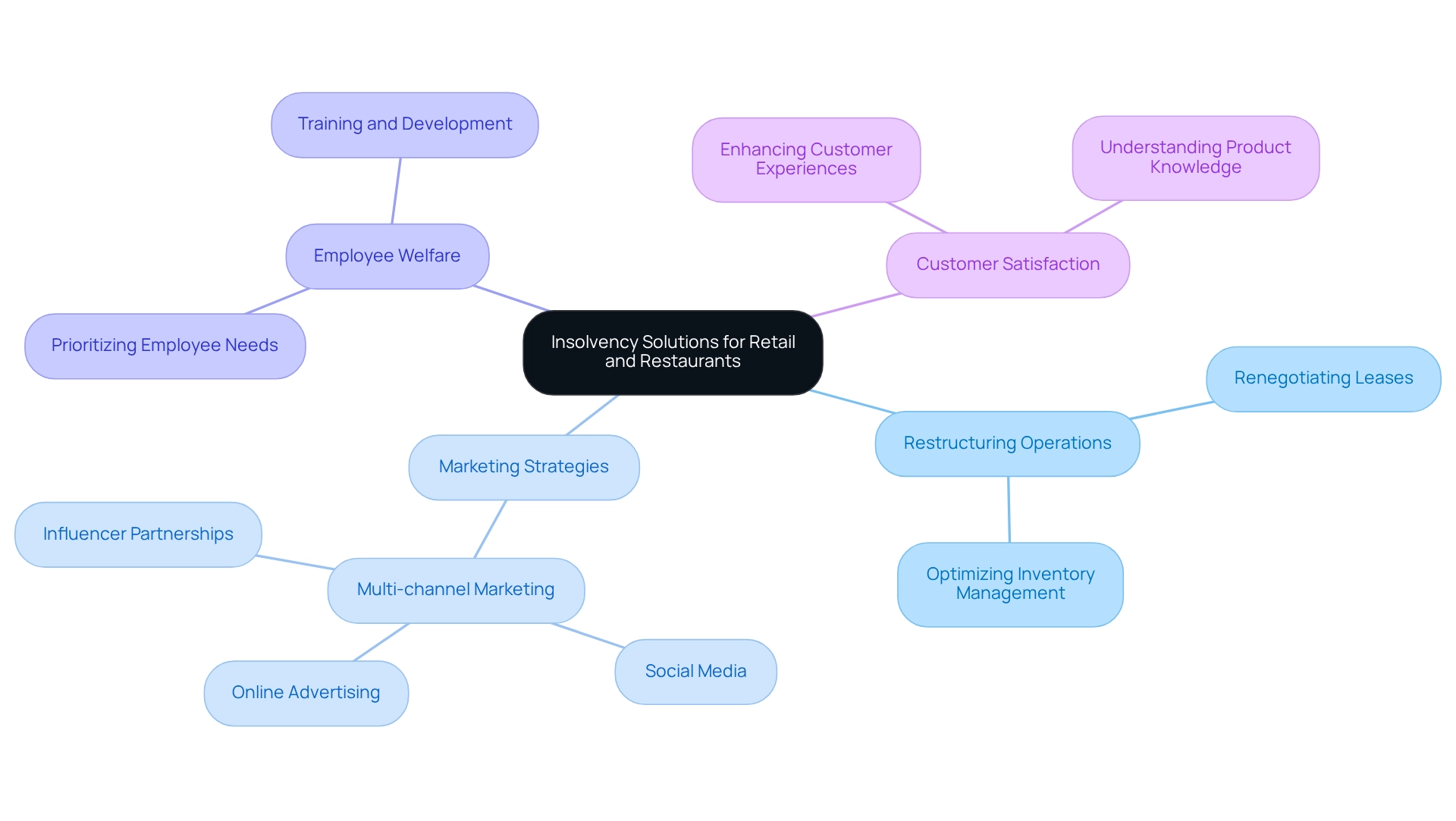

Retail and Restaurant Insolvency Solutions: Tailored Strategies for Recovery

Tailored insolvency resolution services for retail and restaurant enterprises underscore the critical need for restructuring operations, renegotiating leases, and optimizing inventory management. Successful strategies involve executing cost-effective marketing campaigns, enhancing customer experiences, and leveraging technology to improve operational efficiency.

For instance, restaurants that implement multi-channel marketing strategies—utilizing social media, online advertising, and influencer partnerships—can significantly elevate customer engagement and drive traffic.

