Overview

The article delineates four essential business distress solutions that CFOs can utilize to adeptly navigate organizational challenges. It emphasizes the importance of:

- Recognizing distress signs

- Conducting thorough financial assessments

- Implementing structured turnaround strategies

- Continuously monitoring and adjusting these strategies

Each solution is bolstered by actionable steps and insights, such as:

- Leveraging real-time analytics for cash flow management

- Engaging stakeholders to foster collaboration

Collectively, these measures aim to enhance financial stability and promote sustainable growth.

Introduction

In a landscape where financial stability can swiftly become precarious, CFOs play a pivotal role in steering organizations through turbulent waters. The ability to recognize early signs of distress—such as cash flow problems, declining sales, and increased debt—sets the foundation for effective risk management.

Moreover, beyond mere identification, conducting comprehensive financial assessments and implementing structured turnaround strategies are essential steps in navigating these challenges. By continuously monitoring performance and adjusting strategies in response to evolving market conditions, CFOs not only safeguard their organizations but also position them for sustainable growth.

This article delves into the critical practices that finance leaders must adopt to transform potential crises into opportunities for recovery and advancement.

Recognize Signs of Business Distress

Chief financial officers must be vigilant in identifying the early warning signs of organizational distress to effectively apply business distress solutions and mitigate risks. Key indicators include:

- Cash Flow Problems: Persistent negative cash flow is often the initial sign of trouble. CFOs should closely oversee flow statements for irregularities, as 37% of small enterprise owners have contemplated ending operations due to delayed payment problems. As Brian Sutter, Director of Marketing for Wasp Barcode Technologies, states, "But it is possible to manage financial flow." You can certainly control it to a level where it doesn’t pose a risk to your venture. Implementing real-time analytics can help CFOs test hypotheses about cash flow trends and make informed decisions quickly.

- Declining Sales: A consistent decline in sales can signal a loss of market share or customer dissatisfaction. With less than 30% of small enterprise owners anticipating annual sales to surpass $200,000, regular assessments of sales trends are crucial to recognize these problems early. This statistic highlights the economic challenges faced by small businesses and reinforces the importance of monitoring sales trends. By operationalizing lessons learned from past sales data, financial leaders can develop strategies to address these declines effectively.

- Increased Debt Levels: Rising debt without corresponding revenue growth can indicate economic instability. Financial leaders should assess debt ratios to ensure they remain within manageable limits, as high debt levels can exacerbate distress. Utilizing real-time analytics can provide insights into debt management and help in making timely adjustments.

- High Employee Turnover: Frequent turnover may reflect internal issues such as poor morale or management problems, which can further complicate financial distress. High turnover can result in higher expenses and reduced efficiency, making it essential for financial leaders to monitor employee retention rates to comprehend organizational health. Continuous performance monitoring can help identify underlying issues contributing to turnover.

- Supplier Payment Delays: Delays in paying suppliers can indicate cash flow issues. Chief financial officers should monitor payment cycles closely, as prolonged delays may signal deeper financial troubles. Recognizing these signs early can help in implementing corrective measures before the situation escalates. By operationalizing turnaround lessons, financial executives can enhance supplier relationships and improve payment processes through effective business distress solutions.

In addition to these indicators, financial executives should be aware of common pitfalls when monitoring these signs, such as overreacting to short-term fluctuations or failing to consider external market conditions. By maintaining a balanced perspective and leveraging real-time analytics, financial leaders can better navigate the complexities of organizational distress through business distress solutions.

Conduct Comprehensive Financial Assessments

Conducting a thorough monetary evaluation is essential for CFOs aiming to navigate business challenges effectively. Attention: Here are several critical steps to consider:

Interest:

Review Financial Statements: Begin by analyzing balance sheets, income statements, and cash flow statements to identify trends and anomalies. Pay close attention to patterns in revenue, expenses, and profit margins, as these can signal underlying issues.

Evaluate Key Performance Indicators (KPIs): Establish and regularly track relevant KPIs, including liquidity ratios, profitability ratios, and operational efficiency metrics. These indicators are essential for assessing the economic well-being of the organization. Be mindful of potential biases associated with convenience samples when analyzing SBCS results; this awareness can enhance the accuracy of your evaluations.

