Introduction

In an increasingly volatile financial landscape, the threat of financial terrorism looms larger than ever, compelling organizations to adopt robust risk assessment strategies. As financial institutions grapple with the complexities of regulatory compliance and the evolving tactics employed by malicious actors, a proactive approach becomes essential.

This article delves into the critical components of financial terrorism risk assessment, offering a comprehensive guide to navigating the intricate web of vulnerabilities and regulatory demands. From selecting the right risk assessment platforms to implementing effective mitigation strategies, organizations can enhance their defenses and safeguard their assets against misuse.

By understanding the dynamics of financial terrorism and staying ahead of regulatory changes, CFOs can not only protect their institutions but also drive operational efficiency and compliance.

Understanding Financial Terrorism Risk Assessment

Terrorism risk assessment related to monetary activities is a critical process that evaluates the potential exploitation of economic activities for terrorist financing using a financial terrorism risk assessment platform. A thorough monetary review is essential in this context, as it not only identifies vulnerabilities within monetary institutions but also facilitates meticulous analysis of transactions to uncover suspicious patterns. Our economic assessment services utilize a combination of data analytics, transaction monitoring, and compliance checks to ensure a comprehensive evaluation.

Recent findings indicate that AML/CFT internal controls in payment institutions often fall short, underscoring the importance of implementing a financial terrorism risk assessment platform to reduce their susceptibility to money laundering and terrorist financing activities. As Michael Mosier, Acting Director, stated,

The Priorities reflect the U.S. Government’s view of the threat landscape—highlighting longstanding threats like corruption, fraud, and international terrorism, as well as rapidly evolving and acute threats, such as domestic terrorism and ransomware.

The EBA Guidelines on ML/TF Risks emphasize the necessity for robust implementation by both supervisors and institutions to mitigate exposure to these risks, highlighting the importance of using a financial terrorism risk assessment platform to enhance adherence to established guidelines.

By performing a thorough monetary assessment, entities can enhance their emphasis on cash preservation and economic efficiency, crucial for protecting against misuse. Grasping these dynamics is essential for organizations aiming to shield themselves from monetary crimes while upholding regulatory standards. A robust evaluation of threats through a financial terrorism risk assessment platform not only identifies potential areas of concern but also empowers businesses to implement effective controls, thereby safeguarding their assets against misuse.

Particular results of our monetary evaluations include improved adherence to regulatory standards, decreased exposure to hazards, and enhanced operational efficiency. As regulatory updates approach, including FinCEN's proposal for implementing regulations in the coming months, institutions must proactively align their risk-based AML programs with evolving priorities, ensuring they are well-prepared to tackle the challenges posed by monetary terrorism.

