Overview

This article addresses the critical financial reorganization plans that CFOs must implement to navigate restructuring effectively. By conducting thorough assessments and engaging with stakeholders, CFOs can significantly enhance their organizations' chances of achieving successful turnarounds and sustainable growth. Moreover, utilizing strategic financing options, such as Debtor-in-Possession (DIP) financing, offers a pathway to stability in challenging times. In conclusion, it is imperative for CFOs to adopt these strategies to ensure their organizations not only survive but thrive in the face of adversity.

Introduction

In the intricate world of financial reorganization, the stakes are undeniably high, and the path to recovery is fraught with challenges. For CFOs at small to medium enterprises, mastering the nuances of turnaround and restructuring consulting is essential for navigating these turbulent waters. This article delves into multifaceted strategies capable of transforming financial distress into a success story, from leveraging debtor-in-possession financing to effective creditor management.

By exploring practical implications and real-world case studies, it highlights the critical steps CFOs must undertake to ensure not only survival but also sustainable growth in an ever-evolving economic landscape.

With expert insights and actionable advice, this guide serves as a roadmap for those seeking to revitalize their organizations amidst adversity.

Transform Your Small/ Medium Business: Comprehensive Turnaround and Restructuring Consulting

Comprehensive turnaround and restructuring consulting necessitates a meticulous evaluation of a business's financial health, operational efficiency, and the implementation of financial reorganization plans for market positioning. By leveraging expert insights, CFOs can identify critical enhancement areas, streamline operations, and implement strategies that significantly elevate profitability. This approach not only addresses pressing financial challenges but also strategically positions the business for sustainable success.

Our comprehensive consulting services—encompassing interim management, bankruptcy case management, and financial assessments—are designed to tackle the unique challenges faced by small to medium enterprises, fostering a culture of resilience and adaptability. As Cathie Lesjak, Chief Financial Officer of HP, aptly states, "reinvesting saved funds back into the business can produce greater future returns," underscoring the necessity for financial leaders to engage in proactive assessments of economic health.

The turnaround cycle illustrates the importance of timely actions in consulting, with successful cases showcasing how tailored approaches can lead to remarkable improvements in financial performance. Furthermore, as highlighted in the case study 'Battling for Data' by Mark Partin, Chief Financial Officers must actively manage information flow to avert data vacuums and ensure decision-making is grounded in accurate and comprehensive data.

Collaborating with turnaround advisors can be a pivotal step for CFOs seeking to refine their financial reorganization plans. To initiate this process, CFOs should assess their current financial health, pinpoint specific areas where expert guidance could yield significant improvements, and contemplate utilizing our comprehensive consulting services.

