Overview

The article outlines four key strategies for managing risks in distressed businesses:

- Identifying potential risks

- Conducting thorough financial assessments

- Establishing a crisis response team

- Leveraging technology for enhanced decision-making

These strategies are supported by evidence emphasizing the importance of proactive measures. Real-time analytics and tailored interventions play a crucial role in mitigating risks and improving the resilience of struggling enterprises. By implementing these strategies, businesses can navigate challenges more effectively and position themselves for recovery.

Introduction

In the intricate landscape of distressed businesses, grasping the multifaceted challenges they encounter is essential for survival and recovery. From dwindling revenues to operational inefficiencies, these organizations must navigate a multitude of issues that jeopardize their viability.

By identifying early signs of distress, such as cash flow dilemmas and escalating debt levels, companies can execute timely interventions and turnaround strategies. This article explores effective risk management practices, the significance of comprehensive financial assessments, and the role of technology in enhancing decision-making processes.

By examining these critical components, businesses can not only protect their operations but also position themselves for sustainable growth in the face of adversity.

Understand Distressed Business Dynamics

Distressed companies frequently face a multitude of challenges, including declining revenues, heightened competition, and operational inefficiencies. Recognizing these dynamics necessitates an awareness of the signs of distress, such as cash flow problems, escalating debt levels, and customer attrition. For example, a retail company witnessing a decrease in foot traffic must evaluate its market positioning and operational costs. By identifying these factors early, companies can implement proactive measures in distressed business risk management to mitigate risks and launch effective turnaround strategies.

Adopting a pragmatic data strategy enables organizations to test hypotheses and maximize returns on invested capital. Moreover, a streamlined decision-making cycle empowers teams to act decisively, ensuring the organization's sustainability. Continuous monitoring through real-time analytics not only assesses organizational health but also cultivates robust relationships by operationalizing lessons learned during the turnaround process. Understanding industry-specific challenges—such as those encountered in the hospitality or retail sectors—can inform tailored interventions in distressed business risk management that effectively address unique operational hurdles.

Implement Effective Risk Management Strategies

To effectively tackle the challenges faced by struggling enterprises, organizations must implement a comprehensive management framework that includes distressed business risk management and several other critical components. This framework begins with the identification of potential risks, followed by a thorough financial assessment aimed at uncovering opportunities for cash preservation and liability reduction. Recent data indicates that 16 to 26 percent of exports may be affected by supply chain disruptions in the coming five years. This reality urges companies to adopt alternative sourcing strategies and diversify their supplier networks to mitigate reliance on single sources.

Establishing a dedicated crisis response team is essential for facilitating rapid reactions to emerging threats. This team should comprise roles such as a crisis manager, communication lead, and operational coordinator, ensuring that the organization remains agile and responsive in times of uncertainty. Routine evaluations of potential threats and scenario planning are vital activities that enhance readiness, enabling organizations to anticipate difficulties and adjust proactively.

A case study on personalizing hazard control solutions illustrates the effectiveness of tailored approaches. By leveraging research and data to address specific organizational needs, companies can bolster operational resilience and achieve greater success. For instance, organizations that implemented customized strategies reported improved agility in responding to market changes, positioning themselves for sustainable growth in the long term.

Integrating expert perspectives into thorough vulnerability frameworks further strengthens these strategies. CFOs emphasize the importance of incorporating comprehensive fiscal evaluations, benchmarking, continuity planning, and regulatory adherence into their management practices. As one CFO noted, "Effective risk mitigation strategies must be proactive and adaptable, ensuring that we can navigate the complexities of distressed business risk management while safeguarding our operations and ensuring long-term viability." By adopting this approach, organizations can effectively navigate the complexities of distressed business risk management while safeguarding their operations and ensuring long-term viability.

Conduct Thorough Financial Assessments for Cash Preservation

Conducting a comprehensive evaluation of resources is crucial for identifying opportunities for improvement in the context of distressed business risk management for struggling enterprises. This process involves a detailed analysis of cash flow statements, balance sheets, and income statements, bolstered by real-time analytics that facilitate continuous monitoring of financial health.

