Overview

The title "7 Essential Strategies for Distressed Business Continuity Plans" directly addresses the critical question of which strategies are vital for crafting effective business continuity plans in challenging situations. This article delineates seven fundamental strategies, such as:

- Conducting comprehensive financial assessments

- Establishing clear communication plans

- Leveraging technology

Each strategy is designed to bolster resilience and operational effectiveness during crises, thereby equipping organizations to navigate challenges and sustain stability.

Introduction

In the competitive landscape of small and medium businesses, the ability to navigate distress and emerge stronger is crucial. Comprehensive turnaround consulting offers a lifeline, providing tailored strategies that address core issues, optimize operations, and restore financial health.

As organizations face unprecedented challenges, understanding the importance of:

- Thorough financial assessments

- Clear communication plans

- Effective stakeholder engagement

becomes paramount. Moreover, by leveraging interim management and innovative technologies, businesses can stabilize operations and enhance resilience.

This article delves into the multifaceted approach of turnaround consulting, highlighting essential steps and expert insights that empower companies to not only survive but thrive in the face of adversity.

Transform Your Small/ Medium Business: Comprehensive Turnaround Consulting for Distressed Companies

Comprehensive turnaround consulting is crucial for small and medium enterprises facing distress. These services are designed to identify key problems, implement strategic modifications, and enhance operations, ultimately revitalizing economic stability.

Transform Your Small/Medium Enterprise offers extensive turnaround and restructuring consulting, interim management services, and thorough financial evaluations to assist organizations in saving money, streamlining operations, and reducing liabilities.

Collaborating with a turnaround advisor provides customized approaches for distinct organizational challenges, resulting in improved performance and sustainability. For instance, a consultant may conduct a thorough review of operations to assess cash flow issues, suggesting targeted cost-reduction actions or innovative revenue-boosting strategies. This proactive approach not only aids companies in navigating difficult periods but also prepares them for long-term success.

Current trends indicate that companies with distressed business continuity plans are better equipped to manage risks and enhance economic outcomes through comprehensive recovery strategies. Notably, 8% of consultants in the turnaround consulting field possess over a decade of experience, highlighting the depth of expertise available to assist with distressed business continuity plans.

Furthermore, sectors such as healthcare and social assistance demonstrate resilience, illustrating how adaptability in turnaround efforts can lead to successful results. By focusing on efficiency and entrepreneurial strategies, as emphasized by specialists Carter and Schwab, companies can significantly enhance their operational effectiveness and sustain economic stability, even amid inflationary challenges.

To maximize the benefits of turnaround consulting, CFOs should consider specific actions such as:

- Conducting a thorough evaluation of their existing operations

- Engaging seasoned consultants who can provide tailored solutions for their unique challenges

Conduct Thorough Financial Assessments: Preserve Cash and Reduce Liabilities

Conducting thorough monetary assessments is essential for any successful turnaround strategy. This process involves a meticulous examination of monetary statements, cash flow projections, and operational expenses to pinpoint inefficiencies and identify potential savings. Statistics indicate that small enterprises conducting comprehensive fiscal evaluations can achieve average cost reductions of up to 20%, significantly enhancing their cash flow. By conserving cash and reducing obligations, companies can establish a buffer against unforeseen challenges.

For instance, a detailed review may reveal excessive overhead costs that can be eliminated, thereby freeing up vital cash for essential operations. Moreover, renegotiating terms with creditors can alleviate urgent monetary pressures, enabling the company to stabilize and focus on recovery. As Luca Maestri, CFO of Apple, emphasizes, "Today, we conduct significantly more internal development of certain essential technologies than we did a few years back," highlighting the strategic investment in evaluations as a crucial element of organizational resilience.

Expert opinions underscore that comprehensive evaluations are not merely advantageous but essential in 2025, as they empower CFOs to act as corporate strategists, enhancing company valuation and stakeholder confidence. Maureen O'Connell's insights from the case study 'CFO as Corporate Strategist' further illustrate the evolving role of CFOs in adapting to changing market climates.

Real-world examples, such as a small enterprise that successfully maintained cash through a thorough fiscal evaluation by eliminating unnecessary costs, demonstrate the transformative potential of these evaluations in challenging situations. To implement comprehensive monetary evaluations in your organization, consider forming a dedicated team to regularly review fiscal reports and operational expenses, ensuring your enterprise remains agile and prepared for any challenges ahead.

Furthermore, by applying turnaround lessons and utilizing real-time analytics, organizations can streamline decision-making processes, further enhancing their recovery strategies. Transform Your Small/Medium Business offers customized evaluation services designed to assist businesses in identifying inefficiencies and improving cash flow. Our competitive pricing guarantees that you receive maximum value from your investment in financial health.

Implement Clear Communication Plans: Maintain Stakeholder Confidence During Distress

Establishing clear communication plans is vital for sustaining stakeholder confidence during challenging times, particularly when dealing with distressed business continuity plans. A clearly outlined communication plan ensures that all stakeholders—employees, investors, suppliers, and customers—are informed about the company's status and the measures being implemented to address issues related to distressed business continuity plans.

Regular updates are crucial; they not only prevent misinformation but also foster trust. For instance, companies can conduct weekly briefings to share progress and challenges, reinforcing transparency and commitment to recovery. This proactive communication approach significantly strengthens stakeholder relationships and garners support during periods of distress related to distressed business continuity plans.

In fact, 83% of high-performance organizations prioritize ongoing project management training, underscoring the essential role of effective communication methods in crisis management. Conversely, only 34% of underperformers offer similar training, highlighting a significant gap that can impact stakeholder trust.