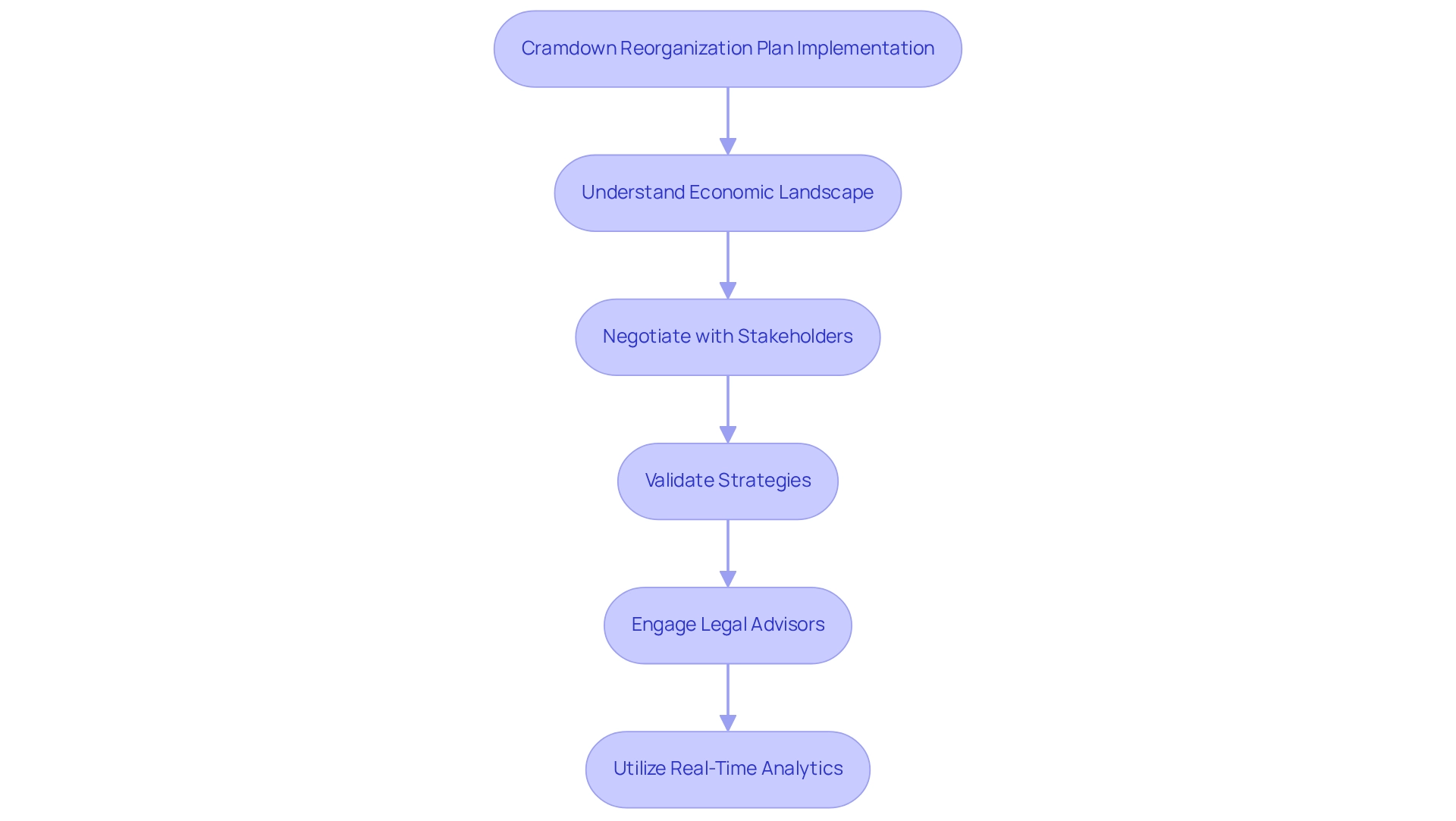

Cramdown Reorganization Plans: Strategies for Successful Implementation

Financial reorganization plans, such as cramdown reorganization plans, empower debtors to confirm a Chapter 11 plan despite creditor objections, as long as they comply with specific legal standards. The successful execution of these plans hinges on a deep understanding of the economic landscape, the ability to negotiate effectively with all stakeholders, and the validation of strategies through rigorous testing. Chief financial officers must prioritize the development of a plan that reflects fairness and equity, supported by robust financial forecasts and a clearly articulated recovery strategy. Engaging knowledgeable legal advisors in bankruptcy matters significantly enhances the likelihood of a successful cramdown.

Recent developments highlight the evolving nature of cramdown strategies. For example, the Cineworld restructuring plan, approved by the court despite opposition from two landlord creditors, exemplifies the potential for favorable outcomes even in the face of substantial challenges. The court's decision to facilitate a large convening of creditor meetings without initial disputes underscores the critical importance of thorough preparation and strategic negotiation. This scenario illustrates how a meticulously planned approach, bolstered by real-time analytics through a client dashboard and a commitment to applying lessons learned, can yield positive results. It emphasizes the need for financial leaders to adopt similar methodologies in their negotiations, especially in the context of financial reorganization plans, as data indicates that the success rates of cramdown restructuring plans can vary; however, with the right approach, many companies have navigated these hurdles successfully. Chief financial officers should consider leveraging successful case studies and expert insights to refine their strategies. By prioritizing clear communication, demonstrating a commitment to equitable solutions, and utilizing real-time business analytics to evaluate performance—coupled with a solid grasp of legal standards and negotiation techniques—financial leaders can enhance their negotiation positions and facilitate smoother executions of cramdown restructuring plans.

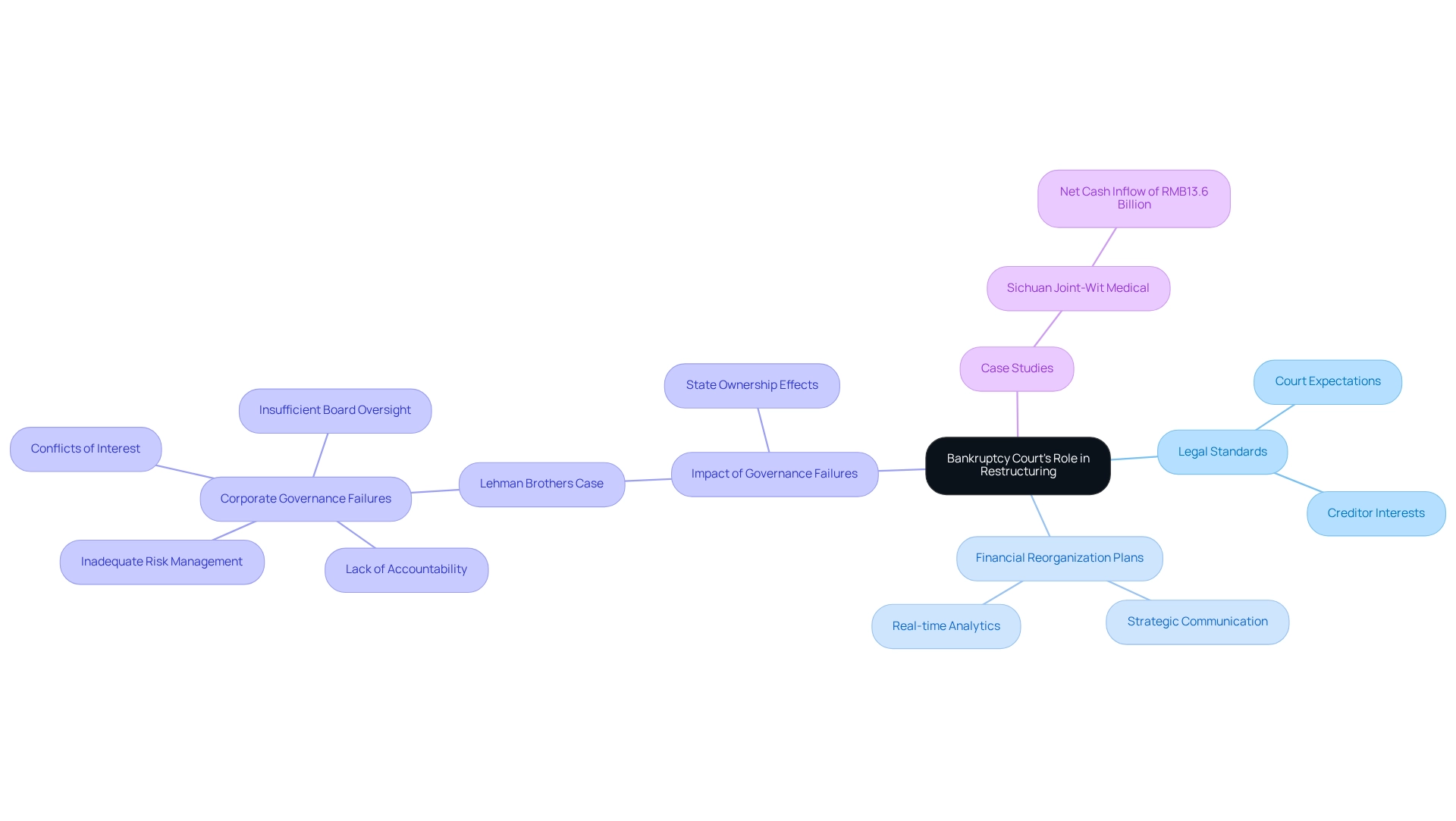

Bankruptcy Court's Role: Navigating Legal Aspects of Reorganization

The bankruptcy court plays a pivotal role in the restructuring process, ensuring adherence to legal standards while safeguarding creditor interests. For financial executives, it is essential to present well-organized financial reorganization plans that effectively communicate strategies for managing debts while sustaining business activities. Familiarity with the court's expectations and the legal ramifications of various decisions is crucial for achieving a favorable outcome.

