Overview

Creating a financial risk assessment template is essential for organizations aiming to navigate financial uncertainties effectively. This process involves:

- Defining clear objectives

- Gathering relevant data

- Identifying potential threats

- Outlining robust mitigation strategies

A structured approach is crucial; a comprehensive template not only aids in recognizing and prioritizing risks but also fosters collaboration among stakeholders. This collaboration ensures informed decision-making and adaptability in a changing economic landscape. Consequently, organizations are better equipped to enhance their resilience against financial challenges.

Introduction

In the intricate world of finance, navigating risks effectively is paramount for organizational success. As businesses confront an ever-evolving landscape marked by market volatility and regulatory changes, financial risk assessment emerges as a critical tool for Chief Financial Officers (CFOs). This article explores the essential components of a robust financial risk assessment template, offering insights into the identification, analysis, and mitigation of potential threats.

By grasping the key concepts and challenges associated with financial risk management, CFOs can cultivate a culture of resilience and informed decision-making, ultimately safeguarding their organizations against unforeseen financial pitfalls. Moreover, with technology playing an increasingly vital role, the importance of collaboration and continuous updates cannot be overstated, ensuring that risk assessments remain relevant and effective in today’s dynamic business environment.

Understanding Financial Risk Assessment: Key Concepts and Importance

Evaluating economic uncertainties is an essential procedure for CFOs, focusing on the identification, analysis, and reduction of threats that could negatively impact an organization's monetary well-being. The key concepts involved in this process include:

- Risk Identification: Recognizing potential financial threats, such as market fluctuations, credit risks, and operational inefficiencies, is crucial. In 2025, the ability to identify these threats is more vital than ever, as companies face an increasingly unstable economic landscape. Our team at Transform Your Small/ Medium Business will identify underlying business issues and work collaboratively to create a plan that mitigates weaknesses, enabling the business to reinvest in key strengths.

- Threat Assessment: Once dangers are recognized, assessing their probability and potential effect on the organization’s financial stability becomes paramount. Continuous cash flow forecasts and what-if scenario analyses serve as effective tools for CFOs to evaluate the ramifications of losing key customers or suppliers, thereby avoiding liquidity shortfalls. Furthermore, scenario analysis should be employed to assess the impact of potential threats and rank concerns accordingly. We adopt a pragmatic approach to data, rigorously testing every hypothesis to deliver maximum return on invested capital in both the short and long term.

- Risk Mitigation: Formulating strategies to reduce the impact of recognized threats is essential. This may involve diversifying investments, enhancing internal controls, or utilizing foreign exchange contracts to lock in favorable rates for future transactions, thus safeguarding against adverse currency fluctuations.

Grasping these concepts is critical for CFOs, as they lay the foundation for developing a robust risk evaluation template. The financial risk assessment template not only guides entities through uncertainties but also fosters a resilient culture that encourages informed risk-taking and continuous learning. A recent case study titled "Building Resilience in Finance" emphasized how CFOs who focused on agility and collaboration strengthened trust and accountability within their organizations, ultimately fostering collective success and enhancing economic performance.

As the landscape of monetary uncertainty evolves, staying abreast of recent trends and expert opinions is crucial. Notably, a survey revealed that 58% of CFOs are allocating more time to business performance than in the previous year, highlighting the growing recognition of the importance of monetary vulnerability evaluation in ensuring organizational stability in 2025. Additionally, incorporating strategies from 'Mastering the Cash Conversion Cycle' can equip CFOs with further tools to enhance business performance and effectively operationalize turnaround lessons.

Essential Components of a Financial Risk Assessment Template

A comprehensive financial risk assessment template is essential for CFOs navigating the complexities of financial management. To create a robust framework, the following components must be included:

- Risk Categories: Clearly define categories such as market risk, credit risk, operational risk, and liquidity risk. Each category should encompass specific challenges pertinent to the organization’s operations and industry.

- Threat Description: Provide a detailed description of each identified threat, including its source and potential impact. This clarity aids stakeholders in grasping the nuances of each challenge and equips them for informed decision-making.

