Overview

The primary advantages of a stakeholder management course and training for CFOs encompass:

- Enhanced communication skills

- Strategic decision-making capabilities

- Improved organizational performance

These elements are essential for navigating complex business environments. Evidence presented in the article illustrates that effective stakeholder engagement correlates with better financial outcomes, fosters increased trust among parties, and equips organizations with the insights necessary for sustainable growth. Ultimately, these factors contribute significantly to the success of small to medium enterprises.

Introduction

In the competitive landscape of small and medium enterprises, effective stakeholder management is not merely an option—it is a necessity for financial success. As CFOs confront unique challenges, tailored training programs emerge as vital tools, equipping them with the skills essential for aligning stakeholder interests with organizational goals.

This article delves into the critical components of stakeholder management, encompassing:

- The enhancement of communication skills

- The mastery of negotiation techniques

All aimed at fostering robust relationships that drive financial stability and growth. By leveraging stakeholder insights and integrating sustainable practices, financial leaders can navigate complex dynamics and steer their organizations toward long-term success.

Through compelling case studies and actionable strategies, the discussion highlights how a proactive approach to stakeholder engagement can yield significant dividends, ultimately transforming the financial landscape for businesses.

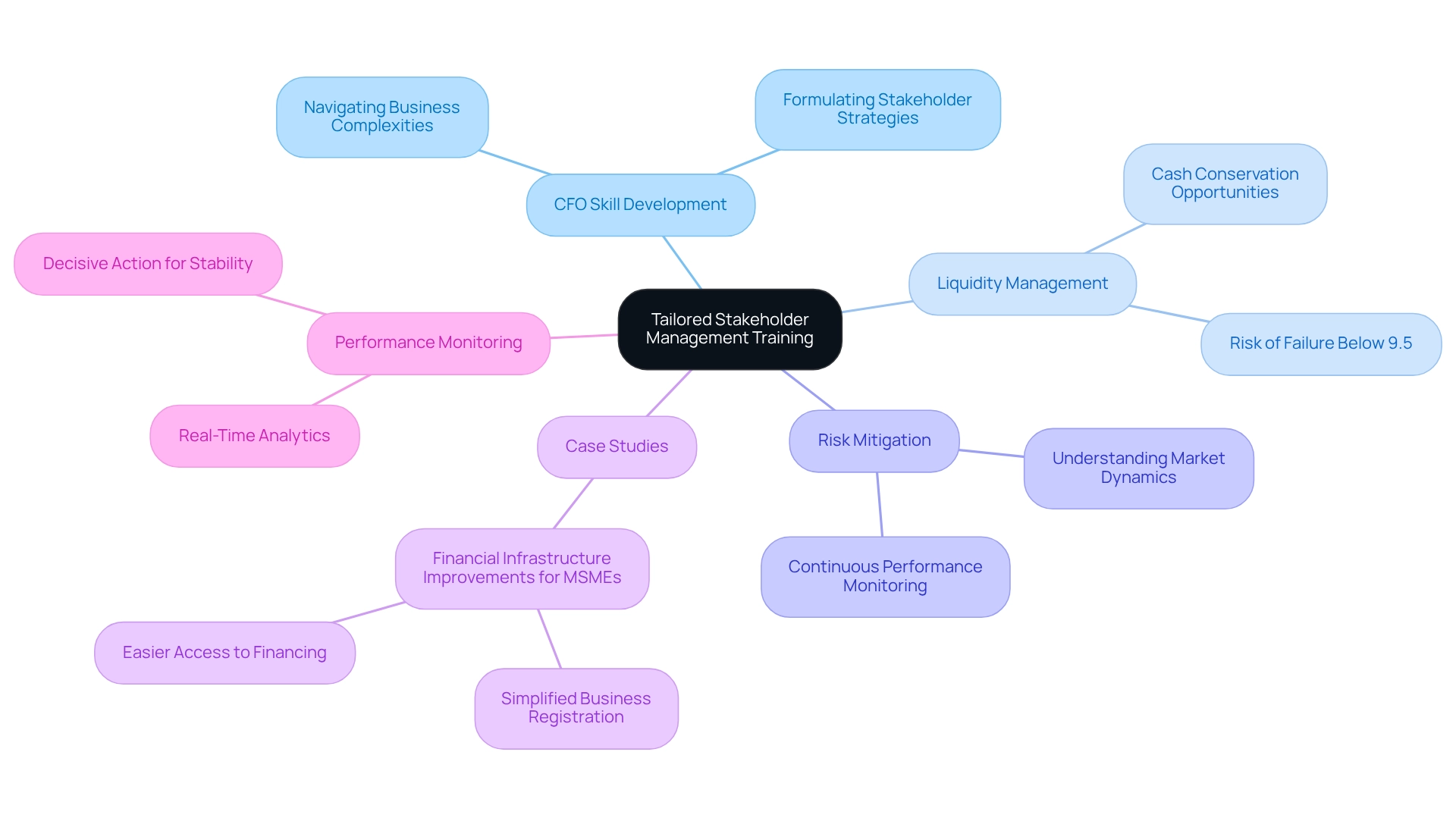

Transform Your Small/ Medium Business: Tailored Stakeholder Management Training for Financial Success

Customized management training equips CFOs with the essential skills necessary to navigate the complexities of their specific business environments. By addressing the unique challenges faced by small to medium enterprises, this stakeholder management course & training empowers leaders to formulate strategies that align the interests of all stakeholders with organizational objectives, thereby fostering economic success.

A thorough monetary evaluation can reveal opportunities to conserve cash and reduce liabilities, which is crucial for maintaining liquidity and mitigating risks associated with economic instability. For instance, a deep understanding of local market dynamics can enhance participant engagement, leading to improved economic outcomes.

Statistics indicate that companies with liquidity below 9.5% encounter a substantial risk of failure, underscoring the critical need for effective stakeholder management course & training to ensure economic stability. This underscores how targeted efforts can pave the way for success.

Furthermore, case studies, such as the monetary infrastructure enhancements for MSMEs in Latin America, demonstrate how streamlined operational processes can facilitate better access to funding and alleviate operational burdens.

By implementing continuous business performance monitoring and leveraging real-time analytics, financial executives can take decisive actions that stabilize economic positions and enhance operations, ultimately making a significant contribution to the overall success of small enterprises.