As we look towards 2025, continues to face challenges, with many companies struggling to maintain profitability amidst declining consumer traffic. Notably, JCPenney has shuttered approximately 200 locations since filing for Chapter 11 bankruptcy in 2020, underscoring the urgency for effective recovery strategies.

Companies that prioritize employee welfare and customer satisfaction, as Kip Tindell, co-founder of the Container Store, emphasizes, often experience superior recovery outcomes. He states, 'Too many companies today are based on driving prices lower by screwing over somebody: pounding suppliers or squeezing employees. We're the opposite. We put our employees first. If you take care of them, they will take care of your customers better than anybody else.' This approach is vital in the context of restructuring operations.

Furthermore, McDonald's CFO Ian Frederick Borden's remarks on the declining restaurant industry traffic highlight the necessity for tailored solutions. By addressing the unique challenges within these sectors, companies can utilize insolvency resolution services to navigate insolvency and emerge stronger, armed with solutions that not only stabilize operations but also position them for sustainable growth.

Optimized decision-making processes and real-time analytics are essential for tracking performance and adjusting strategies effectively. Understanding product knowledge is also crucial for retail success, as it allows businesses to align their offerings with customer needs.

The case study titled 'Marketing Strategies for Restaurants' illustrates that restaurants developing multi-channel marketing strategies can effectively reach their target audience and enhance customer engagement, ultimately leading to improved recovery outcomes.

Interim Management Services: Leadership During Financial Crisis

Interim oversight services are crucial in navigating organizations through financial turmoil by positioning seasoned leaders in essential roles for insolvency resolution services. These professionals bring extensive experience, allowing them to quickly assess challenges, implement necessary changes, and stabilize operations effectively. Their leadership is vital for operational recovery and for maintaining employee morale, which is essential for fostering a culture of resilience and growth through effective insolvency resolution services.

In 2025, the significance of strong leadership during business recovery cannot be overstated. As Jon Younger noted, "Crisis and risk oversight: Handling economic volatility, managing risks, and addressing supply chain challenges while offering effective crisis response solutions." Interim managers are recognized as change agents who excel at cultivating an environment of innovation, balancing stability with the need for transformation. Their capacity to streamline decision-making processes and leverage real-time analytics is crucial for executing effective turnaround strategies. Moreover, understanding the cash conversion cycle is imperative, as it directly impacts liquidity and operational efficiency. Statistics reveal that organizations utilizing insolvency resolution services can stabilize operations within an average of three to six months, significantly reducing recovery time.

Numerous successful leadership examples exist within organizations that have confronted financial distress. For instance, interim leaders have played a pivotal role in implementing turnaround strategies that not only address immediate challenges but also establish a foundation for sustainable growth through insolvency resolution services. Their ability to navigate complex situations and drive change is highlighted by case studies that demonstrate effective interim leadership techniques, such as fostering open communication, setting clear objectives, and empowering teams. These practices underscore the critical role these leaders play in promoting agility and innovation during crises while operationalizing lessons learned through continuous performance monitoring.

As the landscape for engaging temporary leaders evolves, with an increasing number of supply sources like freelance consulting platforms and executive recruiters, the demand for their expertise continues to rise. This trend reflects a growing recognition of the effectiveness of temporary leadership in crisis recovery, making it an essential consideration for CFOs aiming to guide their organizations toward stability and success. Furthermore, understanding the cost implications of is vital for CFOs to make informed financial decisions.

Operational Restructuring Services: Streamline Operations for Efficiency

are essential for analyzing and refining organizational processes to enhance efficiency. This approach often encompasses reengineering workflows, integrating advanced technologies, and eliminating operational bottlenecks. By streamlining operations, organizations can achieve substantial cost savings—research indicates that effective restructuring can lower operational expenses by up to 30%—while simultaneously improving service delivery and strengthening their competitive advantage in the market.

Numerous successful examples abound, particularly in the retail and hospitality sectors, where companies have leveraged restructuring services to optimize their operations. For instance, a mid-sized restaurant chain conducted a thorough operational review, resulting in a 25% reduction in overhead costs and a notable increase in customer satisfaction ratings.

Expert insights highlight the importance of adopting cutting-edge techniques in operational restructuring. Employing tools such as SWOT analysis enables organizations to pinpoint critical dynamics influencing their operations, facilitating targeted enhancements. Furthermore, the integration of artificial intelligence technologies, including machine learning, has proven to enhance efficiency in fraud detection and customer service, further streamlining organizational processes.

