Overview

This article delineates five essential steps for effective financial restructuring guidance:

- Conducting a comprehensive financial assessment

- Developing a tailored restructuring plan

- Implementing the plan with precision

- Evaluating and adjusting the strategy

These steps are vital for organizations grappling with financial difficulties, as they provide a structured approach aimed at improving financial health, operational efficiency, and long-term stability. By leveraging informed decision-making and fostering stakeholder engagement, organizations can navigate their challenges more effectively.

Introduction

In the intricate landscape of modern business, financial restructuring stands out as an essential strategy for companies confronting economic turmoil. This strategic process not only reorganizes a company's financial obligations but also establishes the foundation for renewed stability and growth. As organizations contend with the pressures of insolvency and cash flow challenges, grasping the nuances of financial restructuring becomes imperative.

By utilizing real-time analytics and engaging stakeholders, businesses can navigate their financial hurdles with greater efficacy. This article explores:

- The significance of financial restructuring

- The steps necessary for conducting a comprehensive financial assessment

- The development of tailored plans that guarantee successful implementation and ongoing evaluation

As the economic environment continues to evolve, acknowledging the importance of these strategies can empower businesses to flourish amidst uncertainty.

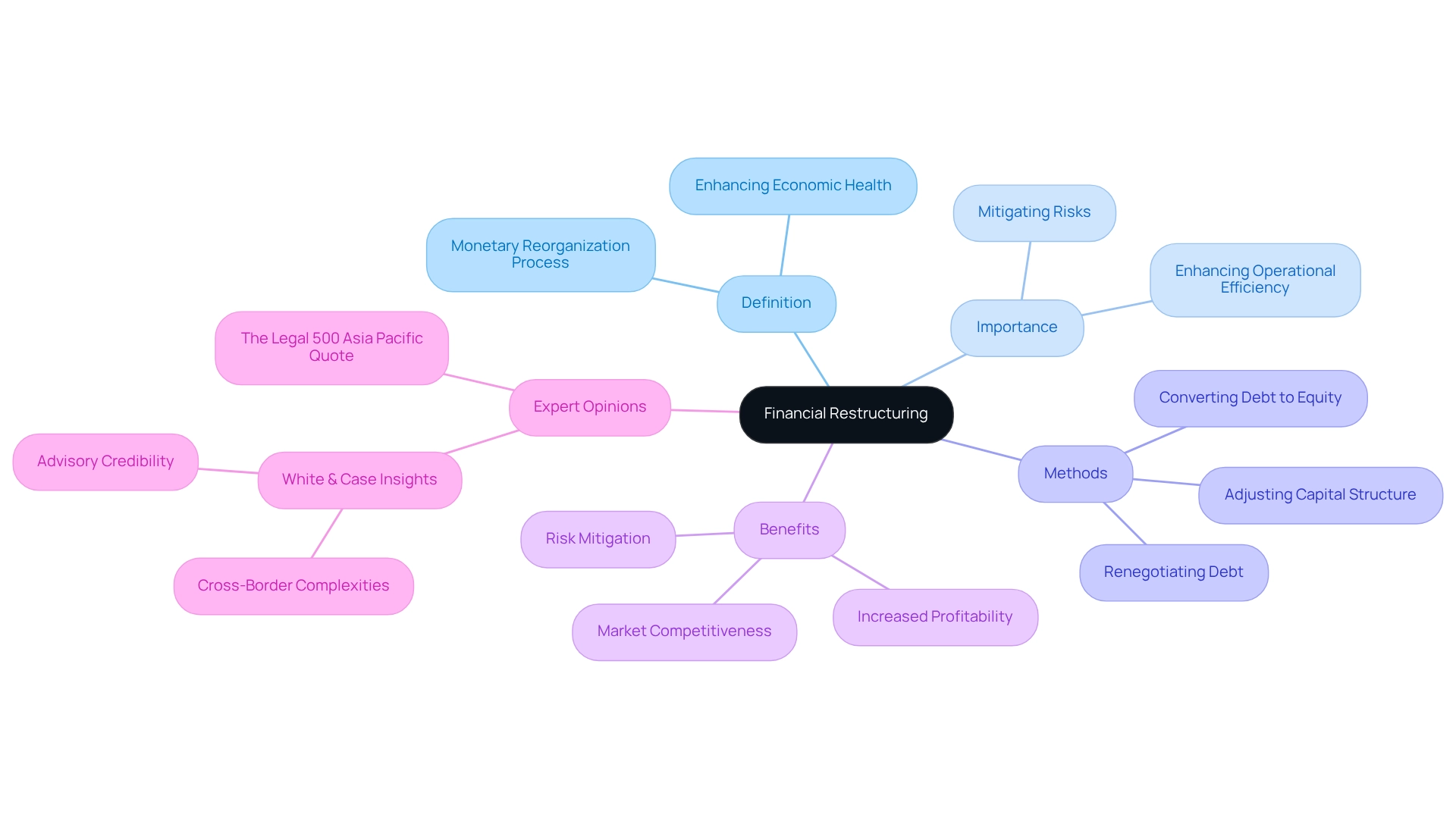

Define Financial Restructuring and Its Importance

Monetary reorganization stands as a strategic process that rearranges a company's monetary commitments and framework to enhance its overall economic health. This essential practice may involve renegotiating debt terms, adjusting the capital structure, or converting debt into equity. The significance of financial restructuring guidance cannot be overstated; it serves as a vital lifeline for firms grappling with insolvency or severe cash flow difficulties. By skillfully managing liabilities and maximizing resources, organizations can regain stability and prepare for sustainable growth.

In 2025, the importance of fiscal reorganization is underscored by its ability to mitigate risks and enhance operational efficiency. Streamlined decision-making processes, coupled with real-time analytics, play a pivotal role in this context, enabling businesses to continuously monitor their performance and make informed decisions swiftly. Statistics indicate that companies engaged in successful economic reorganization can significantly boost their likelihood of long-term success. Furthermore, case studies reveal that small to medium enterprises that undergo monetary reorganization often experience a notable enhancement in profitability and market competitiveness. According to a case study titled "Types of Restructuring," understanding the three primary types of restructuring—financial, organizational, and portfolio—equips companies to select the appropriate method to address their unique circumstances and objectives effectively.