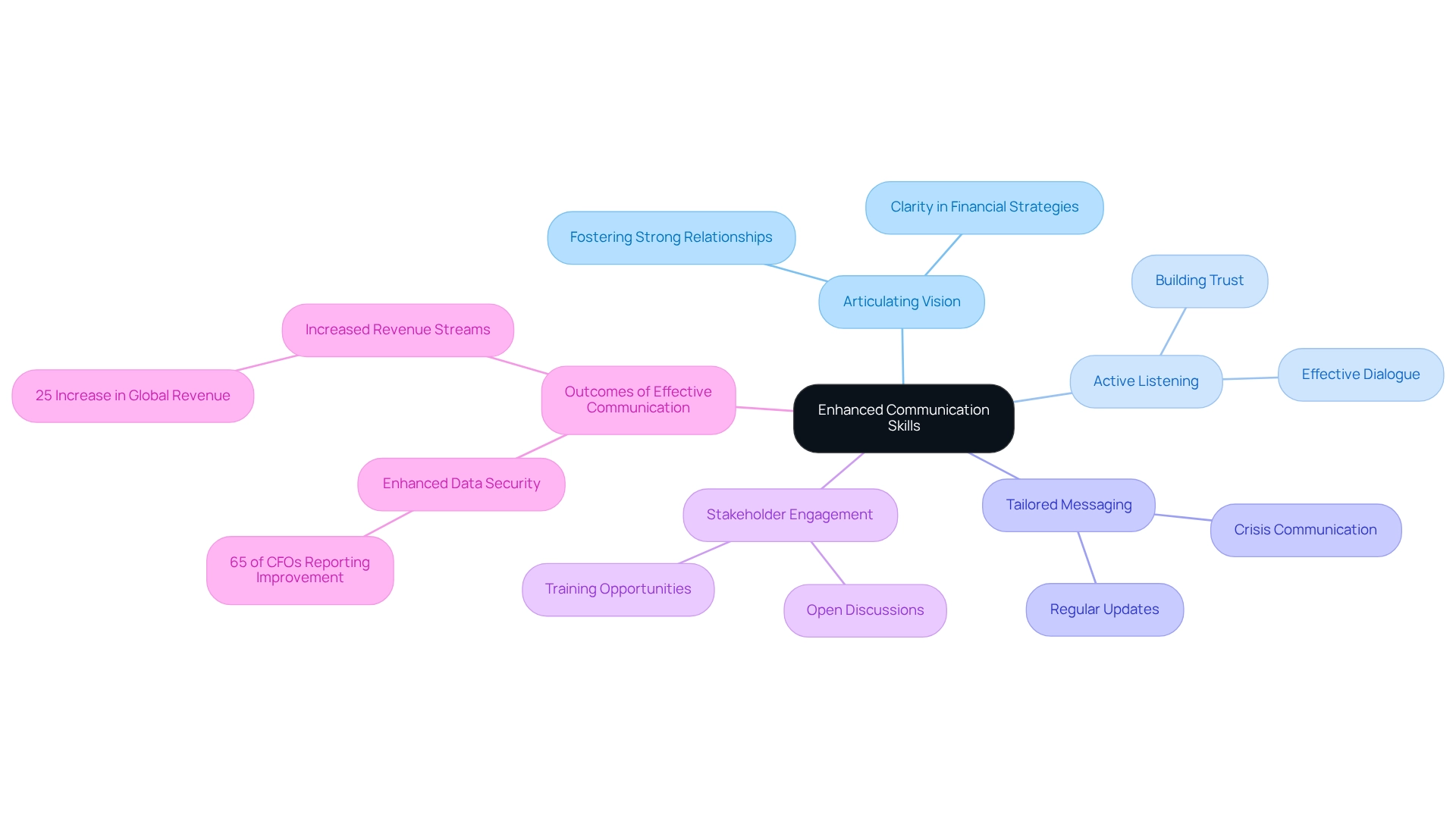

Enhanced Communication Skills: Building Stronger Relationships with Stakeholders

Enhanced communication abilities empower CFOs to articulate their vision and financial strategies with clarity, fostering strong relationships with partners through effective dialogue. Techniques such as active listening and tailored messaging are crucial for enhancing interactions, which can be further developed in a stakeholder management course & training, leading to increased stakeholder buy-in and support.

For instance, regular updates and open discussions regarding economic performance are particularly beneficial in the context of fiscal evaluation and bankruptcy case management, as they build trust and promote collaboration during challenging times. Our approach streamlines the decision-making cycle during the turnaround process, enabling financial leaders to take decisive action to safeguard their organizations.

A notable case study reveals that 58% of financial executives focusing on monetary strategies for market growth experienced a 25% increase in global revenue sources. This illustrates how effective communication can yield significant organizational outcomes, especially in crisis situations where strategic clarity is paramount.

Furthermore, we consistently monitor the success of our strategies through our client dashboard, offering real-time business analytics to assess business health and operationalize turnaround lessons. Statistics indicate that 65% of chief financial officers have reported enhanced data security through the adoption of cloud technologies, underscoring how effective communication facilitates understanding and implementation of such technologies in complex environments.

As financial executives continue to transition into strategic leaders, the capability to communicate effectively will remain a top priority, particularly in sectors like retail and hospitality, where ongoing regulatory and economic challenges necessitate robust communication strategies. To fully leverage these benefits, financial leaders should participate in a stakeholder management course & training and actively engage stakeholders through regular updates and open discussions.