As we look toward 2025, the success rates of operational restructuring initiatives reflect an upward trend, with many enterprises reporting improved efficiency metrics following restructuring efforts. By investing in insolvency resolution services, CFOs can leverage real-time analytics and strategic improvement techniques to position their organizations for sustainable growth and resilience in an ever-evolving market landscape. This ongoing performance monitoring and relationship-building through analytics implements turnaround lessons, ensuring that organizations remain agile and responsive to market demands. Additionally, specific strategies for mastering the cash conversion cycle, such as optimizing inventory management and improving receivables collection, can further enhance operational efficiency and economic performance.

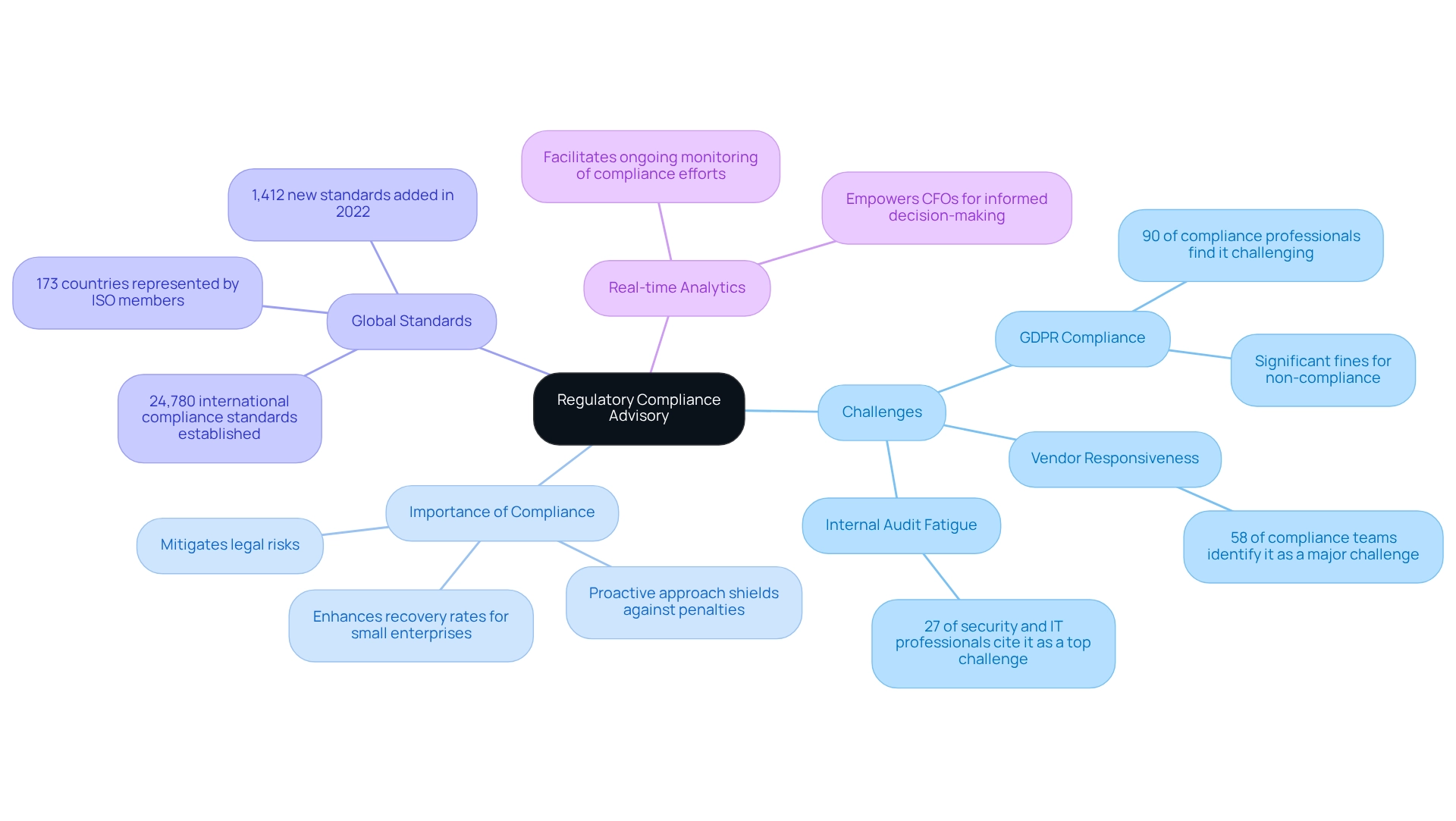

Regulatory Compliance Advisory: Navigate Legal Frameworks Effectively

Regulatory compliance advisory services are crucial for businesses navigating the complex legal frameworks associated with insolvency resolution services. These services encompass adherence to reporting standards, tax obligations, and various regulatory requirements. By ensuring compliance, organizations can mitigate legal risks that may exacerbate their economic situations and hinder recovery efforts.

