Overview

This article presents a structured approach to effective financial operations restructuring, highlighting five essential steps:

- Assessing financial health

- Establishing clear criteria

- Assembling a skilled team

- Communicating with stakeholders

- Monitoring progress

Each step is underpinned by compelling evidence and strategies that underscore the importance of comprehensive evaluation, targeted goals, and consistent communication. These elements are crucial for enhancing organizational efficiency and achieving long-term success. By following this roadmap, organizations can navigate the complexities of financial restructuring with confidence and purpose.

Introduction

In an increasingly complex financial landscape, organizations are compelled to rethink their operational frameworks. Financial operations restructuring emerges as a vital strategy for companies seeking to enhance efficiency, reduce costs, and ultimately drive performance. This process necessitates a meticulous evaluation of:

- Financial strategies

- Cash flow management

- Resource alignment

to meet evolving business objectives. As companies confront mounting pressures from declining revenues and operational inefficiencies, understanding the fundamental components of restructuring becomes essential. By establishing clear goals and assembling skilled teams, businesses can navigate these challenges effectively, ensuring not only survival but also a pathway to sustainable growth in the years ahead.

Understand Financial Operations Restructuring

Restructuring monetary operations through financial operations restructuring is a strategic endeavor aimed at reorganizing a company's fiscal framework to enhance efficiency, reduce expenses, and elevate overall performance. This process of financial operations restructuring involves revising monetary strategies, optimizing cash flow management, and realigning resources to better support business objectives. For companies grappling with economic challenges, understanding the key components of this process is essential for pinpointing specific areas that require transformation.

Key aspects to consider include:

- Financial Assessment: A comprehensive review of current financial operations is crucial to identify inefficiencies and areas ripe for improvement. In 2024, troubled exchanges represented 63% of defaults, emphasizing the urgency for companies to reevaluate their economic strategies to prevent similar pitfalls. Moreover, the expense of cumbersome outdated software is a $1.52 trillion issue, highlighting the necessity for financial operations restructuring to enhance monetary strategies and boost operational efficiency. Employing a Business Valuation Report can offer essential insights into the economic health of the organization, guiding necessary adjustments.

- Objectives: Setting clear targets for the reorganization is crucial. These may include reducing debt, enhancing liquidity, or improving profitability. Companies that set specific, measurable objectives are more likely to achieve sustainable growth. Expert guidance, particularly from professionals experienced in AI/ML strategies, can streamline decision-making and enhance real-time analytics for effective performance monitoring.

- Stakeholder Impact: Understanding how changes will affect various stakeholders—employees, investors, and customers—is critical for successful implementation. Effective communication and teamwork can result in improved alignment between economic performance and strategic objectives. As mentioned, "Organizations that adopt cross-functional collaboration will observe improved alignment between economic performance and strategic objectives," highlighting the significance of teamwork in the reorganization process.

As companies manage the intricacies of financial operations restructuring in 2025, they must prioritize these elements to improve their operational efficiency and promote long-term success. Furthermore, CFOs should consider the five critical questions bank executives need to prioritize in 2025 to effectively navigate these challenges.

Evaluate the Need for Restructuring

To assess whether your organization requires financial operations restructuring, consider the following critical indicators:

- Declining Revenue: A persistent decrease in sales or revenue often points to deeper financial challenges. In 2025, small to medium businesses have reported a notable trend of declining revenues, which can be a precursor to more significant issues if not addressed promptly. Statistics indicate that many businesses are experiencing this decline, highlighting the urgency for evaluation.

- Cash flow problems, like struggling to meet short-term obligations or maintain a positive cash flow, highlight the necessity for financial operations restructuring to address financial distress. Statistics indicate that cash flow issues are prevalent among small businesses, with many facing difficulties in sustaining operations. As Chris Chocola asserts, "cash flow is reality, while balance sheets and income statements are often fictional," emphasizing the critical nature of cash flow management.