Additionally, since 50% of a company's value often derives from just 15-20 key roles, focusing communication efforts on these stakeholders is essential for distressed business continuity plans during times of distress. As one specialist observed, "Every team member is dedicated to productive stakeholder interaction and aims to transform projects from simple tasks into significant efforts by maintaining open dialogue, listening closely, and adjusting approaches as required."

Moreover, by implementing lessons learned from the turnaround process and employing digital tools for stakeholder engagement, organizations can enhance their communication strategies, enabling them to better comprehend and fulfill stakeholder needs. By concentrating on clear, consistent communication and utilizing real-time analytics, organizations can bolster stakeholder confidence and navigate challenges more effectively.

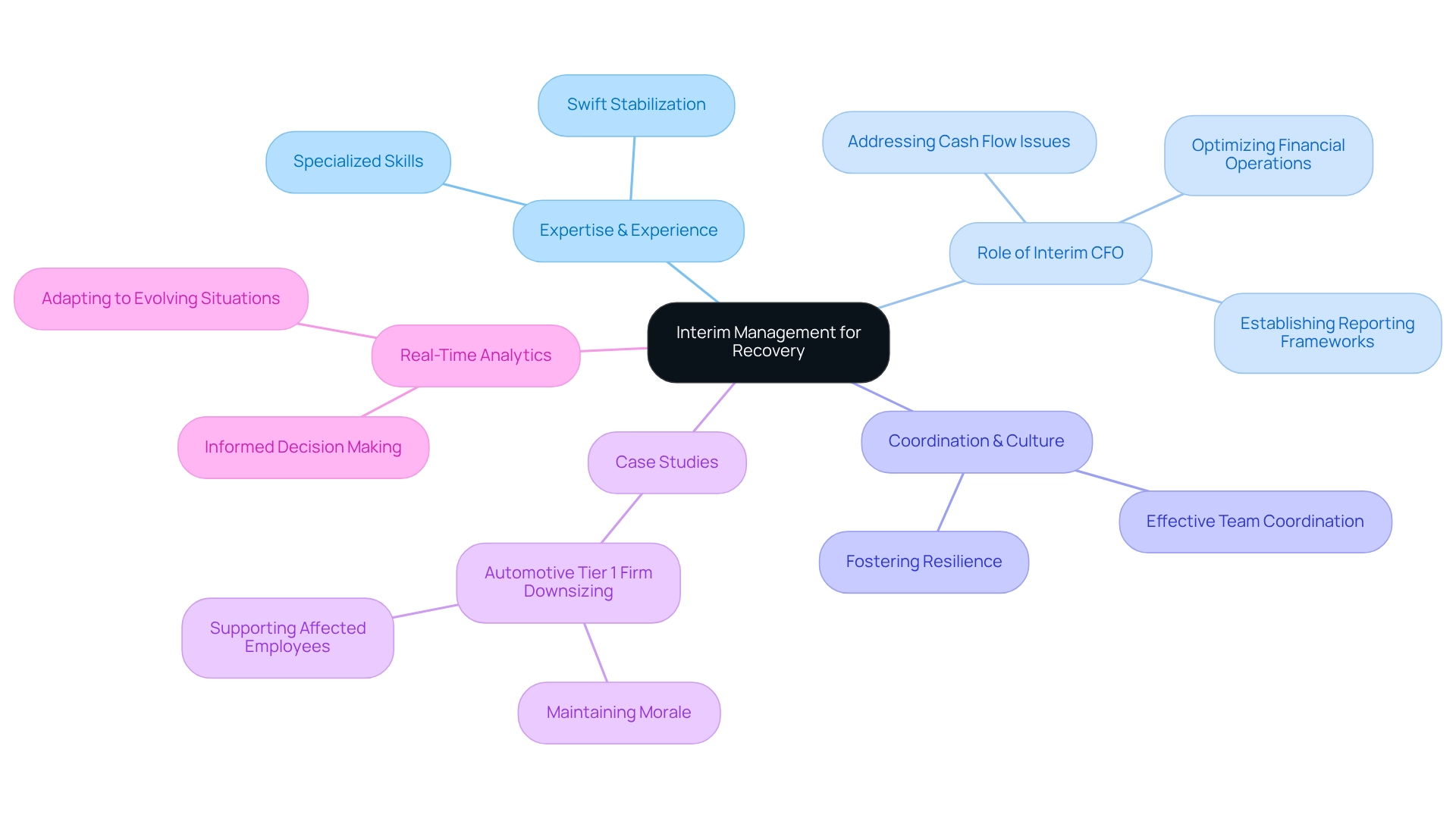

Utilize Interim Management: Stabilize Operations and Drive Quick Recovery

Leveraging interim management serves as a strategic approach for addressing distressed business continuity plans, as these professionals bring specialized expertise and experience to swiftly stabilize operations. Interim managers excel at assessing current challenges, implementing necessary changes, and guiding organizations through recovery. For instance, an interim CFO can promptly address cash flow issues, optimize financial operations, and establish robust reporting frameworks. Their fresh perspectives often yield innovative solutions that permanent employees might overlook, enabling companies to adjust effectively during turbulent times.

As Walt Disney once remarked, 'Of all the things I’ve done, the most vital is coordinating those who work with me and aiming their efforts at a certain goal.' This sentiment resonates profoundly in the context of interim management, where effective coordination is essential for recovery. The success of interim management is underscored by case studies, such as the automotive Tier 1 supplier that successfully navigated downsizing with the assistance of an interim manager, who maintained high morale and productivity throughout the transition. This highlights the critical role interim executives play in not only addressing urgent issues but also in fostering a culture of resilience and adaptability within entities facing distressed business continuity plans.

