Overview

This article highlights four key strategies for CFOs aiming to enhance cash flow management within their operations:

- Optimize inventory management

- Accelerate receivables

- Extend payables

- Monitor financial metrics

Collectively, these strategies promote improved liquidity and financial stability. The article provides a comprehensive analysis of common challenges faced in cash flow management, alongside best practices that can be implemented for effective solutions.

Introduction

In the intricate world of business finance, effective cash flow management stands as a cornerstone for success, particularly for Chief Financial Officers (CFOs) navigating complex economic landscapes. Cash inflows and outflows directly impact a company's viability, making an understanding of cash flow fundamentals essential.

From the challenges posed by inconsistent revenue streams and delayed payments to the strategic implementation of technology for real-time monitoring, CFOs must adopt a comprehensive approach to ensure financial stability.

This article delves into the critical components of cash flow management, identifies common pitfalls, and outlines best practices that empower organizations to master their cash conversion cycles. Ultimately, this mastery paves the way for sustainable growth.

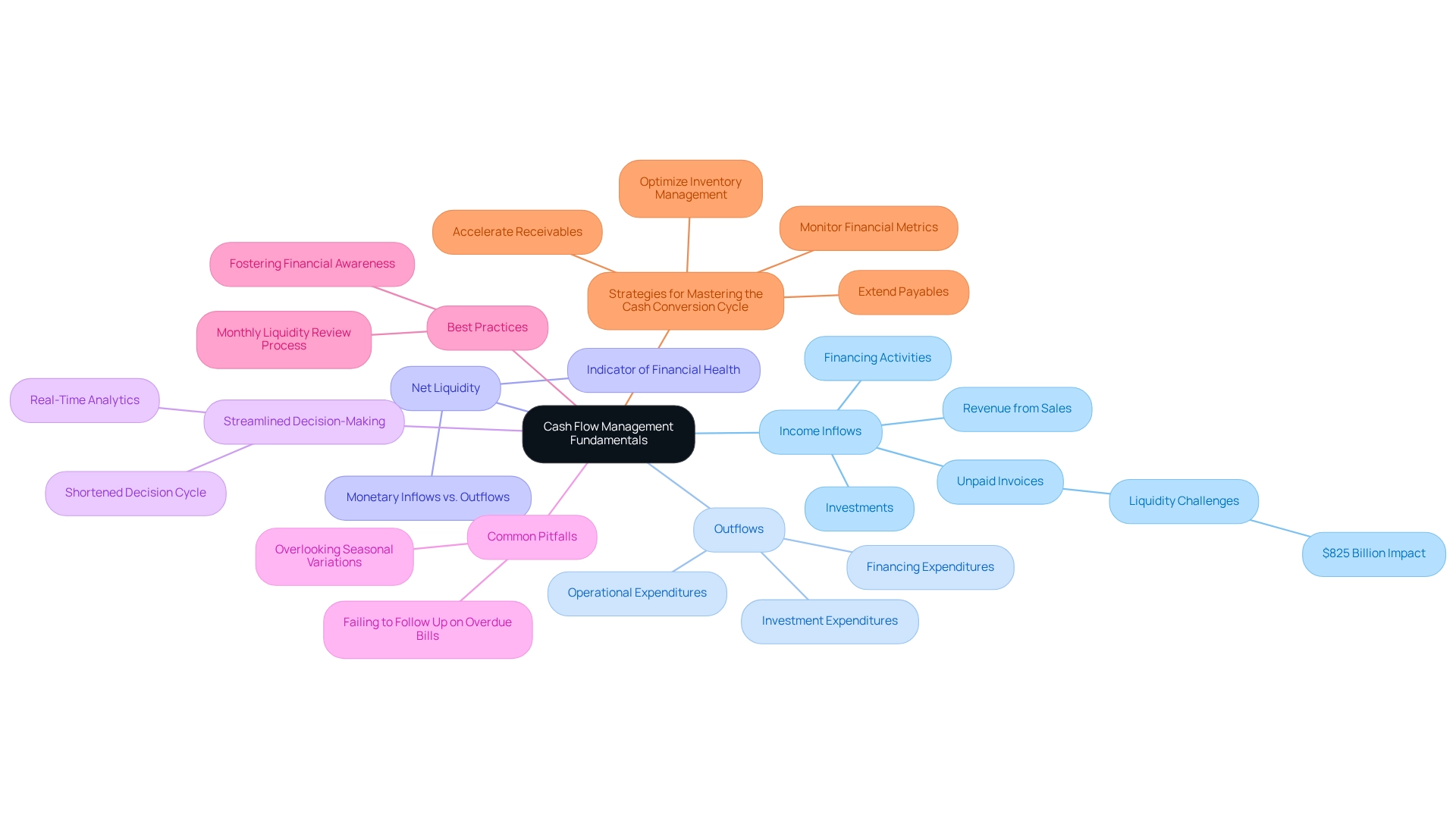

Understand Cash Flow Management Fundamentals

Efficient handling of finances is essential for the economic well-being of any enterprise, particularly for CFOs focusing on cash flow enhancement while navigating intricate financial environments. The essential elements of financial management encompass:

- Income Inflows: This includes revenue generated from sales, investments, and financing activities, which are crucial for maintaining operations and growth. Notably, unpaid invoices contribute to roughly $825 billion in liquidity challenges for small enterprises, highlighting the necessity of cash flow enhancement through efficient management of receivables.

- Outflows: These expenditures incurred through operations, investments, and financing must be carefully monitored to maintain a positive liquidity situation.

- Net Liquidity: This figure represents the difference between monetary inflows and outflows, serving as an indicator of whether an enterprise is generating or consuming funds.