- High debt levels can severely limit operational flexibility and hinder growth potential, often necessitating financial operations restructuring. Organizations must evaluate their debt ratios to ensure they remain sustainable.

- Identifying operational inefficiencies, such as areas where expenses surpass industry standards or where processes are outdated, can highlight the necessity for financial operations restructuring. For instance, businesses that leverage statistical insights can gain a competitive edge by pinpointing inefficiencies and planning for future growth. A case study titled "Leveraging Business Statistics for Planning" illustrates how small businesses can gain insights from statistics to understand the general business climate and plan for future growth.

- Moreover, performing a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) can provide valuable insights into your entity's current status and highlight the necessity for financial operations restructuring. This strategic approach allows CFOs to make informed decisions based on a comprehensive understanding of both internal and external factors affecting their business. By identifying underlying issues and collaboratively creating a plan, organizations can mitigate weaknesses and reinvest in key strengths, ultimately enhancing their operational performance.

Establish Clear Restructuring Criteria

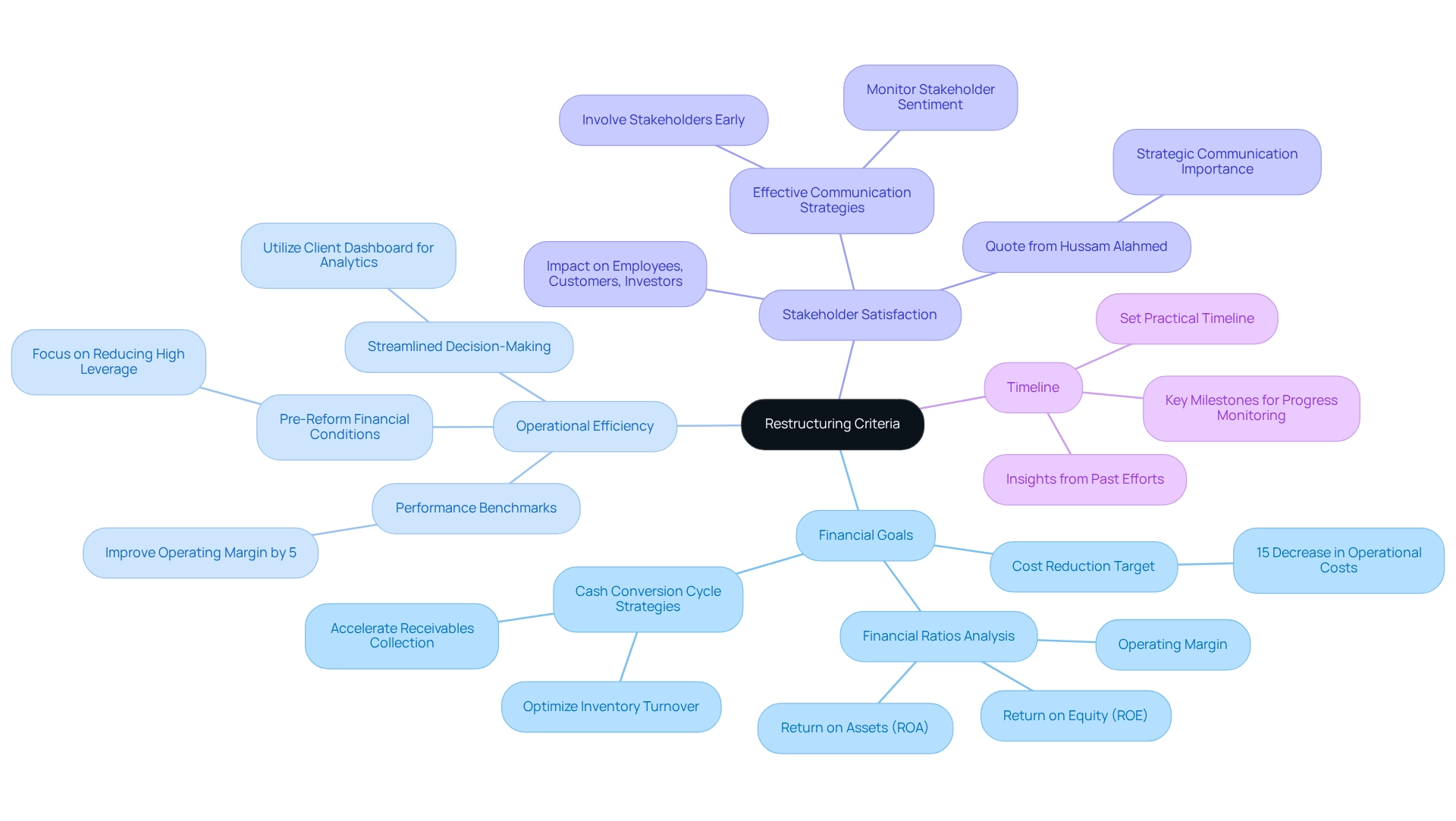

Setting clear criteria for reorganization is crucial for directing the process efficiently. Organizations must define specific goals and metrics that will serve as a roadmap. Key criteria to consider include:

- Financial Goals: Establish measurable targets aimed at reducing costs, enhancing cash flow, or boosting profitability. For instance, companies may target a 15% decrease in operational costs within the first year of reorganization. Additionally, analyzing key financial ratios such as Return on Assets (ROA) and Return on Equity (ROE) over a ten-year period can provide valuable insights into financial performance and help set realistic goals. Strategies for mastering the cash conversion cycle, such as optimizing inventory turnover and accelerating receivables collection, can further enhance these goals, ensuring that financial operations restructuring optimizes cash flow throughout the process.

- Operational Efficiency: Identify benchmarks for operational performance that must be achieved post-restructuring. This could involve improving the operating margin by at least 5% over the next two years, ensuring that the organization operates more efficiently. Research indicates that firms with well-defined pre-restructuring financial conditions, such as a focus on reducing high leverage, tend to achieve better results following financial operations restructuring. Streamlined decision-making processes can facilitate quicker adjustments to operational strategies, enhancing overall efficiency. Utilizing a client dashboard for real-time analytics can support this effort by providing insights into operational performance.