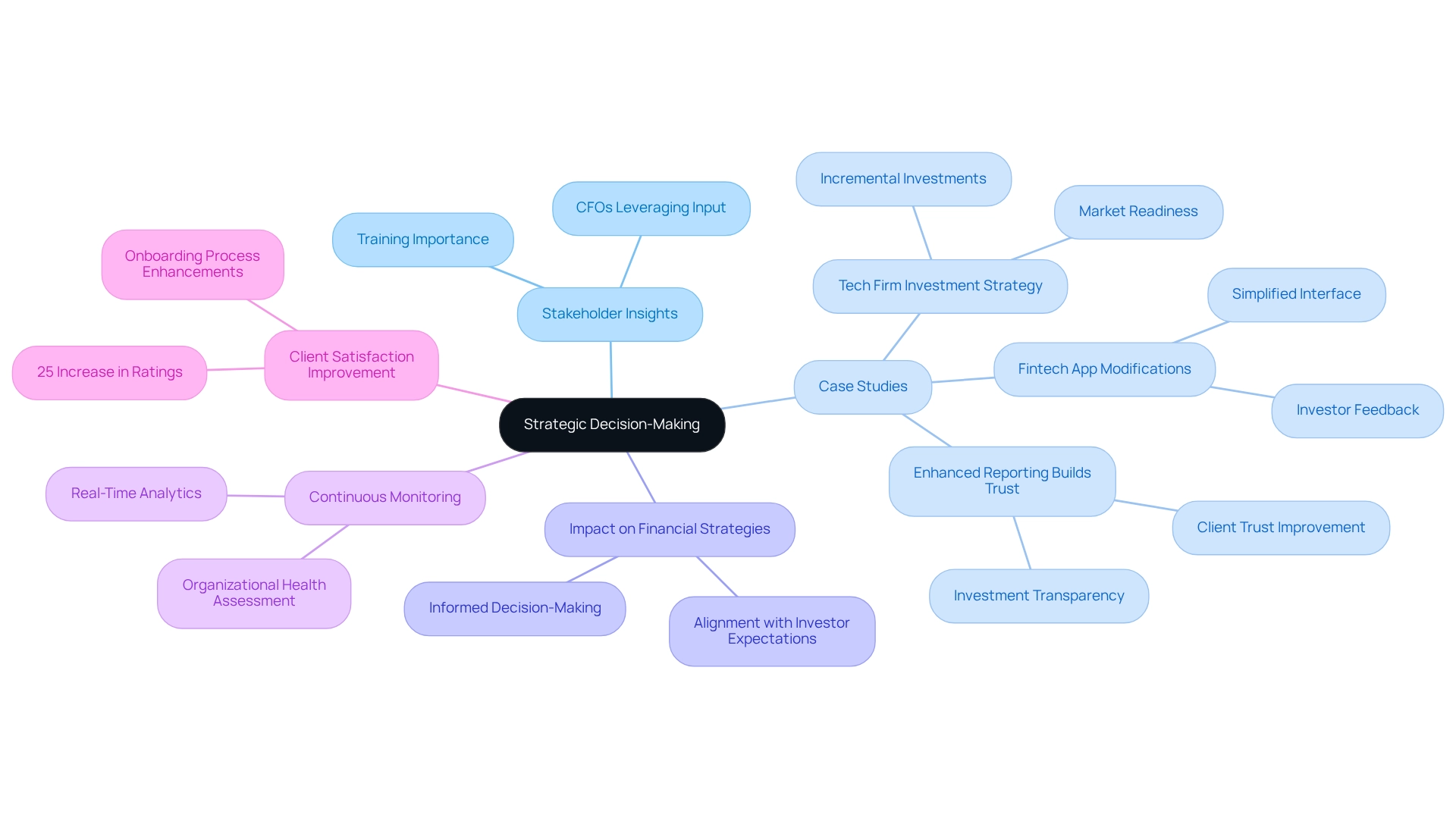

Strategic Decision-Making: Leveraging Stakeholder Insights for Business Growth

Strategic decision-making increasingly relies on insights gathered from interested parties, highlighting the importance of a stakeholder management course & training in steering business growth. Chief Financial Officers (CFOs) can leverage input from these stakeholders to identify market trends, comprehend customer preferences, and recognize potential risks. By integrating these insights into their financial strategies, CFOs can make informed decisions that align with investor expectations and foster sustainable growth.

For example, a mid-sized tech firm adjusted its investment strategy based on stakeholder feedback, opting for smaller, incremental investments after realizing the market was unprepared for a full-scale rollout of a new AI technology. Moreover, a fintech startup improved user adoption rates of its budgeting app by simplifying its interface, a modification prompted by a key investor's feedback on its complexity. These instances underscore the significance of participant perspectives in crafting effective financial strategies.

Furthermore, a case study highlighted how an organization bolstered client trust by overhauling its reporting system in response to stakeholder concerns about investment transparency. This transformation not only strengthened relationships but also illustrated that actively listening to stakeholders can yield substantial enhancements in financial practices. As Lukasz Zelezny, an SEO Consultant, remarked, 'Their feedback was a game-changer.'

In addition, our team streamlines the decision-making cycle during the turnaround process, empowering financial leaders to take decisive action to protect their operations. By continuously monitoring the success of strategies through a client dashboard that provides real-time analytics, financial executives can effectively assess their organization's health.

Overall, financial leaders aiming to drive business expansion and refine their strategic decision-making processes in 2025 find that a stakeholder management course & training is essential for harnessing input from interested parties. Notably, client satisfaction ratings surged by 25% following improvements to the onboarding process, further illustrating the impact of participant insights.

