Overview

This article provides an authoritative overview of best practices for cost reduction strategies in procurement, underscoring the critical roles of:

- Strategic sourcing

- Technology integration

- Supplier relationship management for CFOs

By detailing various cost categories and presenting actionable strategies, it illustrates how financial leaders can optimize procurement processes. This optimization not only enhances efficiency but also achieves significant savings, ultimately bolstering their organizations' financial health.

Introduction

In the intricate landscape of modern business, procurement costs have emerged as a pivotal concern for CFOs aiming to enhance profitability and operational efficiency. These costs encompass a wide array of expenses, ranging from direct purchases to indirect overheads, making it essential to understand their nuances for effective financial management.

With the rise of online shopping and logistical challenges affecting delivery times, CFOs must adopt a meticulous approach to analyze procurement expenditures and identify opportunities for optimization.

Moreover, as organizations increasingly turn to strategic sourcing and technology-driven solutions, the role of the CFO in navigating these changes becomes even more crucial.

By leveraging data analytics and fostering strong supplier relationships, businesses can not only streamline their procurement processes but also drive significant cost savings that contribute to long-term financial health.

Understanding Procurement Costs: A CFO's Perspective

Procurement expenses represent the total outlays associated with acquiring the goods and services essential for business operations. These expenses can be categorized into direct outlays, such as the purchase price of materials, and indirect expenditures, which include administrative fees related to sourcing processes. For financial officers, a comprehensive understanding of these expenses is crucial in formulating efficient strategies to optimize spending and enhance profitability.

Recent trends indicate that purchasing expenses have gained heightened significance, with the average delivery period from supplier to customer increasing by 20% since 2020, primarily due to the surge in online shopping and shipping delays. This shift underscores the necessity for CFOs to conduct a thorough analysis of purchasing expenses to identify inefficiencies and uncover potential savings. Furthermore, the number of container vessels awaiting to offload cargo at the Port of Los Angeles has recently reached a record-high of 73 ships, nearly double compared to the previous month, highlighting the ongoing logistical challenges that can impact sourcing expenses.

As companies navigate these challenges, successful case studies on cost reduction strategies in procurement demonstrate that organizations can achieve substantial improvements in financial health by strategically managing their purchasing processes. Transform Your Small/Medium Business will identify underlying business issues and collaborate to create a plan to mitigate weaknesses, enabling businesses to reinvest in key strengths. For instance, sectors with varying success rates, such as healthcare, which boasts a 60% first-year survival rate, emphasize the importance of informed decision-making in purchasing strategies.

Indeed, Gartner reveals that Chief Supply Chain Officers (CSCOs) plan to allocate 73% of their supply chain IT budgets to growth and performance enhancements in 2023, illustrating a strong focus on refining purchasing methodologies.

Looking ahead to 2025, it is projected that AI technologies will contribute an impressive $5 trillion in economic value, further emphasizing the imperative for financial executives to leverage technology in their purchasing practices. By viewing purchasing expenses as a component of revenue and utilizing expert insights, financial leaders can effectively optimize these expenditures, ensuring their organizations remain competitive and financially robust. Our approach to data is pragmatic; we rigorously test every hypothesis to deliver maximum return on invested capital in both the short and long term.

Types of Procurement Costs: Key Categories to Monitor

CFOs must closely oversee several essential categories of purchasing expenses to effectively implement savings strategies:

- Direct Costs: These expenses are directly associated with the acquisition of goods and services, including raw materials and inventory. Effective management of direct expenses is essential for maintaining production efficiency and profitability. Direct purchasing processes are typically organized and synchronized with production timelines, ensuring that these expenses are handled efficiently.

- Indirect Costs: These encompass overhead expenses related to purchasing activities, such as salaries for purchasing staff and office supplies. A substantial share of indirect expenses frequently remains unaddressed; research shows that two-thirds of companies do not efficiently monitor up to 40% of their indirect acquisitions, emphasizing an important area for enhancement. Tackling issues like rogue expenditures and excessive purchase orders can assist financial executives in achieving improved oversight of these expenses.

- Fixed Expenses: These expenses remain constant regardless of the volume of goods acquired, such as lease payments for storage facilities. Comprehending fixed expenses aids financial executives in assessing their long-term monetary obligations and enhancing resource distribution.