Notably, 90% of compliance professionals regard GDPR compliance as particularly challenging, reflecting the broader difficulties encountered in meeting . Furthermore, sustaining robust compliance practices can significantly enhance recovery rates for small enterprises, as adept navigation of legal structures is vital during financial hardship. Legal experts underscore that a proactive approach to compliance not only shields against potential penalties but also cultivates a more resilient operational framework.

As the landscape of insolvency regulations evolves, staying informed about updates and best practices is essential for organizations striving to excel amidst challenges. With 173 countries represented by ISO members and 24,780 international compliance standards established—including 1,412 new standards added in 2022—the global significance of compliance standards in insolvency cannot be overstated.

Additionally, leveraging real-time analytics can facilitate ongoing monitoring of compliance efforts, empowering CFOs to make informed decisions swiftly. This is particularly critical as 58% of compliance teams identify gauging vendor responsiveness as their greatest challenge, highlighting the complexities CFOs face in managing compliance during insolvency. Moreover, 27% of security and IT professionals cite mitigating internal audit fatigue as a top compliance challenge, further emphasizing the obstacles organizations may encounter.

Therefore, a comprehensive understanding of these dynamics, coupled with streamlined decision-making processes and real-time performance monitoring, is vital for effective compliance oversight in insolvency resolution services. By applying lessons learned and rigorously testing every hypothesis, companies can maximize their returns and bolster their resilience against regulatory challenges.