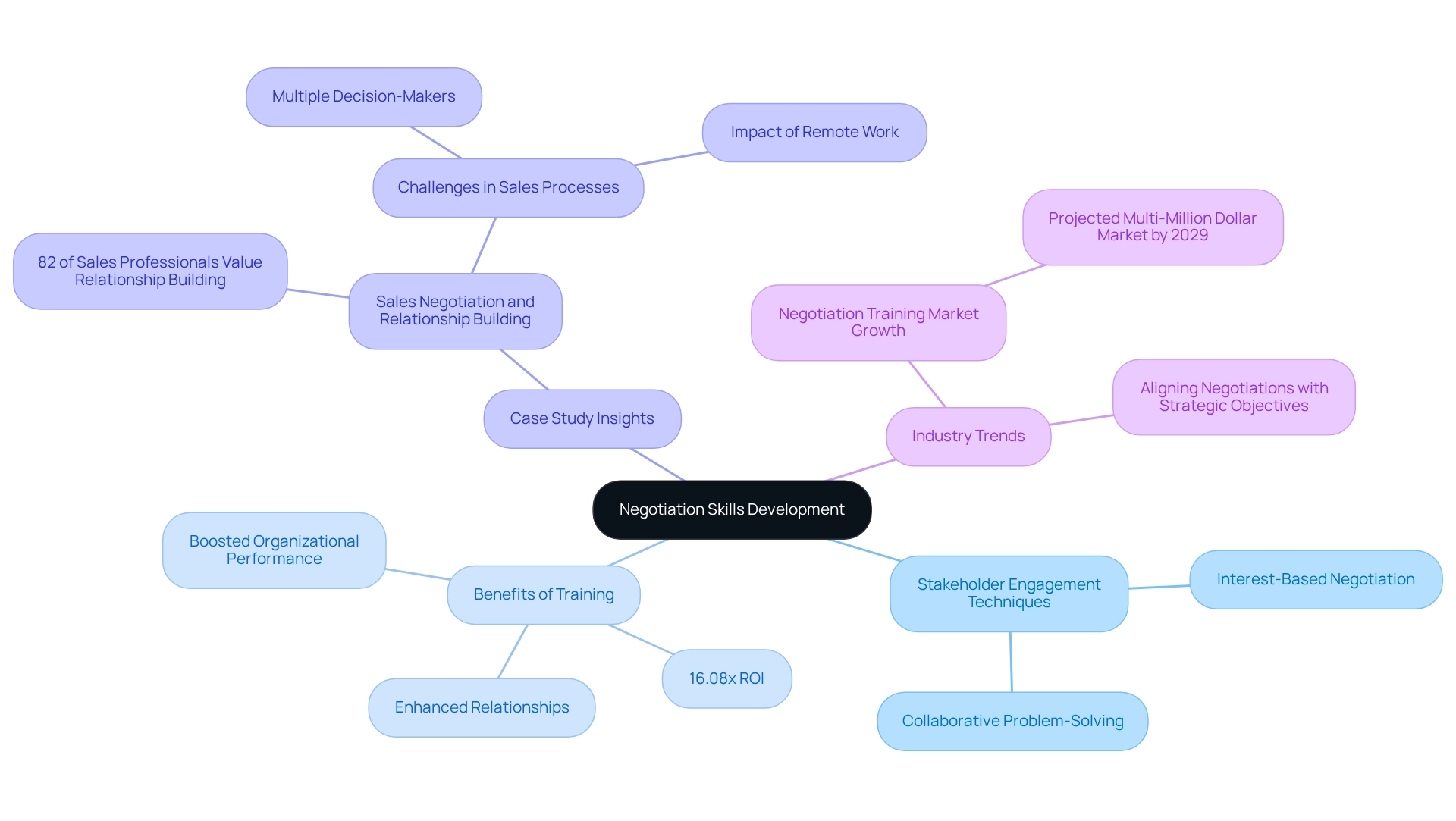

Negotiation Skills Development: Mastering Stakeholder Engagement Techniques

Mastering negotiation skills is essential for financial leaders who seek to effectively engage interested parties by participating in a stakeholder management course & training to achieve favorable outcomes. Techniques such as interest-based negotiation and collaborative problem-solving taught in the stakeholder management course & training empower financial executives to navigate complex discussions with various stakeholders.

By thoroughly understanding the motivations and interests of different parties, financial leaders can benefit from a stakeholder management course & training to craft mutually beneficial solutions that address everyone's needs, enhance relationships, and boost overall organizational performance. Notably, a case study on sales negotiation reveals that 82% of sales professionals consider relationship building crucial to successful selling, underscoring the significance of trust and understanding in negotiations.

Furthermore, statistics demonstrate that investing in a stakeholder management course & training can yield an impressive average ROI of 16.08 times the course fee within just three months, illustrating the tangible benefits of developing negotiation skills. As compromises typically function only during periods of abundance, financial leaders must adopt strategic negotiation methods.

Moreover, with the negotiation training service industry projected to reach multi-million US dollars by 2029, it is imperative for financial leaders to prioritize a stakeholder management course & training to align negotiations with their organization's strategic objectives and foster effective engagement with involved parties.

Understanding Stakeholder Dynamics: Navigating Complex Relationships

Understanding the dynamics among involved parties is crucial for financial executives, as it requires recognizing the diverse interests, influences, and connections within an organization. Navigating these complexities is vital for fostering collaboration and mitigating conflicts. By effectively mapping out the relationships among stakeholders and assessing their impact, financial leaders can develop strategies that address challenges and align interests.

For instance, engaging key participants early in the decision-making process can markedly diminish resistance and bolster support for financial initiatives. Streamlined decision-making, facilitated by real-time analytics via our client dashboard, empowers CFOs to consistently monitor business performance and adapt strategies as necessary.

Research indicates that cultivating trust with stakeholders can lead to a 10% improvement in employee retention, underscoring the significance of adept management of involved parties. A case study from a distribution firm illustrates this point: when a project manager identified a lack of visible commitment from the sponsor, they organized a weekend testing session that increased the sponsor's engagement, ultimately revitalizing the project and enhancing perceptions among all parties involved.

As one expert emphasized, "Every team member is committed to effective engagement with stakeholders and strives to transform projects from mere tasks into meaningful endeavors by fostering open dialogue, actively listening, and modifying strategies as needed." Such proactive engagement, coupled with ongoing assessment and adaptation to shifting project dynamics, is essential for financial leaders aiming to successfully navigate intricate relationships with stakeholders.

Comprehensive stakeholder management course & training can equip financial leaders with the necessary skills to implement these strategies effectively, applying learned lessons to cultivate robust, lasting relationships.

Sustainable Business Practices: Integrating Stakeholder Management for Long-Term Success

Incorporating interest group management into sustainable business practices is essential for attaining long-term success. CFOs play a crucial role in promoting sustainability by actively involving interested parties in discussions surrounding environmental, social, and governance (ESG) initiatives. This alignment of participant interests with sustainability objectives not only enhances organizational reputation but also fosters trust among various parties.

For instance, when stakeholders—including employees, customers, suppliers, and communities—are involved in sustainability initiatives, it can lead to innovative solutions that yield mutual benefits for both the organization and the community. Statistics indicate that effective participant engagement leads to a significant reduction in risk across all categories, underscoring its necessity in responsible business practices. Furthermore, organizations that effectively involve their interested parties will be better positioned to navigate challenges and seize opportunities in sustainable development.

