Overview

The article presents five essential steps for optimizing insolvency outcomes, with a clear focus on maximizing creditor returns while ensuring the entity's viability. It emphasizes the importance of:

- Stakeholder engagement

- Understanding legal frameworks

- Utilizing real-time analytics

- Implementing operational efficiencies

These strategies illustrate how they contribute to improved financial recovery during insolvency processes. By adopting these methods, stakeholders can enhance their approach to insolvency and achieve better outcomes.

Introduction

In the intricate landscape of insolvency, businesses confront the formidable challenge of not merely surviving but thriving amidst financial turmoil. The concept of insolvency outcome optimization emerges as a beacon of hope, underscoring strategies that maximize recovery for creditors while preserving the viability of the business.

This multifaceted approach encompasses:

- A thorough understanding of legal frameworks

- Engagement with stakeholders

- The leveraging of real-time analytics to navigate the complexities of insolvency proceedings

As organizations grapple with historical trends and the evolving economic climate, mastering the art of optimizing insolvency outcomes becomes imperative for those seeking to transform challenges into opportunities for future growth.

Understand Insolvency Outcome Optimization

Insolvency outcome optimization is a strategic approach designed to improve the results of insolvency processes, concentrating on maximizing creditor returns while maintaining the entity's viability. This process necessitates a comprehensive understanding of legal frameworks, stakeholder interests, and the operational realities that shape outcomes. The key elements of this strategy include:

- Preserving Going Concern Value: The primary objective is to maintain operations, thereby maximizing asset value and recovery potential. This approach not only benefits creditors but also positions the organization for future growth.

- Stakeholder Engagement: Early involvement of creditors, employees, and other stakeholders is essential. Engaging these parties can lead to more favorable outcomes, fostering collaboration and transparency throughout the process. Our commitment to implementing insights gained from past turnarounds enhances this collaboration, ensuring that all stakeholders are aligned in pursuing shared objectives.

- Legal Frameworks: A thorough understanding of local bankruptcy regulations and practices is vital for effectively navigating the intricacies of the process. This knowledge empowers companies to leverage legal provisions that can bolster recovery efforts.

- Real-Time Analytics: Utilizing real-time analytics through our client dashboard allows for continuous monitoring of performance and health, enabling timely adjustments to strategies as necessary. This data-driven approach facilitates rapid decision-making, which is critical during pivotal stages of financial distress. By mastering these components, companies can strategically prepare for the next steps in their insolvency outcome optimization for enhancing financial recovery outcomes.

Recent trends indicate a shift towards more proactive stakeholder engagement, positively influencing financial outcomes. For instance, in 2024, the overall count of corporate failures in the UK reached 23,872, reflecting a 5% decrease from the previous year's total of 25,100, suggesting that enhanced strategies are yielding better results. Additionally, the manufacturing sector alone faced 1,917 business failures, underscoring specific challenges within this industry. Case studies, such as the Restructuring Webcast Series, provide valuable insights and methodologies that companies can adopt to effectively navigate challenging economic circumstances. Sarah O'Toole, a partner in Restructuring and Insolvency, underscores the importance of understanding these strategies for maximizing recovery during financial distress proceedings. Furthermore, the historical trend of company insolvencies tracked since January 2000 illustrates the evolving landscape of insolvency outcomes, offering context for current trends.

Conduct a Comprehensive Financial Assessment

To conduct a comprehensive financial assessment, follow these essential steps:

- Gather Financial Statements: Compile the last three years of financial statements, including balance sheets, income statements, and cash flow statements. This historical data is crucial for understanding the company's financial trajectory.

- Analyze Key Ratios: Calculate critical financial ratios such as liquidity ratios (e.g., current ratio), profitability ratios (e.g., net profit margin), and leverage ratios (e.g., debt-to-equity). These ratios provide insights into the company's financial health and operational efficiency. Significantly, a recent study carried out for The Zebra uncovered that companies that frequently assess these ratios are better equipped to handle financial difficulties.

- Identify Trends: Examine trends in revenue, expenses, and cash flow over the assessment period. Recognizing patterns can help pinpoint areas of concern and opportunities for improvement. The Financial Times reports a 50% increase in the use of Monte Carlo simulations in financial modeling since 2021, which can enhance the reliability of projections by allowing companies to better account for market uncertainties.

- Evaluate Cash Flow: Conduct a thorough cash flow analysis to understand the timing of cash inflows and outflows. This step is essential for identifying potential shortfalls that could affect the organization's ability to meet its obligations. Mastering the cash conversion cycle through effective strategies can significantly enhance cash flow and profitability, ensuring that companies can sustain operations even during challenging times.