Frequent discussions with legal consultants empower financial officers to navigate this intricate environment, enhancing their ability to meet existing legal obligations for restructuring plans. Significantly, effective financial reorganization plans sanctioned by bankruptcy courts often reflect meticulous preparation and a clear understanding of the legal framework, underscoring the importance of strategic planning in these challenging situations.

Moreover, the integration of real-time business analytics can greatly enhance the decision-making process, enabling CFOs to continuously monitor performance and adjust strategies as necessary. For instance, in 2003, Sichuan Joint-Wit Medical achieved a net cash inflow of RMB13.6 billion after redundancy payments, exemplifying the potential positive outcomes of efficient restructuring plans.

Furthermore, the collapse of Lehman Brothers illustrates the critical necessity for sound corporate governance practices, as severe governance failures significantly contributed to its downfall. This case highlights the importance of thorough preparation in financial reorganization plans. Additionally, the bankruptcy of Lehman Brothers triggered a chain reaction of losses for other financial institutions, emphasizing the broader implications of a company's failure on the financial system.

Furthermore, financial executives must recognize that state ownership can adversely impact companies' distress-management approaches, adding another layer of complexity to the restructuring process. By operationalizing lessons learned from past experiences and adopting a pragmatic approach to data, financial leaders can refine their strategies and enhance the likelihood of a successful turnaround.

Valuation Importance: Assessing Financial Health in Reorganization Plans

Valuation is essential to the restructuring process, providing a comprehensive view of a company's financial health. Chief financial officers should utilize a range of valuation methods, including discounted cash flow analysis and market comparisons, to determine a credible business value. This valuation is pivotal for shaping the financial reorganization plans and acts as a vital instrument in negotiations with creditors and stakeholders. Accurate and transparent valuations foster trust, paving the way for more effective discussions during restructuring.

In 2025, attaining complete visibility over company expenditures is crucial, enabling chief financial officers to make informed decisions based on accurate evaluations of funds. This visibility is essential in the valuation process, allowing financial leaders to identify areas for enhancement and allocate resources efficiently. Furthermore, successful financial health assessments significantly improve outcomes in financial reorganization plans, highlighting the necessity of robust valuation methods.

As Luca Maestri observes, the transition to in-house development can improve innovation management, indicating that financial leaders should contemplate utilizing internal resources when evaluating value. Additionally, while certain tactics may not resolve all balance sheet woes, they can provide companies with more time to address their challenges without court oversight.

Case studies exploring differing restructuring methods in Chinese companies show how local dynamics affect valuation practices, emphasizing the necessity for financial leaders to adjust their plans to their unique situations. Ultimately, a well-executed valuation process, supported by expert guidance and AI/ML approaches, is crucial for navigating the complexities of financial distress and ensuring the success of financial reorganization plans.

Challenges in Reorganization: Identifying and Overcoming Obstacles

Reorganization efforts frequently encounter significant challenges, including:

- Creditor resistance

- Operational disruptions

- Regulatory hurdles

To navigate these complexities, CFOs must conduct a comprehensive risk assessment to identify potential obstacles early in the process. Developing robust contingency plans and fostering open communication with all stakeholders are essential strategies for mitigating these challenges. For instance, The Leadership Lighthouse, a healthcare organization, successfully revamped its patient care system by ensuring strong leadership and actively seeking feedback from diverse stakeholders. This approach ultimately improved patient care metrics and boosted staff morale, illustrating the significance of stakeholder involvement and leadership in addressing restructuring challenges.

Moreover, utilizing the knowledge of turnaround advisors can offer invaluable perspectives on addressing particular challenges that may arise during restructuring. As one turnaround consultant noted, "Effective communication and stakeholder buy-in are critical to navigating the complexities of reorganization." In addition, adopting a pragmatic approach to data by testing hypotheses can deliver maximum return on invested capital, while real-time analytics can continually diagnose business health and inform decision-making. Statistics indicate that investing in employee training can reduce operational costs by up to 15%, highlighting the importance of equipping teams to adapt to new processes.

As the economic landscape evolves in 2025, with potential winners and losers arising from regulatory changes, understanding common challenges encountered during financial reorganization plans—such as creditor resistance—will be essential for financial leaders aiming to achieve successful outcomes. Furthermore, the effect of government expenditure and insurance mandates on healthcare providers underscores the necessity for financial leaders to remain alert and flexible in their strategies.