- Variable Expenses: These expenses vary depending on the volume of purchases, including shipping fees and bulk discounts. Tracking fluctuating expenses enables financial leaders to take advantage of savings prospects as buying quantities shift.

- Sunk Costs: These are expenses that have already been incurred and cannot be recovered. While invested expenses should not determine future procurement choices, they must be recognized in the decision-making process to prevent misallocation of resources.

By classifying these expenditures, CFOs can gain clearer insights into their procurement landscape, enabling them to identify areas for cost reduction strategies in procurement and effectively streamline operations. For instance, developing cost reduction strategies in procurement through a strategic sourcing plan based on spend analysis can unlock significant savings while ensuring alignment with business objectives. This proactive method not only improves financial management but also encourages the implementation of cost reduction strategies in procurement.

In fact, the chief controller of each money room at Bayer was expected to reduce expenses by 20% compared to historical figures, illustrating the significance of effective financial management in achieving monetary goals.

Moreover, utilizing real-time analytics can enable ongoing oversight of these expense categories, allowing financial executives to make informed choices rapidly and apply insights gained from previous experiences. This strategic focus on data-driven decision-making can significantly enhance the turnaround process and overall business performance.

Strategic Sourcing: A Pathway to Cost Efficiency

Strategic sourcing represents a comprehensive approach to purchasing that prioritizes long-term supplier partnerships and value generation over mere short-term savings. For financial leaders seeking to enhance procurement efficiency and realize savings, implementing cost reduction strategies through strategic sourcing can be transformative. Consider the following key strategies:

- Conducting Market Research: Gaining insights into market trends and supplier capabilities is crucial for negotiating favorable terms. This proactive strategy enables CFOs to identify opportunities for savings and innovation, aligning with the necessity for continuous performance monitoring.

- Supplier Consolidation: By streamlining the number of suppliers, organizations can leverage their purchasing power to negotiate volume discounts. Current trends indicate that 40% of firms have faced higher sourcing expenses, making cost reduction strategies like supplier consolidation essential for mitigating financial impacts while simplifying decision-making processes.

- Collaborative Negotiations: Engaging in negotiations that emphasize mutual benefits can enhance value for both the organization and its suppliers. This approach not only strengthens relationships but also fosters innovation and quality improvements, operationalizing lessons learned from previous negotiations.

- Proactive Risk Management: Preventing disruptions through proactive risk management is vital for maintaining supply chain stability. This strategy helps avoid costly delays and interruptions, ensuring that purchasing processes remain efficient even in challenging circumstances, supported by real-time analytics from our client dashboard.

The evolution of strategic sourcing from cost reduction strategies to value maximization is evident in recent industry developments. As Lamia Yasmin asserts, "This alignment is essential for companies looking to enhance their competitiveness in increasingly complex and dynamic markets." Successful implementations of strategic sourcing have demonstrated significant efficiency savings and operational enhancements through cost reduction strategies.

For instance, a study on strategic purchasing practices in Export Processing Zones in Kenya revealed that adopting these practices resulted in improved operational efficiency and product quality, underscoring the importance of strategic sourcing in achieving overall economic performance.

By embracing these optimal strategies, CFOs can not only reduce expenses but also position their organizations for sustainable growth and resilience in an increasingly intricate market landscape. This approach aligns with Transform Your Small/Medium Business's expertise in guiding companies through crises and achieving success via efficient sourcing methods, utilizing real-time analytics to monitor performance and adjust strategies as necessary, while consistently challenging assumptions to ensure optimal decision-making.

Leveraging Technology: Automation and Data Analytics in Procurement

Integrating technology into purchasing processes can significantly enhance efficiency and implement cost reduction strategies in procurement. CFOs should prioritize the following strategies:

- Automation: Implementing procurement software to automate repetitive tasks such as purchase orders and invoice processing can free up valuable staff time for more strategic initiatives. In 2025, 31% of organizations plan to focus on workflow automation, underscoring its importance in achieving operational excellence. However, financial executives should be aware that a study by Gartner revealed that 70% of digital transformations fail to reach their goals, often due to the complexity of implementation and integration.