Expert opinions highlight that financial restructuring guidance not only addresses immediate financial distress but also fosters a culture of resilience and adaptability within organizations. By implementing insights gained during the turnaround phase, companies can forge robust, enduring connections with stakeholders. As noted by The Legal 500 Asia Pacific, "The sizeable six-partner practice at White & Case counsels creditors on the complete range of reorganization and insolvency issues, many of which involve cross-border complexities." By comprehending the intricacies of this process, stakeholders can make informed choices that lay the groundwork for successful reorganization strategies, ultimately leading to improved business performance and stability. Moreover, the acknowledgment of White & Case achieving several Band 1 rankings in Chambers France 2025 further underscores the credibility of advisory services in restructuring.

Conduct a Comprehensive Financial Assessment

To conduct a comprehensive monetary assessment, follow these essential steps:

- Gather Fiscal Statements: Collect the last three years of fiscal statements, including balance sheets, income statements, and cash flow statements. As Tim Stobierski observes, the annual report is a document that outlines the company’s operations and economic conditions, making this essential data vital for comprehending historical performance.

Analyze Key Metrics: Evaluate critical economic ratios such as liquidity, profitability, and leverage ratios. These metrics provide insights into the company's financial health and operational efficiency, guiding strategic decisions. By testing these hypotheses, businesses can identify areas for improvement and ensure that their strategies are data-driven. - Identify Cash Flow Issues: Scrutinize cash flow statements to identify periods of negative cash flow. Understanding the underlying causes of these fluctuations is vital for developing effective solutions. Continuous monitoring of cash flow can facilitate quick decision-making and operational adjustments.

- Review Operational Efficiency: Assess operational costs to pinpoint areas where expenses can be trimmed without compromising quality or service. Notably, many finance teams still rely on spreadsheets and manual processes, highlighting a gap in technology adoption. This step is essential for enhancing profitability and sustainability, especially as 81% of CFOs anticipate increased technology investments in 2024. Implementing real-time analytics can further streamline decision-making and improve operational efficiency.

- Engage Stakeholders: Involve key stakeholders, including CFOs and department heads, to gather insights on monetary challenges and operational bottlenecks. Collaborative input can lead to more comprehensive solutions and foster a culture of transparency. By implementing lessons learned from these discussions, companies can foster stronger connections and consistently enhance their performance. Additionally, financial restructuring guidance through these steps allows companies to achieve a clear comprehension of their economic situation, enabling informed choices that are essential for successful reorganization. The statistic that 70% of CFOs report their finance transformation efforts have been slower than expected underscores the importance of thorough assessments in driving timely and effective change.

