Overview

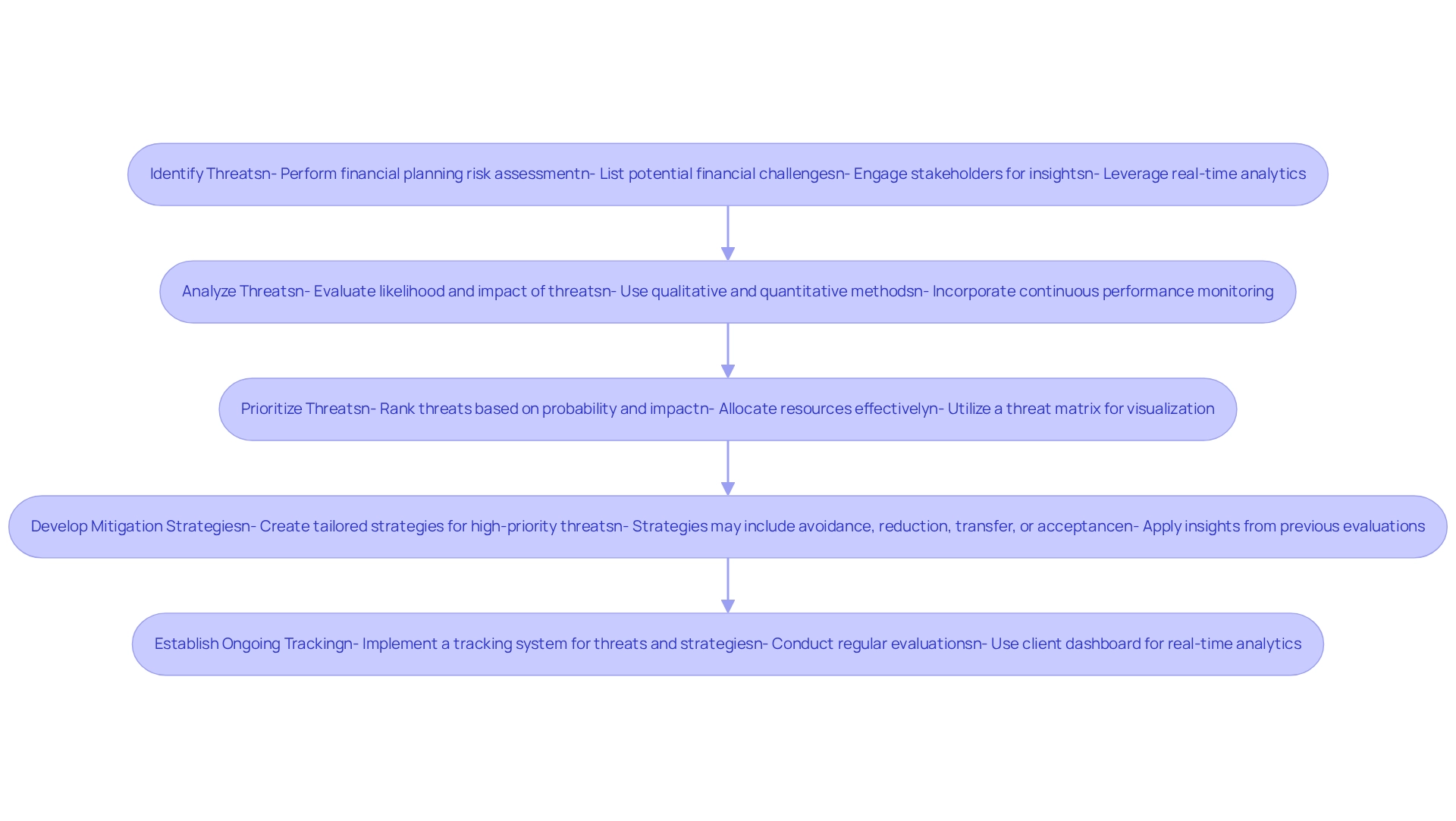

This article presents a five-step process for conducting an effective financial planning risk assessment:

- Identifying threats

- Analyzing their likelihood and impact

- Prioritizing them

- Developing mitigation strategies

- Establishing an ongoing tracking system

Such a structured approach is crucial for businesses aiming to safeguard their financial health. By enabling proactive management of potential risks and adapting to changing circumstances, this process ultimately ensures long-term sustainability and resilience.