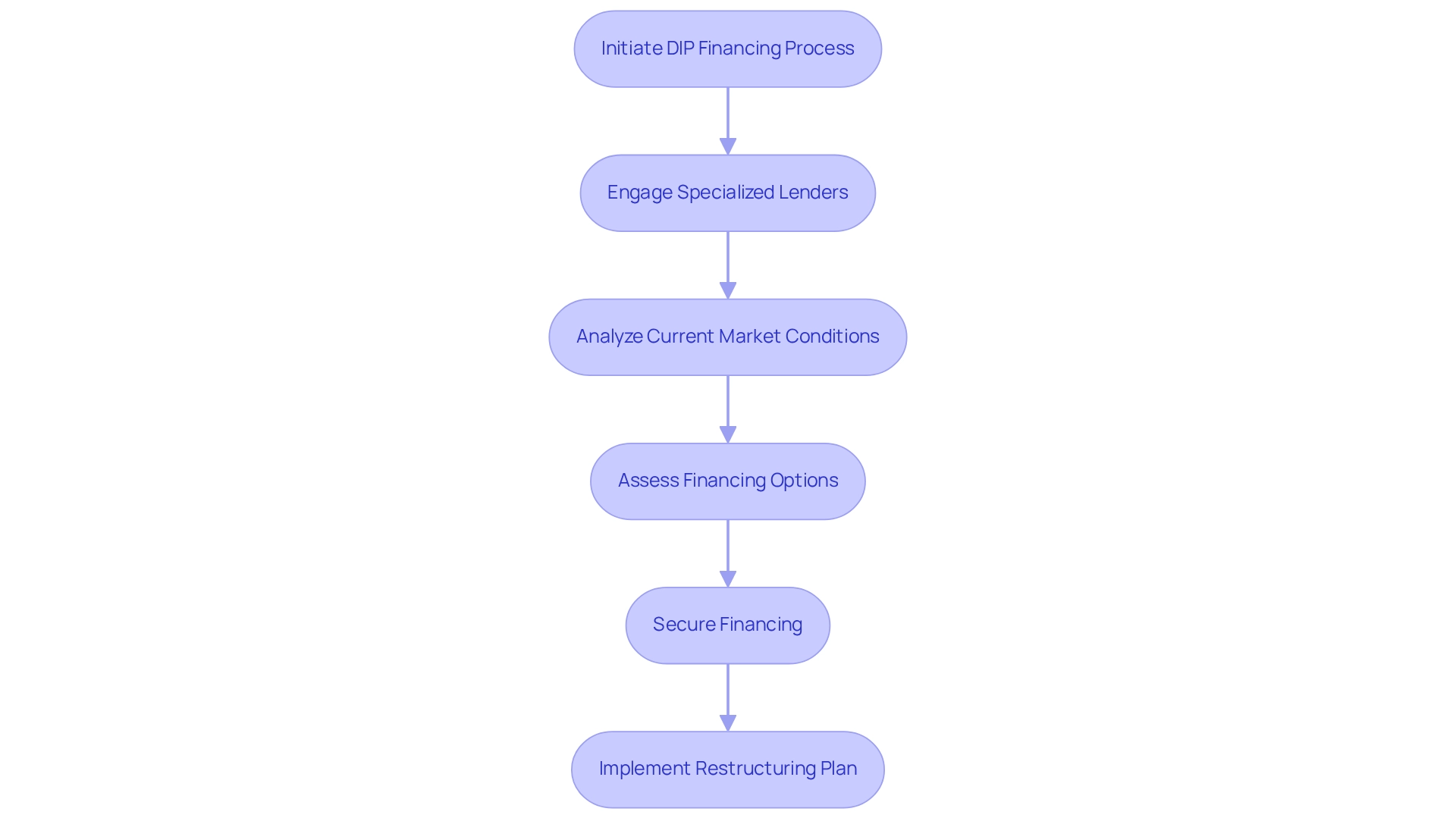

Debtor-in-Possession Financing: A Key Component of Reorganization Plans

Debtor-in-Possession (DIP) financing is a crucial lifeline for companies undergoing Chapter 11 bankruptcy, enabling them to secure necessary funds to sustain operations during the restructuring phase. For CFOs, prioritizing the acquisition of DIP financing at the beginning of the restructuring process is essential, as it provides the liquidity required to meet operational expenses and supports a more seamless transition. Engaging with lenders who specialize in DIP financing can significantly improve the likelihood of securing favorable terms, pivotal for the overall success of the reorganization plan.

In today's fast-paced financial landscape, the ability to make quick decisions is paramount. Our approach emphasizes testing hypotheses and utilizing real-time analytics to continuously monitor business performance. This pragmatic methodology enables financial executives to make informed decisions that can preserve their business during challenging times. As John Maynard Keynes aptly stated, "If I owe you a pound, I have a problem; but if I owe you a million, the problem is yours." This highlights the complexities of debt management during bankruptcy, underscoring the importance of securing adequate financing.

Current statistics indicate that companies utilizing DIP financing have a higher success rate in emerging from bankruptcy, with many securing loans that are overcollateralized and accompanied by strict covenants, resulting in minimal repayment risk. A recent case study titled 'Debtor-in-Possession Loans Analysis' examined 545 DIP loan facilities and revealed that these loans are often highly overcollateralized, contributing to their low repayment risk. In 2025, CFOs should consider innovative DIP financing strategies, such as leveraging relationships with specialized lenders and exploring alternative financing structures to enhance their negotiating position.

Case studies demonstrate successful instances of companies that effectively navigated Chapter 11 by securing DIP funding, showcasing the transformative impact of timely monetary assistance. Insights from industry experts highlight the significance of proactive engagement with potential lenders, emphasizing that a well-prepared approach can lead to more favorable financing conditions.

As the landscape of DIP financing evolves, staying informed about the latest trends and news is vital. For instance, the current market conditions reflect a shift away from static measures like the Base Rate, favoring more dynamic indicators such as the Market Cost of Funds (MCOF), which better align with real-time financial environments. This change affects financial leaders' strategies for obtaining DIP financing, as grasping these nuances can enhance their companies' prospects for successful restructuring results. Moreover, using a client dashboard can assist in real-time business analytics, enabling financial leaders to continuously monitor their business health and make necessary adjustments.