- Stakeholder Satisfaction: Clearly define how the reorganization will affect employees, customers, and investors. As Hussam Alahmed remarked, "Effective communication, while essential, strategic communication is lacking in reorganization or bankruptcy to attain agreement among stakeholders." Involving stakeholders early in the process can result in improved outcomes and agreement, as efficient communication is essential during this transition. Continuous monitoring of stakeholder sentiment through real-time analytics can help adjust strategies to maintain satisfaction.

- Timeline: Set a practical timeline for achieving organizational goals, including key milestones to monitor progress. A structured timeline helps maintain momentum and accountability throughout the process. By implementing insights gained from past reorganization efforts, establishments can enhance their schedules and ensure that they are practical and attainable.

By applying these standards, entities can sustain focus and direction, greatly enhancing the chances of successful transformation results. This strategic approach not only addresses immediate challenges but also positions the organization for sustainable growth in the long term. In light of the historic reorganization of the world economy, as noted by Chris Alexander, adopting market-based principles can further enhance the effectiveness of these efforts.

Assemble a Skilled Restructuring Team

Building a proficient reorganization group is essential for efficiently managing financial operations restructuring during economic difficulties. It entails choosing individuals with varied expertise and experience across several key roles:

- Analysts: Crucial for evaluating monetary data and creating actionable strategies for enhancement. Their insights are essential, as organizations with proficient monetary teams are statistically more likely to achieve successful transformation results. A comprehensive assessment of finances can assist in recognizing chances to retain cash and lower obligations, which is essential during financial operations restructuring. Transform Your Small/ Medium Business offers comprehensive financial assessment services to support this effort.

- Operations Managers: Tasked with identifying inefficiencies in current processes, they recommend changes that can streamline operations and enhance productivity. Their role is especially crucial, particularly since 50% of leaders are uncertain whether recent organizational changes have been successful, highlighting the need for effective oversight during transformation efforts. Our temporary management services offer practical leadership to tackle these challenges.

