Overview

This article delineates four essential strategies for achieving success in business distress financial planning. It emphasizes identifying financial distress indicators, implementing proactive management strategies, engaging stakeholders, and developing effective turnaround plans. Each strategy is underpinned by compelling evidence and case studies that highlight the significance of early detection, real-time monitoring, stakeholder involvement, and structured execution. These elements are crucial for enhancing recovery rates and ensuring long-term financial stability.

Firstly, identifying financial distress indicators is paramount. Recognizing these signs early allows businesses to take timely action. Moreover, implementing proactive management strategies can mitigate risks before they escalate. Engaging stakeholders throughout the process fosters collaboration and support, which is vital for successful outcomes. Lastly, developing effective turnaround plans ensures that recovery efforts are well-structured and executed.

In conclusion, by focusing on these strategies, businesses can navigate financial distress more effectively. The evidence presented underscores the importance of these approaches in achieving sustainable financial health. Therefore, it is imperative for organizations to adopt these strategies to enhance their resilience in challenging times.

Introduction

In the intricate realm of modern business, financial distress can emerge suddenly, leaving organizations to contend with uncertainty. Identifying critical indicators such as declining cash flow and rising debt is essential for early intervention.

However, recognizing these signs is merely the starting point; businesses must also adopt proactive financial management strategies to navigate challenges effectively. Engaging stakeholders and leveraging expert advisory services can significantly bolster recovery efforts, fostering a collaborative environment that is crucial for overcoming obstacles.

This article explores the comprehensive approach necessary for businesses to formulate and implement robust turnaround and restructuring plans, ensuring they not only endure but flourish in a competitive marketplace.

Identify Key Indicators of Financial Distress

Key indicators of economic distress are crucial for business distress financial planning and encompass several critical factors, including declining cash flow, escalating debt levels, and diminishing profitability. Companies must vigilantly monitor their monetary statements for warning signs such as negative cash flow trends, delayed customer payments, and increasing operational costs.

Moreover, high employee turnover rates and frequent management changes often indicate deeper organizational issues. To improve decision-making, our team advocates for a reduced decision-making cycle during the turnaround process, enabling organizations to take decisive action to maintain their economic stability.

Consistently examining these metrics is crucial for early detection of economic distress, which is essential for effective business distress financial planning, allowing enterprises to take corrective actions before issues intensify. A case study on Central European businesses emphasizes how proactive bankruptcy prediction and comprehension of the corporate life cycle can greatly improve operational practices and corporate longevity.

Significantly, the healthcare and social assistance sectors have the highest survival rates among small enterprises, highlighting the importance of effective economic management in these fields. Furthermore, as Abdi Insani Riezky Amalia highlights, many small enterprises encounter difficulties in using accounting software due to insufficient training, which can impede their capacity to manage finances efficiently.

By utilizing real-time analytics via client dashboards, organizations can consistently assess their economic status and implement the insights gained from their recovery processes. Identifying these signs early and addressing the practical challenges in fiscal oversight can protect their economic well-being and ensure effective business distress financial planning.

Implement Proactive Financial Management Strategies

To implement proactive monetary management strategies effectively, businesses must prioritize cash flow forecasting, budgeting, and expense management. A flexible budget that adapts to changing circumstances is vital for preserving economic health. Consistently assessing performance against set benchmarks enables organizations to make informed modifications to their strategies. Moreover, utilizing technology for real-time economic monitoring, including our client dashboard, significantly enhances decision-making abilities, allowing faster reactions to emerging challenges. Our group endorses a streamlined decision-making cycle during the turnaround process, enabling your team to take decisive action to safeguard your enterprise.

Given that 40% of small enterprise owners cite taxes and accounting as their most significant obstacles, enhancing fiscal education and resources is essential. This proactive strategy not only assists in crisis handling but also positions organizations for sustainable growth, as demonstrated by effective cash flow forecasting practices in business distress financial planning.

As Jason Carlson, CFO of Mood Media, emphasizes, prompt payments are essential for maintaining operations, especially for small to medium-sized enterprises that frequently operate with restricted monetary resources. Furthermore, with households expecting inflation to soar to 6.5%, CFOs must navigate a challenging economic landscape. As Suze Orman states, economic freedom includes liberation from worry, underscoring the emotional advantages of effective money management.

By adopting these best practices, including the 20 strategies for optimal organizational performance, and continuously monitoring operational health through real-time analytics, CFOs can navigate economic uncertainties more effectively and foster long-term stability.