- Likelihood Assessment: Evaluate the probability of each threat occurring using a scale (e.g., low, medium, high). This evaluation permits prioritization of threats based on their likelihood, enabling more focused resource distribution.

- Impact Evaluation: Assess the possible monetary effect of each threat on the organization. For instance, the $18.5 million class action settlement for Target, resulting from a data breach impacting 41 million customers, highlights the substantial financial consequences that threats can present. Understanding these impacts is crucial for developing effective mitigation strategies and ensuring organizational resilience.

- Mitigation Strategies: Outline specific actions to reduce or eliminate each threat. This proactive strategy not only reduces potential losses but also fosters a culture of awareness regarding uncertainties within the organization. Moreover, managing foreign exchange exposure can involve operational strategies like diversifying facility locations and utilizing currency swaps.

- Monitoring Plan: Create a procedure for frequently evaluating and revising the threat evaluation. Ongoing monitoring, supported by real-time business analytics, guarantees that the evaluation remains pertinent and adaptable to evolving market conditions and organizational dynamics. This aligns with the need for streamlined decision-making and effective performance monitoring, allowing CFOs to take decisive actions based on current data. This approach reflects the 'Decide & Execute' framework, enabling quicker decision-making during the turnaround process, while the 'Update & Adjust' aspect emphasizes the importance of continually monitoring success and adjusting plans accordingly.

Integrating these elements into a financial risk assessment template not only enhances the efficiency of management strategies but also prepares the organization for sustainable expansion in a progressively intricate economic environment. As emphasized by Allianz Trade, 'At Allianz Trade, we are firmly dedicated to equity for everyone without bias, among our own team and in our numerous connections with those outside our organization,' which aligns with the tenets of efficient management of uncertainties. Additionally, Transform Your Small/ Medium Business provides consulting services, including monetary evaluations, to assist companies in overcoming challenges and attaining growth, emphasizing the importance of this subject.

Step-by-Step Guide to Creating Your Financial Risk Assessment Template

Developing a robust financial risk assessment template is essential for CFOs who seek to shield their companies from potential financial challenges. Below is a step-by-step guide designed to assist you in creating an effective template:

- Define Objectives: Clearly articulate the purpose of your risk evaluation. What specific outcomes do you wish to achieve? This foundational step guarantees that the evaluation aligns with your organization’s strategic goals.

- Gather Data: Collect relevant economic data, including historical performance metrics and industry benchmarks. This information serves as the foundation of your evaluation, providing context and insight into potential challenges. Utilizing real-time analytics can enhance this process, facilitating continuous monitoring of business health and performance.

- Identify Hazards: Compile a comprehensive list of possible monetary dangers. Use the information gathered along with your sector knowledge to pinpoint threats that could impact your organization’s financial well-being. As Joe Garafalo notes, "Market exposure is the possibility that macroeconomic changes could harm your business’s capacity to stay competitive," underscoring the importance of understanding these elements in your evaluation.

- Assess Threats: Evaluate each identified threat by determining its likelihood and potential impact. Employ a standardized scoring system to ensure consistency and objectivity in your evaluations. Be cautious of common errors in assessments, such as confusing them with performance reviews or allowing organizational goals to skew your evaluations.

- Develop Mitigation Strategies: For every identified threat, outline specific actions that can be taken to diminish its impact. This proactive approach not only prepares your organization for potential challenges but also enhances resilience. For instance, in managing currency exposure, companies can denominate contracts in stable currencies and implement hedging strategies to protect against volatility. Continuous performance monitoring through real-time analytics can assist in adjusting these strategies as necessary.

- Create the Template: Organize the information into a clear and structured format. Ensure that the template is user-friendly, enabling stakeholders to easily navigate and comprehend the evaluation process.

- Review and Revise: Share the draft template with key stakeholders to gather feedback. Incorporate their insights and make necessary adjustments to improve the template’s effectiveness. Retaining existing customers is vital; employing customer success teams can help address customer needs and secure long-term contracts.