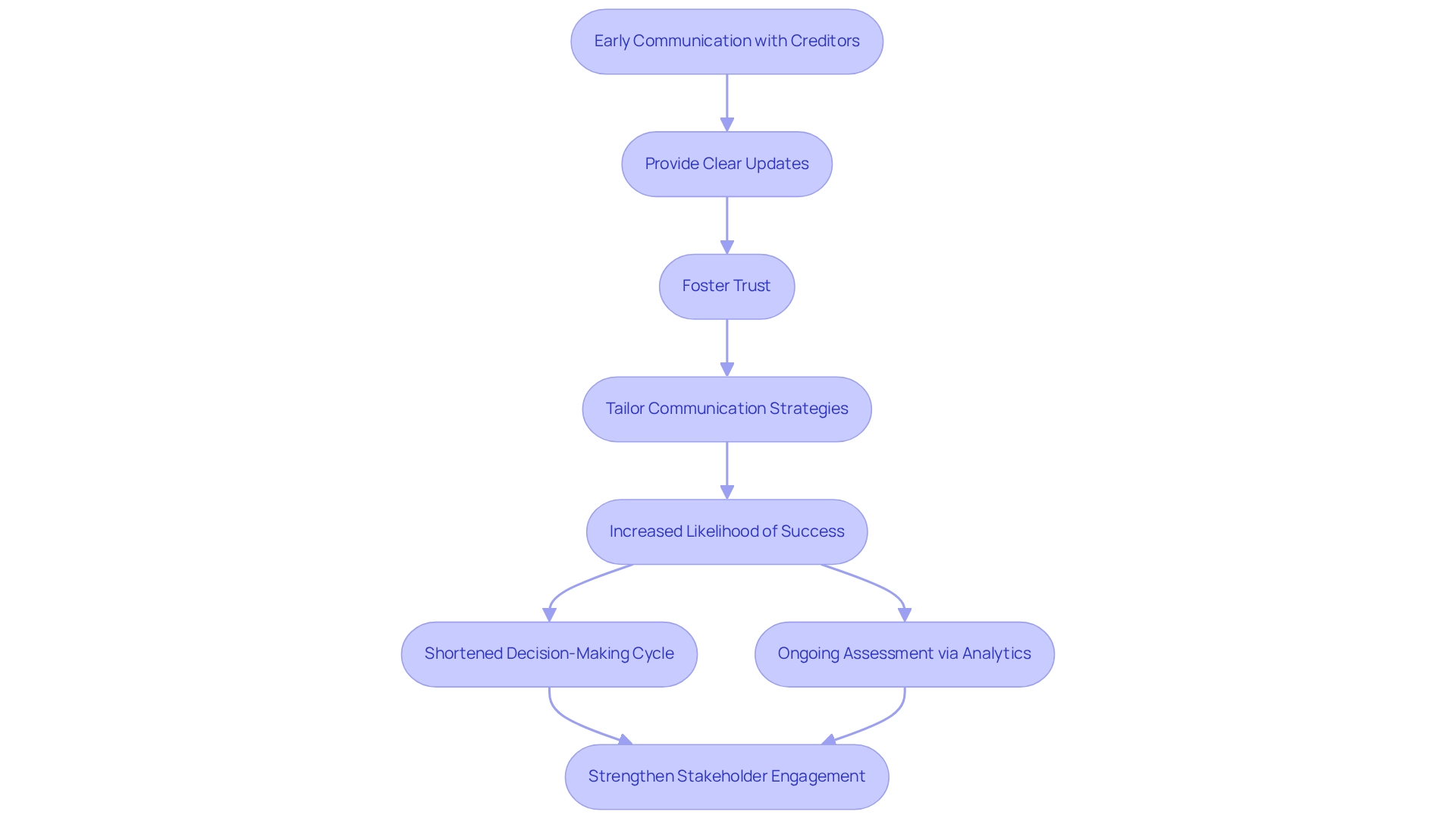

Creditors' Role: Managing Stakeholder Relationships in Reorganization

Effective management of creditor relationships is paramount during the restructuring process. Financial executives must prioritize early and frequent communication with creditors, ensuring they provide clear updates regarding the company's financial status and its financial reorganization plans. This open line of communication fosters trust, which is essential for successful negotiations and securing the necessary backing for proposed plans. Comprehending the diverse interests and concerns of different creditor groups enables financial leaders to tailor their communication strategies, addressing potential objections proactively. Statistics indicate that proactive creditor engagement can increase the likelihood of successful reorganization outcomes by up to 30%.

Moreover, our team promotes a shortened decision-making cycle during the turnaround process, allowing financial leaders to take decisive action that maintains business integrity. Ongoing assessment of business performance via real-time analytics, enabled by our client dashboard, permits financial executives to evaluate their business health efficiently and modify approaches as necessary. Insights from financial experts underscore that disciplined reinvestment of savings can amplify future business value, reinforcing the importance of strategic financial management during this critical phase.

Furthermore, the stock market frequently views government ownership as harmful to companies' distress-resolution strategies, emphasizing the necessity for financial leaders to manage these external perceptions with caution. Case studies, such as those highlighting the leadership approach of Chad Martin, CFO at MeridianLink, illustrate that valuing all contributions in discussions can lead to more effective stakeholder engagement. Ultimately, transparent communication, supported by real-time analytics and streamlined decision-making through our client dashboard, not only strengthens relationships with creditors but also plays a crucial role in the overall success of the financial reorganization plans.