Step-by-Step Guide to Using Risk Assessment Platforms

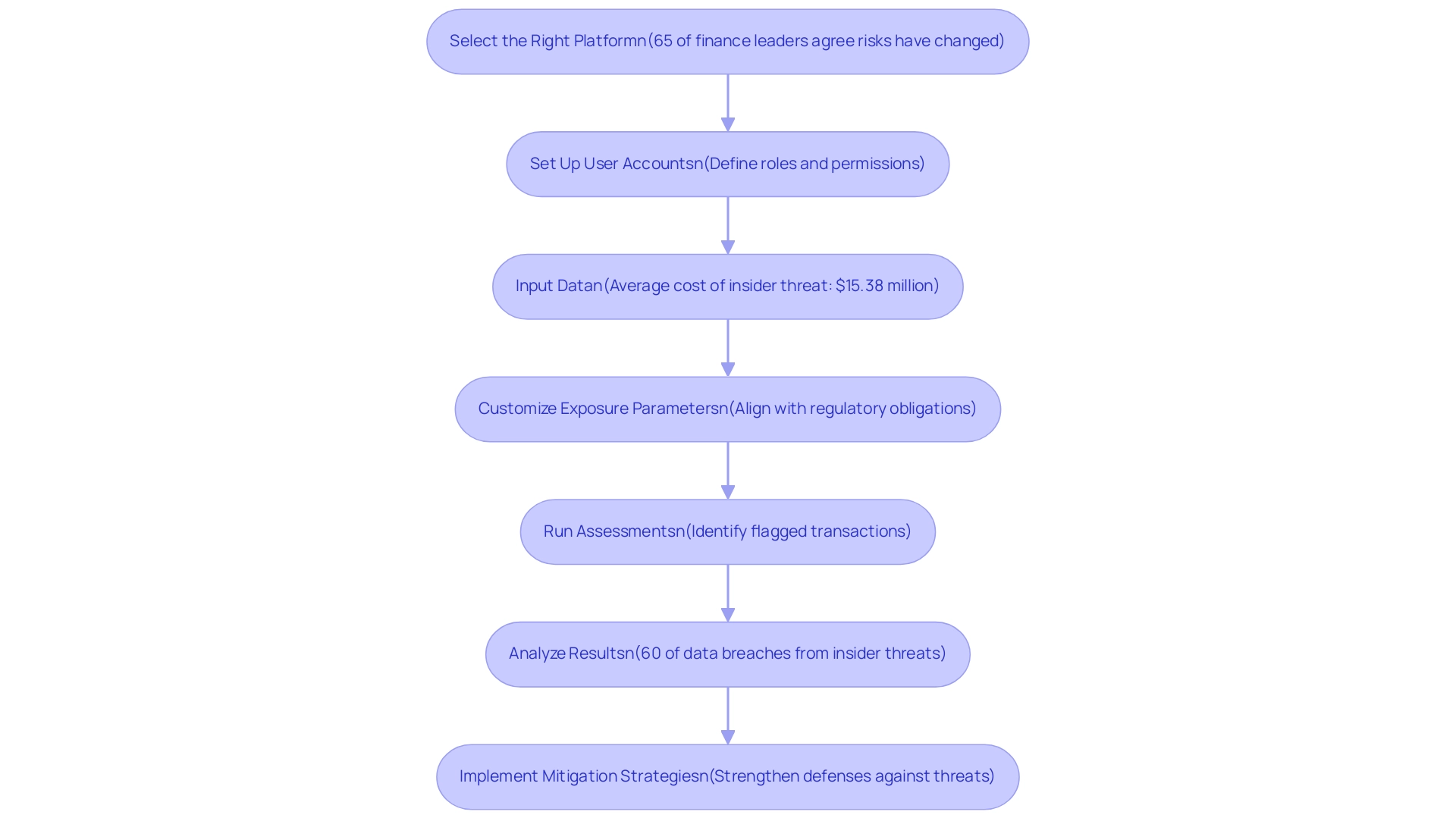

- Select the Right Platform: Begin by thoroughly investigating different financial terrorism risk assessment platforms that address your organization’s unique needs. Prioritize features such as robust transaction monitoring and comprehensive reporting capabilities, along with user-friendly interfaces that facilitate ease of use for your team. As AICPA and NC State University emphasize, 65% of senior finance leaders acknowledge that corporate challenges have evolved significantly, making the right platform essential to navigate these complexities effectively. Furthermore, with 48% of companies still depending on spreadsheets for third-party management, the significance of selecting a suitable financial terrorism risk assessment platform cannot be overstated.

- Set Up User Accounts: Create individualized user accounts for all relevant team members. Clearly define roles and permissions to ensure security and accountability within the platform. This step is crucial as it fosters a controlled environment where sensitive data is handled with care.

- Input Data: Collect and input historical transaction data into your selected platform. It's imperative that this data is clean and well-organized to support accurate analysis. In 2023, the average cost of an insider threat incident reached $15.38 million, underscoring the importance of precise data management in preventing such costly breaches. Furthermore, 58% of survey participants think current expenditures on insider threat programs are insufficient, emphasizing the necessity for strong evaluation solutions.

- Customize Exposure Parameters: Tailor the financial terrorism risk assessment platform by establishing thresholds and parameters that align with your organization’s appetite for uncertainty and regulatory obligations. This customization is vital for effective threat detection and compliance adherence.

- Run Assessments: Launch evaluations using the platform’s advanced algorithms on your data. Carefully review the generated reports to identify flagged transactions or emerging patterns that may indicate potential threats.

- Analyze Results: Perform a detailed analysis of the assessment outcomes, paying particular attention to high-risk areas that necessitate immediate action. With insider threats contributing to approximately 60% of data breaches, this step is crucial for proactive management, emphasizing the urgency of addressing identified vulnerabilities.

- Implement Mitigation Strategies: Based on your analysis, develop and execute strategies designed to reduce identified threats. By doing so, you strengthen your entity's defenses against potential threats, ensuring a secure economic environment.