Engage Stakeholders and Leverage Expert Advisory Services

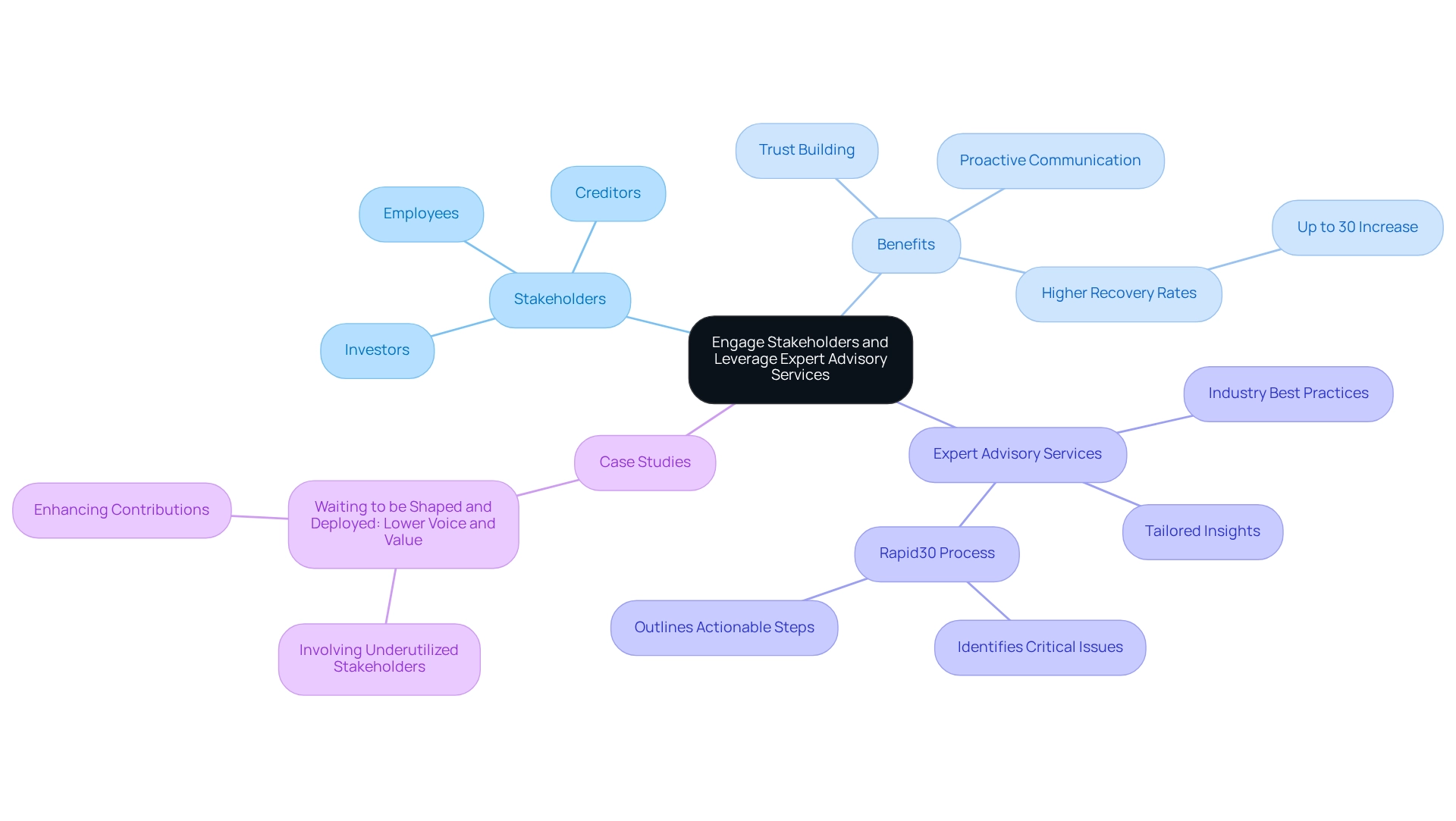

Involving stakeholders—employees, creditors, and investors—is essential for fostering a collaborative atmosphere during business distress financial planning. Regular communication not only manages expectations but also builds trust, which is crucial for recovery. Studies indicate that businesses dealing with distress can enhance their financial planning through strong stakeholder engagement during financial challenges, leading to significantly higher recovery rates, with some reports suggesting these businesses may see recovery rates increase by up to 30%.

Moreover, leveraging expert advisory services, such as those provided by Transform Your Small/Medium Business, equips organizations with tailored insights and strategies for effective business distress financial planning to navigate their unique challenges. Our consultants introduce industry best practices in business distress financial planning, enabling the execution of effective recovery plans, including our innovative 'Rapid30' process that identifies critical issues and outlines actionable steps for improvement.