Moreover, the focus on testing hypotheses and utilizing real-time analytics empowers interim managers to make informed decisions swiftly, ensuring that organizations can adapt effectively to evolving situations. The confusion within the interim market presents challenges in quickly identifying the best candidate for specific issues, emphasizing that the results delivered by interim managers are what truly matter. Ultimately, these professionals assist companies in achieving sustainable growth through comprehensive services, reinforcing the overarching aim of interim management in the context of corporate recovery.

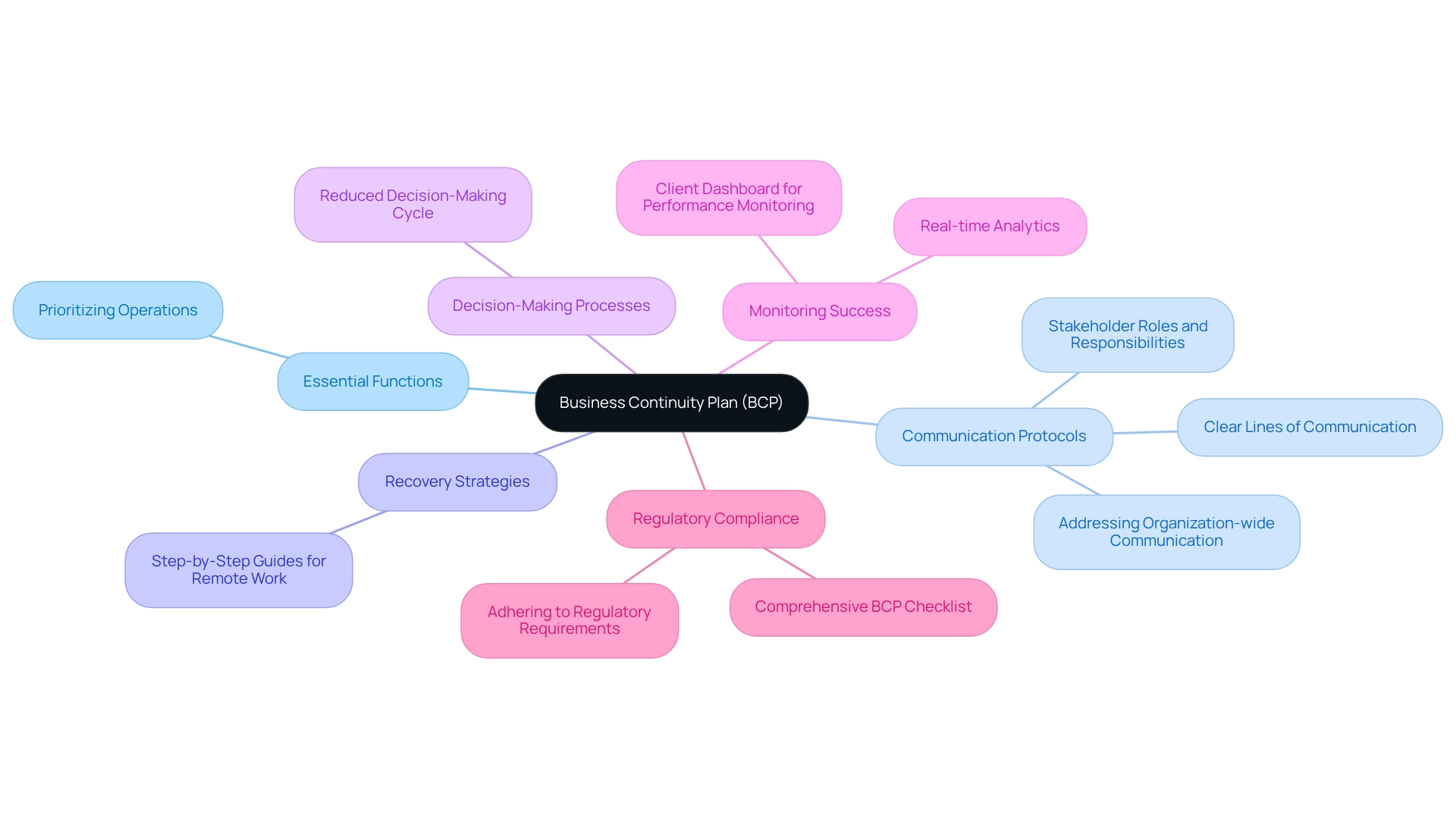

Develop a Structured Business Continuity Plan: Guide Your Organization Through Crisis

A structured continuity plan (BCP) is essential for guiding entities through crises, as it helps in managing distressed business continuity plans to ensure that vital operations can be sustained during disruptions such as natural disasters, cyberattacks, or financial downturns.

- Identification of Essential Functions is crucial; it involves clearly defining which operations are vital for the organization’s survival and prioritizing them in the plan.

- Communication Protocols must be established to ensure clear lines of communication, keeping all stakeholders informed during a crisis. This ensures that everyone understands their roles and responsibilities. A key lesson learned from recent studies indicates that plans often do not adequately address organization-wide communication and collaboration, underscoring the need for robust protocols.

- Recovery Strategies should include detailed procedures for restoring operations, featuring step-by-step guides for remote work to maintain productivity regardless of external challenges.

Incorporating streamlined decision-making processes can significantly enhance the effectiveness of a BCP. Our team endorses a reduced decision-making cycle during the turnaround process, enabling your company to take decisive action to maintain operational integrity. Furthermore, we continually monitor the success of our plans through a client dashboard that provides real-time business analytics, enabling continuous performance monitoring and timely adjustments.