A notable example is Interface, a global flooring manufacturer, which involved its partners to address environmental challenges, resulting in a remarkable 96% reduction in greenhouse gas emissions since 1996 and substantial energy cost savings. Such case studies emphasize the transformative effect of incorporating interest group engagement into sustainable business practices, reinforcing the significance of stakeholder management course & training in fostering trust and driving organizational success.

As one expert noted, "Yet, the rewards of a more sustainable, inclusive, and successful future are well worth the effort." By embracing these practices, financial leaders can not only contribute to sustainability but also enhance financial performance and organizational resilience.

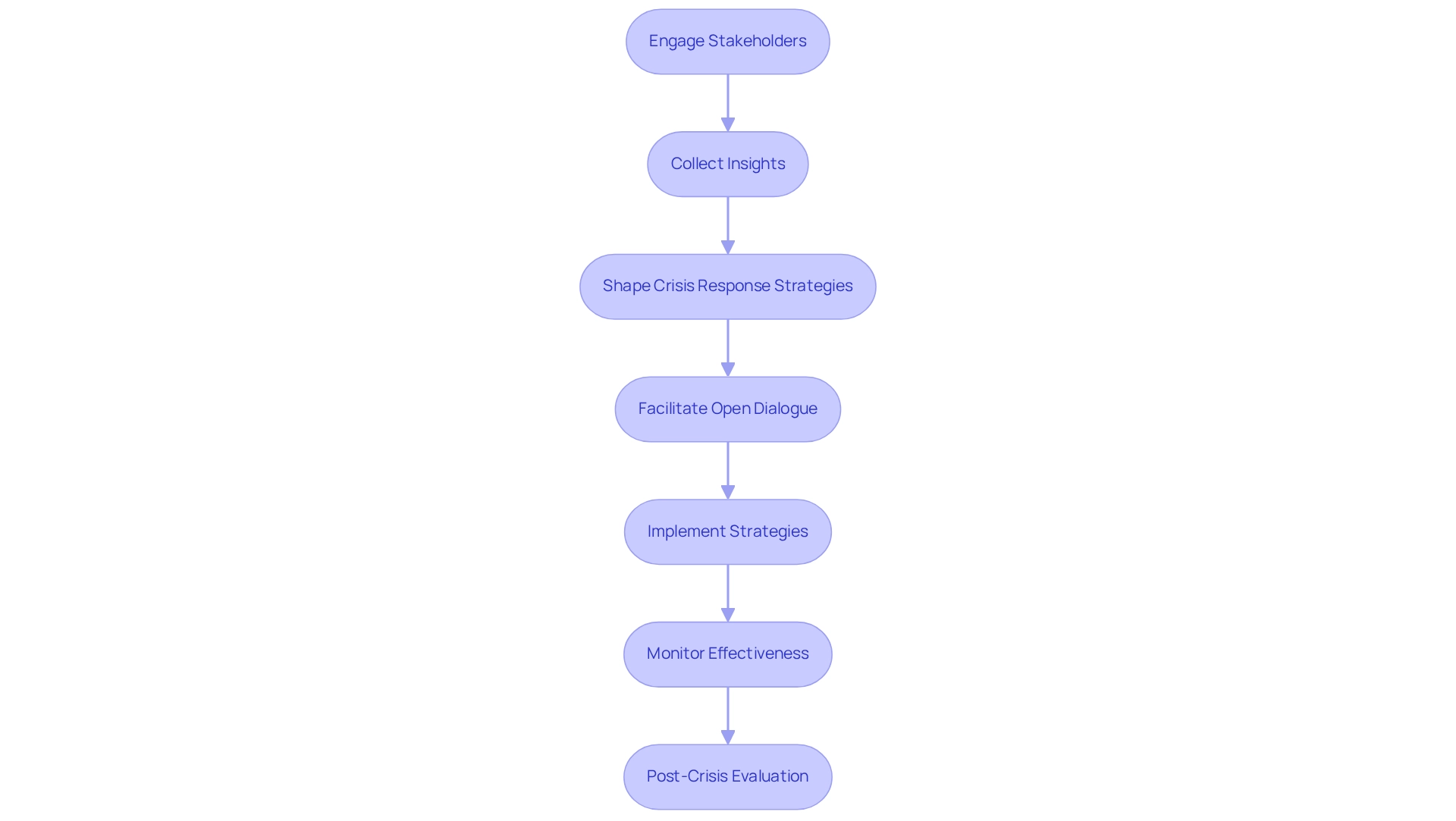

Crisis Management: Utilizing Stakeholder Engagement to Navigate Challenges

In times of crisis, effective engagement with involved parties, as taught in a stakeholder management course & training, is essential for successfully navigating challenges. CFOs can leverage insights from interested parties gained in a stakeholder management course & training to shape their crisis response strategies, particularly through streamlined decision-making processes. By fostering open dialogue and actively involving participants in decision-making through a stakeholder management course & training, organizations can cultivate resilience and trust. For instance, during a financial decline, a stakeholder management course & training can facilitate engaging interested parties in discussions about potential solutions, leading to cooperative strategies that not only mitigate risks but also enhance recovery efforts.

Real-time analytics, facilitated by our client dashboard, play a critical role in this process, enabling CFOs to monitor the effectiveness of their strategies and make informed adjustments as necessary. Statistics indicate that incorporating crisis management at every phase of the software development lifecycle significantly enhances results, underscoring the necessity for proactive participant engagement. A notable case study involving a financial services firm's infrastructure enhancement illustrates how nurturing a culture of trust and mutual respect among various interest groups strengthened collaborative efforts toward common objectives. This highlights the vital importance of inclusive environments and ongoing dialogue in crisis management.

Moreover, implementing insights gained from previous experiences is crucial for establishing robust, enduring connections with partners. Post-crisis evaluations that assess response times and the overall impact on operations and reputation are essential for evaluating the effectiveness of participant engagement. Ultimately, effective stakeholder communication, supported by real-time analytics from our client dashboard and a commitment to applying insights through a 'Test & Measure' approach, can profoundly influence outcomes in the stakeholder management course & training, especially during crisis management. This enables financial leaders to navigate economic downturns with enhanced agility and awareness. As Bob Feller wisely stated, 'Every day is a new opportunity,' reminding financial executives that each challenge presents a chance for growth and improvement.