For instance, the case study titled "Waiting to be Shaped and Deployed: Lower Voice and Value" illustrates how involving previously underutilized stakeholders in high-value projects can enhance their contributions and foster organizational growth. This method highlights the significance of proactive communication with creditors and investors as part of business distress financial planning, ensuring that all parties are aligned and informed throughout the recovery process.

As noted, "Effective communication plays a crucial role in managing and resolving conflicts," underscoring the need for addressing issues promptly to maintain stakeholder trust. Furthermore, our clients have relayed positive experiences, observing how our monetary evaluation and interim management services, which focus on business distress financial planning, have transformed their operations and resulted in sustainable growth.

Develop and Execute Turnaround and Restructuring Plans

Developing an effective recovery plan requires a comprehensive evaluation of the company's financial environment, identifying key challenges, and formulating actionable strategies within the framework of business distress financial planning for small to medium enterprises. Key components typically encompass:

- Implementing cost-cutting measures

- Restructuring debt

- Identifying new revenue opportunities

For instance, a study on manufacturing firms in Kenya revealed that strategic repositioning significantly enhanced performance, underscoring the value of meticulous planning in turnaround efforts for similarly sized enterprises.

Once the plan is established, execution becomes paramount. Businesses must set clear timelines and accountability frameworks to effectively track progress. Our group advocates for a streamlined decision-making cycle during the turnaround process, empowering your team to take decisive action to safeguard your enterprise. Regular evaluations of the plan's impact are essential, facilitated by real-time business analytics through our client dashboard, which continually diagnoses your business health. Notably, statistics indicate that 48% of companies face cash flow challenges, highlighting the importance of business distress financial planning for proactive fiscal management. As Eidleman observes, a score lower than 2.90 signifies some economic stress, reinforcing the necessity for vigilance in oversight.

By adopting these strategies, organizations can effectively manage business distress financial planning and cultivate long-term stability. However, common pitfalls such as a lack of clear communication and insufficient resource allocation can derail even the most meticulously crafted plans. Therefore, understanding these risks is crucial. Ultimately, the implementation of these strategies can lead to improved financial health and operational resilience, positioning businesses for sustainable growth.

Conclusion

Recognizing the key indicators of financial distress is merely the first step in safeguarding a business's future. By diligently monitoring factors such as cash flow, debt levels, and profitability, organizations can identify potential challenges before they escalate. Implementing proactive financial management strategies—including effective budgeting and real-time monitoring—empowers businesses to respond swiftly to emerging issues and maintain financial health.

Moreover, engaging stakeholders and leveraging expert advisory services fosters a collaborative environment essential for recovery. Strong communication with employees, creditors, and investors not only builds trust but also significantly enhances recovery rates. Coupled with tailored insights from experienced consultants, businesses can navigate their unique challenges more effectively.

Finally, developing and executing comprehensive turnaround and restructuring plans is vital for long-term sustainability. By assessing financial landscapes, identifying critical issues, and implementing actionable strategies, organizations position themselves for success. Awareness of common pitfalls and maintaining clear communication throughout the process are crucial for ensuring these strategies are effective.

In summary, a holistic approach that combines early identification of distress signals, proactive financial management, stakeholder engagement, and strategic planning will not only help businesses endure challenging times but also enable them to thrive in a competitive marketplace. Embracing these practices is essential for fostering resilience and achieving sustainable growth.

Frequently Asked Questions

What are key indicators of economic distress for businesses?

Key indicators include declining cash flow, escalating debt levels, and diminishing profitability. Companies should monitor their monetary statements for signs like negative cash flow trends, delayed customer payments, and increasing operational costs.

How can high employee turnover and management changes indicate economic distress?

High employee turnover rates and frequent management changes can signify deeper organizational issues that may affect the company’s stability and performance.

Why is it important to consistently examine financial metrics?

Consistently examining financial metrics is crucial for early detection of economic distress, which allows businesses to take corrective actions before issues worsen.

What does the case study on Central European businesses highlight?

The case study emphasizes the benefits of proactive bankruptcy prediction and understanding the corporate life cycle, which can enhance operational practices and improve corporate longevity.

Which sector has the highest survival rates among small enterprises?

The healthcare and social assistance sectors have the highest survival rates among small enterprises, underscoring the importance of effective economic management in these fields.

What challenges do small enterprises face in managing their finances?

Many small enterprises struggle with using accounting software due to insufficient training, which can hinder their ability to manage finances effectively.

How can organizations assess their economic status?

Organizations can utilize real-time analytics through client dashboards to consistently assess their economic status and implement insights from their recovery processes.

What is the significance of early identification of economic distress signs?

Early identification of economic distress signs allows businesses to address practical challenges in fiscal oversight, protecting their economic well-being and ensuring effective financial planning.