- Data Analytics: Utilizing advanced analytics tools allows CFOs to gain critical insights into spending patterns, supplier performance, and potential cost-saving opportunities. This data-driven approach not only facilitates informed decision-making but also enables proactive cost management. Significantly, organizations that utilize data analytics in purchasing decision-making have reported enhanced efficiency and effectiveness in their operations. Furthermore, ongoing observation via real-time analytics can assist in diagnosing business health and modifying strategies quickly, ensuring that purchasing processes stay aligned with overall business goals.

- E-Procurement Solutions: Embracing e-procurement platforms simplifies the purchasing process by enabling online transactions, speeding up approvals, and improving visibility into buying activities. This change not only lowers purchasing expenses but also lessens risks linked to manual processes. Currently, 82% of organizations still rely on Excel for managing business processes, which poses significant operational risks. Moreover, a case study named 'Ethical Considerations in AI Acquisition' emphasizes the significance of transparency and fairness in AI systems, as a public sector organization encountered criticism for neglecting small, minority-owned enterprises in its AI-driven acquisition process.

By strategically utilizing these technologies, including real-time analytics for ongoing performance monitoring, financial executives can enhance purchasing operations through cost reduction strategies in procurement, resulting in significant cost savings and better overall performance.

Supplier Relationship Management: Building Partnerships for Savings

Effective supplier relationship management (SRM) is essential for driving cost reduction strategies in procurement and enhancing overall supply chain efficiency. Financial leaders at Transform Your Small/Medium Business can greatly enhance SRM by applying the following approaches:

- Establishing Clear Communication: Open lines of communication with suppliers are vital for fostering trust and collaboration. This transparency not only strengthens relationships but also facilitates quicker resolution of issues, leading to improved operational efficiency. CPOs should exhibit customer-of-choice behaviors and create open feedback loops to reinforce these relationships.

- Regular Performance Reviews: Conducting periodic assessments of supplier performance is crucial. These evaluations guarantee that providers consistently fulfill quality and pricing expectations, enabling financial executives to make informed choices regarding supplier retention and negotiation approaches. By leveraging real-time business analytics through our client dashboard, financial executives can continually monitor supplier performance and adjust strategies as needed, ensuring alignment with overall business goals. Reevaluating value assessment is also essential for obtaining support for resources designated for strategic supplier partnerships.

- Joint Problem Solving: Working together with suppliers to address challenges can reveal new possibilities for savings. By participating in collaborative problem-solving efforts, companies can utilize supplier knowledge and experience, resulting in creative solutions that advantage both sides.

Focusing on cost reduction strategies in procurement allows financial executives to negotiate improved terms, lower expenses, and develop a more robust supply chain. In fact, statistics indicate that 20% of organizations view emerging technologies in supply chain management as critical investments, underscoring the importance of integrating technology into SRM practices. The trend of leveraging technology for supplier collaboration has gained traction since the late 2000s, with companies like IKEA successfully utilizing supplier collaboration platforms to streamline communication and enhance transparency.

This demonstrates the tangible benefits of effective SRM. As Costas Xyloyiannis, CEO of HICX, noted, the future of supplier experience will require out-of-the-box thinking to create net efficiency gains. By implementing cost reduction strategies in procurement, financial leaders can not only attain prompt reductions in expenses but also establish a foundation for sustainable growth and enhanced supplier relationships over time.

Practical Cost Reduction Strategies: Tips for Immediate Implementation

Chief Financial Officers can implement various effective cost reduction strategies to improve their purchasing processes and generate prompt savings:

- Conducting Spend Analysis: Regularly examining purchasing data is essential for pinpointing areas of overspending and revealing potential savings. A comprehensive spend overview dashboard from Transform Your Small/ Medium Business can categorize data by organization, supplier, and spend type, allowing financial leaders to identify inefficiencies and optimize expenditures. Spend analysis not only streamlines procurement processes but also plays a crucial role in implementing cost reduction strategies in procurement, thereby enhancing financial efficiency and establishing itself as a vital tool for organizations. Moreover, integrating real-time analytics into this process allows for continuous monitoring of business health, enabling CFOs to make informed decisions swiftly. This proactive engagement with suppliers to renegotiate contracts for better pricing and terms as contract renewals approach not only reduces expenses but also fosters stronger supplier relationships, which can be advantageous over time. Employing real-time information can enhance negotiation tactics by providing insights into market trends and supplier performance.