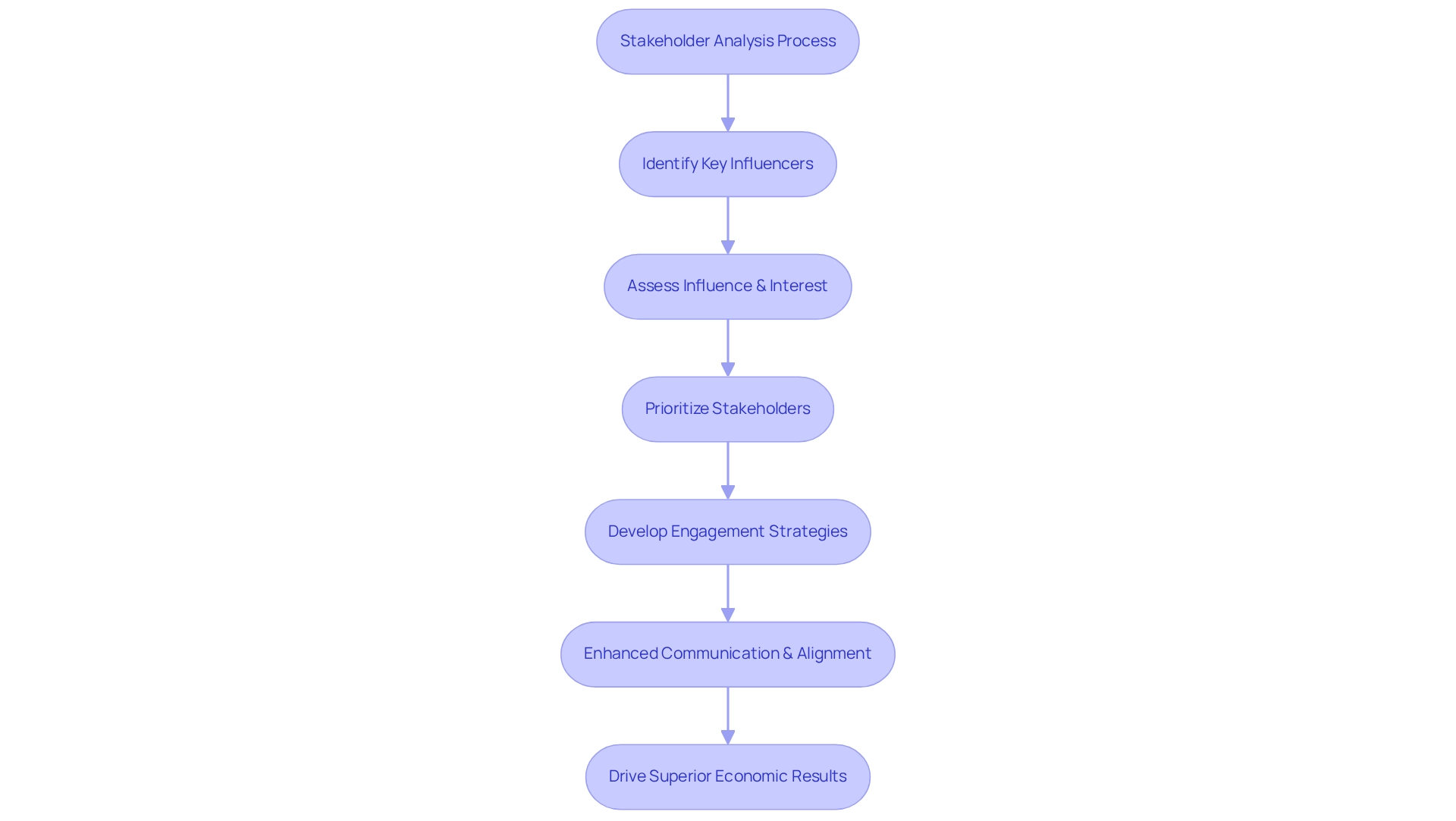

Stakeholder Analysis Skills: Identifying and Prioritizing Key Influencers

Skills gained from a stakeholder management course & training are essential for financial leaders who seek to identify and prioritize key influencers within their organizations. By effectively categorizing key players based on their influence and interest, financial leaders can strategically direct their engagement efforts, utilizing insights from a stakeholder management course & training, toward those who significantly impact organizational success.

A well-executed mapping exercise, for instance, allows financial executives to pinpoint which parties warrant greater focus and resources, thereby enhancing engagement strategies. This approach, which is part of the stakeholder management course & training, not only fosters improved communication but also aligns the interests of involved parties with organizational objectives, ultimately driving superior economic results.

In 2025, as technological proficiency becomes as vital as traditional economic understanding, participating in a stakeholder management course & training will be crucial for CFOs navigating complex interest group environments.

Furthermore, a case study of Interface illustrates the economic and environmental benefits of engaging interested parties; the company has reduced its greenhouse gas emissions by 96% since 1996 and saved millions in energy costs through its sustainability initiatives. This example underscores the tangible outcomes that can stem from effective stakeholder analysis.

Additionally, with 75% of chief financial officers investing in financial literacy programs within their organizations, the cultivation of analysis skills for engaging interested parties is increasingly recognized as a pivotal aspect of stakeholder management course & training in broader financial literacy efforts.

