Overview

The article primarily emphasizes the crucial steps for executing an effective FCA financial crime risk assessment. It delineates a structured approach that encompasses:

- Understanding FCA regulations

- Identifying and evaluating financial crime risks

- Implementing mitigation strategies

- Establishing continuous monitoring

- Documenting findings

This comprehensive methodology ensures compliance and fosters proactive management of financial crime threats.

Introduction

In an increasingly complex financial landscape, organizations must navigate a maze of regulations designed to combat financial crime. The Financial Conduct Authority (FCA) plays a pivotal role in establishing guidelines that firms must follow to prevent illicit activities such as money laundering and fraud. As the stakes rise, understanding these regulations and implementing effective risk management strategies becomes not just a legal obligation but a critical component of operational integrity.

This article delves into the essential steps organizations should take to identify, evaluate, and mitigate financial crime risks. Moreover, it emphasizes the importance of continuous monitoring and transparent communication. By fostering a proactive approach, businesses can safeguard their assets, enhance compliance, and contribute to a more secure financial environment.

Understand FCA Financial Crime Regulations

To conduct a thorough evaluation of monetary offenses, it is essential to have a deep understanding of the FCA financial crime risk assessment. These regulations delineate the expectations for companies in preventing monetary offenses such as money laundering and fraud. A crucial resource is the FCA's Financial Crime Risk Assessment, which offers practical advice on mitigating crime-related risks.

Moreover, reviewing the pertinent sections of the FCA Handbook will clarify the specific requirements applicable to your organization concerning the FCA financial crime risk assessment. This foundational knowledge is vital for conducting an FCA financial crime risk assessment, as it not only guides your evaluation process but also ensures compliance with legal obligations.

In 2022/23, the value of criminal confiscation orders reached £0.9 million, underscoring the economic ramifications of non-compliance. Additionally, case studies, including those concerning unauthorized business inquiries, highlight the risks posed by companies operating without proper authorization, which can lead to enforcement actions and prosecutions for fraud.

By prioritizing effective communication and collaboration with global law enforcement agencies, organizations can bolster their compliance efforts and contribute to a more robust framework for preventing illicit activities. As we look forward, we anticipate initiating significant positive changes in this domain in the coming year, reinforcing the importance of staying informed with updates from the FCA Financial Crime Guide and expert insights.