Regularly reviewing liquidity statements is essential for CFOs to identify trends and make informed financial decisions. Creating a financial forecast enables companies to predict upcoming monetary requirements, which supports cash flow enhancement and helps avoid liquidity emergencies. SMEs that track their finances monthly benefit from cash flow enhancement, resulting in an impressive 80% survival rate, underscoring the significance of diligent fiscal oversight.

-

Streamlined Decision-Making: To enhance financial oversight, CFOs should support a shortened decision-making cycle. This method enables teams to take decisive actions swiftly, maintaining organizational health during challenging times. Moreover, employing real-time analytics via client dashboards can consistently assess business health, ensuring that strategies are modified as necessary.

-

Common Pitfalls: CFOs should be mindful of typical errors in liquidity oversight, such as overlooking seasonal variations in revenue or failing to follow up on overdue bills, which can result in financial shortages.

-

Best Practice: Establishing a monthly liquidity review process guarantees that all stakeholders are updated about the company's financial status, facilitating proactive actions to tackle potential challenges. This practice not only enhances transparency but also promotes cash flow enhancement by fostering a culture of financial awareness within the organization.

-

Strategies for Mastering the Cash Conversion Cycle:

- Optimize Inventory Management: Reduce excess inventory to free up cash.

- Accelerate Receivables: Implement strategies to collect payments faster.

- Extend Payables: Negotiate improved terms with suppliers to postpone outflows.

- Monitor Financial Metrics: Regularly track key performance indicators related to liquidity.

By adopting these monetary oversight practices, including testing hypotheses and applying lessons learned, CFOs can expect enhanced financial stability and the capacity for cash flow enhancement, which ultimately leads to sustainable growth.

Identify Common Cash Flow Management Challenges

Frequent liquidity management obstacles significantly impact the financial well-being of enterprises, particularly for CFOs navigating complex environments. Key issues include:

- Inconsistent Revenue Streams: Many businesses face fluctuations in sales, resulting in unpredictable cash inflows. This inconsistency can impede effective financial planning and resource allocation. Streamlined decision-making processes empower CFOs to respond swiftly to these fluctuations, thereby maintaining organizational health.