- Human Resources Specialists: They oversee employee relations and ensure seamless transitions during organizational changes. Their involvement is critical, especially in maintaining morale and minimizing turnover. This is evidenced by organizations where not one employee has voluntarily departed in three years due to strong cultural alignment, emphasizing the significance of nurturing a supportive environment during periods of change.

- Legal Advisors: Tasked with navigating the legal implications of the organizational transformation process, they ensure compliance and mitigate risks associated with organizational changes.

It is essential that team members not only possess the necessary skills but also align with the organization's goals and culture. Regular meetings and open communication foster collaboration, ensuring that everyone is on the same page. Additionally, utilizing time management resources can empower team members to use their time more effectively, enhancing overall productivity.

A case study on organizational relevance emphasizes that aligning change initiatives with employees' daily work is vital for effective change management. Without this alignment, 71% of employees risk misdirecting their efforts, which can hinder the success of organizational changes. By forming a cohesive and skilled team for financial operations restructuring, backed by the customized services of Transform Your Small/ Medium Business, companies can greatly increase their likelihood of successful financial operations transformation.

Communicate Effectively with Stakeholders

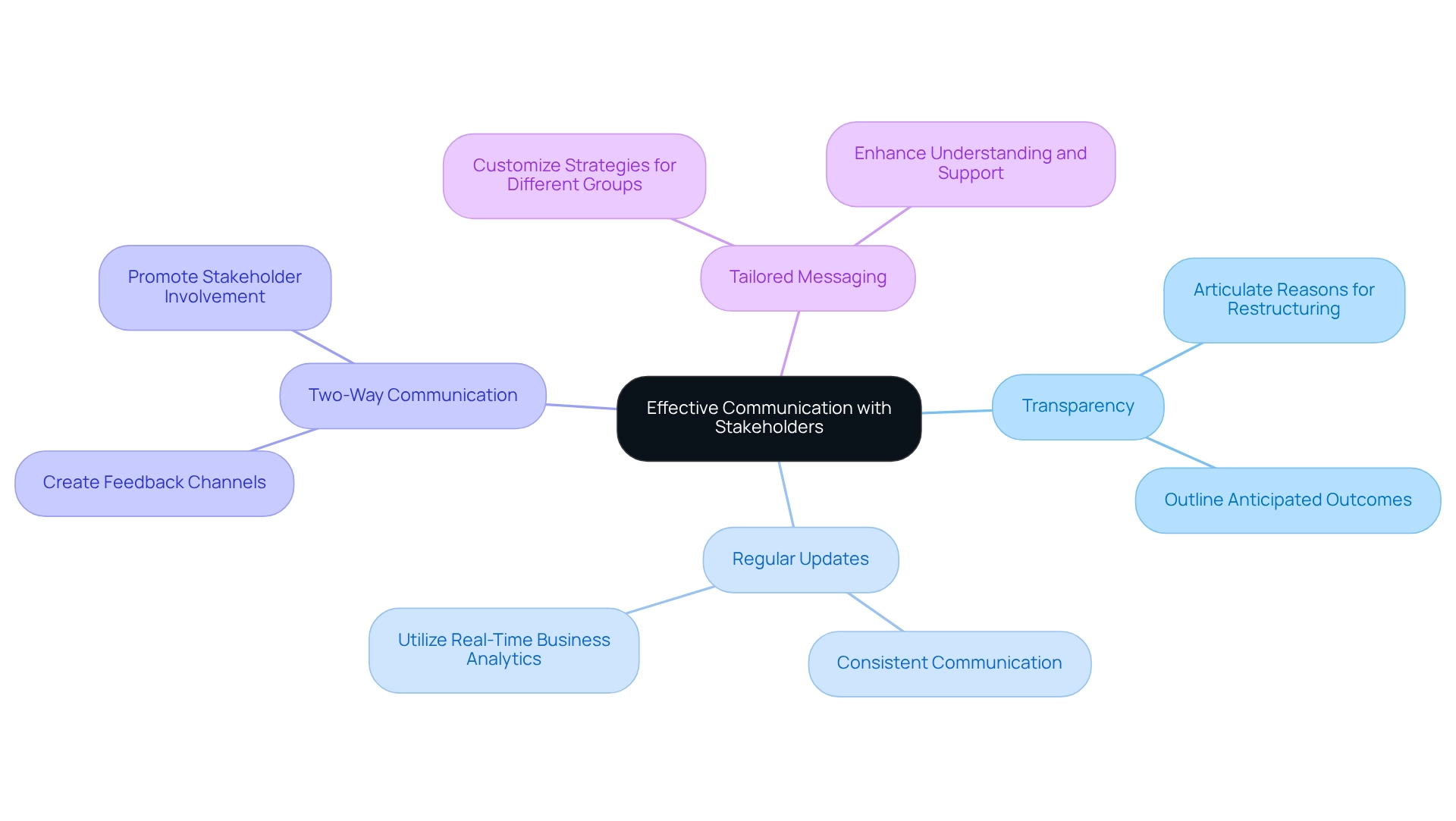

Effective communication with stakeholders during the reorganization process is essential for fostering trust and ensuring a smooth transition. To achieve this, consider implementing the following key strategies:

- Transparency: Clearly articulate the reasons behind the restructuring and outline the anticipated outcomes. This openness not only builds trust but also alleviates uncertainty among stakeholders.

