Introduction

In an era where financial institutions face an onslaught of cyber threats, the importance of robust cybersecurity measures cannot be overstated. As the digital landscape evolves, so too do the tactics employed by malicious actors, making it imperative for organizations to stay vigilant.

Financial cybersecurity risk assessment companies have emerged as critical allies in this battle, providing comprehensive evaluations that identify vulnerabilities and threats. These assessments not only safeguard sensitive data but also enhance the overall resilience of institutions.

With regulatory demands tightening and the stakes higher than ever, understanding the intricacies of risk assessment frameworks, common cybersecurity risks, and compliance requirements is essential for financial leaders.

This article delves into the multifaceted approach needed to navigate today’s complex cybersecurity landscape, offering practical insights and strategies for fortifying defenses against an ever-changing threat environment.

Defining Financial Cybersecurity Risk Assessment Companies

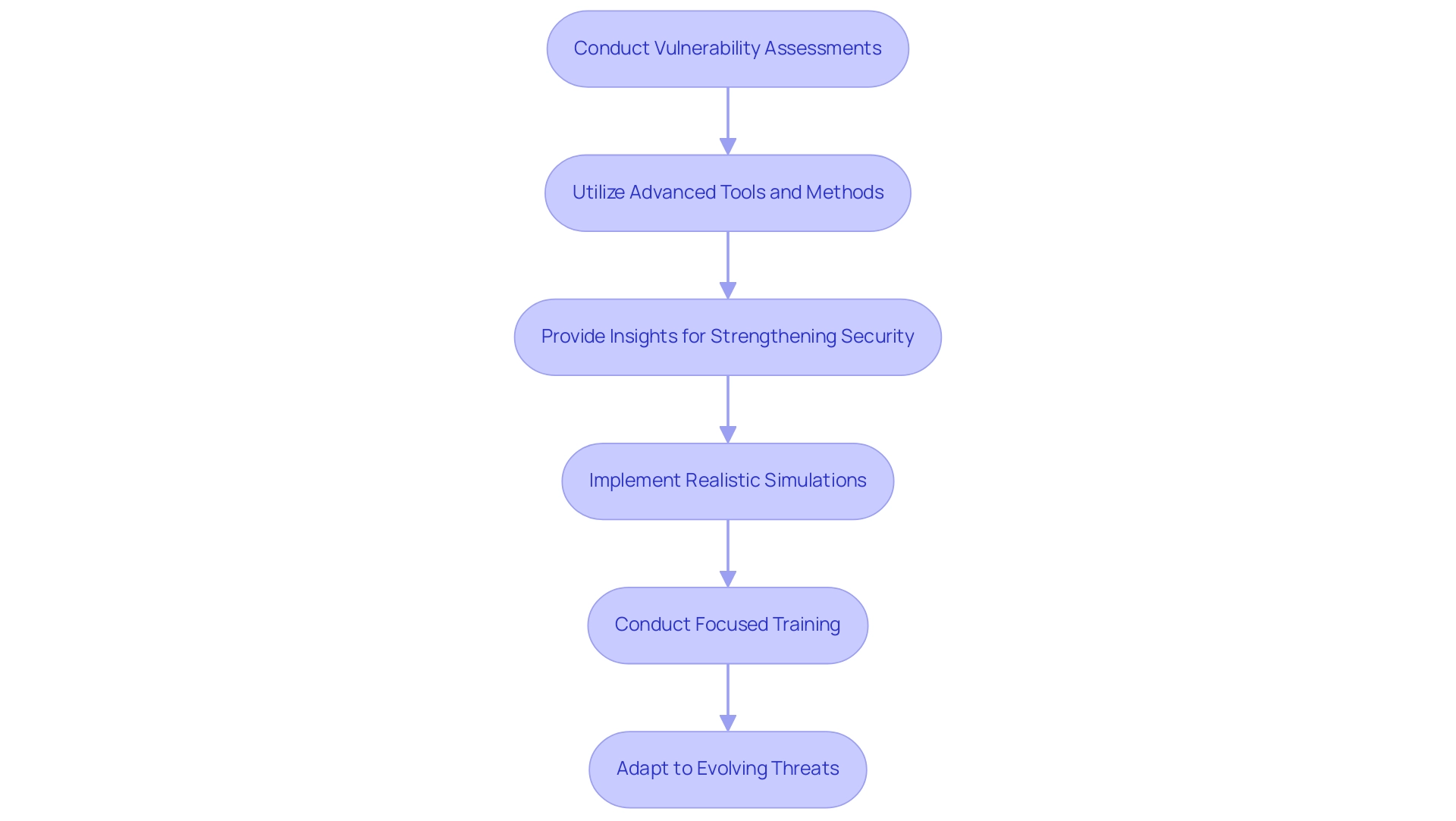

A financial cybersecurity risk assessment company plays an essential part in protecting the digital integrity of monetary organizations by evaluating threats to finance. By conducting comprehensive evaluations of vulnerabilities and threats, a financial cybersecurity risk assessment company ensures that potential hazards are identified and mitigated. Employing sophisticated tools and methods, they examine systems, processes, and controls, providing essential insights that enable organizations to strengthen their security measures.