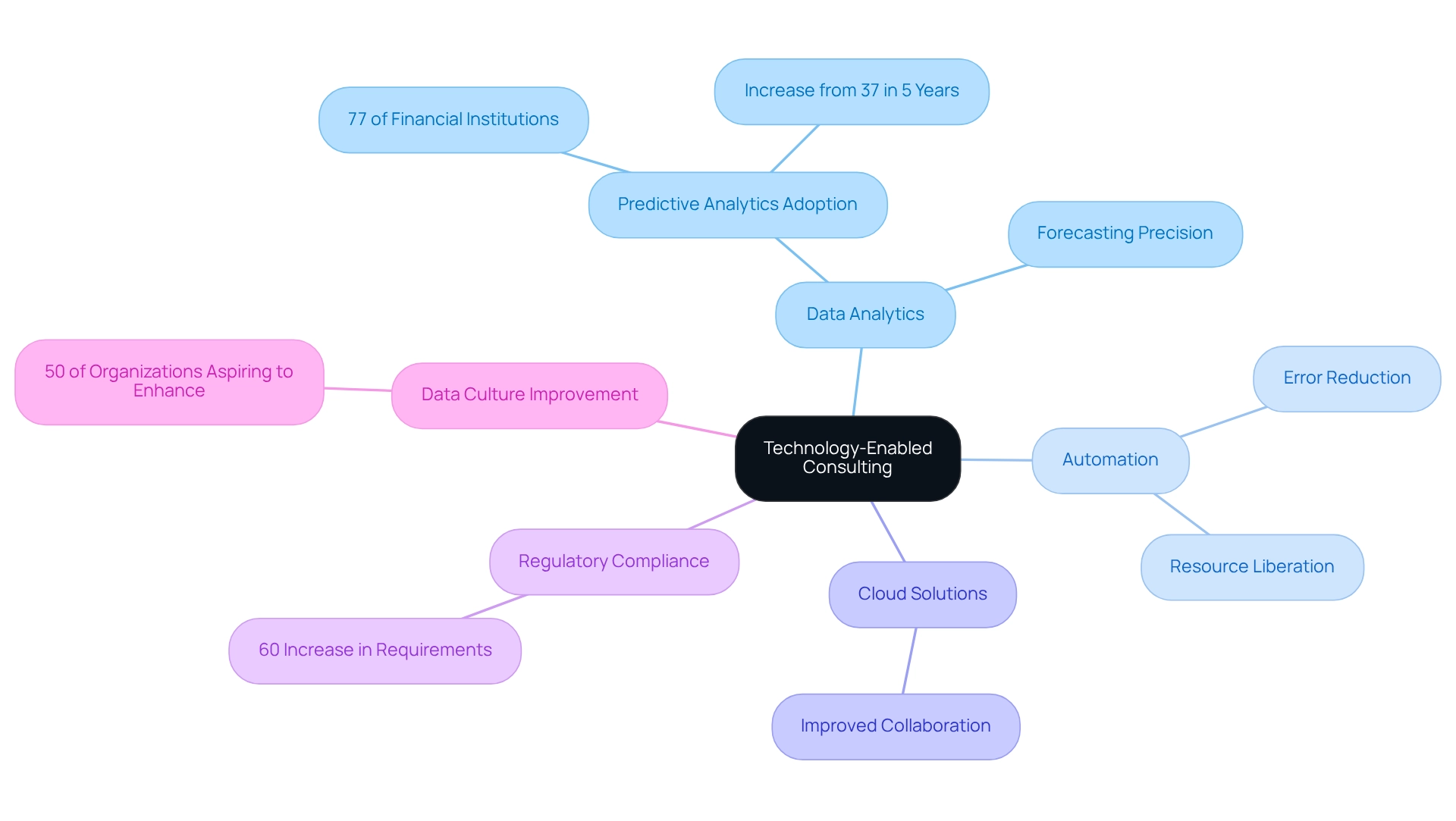

Technology-Enabled Consulting: Leverage Innovation in Financial Management

Technology-enabled consulting services harness advanced tools and software to significantly enhance fiscal management processes. By applying data analytics, companies can achieve more precise forecasting—an increasingly essential capability, as evidenced by the fact that 77% of monetary institutions have embraced predictive analytics, a substantial increase from 37% five years ago. Furthermore, over 60% of banking organizations have reported an uptick in regulatory requirements, underscoring the necessity for robust technology solutions to ensure compliance.

Automation of routine tasks minimizes errors and liberates valuable resources, while cloud-based solutions promote improved collaboration across teams. By adopting these technologies, organizations can optimize operations, gain deeper insights into economic performance, and make informed decisions critical for recovery and sustainable growth. Mastering the cash conversion cycle through the strategic implementation of these technologies can lead to optimal business performance.

As noted by Deloitte, 50% of organizations aspire to enhance , highlighting the significance of leveraging technology for efficient resource management. Continuous monitoring through real-time analytics not only supports decision-making but also fosters relationship-building, operationalizing turnaround lessons for sustained success. As the economic landscape evolves, leveraging innovation becomes essential for navigating challenges and seizing opportunities.

Tailored Consulting Services: Customized Solutions for Unique Challenges

Tailored consulting services are essential for creating personalized plans that effectively tackle the unique challenges businesses encounter in insolvency resolution services. This approach encompasses personalized financial assessments, operational enhancements, and strategic planning, all designed to align with the specific needs of each client. By prioritizing these individualized solutions, consultants can significantly increase the likelihood of achieving successful outcomes and fostering sustainable growth.

For instance, the SMB team's 'Rapid30' plan, priced at $99.00, has proven transformative for clients, enabling them to diagnose issues quickly and implement effective strategies. Statistics reveal that companies utilizing customized solutions often experience a median return on investment of seven times their initial coaching investment, as highlighted in the case study titled 'Impact of Coaching on Consultants.' Furthermore, 96% of clients who hire coaches would repeat the process, indicating high satisfaction and perceived value.

As one pleased client remarked, 'Within 100 days of meeting the SMB team, my company was in a better position financially and strategically than it had been in years.' Expert insights highlight that is essential in developing customized insolvency resolution services, ultimately resulting in enhanced performance and recovery rates for small enterprises facing financial challenges.

As Bobby Darnell wisely points out, 'Learning new systems and processes is not essential…but neither is remaining operational,' highlighting the importance of adjusting to new approaches in insolvency circumstances.

Sustainable Growth Strategies: Planning for Long-Term Success After Insolvency

are essential for companies that require insolvency resolution services to not only recover but also thrive in the long term. A pivotal aspect of this journey is the establishment of clear growth objectives that steer recovery efforts. Investing in innovation and nurturing robust customer relationships are critical components of this strategy. Research reveals that approximately 70% of enterprises with a strategic plan endure beyond their first five years, underscoring the necessity of long-term planning for sustainable success, particularly in the context of insolvency resolution services to aid recovery.

