Introduction

Navigating the turbulent waters of financial distress is a critical challenge for organizations in today's volatile economic landscape. As CFOs face mounting pressures to ensure financial stability, understanding the key concepts and indicators of distress becomes paramount.

With liquidity risks looming and solvency concerns on the rise, the ability to identify warning signs early can make the difference between recovery and decline. This article delves into essential methodologies for assessing financial distress, offering practical strategies and insights that empower CFOs to build a robust risk assessment framework and foster organizational resilience.

By leveraging advanced analytics and industry benchmarks, finance leaders can not only safeguard their companies against potential crises but also position them for sustainable growth in an unpredictable market.

Understanding Financial Distress: Key Concepts and Definitions

Economic distress arises when a company encounters substantial difficulties in fulfilling its monetary commitments, possibly leading to bankruptcy or liquidation if corrective measures are not implemented promptly. Grasping the following key concepts is crucial for any CFO seeking to navigate these turbulent waters:

- Liquidity Risk: This refers to the risk that an organization may be unable to fulfill its short-term monetary obligations, which can lead to immediate operational disruptions. Streamlined decision-making processes and continuous monitoring can significantly mitigate this risk.

- Solvency: Solvency evaluates a company’s capacity to meet long-term debts and obligations, serving as a crucial indicator of economic health. Prompt decision-making, backed by real-time analytics, is crucial in tackling solvency problems before they worsen.

- Operational Efficiency: This idea investigates how effectively a company employs its resources to provide products or services, directly influencing its economic stability. Implementing insights gained from previous outcomes and evaluating theories can improve efficiency and resilience.

In 2024, economic strain continues to be a significant issue, with data showing that a substantial number of organizations face difficulties associated with liquidity. As mentioned by Erin El Issa, a credit card specialist at NerdWallet, understanding these components is crucial for recognizing warning signs of economic distress and for formulating a financial distress risk assessment report. Furthermore, recent trends suggest that many individuals—47 percent—state that monetary concerns adversely influence their mental well-being, emphasizing the wider consequences of liquidity challenges.

Furthermore, the Federal Reserve Board indicated that in 2022, 35 percent of respondents believed they were economically 'worse off' than the prior year, highlighting the challenges of the current monetary landscape. A practical approach to managing liquidity risk includes employing strategies such as thorough budgeting, which research shows that 53% of respondents utilize to alleviate economic stress. This aligns with the case study titled 'Budgeting to Cope,' where the majority of respondents manage stress related to money by creating and adhering to a budget.

By prioritizing these strategies and leveraging real-time analytics through a client dashboard, CFOs can foster a more resilient economic environment within their organizations, ensuring they are well-equipped to address potential crises.

Identifying Indicators of Financial Distress: Ratios and Warning Signs

To effectively identify economic distress, CFOs should focus on the following key indicators:

- Current Ratio: A current ratio below 1 often signals potential liquidity challenges. For instance, industries such as lodging and airlines have current ratios of 0.68 and 0.69, respectively, indicating that these sectors may face significant economic difficulties.

- Quick Ratio: This ratio, which excludes inventory, is crucial for assessing short-term obligations. A low quick ratio suggests that a company may struggle to meet its immediate monetary commitments. Average quick ratio benchmarks for companies generally remain around 1, which emphasizes the danger for those below this threshold.

- Debt-to-Equity Ratio: A high debt-to-equity ratio can suggest excessive leverage, raising the entity's monetary exposure. Monitoring this ratio helps in understanding the balance between debt financing and shareholder equity.

- Cash Flow Trends: Negative cash flow over consecutive periods is a serious red flag that requires immediate attention. This trend can signal underlying operational issues that need to be addressed promptly.

- Profit Margin Decline: A consistent decline in profit margins often points to operational inefficiencies or increased competition, which can erode economic stability over time.

By regularly monitoring these ratios, organizations can utilize a financial distress risk assessment report to detect early warning signs of distress and respond proactively. In October 2024, personal income growth of +0.6% reflects ongoing economic conditions that CFOs should consider in their assessments. Moreover, with the U.S. goods and services trade deficit increasing from $70.8 billion in August to $84.4 billion in September, it highlights the significance of comprehending how external economic elements, such as trade balances, can affect economic well-being and exposure to vulnerabilities.

Keeping a close eye on these indicators allows for timely adjustments in strategy and resource allocation. Additionally, considering historical growth rates and growth rate estimations can provide further insight into long-term economic health and potential risks.