Benchmark Against Industry Standards: Compare your economic performance with that of industry peers. This benchmarking process can highlight competitive disadvantages and areas requiring improvement, enabling targeted strategic adjustments. For example, using Decimal's fixed monthly pricing can offer significant cost reductions compared to conventional accounting solutions, highlighting the importance of economic efficiency in evaluations.

Engage Stakeholders: Collaborate with department heads to gather insights on operational challenges and budgetary limitations. This holistic method can uncover underlying issues that monetary statements alone may not reveal, promoting a more thorough understanding of the business environment. As Steve McNally suggests, during 2025, CFOs should try new approaches to drive their organizations to greater success.

Utilize Technology: Leverage analysis software and the client dashboard to automate data gathering and examination. This technology not only improves accuracy but also enables prompt evaluations, essential in today’s fast-paced corporate landscape. By utilizing real-time analytics, chief financial officers can consistently oversee organizational performance, test hypotheses, and apply lessons learned from earlier evaluations, ensuring a proactive approach to resource oversight.

By following these steps, chief financial officers can conduct thorough evaluations that not only identify distress signals but also lead to effective business distress solutions, paving the way for informed decision-making and strategic recovery. The evolving position of chief financial officers, as emphasized in the case study 'The Evolving Role of CFOs,' underscores the necessity of comprehensive financial assessments in strategic leadership and business transformation.

Action: Engage in these practices to enhance your financial evaluations and drive your organization toward success.

Implement Structured Turnaround Strategies

To effectively implement turnaround strategies, CFOs should consider the following approaches:

- Prioritize Cash Flow Management: Immediate cash flow improvements are crucial. CFOs can renegotiate payment terms with suppliers, reduce unnecessary expenses, and optimize inventory levels. Given that 37% of small enterprise owners have contemplated shutting down their operations due to delayed payments, prioritizing liquidity can significantly mitigate this risk. Mastering liquidity flow forecasting empowers businesses to monitor finances, take control, and plan for a successful future, ultimately boosting reserves and supporting growth initiatives.

- Comprehensive Economic Evaluations: Conducting thorough economic assessments is vital for cash preservation and liability reduction. By utilizing specialized turnaround consulting services, including interim management and bankruptcy case management, CFOs can uncover hidden value and identify areas for cost reduction, thereby implementing effective business distress solutions to ensure a more resilient economic position.

- Restructure Debt: Engaging with creditors to negotiate better terms or consolidate debts can alleviate immediate financial pressure. This strategy not only provides breathing space for recovery but also aligns with the trend of rising debt restructuring among small enterprises in 2025.

- Streamline Operations: Identifying inefficiencies within the organization and implementing process improvements is essential. This may involve adopting new technologies or restructuring teams to enhance productivity, ultimately supporting growth initiatives and improving cash reserves. Ongoing observation via real-time analytics can assist in diagnosing organizational health and implementing lessons learned during the turnaround process.

- Develop a Clear Communication Plan: Transparent communication with all stakeholders—including employees, investors, and creditors—is vital. Keeping everyone informed fosters trust and collaboration during the turnaround process, which is critical for maintaining morale and support.

- Set Realistic Goals: Establishing achievable and measurable short-term and long-term goals is important. Regularly reviewing progress against these goals helps maintain focus and accountability, ensuring that the organization stays on track during its recovery journey.

By incorporating these strategies, financial leaders can not only navigate challenges but also position their businesses for sustainable growth in the future. As Robert D. Katz noted, "If you incorporate these attributes into your plan, you could increase gross margins by 2% to 3% per year." It is also essential to be aware of common pitfalls, such as neglecting stakeholder communication or setting unrealistic goals, which can hinder the turnaround process. By mastering financial flow forecasting and implementing business distress solutions, financial officers can effectively support their organizations in overcoming challenges and achieving long-term success.