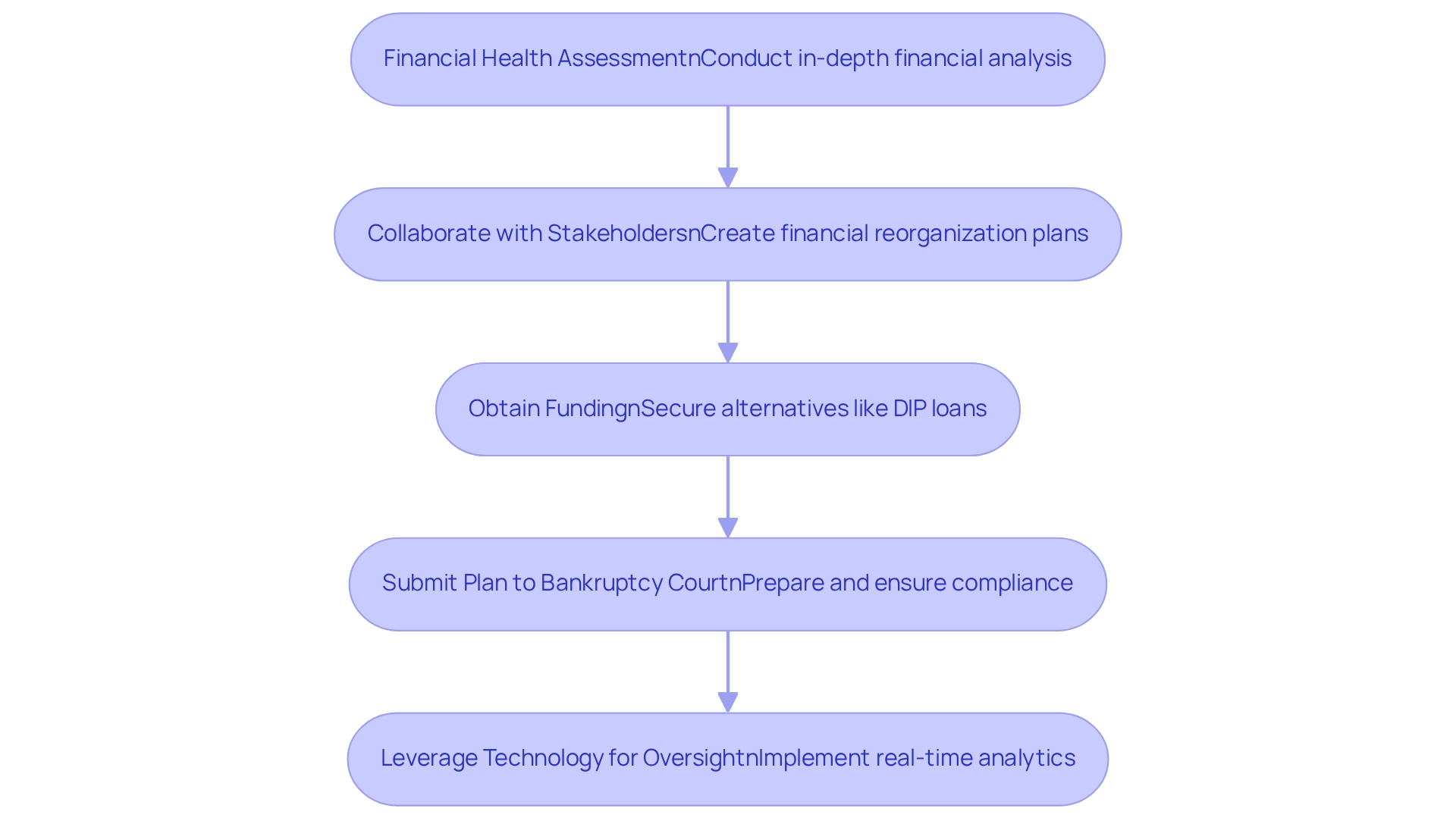

Steps in the Reorganization Process: A Roadmap for CFOs

The restructuring process is a multifaceted journey that requires careful navigation through several critical steps. It begins with a comprehensive assessment of financial health, where chief financial officers must conduct an in-depth financial analysis to pinpoint areas needing improvement. This evaluation is crucial, as it establishes the foundation for informed decision-making and strategic planning, facilitating a streamlined decision-making process that can greatly improve the turnaround procedure.

Following the assessment, financial leaders should collaborate with key stakeholders to jointly create financial reorganization plans. This plan should clearly outline the necessary steps for recovery, ensuring alignment among all parties involved. Obtaining funding is another critical step; alternatives like Debtor-in-Possession (DIP) loans are vital for maintaining operations during the restructuring phase.

Once the strategy is set and funding secured, the next step involves submitting the restructuring plan to the bankruptcy court for approval. This stage demands meticulous preparation and legal guidance to ensure compliance with all regulatory requirements. According to a recent study, 58% of chief financial officers emphasize fiscal strategies focused on market growth, resulting in a 25% rise in worldwide revenue sources. This underscores the significance of a well-organized restructuring strategy that can directly aid in revenue growth, particularly as the financial reorganization plans for 2025 emphasize the need for incorporating technology and real-time analytics into the restructuring process.

As Deloitte observes, financial leaders encounter three main challenges in converting data into actionable insights:

- Outdated technology

- Insufficient skills for interpreting data

- A shortage of experienced professionals adept in data analysis

Addressing these challenges is essential for efficient restructuring. Moreover, investing in research and development can establish new income sources, emphasizing the necessity for creative approaches during the recovery phase.

Additionally, Luca Maestri's remarks on the transition to internal development of technologies indicate that financial officers can leverage technology for improved oversight during the restructuring process. By implementing the lessons learned and consistently overseeing business performance through real-time analytics, financial leaders can effectively guide their organizations through the complexities of financial reorganization plans, ultimately achieving sustainable growth.