Moreover, understanding these steps not only highlights the importance of risk assessment but also empowers businesses to take actionable measures. As you consider your financial strategies, ask yourself: Are you prepared to navigate potential threats? This comprehensive assessment framework is your pathway to securing a robust financial future.

Introduction

In an increasingly complex financial landscape, understanding and managing risk is paramount for organizations striving for sustainability and growth. A financial risk assessment serves as a crucial tool that enables businesses to identify, analyze, and prioritize potential threats to their financial health. This systematic process not only aids in developing effective mitigation strategies but also empowers organizations to make informed decisions that enhance their resilience against unforeseen challenges.

With the prevalence of market fluctuations, credit defaults, and operational failures, the significance of a thorough risk assessment cannot be overstated. As companies navigate these turbulent waters, they must adopt a proactive approach to risk management, utilizing real-time analytics and tailored strategies to safeguard their assets and ensure long-term success.

Define Financial Risk Assessment and Its Importance

An economic hazard evaluation, often referred to as a financial planning risk assessment, is a methodical procedure that recognizes, examines, and appraises potential threats that could negatively impact a company's monetary well-being. This evaluation is essential for small to medium businesses, as it aids in prioritizing threats and conducting a financial planning risk assessment to formulate effective mitigation strategies, ultimately safeguarding assets while ensuring long-term sustainability. Understanding specific economic risks—such as market variations, credit defaults, and operational failures—enables entities to make informed choices that bolster their resilience against unexpected challenges.

Significantly, 50% of organizations maintain indirect connections with at least 200 fourth parties that have faced breaches, highlighting the importance of comprehensive evaluations. Moreover, as 35% of compliance leaders express adherence and regulatory challenges as their primary concern, the significance of financial planning risk assessment becomes increasingly evident. This proactive measure not only prevents financial distress but also aids in financial planning risk assessment, making it an indispensable component of modern business management.

Furthermore, entities should engage in ongoing education to adjust their management strategies, ensuring they remain responsive to evolving threats. For instance, nearly two-thirds of entities indicate having an insufficient cybersecurity team, emphasizing the operational dangers that can arise from inadequate evaluation and management. Addressing these gaps through efficient monetary evaluation and a comprehensive financial planning risk assessment can significantly enhance an organization's capacity to navigate challenges and sustain growth, especially by leveraging real-time analytics and operational insights to guide decision-making and assess investment returns.

At Transform Your Small/Medium Business, we offer customized turnaround consulting and monetary assessment services tailored specifically for small to medium enterprises. Our goal is to assist them in saving money, streamlining operations, reducing overhead, and increasing revenues.

Outline the 5 Steps to Conduct a Financial Risk Assessment

- Identify threats by performing a financial planning risk assessment to list all potential financial challenges your business may encounter. This encompasses both internal uncertainties, such as operational inefficiencies, and external challenges, including market volatility. Engaging in brainstorming sessions with key stakeholders can yield diverse insights and contribute to a comprehensive financial planning risk assessment of potential issues. Furthermore, leveraging real-time analytics can facilitate the swift identification of emerging threats, enabling a proactive management strategy.

Analyze Threats: Perform a financial planning risk assessment to evaluate the likelihood of each identified threat and its potential impact on your organization. This financial planning risk assessment can utilize qualitative techniques, such as expert judgment, or quantitative methods, like statistical analysis, to provide a thorough understanding of the significance of each threat. Incorporating data from continuous performance monitoring can enhance the accuracy of the financial planning risk assessment, ensuring decisions are grounded in the most current information available.

Prioritize threats by conducting a financial planning risk assessment to rank the identified threats based on their probability and impact. This prioritization enables the effective allocation of resources in the financial planning risk assessment to address the most critical threats. Utilizing a threat matrix can assist in clearly visualizing this prioritization process. Streamlined decision-making processes can further expedite the financial planning risk assessment step, allowing for quicker responses to high-priority risks.