Data Collection and Analysis: Building a Robust Assessment Framework

To establish a robust framework for assessing economic distress and enhancing decision-making efficiency, follow these comprehensive steps:

- Gather Financial Statements: Begin by compiling the most recent balance sheets, income statements, and cash flow statements, as these documents are foundational for your analysis and essential for identifying opportunities to preserve cash and reduce liabilities.

- Conduct Stakeholder Interviews: Engage with essential stakeholders to uncover insights regarding operational challenges and monetary concerns. This qualitative data is crucial for understanding the nuances of your organization's economic health and for creating meaningful strategies to mitigate weaknesses and reinforce strengths.

- Utilize Software: Leverage advanced analysis software or tools like Excel to systematically organize and analyze your data. Notably, recent advancements in software have made it easier to manage complex datasets effectively, allowing for real-time analytics that can drive immediate performance monitoring.

- Benchmark Against Industry Standards: Compare your monetary metrics against industry averages to identify potential areas of concern. This benchmarking process is vital for contextualizing your entity's performance within the market and uncovering value that can be operationalized for better cash flow management.

- Establish a Regular Review Process: Implement a routine for ongoing data collection and analysis to ensure timely updates and insights. This regular review enhances the accuracy and relevance of your financial distress risk assessment report, aligning with best practices in data collection and analysis, and supports continuous performance monitoring and relationship building.

In light of the current economic landscape, where the goods deficit has notably increased by $14.2 billion to $109.0 billion, understanding these economic dynamics is more critical than ever. Furthermore, standardizing reporting formats can create consistency and minimize errors, which improves decision-making efficiency throughout the entity. The findings from the 2014 Annual Report to Congress highlight the importance of addressing excessive risk-taking and market fragility, emphasizing that enhanced economic data and analysis should be included in the financial distress risk assessment report.

By following this structured approach, you not only improve the accuracy of your assessments but also enhance strategic business improvement and overall performance across the organization. This comprehensive economic assessment process, which we refer to as the 'Button Financial Assessment,' underscores the importance of collaboration in planning solutions and testing hypotheses to ensure maximum return on invested capital.

Methodologies for Assessing Financial Distress Risk: Statistical Approaches

To effectively evaluate economic distress potential, several robust statistical methodologies can be utilized:

-

Z-Score Analysis: This widely recognized model predicts bankruptcy risk through a combination of five critical financial ratios:

-

Working capital to total assets

-

Retained earnings to total assets

-

Earnings before interest and taxes to total assets

-

Market value of equity to book value of total liabilities

-

Sales to total assets

A Z-Score below 1.6 suggests a very weak financial condition, indicating grave danger for the firm. As Professor Altman noted in his 2019 lecture, a Z-Score of 0 is the threshold that should alarm investors regarding a company's economic health.

-

-

Logistic Regression Models: These advanced models assess the likelihood of economic difficulties by examining various predictive factors, allowing for a more detailed comprehension of uncertainty. They are particularly valuable in contemporary economic analysis, allowing for dynamic adjustments based on new data.

-

Altman’s Z-Score Adaptations: Originally intended for manufacturing companies, the Z-Score integrates the previously mentioned five ratios to deliver a clear evaluation of bankruptcy exposure. Notably, the model has evolved; Altman introduced the Z'-Score and Z''-Score adaptations to enhance accuracy for non-manufacturing firms and private entities. These adaptations tackle the constraints of the original model by incorporating factors that represent the economic realities of various business types, ensuring a more precise evaluation of potential issues.

-

Machine Learning Approaches: By utilizing advanced techniques, organizations can analyze extensive datasets to identify patterns that may predict economic challenges. These techniques are becoming more pertinent in the digital era, boosting the predictive precision of conventional models such as the Z-Score.

Integrating these approaches into your financial distress risk assessment report will enhance the thoroughness of your evaluations and establish a strong basis for strategic decision-making. As James R. Leichter aptly states, 'Understanding and managing deferred revenue ensures accurate reporting,' highlighting the importance of these assessments in maintaining economic integrity.