For instance, a retail business might implement a BCP that includes alternative supply chain strategies to mitigate disruptions. Regular reviews and updates of the distressed business continuity plans are essential to adapt to evolving risks and ensure their ongoing effectiveness. Statistics suggest that entities with distressed business continuity plans are significantly more resilient during crises, emphasizing the importance of proactive planning in protecting operational integrity and reputation.

As Dwight Eisenhower once said, "Leadership is the art of getting someone else to do something you want done because he wants to do it," highlighting the importance of effective planning and execution in crisis situations. Additionally, monetary services organizations must comply with various regulatory requirements related to business continuity, as illustrated by a case study on regulatory compliance in BCP. Ensuring that the BCP meets all necessary criteria helps avoid legal and economic penalties, thereby protecting the institution's reputation and operational integrity. A comprehensive BCP checklist is vital for monetary institutions to be well-prepared for disruptions.

Conduct Risk Assessments: Identify and Mitigate Potential Threats to Continuity

Performing risk evaluations is crucial for recognizing and reducing potential threats to distressed business continuity plans. This proactive approach involves a thorough evaluation of both internal and external risks, including distressed business continuity plans, operational inefficiencies, market fluctuations, and cybersecurity threats. For instance, if a risk assessment uncovers vulnerabilities in a company's IT infrastructure, implementing enhanced cybersecurity measures becomes a critical response. Frequent risk evaluations not only assist companies in remaining alert but also equip them for unexpected obstacles, ultimately protecting their operations and ensuring their distressed business continuity plans are effective for economic well-being.

In 2025, the trend indicates that small to mid-sized businesses, often with limited resources, are particularly vulnerable, underscoring the importance of distressed business continuity plans for these assessments. Statistics indicate that the average expenditure on post-incident activities can reach up to $179,209 for containment and $125,221 for remediation, underscoring the financial impact of inadequate risk management. By implementing effective risk management approaches, such as:

- Avoidance

- Reduction

- Sharing

- Retention

troubled companies can greatly enhance their resilience and recovery capabilities, especially in the context of distressed business continuity plans.

Furthermore, our team supports a streamlined decision-making process throughout the turnaround, allowing for decisive actions based on real-time analytics. As Dale Shulmistra, co-founder of Invenio IT, highlights, "Technology plays a crucial role in addressing intricate organizational challenges, making it essential for companies to utilize it in their risk evaluations." Comprehending prevalent cyberattack methods, like man-in-the-middle assaults, emphasizes the importance of these evaluations in detecting weaknesses and strengthening defenses. Moreover, ongoing monitoring via client dashboards allows organizations to modify strategies based on real-time information.