Identify and Evaluate Financial Crime Risks

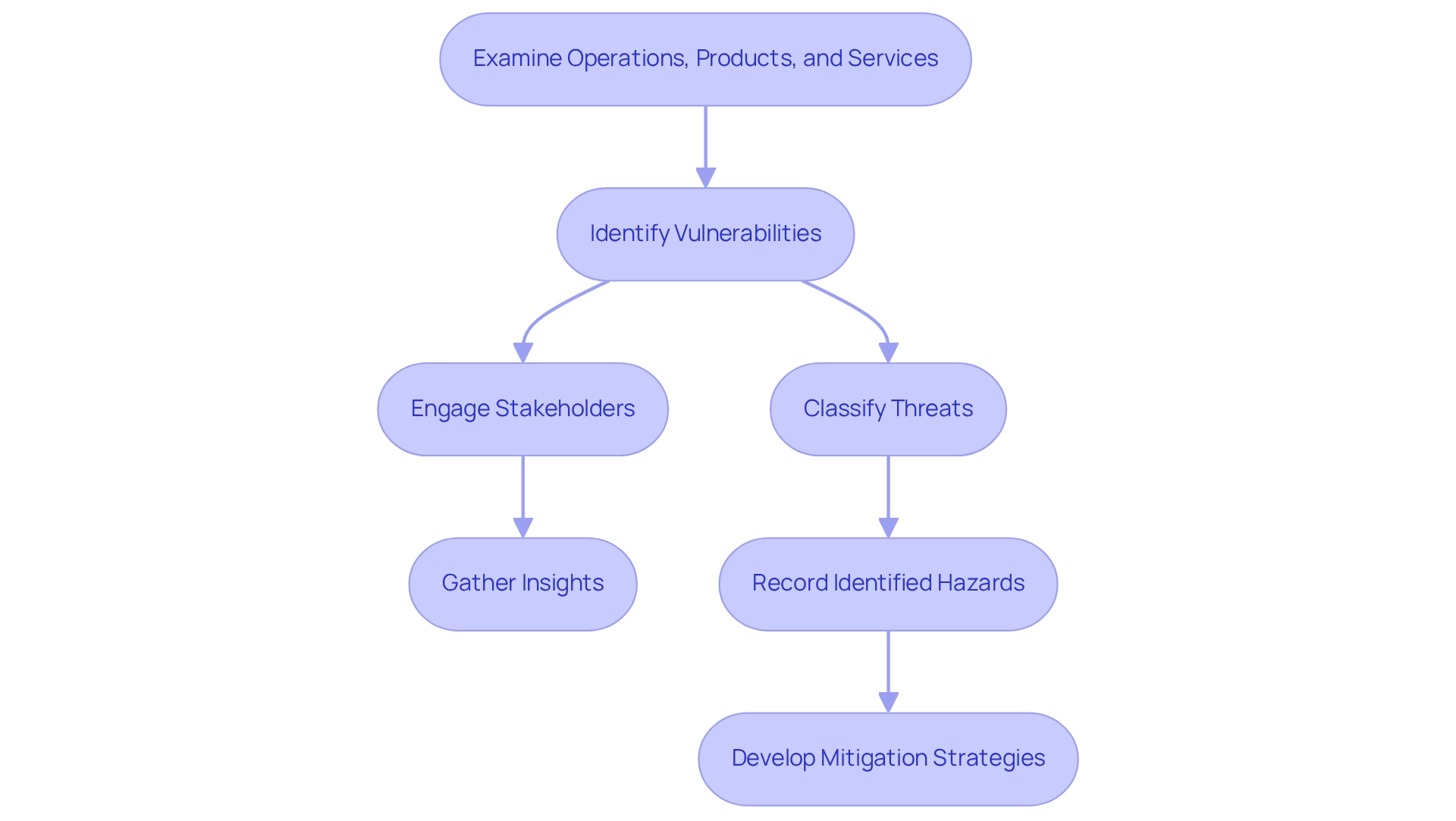

To efficiently recognize and assess monetary wrongdoing threats within your organization, begin with a thorough examination of your operations, products, and services. This foundational step is crucial for uncovering potential vulnerabilities. Employ matrices to classify identified threats according to their probability and possible consequences, facilitating a systematic method for management.

Engage stakeholders from various departments to gather diverse insights, as different perspectives can highlight areas susceptible to financial crime. Pay particular attention to factors such as customer demographics, transaction types, and geographic locations, as these can significantly affect exposure to potential losses.

Recording these identified hazards is crucial, as it will act as the foundation for your evaluation and following mitigation strategies. In 2025, statistics show that monetary wrongdoing threats continue to be a significant issue, with 56% of worldwide banking leaders claiming their organizations did not meet even 50% of their cost reduction goals last year. This emphasizes the necessity of tackling monetary misconduct challenges efficiently.

As Muhammad Ali once stated, "He who is not brave enough to embrace challenges will achieve nothing in life." This sentiment is especially pertinent when contemplating the proactive steps required to tackle economic wrongdoing. By adopting best practices and utilizing tools created for evaluating crime-related challenges, businesses can improve their adherence to the FCA financial crime risk assessment and protect their operations from potential threats. Additionally, as emphasized in the case study on wealth management market prospects, financial organizations must adjust to growing competition and regulatory attention, making it essential to investigate new opportunities while handling challenges efficiently.