Develop a Tailored Restructuring Plan

Creating a customized reorganization strategy with financial restructuring guidance is crucial for effectively managing financial difficulties. Here are the key steps to ensure a successful process:

- Set Clear Objectives: Establish specific, measurable goals for the restructuring, such as aiming for an average debt reduction of 20% or enhancing cash flow within six months. Clear objectives provide a benchmark for success and guide decision-making.

- Identify Key Strategies: Determine the strategies necessary to meet these objectives. This may involve applying cost-reduction strategies, selling non-essential assets, or renegotiating debt conditions to ease monetary pressure. Moreover, mastering the cash conversion cycle through targeted strategies, including the 20 strategies for optimal business performance, can significantly enhance cash flow and profitability.

- Allocate Resources: Evaluate the resources needed for successful implementation. This includes financial capital, skilled personnel, and technology solutions that can streamline operations and reduce overhead. Utilizing real-time analytics can help in monitoring resource allocation and improving operational efficiency.

- Create a Timeline: Develop a realistic schedule for each phase of the reorganization. Setting milestones allows for tracking progress and making necessary adjustments along the way, ensuring that the plan remains on course. A shortened decision-making cycle can enable faster adjustments to the reorganization plan as required.

- Communicate the Plan: Formulate a robust communication strategy to keep all stakeholders informed about the reorganization plan, its objectives, and their roles. Effective communication fosters transparency and collaboration, which are vital for successful execution. Implementing insights gained from past strategies can improve stakeholder involvement and dedication.

This organized method not only connects the reorganization plan with the company's overall objectives but also increases the chances of attaining sustainable growth during ongoing economic difficulties. As bankruptcy submissions continue to rise, with predictions of this upward trend lasting into 2026 and beyond, a well-designed recovery plan becomes essential for small to medium-sized enterprises striving to succeed in a competitive environment. Furthermore, while bankruptcy filings have increased, they remain lower than levels seen before the pandemic, suggesting an ongoing economic recovery with persistent financial challenges. This context emphasizes the necessity of financial restructuring guidance in creating a customized reorganization plan.