Monitor and Adjust Strategies Continuously

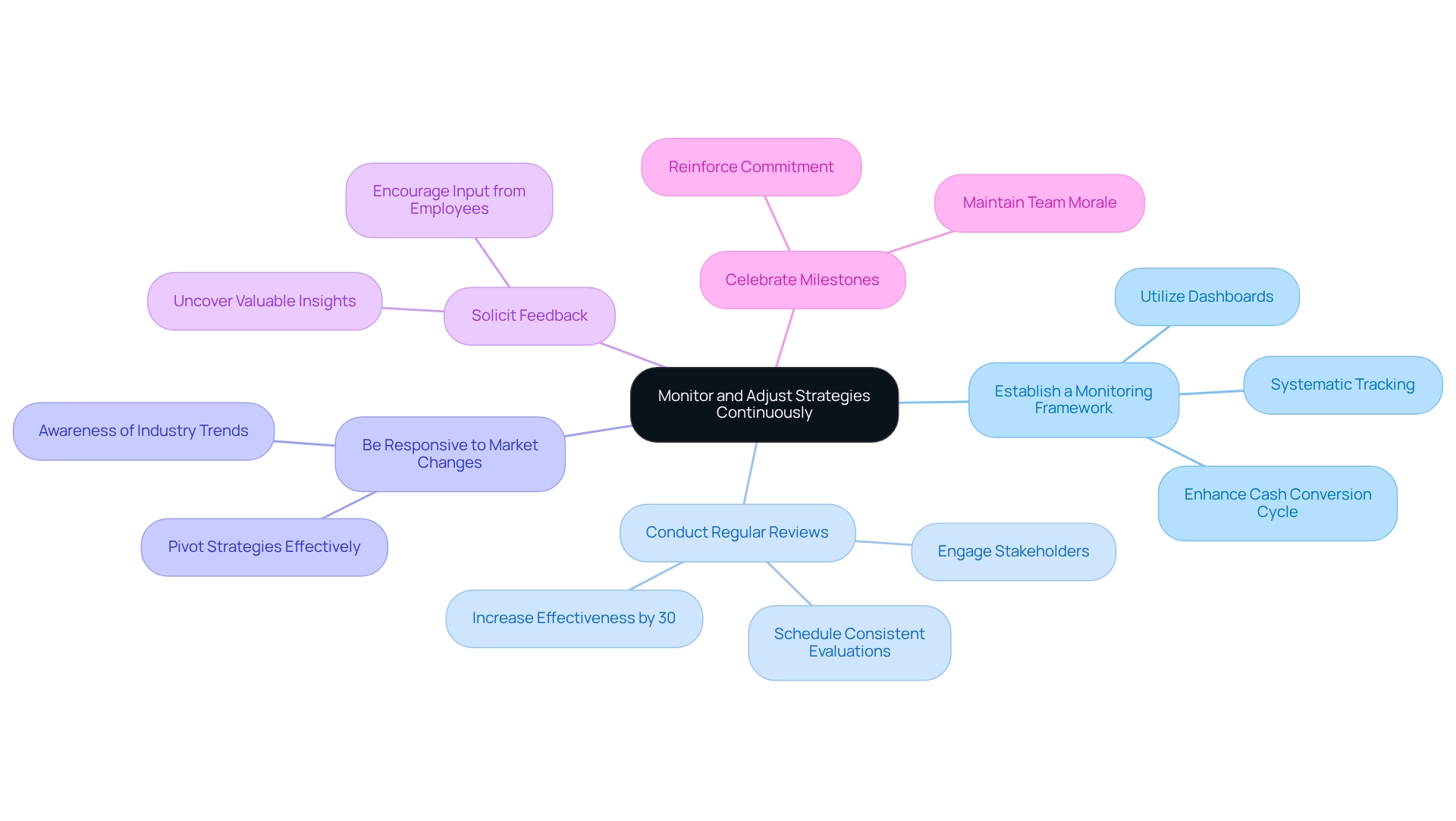

To ensure the success of turnaround strategies, CFOs must implement a robust monitoring framework that encompasses the following key practices:

- Establish a Monitoring Framework: Develop a systematic approach for tracking financial performance and operational metrics. Utilizing dashboards can facilitate real-time insights into critical indicators, enabling proactive decision-making and enhancing the cash conversion cycle.

- Conduct Regular Reviews: Schedule consistent evaluations of the turnaround plan to assess progress and make necessary adjustments. Engaging all relevant stakeholders during these reviews fosters diverse perspectives and enhances the decision-making process. Research indicates that organizations conducting regular reviews see a 30% increase in the effectiveness of their turnaround strategies.

- Be Responsive to Market Changes: Maintain awareness of industry trends and economic conditions that could impact the commercial landscape. This vigilance allows CFOs to pivot strategies effectively in response to emerging challenges or opportunities, ensuring alignment with market dynamics.