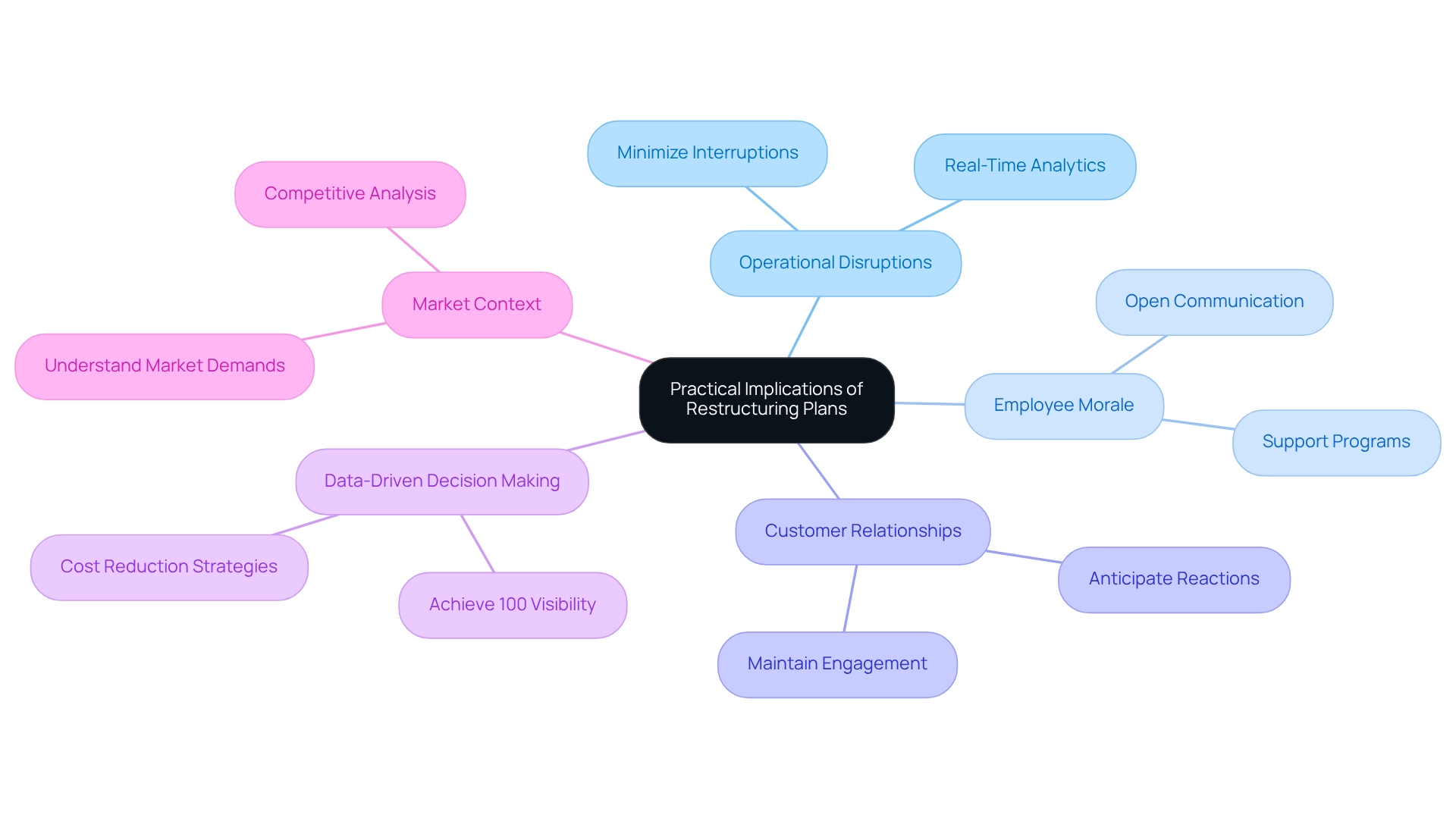

Practical Implications of Restructuring Plans: Real-World Considerations

Financial reorganization plans must carefully consider a range of practical implications, particularly operational disruptions, employee morale, and customer relationships. Effective change management is a calculated journey, guided by data and commitment. Financial executives should emphasize financial reorganization plans that minimize interruptions during the shift, such as maintaining open communication with both staff and clients.

Addressing employee concerns and providing necessary support can significantly bolster morale and productivity during these challenging times. Moreover, understanding the broader market context and anticipating potential customer reactions are essential for informing the restructuring strategy, ensuring that the business remains competitive and responsive to evolving market demands.

Statistics suggest that achieving complete visibility over company expenditures can significantly aid in successfully managing these transitions, as it enables executives to pinpoint areas for cost reduction and enhance oversight. A recent client experience with the SMB team demonstrated that the implementation of their 'Rapid30' plan resulted in a 30% increase in operational efficiency and a 25% improvement in financial metrics within just 100 days.

This underscores the importance of quick decision-making and real-time analytics in the turnaround process. By concentrating on these elements, financial executives can improve the chances of a successful restructuring and enhance the effectiveness of financial reorganization plans while promoting a resilient organizational culture.

The evolving role of chief financial officers into corporate strategists underscores the importance of these considerations, as they work to enhance the firm's valuation and build trust with stakeholders.

