Overview

The article focuses on best practices for distressed business solutions, emphasizing proven strategies for recovery that include recognizing early warning signs of financial trouble and implementing effective recovery strategies. It supports this by detailing methods such as financial restructuring, operational improvements, and the role of commercial finance brokers, which collectively enable organizations to stabilize their operations and position themselves for long-term growth despite economic challenges.

Introduction

Navigating the turbulent waters of business distress requires both keen insight and decisive action. As organizations face mounting challenges—from declining sales to liquidity crises—recognizing the early warning signs becomes paramount. The ability to identify these indicators not only helps in mitigating risks but also paves the way for strategic recovery.

This article delves into:

- Proven strategies for overcoming financial obstacles

- The pivotal role of commercial finance brokers in securing necessary funding

- The importance of effective cash flow management

By understanding the landscape of distressed assets and implementing robust operational improvements, businesses can not only stabilize their financial health but also position themselves for sustainable growth in an ever-evolving market.

Identifying Distress: Key Warning Signs and Causes

In the initial stages of financial trouble, several important warning signs may appear, including:

- Declining sales

- Increasing debt

- Negative liquidity

- Loss of key clients

Delays in paying salaries, taxes, or invoices are clear indicators of liquidity issues and suggest a company is trying to preserve liquidity. For instance, a restaurant facing a significant drop in foot traffic, coupled with rising food costs that exceed revenue growth, illustrates the impact of these distress signals.

A recent analysis highlighted that industries such as agriculture, forestry, fishing, and hunting demonstrate after 10 years at 49.5%, emphasizing the importance of recognizing these indicators early. Common causes of distress often stem from:

- Poor management practices

- Shifts in market dynamics

- Broader economic downturns

As Indermit Gill, a Nonresident Senior Fellow at Global Economy and Development, states, 'If the U.S. labor market merely remains as resilient as it has been since late 2020, U.S. growth could be half a percentage point stronger in 2023 and 0.7 point stronger in 2025.'

By recognizing these early warning signs, companies can take proactive measures, such as enlisting the expertise of a turnaround consultant to assess their economic health and implement distressed business solutions to devise a strategic recovery plan. This approach includes a 'Test & Measure' strategy, where hypotheses are rigorously tested to ensure maximum return on invested capital. Supported by real-time business analytics—such as monitoring cash flow metrics and customer acquisition costs—and a commitment to operationalizing lessons learned, this method not only mitigates risks but also positions the company to navigate challenges effectively.

Additionally, the commercial real estate sector's ongoing distress, evidenced by 187 Chapter 11 filings in 2024, serves as a stark reminder of the consequences of ignoring these signals.

Proven Strategies for Recovery: Financial Restructuring and Operational Improvements

Effective recovery mandates , which may encompass:

- Renegotiating existing debts

- Consolidating loans

- Attracting new investors

Our full-service turnaround and restructuring consulting, including interim management services and bankruptcy case management, provides distressed business solutions through tailored financial assessments. Operational improvements, such as streamlining processes and enhancing productivity, play a pivotal role in achieving these goals.

For instance, a retail chain could adopt advanced inventory management systems to minimize excess stock and significantly boost cash flow. The current landscape reveals that the demand for distressed business solutions is on the rise, particularly in sectors like health services, as many providers seek to address balance sheet vulnerabilities amid evolving regulatory environments. As reported by Golub Capital, companies can achieve notable year-over-year revenue and earnings growth—7.4% and 16.3% respectively in the early months of Q4’23—by embracing these strategic adjustments.

Furthermore, with 475,575 Chapter 7 filings and 7,095 Chapter 11 filings in 2018, the challenges in the restructuring landscape are clear. A pertinent example is the restructuring in health services, where there is considerable pent-up demand for transformation amid rigorous scrutiny of M&A activity by the FTC. With potential deregulation on the horizon, struggling providers may seek distressed business solutions to find new opportunities for addressing balance sheet weaknesses through transactions.

By implementing these strategies, organizations can not only stabilize their economic footing but also position themselves for sustainable, long-term growth.