- Regular Updates: Maintain consistent communication by providing stakeholders with updates on progress, challenges, and successes throughout the restructuring journey. Utilizing real-time business analytics from your client dashboard can enhance this practice, keeping everyone informed and engaged.

- Two-Way Communication: Create channels for feedback and questions from stakeholders. Promoting conversation aids in addressing concerns and boosts stakeholder involvement, making them feel appreciated during the experience.

- Tailored Messaging: Customize communication strategies for different stakeholder groups—employees, investors, and customers—to ensure that the messaging is relevant and clear. As Anthony Robbins noted, "To effectively communicate, we must realize that we are all different in the way we perceive the world and use this understanding as a guide to our communication with others." This targeted approach enhances understanding and support.

Moreover, dedicating efforts to implement lessons from the turnaround can significantly enhance relationships with stakeholders. The case study titled "Challenges of Remote Work Communication" highlights how the shift to remote work has introduced new communication barriers. Companies that adopted reliable communication tools and strategies successfully bridged the gap between remote and in-office workers, improving overall collaboration. Focusing on these communication strategies, combined with ongoing business performance assessment through real-time analytics, can greatly enhance stakeholder trust and support, ultimately enabling financial operations restructuring for a more efficient organization. Notably, companies that promote collaborative working are five times more likely to achieve high performance, underscoring the importance of effective communication in driving successful outcomes. Nitin Nohria stressed that communication is essential to leadership, highlighting the importance of strong communication practices during organizational change.