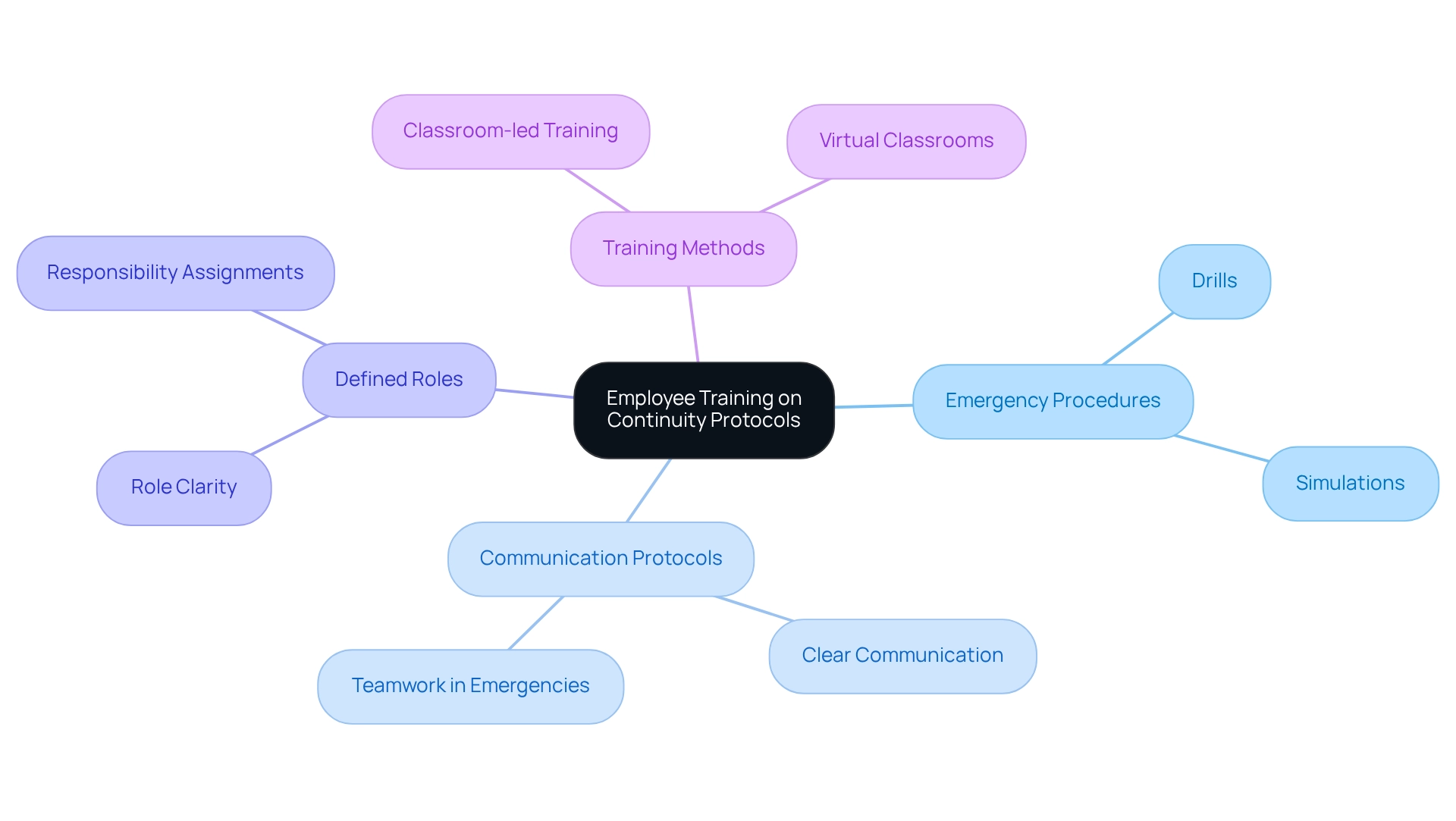

Train Employees on Continuity Protocols: Prepare Your Workforce for Crisis Response

Training employees on distressed business continuity plans is essential for ensuring a swift and effective response during crises. This training must encompass:

- Emergency procedures

- Communication protocols

- Clearly defined roles during disruptions

Regular drills and simulations reinforce these protocols, ensuring employees are well-acquainted with their responsibilities. For instance, conducting fire drills not only prepares staff for evacuation but also underscores the significance of clear communication and teamwork in emergencies. A well-prepared workforce can significantly minimize downtime and bolster organizational resilience.

Notably, statistics reveal that 1 in 5 small to medium enterprise executives lacks a recovery plan, emphasizing the urgent need for comprehensive training programs. Furthermore, a study indicates that:

- 39% of small enterprises utilize classroom-led training

- 17% employ virtual classrooms

This suggests a blend of traditional and modern training methods that can be optimized for improved employee engagement and learning outcomes. Organizations prioritizing crisis management education not only shield themselves from potential dangers but also cultivate a culture of resilience, ultimately enhancing their distressed business continuity plans.

As Beth Revis aptly stated, "Power isn’t control at all. Power is strength and giving that strength to others," highlighting the importance of empowering employees through effective training.

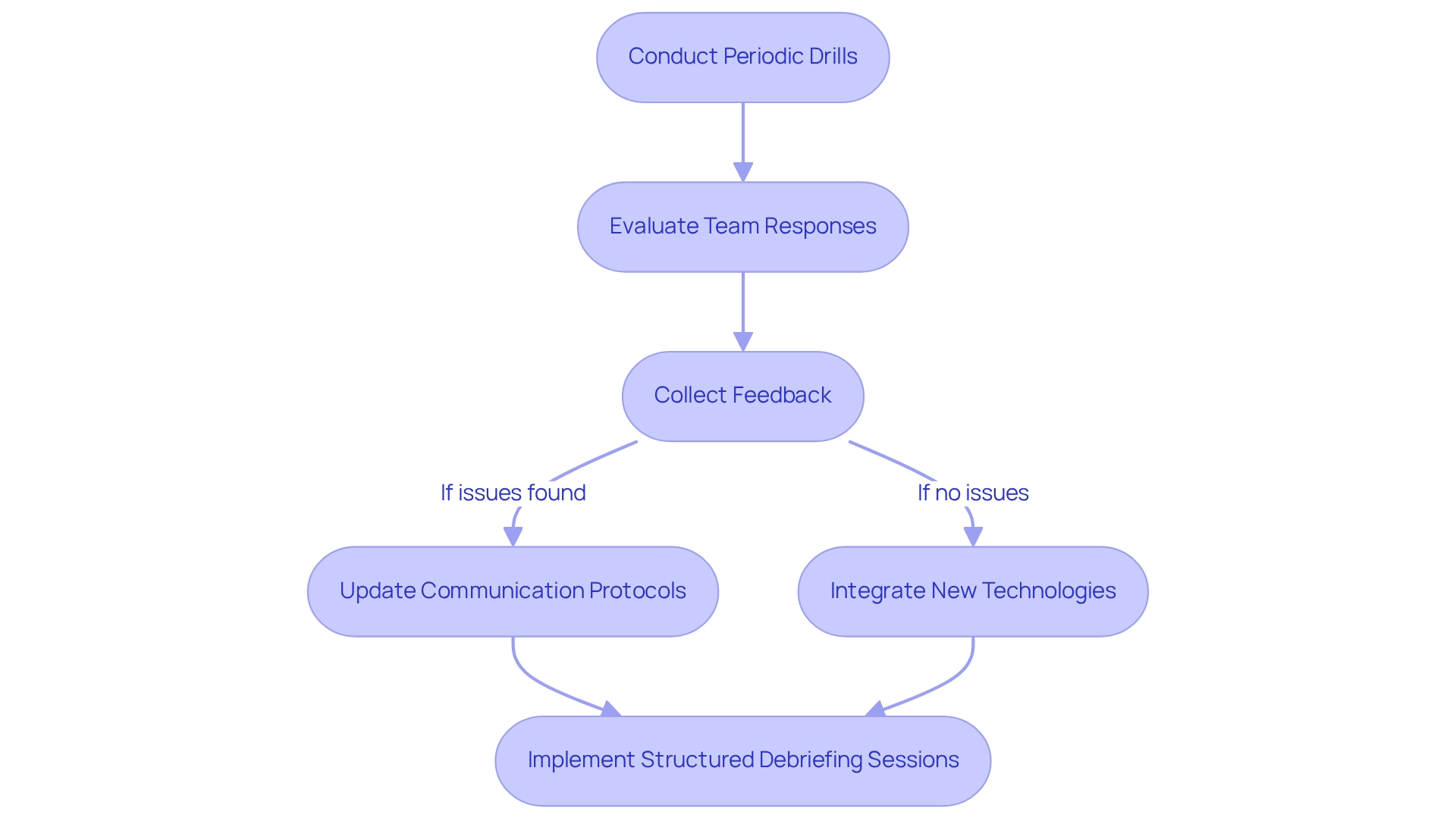

Test and Update Business Continuity Plans Regularly: Ensure Effectiveness and Relevance