By diligently following these steps, CFOs can develop a comprehensive financial risk assessment template that not only identifies potential threats but also lays the groundwork for strategic decision-making and long-term success. Just as the effectiveness of anti-virus software is deemed feasible, the strength of your evaluation tools is crucial in safeguarding your organization’s financial well-being.

Common Challenges in Financial Risk Assessment and How to Overcome Them

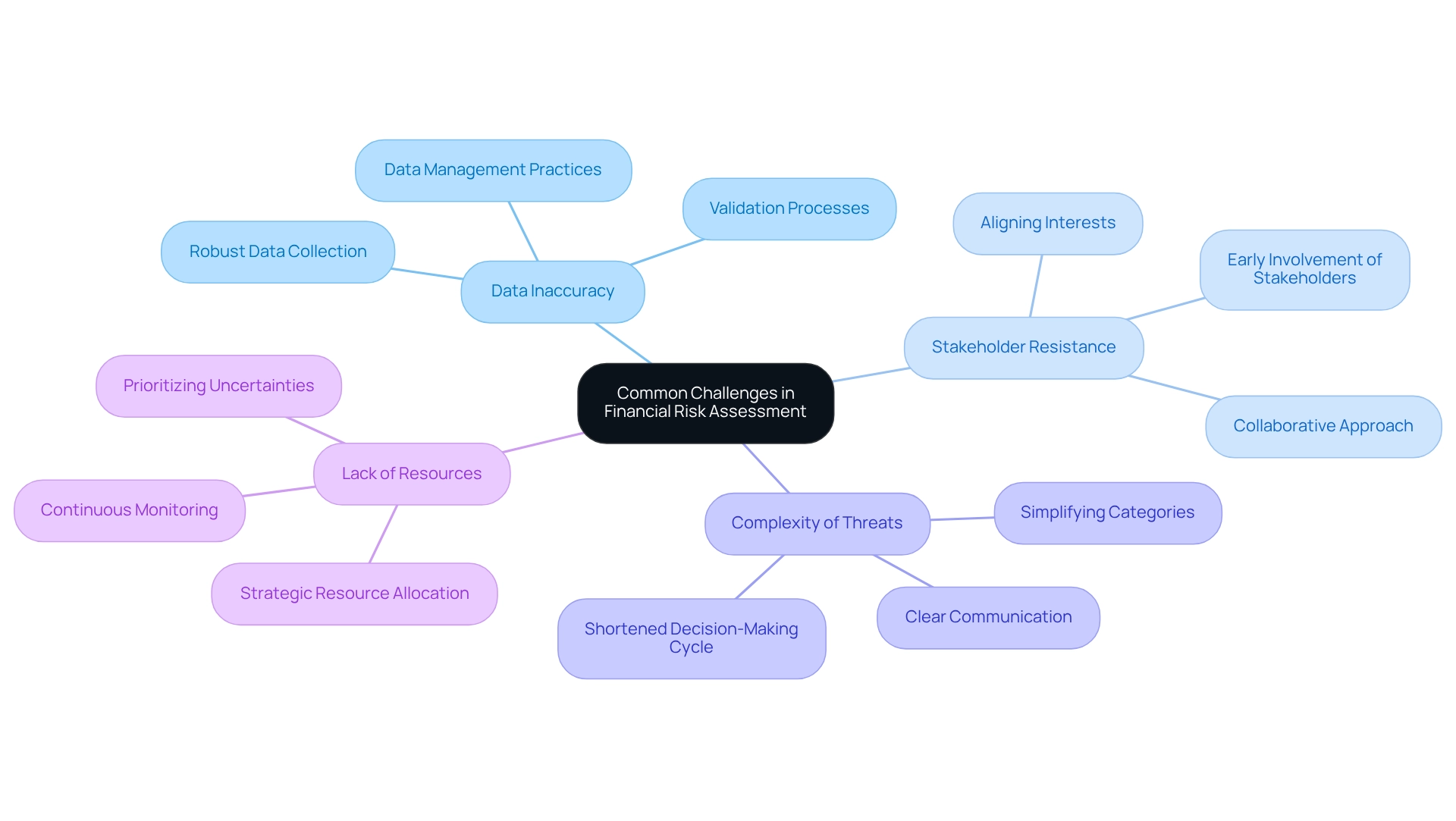

CFOs encounter a multitude of challenges during financial evaluations, significantly impacting their decision-making processes, particularly when employing a financial risk assessment template. Key issues include:

- Data Inaccuracy: Ensuring data integrity is paramount. Implementing robust data collection and validation processes can mitigate inaccuracies that often skew evaluations made using a financial risk assessment template. Statistics indicate that nearly 30% of organizations report data quality issues, underscoring the need for meticulous data management. As Sheng from the China Banking Regulatory Commission aptly stated, "Why is an engineer paid four, four times what a real engineer is paid? An engineer constructs bridges, a finance engineer creates dreams." This highlights the essential function of financial engineering in effectively evaluating uncertainty.

- Stakeholder Resistance: Gaining stakeholder buy-in is crucial for successful assessments. Involving stakeholders early in the process promotes cooperation and aligns their interests with the organization's management goals. Transform Your Small/ Medium Business emphasizes the importance of a collaborative approach, enabling teams to take decisive action and preserve business integrity.

- Complexity of Threats: The multifaceted nature of financial hazards can lead to confusion. Simplifying categories and descriptions enhances understanding and facilitates clearer communication among team members and stakeholders. Our team supports a shortened decision-making cycle throughout the turnaround process, ensuring that complexities are addressed efficiently.

- Lack of Resources: Resource limitations can obstruct effective threat evaluation. CFOs should utilize a financial risk assessment template to prioritize uncertainties based on their potential impact, allowing for strategic resource allocation to address the most pressing challenges. Continuous monitoring through real-time analytics, as provided by our client dashboard, enables CFOs to diagnose business health and adjust strategies accordingly.

To successfully navigate these challenges, CFOs must establish clear communication pathways within their teams, leverage technology for effective data management, and cultivate a culture of awareness regarding potential issues throughout the organization. Additionally, adopting responsible business practices, as highlighted in the case study on Responsible Business Practices, can lead to sustainable growth and build trust with stakeholders. By thinking outside the box, CFOs can foster innovation and creativity in addressing the challenges encountered during financial evaluations.

By doing so, they can enhance the precision and efficiency of their evaluations using a financial risk assessment template, ultimately resulting in more informed decision-making. Moreover, by applying the 'Identify & Plan' and 'Decide & Execute' methodologies, CFOs can optimize their procedures and ensure that their evaluations of potential issues are both thorough and practical. The 'Test & Measure' method will also facilitate continuous assessment and modification of strategies, ensuring that the organization remains agile and responsive to evolving economic conditions.