Monitor Progress and Share Successes

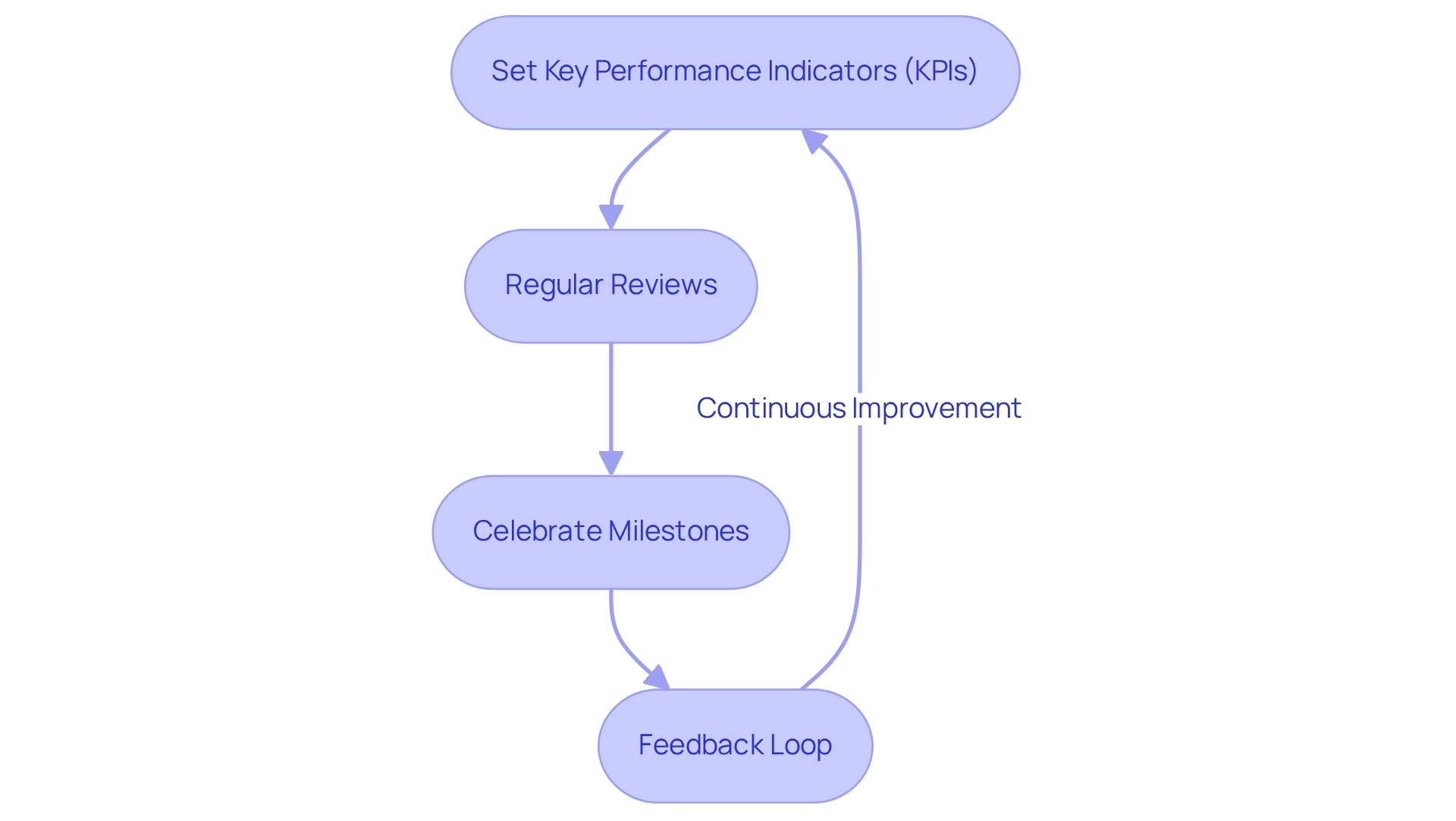

Monitoring progress during the financial operations restructuring process is essential for ensuring that entities stay aligned with their financial goals. To effectively track and enhance performance, consider the following key steps:

- Set Key Performance Indicators (KPIs): Establish specific metrics that reflect success, such as cost savings, revenue growth, and operational efficiency. A well-defined set of KPIs, supported by a robust measurement framework, can unlock new analytics opportunities, driving business growth and facilitating better performance tracking and optimization. By testing every hypothesis, entities can maximize their return on invested capital in both the short and long term.

- Regular Reviews: Implement a schedule for periodic evaluations against these KPIs. This allows for timely adjustments and ensures that the organization remains agile in response to changing circumstances. A shortened decision-making cycle supports decisive actions that maintain business health.

- Celebrate Milestones: Recognizing and sharing achievements with the team and stakeholders fosters a positive environment and reinforces commitment to the reorganization objectives. Celebrating small wins can significantly boost morale and motivation.