- Solicit Feedback: Actively encourage input from employees and stakeholders regarding the effectiveness of implemented strategies. This feedback can uncover valuable insights and highlight areas for improvement, driving continuous enhancement of turnaround efforts.

- Celebrate Milestones: Recognizing and celebrating achievements throughout the turnaround process is crucial for maintaining team morale and motivation. Acknowledging progress not only fosters a positive culture but also reinforces commitment during challenging times.

In 2025, the implementation of Key Performance Indicators (KPIs) will be essential for informed decision-making and operational optimization. Continuous improvement of these KPIs involves thorough data analysis and the implementation of strategic changes. For instance, trend analysis serves as a vital tool in strategic monetary planning, allowing businesses to examine economic data over time, identify patterns, and predict future performance. By incorporating trend analysis, organizations can refine economic forecasting, proactively adjust strategies, and enhance agility, ultimately fostering sustainable growth and long-term success. Regular evaluations have been demonstrated to greatly enhance the effectiveness of turnaround strategies, underscoring the significance of a structured approach to monitoring economic performance. As Kristina Russo, CPA, MBA, states, "Achieving FPM’s ultimate goal of using reporting, planning and analytics to improve financial decision-making may take various shapes in different companies, reflecting each organization’s unique needs." This highlights the necessity of tailoring monitoring frameworks to fit specific organizational contexts. Furthermore, it is crucial to be aware of common pitfalls in monitoring and adjusting turnaround strategies, such as neglecting stakeholder engagement or failing to adapt to new information, which can hinder the effectiveness of these practices.

Conclusion

The role of CFOs in navigating financial challenges is paramount in today's volatile business environment. Recognizing early signs of distress—such as cash flow problems, declining sales, increased debt, high employee turnover, and supplier payment delays—enables CFOs to take proactive measures to mitigate risks. Implementing real-time analytics and maintaining a balanced perspective are essential tools for effective monitoring and decision-making.

Conducting comprehensive financial assessments is equally critical. By reviewing financial statements, evaluating key performance indicators, benchmarking against industry standards, and engaging stakeholders, CFOs can uncover underlying issues and develop informed strategies. Utilizing technology for data collection and analysis enhances accuracy and timeliness, allowing for agile responses to emerging challenges.

Structured turnaround strategies further empower CFOs to steer their organizations toward recovery and growth. Prioritizing cash flow management, restructuring debt, streamlining operations, and establishing clear communication with stakeholders are vital components of a successful turnaround plan. Setting realistic goals and continuously monitoring progress ensures that organizations remain focused and adaptable in the face of adversity.

Ultimately, the continuous monitoring and adjustment of strategies are crucial for long-term success. By establishing robust frameworks and soliciting feedback from stakeholders, CFOs can refine their approaches and foster a culture of resilience within their organizations. The ability to navigate financial distress not only safeguards stability but also positions businesses for sustainable growth, transforming potential crises into opportunities for advancement.

Frequently Asked Questions

What are the key indicators of organizational distress that CFOs should monitor?

Key indicators include cash flow problems, declining sales, increased debt levels, high employee turnover, and supplier payment delays.

How can cash flow problems signal organizational distress?

Persistent negative cash flow is often the initial sign of trouble. CFOs should oversee flow statements for irregularities, as many small enterprise owners consider ending operations due to delayed payments.

Why is it important to monitor sales trends?

A consistent decline in sales can indicate a loss of market share or customer dissatisfaction, making regular assessments crucial to recognize these problems early.

What does increased debt levels indicate about an organization?

Rising debt without corresponding revenue growth can suggest economic instability, requiring financial leaders to assess debt ratios to ensure they remain manageable.

How does high employee turnover relate to organizational health?

Frequent turnover may reflect internal issues such as poor morale or management problems, complicating financial distress and leading to higher expenses and reduced efficiency.

What should CFOs watch for regarding supplier payment delays?

Delays in paying suppliers can indicate cash flow issues, and prolonged delays may signal deeper financial troubles that need to be addressed promptly.

What common pitfalls should financial executives avoid when monitoring distress indicators?

Financial executives should avoid overreacting to short-term fluctuations and failing to consider external market conditions, maintaining a balanced perspective is essential.