- Delayed Payments: Late payments from clients pose a common challenge, straining financial reserves and complicating operational stability. Approximately 40% of small business owners cite tax and accounting difficulties as the most significant challenges in managing their businesses, exacerbating financial flow issues. This highlights the need for enhanced resource allocation to address these complexities, including cash flow enhancement through real-time analytics to monitor payment behaviors and adjust strategies accordingly.

- High Overhead Expenses: Excessive fixed costs can rapidly deplete financial reserves, especially during economic downturns. Implementing strategies such as Just-in-Time (JIT) inventory can help lower storage costs and minimize waste. For instance, a retail business that adopted JIT inventory management successfully reduced its holding expenses by 30%, facilitating better financial management. Regular updates and adjustments based on real-time data can further bolster operational efficiency.

- Poor Forecasting: Inaccurate revenue projections often lead to unexpected deficits, making it crucial for CFOs to frequently revise estimates in line with current operational conditions and market dynamics. Utilizing a client dashboard for real-time business analytics can markedly enhance forecasting accuracy and decision-making speed.

Best Practice: Conducting a comprehensive examination of financial movement patterns and client payment behaviors is essential. By identifying patterns and adjusting approaches accordingly, CFOs can achieve cash flow enhancement in their financial management strategies. Regular updates to financial projections will ensure alignment with shifting market conditions, enabling leaders to make informed decisions and strategize effectively for the future. As Nick Chandi, CEO of Forwardly, stated, "Understanding financial movement empowers entrepreneurs to make informed decisions and prepare for what lies ahead." Moreover, CFOs must recognize common pitfalls in financial management, such as overestimating income or underestimating costs, to avert misapplications of the practices discussed.

Develop a Scalable Cash Flow Management Strategy

To develop a scalable cash flow management strategy, CFOs should focus on the following key practices:

- Establish Clear Financial Flow Policies: Defining comprehensive guidelines for monetary inflows and outflows, including payment terms and credit policies, is essential. Clear policies streamline operations and contribute to cash flow enhancement, which is crucial for effective decision-making. As Cathie Lesjak, CFO of HP, notes, "If you save a dollar and you reinvest that back into the business in a disciplined way, that dollar is actually worth a lot more in the future."

- Implement Regular Financial Flow Forecasting: By utilizing historical data alongside market analysis, CFOs can achieve accurate projections of future monetary needs. Aiming for 100% visibility over company spending serves as a concrete benchmark. This proactive approach allows CFOs to anticipate fluctuations and adjust strategies accordingly, thereby facilitating cash flow enhancement and ensuring that the organization remains financially agile.

- Optimize Working Capital: Effective management of inventory levels, accounts receivable, and accounts payable is crucial for enhancing liquidity. Understanding how clients create value is as important as being aware of one's own operational processes. By concentrating on these aspects, companies can achieve cash flow enhancement, improve liquidity, and lower the risk of financial shortages, ultimately fostering sustainable growth. A comprehensive financial evaluation can assist in recognizing opportunities to maintain liquidity and decrease liabilities, further enhancing working capital management. Consider utilizing our Financial Assessment service to uncover specific strategies customized to your organization's needs.

- Create Contingency Plans: Preparing for possible financial disruptions is essential. CFOs should establish backup financing options and cost-cutting measures to mitigate risks associated with unforeseen circumstances. Integrating scenario planning into financial oversight enables CFOs to assess the effects of different market conditions. This strategic foresight allows for proactive adjustments, ensuring that the organization can navigate challenges effectively while maintaining financial stability. Furthermore, as emphasized in the case study featuring Brad Halverson, focusing on customer interactions instead of data analysis can lead to more perceptive decision-making, further improving financial oversight. For more insights, explore our Financial Assessment service.