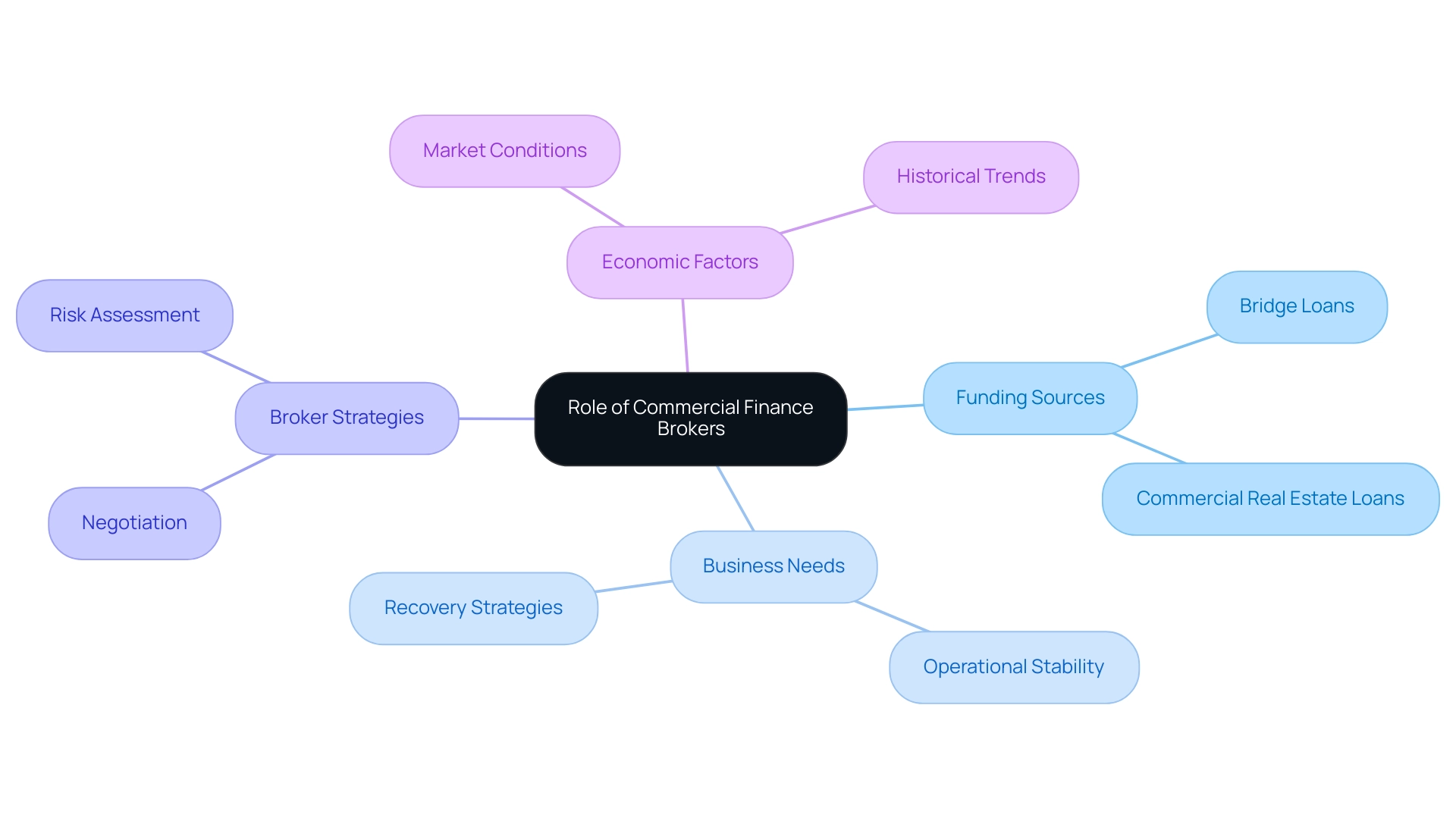

The Role of Commercial Finance Brokers in Distressed Business Solutions

Commercial finance brokers are essential allies in providing distressed business solutions, serving as vital connectors between companies and suitable funding sources. Their in-depth understanding of the financial landscape enables them to negotiate favorable terms with lenders, ensuring that companies can access the capital they need to navigate challenging times. As Randall Sakamoto, Partner at Rosen Consulting Group, notes, 'Nearly $400 billion of dry powder capital is available,' highlighting the opportunities for companies to secure necessary funding.

For instance, a restaurant facing operational difficulties might seek a bridge loan to cover immediate expenses while it restructures its operational model. By engaging a finance broker, this establishment can effectively secure the necessary funding to stabilize its operations, thereby allowing it to channel efforts into robust recovery strategies. Furthermore, the swift decision-making process facilitated by finance brokers guarantees that companies can act decisively, preserving their operations amidst challenges.

Moreover, with banks possessing nearly $1.8 trillion of , the economic climate is crucial for struggling enterprises. Industry insights suggest that brokers play an invaluable role in providing distressed business solutions, which can help distressed enterprises average significant funding during critical recovery phases. Ongoing observation of performance via real-time analytics enables organizations to assess their operational health effectively, applying insights gained from prior downturns.

Finance brokers also aid companies in testing hypotheses regarding their financial strategies, ensuring maximum return on invested capital. Additionally, the analysis of current risks in the CRE sector illustrates how historical parallels, such as the shift to remote work and potential obsolescence of office spaces, can impact loan defaults, further emphasizing the importance of finance brokers in navigating these challenges. By fostering strong relationships throughout the turnaround process, brokers enhance the support system available for distressed business solutions, ensuring a more comprehensive approach to recovery.