Regular testing and updating of distressed business continuity plans (BCPs) is essential for maintaining their effectiveness and relevance in today's rapidly changing environment. Organizations should conduct periodic drills that simulate crisis scenarios, allowing teams to evaluate their responses under pressure. It is crucial to recognize that the effectiveness of a BCP is dependent on the people executing it; therefore, training and engagement are vital.

After each drill, collecting feedback is essential. For example, if a drill reveals communication issues, groups can enhance their communication protocols to boost clarity and efficiency. Statistics indicate that 75% of organizations have faced at least one IT downtime event in the past two years due to their distressed business continuity plans, highlighting the need for regular updates.

A comprehensive Business Continuity Plan Checklist is available for financial services, providing a practical resource for ensuring thorough preparation for disruptions. Integrating new technologies and approaches into distressed business continuity plans ensures they remain robust against evolving threats.

The case study titled 'The Evolving Threat Landscape' illustrates how entities must adapt their backup strategies to address modern threats, ensuring that data protection measures are capable of withstanding advanced cyberattacks. Moreover, regular updates informed by drill feedback not only improve the effectiveness of distressed business continuity plans but also foster a culture of readiness within the entity, ultimately leading to enhanced resilience and performance.

To effectively gather feedback after crisis drills, groups should implement structured debriefing sessions that encourage open dialogue and constructive criticism, ensuring that all insights are captured and utilized for future improvements. Furthermore, utilizing real-time analytics via a client dashboard can greatly enhance decision-making during the turnaround process, enabling entities to track their performance continuously and make informed modifications as required, thereby facilitating a reduced decision-making cycle.

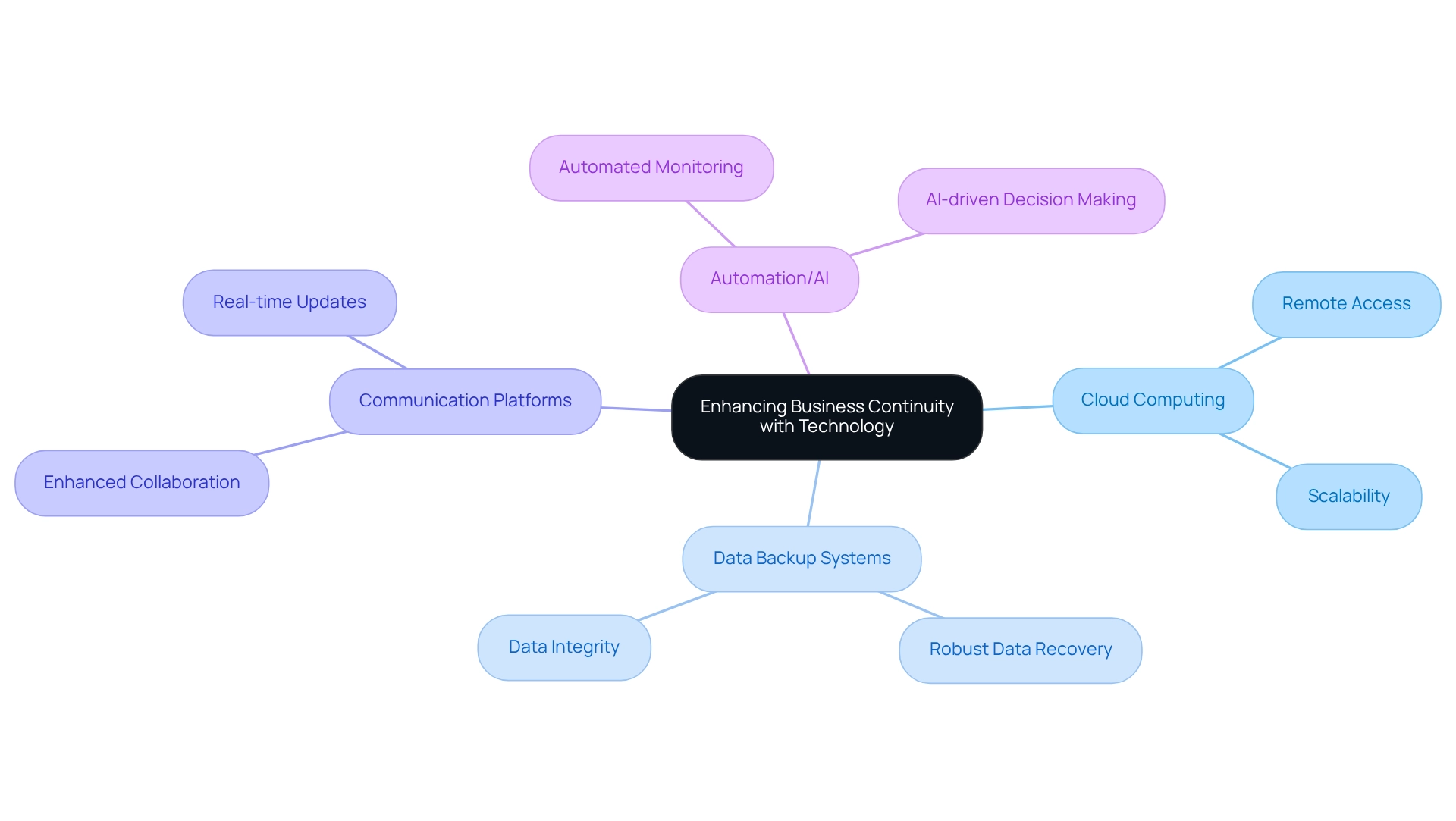

Leverage Technology: Enhance Business Continuity Efforts with Innovative Solutions