Implementing cost reduction strategies in procurement is essential for establishing robust policies to monitor and manage purchasing expenditures. By ensuring compliance with budgetary constraints, organizations can utilize these strategies to prevent unnecessary expenditures and maintain financial discipline. Ongoing performance assessment via analytics can assist in recognizing discrepancies from planned expenditures in real-time, enabling swift corrective measures.

- Promoting Cross-Department Cooperation: Cooperation among departments can significantly improve purchasing efficiency. By aligning purchasing requirements and consolidating acquisitions, organizations can leverage their buying power to negotiate improved agreements and lower expenses. Real-time analytics from Transform Your Small/ Medium Business can facilitate this collaboration by providing a shared view of purchasing data across departments, fostering transparency and teamwork.

These cost reduction strategies in procurement not only yield immediate savings but also establish a foundation for sustainable financial health. For example, a survey indicated that 60% of finance executives lack full visibility into their organizations' transactions, emphasizing the crucial need for transparency and cooperation between purchasing and finance departments. By addressing these visibility issues and utilizing real-time analytics, financial leaders can unlock further savings and enhance overall financial efficiency.

As noted by Sievo, a provider of purchasing analytics acknowledged by leading analysts, 'we provide solutions for Spend Analytics, Purchasing Performance Measurement, ESG Analytics, and Financial Planning and Analysis,' which can assist financial leaders in improving their spend management practices. Additionally, enhancing data verification remains a top priority for small organizations, further underscoring the importance of effective spend analysis in achieving financial success.