Key Risk Mitigation Strategies for Financial Terrorism

- Routine Training: Creating a culture of adherence starts with routine training sessions customized for staff, focused on increasing awareness about terrorism risks related to finances and the vital significance of utilizing a financial terrorism risk assessment platform to follow regulations. Given that 1 in 3 employees believe their organization’s training is outdated, investing in modern training methods is essential. As highlighted by Technavio, "The combination of big data, AI, and learning analytics is anticipated to produce a tailored learning experience, enhancing productivity and promoting growth in the US training market for monetary institutions." This anticipated enhancement in training effectiveness underscores the need for a proactive approach in the financial sector.

- Robust Due Diligence: Implementing robust due diligence practices is vital when onboarding clients and partners. This entails thorough background evaluations and risk assessments to ensure that all parties adhere to regulatory standards. The shift towards online solutions in compliance training, as illustrated in the case study titled "Technological Advancements in Training," underscores the need for these practices to adapt to modern technological advancements and the effectiveness of these methods.

- Transaction Monitoring: Utilizing real-time transaction monitoring systems enables entities to detect unusual patterns or activities that might indicate potential terrorist financing. These advanced systems are crucial for maintaining vigilance in an increasingly complex financial landscape, especially when integrated with a financial terrorism risk assessment platform.

- Clear Reporting Protocols: Establishing clear reporting protocols for suspicious activities is paramount. Employees must be well-informed about how to escalate concerns quickly and effectively, thereby fostering a proactive adherence culture within the company.

- Collaboration with Authorities: Building strong relationships with regulatory authorities and law enforcement agencies is essential for staying informed about emerging threats and compliance requirements. Collaborative efforts can enhance a company's overall security posture against financial terrorism by utilizing a financial terrorism risk assessment platform.

- Continual Risk Assessment: Financial terrorism risks are dynamic, making it imperative to treat risk assessments as an ongoing process. Regularly revisiting and updating strategies is crucial for organizations to effectively utilize a financial terrorism risk assessment platform, ensuring they remain responsive to new threats and evolving regulations. As the regulatory training landscape shifts, particularly towards mobile-based solutions—which 90% of employers acknowledge as beneficial—CFOs must champion these changes to safeguard their institutions effectively.

Navigating Regulatory Compliance in Risk Assessments

Navigating the complexities of regulatory adherence is crucial for effective assessments using the financial terrorism risk assessment platform. Organizations must be well-versed in critical legislation like the USA PATRIOT Act, which has fundamentally shaped the compliance landscape for monetary institutions. As underscored by the Executive Board of the IMF,

The fight against financial crime isn’t lost, but the world will need to do more to win.

This statement acts as a call to action for CFOs, highlighting the necessity for vigilance and proactive measures.

Compliance necessitates entities to regularly update their policies in accordance with evolving legislation and international guidelines, including those from the financial terrorism risk assessment platform such as the Financial Action Task Force (FATF). The AML/CFT Thematic Fund plays a crucial role in strengthening these frameworks, assisting countries in enhancing their AML/CFT measures and ultimately supporting their exit from the FATF grey list. Routine internal evaluations are crucial for ensuring adherence to these standards, while thorough documentation of all assessment activities is important for transparency and accountability.

Establishing a strong culture of adherence within the financial terrorism risk assessment platform is important. This culture promotes a sense of accountability and enhances awareness of regulatory obligations among employees, thereby supporting the financial terrorism risk assessment platform and mitigating risks associated with economic terrorism. The successful efforts of the AML/CFT Thematic Fund, which assisted Jordan and Uganda in leaving the FATF grey list, demonstrate how robust regulatory frameworks can result in significant positive outcomes not only for individual nations but also for entities aiming to achieve similar standards.

For example, entities that emphasize adherence to regulations frequently observe a decrease in crime-related incidents by as much as 30%, underscoring the concrete advantages of such initiatives. By emphasizing regulatory compliance, entities not only conform to legal standards but also improve their overall management strategies, ultimately protecting their economic integrity.

Adapting to Evolving Financial Terrorism Threats

The monetary terrorism threat landscape is in a state of constant flux, with new challenges surfacing on a regular basis. To effectively navigate this evolving terrain, organizations must adopt a proactive strategy that includes a financial terrorism risk assessment platform. This entails:

- Establishing a financial terrorism risk assessment platform that includes ongoing monitoring systems to observe trends in economic crime.

- Utilizing sophisticated analytical tools to identify possible weaknesses.