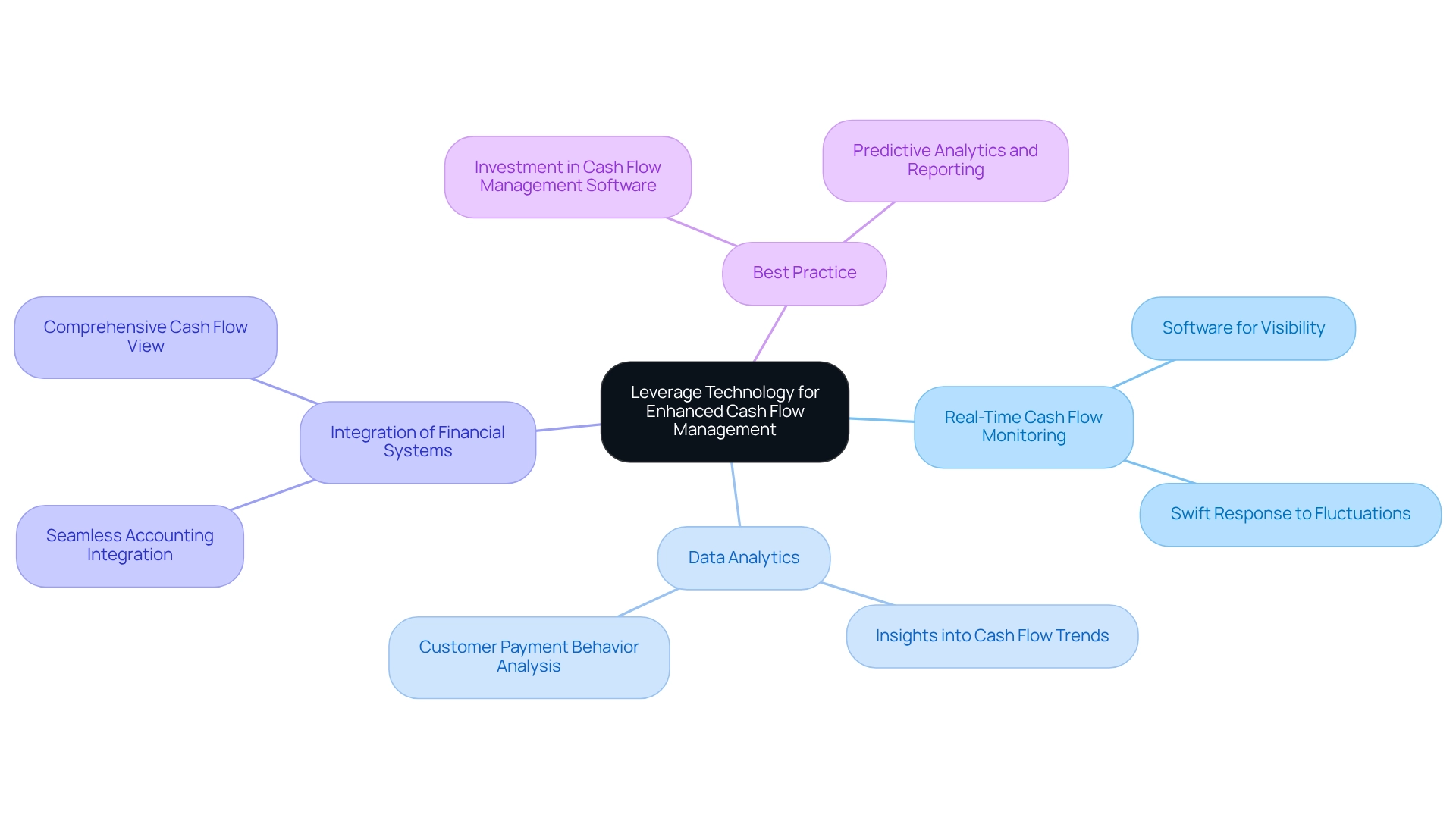

Leverage Technology for Enhanced Cash Flow Management

CFOs can leverage technology in several impactful ways for cash flow enhancement, including the implementation of automated invoicing and payment systems to significantly reduce delays in cash inflows. This approach aligns with strategies aimed at achieving optimal business performance.

- Real-Time Cash Flow Monitoring: Utilize software that offers real-time visibility into cash positions. This capability enables swift responses to cash flow fluctuations, thereby supporting a streamlined decision-making process.