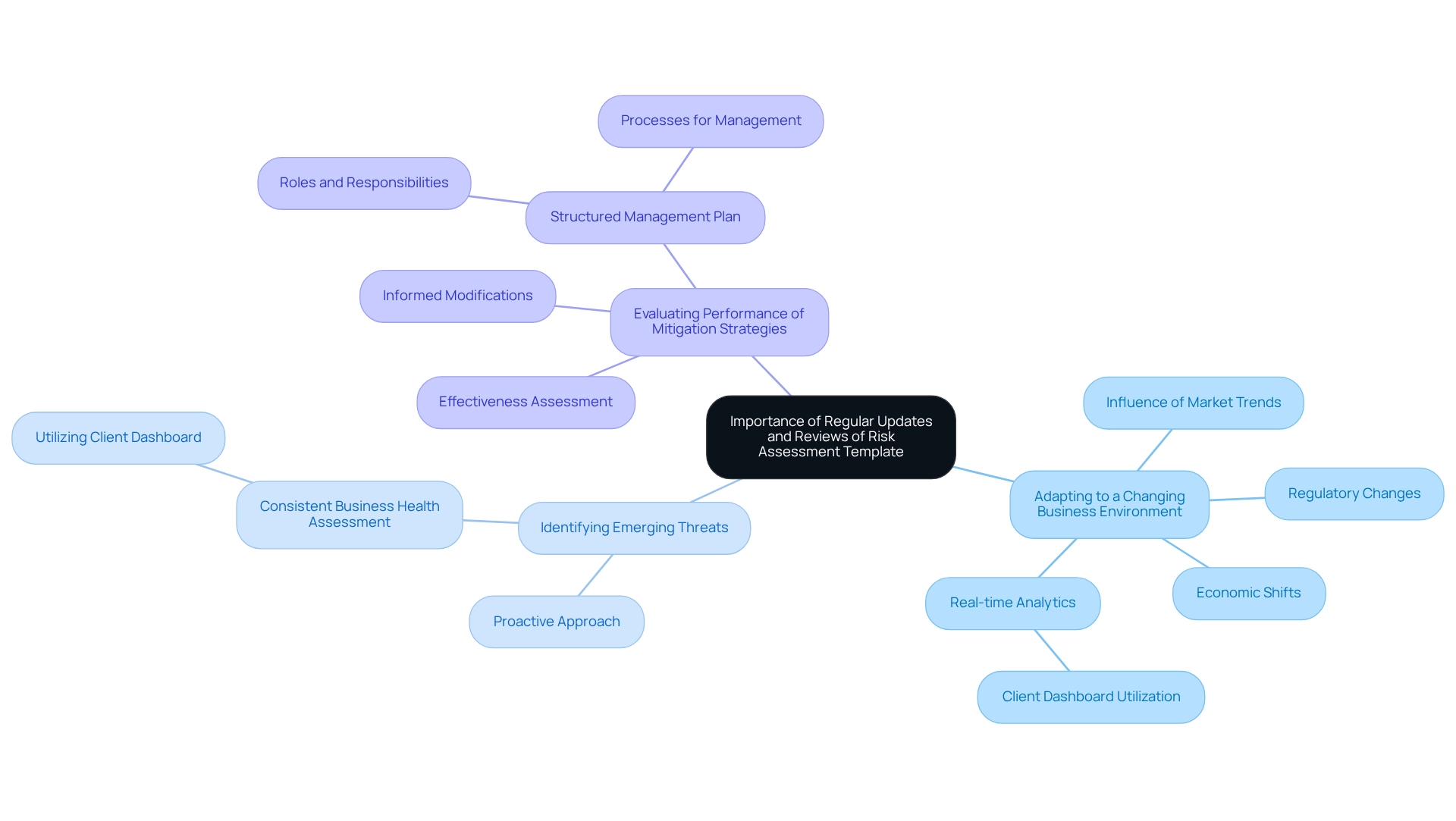

The Importance of Regular Updates and Reviews of Your Risk Assessment Template

Regular updates and reviews of your financial risk assessment template are essential for several key reasons:

-

Adapting to a Changing Business Environment: The financial landscape is in constant flux, influenced by market trends, regulatory changes, and economic shifts. The recent $18.5 million class action settlement for Target due to a data breach underscores how rapidly threats can develop and impact businesses. As David Goggins aptly states, "Can't Hurt Me: Master Your Mind and Defy the Odds," highlighting the resilience required to navigate these challenges. Leveraging real-time analytics through the client dashboard provided by Transform Your Small/Medium Business can further enhance your ability to adapt swiftly to these changes, enabling more informed decision-making.

-

Identifying Emerging Threats: As industries evolve, new challenges may arise that were previously unrecognized. This necessitates a proactive approach to updating your financial risk assessment template to ensure all potential threats are accounted for. Utilizing the client dashboard for real-time business analytics can assist in consistently assessing your business health, ensuring that emerging issues are recognized swiftly.