- Frequently refreshing assessment frameworks to incorporate the most recent insights.

As emphasized by Secretary Paulson, 'Information about the effectiveness and efficiency of the BSA' is paramount in this ever-changing environment. Moreover, the FinCEN Notice FIN-2020-NTC1, released on March 16, 2020, emphasizes the significance of remaining informed about regulatory updates related to the financial terrorism risk assessment platform.

Industry forums and collaborative networks with other monetary institutions provide invaluable resources for gaining insights into the financial terrorism risk assessment platform and emerging threats.

Furthermore, the case study concerning the clarification of time for designating exempt individuals illustrates practical applications of adherence and evaluation strategies. By cultivating a culture of adaptability and resilience, organizations position themselves to respond effectively to evolving risks with a financial terrorism risk assessment platform, thereby safeguarding their financial integrity and ensuring compliance with regulatory standards.

Conclusion

In the face of rising financial terrorism threats, organizations must prioritize robust risk assessment strategies to protect their assets and ensure compliance with evolving regulations. A comprehensive financial terrorism risk assessment process not only identifies vulnerabilities within institutions but also employs advanced data analytics and transaction monitoring to detect suspicious activities. Regular training and robust due diligence practices are key to fostering a culture of compliance, while real-time transaction monitoring systems enhance vigilance against potential terrorist financing.

The selection of appropriate risk assessment platforms is crucial, as these tools enable organizations to tailor their approach to risk management effectively. By customizing risk parameters and conducting ongoing assessments, institutions can remain responsive to the dynamic landscape of financial crime. Moreover, establishing clear reporting protocols and collaborating with regulatory authorities strengthens the overall security posture and enhances compliance efforts.

Ultimately, organizations that embrace proactive risk assessment and compliance strategies will not only mitigate risks associated with financial terrorism but also improve operational efficiency. By staying ahead of regulatory changes and fostering a culture of adaptability, CFOs can safeguard their institutions against misuse, ensuring long-term resilience in an increasingly complex financial environment. Taking these decisive actions now is essential for building a secure and compliant future.

Frequently Asked Questions

What is the purpose of a financial terrorism risk assessment platform?

A financial terrorism risk assessment platform evaluates the potential exploitation of economic activities for terrorist financing, identifying vulnerabilities within monetary institutions and analyzing transactions to uncover suspicious patterns.

Why is a thorough monetary review important?

A thorough monetary review is essential for identifying vulnerabilities in monetary institutions and facilitating the analysis of transactions, which helps in uncovering suspicious patterns that may indicate terrorist financing.

What recent findings highlight the importance of financial terrorism risk assessment?

Recent findings indicate that internal controls related to Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) in payment institutions often fall short, emphasizing the need for a financial terrorism risk assessment platform to mitigate risks of money laundering and terrorist financing.

How do economic assessment services contribute to risk evaluation?

Economic assessment services utilize data analytics, transaction monitoring, and compliance checks to ensure a comprehensive evaluation of potential financial terrorism risks.

What are the expected outcomes of performing a monetary assessment?

Expected outcomes include improved adherence to regulatory standards, decreased exposure to hazards, and enhanced operational efficiency.

What steps should organizations take to implement a financial terrorism risk assessment platform?

Organizations should select the right platform, set up user accounts, input data, customize exposure parameters, run assessments, analyze results, and implement mitigation strategies.

Why is routine training important for staff in financial institutions?

Routine training increases awareness about terrorism risks related to finances and the importance of utilizing a financial terrorism risk assessment platform, fostering a culture of adherence within the organization.

What role does robust due diligence play in mitigating risks?

Robust due diligence practices are vital when onboarding clients and partners, ensuring that all parties adhere to regulatory standards and reducing the risk of financial terrorism.

How can organizations stay informed about emerging threats?

Organizations can build strong relationships with regulatory authorities and law enforcement agencies to stay informed about emerging threats and compliance requirements.

Why is continual risk assessment necessary in the financial sector?

Financial terrorism risks are dynamic; therefore, continual risk assessment is crucial for organizations to remain responsive to new threats and evolving regulations.

What legislation is important for compliance in financial institutions?

The USA PATRIOT Act and guidelines from the Financial Action Task Force (FATF) are critical for ensuring compliance in financial institutions.

How can organizations enhance their overall management strategies?

By emphasizing regulatory compliance, organizations can improve their management strategies, protect their economic integrity, and potentially decrease crime-related incidents.