Implement the Restructuring Plan with Precision

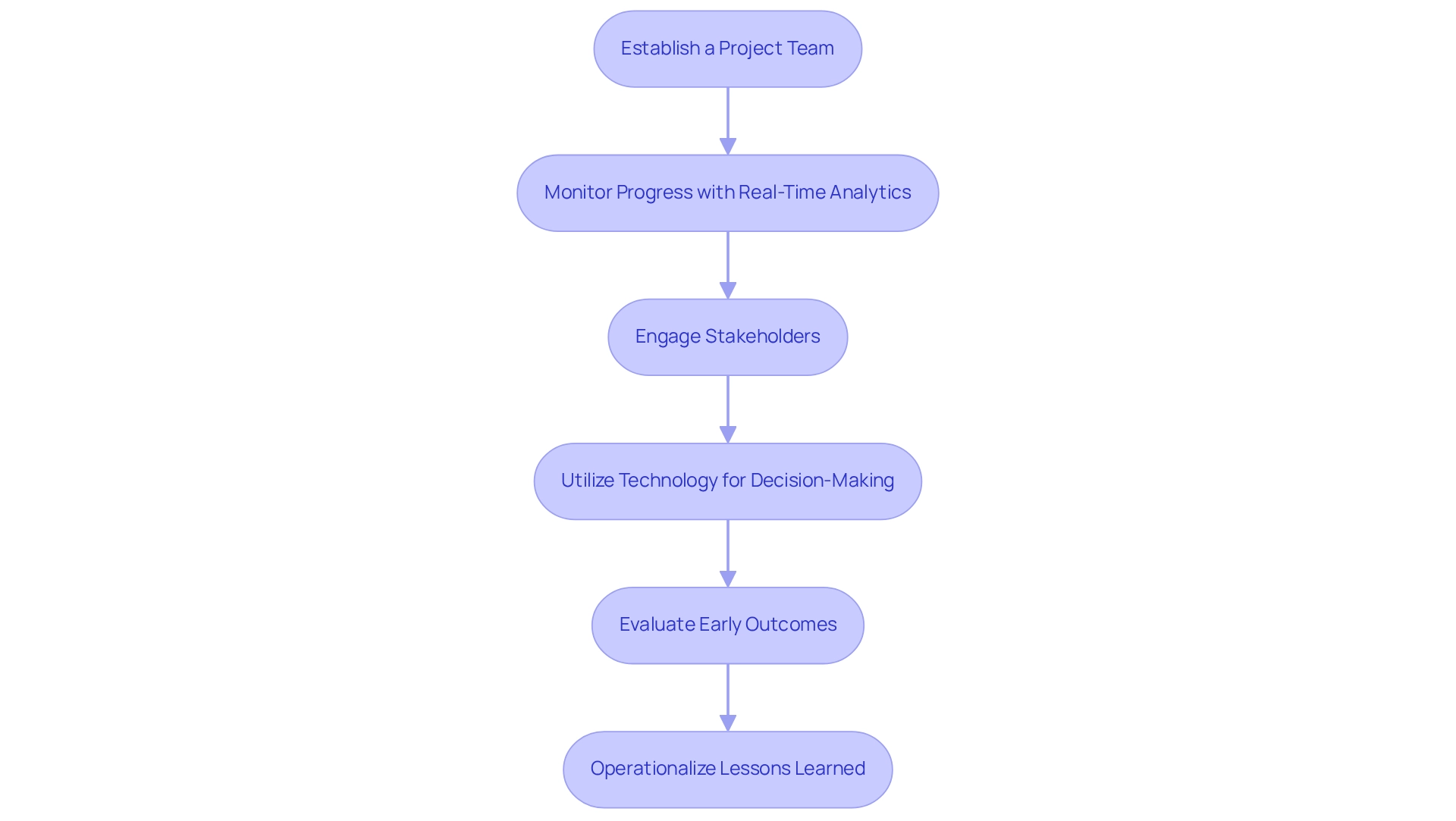

To implement the restructuring plan effectively, consider the following steps:

- Establish a Project Team: Form a dedicated group responsible for managing the execution of the reorganization plan. This team should include members with diverse skills and expertise to ensure accountability and focus. Organizations with well-defined project teams are 2.5 times more likely to succeed in their initiatives.

- Monitor Progress with Real-Time Analytics: Regularly track the progress of the implementation against the established timeline and objectives using real-time business analytics. This approach allows for continuous monitoring of performance and quick adjustments as needed. Statistics indicate that 41% of organizations struggle to demonstrate the added value of their project management office (PMO), underscoring the need for robust monitoring practices to ensure transparency and accountability.

- Engage Stakeholders: Maintain open lines of communication with all stakeholders. Offering regular updates and addressing concerns fosters backing for the restructuring initiatives, which is vital for sustaining momentum and alignment during the endeavor.

- Utilize Technology for Streamlined Decision-Making: Leverage technology tools to optimize workflows, enhance communication, and improve data management. High-performance organizations frequently employ structured methods to enhance project management skills, with 77% of these organizations having implemented these methods. As noted by ProofHub, "Plan, manage, collaborate and deliver projects seamlessly with ProofHub – All-in-one solution for projects, tasks, and teams."

- Evaluate Early Outcomes and Operationalize Lessons Learned: Assess the initial results of the organizational changes to identify successes and areas for improvement. This evaluation allows for timely adjustments to the plan, ensuring that the organization remains agile and responsive to changing circumstances. Additionally, operationalizing the lessons learned from these evaluations can strengthen future decision-making processes. It's important to note that a significant portion of project managers, 51%, do not hold any certifications, while 31% have a PMP or other PMI certification. This indicates a potential area for growth in professional development and certification within the project management community.

By following these steps, businesses can implement their reorganization plans with precision, maximizing the chances of achieving operational efficiency and benefiting from financial restructuring guidance for sustainable growth.