Develop Mitigation Strategies: In the context of financial planning risk assessment, create tailored strategies for each high-priority threat to mitigate its impact. These strategies may involve avoidance, reduction, transfer, or acceptance, all aligned with your business context and objectives. It is essential to apply insights gained from previous evaluations to inform the financial planning risk assessment strategies, ensuring they are rooted in practical experience.

Establish an ongoing tracking system for threats and the effectiveness of your mitigation strategies as part of your financial planning risk assessment. Regular evaluations are crucial to ensure that your financial planning risk assessment remains relevant and adaptable to changing business conditions. This proactive approach is vital, particularly as 52% of cybersecurity experts report an increase in cyberattacks, and 98.3% of organizations have a connection with a third party that has experienced a breach, emphasizing the necessity of financial planning risk assessment for effective threat management. As emphasized by the Cyentia Institute and SecurityScorecard, understanding these connections is critical for effective evaluation. By utilizing a client dashboard for real-time business analytics, you can continuously assess your business's health and adjust strategies as needed.

Identify Tools and Resources for Effective Risk Assessment

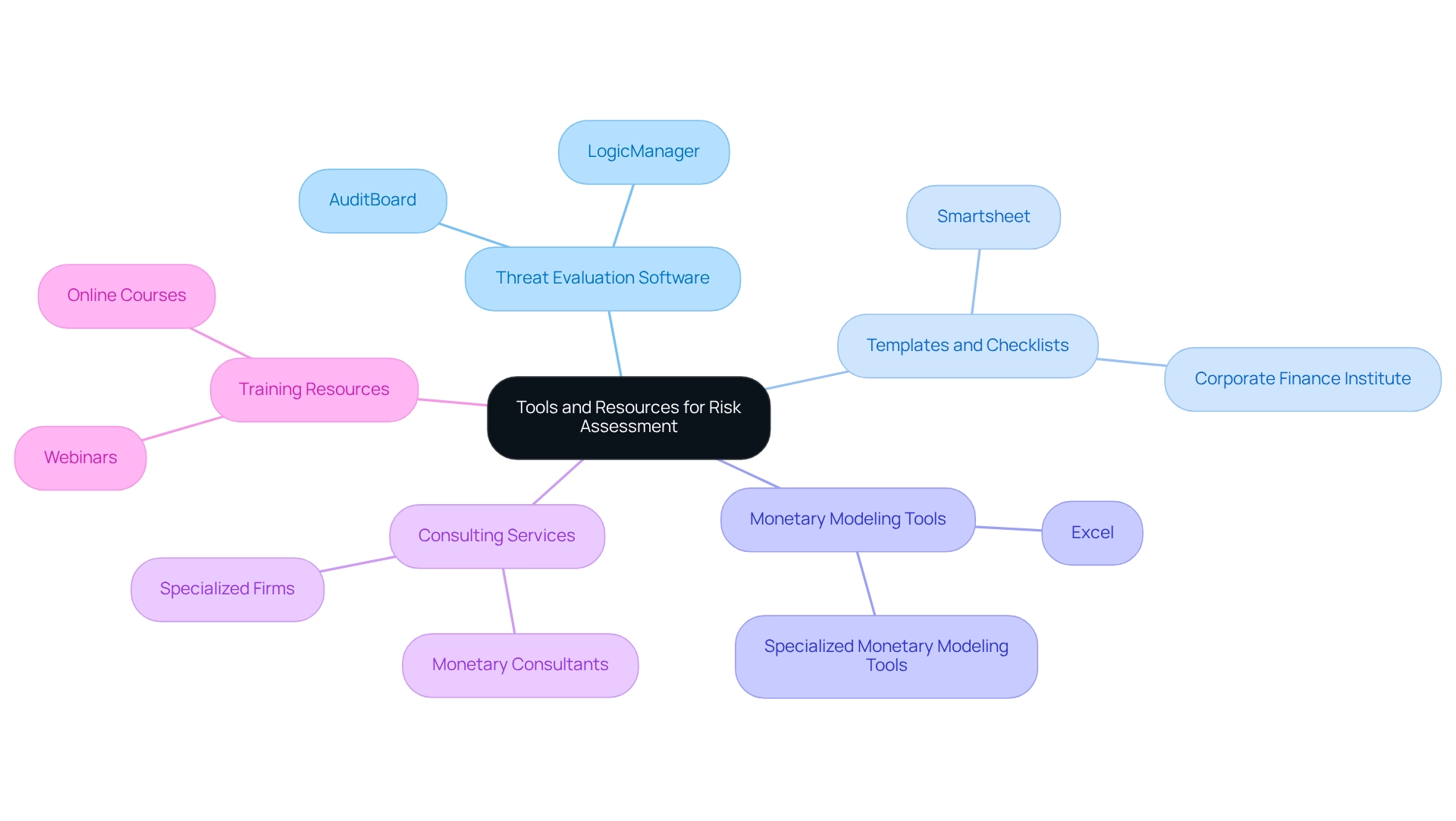

To conduct an effective monetary threat evaluation, consider utilizing the following tools and resources:

- Threat Evaluation Software: Platforms like LogicManager and AuditBoard offer robust solutions for identifying and managing monetary threats, enabling entities to streamline their threat management processes.

- Templates and Checklists: Standardize your evaluation process with templates from resources such as Smartsheet or the Corporate Finance Institute, ensuring consistency and thoroughness in evaluations.

- Monetary Modeling Tools: Employ software like Excel or specialized monetary modeling tools to simulate various threat scenarios and analyze their potential impacts on your entity’s financial health.

- Consulting Services: Collaborating with monetary consultants or firms that specialize in threat management can provide tailored insights and strategies, enhancing your evaluation efforts.

- Training Resources: Invest in online courses and webinars focused on monetary threat management to elevate your team's expertise and skills in conducting thorough evaluations.

