Introduction

In an increasingly complex financial landscape, the importance of robust financial statement risk assessments cannot be overstated. As organizations face mounting pressures from market volatility, regulatory changes, and potential fraud, understanding and mitigating these risks is essential for maintaining financial integrity and operational efficiency. By employing advanced analytics and real-time monitoring, businesses can identify vulnerabilities and implement strategies that not only safeguard their assets but also enhance decision-making processes.

This article delves into the critical components of financial risk assessments, the role of fraud detection, and practical steps organizations can take to navigate these challenges effectively, ensuring they remain resilient in the face of uncertainty.

Understanding Financial Statement Risk Assessment

Monetary report evaluation is an essential review procedure focused on pinpointing possible threats that could undermine the precision and dependability of a financial statement risk assessment example. In 2024, with the increasing emphasis on data accuracy, businesses must recognize that inaccuracies can lead to detrimental decision-making and significant operational inefficiencies. As Alan Anderson, CPA, CGMA, founder of ACCOUNTability Plus, emphasizes,

Auditors taking outliers identified by data analytics at the data or transaction level, determining if they are appropriate or inappropriate, and then moving them into a Gen AI program that would continuously monitor the area where the outlier occurred.

This underscores the necessity of leveraging advanced analytics to enhance the risk evaluation process and streamline decision-making.

A financial statement risk assessment example includes key components such as:

- A thorough understanding of the internal controls currently in place

- A diligent evaluation of the financial reporting process

- The identification of areas most vulnerable to errors or [fraud

Continuous business performance monitoring](https://planergy.com/blog/financial-analysis-data) is essential, as it fosters relationship-building through real-time analytics and enables entities to operationalize lessons learned during turnaround efforts. Utilizing a client dashboard that provides real-time business analytics, companies can continually diagnose their business health and make informed adjustments.

However, auditors must be cautious of the possibility of misinterpretation of complex visualizations, which can obscure critical insights. A case study on corporate finance illustrates that reliance on accurate data is paramount to avoid monetary losses and operational inefficiencies. By automating processes with advanced software solutions, organizations can significantly improve data reliability, thus supporting informed decision-making.

For example, PLANERGY has assisted clients in saving billions of dollars through improved expenditure management and process automation, showcasing the economic advantages of efficient evaluations. In the end, through a thorough evaluation of potential issues and a dedication to revise and modify plans based on real-time information, businesses can protect their economic stability and uphold the confidence of stakeholders.

The Role of Fraud Risk Assessments in Financial Statements

Fraud evaluations serve as a financial statement risk assessment example, crucial for analyzing financial statement vulnerabilities and identifying areas susceptible to deceitful actions. These evaluations necessitate a comprehensive examination of a company's internal controls, employee behaviors, and potential external threats in a financial statement risk assessment example. Based on PwC's 2024 Global Economic Crime Survey, which represents over 20 years of research on economic crime challenges encountered by entities, the necessity for strong fraud evaluations has never been more urgent.

Furthermore, a report from BusinessWire indicates that 52% of polled cybersecurity experts have observed a rise in cyberattacks compared to the previous year, highlighting the necessity for businesses to implement thorough fraud evaluations. By recognizing possible fraud schemes early, entities can reduce monetary losses and maintain their reputational integrity. Effective strategies include:

- Conducting regular audits

- Providing employee training focused on ethical practices

- Implementing a whistleblower policy that encourages the reporting of suspicious activities

Moreover, ongoing evaluation of fraud control initiatives, as emphasized in the case study on continuous reviews, guarantees that entities stay adaptable against developing fraud threats, underscoring the importance of these evaluations in economic oversight.

Steps to Conduct an Effective Financial Risk Assessment

Carrying out a thorough risk evaluation is essential for informed decision-making within a business. Here are the essential steps to follow:

-

Identify Objectives: Clearly define the purpose of your evaluation, pinpointing the specific outcomes you wish to achieve.

Establishing well-defined objectives sets a solid foundation for the entire process.

-

Gather Data: Accumulate relevant financial data, including historical performance metrics and current financial statements.

Quality data is the backbone of any effective evaluation, enabling a thorough analysis of potential challenges.

-

Assess Hazards: Dive into the collected data to pinpoint potential threats such as market volatility, operational inefficiencies, and compliance challenges.