Evaluate and Adjust the Restructuring Strategy

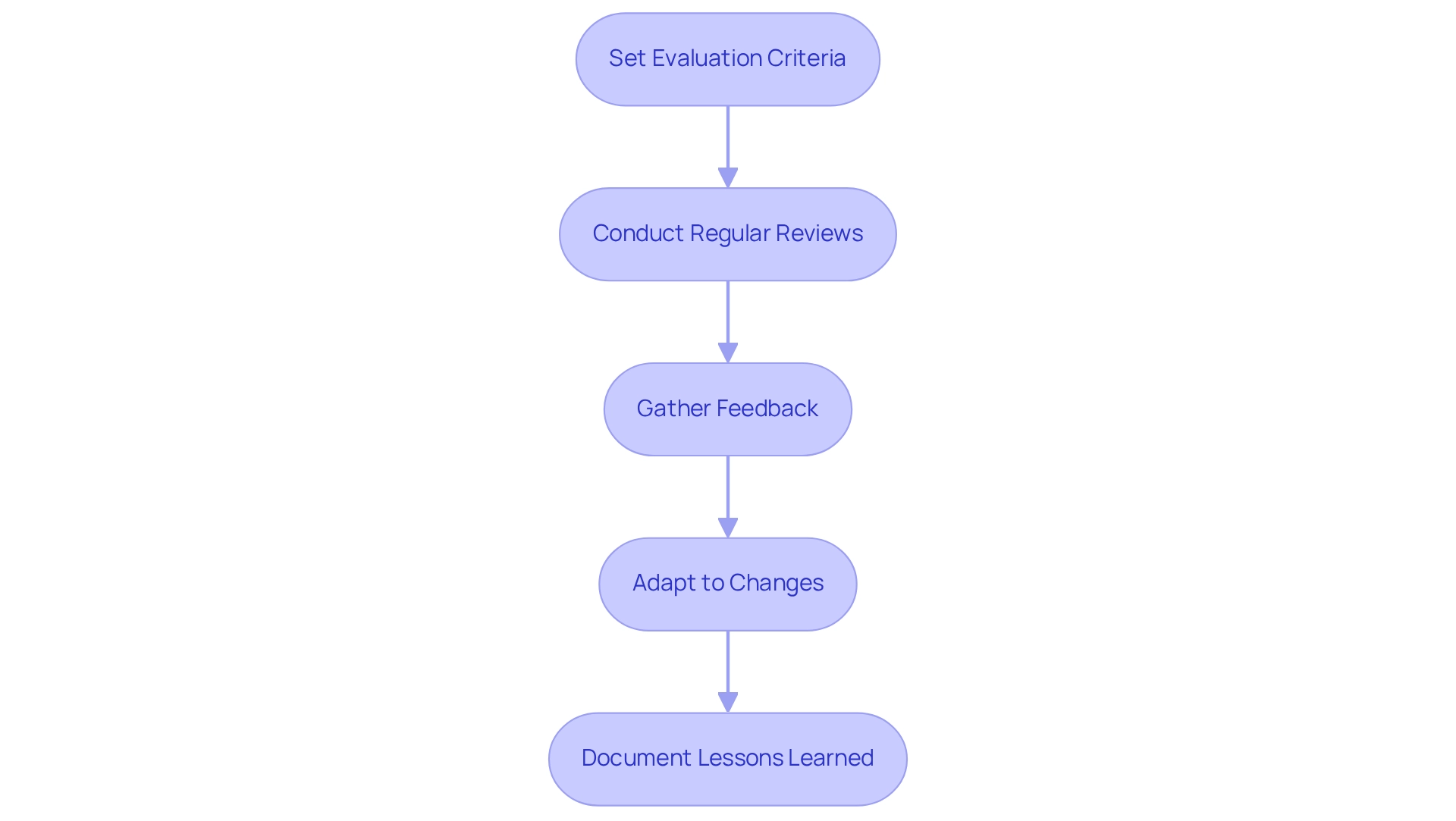

To effectively evaluate and adjust the restructuring strategy, consider the following steps:

- Set Evaluation Criteria: Establish clear criteria for assessing the success of organizational changes, focusing on financial performance metrics and operational efficiency indicators. This foundational step ensures that all stakeholders have a common understanding of what success looks like.

- Conduct Regular Reviews: Implement a schedule for frequent evaluations of the reorganization strategy. These assessments are crucial for determining effectiveness and identifying necessary adjustments, allowing organizations to remain agile in a dynamic market environment. Statistics indicate that organizations that frequently evaluate their reorganization strategies can improve efficiency and profitability over time. Moreover, employing real-time business analytics can greatly assist in this endeavor, offering prompt insights into performance metrics.

- Gather Feedback: Actively seek input from stakeholders engaged in the reorganization process. This input provides valuable insights into both challenges faced and successes achieved, fostering a culture of continuous improvement. By operationalizing the lessons learned from these experiences, organizations can refine their strategies and enhance overall effectiveness.