- Feedback Loop: Develop a structured mechanism for collecting feedback from team members and stakeholders. This ongoing input is essential for enhancing the financial operations restructuring method and addressing any emerging challenges. By consistently observing the effectiveness of strategies through real-time business analytics, organizations can assess their status efficiently.

In 2025, organizations that proactively track their KPIs can anticipate average cost reductions of up to 20% from successful reorganization efforts. This statistic underscores the importance of KPI tracking, as leveraging real-time data enables employees to prioritize tasks effectively, enhancing collaboration and overall performance. A data-driven approach to KPI selection not only improves tracking but also contributes to sustained growth and operational excellence. As Sam Levenson wisely stated, 'Don’t watch the clock; do what it does. Keep going.' This mindset is crucial for maintaining momentum throughout the financial operations restructuring process.

Conclusion

Navigating the complexities of financial operations restructuring presents organizations with a strategic opportunity to enhance efficiency, reduce costs, and drive sustainable growth. By concentrating on critical components such as financial assessment, clear objectives, stakeholder impact, and assembling a skilled team, companies can effectively tackle the pressing challenges posed by declining revenues and operational inefficiencies.

Establishing clear restructuring criteria is essential. By setting measurable financial goals, enhancing operational efficiency, ensuring stakeholder satisfaction, and adhering to a realistic timeline, organizations can maintain focus and direction throughout the restructuring process. This strategic approach not only addresses immediate issues but also positions the company for long-term success in a rapidly evolving financial landscape.

Furthermore, effective communication with stakeholders emerges as a vital element in fostering trust and engagement. Transparency, regular updates, and tailored messaging contribute significantly to a positive restructuring experience. By prioritizing communication, organizations can mitigate resistance to change and garner the necessary support from employees, investors, and customers alike.

Ultimately, the commitment to monitoring progress and celebrating successes serves as a catalyst for motivation and continuous improvement. By leveraging key performance indicators and real-time analytics, businesses can ensure alignment with their financial goals while adapting to changing circumstances. As organizations embark on their restructuring journeys, embracing these principles will not only facilitate immediate recovery but also pave the way for a resilient and prosperous future.

Frequently Asked Questions

What is financial operations restructuring?

Financial operations restructuring is a strategic process aimed at reorganizing a company's fiscal framework to enhance efficiency, reduce expenses, and improve overall performance. It involves revising monetary strategies, optimizing cash flow management, and realigning resources to better support business objectives.

Why is a financial assessment important in restructuring?

A financial assessment is crucial as it involves a comprehensive review of current financial operations to identify inefficiencies and areas for improvement. This helps companies address economic challenges and prevent defaults, as highlighted by the 63% of defaults from troubled exchanges in 2024.

What objectives should companies set during financial operations restructuring?

Companies should set clear targets such as reducing debt, enhancing liquidity, or improving profitability. Specific, measurable objectives increase the likelihood of achieving sustainable growth.

How does stakeholder impact play a role in financial operations restructuring?

Understanding how changes will affect stakeholders—employees, investors, and customers—is critical for successful implementation. Effective communication and teamwork can lead to improved alignment between economic performance and strategic objectives.

What indicators suggest that an organization may need financial operations restructuring?

Key indicators include declining revenue, cash flow problems, high debt levels, operational inefficiencies, and insights from a SWOT analysis. These factors highlight the necessity for restructuring to address underlying financial challenges.

How can cash flow issues affect a company's operations?

Struggling to meet short-term obligations or maintain positive cash flow can indicate financial distress, emphasizing the need for restructuring. Cash flow management is critical, as it reflects the actual financial health of a business.

What role does a SWOT analysis play in financial operations restructuring?

A SWOT analysis provides valuable insights into a company's current status by identifying strengths, weaknesses, opportunities, and threats. This strategic approach helps CFOs make informed decisions and create plans to mitigate weaknesses and enhance operational performance.