A 1-month 5% Value at Risk (Var) of $5 million illustrates that there is a 5% chance your portfolio could lose more than $5 million within the upcoming month, showcasing the tangible consequences of exposure. Additionally, the Sharpe ratio, which is calculated by subtracting the risk-free rate of return from an investment's total return and dividing by the standard deviation of the investment's excess return, can also be utilized to assess risk-adjusted performance.

-

Evaluate Controls: Review existing internal controls to assess their effectiveness in reducing the identified threats.

This step is vital for ensuring that your entity is fortified against potential financial pitfalls.

-

Develop Mitigation Strategies: Formulate actionable plans to address each identified threat, ensuring these strategies align with organizational goals and objectives.

Customizing your strategy to suit the particular context of your company improves the significance of your management efforts.

-

Monitor and Review: Establish a framework for regularly monitoring the effectiveness of implemented strategies.

This continuous evaluation procedure is essential as it enables modifications based on changing challenges and market conditions, maintaining your entity adaptable in the presence of unpredictability. For instance, banks utilize credit assessment models to evaluate the likelihood of mortgage defaults based on factors like FICO scores and debt-to-income ratios, as seen in the case study titled 'Credit Assessment Modeling for Mortgages.'

By following these steps, organizations can cultivate a strong structure for implementing a financial statement risk assessment example, ultimately resulting in more careful lending choices and enhanced economic stability. As Volkan Evrin, a CISA and CRISC specialist, highlights, effective monetary assessment is not solely about identifying threats but also about applying strategies that align with organizational objectives.

Identifying Key Types of Financial Risks

Organizations face a range of crucial monetary challenges that can greatly affect their operations and profitability. Comprehending these uncertainties is vital for CFOs to create strong management strategies customized to their distinct environments. Here are the main categories of monetary uncertainties that entities must manage, along with tactics for mastering the cash conversion cycle to improve overall business performance:

- Market Risk: This involves the potential for losses as a result of fluctuations in market prices or interest rates. With financial volatility on the rise, as highlighted by recent analyses, market uncertainty is increasingly acknowledged as a primary concern for organizations. To mitigate this, CFOs can implement strategies such as optimizing cash flow forecasting and diversifying investment portfolios to reduce exposure to market fluctuations.

- Operational Threat: Arising from internal processes, systems, or human factors, operational threat can lead to significant operational failures. The necessity for effective Operational Risk Management (ORM) programs is emphasized by the fact that 61% of leaders recognize attracting and retaining talent as a top concern heading into 2034. Additionally, with 52% of cybersecurity professionals reporting an increase in cyber attacks, organizations must adapt their ORM strategies accordingly, ensuring that cash resources are available for necessary investments in security measures, such as implementing robust training programs and investing in advanced cybersecurity technologies.

- Credit Risk: This concern pertains to the possibility of loss due to a borrower’s failure to fulfill repayment obligations. Organizations must rigorously evaluate their credit portfolios and implement proactive cash management strategies, such as establishing clear credit policies and closely monitoring receivables, to ensure liquidity and minimize potential economic losses.

- Liquidity Challenge: Organizations encounter liquidity challenges when they struggle to meet short-term monetary obligations. Effective liquidity management is essential to ensure operational continuity and monetary stability. By mastering the cash conversion cycle through strategies such as optimizing inventory turnover and streamlining accounts receivable processes, CFOs can improve cash flow timing and enhance their ability to meet obligations.

- Regulatory Risk: With the regulatory landscape continuously evolving, the threat of incurring losses due to changes in laws or regulations is significant. In fact, 35% of compliance executives cite adherence and regulatory challenges as their top concern, reflecting the increasing complexity of these environments. This issue emphasizes the significance of creating compliance approaches that correspond with regulatory shifts, such as performing regular audits and initiating compliance training programs, to alleviate possible dangers.

By thoroughly comprehending these monetary challenges and utilizing the previously mentioned strategies for mastering the cash conversion cycle, entities can use a financial statement risk assessment example to enhance their evaluations and effectively tackle the most urgent weaknesses, thereby positioning themselves for enduring resilience and achievement.

Real-World Examples of Financial Statement Risk Assessments

Many entities have effectively utilized a financial statement risk assessment example to tackle obstacles and achieve significant advancements. For example, a medium-sized retail firm, facing decreasing sales in a competitive environment, conducted a financial statement risk assessment example to evaluate its monetary uncertainties. This process revealed inefficiencies in their inventory management and supplier contracts.