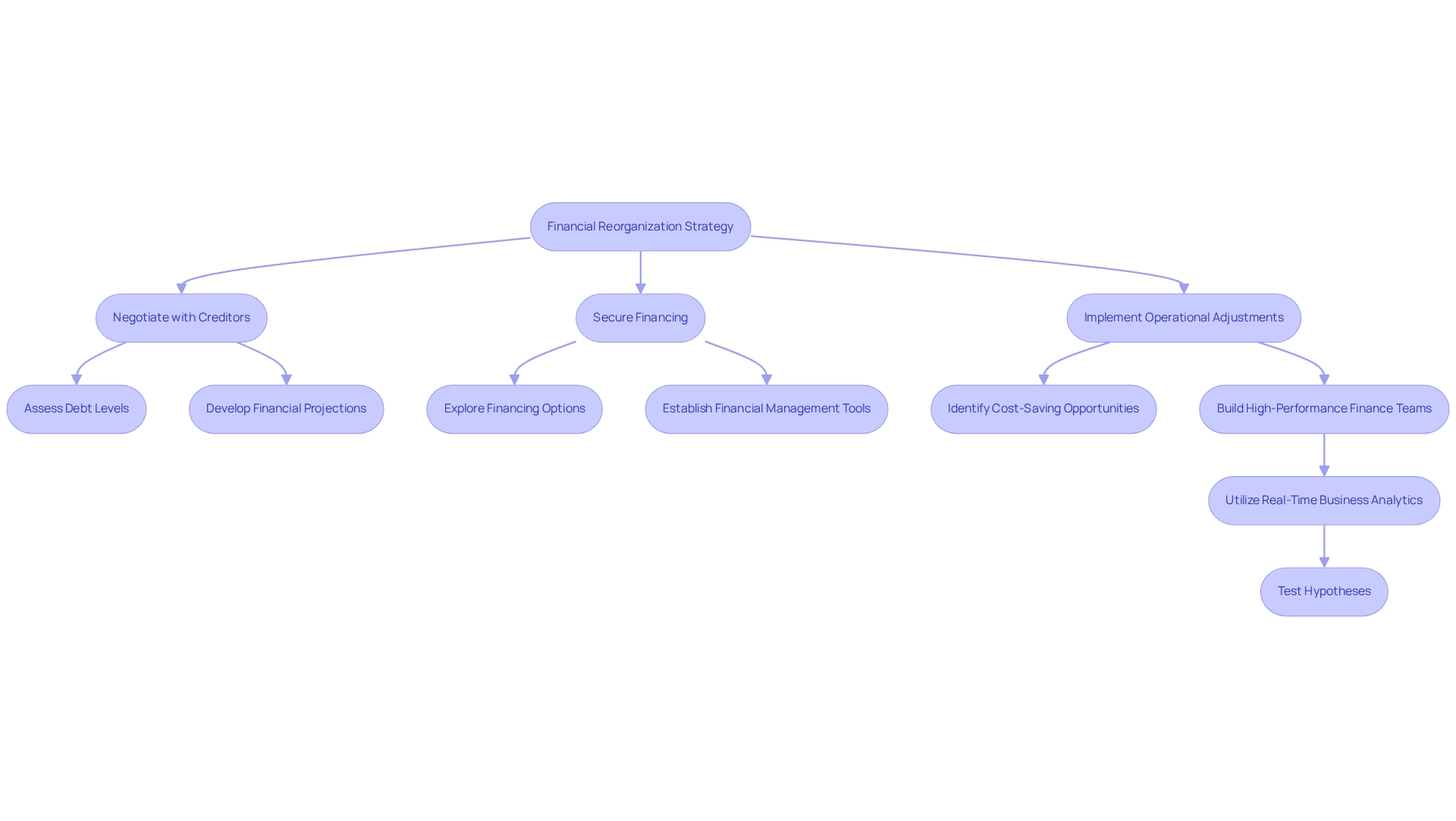

Quick Action and Strategy: Essential for Successful Financial Reorganization

In the dynamic environment of fiscal restructuring, swift action combined with strategic planning is essential to implement effective financial reorganization plans. Chief financial officers must prioritize developing financial reorganization plans that outline immediate steps to stabilize operations and address fiscal challenges. This includes:

- Negotiating with creditors

- Securing necessary financing

- Implementing operational adjustments

Statistics reveal that 77% of filers attribute debt collection as a significant factor in their bankruptcy, underscoring the urgency of proactive measures. By decisively tackling these challenges and maintaining focus on strategic goals, CFOs can significantly enhance the likelihood of a successful restructuring through effective financial reorganization plans, ultimately positioning the business for sustainable growth.

Successful instances of strategic planning in business turnarounds underscore the effectiveness of swift action, reinforcing the idea that timely interventions, including financial reorganization plans, are vital in managing economic distress. As Luca Maestri, CFO of Apple, pointed out, "Today, we conduct significantly more in-house development of certain essential technologies than we did a few years back," highlighting the significance of strategic investment in technology during our financial reorganization plans.

Furthermore, constructing high-performance finance teams is vital; these groups should embody adaptability and a growth mindset to respond to new challenges, which is crucial during periods when financial reorganization plans are necessary due to economic distress. Utilizing financial management tools can also assist chief financial officers in streamlining forecasting and enhancing team performance, which is essential for the success of their financial reorganization plans.

Moreover, by implementing real-time business analytics through our client dashboard and continuously monitoring performance, CFOs can operationalize lessons learned from past experiences, ensuring that their financial reorganization plans are designed to be both reactive and proactive in fostering long-term success. Testing hypotheses throughout this process allows for informed decision-making, further solidifying the foundation for a successful turnaround.

Conclusion

Navigating the complexities of financial reorganization presents a formidable challenge, yet it paves the way for revitalization and sustainable growth for small to medium enterprises. This article outlines essential strategies that CFOs can employ, including:

- Comprehensive turnaround consulting

- Effective creditor management

- Utilization of debtor-in-possession financing

Each of these elements plays a crucial role in transforming financial distress into opportunity.

The importance of proactive engagement with stakeholders, particularly creditors, cannot be overstated. Transparent communication fosters trust and facilitates smoother negotiations, which are vital for successful reorganization outcomes. Moreover, leveraging real-time analytics and robust valuation methods empowers CFOs to make informed decisions that enhance operational efficiency and strengthen the overall financial health of their organizations.

Ultimately, the journey through financial reorganization requires a meticulous approach that balances immediate action with long-term strategic planning. By embracing these multifaceted strategies and learning from real-world case studies, CFOs can not only navigate the turbulent waters of financial distress but also reposition their companies for future success. The insights shared in this guide serve as a valuable roadmap for those committed to achieving resilience and adaptability in an ever-evolving economic landscape.

Frequently Asked Questions

What is the purpose of comprehensive turnaround and restructuring consulting?

The purpose is to evaluate a business's financial health and operational efficiency, implement financial reorganization plans, and strategically position the business for sustainable success.

How can CFOs benefit from expert insights in turnaround consulting?

CFOs can identify critical enhancement areas, streamline operations, and implement strategies that significantly elevate profitability, addressing financial challenges effectively.

What services are included in comprehensive consulting for small to medium enterprises?

The services include interim management, bankruptcy case management, and financial assessments tailored to the unique challenges faced by these businesses.

What does the turnaround cycle emphasize in consulting?

It emphasizes the importance of timely actions and tailored approaches that can lead to remarkable improvements in financial performance.

How can CFOs avoid data vacuums during the decision-making process?

CFOs must actively manage information flow to ensure that decision-making is based on accurate and comprehensive data.

What should CFOs do to refine their financial reorganization plans?

CFOs should assess their current financial health, identify specific areas for improvement, and consider utilizing comprehensive consulting services.

What are cramdown reorganization plans?

Cramdown reorganization plans allow debtors to confirm a Chapter 11 plan despite creditor objections, provided they meet specific legal standards.

What factors contribute to the successful execution of cramdown plans?

A deep understanding of the economic landscape, effective negotiation with stakeholders, and validation of strategies through rigorous testing are crucial for success.

What recent example illustrates the potential for favorable outcomes in cramdown strategies?

The Cineworld restructuring plan, which was approved by the court despite opposition from creditors, demonstrates the importance of thorough preparation and strategic negotiation.

How can real-time analytics assist CFOs during restructuring?

Real-time analytics can enhance decision-making by enabling CFOs to continuously monitor performance and adjust strategies as necessary.

What role does the bankruptcy court play in the restructuring process?

The bankruptcy court ensures adherence to legal standards and protects creditor interests while evaluating financial reorganization plans.

Why is familiarity with the court's expectations important for financial executives?

It is crucial for presenting well-organized financial reorganization plans that effectively communicate strategies for managing debts and sustaining business activities.

What lesson can be learned from the collapse of Lehman Brothers regarding corporate governance?

The collapse underscores the necessity for sound corporate governance practices and the importance of thorough preparation in financial reorganization plans.

How does state ownership impact companies' distress-management approaches?

State ownership can complicate restructuring processes, adding another layer of complexity to managing financial distress.