Sustaining Savings: Continuous Improvement in Procurement Practices

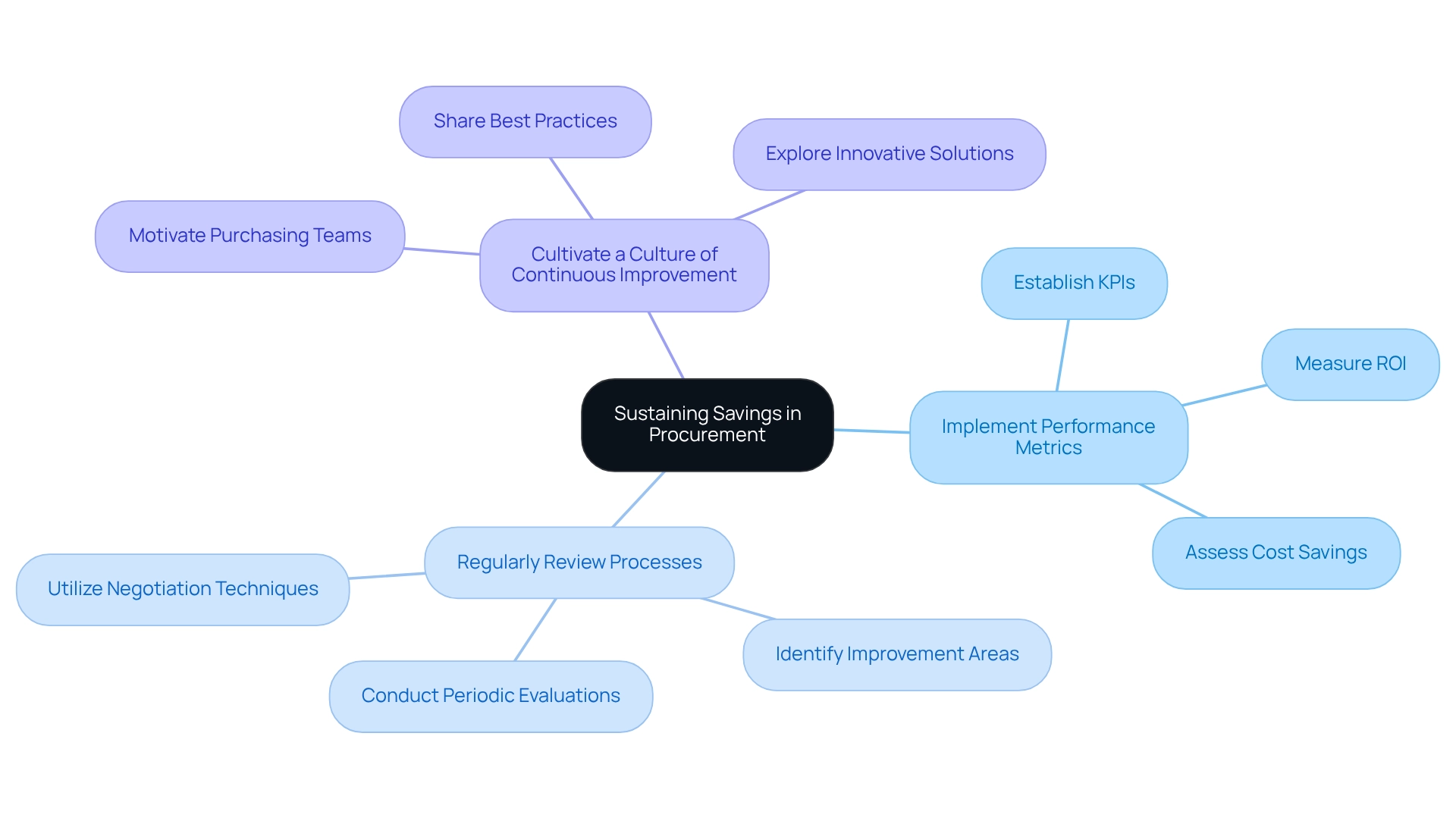

To maintain cost savings in purchasing, CFOs should take strategic actions that are both impactful and effective:

- Implement Performance Metrics: Establishing key performance indicators (KPIs) is crucial for measuring purchasing efficiency and tracking cost savings over time. Metrics such as return on investment (ROI) provide insights into the effectiveness of financial decisions, highlighting the balance between savings and expenses. A positive purchasing ROI indicates effective investments, while a negative ROI signals potential inefficiencies that require reassessment. By grasping this balance, CFOs can make informed choices that enhance purchasing strategies.

- Regularly Review Processes: Conducting periodic evaluations of purchasing practices is essential to identify areas for improvement and adapt to evolving market conditions. This proactive approach enables organizations to stay ahead of price hikes and utilize negotiation techniques to achieve cost avoidance, commonly referred to as 'soft savings.' By consistently assessing processes, companies can uncover opportunities for additional savings and operational efficiencies through cost reduction strategies in procurement, ultimately strengthening their financial standing.

- Cultivate a Culture of Continuous Improvement: Motivating purchasing teams to pursue innovative solutions and share best practices across the organization is vital for sustaining savings. By fostering a culture that prioritizes ongoing enhancement, financial leaders empower their teams to explore innovative approaches and technologies that elevate purchasing performance.

Indeed, to achieve the same operating margin increase from 16.67% to 21.67%, a firm must boost subscription revenue from $1,000,000 to $1,500,000—a 50% increase. This statistic underscores the potential financial impact of efficient purchasing strategies.

By committing to these practices, financial officers can ensure that cost reduction strategies in procurement not only preserve but also enhance cost savings over the long term, ultimately contributing to the organization's overall financial well-being and robustness.