Implement Risk Mitigation Strategies

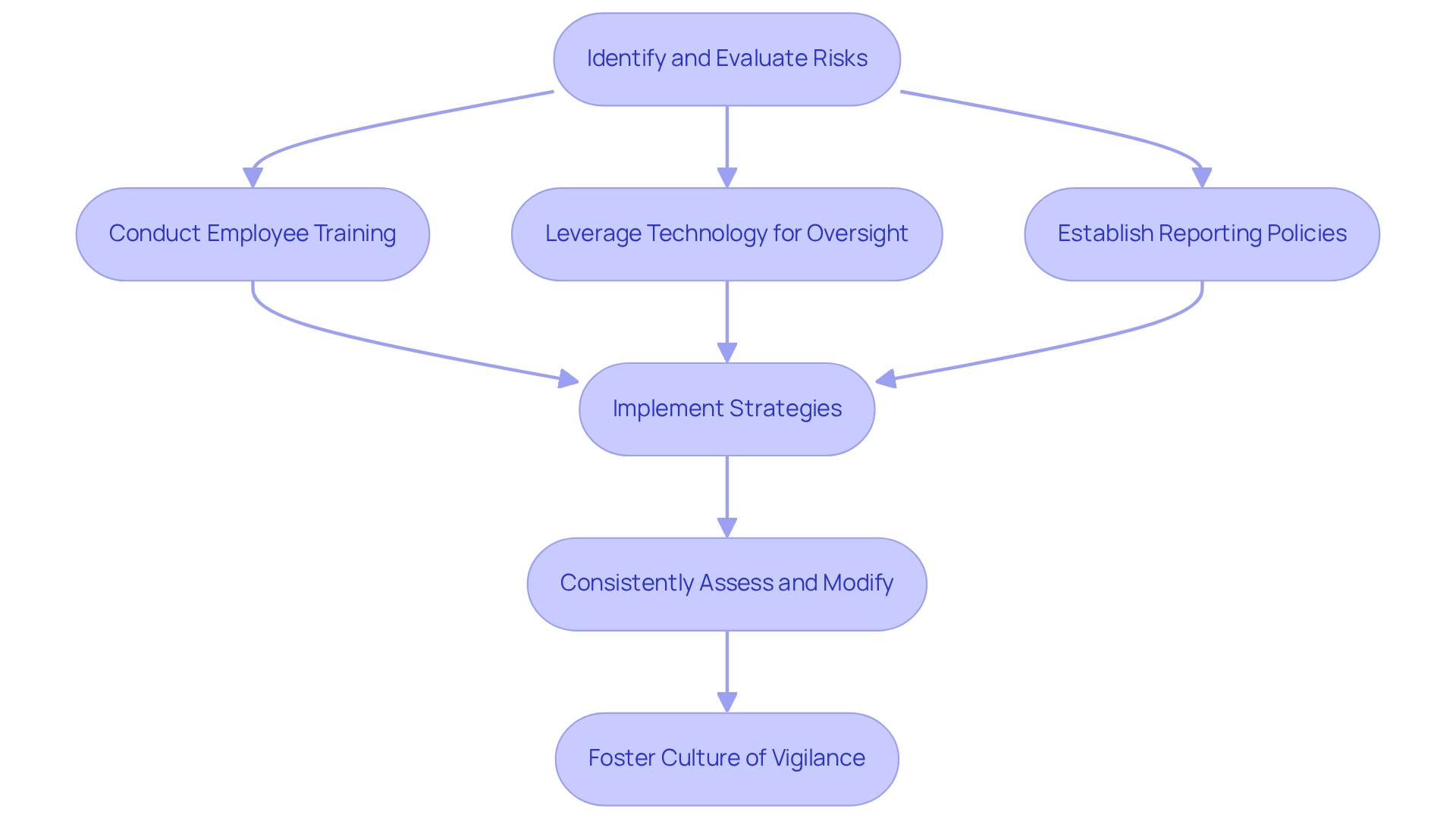

Once risks have been identified and evaluated, it is crucial to develop and implement risk mitigation strategies tailored to your organization's specific needs. Given that procurement fraud ranks among the top three most disruptive economic offenses faced by companies worldwide in the last 24 months, enhancing internal controls is essential. This may involve:

- Conducting thorough employee training on identifying monetary wrongdoing

- Leveraging technology for efficient transaction oversight, showcasing a commitment to innovation and efficiency

- Establishing clear policies and procedures for reporting suspicious activities, ensuring transparency in your operations

Consistently assessing and modifying these strategies will aid in adapting to evolving threats and regulatory developments. Furthermore, ensuring that all employees understand their roles in maintaining compliance and safeguarding against monetary wrongdoing fosters a culture of vigilance and accountability. Involving the board in these processes significantly enhances the effectiveness of management initiatives, as companies that engage their boards in assessments are better equipped to navigate the complexities of criminal threats. Additionally, sharing monetary insights is crucial for addressing emerging global challenges, thereby strengthening the collaborative aspect of effective uncertainty management.