- Data Analytics: Employ advanced analytics tools to gain crucial insights into cash flow trends and customer payment behaviors. Such insights facilitate better forecasting and continuous monitoring of business performance.

- Integration of Financial Systems: Ensure that accounting, sales, and inventory systems are seamlessly integrated. This integration provides a comprehensive view of cash flow, operationalizing turnaround lessons for cash flow enhancement and improved performance.

- Best Practice: Invest in cash flow management software that features predictive analytics and robust reporting capabilities, such as [specific software name]. This investment empowers CFOs to make data-driven decisions, thereby enhancing overall financial health while mastering the cash conversion cycle.

Conclusion

Effective cash flow management is paramount for the financial stability and growth of any organization, particularly for CFOs steering through complex economic terrains. By understanding the fundamentals of cash inflows and outflows, and regularly reviewing cash flow statements, businesses can make informed decisions that safeguard their financial health. The importance of implementing streamlined decision-making processes and being aware of common pitfalls cannot be overstated, as these practices significantly reduce the risk of cash shortages.

Identifying and addressing common cash flow challenges such as inconsistent revenue streams, delayed payments, and high overhead costs is essential for maintaining operational stability. Moreover, by leveraging technology and employing best practices like regular cash flow forecasting and optimizing working capital, CFOs can enhance their organizations' liquidity and resilience. Furthermore, establishing clear cash flow policies and preparing contingency plans can equip businesses to navigate unforeseen disruptions effectively.

Ultimately, mastering cash flow management not only ensures immediate financial stability but also lays the groundwork for sustainable growth. By adopting a proactive and strategic approach, CFOs can empower their organizations to thrive, turning potential challenges into opportunities for success. The journey toward financial mastery begins with a commitment to understanding and optimizing cash flow, paving the way for a prosperous future.

Frequently Asked Questions

Why is efficient handling of finances important for enterprises?

Efficient handling of finances is essential for the economic well-being of any enterprise, especially for CFOs focusing on cash flow enhancement while navigating complex financial environments.

What are the key elements of financial management?

The key elements of financial management include income inflows, outflows, net liquidity, streamlined decision-making, common pitfalls, best practices, and strategies for mastering the cash conversion cycle.

What are income inflows and why are they important?

Income inflows consist of revenue generated from sales, investments, and financing activities, which are crucial for maintaining operations and supporting growth. Unpaid invoices can create significant liquidity challenges for small enterprises.

What are outflows in financial management?

Outflows are expenditures incurred through operations, investments, and financing that must be monitored to maintain a positive liquidity situation.

How is net liquidity defined?

Net liquidity is the difference between monetary inflows and outflows, indicating whether an enterprise is generating or consuming funds.

Why is it important for CFOs to review liquidity statements regularly?

Regularly reviewing liquidity statements is essential for CFOs to identify trends and make informed financial decisions, which supports cash flow enhancement and helps avoid liquidity emergencies.

What benefits do SMEs gain from tracking their finances monthly?

SMEs that track their finances monthly benefit from improved cash flow management, resulting in an impressive 80% survival rate.

How can CFOs enhance financial oversight?

CFOs can enhance financial oversight by supporting a shortened decision-making cycle and employing real-time analytics via client dashboards to assess business health continuously.

What common pitfalls should CFOs avoid in liquidity oversight?

CFOs should be mindful of overlooking seasonal variations in revenue and failing to follow up on overdue bills, which can lead to financial shortages.

What is a best practice for financial management?

Establishing a monthly liquidity review process ensures all stakeholders are updated about the company’s financial status, promoting transparency and proactive actions to address potential challenges.

What strategies can CFOs use to master the cash conversion cycle?

Strategies include optimizing inventory management, accelerating receivables, extending payables, and monitoring financial metrics regularly.

What is the expected outcome of adopting effective monetary oversight practices?

By adopting these practices, CFOs can expect enhanced financial stability and improved cash flow management, leading to sustainable growth.