In addition to these evaluations, realistic simulations and focused training enhance organizations' ability to defend against evolving phishing techniques, which are increasingly sophisticated. As cyber threats keep advancing, especially considering geopolitical occurrences such as the Russia-Ukraine conflict, where '51% of organizations revised their business continuity and enterprise management plans in 2023,' according to Accenture, these evaluations become increasingly vital. As a financial cybersecurity risk assessment company, they not only assist in safeguarding sensitive monetary information but also strengthen the overall cybersecurity stance of organizations, allowing them to react effectively to the evolving threat environment.

The unpredictability of data recovery after cyberattacks, as emphasized in the case study titled 'Challenges in Data Recovery Post-Ransom Payment,' highlights the importance of proactive evaluations in ensuring resilience against such challenges.

The Importance of Regular Risk Assessments in Financial Services

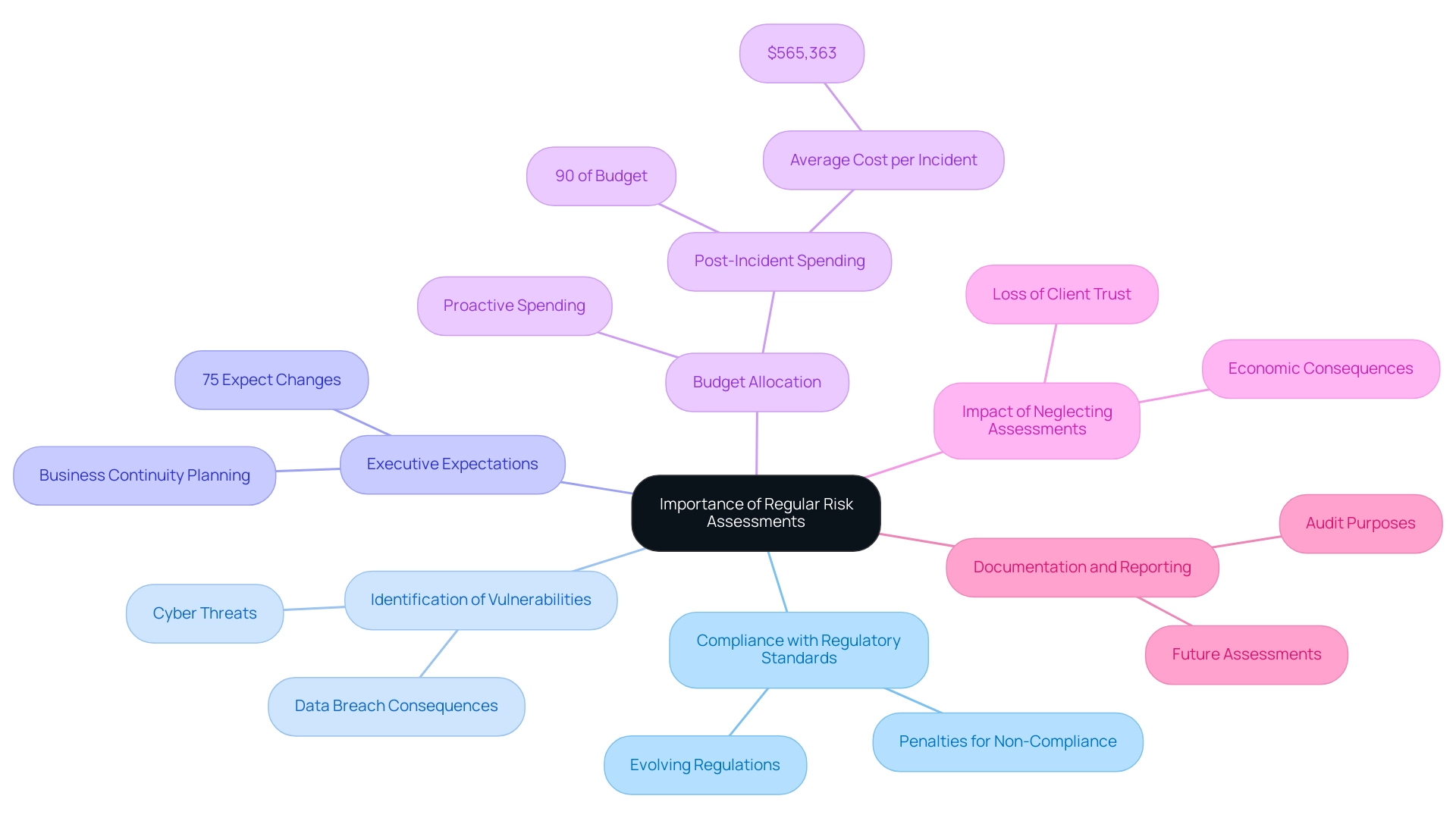

In 2024, routine evaluations are not simply optional but crucial for service providers aiming to uphold compliance with evolving regulatory standards and protect against advanced cyber threats. These assessments serve as a comprehensive framework for identifying vulnerabilities, evaluating the potential consequences of data breaches, and implementing effective controls. Significantly, 75% of executives expect considerable changes in their organizations' business continuity and crisis management strategies, indicating an increasing awareness of the necessity for strong management practices.

Moreover, monetary establishments that conduct routine evaluations through a financial cybersecurity risk assessment company can obtain a clearer grasp of their threat environment, enabling them to distribute resources wisely and emphasize their cybersecurity efforts. Alarmingly, the remaining 90% of insider risk management budgets, averaging $565,363 per incident, is often spent on post-incident activities, highlighting the economic impact of neglecting regular assessments. This proactive stance not only strengthens security measures but also fosters trust among clients and stakeholders, who increasingly expect their data to be protected.

As Monica Bolin, Manager of Enterprise Risk Management, aptly states,

The penalties for failing to comply with these laws are too steep to ignore and may jeopardize the very existence of your institution.

This emphasizes the essential nature of regular evaluations in monetary services, particularly in the face of stringent compliance requirements. Furthermore, effective documentation and reporting of the assessment process are crucial, as they provide accessible information for audit purposes and inform future evaluations.