Establish Continuous Monitoring and Review

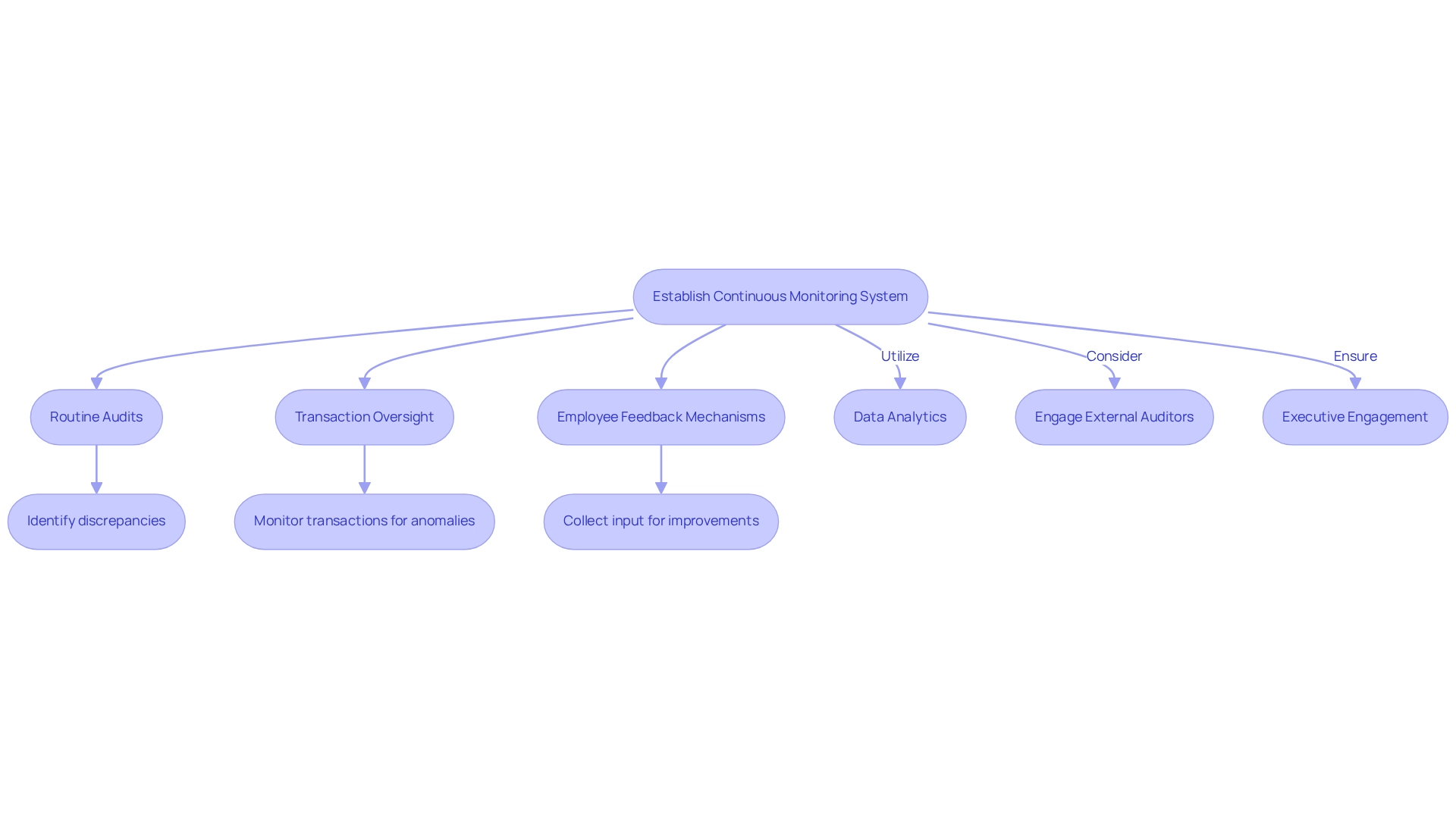

To effectively evaluate the effectiveness of your mitigation strategies, implement a continuous monitoring system that encompasses:

- Routine audits

- Transaction oversight

- Employee feedback mechanisms

This proactive method is crucial for recognizing possible monetary misconduct threats early. Moreover, data analytics plays a pivotal role in this process, allowing organizations to identify patterns suggestive of financial misconduct. Consistently planned evaluations of your threats and reduction strategies are essential to preserving their importance and efficiency in a swiftly evolving regulatory environment.

Engaging external auditors or consultants can provide an objective evaluation of your processes, ensuring compliance with FCA regulations and fostering a culture of vigilance against economic crime through the FCA financial crime risk assessment. Notably, nearly three-quarters of companies report that their boards are actively updated on fraud investigation efforts, underscoring the importance of executive engagement in compliance initiatives. This level of oversight is vital for cultivating a robust compliance culture within organizations.