-

Evaluating Performance of Mitigation Strategies: Regular reviews provide an opportunity to assess the effectiveness of your threat mitigation strategies. By examining results through real-time information from the client dashboard, organizations can make informed modifications to enhance their management processes. A structured management plan can assist in identifying, evaluating, and reducing threats, outlining roles, responsibilities, and processes for effective management.

To ensure your financial risk assessment template remains pertinent and efficient, it is recommended to arrange regular reviews—preferably quarterly or biannually. Involving essential stakeholders in this process not only promotes teamwork but also guarantees that diverse viewpoints are considered, resulting in a stronger management framework.

Incorporating insights from experts like Becky Todd, who has over 20 years of experience in financial operations, can further enrich the review process. Her expertise emphasizes the importance of adjusting evaluations of potential challenges to the changing business landscape, ensuring that organizations remain robust amid unpredictability. Furthermore, utilizing advancements in technology, such as AI and machine learning, can significantly enhance the precision of evaluations and facilitate proactive management, ultimately aiding a streamlined decision-making process.

Leveraging Technology for Effective Financial Risk Assessment Management

Technology is crucial for enhancing financial uncertainty evaluation management. CFOs should consider the following key tools and techniques:

- Risk Management Software: Implement specialized software solutions that automate data collection, risk scoring, and reporting processes. This automation not only streamlines operations but also improves precision in assessments, allowing for quicker decision-making during critical turnaround phases.

- Data Analytics: Utilize advanced data analytics tools to uncover trends and patterns within financial data. These insights are essential for recognizing potential challenges early, enabling proactive management strategies and ongoing performance monitoring through real-time analytics.

- Collaboration Platforms: Adopt collaboration tools that facilitate smooth communication among stakeholders during the evaluation process. Efficient teamwork ensures that all pertinent parties are coordinated and informed, which is essential for thorough assessment and implementing lessons learned from previous experiences.

- Cloud Solutions: Utilize cloud-based platforms to provide real-time access to hazard evaluation data and a financial risk assessment template. This accessibility enables CFOs and their teams to make informed decisions quickly, adapting to changing circumstances as needed, thereby enhancing the overall turnaround strategy.

Incorporating these technological solutions into the assessment framework enables CFOs to boost efficiency, increase accuracy, and ultimately promote more effective management strategies. As entities encounter rising complexities, especially in sectors such as ESG compliance—where 67% of global executives perceive regulations as excessively intricate—utilizing technology becomes even more essential. Furthermore, with the average cost of a data breach reaching USD 4.88 million in 2024, the importance of proactive risk management cannot be overstated.

A case study titled 'Data Breach Costs and Compliance' highlights that companies implementing employee training experienced lower breach costs, emphasizing the importance of proactive compliance measures in reducing economic losses. Moreover, as Rob Gutierrez, Senior Cybersecurity and Compliance Manager, points out, "Nearly three-fourths (75%) of executives think there will be substantial changes in their company's approach to business continuity planning and crisis management." By adopting these tools, CFOs can more effectively navigate the economic environment and protect their entities from potential risks.