By implementing targeted changes and leveraging real-time analytics through our client dashboard, the company achieved a remarkable 20% reduction in costs, significantly enhancing their cash flow. Likewise, a restaurant chain struggling with cash flow problems from seasonal changes employed a comprehensive evaluation to create a flexible pricing strategy designed for peak seasons. This initiative led to a 15% increase in overall profitability.

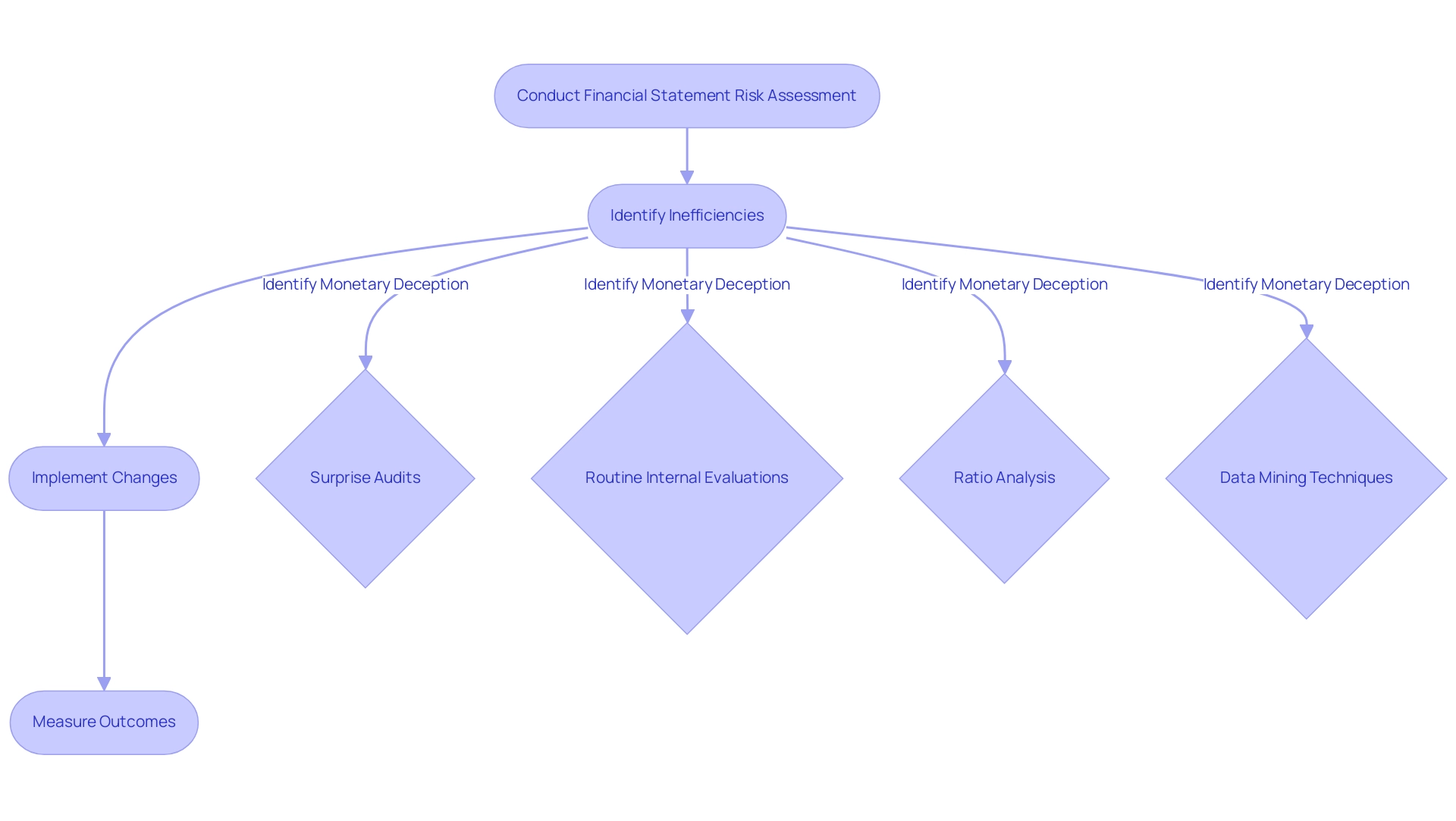

These real-world examples serve as a financial statement risk assessment example, demonstrating the essential function customized statement evaluations have in promoting sustainable growth and operational efficiency. With a 50% projected likelihood guaranteeing 95.5% precision in forecasting companies likely to engage in fraud, including risk evaluations is crucial for organizations. Common approaches for identifying monetary deception include:

- Surprise audits

- Routine internal evaluations

- Ratio analysis

- Data mining techniques

These approaches further enhance the effectiveness of these evaluations.