Effective cash preservation strategies include:

- Minimizing unnecessary expenses

- Renegotiating payment terms with suppliers

- Optimizing inventory levels

For instance, a restaurant facing declining sales can undertake a menu analysis to identify underperforming items, leading to their elimination and a subsequent reduction in food costs. Furthermore, implementing distressed business risk management through cash flow forecasting allows businesses to anticipate future cash needs, thereby averting liquidity crises and enhancing overall business liquidity.

Regular financial assessments, supported by real-time analytics, are vital for distressed business risk management as they help organizations remain vigilant and adaptable to shifting economic conditions. By 2025, efficient cash management strategies, supported by streamlined decision-making processes, are expected to significantly enhance the resilience and profitability of struggling companies, emphasizing the need for distressed business risk management and proactive financial evaluations.

Additionally, addressing potential conflicts of interest and ensuring transparency can mitigate risks through effective distressed business risk management during financial distress. As noted by Priya, 'Ultimately, a critical evaluation of these metrics by the board may assist in refining existing models, lead to future oversight updates that include information that is more pertinent to the board, and more importantly, reveal the possibility of economic distress early.'

Insights from the case study titled 'Proactive Management of Financial Distress' further highlight the importance of distressed business risk management, emphasizing proactive monitoring of financial health and transparency in decision-making.