Document Findings and Communicate Results

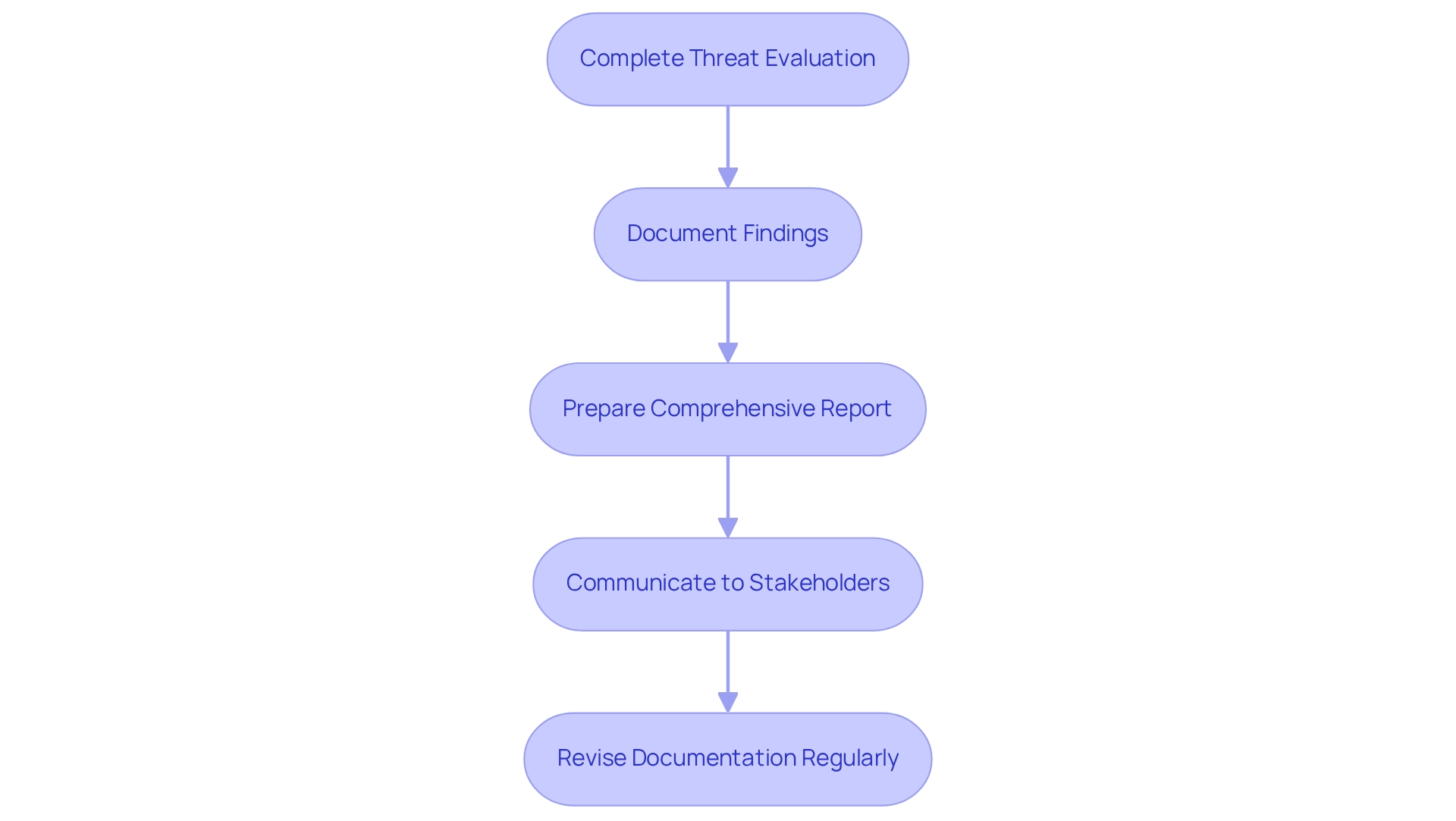

After completing your threat evaluation and implementing mitigation strategies, it is imperative to document all findings meticulously. This documentation should encompass identified hazards, evaluation outcomes, and the effectiveness of executed strategies. Prepare a comprehensive report summarizing these findings and communicate it to relevant stakeholders, including senior management and compliance teams. Ensure that this report is accessible and clear, as it will serve as a crucial reference for future evaluations and audits. Regularly revise this documentation to incorporate any changes in the threat landscape or legal requirements.