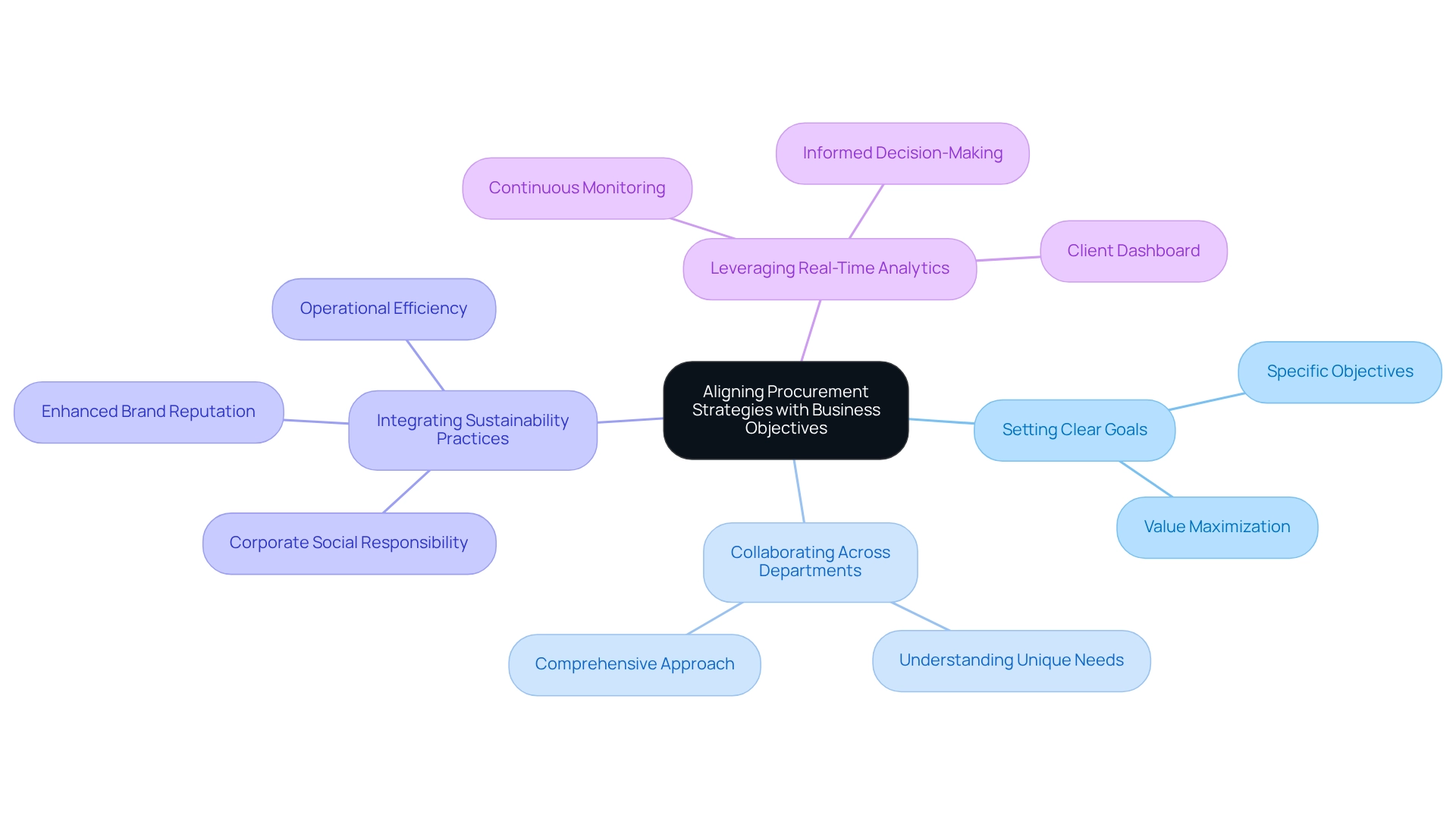

Aligning Procurement Strategies with Business Objectives: A Holistic Approach

Chief Financial Officers play an essential role in ensuring that purchasing strategies are closely aligned with overall business goals. This alignment can be achieved through several key practices:

-

Setting Clear Goals: Defining purchasing goals that not only support the organization's strategic vision but also align with its financial targets is crucial. By establishing specific, measurable objectives, CFOs can steer purchasing efforts toward maximizing value and efficiency.

-

Collaborating Across Departments: Engaging with various departments is vital for understanding their unique needs and how sourcing can effectively support them. Cross-department collaboration encourages a comprehensive approach, ensuring that purchasing strategies remain responsive and relevant to the entire organization.

-

Integrating Sustainability Practices: Incorporating sustainability into purchasing strategies is increasingly important. This not only aligns with corporate social responsibility objectives but also enhances brand reputation and can lead to significant savings. Organizations that embrace sustainable practices in sourcing often experience improved operational efficiency and heightened customer loyalty.

-

Leveraging Real-Time Analytics: Utilizing real-time analytics enables financial leaders to continuously monitor sourcing performance and make informed decisions promptly. By creating a client dashboard that offers real-time business analytics, organizations can assess their purchasing health and modify approaches as necessary, ensuring that expense reduction efforts are efficient and aligned with business goals. This corresponds with the 'Test & Measure' method, underscoring the importance of assessing performance to foster enhancements.