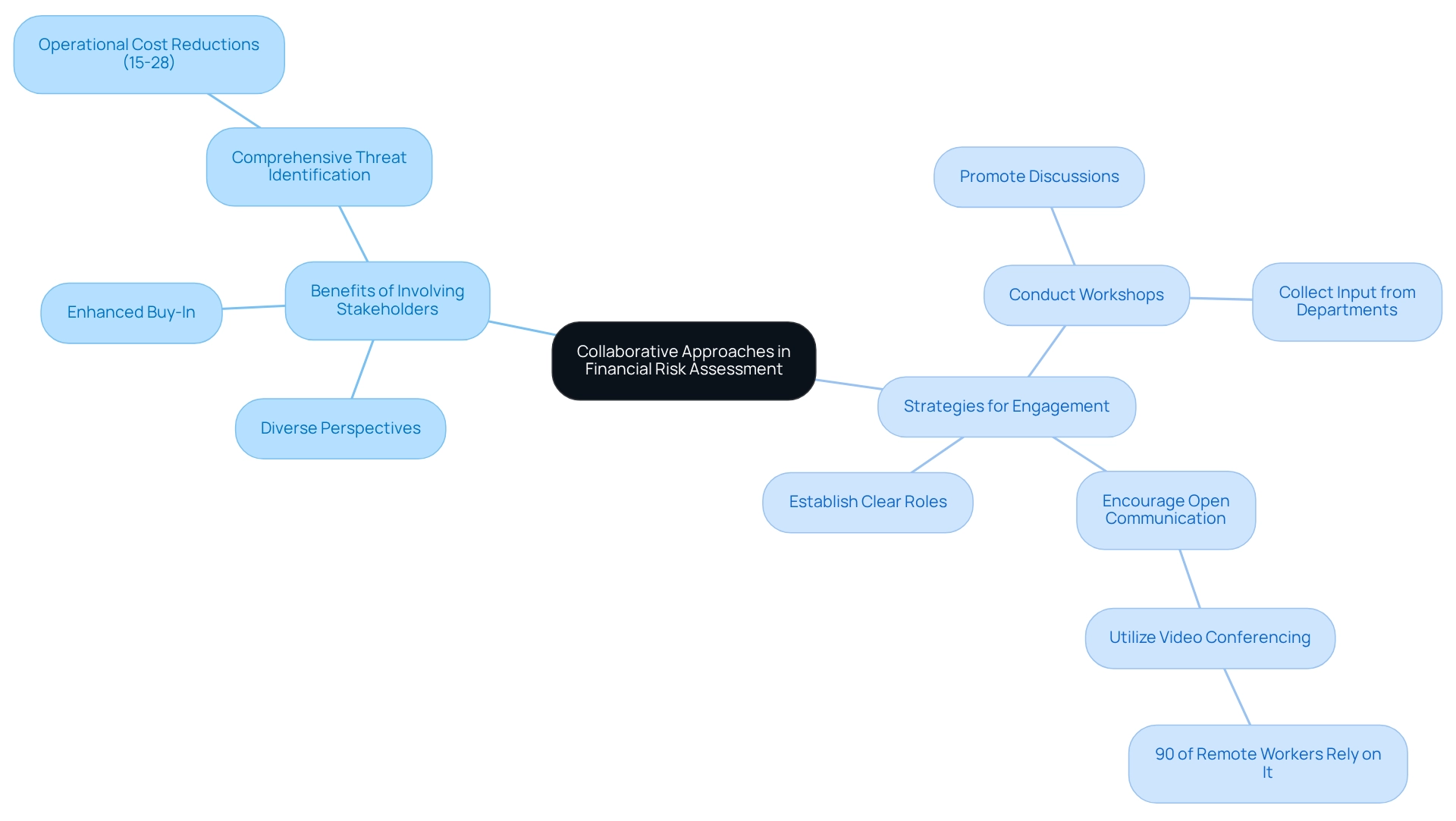

Collaborative Approaches: Involving Stakeholders in Financial Risk Assessment

Involving stakeholders in the monetary threat evaluation process is essential for several compelling reasons:

- Diverse Perspectives: Engaging various departments brings unique insights into potential dangers and their impacts, enriching the evaluation with a broader understanding of the entity's landscape.

- Enhanced Buy-In: When stakeholders are actively involved, it fosters a sense of ownership and commitment to the threat management process, which is vital for successful implementation.

- Comprehensive Threat Identification: Collaboration ensures that all relevant dangers are considered, leading to a more thorough and effective evaluation. Studies show that entities that emphasize stakeholder engagement can realize operational cost savings of 15-28%, highlighting the monetary advantages of a comprehensive management approach.

To effectively engage stakeholders in the financial evaluation process, consider the following strategies:

- Conduct Workshops: Organize workshops that promote discussions about uncertainties and collect input from various departments. These collaborative sessions can significantly improve the quality of the danger evaluation. For example, a case study from Secureframe emphasizes how compliance and regulatory challenges can be more effectively handled through stakeholder engagement, illustrating the difficulties organizations encounter in this domain.