- Assess Liabilities: Review all outstanding debts and obligations to gain a comprehensive understanding of total liabilities. This evaluation is essential for assessing the effect of these liabilities on the company's financial stability. As emphasized by R3, there were 4,896 underlying corporate insolvencies reported in the first quarter of 2022, highlighting the necessity of performing a thorough financial evaluation in the current economic environment.

By adhering to these steps, organizations can obtain a clear understanding of their financial status, allowing for informed decision-making that is crucial for insolvency outcome optimization and enhancing recovery results. Our team will identify underlying organizational issues and work collaboratively to create a plan that mitigates weaknesses, allowing the organization to reinvest in key strengths. The significance of a thorough financial evaluation cannot be emphasized enough, particularly in 2025, as companies encounter growing complexities in their financial environments. Our organization is dedicated to offering effective solutions for enterprises in crisis, ensuring they possess the tools necessary for successful recovery.

Implement Operational Efficiency Strategies

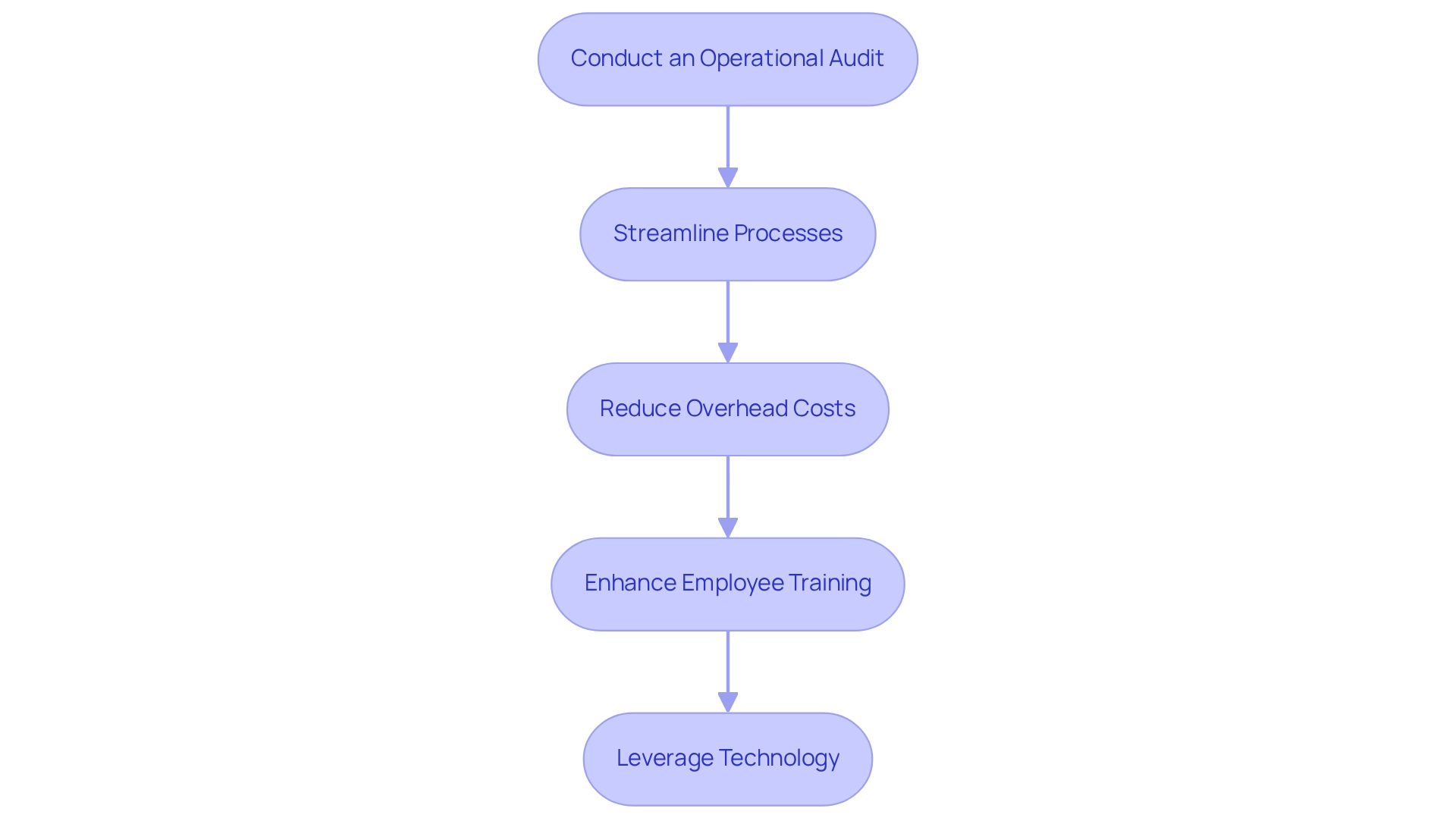

To effectively execute operational efficiency plans, companies should follow these essential steps:

- Conduct an Operational Audit: Begin by thoroughly reviewing current processes to pinpoint inefficiencies and bottlenecks. This audit serves as a foundation for identifying areas needing improvement and allows for the testing of various hypotheses to ensure maximum return on invested capital.