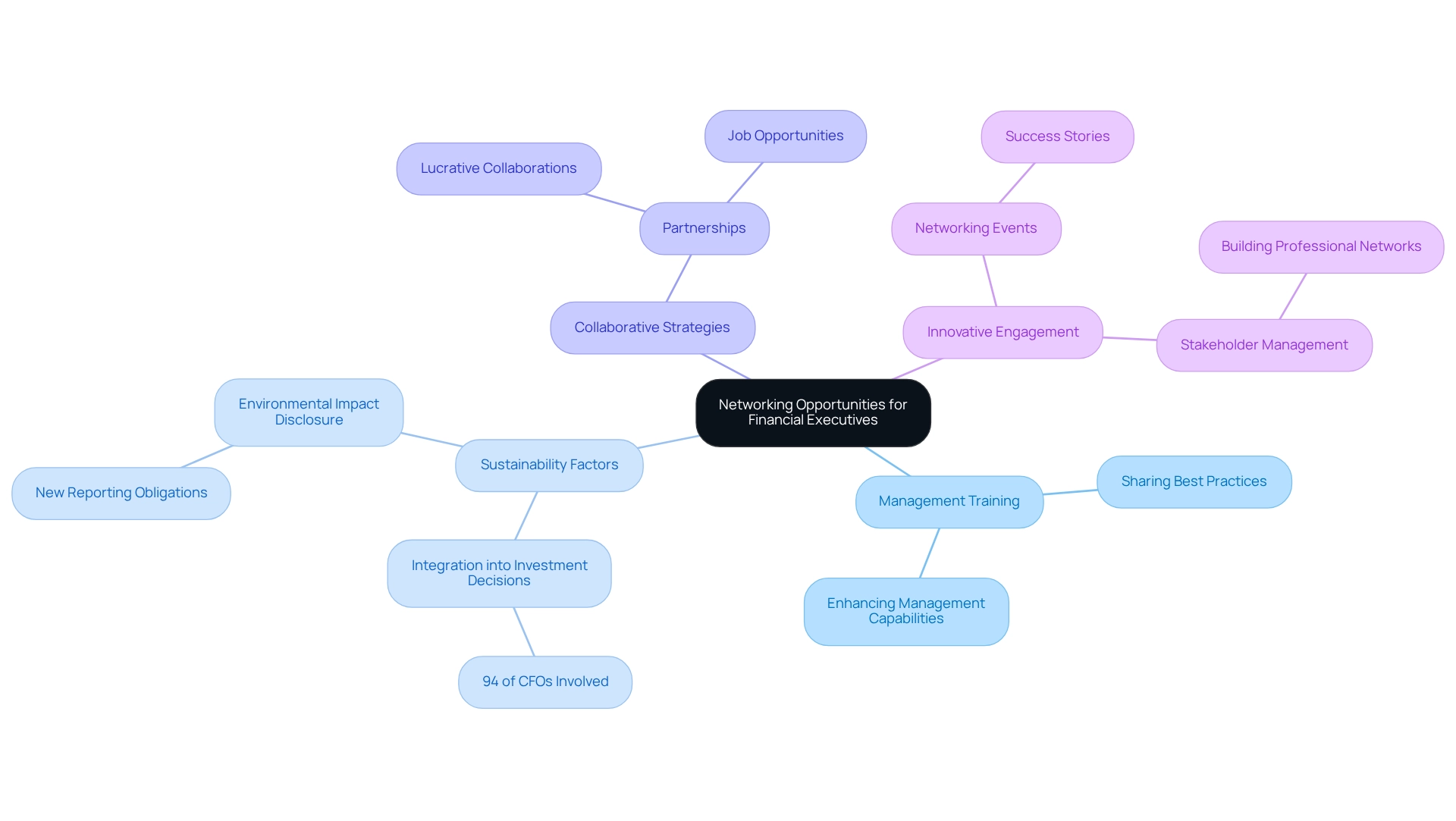

Networking Opportunities: Expanding Professional Connections through Training

Participating in management training presents financial executives with invaluable networking opportunities. Engaging with colleagues and industry specialists enables financial leaders to share experiences, best practices, and insights that significantly enhance their management capabilities with interested parties. Notably, statistics indicate that 94% of financial executives now integrate sustainability factors into their investment decisions, underscoring the necessity for collaborative strategies in addressing these challenges.

Connecting with fellow chief financial officers not only fosters the exchange of innovative engagement strategies with interested parties but also creates avenues for potential partnerships and collaborations that can drive substantial business growth. For instance, a case study revealed that chief financial officers who attended finance conferences reported forming lucrative partnerships and securing job opportunities, illustrating the immediate and long-term benefits of active engagement in networking activities.

As organizations prepare for evolving sustainability disclosure standards, the ability to build and leverage professional networks will be crucial for financial leaders, which can be enhanced through a stakeholder management course & training, in effectively managing stakeholder relationships.

As Ingmar Rentzhog noted, financial leaders must evaluate and disclose their environmental impact, and networking can facilitate the exchange of strategies to navigate these new obligations. Establishing and nurturing robust professional networks is essential for financial leaders to thrive in this dynamic landscape.