Clear communication of monetary misconduct findings is essential. Statistics reveal that 57% of compliance professionals indicate their roles have become more specialized, underscoring the necessity for clear and targeted communication strategies. Additionally, a quote from Thomson Reuters emphasizes that AI is anticipated to significantly impact the strategy of 94% of corporations, highlighting the need for organizations to adapt their documentation practices in this evolving environment. For instance, a case study on evaluating and managing uncertainties in startups illustrates how an organized evaluation process can mitigate potential losses and can be applied to monetary misconduct assessments. By effectively documenting and conveying the results of the FCA financial crime risk assessment, organizations can foster a culture of transparency and proactive management. Furthermore, with 77% of corporate risk and compliance professionals stressing the importance of staying informed on ESG developments, it is crucial to integrate these considerations into your risk assessment documentation.

Conclusion

Navigating the complexities of financial crime regulations is essential for organizations aiming to maintain operational integrity and compliance. A thorough understanding of the Financial Conduct Authority (FCA) guidelines provides the foundation for effective risk assessment and management. By familiarizing themselves with the FCA's Financial Crime Guide and the broader regulatory framework, firms can better prepare to combat financial crimes such as money laundering and fraud, thereby mitigating potential legal and financial repercussions.

Identifying and evaluating financial crime risks is a critical step that requires a comprehensive analysis of operations, products, and services. Engaging diverse stakeholders and employing risk matrices allows organizations to uncover vulnerabilities and categorize risks systematically. The urgency of addressing these risks is underscored by the pressing statistics from the financial sector, highlighting the need for proactive measures to safeguard against potential threats.

Implementing tailored risk mitigation strategies is vital for enhancing internal controls and fostering a culture of vigilance. Training employees, establishing clear reporting procedures, and engaging the board in risk management initiatives significantly bolster an organization's defense against financial crime. Continuous monitoring and regular reviews of risk strategies ensure ongoing compliance and adaptability to evolving regulatory landscapes.

Finally, documenting findings and communicating results effectively is paramount for transparency and accountability. By preparing comprehensive reports and maintaining open channels of communication, organizations can not only enhance their compliance efforts but also cultivate a proactive risk management culture. As the financial landscape continues to evolve, staying informed and adaptable will be key to successfully navigating the challenges posed by financial crime.

Frequently Asked Questions

What are the FCA financial crime regulations?

The FCA financial crime regulations outline the expectations for companies to prevent monetary offenses such as money laundering and fraud. They provide a framework for conducting a financial crime risk assessment.

Why is the FCA's Financial Crime Risk Assessment important?

The FCA's Financial Crime Risk Assessment offers practical advice on mitigating crime-related risks, ensuring organizations can conduct thorough evaluations and comply with legal obligations.

How can organizations stay informed about FCA regulations?

Organizations can stay informed by reviewing the relevant sections of the FCA Handbook and keeping up with updates from the FCA Financial Crime Guide and expert insights.

What are the economic impacts of non-compliance with FCA regulations?

In 2022/23, the value of criminal confiscation orders reached £0.9 million, highlighting the significant economic ramifications of non-compliance.

How can organizations identify and evaluate financial crime risks?

Organizations should conduct a thorough examination of their operations, products, and services, using matrices to classify threats by probability and potential consequences. Engaging stakeholders from various departments can provide diverse insights.

What factors should be considered when assessing financial crime risks?

Factors such as customer demographics, transaction types, and geographic locations should be considered, as they can significantly affect exposure to potential losses.

Why is it important to record identified financial crime hazards?

Recording identified hazards is crucial as it serves as the foundation for evaluation and subsequent mitigation strategies.

What challenges do financial organizations face regarding monetary wrongdoing?

In 2025, 56% of worldwide banking leaders reported their organizations did not meet even 50% of their cost reduction goals, emphasizing the need to address monetary misconduct challenges effectively.

How can businesses improve their adherence to the FCA financial crime risk assessment?

By adopting best practices and utilizing tools designed for evaluating crime-related challenges, businesses can enhance their compliance and protect their operations from potential threats.