Aligning purchasing strategies with business goals empowers CFOs to create greater value and ensures that cost reduction strategies in procurement support the organization's sustained success. Recent discoveries indicate that 57% of firms have reported enhanced decision-making due to risk insights from advanced technologies, emphasizing the importance of incorporating data analytics and automation in purchasing processes. Furthermore, with the acquisition workload expected to rise by 8% in 2024, leading to productivity and efficiency gaps, proactive alignment and strategic planning will be crucial for effectively addressing these challenges.

Companies are anticipated to invest in purchasing automation and data analytics solutions to bridge these gaps and enhance operational efficiency. As Stefan Gergely noted, '57% of surveyed procurement professionals reported significant improvements in risk management based on insights from various technologies, such as automated workflows, advanced analytics, and machine learning/AI.

Conclusion

Understanding and managing procurement costs is essential for CFOs aiming to enhance profitability and operational efficiency in today’s complex business environment. This article underscores the critical importance of analyzing both direct and indirect costs, as a significant portion of indirect costs often remains unmanaged. By categorizing these costs, CFOs can effectively identify inefficiencies and implement robust strategies for optimization.

The discussion on strategic sourcing emphasizes the value of cultivating long-term supplier relationships alongside the necessity for proactive risk management. By leveraging technology—such as automation and data analytics—organizations can streamline procurement processes, enhance decision-making, and drive substantial cost savings. Furthermore, effective supplier relationship management fosters collaboration and innovation, leading to improved operational efficiency.

To sustain these savings, CFOs must commit to continuous improvement through regular reviews and the establishment of performance metrics. Aligning procurement strategies with broader business objectives, including sustainability practices, will not only enhance financial health but also support the organization's strategic vision.

In conclusion, a multifaceted approach that integrates cost analysis, strategic sourcing, technology, and supplier collaboration will empower CFOs to optimize procurement costs effectively. This proactive stance is crucial for navigating the challenges of modern business and ensuring long-term financial resilience. By embracing these practices, organizations can unlock significant savings and achieve sustainable growth in an increasingly competitive landscape.

Frequently Asked Questions

What are procurement expenses?

Procurement expenses represent the total outlays associated with acquiring the goods and services essential for business operations. They can be categorized into direct outlays, such as the purchase price of materials, and indirect expenditures, which include administrative fees related to sourcing processes.

Why is it important for financial officers to understand procurement expenses?

A comprehensive understanding of procurement expenses is crucial for financial officers as it helps them formulate efficient strategies to optimize spending and enhance profitability.

What recent trends have affected purchasing expenses?

Recent trends indicate that purchasing expenses have gained heightened significance, with the average delivery period from supplier to customer increasing by 20% since 2020 due to the surge in online shopping and shipping delays.

How do logistical challenges impact sourcing expenses?

Logistical challenges, such as the record-high number of container vessels awaiting to offload cargo at ports, can significantly impact sourcing expenses by causing delays and inefficiencies in the supply chain.

What strategies can organizations implement for cost reduction in procurement?

Successful case studies demonstrate that organizations can achieve substantial improvements in financial health by strategically managing their purchasing processes and implementing cost reduction strategies.

What categories of purchasing expenses must CFOs oversee?

CFOs must closely oversee several categories of purchasing expenses, including direct costs, indirect costs, fixed expenses, variable expenses, and sunk costs.

What are direct costs in procurement?

Direct costs are expenses directly associated with the acquisition of goods and services, such as raw materials and inventory, and are essential for maintaining production efficiency and profitability.

What are indirect costs in procurement?

Indirect costs encompass overhead expenses related to purchasing activities, such as salaries for purchasing staff and office supplies. Many companies do not efficiently monitor a significant portion of these expenses.

How do fixed and variable expenses differ?

Fixed expenses remain constant regardless of the volume of goods acquired, while variable expenses fluctuate depending on the volume of purchases, such as shipping fees and bulk discounts.

What are sunk costs, and how should they be treated in procurement decisions?

Sunk costs are expenses that have already been incurred and cannot be recovered. While they should not dictate future procurement choices, they must be recognized in the decision-making process to avoid misallocation of resources.

How can financial executives utilize real-time analytics in procurement?

Utilizing real-time analytics enables ongoing oversight of procurement expense categories, allowing financial executives to make informed choices rapidly and apply insights gained from previous experiences to enhance business performance.