As a prominent business leader stated, 'Aligning financial strategies with strong evaluation practices not only ensures compliance but also drives operational excellence and profitability.' By operationalizing the lessons learned through these assessments and fostering strong relationships, organizations can continually monitor their performance and make swift, informed decisions that bolster their turnaround strategies. Our pragmatic approach emphasizes the 'Test & Measure' methodology, ensuring that every hypothesis is validated to maximize return on invested capital.

Additionally, our 'Decide & Execute' strategy supports a shortened decision-making cycle, empowering your team to take decisive action swiftly.

Conclusion

In navigating the complexities of today’s financial landscape, the significance of thorough financial statement risk assessments cannot be overstated. The article highlights the necessity of identifying potential risks, from internal control weaknesses to external fraud threats, ensuring organizations maintain the accuracy and reliability of their financial reporting. By leveraging advanced analytics and monitoring tools, businesses can proactively address vulnerabilities, thereby safeguarding their assets and enhancing decision-making processes.

The role of fraud risk assessments emerges as a critical component in this framework, underscoring the urgency for organizations to adopt robust strategies to mitigate financial losses and preserve their reputational integrity. Implementing regular audits, employee training, and continuous evaluation of fraud risk management programs are essential steps that can significantly bolster an organization’s defenses against evolving threats.

Moreover, the article outlines actionable steps to conduct effective financial risk assessments, emphasizing the importance of:

- Clear objectives

- Data gathering

- Ongoing monitoring

By understanding key financial risks—such as market, operational, credit, liquidity, and regulatory risks—CFOs can develop tailored strategies that enhance overall organizational resilience.

Real-world examples illustrate the transformative power of financial statement risk assessments. Organizations that have embraced these practices not only achieved significant cost reductions and profitability increases but also positioned themselves for sustainable growth. By prioritizing financial risk assessments and aligning them with strategic objectives, businesses can navigate uncertainties with confidence and ensure long-term operational efficiency.

Frequently Asked Questions

What is the purpose of monetary report evaluation?

Monetary report evaluation is a review procedure aimed at identifying potential threats that could compromise the accuracy and reliability of financial statement risk assessments.

Why is data accuracy important for businesses in 2024?

In 2024, the emphasis on data accuracy is crucial because inaccuracies can lead to poor decision-making and significant operational inefficiencies.

What role do auditors play in data analytics according to Alan Anderson?

Auditors identify outliers through data analytics at the transaction level, assess their appropriateness, and use Gen AI programs to continuously monitor those areas.

What are the key components of a financial statement risk assessment?

The key components include understanding the internal controls in place, evaluating the financial reporting process, and identifying areas vulnerable to errors or fraud.

How does continuous business performance monitoring benefit companies?

Continuous monitoring fosters relationship-building through real-time analytics and allows companies to operationalize lessons learned from previous challenges.

What tools can companies use for real-time business analytics?

Companies can utilize client dashboards that provide real-time business analytics to diagnose their business health and make informed adjustments.

What caution should auditors take regarding data visualization?

Auditors must be cautious of misinterpretation of complex visualizations, which can obscure critical insights.

Why are fraud evaluations important in financial statement risk assessments?

Fraud evaluations are crucial for analyzing vulnerabilities in financial statements and identifying areas susceptible to deceitful actions.

What does PwC's 2024 Global Economic Crime Survey indicate about fraud evaluations?

The survey highlights the urgent need for strong fraud evaluations due to rising economic crime challenges faced by entities.

What percentage of cybersecurity experts reported a rise in cyberattacks?

According to a report from BusinessWire, 52% of cybersecurity experts observed an increase in cyberattacks compared to the previous year.

What strategies can businesses implement to combat fraud?

Effective strategies include conducting regular audits, providing employee training on ethical practices, and implementing a whistleblower policy.

How can ongoing evaluation of fraud control initiatives benefit businesses?

Ongoing evaluation ensures that entities remain adaptable to evolving fraud threats, reinforcing the importance of these evaluations for economic oversight.