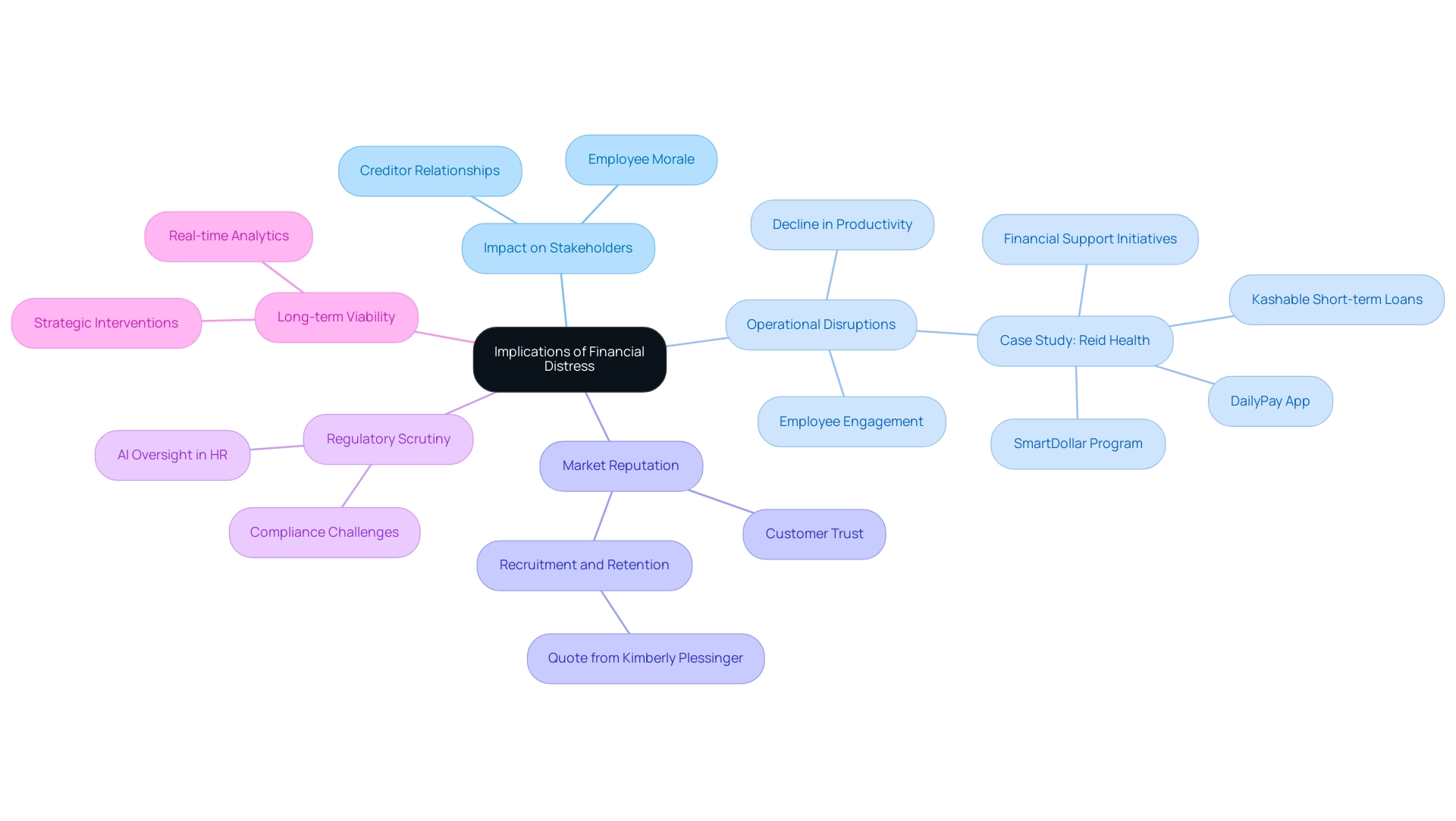

Implications of Financial Distress: Understanding the Broader Impact

Financial difficulties highlighted in the financial distress risk assessment report pose a myriad of significant implications that demand careful consideration from Chief Financial Officers. These include:

- Impact on Stakeholders: Employees often grapple with job insecurity during times of economic turmoil, leading to decreased morale and productivity. Concurrently, creditors face potential losses that can strain relationships and hinder future financing opportunities. For instance, data indicates that distressed companies may experience creditor losses that escalate operational challenges.

- Operational Disruptions: The ripple effects of economic distress can severely disrupt operations. A decline in employee engagement and productivity not only affects performance but can also lead to a cycle of decline, making recovery more difficult. The experience of Reid Health during the COVID-19 pandemic highlights this: their proactive monetary support initiatives, such as providing access to short-term loans and economic education programs, were crucial in alleviating employee stress and enhancing productivity. Additionally, Marsh McLennan's efforts have enhanced productivity and job satisfaction for over 20,000 employees, showcasing the beneficial effects of efficient support systems.