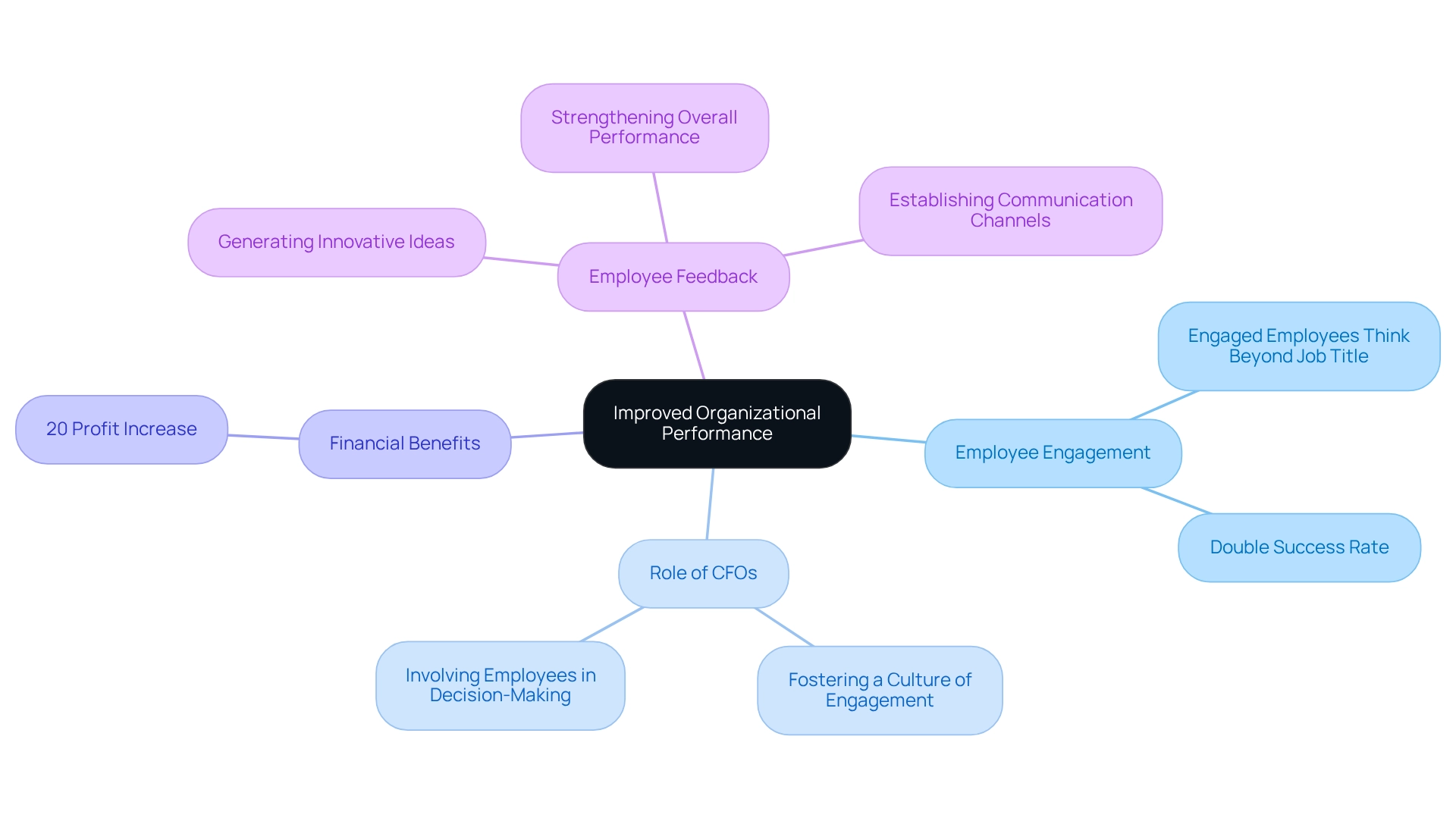

Improved Organizational Performance: Enhancing Employee Engagement through Stakeholder Management

Effective management of interested parties is pivotal in boosting employee engagement, a key driver of enhanced organizational performance. CFOs play a vital role in fostering a culture of engagement by actively involving employees in discussions with interested parties and decision-making processes. By acknowledging and addressing employee concerns, organizations can cultivate a motivated and productive workforce. Our team endorses a condensed decision-making cycle during the turnaround process, enabling your team to take decisive action to protect your enterprise.

Moreover, businesses that excel in engaging with interested parties report a remarkable 20% increase in profits, underscoring the financial benefits of such practices. Furthermore, engaged organizations demonstrate double the success rate compared to their less engaged counterparts, illustrating the tangible impact of employee involvement. Notably, 72% of employees agree that engaged employees think beyond their job title, highlighting the importance of fostering a culture of engagement. By continually monitoring the success of engagement initiatives through real-time business analytics, financial leaders can diagnose business health and operationalize turnaround lessons effectively.

In addition, soliciting employee feedback on these initiatives not only generates innovative ideas but also strengthens the overall performance of the organization, creating a win-win scenario for all parties involved. CFOs can implement these strategies by establishing regular communication channels, encouraging participation in decision-making, and recognizing employee contributions as part of their stakeholder management course & training.

Conclusion

The significance of tailored stakeholder management training for CFOs in small and medium enterprises is paramount. By enhancing communication skills and mastering negotiation techniques, financial leaders can forge stronger relationships with stakeholders, ultimately driving financial success. The integration of stakeholder insights into strategic decision-making is essential for fostering sustainable growth and navigating the complexities of today’s business environment.

Moreover, understanding stakeholder dynamics and engaging them effectively during crises can significantly bolster organizational resilience and performance. The case studies presented illustrate how proactive stakeholder engagement not only mitigates risks but also creates opportunities for innovation and collaboration. Organizations that prioritize stakeholder management reap tangible benefits, including increased profitability and improved employee engagement.

In an era where financial landscapes are in constant flux, CFOs must adopt these strategies to ensure their organizations thrive. By investing in stakeholder management training, financial leaders position themselves to navigate challenges with agility and insight, ultimately transforming their organizations for long-term success. The journey toward effective stakeholder engagement transcends mere relationship management; it embodies the cultivation of a collaborative culture that drives sustainable outcomes for all involved.

Frequently Asked Questions

What is the purpose of customized management training for CFOs?

Customized management training equips CFOs with essential skills to navigate the complexities of their specific business environments, addressing unique challenges faced by small to medium enterprises and empowering leaders to align stakeholder interests with organizational objectives.

How can monetary evaluation benefit businesses?

A thorough monetary evaluation can reveal opportunities to conserve cash and reduce liabilities, which is crucial for maintaining liquidity and mitigating risks associated with economic instability.

Why is liquidity important for companies?

Companies with liquidity below 9.5% face a substantial risk of failure, highlighting the critical need for effective stakeholder management training to ensure economic stability.

What role do case studies play in understanding financial strategies?

Case studies, such as those on monetary infrastructure enhancements for MSMEs in Latin America, demonstrate how streamlined operational processes can improve access to funding and alleviate operational burdens.

How can continuous business performance monitoring help financial executives?

By implementing continuous business performance monitoring and leveraging real-time analytics, financial executives can take decisive actions that stabilize economic positions and enhance operations.

What communication skills are essential for CFOs?

Enhanced communication abilities empower CFOs to articulate their vision and financial strategies clearly, fostering strong relationships with partners through effective dialogue, active listening, and tailored messaging.

How does effective communication impact organizational outcomes?

Effective communication can lead to significant organizational outcomes, such as increased stakeholder buy-in and support, particularly during challenging times, as illustrated by a case study showing a 25% increase in global revenue for financial executives focusing on monetary strategies.

What is the significance of stakeholder feedback in strategic decision-making?

Stakeholder feedback helps CFOs identify market trends, comprehend customer preferences, and recognize potential risks, allowing them to make informed decisions that align with investor expectations and foster sustainable growth.

Can you provide an example of how stakeholder feedback influenced a business decision?

A mid-sized tech firm adjusted its investment strategy to smaller, incremental investments based on stakeholder feedback, realizing the market was unprepared for a full-scale rollout of a new AI technology.

How can a stakeholder management course & training benefit financial leaders?

A stakeholder management course & training is essential for financial leaders aiming to drive business expansion and refine their strategic decision-making processes by harnessing input from interested parties.