- Adapt to Changes: Stay prepared to modify the organizational strategy in response to evolving market conditions, financial performance, or operational challenges. Flexibility is key to maintaining relevance and effectiveness in a rapidly changing business landscape. As emphasized in the case study 'Continuous Improvement in Restructuring,' organizations that adopt continuous improvement can reach their transformation objectives and boost efficiency and profitability over time.

- Document Lessons Learned: Keep a detailed account of lessons learned during the reorganization. This documentation not only informs future strategies but also enhances overall organizational resilience, ensuring that past experiences contribute to ongoing success. The commitment to operationalizing these lessons is vital for fostering strong, lasting relationships within the organization.

In the words of Brian Roberts, CFO of Lyft, "From a finance hiring perspective, you need to hire the best athletes who want to be part of a high-performance team." This highlights the significance of forming a capable team during organizational changes.

By implementing a robust evaluation process and developing a comprehensive restructuring plan, businesses can ensure their restructuring strategies remain effective and aligned with their goals, ultimately driving sustainable growth.

Conclusion

Financial restructuring stands as a pivotal strategy for organizations grappling with economic challenges, allowing them to reorganize their financial obligations and lay the groundwork for stability and growth. This article has underscored the importance of grasping the nuances of financial restructuring, illustrating how it not only alleviates immediate financial distress but also fosters resilience and adaptability within businesses.

Through a thorough financial assessment, organizations can pinpoint cash flow issues and operational inefficiencies that shape their customized restructuring plans, ultimately aligning their strategies with broader business objectives.

The formulation and execution of a well-structured restructuring plan are essential for effectively navigating financial obstacles. Establishing clear objectives, engaging stakeholders, and leveraging technology for real-time monitoring are critical steps in this process. Furthermore, the necessity of continuous evaluation and adjustment of the restructuring strategy is paramount. Regular reviews and the integration of stakeholder feedback ensure that organizations remain agile and responsive to evolving market conditions, thereby enhancing operational efficiency and profitability.

As the economic landscape continues to shift, the capacity to adapt through financial restructuring becomes increasingly crucial. By operationalizing lessons learned and nurturing strong relationships with stakeholders, businesses can not only survive but also thrive in a competitive arena. Embracing these strategies empowers organizations to transform challenges into opportunities, ultimately paving the way for sustainable growth and long-term success.

Frequently Asked Questions

What is monetary reorganization?

Monetary reorganization is a strategic process that rearranges a company's financial commitments and structure to improve its overall economic health. This may involve renegotiating debt terms, adjusting the capital structure, or converting debt into equity.

Why is financial restructuring guidance important?

Financial restructuring guidance is crucial for companies facing insolvency or significant cash flow challenges. It helps manage liabilities and maximize resources, enabling organizations to regain stability and prepare for sustainable growth.

How does fiscal reorganization benefit companies in 2025?

In 2025, fiscal reorganization is important for mitigating risks and enhancing operational efficiency. It allows for streamlined decision-making processes and real-time analytics, which help businesses monitor performance and make informed decisions quickly.

What types of restructuring are there?

There are three primary types of restructuring: financial, organizational, and portfolio restructuring. Understanding these types helps companies choose the appropriate method to address their specific circumstances and objectives.

What role do expert opinions play in financial restructuring?

Expert opinions highlight that financial restructuring guidance not only addresses immediate financial distress but also promotes a culture of resilience and adaptability within organizations, helping them build strong connections with stakeholders.

What are the essential steps for conducting a comprehensive monetary assessment?

The essential steps include gathering fiscal statements, analyzing key metrics, identifying cash flow issues, reviewing operational efficiency, and engaging stakeholders to gather insights on financial challenges.

How can companies identify cash flow issues?

Companies can identify cash flow issues by scrutinizing cash flow statements to find periods of negative cash flow and understanding the underlying causes, which is crucial for developing effective solutions.

What is the significance of engaging stakeholders in the financial assessment process?

Engaging stakeholders, such as CFOs and department heads, helps gather insights on monetary challenges and operational bottlenecks, leading to more comprehensive solutions and fostering a culture of transparency.

What statistic highlights the challenges CFOs face in finance transformation?

A statistic indicates that 70% of CFOs report their finance transformation efforts have been slower than expected, underscoring the importance of thorough assessments in driving timely and effective change.