- Establish Clear Roles: Clearly define roles and responsibilities for stakeholders in the evaluation process to ensure accountability and streamline collaboration.

- Encourage Open Communication: Create an environment where stakeholders feel comfortable sharing their insights and concerns. This transparency is crucial for recognizing possible dangers that might otherwise remain overlooked. In a remote work environment, utilizing video conferencing tools, as noted by Buffer's data showing that 90% of remote workers rely on such technology, can facilitate effective communication and collaboration. By adopting a collaborative approach and implementing a financial risk assessment template, CFOs can significantly enhance the effectiveness of their financial risk assessments, ultimately leading to better decision-making and improved organizational resilience. As Gensler notes, open office layouts can increase collaboration by up to 62%, a principle that can be applied to virtual settings as well.

Conclusion

In the intricate realm of finance, effective financial risk assessment serves as a cornerstone for organizational resilience. This article has explored the essential components of a robust financial risk assessment template, underscoring the significance of risk identification, analysis, and mitigation strategies. By recognizing potential threats and evaluating their impacts, CFOs can devise proactive measures that not only protect their organizations but also cultivate a culture of informed decision-making.

Moreover, the integration of technology is pivotal in enhancing risk management processes. Tools such as risk management software and advanced data analytics empower CFOs to streamline operations and make data-driven decisions swiftly. Regular updates to the risk assessment template ensure that organizations remain agile and responsive to the ever-evolving financial landscape, enabling them to adapt to new challenges and emerging risks.

Collaboration with stakeholders further enriches the risk assessment process, introducing diverse perspectives that enhance understanding and commitment. By engaging various departments, CFOs can achieve a more comprehensive identification of risks, ultimately leading to improved strategies for mitigation and overall organizational success.

In summary, the importance of a well-structured financial risk assessment cannot be overstated. As businesses continue to navigate uncertainties, the ability to anticipate, analyze, and address risks will be crucial in maintaining stability and driving sustainable growth. Embracing these practices not only prepares organizations for potential pitfalls but also positions them for long-term success in a dynamic financial environment.

Frequently Asked Questions

Why is evaluating economic uncertainties important for CFOs?

Evaluating economic uncertainties is crucial for CFOs as it involves identifying, analyzing, and reducing threats that could negatively impact an organization’s financial well-being.

What are the key concepts involved in the process of evaluating economic uncertainties?

The key concepts include Risk Identification, Threat Assessment, and Risk Mitigation.

What does Risk Identification entail?

Risk Identification involves recognizing potential financial threats such as market fluctuations, credit risks, and operational inefficiencies, which is increasingly vital in today's unstable economic landscape.

How do CFOs assess threats once they are identified?

CFOs assess threats by evaluating their probability and potential impact on financial stability, using tools like continuous cash flow forecasts and what-if scenario analyses.

What strategies can be employed for Risk Mitigation?

Risk Mitigation strategies may include diversifying investments, enhancing internal controls, and utilizing foreign exchange contracts to protect against adverse currency fluctuations.

What is the purpose of a financial risk assessment template?

A financial risk assessment template guides organizations through uncertainties and fosters a culture of informed risk-taking and continuous learning.

What components should be included in a comprehensive financial risk assessment template?

The template should include Risk Categories, Threat Descriptions, Likelihood Assessments, Impact Evaluations, Mitigation Strategies, and a Monitoring Plan.

How can organizations evaluate the likelihood and impact of identified threats?

Organizations can evaluate the likelihood of each threat occurring using a scale (e.g., low, medium, high) and assess the potential monetary impact to prioritize threats effectively.

What role does ongoing monitoring play in financial risk assessment?

Ongoing monitoring ensures that the threat evaluation remains relevant and adaptable, allowing CFOs to make informed decisions based on current data.

How are consulting services related to financial risk assessment beneficial for organizations?

Consulting services, such as those provided by Transform Your Small/Medium Business, assist companies in overcoming challenges and achieving growth by offering monetary evaluations and strategies for managing uncertainties.