Moreover, organizations that integrate both strategic and implementation plans significantly bolster their chances of achieving their goals. Case studies illustrate that companies prioritizing sustainability not only comply with regulations but also create substantial value, positioning themselves for resilience in a volatile market. Phil Harding aptly states, "Without environmental sustainability, economic stability and social cohesion cannot be achieved," reinforcing the notion that sustainable practices are integral to long-term success.

Incorporating insolvency resolution services along with sustainable growth strategies post-insolvency necessitates a commitment to continuous improvement and adaptability. Successful examples abound of companies that have redefined their operational models to align with market demands while maintaining a focus on environmental and social governance. By embracing principles such as mastering the cash conversion cycle and leveraging real-time analytics, organizations can adeptly navigate challenges and emerge stronger, ensuring their long-term viability and success. To implement these strategies effectively, CFOs should contemplate developing a comprehensive sustainability plan that aligns with their overarching business objectives, fostering a culture of innovation and accountability throughout the organization.

Conclusion

The journey through financial distress can be daunting for small and medium enterprises; however, with the right strategies and expert guidance, recovery is not just possible—it can lead to sustainable growth. Comprehensive insolvency resolution consulting provides the necessary framework for assessing and improving a business's financial health, operational efficiency, and market positioning. By crafting tailored solutions, organizations can navigate the complexities of financial challenges while laying the groundwork for future success.

Effective cash flow management and financial assessment services are crucial in this landscape, enabling businesses to identify opportunities for cost reduction and enhance their overall performance. By leveraging innovative strategies and technologies, organizations can streamline operations, optimize resources, and make informed decisions that bolster their financial stability. Moreover, interim management services and operational restructuring play pivotal roles in guiding companies through crises, ensuring they maintain momentum and employee morale during turbulent times.

As businesses face the ongoing challenges of insolvency, embracing tailored consulting services and sustainable growth strategies becomes essential. The ability to adapt to changing market conditions and prioritize long-term planning will not only improve recovery rates but also position organizations for enduring success. By committing to continuous improvement and integrating sustainability into their business models, companies can emerge from financial distress with renewed strength and resilience.

Ultimately, the proactive approach to insolvency resolution and strategic planning is vital for organizations aiming to thrive in an ever-evolving economic landscape. With expert guidance and a focus on tailored solutions, businesses can transform challenges into opportunities, ensuring their longevity and success in the competitive marketplace.

Frequently Asked Questions

What are the initial steps in insolvency resolution services?

Thorough insolvency resolution services begin with a meticulous assessment of an organization's economic stability, operational effectiveness, and market positioning.

How does Transform Your Small/Medium Enterprise assist businesses facing economic challenges?

Consultants at Transform Your Small/Medium Enterprise collaborate closely with enterprise owners to craft customized strategies that address the unique challenges faced by each organization, facilitating navigation through economic difficulties and laying the groundwork for sustainable growth.

What services are included in the comprehensive turnaround and restructuring consulting?

The services include comprehensive turnaround and restructuring consulting, interim management services, and assistance with fiscal assessment and bankruptcy case management.

What recent trends in bankruptcy filings highlight the need for insolvency resolution services?

Recent trends show that Chapter 7 filings are prevalent, with weekly Chapter 13 filings estimated between 4,000 and 4,500, underscoring the urgent need for effective insolvency resolution services.

Why is effective cash flow management important for businesses?

Effective cash flow management is vital for sustaining economic stability, particularly in today's economic landscape, where it helps businesses forecast cash needs, optimize receivables, and control expenses.

What strategies can improve cash flow for businesses?

Strategies for improving cash flow include negotiating favorable payment terms with suppliers, offering discounts for early payments, and tightening credit policies.

What benefits can small enterprises experience from organized cash flow management?

Small enterprises that implement organized cash flow management techniques can experience average enhancements of up to 20% in their cash flow situations.

How do financial assessment services help businesses?

Financial assessment services provide a thorough analysis of a company's financial statements, operational processes, and market conditions, helping to identify inefficiencies and implement targeted cost-cutting measures.

What are some strategies for cost reduction identified through financial assessment services?

Strategies for cost reduction may involve renegotiating contracts, streamlining operations, and eliminating redundant processes.

What is the pricing for financial assessment services and what value do they provide?

The pricing for financial assessment services is set at $99.00, representing a valuable investment for CFOs aiming to enhance their company's financial health.