In 2023, a significant number of entities encountered challenges due to suboptimal consumption behaviors, resulting in the download of 2.1 billion open-source software components with known vulnerabilities (Source: State of the Software Supply Chain Report, Sonatype). This underscores the importance of employing efficient instruments and resources to mitigate uncertainties and bolster economic stability. As 86% of executives highlight cybersecurity, integrating these tools into your management strategy is essential for safeguarding your organization against potential threats.

Moreover, with over half of respondents anticipating that the skills required for their positions will evolve considerably in the next five years, CFOs must adapt their strategies to remain competitive in the ever-changing landscape of economic evaluation. A practical example is ClickUp, a productivity platform that provides customizable features for managing uncertainties and project updates, streamlining team collaboration and task management, ultimately enhancing efficiency and project oversight.

In addition, treatment strategies for uncertainties—including avoidance, reduction, sharing, and retention—should be considered when implementing these tools to deliver a comprehensive approach to economic management.

Troubleshoot Common Issues in Financial Risk Assessment

Conducting a financial risk assessment often reveals several prevalent challenges that can impede effective analysis:

- Lack of Data: Insufficient data stands as a significant barrier to accurate risk evaluation. Ensuring access to comprehensive financial records and relevant market data is essential for a financial planning risk assessment to support informed decision-making. Utilizing real-time analytics, like those offered by our client dashboard, can improve data accessibility and precision, enabling more informed evaluations.

- Stakeholder Resistance: Engaging stakeholders from the outset can significantly reduce resistance. Clearly communicating the importance of the assessment and actively involving them in discussions fosters buy-in and collaboration. This cooperative method simplifies decision-making procedures, allowing for faster reactions to emerging challenges.

- Overlooking Minor Threats: In the quest to identify significant dangers, minor threats can be neglected; yet, they may accumulate and result in considerable problems over time. Consistently assessing all recognized threats upholds a comprehensive perspective of the hazard environment. Ongoing observation via established systems, such as our client dashboard, assists in recognizing these minor issues before they escalate.

- Inadequate Monitoring: Establishing a robust monitoring system is crucial for ongoing threat tracking. This proactive approach allows organizations to perform a financial planning risk assessment and adapt strategies as new risks emerge, ensuring ongoing resilience. Utilizing real-time business analytics significantly enhances this monitoring capability, providing insights that inform timely adjustments.