Choosing the Right Risk Assessment Framework for Financial Institutions

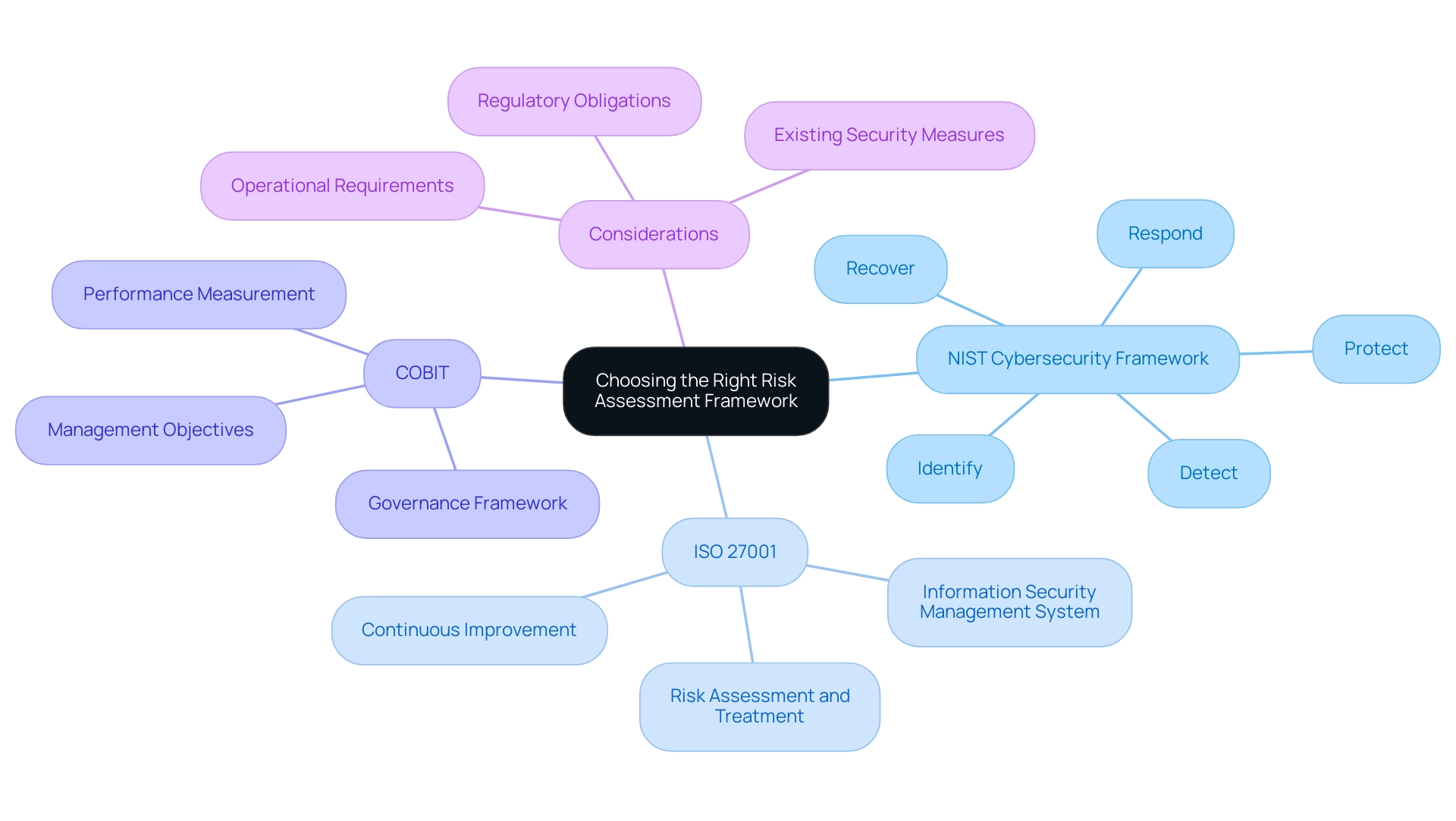

Choosing the appropriate assessment framework is crucial for a financial cybersecurity risk assessment company that aims to enhance the cybersecurity stance of financial institutions. Frameworks such as the NIST Cybersecurity Framework, ISO 27001, and COBIT offer structured methodologies for identifying, assessing, and managing uncertainties effectively. The urgency of adopting a robust evaluation framework is underscored by the statistic that the likelihood of 'change in current interest rate environment' jumped from 14th to 7th place in the 2034 outlook.

When selecting a framework, institutions must consider their unique operational requirements, regulatory obligations, and the robustness of their existing security measures. A well-suited framework enables a financial cybersecurity risk assessment company to systematically assess cybersecurity threats and develop a comprehensive mitigation strategy. Moreover, as emphasized by DTEX Systems, the leftover 90% of incident expenses, averaging $565,363 per incident, is allocated to post-incident activities, highlighting the consequences of insufficient management.

This proactive approach not only enhances resilience against potential threats but also aligns with the need for prudent planning, as underscored in recent OCC reports on firmwide resilience efforts. Establishing a system for ongoing threat monitoring and reporting is essential for continuous evaluation and adaptation of strategies. By investing in the appropriate framework, organizations can significantly enhance their capability to manage the intricate environment of security risks.

Identifying Common Cybersecurity Risks in Financial Institutions

Financial organizations are presently maneuvering through a complicated terrain of cybersecurity threats, with the following issues surfacing as the most urgent:

- Phishing attacks

- Ransomware

- Data breaches

- Insider threats

Phishing attacks, which exploit human vulnerabilities, are particularly insidious, often targeting employees to gain unauthorized access to sensitive information. The impact of these attacks is stark, as recent reports indicate that 20% of organizations experienced security breaches linked to remote workers during the pandemic, according to Malwarebytes.