- Streamline Processes: Focus on eliminating unnecessary steps in workflows to boost productivity. For instance, automating repetitive tasks can significantly enhance operational speed and accuracy, facilitating quicker decision-making throughout the turnaround process.

- Reduce Overhead Costs: Conduct a detailed analysis of both fixed and variable costs to uncover potential savings. Strategies may include renegotiating supplier contracts or implementing energy-saving measures, which can lead to substantial cost reductions and improve the cash conversion cycle.

- Enhance Employee Training: Invest in comprehensive training programs that equip employees with the skills needed to operate more efficiently. Empowered employees are crucial for driving operational improvements and can help operationalize the lessons learned during the turnaround process.

- Leverage Technology: Adopt technology solutions, such as a client dashboard, that facilitate better communication, project management, and data analysis. These tools can enhance operations and offer valuable insights into performance metrics, enabling ongoing assessment of organizational health through real-time analytics, which is vital for insolvency outcome optimization.

Concentrating on these approaches can lead to substantial enhancements in operational performance, crucial for effectively managing financial distress. For example, businesses that have conducted operational audits during insolvency scenarios have reported average cost savings of up to 20%, highlighting the tangible benefits of insolvency outcome optimization initiatives. Key performance indicators like Overall Equipment Effectiveness (OEE), throughput, and productivity per person hour can further demonstrate the effect of these approaches.

Moreover, as Robert Waterman remarked, 'A plan is essential because the future is uncertain,' emphasizing the significance of strategic planning in operational efficiency. Case studies highlight how interim management, such as the insights provided by experienced interim COOs, can drive meaningful change by aligning company actions with strategic goals, ultimately enhancing overall business performance. It is essential to remember that operational efficiency is a continuous improvement strategy that requires ongoing assessment to maintain excellence.

Utilize Interim Management for Effective Leadership

To effectively utilize interim management during financial distress, consider the following guidelines:

- Identify Leadership Gaps: Conduct a thorough assessment of current leadership capabilities to pinpoint areas where interim management can provide essential support.

- Select the Right Interim Manager: Choose an interim manager with a strong background in turnaround situations and a proven success record within your specific industry.

- Define Clear Objectives: Establish specific, measurable goals for the interim manager, such as enhancing cash flow, minimizing costs, or stabilizing operations.

- Facilitate Communication: Ensure that the interim manager maintains open lines of communication with existing staff and stakeholders, fostering a collaborative environment.

- Monitor Progress: Regularly assess the interim manager's performance against the established objectives for insolvency outcome optimization to ensure alignment with recovery goals.

Incorporating efficient decision-making processes and real-time analytics is vital for organizations navigating financial distress. By utilizing tools that offer real-time business analytics, organizations can consistently assess their performance and modify approaches as necessary. Given the forecasted 30% average annual increase in insolvencies from 2022 to 2024, effective interim management is crucial for insolvency outcome optimization. Organizations that adopt these approaches often report enhanced success rates in revitalization efforts, emphasizing the significance of insolvency outcome optimization by choosing the appropriate leadership during difficult periods. Furthermore, recognizing the significant role of leadership in organizational outcomes reinforces the necessity of choosing an interim manager who can effectively guide the team through turbulent periods. Staying informed about the latest research and statistics is essential for CFOs to make well-informed decisions in these critical situations.

Monitor and Adjust Strategies for Long-Term Success

To efficiently observe and modify approaches during the restoration process, consider the following steps:

- Establish Key Performance Indicators (KPIs): Identify KPIs that directly support recovery objectives, including cash flow targets, expense reduction metrics, and revenue growth rates. These indicators serve as benchmarks for measuring progress and success. As highlighted in a recent study, implementing Recovery Management Checkups can significantly enhance the cost-effectiveness of monitoring these KPIs.

- Regularly Review Financial Performance: Implement a routine of monthly or quarterly reviews of financial statements and KPIs. This practice enables prompt evaluations of progress and supports essential modifications to approaches based on performance data. Utilizing real-time analytics, as demonstrated in our client dashboard, can provide insights into revenue trends and reimbursement patterns, aiding in these reviews.