Harnessing technology is essential for strengthening distressed business continuity plans. Innovative solutions such as cloud computing, robust data backup systems, and advanced communication platforms play a pivotal role in enhancing operational resilience. For instance, cloud-based solutions facilitate remote access to essential data, empowering employees to sustain productivity from any location during disruptions. Moreover, the integration of automated monitoring and alert systems enables organizations to respond promptly to emerging threats.

By embedding technology into their continuity frameworks, organizations can optimize processes and significantly enhance their recovery capabilities in times of crisis. Notably, nearly half of surveyed companies are investing in automation and AI-driven solutions for disaster recovery, underscoring the trend towards tech-enabled resilience. The capacity to evaluate hypotheses and make swift choices is crucial during a turnaround process, allowing teams to take decisive action to maintain organizational health.

Ongoing observation via real-time analytics, enabled by our client dashboard, not only assists in diagnosing organizational performance but also nurtures strong relationships by implementing lessons learned. A troubling statistic reveals that 1 in 5 small to medium-sized enterprise leaders lack a recovery plan, emphasizing the urgent need for comprehensive approaches that utilize technology to ensure readiness and sustainability.

With almost 600,000 enterprises in the United States shutting down each year, the dangers of insufficient planning are evident. The lack of recovery plans among SMB leaders further emphasizes the critical need for companies to create robust strategies that include distressed business continuity plans and reliable BC/DR technologies.

Engage Stakeholders: Foster Collaboration for Effective Business Continuity Planning