Ransomware presents an additional challenge by crippling operations through the encryption of critical data, resulting in significant disruptions and economic losses. Moreover, data breaches frequently occur due to insufficient security practices or software weaknesses, leading to both monetary and reputational harm to organizations. Insider threats, whether arising from malicious intent or accidental disclosure, pose further challenges, as employees may unintentionally reveal sensitive information.

Identifying and tackling these typical risks is essential for a financial cybersecurity risk assessment company and monetary institutions. The worldwide expenditure on cybersecurity products and services is anticipated to reach $1.75 trillion from 2021 to 2025, highlighting the economic implications of investing in strong cybersecurity measures. Implementing strategies such as Third-Party Risk Management and Multi-Factor Authentication can significantly enhance security and mitigate the impact of these threats.

The case study titled 'Defending Against Financial Services Cyber Threats' highlights that common security vulnerabilities across financial entities can be mitigated through a financial cybersecurity risk assessment company to prevent recurring cyberattacks. The outcome of implementing these measures demonstrates their effectiveness in strengthening defenses against such risks.

Navigating the Regulatory Landscape of Cybersecurity in Finance

Navigating the regulatory landscape of digital security in finance requires a comprehensive understanding of critical compliance requirements, notably the Gramm-Leach-Bliley Act (GLBA) and the Payment Card Industry Data Security Standard (PCI DSS). These guidelines are essential for organizations seeking to protect consumer information and maintain trust. As Emily Bonnie, Senior Content Marketing Manager, emphasizes,

The main skill required for an ideal compliance officer is subject matter expertise

<— highlighting the importance of informed leadership in navigating these complexities.