- Market Reputation: A company encountering economic challenges often suffers reputational damage, eroding customer trust and loyalty. As Kimberly Plessinger, benefits manager at Kimley-Horn, notes, economic stability is increasingly viewed as a vital component of a company’s attractiveness to potential employees, positioning it as a “phenomenal recruiting and retention tool.”

- Regulatory Scrutiny: Economic difficulties can also draw the attention of regulators, resulting in increased scrutiny that complicates compliance efforts. The regulatory landscape is evolving, particularly with new AI laws on the horizon. This highlights the necessity for HR to integrate human intelligence and supervision of AI-driven choices pertaining to recruitment and termination, ensuring compliance and ethical standards are upheld.

- Long-term Viability: Extended economic challenges jeopardize the long-term sustainability of organizations. Strategic interventions, including the operationalization of turnaround lessons and real-time analytics, are essential for recovery; without them, businesses risk entering a downward spiral. Recent implications observed in 2024 underscore the critical nature of addressing monetary challenges not just as a temporary setback, but as a determinant of future success.

CFOs must grasp these implications to navigate the complexities of monetary issues effectively. By developing robust strategies that prioritize stakeholder well-being and organizational resilience, including testing hypotheses through structured methodologies and quick decision-making processes supported by real-time analytics via a client dashboard, they can steer their companies toward recovery and sustainable growth. Practical solutions, such as TIAA's comprehensive benefits package—which includes onsite medical care and a financial distress risk assessment report—can serve as a model for CFOs aiming to mitigate the effects of financial distress.

Conclusion

Navigating financial distress is a pressing concern that requires proactive measures and informed decision-making from CFOs. Understanding key concepts such as:

- Liquidity risk

- Solvency

- Operational efficiency

is crucial for identifying early warning signs and developing a resilient risk assessment framework. By leveraging essential financial ratios and indicators, organizations can detect potential challenges and implement timely interventions to safeguard their financial health.

Moreover, adopting robust methodologies for data collection and analysis, including:

- Z-Score analysis

- Machine learning approaches

enhances the accuracy of financial assessments. This not only allows for better predictive insights but also equips finance leaders with the tools necessary to make informed strategic decisions. Continuous monitoring and benchmarking against industry standards further strengthen the ability to respond to evolving economic conditions.

The implications of financial distress extend beyond immediate financial metrics; they impact stakeholders, operational efficiency, market reputation, and long-term viability. By prioritizing stakeholder well-being and organizational resilience, CFOs can foster an environment that mitigates risks and positions their companies for sustainable growth. Taking decisive action now will not only address current challenges but also pave the way for a more stable and prosperous future.

Frequently Asked Questions

What is economic distress?

Economic distress occurs when a company faces significant challenges in meeting its financial obligations, which may lead to bankruptcy or liquidation if not addressed timely.

What is liquidity risk?

Liquidity risk is the possibility that an organization cannot meet its short-term financial obligations, potentially causing operational disruptions. Effective decision-making and continuous monitoring can help reduce this risk.

How is solvency defined?

Solvency refers to a company's ability to meet its long-term debts and obligations, serving as a key indicator of its economic health. Quick decision-making supported by real-time analytics is essential for addressing solvency issues.

What does operational efficiency mean?

Operational efficiency assesses how well a company utilizes its resources to deliver products or services, directly impacting its economic stability. Improving efficiency can be achieved by analyzing past outcomes and theories.

What are some signs of economic distress that CFOs should monitor?

CFOs should watch for the following indicators: 1. Current Ratio: A ratio below 1 suggests potential liquidity issues. 2. Quick Ratio: A low quick ratio indicates difficulty in meeting short-term obligations. 3. Debt-to-Equity Ratio: A high ratio may indicate excessive leverage and financial risk. 4. Cash Flow Trends: Consistent negative cash flow signals operational problems. 5. Profit Margin Decline: A decrease in profit margins can reflect inefficiencies or increased competition.

What are some strategies to manage liquidity risk?

Effective strategies for managing liquidity risk include thorough budgeting, which 53% of respondents use to alleviate economic stress, and leveraging real-time analytics through client dashboards.

What recent trends indicate the current economic challenges?

Recent data shows that 35% of individuals felt economically worse off than the previous year, and 47% reported that financial worries negatively impacted their mental well-being.

How does the U.S. trade deficit affect economic health?

An increasing trade deficit, such as the rise from $70.8 billion in August to $84.4 billion in September, highlights the importance of understanding external economic factors that can influence a company's financial stability.

Why is it important for CFOs to monitor financial ratios?

Regular monitoring of financial ratios helps organizations detect early warning signs of economic distress, allowing for proactive responses and strategic adjustments to resource allocation.