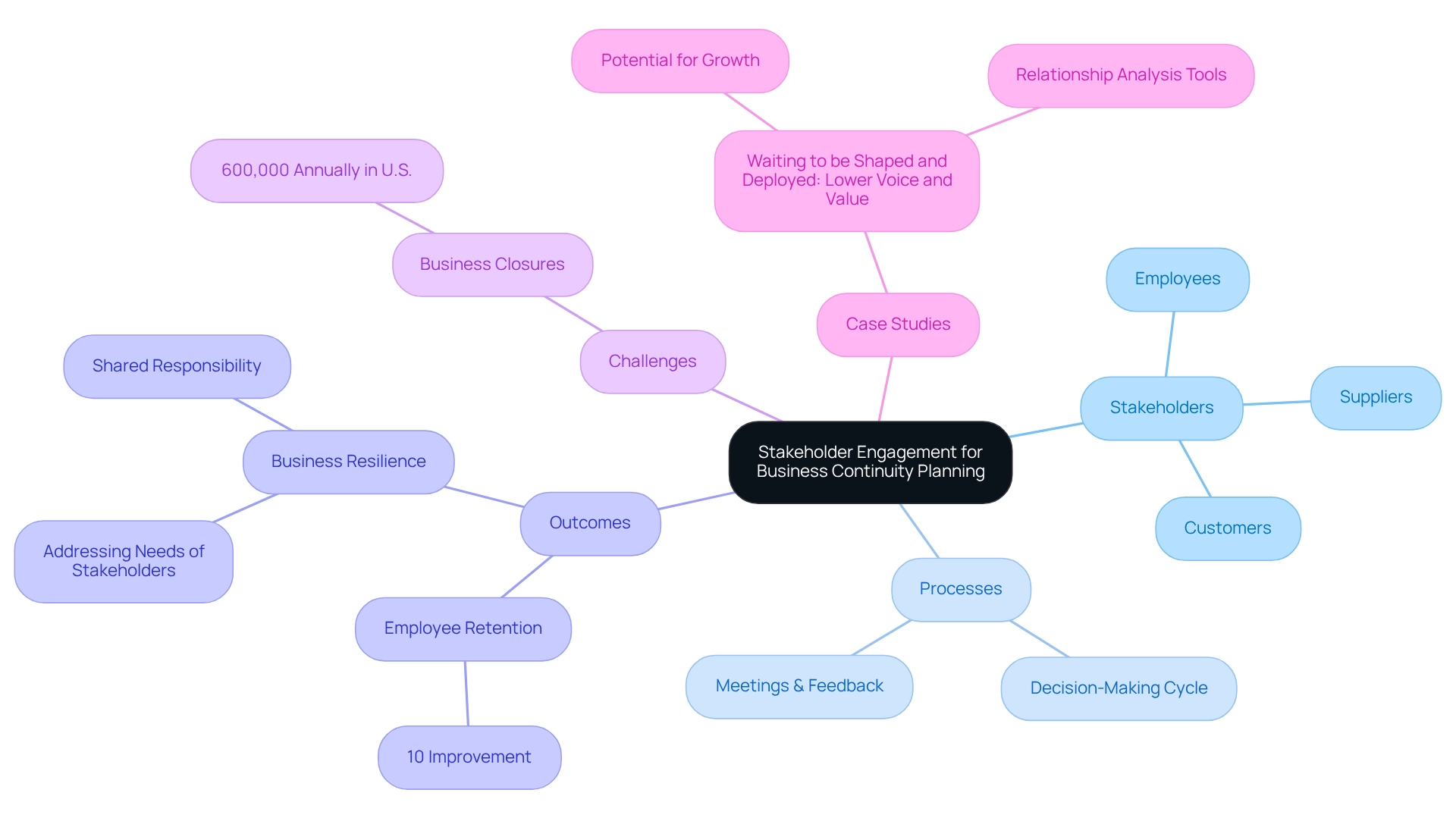

Involving stakeholders is crucial for developing distressed business continuity plans that are effective. Engaging essential stakeholders—like employees, suppliers, and customers—ensures that a range of viewpoints are incorporated, leading to more resilient distressed business continuity plans.

Our team supports a shortened decision-making cycle throughout the turnaround process, empowering your team to take decisive action to preserve your business. Regular meetings and feedback sessions facilitate collaboration, enhancing buy-in from all parties involved.

For instance, establishing a stakeholder advisory group can provide valuable insights into continuity strategies, ensuring that the plan addresses the needs and concerns of all relevant parties. This collaborative approach not only strengthens the plan but also cultivates a sense of shared responsibility and commitment to organizational resilience.

Notably, organizations that prioritize stakeholder collaboration can see a significant impact. Studies indicate that such engagement can lead to a 10% improvement in employee retention in the tech sector, which is crucial during challenging times. Moreover, almost 600,000 enterprises in the U.S. shut down each year due to various factors, which underscores the importance of having distressed business continuity plans.

By encouraging cooperation among stakeholders and leveraging real-time analytics through our client dashboard, organizations can create distressed business continuity plans that are both thorough and flexible to adapt to changing challenges.

As Wilian, CEO of Bonsai Technologies Inc., states, 'Bonsai streamlines operations in our thriving team of 32+ people. Its blend of simplicity and data-driven insights are invaluable as we scale and grow.'

Additionally, the case study 'Waiting to be Shaped and Deployed: Lower Voice and Value' illustrates how stakeholder involvement can foster growth through significant projects, reinforcing the argument for collaboration in developing distressed business continuity plans.

Conclusion

Navigating the complexities of distress in small and medium businesses mandates a comprehensive approach to turnaround consulting. By conducting thorough financial assessments, companies can pinpoint inefficiencies and preserve cash, establishing a robust foundation for recovery. Clear communication plans are vital for maintaining stakeholder confidence, fostering transparency and trust during challenging times. Engaging interim management delivers the expertise necessary for swift stabilization, while structured business continuity plans steer organizations through crises, ensuring that critical operations remain intact.

Moreover, regular testing and updates of these plans, alongside proactive risk assessments, are crucial for identifying and mitigating potential threats. Training employees on continuity protocols empowers them to respond effectively during emergencies, minimizing downtime and reinforcing resilience. Leveraging technology enhances these efforts, rendering operations more agile and responsive to disruptions. Finally, involving stakeholders in the planning process cultivates collaboration, ensuring that diverse perspectives contribute to robust strategies.

Overall, adopting a multifaceted turnaround consulting strategy not only aids in immediate recovery but also positions businesses for long-term sustainability and growth. By concentrating on these critical areas, organizations can transform adversity into opportunity, emerging stronger and more resilient in the face of future challenges.

Frequently Asked Questions

What is the purpose of comprehensive turnaround consulting for small and medium enterprises?

Comprehensive turnaround consulting aims to identify key problems, implement strategic modifications, and enhance operations to revitalize economic stability for small and medium enterprises facing distress.

What services does Transform Your Small/Medium Enterprise offer?

Transform Your Small/Medium Enterprise offers turnaround and restructuring consulting, interim management services, and thorough financial evaluations to help organizations save money, streamline operations, and reduce liabilities.

How can a turnaround advisor assist a business?

A turnaround advisor provides customized approaches to distinct organizational challenges, conducts thorough reviews of operations to assess cash flow issues, and suggests targeted cost-reduction actions or innovative revenue-boosting strategies.

What are the benefits of having distressed business continuity plans?

Companies with distressed business continuity plans are better equipped to manage risks and enhance economic outcomes through comprehensive recovery strategies.

What is the significance of conducting monetary assessments in a turnaround strategy?

Conducting thorough monetary assessments helps pinpoint inefficiencies, identify potential savings, and can lead to average cost reductions of up to 20%, significantly enhancing cash flow and establishing a buffer against unforeseen challenges.

What actions should CFOs take to maximize the benefits of turnaround consulting?

CFOs should conduct a thorough evaluation of their existing operations and engage seasoned consultants who can provide tailored solutions for their unique challenges.

How does clear communication impact stakeholder confidence during distress?

Establishing clear communication plans ensures all stakeholders are informed about the company's status and recovery measures, fostering trust and preventing misinformation.

What role does ongoing project management training play in crisis management?

Ongoing project management training is prioritized by 83% of high-performance organizations, highlighting its essential role in effective communication methods during crisis management.

Why is it important to focus communication efforts on key stakeholders?

Since 50% of a company's value often derives from just 15-20 key roles, focusing communication efforts on these stakeholders is essential for maintaining stakeholder confidence during times of distress.

How can organizations enhance their communication strategies during a turnaround?

Organizations can enhance their communication strategies by implementing lessons learned from the turnaround process, employing digital tools for stakeholder engagement, and utilizing real-time analytics to better comprehend and fulfill stakeholder needs.