- Solicit Feedback: Actively gather insights from employees, stakeholders, and interim managers. Their viewpoints can uncover essential areas for enhancement and assist in fine-tuning approaches to better align with operational realities. For instance, defining optimal reorder points based on sales data can prevent overstocking or stock shortages that disrupt operations.

- Be Prepared to Pivot: Stay agile in your approach. If specific methods fail to produce the anticipated results, be prepared to adjust and investigate different strategies. Adaptability is essential for managing the intricacies of restoration, and our group facilitates a streamlined decision-making cycle during this process to enable your team to take assertive action.

- Document Lessons Learned: Keep a thorough account of approaches that were successful and those that were not. This documentation will be invaluable for guiding future decision-making and enhancing restoration strategies. By applying the insights gained from the turnaround process, businesses can establish robust, enduring connections that strengthen their efforts for resurgence. By embracing a proactive approach to overseeing and modifying strategies, businesses can greatly enhance their chances for insolvency outcome optimization and sustainable growth in the wake of insolvency. The importance of KPIs in this process cannot be overstated, as they provide a clear framework for evaluating performance and guiding recovery efforts.

Conclusion

Insolvency outcome optimization stands as a vital strategy for businesses navigating financial distress. By focusing on preserving going concern value, engaging stakeholders, and leveraging legal frameworks, organizations can create pathways for recovery that not only benefit creditors but also ensure the long-term viability of the business. Moreover, the integration of real-time analytics further enhances this process, allowing for timely adjustments to strategies and improved decision-making.

Conducting a comprehensive financial assessment is critical in understanding the full scope of a business's financial health. By gathering historical data, analyzing key ratios, and evaluating cash flows, companies can identify both challenges and opportunities for improvement. This foundational knowledge is essential for informed decision-making and effective recovery planning.

Implementing operational efficiency strategies is equally important. Businesses can streamline processes, reduce overhead costs, and enhance employee training to drive productivity and performance. The role of interim management cannot be overlooked, as effective leadership can guide organizations through turbulent times, ensuring that strategies align with recovery goals.

Finally, a commitment to monitoring and adjusting strategies is crucial for long-term success. Establishing key performance indicators and regularly reviewing financial performance allows businesses to remain agile and responsive to changing circumstances. By documenting lessons learned and soliciting feedback from stakeholders, organizations can refine their approaches and build resilience for the future.

In summary, mastering insolvency outcome optimization equips businesses with the tools necessary to turn challenges into opportunities. By focusing on strategic engagement, operational efficiency, and continuous improvement, companies can navigate the complexities of insolvency and emerge stronger on the other side.

Frequently Asked Questions

What is insolvency outcome optimization?

Insolvency outcome optimization is a strategic approach aimed at improving the results of insolvency processes by maximizing creditor returns while maintaining the viability of the entity.

What are the key elements of insolvency outcome optimization?

The key elements include preserving going concern value, stakeholder engagement, understanding legal frameworks, and utilizing real-time analytics.

How does preserving going concern value benefit creditors?

By maintaining operations, this approach maximizes asset value and recovery potential, which ultimately benefits creditors and positions the organization for future growth.

Why is stakeholder engagement important in the insolvency process?

Early involvement of creditors, employees, and other stakeholders fosters collaboration and transparency, leading to more favorable outcomes during the insolvency process.

What role do legal frameworks play in insolvency outcome optimization?

A thorough understanding of local bankruptcy regulations allows companies to navigate the complexities of the process and leverage legal provisions that can enhance recovery efforts.

How does real-time analytics contribute to insolvency outcome optimization?

Real-time analytics enable continuous monitoring of performance and health, allowing for timely adjustments to strategies, which is critical during financial distress.

What recent trends have been observed in corporate insolvencies?

There has been a shift towards more proactive stakeholder engagement, with a reported decrease in corporate failures in the UK, suggesting that enhanced strategies are yielding better results.

What steps should be taken to conduct a comprehensive financial assessment?

The essential steps include gathering financial statements, analyzing key ratios, identifying trends, evaluating cash flow, and assessing liabilities.

Why is cash flow analysis important in financial assessments?

Understanding the timing of cash inflows and outflows helps identify potential shortfalls that could impact the organization’s ability to meet its obligations.

How does assessing liabilities contribute to financial stability?

Reviewing outstanding debts and obligations provides a comprehensive understanding of total liabilities, which is essential for evaluating the company’s financial stability.

What is the significance of a thorough financial evaluation in the current economic environment?

A thorough financial evaluation is crucial for informed decision-making, particularly as companies face growing complexities in their financial environments.