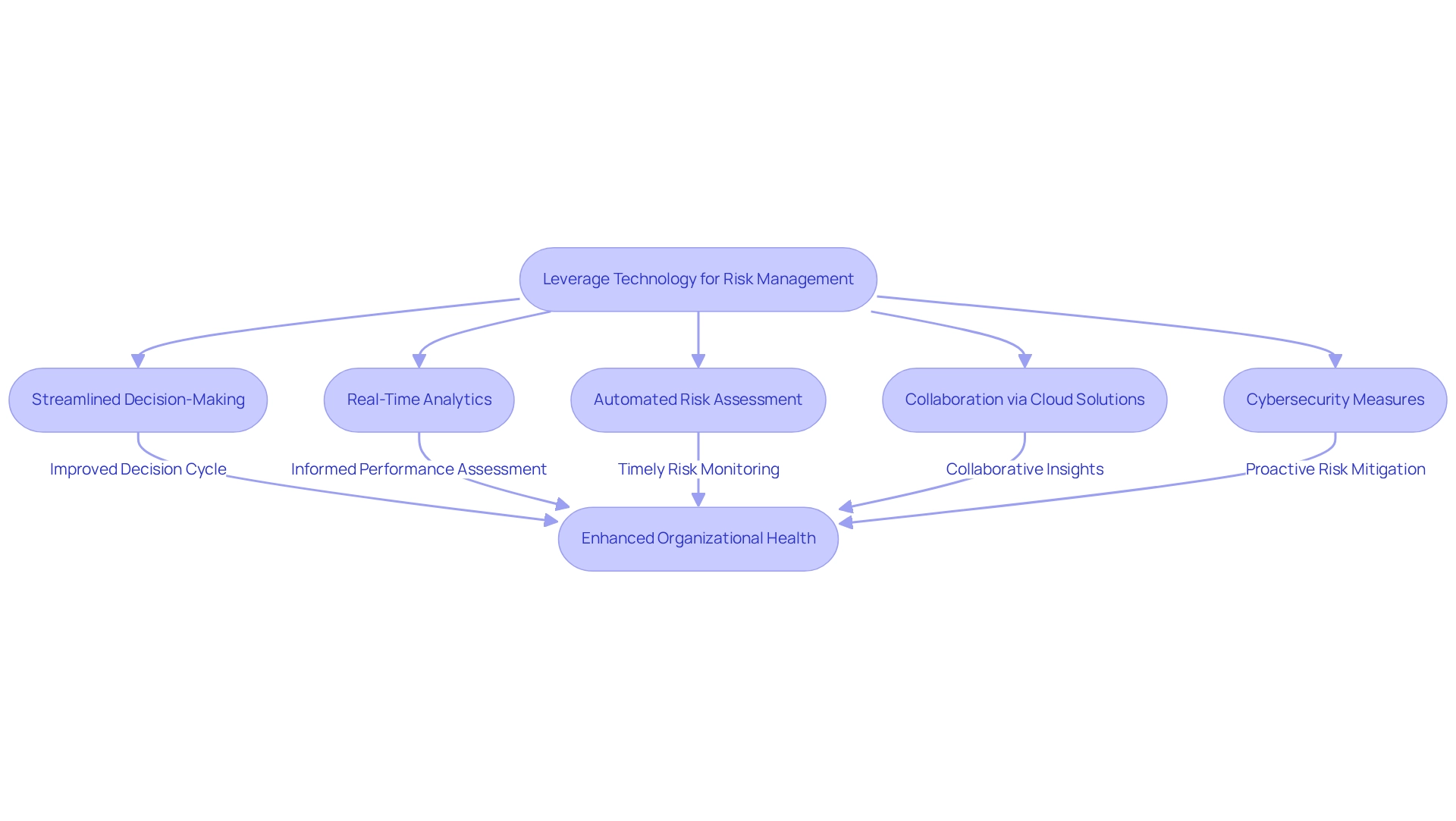

Leverage Technology for Enhanced Risk Management

Technology plays a crucial role in enhancing safety practices, particularly through streamlined decision-making and real-time analytics. Companies can leverage data analytics tools to gain insights into operational performance and identify potential challenges. For instance, the implementation of distressed business risk management software can automate the risk assessment process, facilitating real-time monitoring and reporting—an essential aspect for making timely decisions during a turnaround.

Moreover, our team shortens the decision-making cycle during the turnaround process, enabling decisive actions that uphold organizational health. In addition, utilizing cloud-based solutions fosters collaboration among teams, ensuring that all stakeholders have access to critical information. Ongoing observation via client dashboards provides real-time analytics, allowing organizations to assess their performance effectively.

Cybersecurity measures are also paramount, as safeguarding sensitive information from breaches is a key element of risk mitigation. By embracing technology, businesses not only enhance their processes for distressed business risk management but also cultivate a culture of proactive risk awareness.

Conclusion

Navigating the complexities of distressed businesses necessitates a multifaceted approach that encompasses an understanding of their unique challenges, the implementation of robust risk management strategies, thorough financial assessments, and effective leverage of technology. Recognizing signs of distress early, such as cash flow issues and operational inefficiencies, enables businesses to take proactive measures that can significantly enhance their chances of recovery.

Effective risk management is paramount, requiring a comprehensive framework that identifies potential risks and fosters agility through dedicated crisis management teams. By engaging in regular financial assessments, organizations can implement cash preservation strategies that help mitigate financial strain and enhance liquidity. Moreover, the integration of real-time analytics and technology into these processes not only streamlines decision-making but also empowers businesses to respond swiftly to emerging threats.

Ultimately, the ability to adapt and respond effectively to challenges in distressed environments is crucial for long-term viability and sustainable growth. By embracing these strategies and fostering a culture of proactive risk management, businesses can not only survive adversity but also emerge stronger, ready to seize new opportunities in the marketplace. The commitment to continuous improvement and strategic foresight will be the defining factors in navigating the road to recovery and achieving lasting success.

Frequently Asked Questions

What challenges do distressed companies commonly face?

Distressed companies frequently face challenges such as declining revenues, heightened competition, and operational inefficiencies.

What are some signs that a company is in distress?

Signs of distress include cash flow problems, escalating debt levels, and customer attrition.

How can a retail company identify its distress?

A retail company can identify distress by evaluating its market positioning and operational costs, especially if it experiences a decrease in foot traffic.

What is the importance of early identification of distress factors?

Early identification allows companies to implement proactive measures in distressed business risk management to mitigate risks and launch effective turnaround strategies.

How can a pragmatic data strategy benefit organizations in distress?

A pragmatic data strategy enables organizations to test hypotheses and maximize returns on invested capital.

What role does decision-making play in managing distressed companies?

A streamlined decision-making cycle empowers teams to act decisively, which is crucial for ensuring the organization’s sustainability.

Why is continuous monitoring important during a turnaround process?

Continuous monitoring through real-time analytics assesses organizational health and helps cultivate robust relationships by operationalizing lessons learned.

How can understanding industry-specific challenges assist in distressed business risk management?

Understanding industry-specific challenges, such as those in the hospitality or retail sectors, informs tailored interventions that effectively address unique operational hurdles.