Significantly, the Federal Financial Institutions Examination Council (FFIEC) also plays a crucial role in directing compliance initiatives, ensuring organizations adopt strong digital security practices. With phishing attacks accounting for over 80 percent of reported security incidents and resulting in losses of $17,700 every minute, compliance is not merely a legal obligation but a strategic necessity. Moreover, 57 percent of organizations encounter weekly or daily phishing attempts, highlighting the ongoing risk that monetary entities confront.

By staying alert to regulatory updates and proactively making required adjustments, organizations can strengthen their security stance while efficiently handling cybersecurity challenges. This proactive approach facilitates compliance with evolving regulations and addresses the complexities highlighted by 67% of global executives, who believe ESG regulation is overly complicated. This complexity poses significant challenges for compliance, requiring institutions to navigate a landscape that is not only legally demanding but also operationally intricate.

Moreover, as organizations adapt to remote work environments—responsible for 20 percent of security breaches during the pandemic—staying compliant becomes ever more critical for maintaining operational integrity and consumer confidence. In this context, leveraging third-party service providers for analytics and payment processing, while ensuring adherence to PCI-DSS standards, is vital for secure handling of payment information. These third-party services not only enhance operational efficiency but also adhere to strict privacy practices, safeguarding consumer data.

By understanding and implementing these practices, including how third-party payment processors comply with PCI-DSS standards, CFOs can enhance their organization's compliance framework and mitigate financial terrorism risks effectively.

Conclusion

Financial institutions today face an increasingly complex and perilous cybersecurity landscape that demands proactive and strategic action. Regular risk assessments emerge as a critical component in fortifying defenses against sophisticated threats, ensuring compliance with regulatory standards, and safeguarding sensitive data. By engaging with financial cybersecurity risk assessment companies, organizations can identify vulnerabilities, implement robust frameworks, and enhance their resilience in the face of evolving cyber threats.

The emphasis on selecting the right risk assessment framework cannot be overstated. Frameworks such as NIST, ISO 27001, and COBIT enable financial institutions to systematically evaluate risks and develop comprehensive mitigation strategies tailored to their specific operational needs. Moreover, recognizing and addressing common cybersecurity risks—ranging from phishing attacks to insider threats—is crucial for maintaining operational integrity and protecting client trust.

As institutions navigate the regulatory landscape, a thorough understanding of compliance requirements, such as GLBA and PCI DSS, is essential. This knowledge not only facilitates adherence to legal obligations but also empowers organizations to cultivate a security-first culture that prioritizes data protection. By leveraging third-party services for analytics and payment processing, financial leaders can further enhance their compliance frameworks while mitigating risks associated with financial terrorism.

In conclusion, the landscape of financial cybersecurity is fraught with challenges, but taking decisive action through regular risk assessments and strategic planning will significantly bolster an institution's defenses. The time for financial leaders to act is now—investing in robust cybersecurity measures is not just a necessity but a strategic imperative for safeguarding the future of their organizations.

Frequently Asked Questions

What is the role of a financial cybersecurity risk assessment company?

A financial cybersecurity risk assessment company evaluates threats to financial organizations, identifies vulnerabilities, and mitigates potential hazards to protect digital integrity.

How do these companies enhance organizations' security measures?

They employ sophisticated tools and methods to examine systems, processes, and controls, providing insights that help organizations strengthen their security.

What additional services do financial cybersecurity risk assessment companies provide?

They conduct realistic simulations and focused training to improve organizations' defenses against evolving phishing techniques.

Why are these evaluations becoming increasingly vital?

As cyber threats advance, particularly due to geopolitical events like the Russia-Ukraine conflict, organizations need to adapt their business continuity and management plans to respond effectively.

What are the consequences of not conducting routine evaluations?

Neglecting regular assessments can lead to significant economic impacts, as organizations may spend a substantial portion of their budgets on post-incident activities rather than proactive measures.

How do routine evaluations help organizations understand their threat environment?

They provide a clearer grasp of potential vulnerabilities, enabling organizations to allocate resources wisely and focus their cybersecurity efforts.

What is the impact of regulatory compliance on financial services?

Routine evaluations are crucial for compliance with evolving regulatory standards, and failing to comply can result in steep penalties that jeopardize the institution's existence.

Why is effective documentation and reporting of the assessment process important?

It provides accessible information for audit purposes and informs future evaluations, ensuring organizations maintain strong cybersecurity practices.