- Failure to Update: Risk evaluations should not be regarded as one-off tasks. Scheduling regular reviews ensures that evaluations reflect current business conditions and market dynamics, thereby maintaining their relevance and effectiveness. Implementing lessons learned from prior evaluations can further enhance this process.

In 2025, organizations encounter heightened challenges in financial evaluation, particularly with the growing dependence on third-party vendors. Effective uncertainty management processes are essential to navigate these complexities. For example, a recent survey emphasized that attracting and retaining talent continues to be a major issue for leaders, highlighting the necessity for thorough strategies that tackle both immediate and long-term challenges. Furthermore, the adoption of predictive analytics in finance has surged, with 77% of financial institutions now implementing these tools, up from 37% five years ago. This trend demonstrates the increasing need for organizations to utilize data-driven insights to improve their management capabilities. As one expert noted, "Risk management is crucial as it helps organisations understand, manage, and mitigate risks, ensuring stability and profitability." This quote reinforces the importance of addressing the challenges outlined in this assessment.

Conclusion

Understanding and managing financial risk is imperative for organizations aiming to thrive in today's volatile landscape. A comprehensive financial risk assessment not only identifies and prioritizes potential threats but also empowers businesses to develop effective mitigation strategies, ensuring they remain resilient against unforeseen challenges. By systematically identifying risks, analyzing their potential impacts, and implementing tailored strategies, organizations can significantly enhance their financial stability and long-term growth prospects.

The five-step process of conducting a financial risk assessment—identifying, analyzing, prioritizing, developing mitigation strategies, and continuous monitoring—serves as a roadmap for organizations to navigate complex financial environments. Moreover, utilizing the right tools and resources, such as risk assessment software and financial modeling tools, further strengthens these efforts, enabling businesses to make informed decisions grounded in real-time data.

As companies face common challenges in risk assessment, including data limitations and stakeholder resistance, addressing these issues through proactive engagement and regular updates is crucial. By treating risk assessments as ongoing processes rather than one-time tasks, organizations can adapt to evolving circumstances and safeguard their assets more effectively.

Ultimately, embracing a robust financial risk assessment framework is essential for organizations seeking to thrive amidst uncertainty. By prioritizing risk management, businesses not only protect their financial health but also position themselves for sustainable growth in an ever-changing marketplace. Now is the time for organizations to take action, ensuring their strategies are aligned with the complexities of the modern financial landscape.

Frequently Asked Questions

What is an economic hazard evaluation?

An economic hazard evaluation, also known as a financial planning risk assessment, is a systematic process that identifies, analyzes, and assesses potential threats that could negatively impact a company's financial health.

Why is an economic hazard evaluation important for small to medium businesses?

It helps prioritize threats, conduct financial planning risk assessments, and develop effective mitigation strategies, ultimately protecting assets and ensuring long-term sustainability.

What specific economic risks should businesses understand?

Businesses should understand risks such as market variations, credit defaults, and operational failures to make informed decisions that enhance their resilience against unexpected challenges.

How prevalent are indirect connections to security breaches among organizations?

Approximately 50% of organizations have indirect connections with at least 200 fourth parties that have experienced breaches.

What concerns do compliance leaders have regarding financial planning risk assessments?

About 35% of compliance leaders cite adherence and regulatory challenges as their primary concerns, highlighting the growing importance of financial planning risk assessments.

What role does ongoing education play in financial planning risk assessments?

Ongoing education helps organizations adjust their management strategies to remain responsive to evolving threats and challenges.

What operational dangers can arise from inadequate evaluation and management?

Nearly two-thirds of entities report having an insufficient cybersecurity team, which can lead to significant operational risks.

How can organizations enhance their capacity to navigate challenges?

By addressing gaps through effective monetary evaluation and comprehensive financial planning risk assessments, organizations can leverage real-time analytics and operational insights to guide decision-making and assess investment returns.

What services does Transform Your Small/Medium Business offer?

Transform Your Small/Medium Business provides customized turnaround consulting and monetary assessment services specifically designed for small to medium enterprises, aiming to help them save money, streamline operations, reduce overhead, and increase revenues.