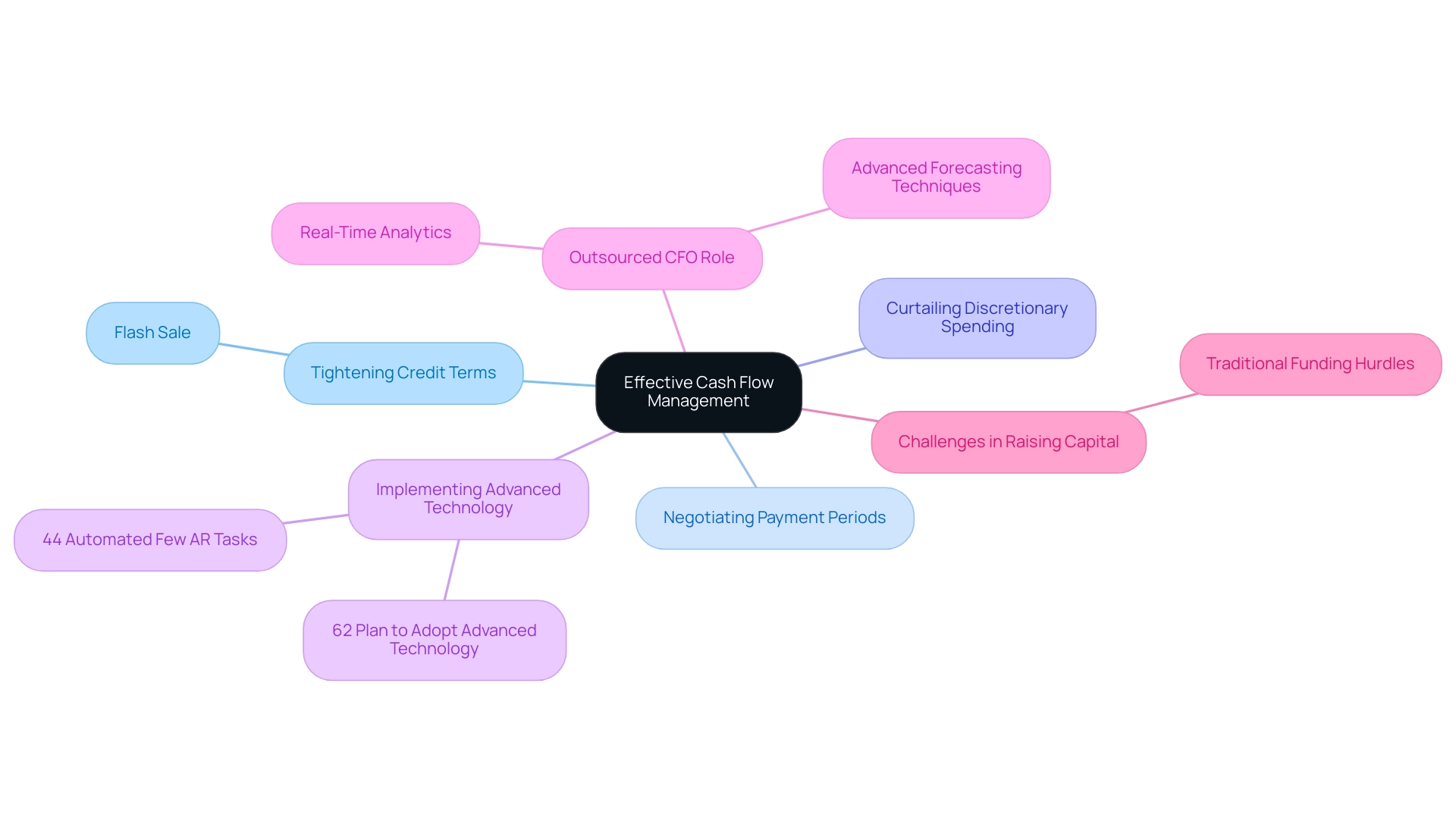

Effective Cash Flow Management: Strategies for Liquidity in Distress

is crucial for companies facing challenges, and implementing distressed business solutions can help mitigate the concerning statistic that 20% of small enterprises collapse within their initial year, often due to financial difficulties. To reduce risks, businesses should emphasize regular revenue forecasting, enabling them to foresee possible shortfalls and make informed decisions. An outsourced CFO can play an essential role in this process by utilizing advanced forecasting methods and real-time analytics to predict financial trends and develop contingency plans.

Implementing strategies such as:

- Tightening credit terms with customers

- Negotiating extended payment periods with suppliers

- Curtailing discretionary spending

can significantly enhance liquidity. For example, a retail company could conduct a flash sale to quickly transform inventory into funds, thus enhancing immediate liquidity. Additionally, nearly half (44%) of companies have automated only a few accounts receivable tasks, highlighting the challenges faced by those still relying on manual processes.

As companies adopt advanced accounts receivable technology—62% plan to do so in 2024—they can further streamline these processes, reducing reliance on manual methods that may lead to errors. Moreover, securing funding remains a significant challenge for entrepreneurs, complicating liquidity management even more. By actively managing cash flow and applying the lessons learned from past experiences, organizations can navigate monetary challenges more effectively and develop distressed business solutions to lay the groundwork for a successful recovery.

Moreover, the implementation of a client dashboard for continuous monitoring allows businesses to diagnose their health in real time, facilitating a shortened decision-making cycle that supports timely interventions and strategic adjustments. Building strong connections during this process is also essential to ensure cooperative efforts in overcoming economic challenges.

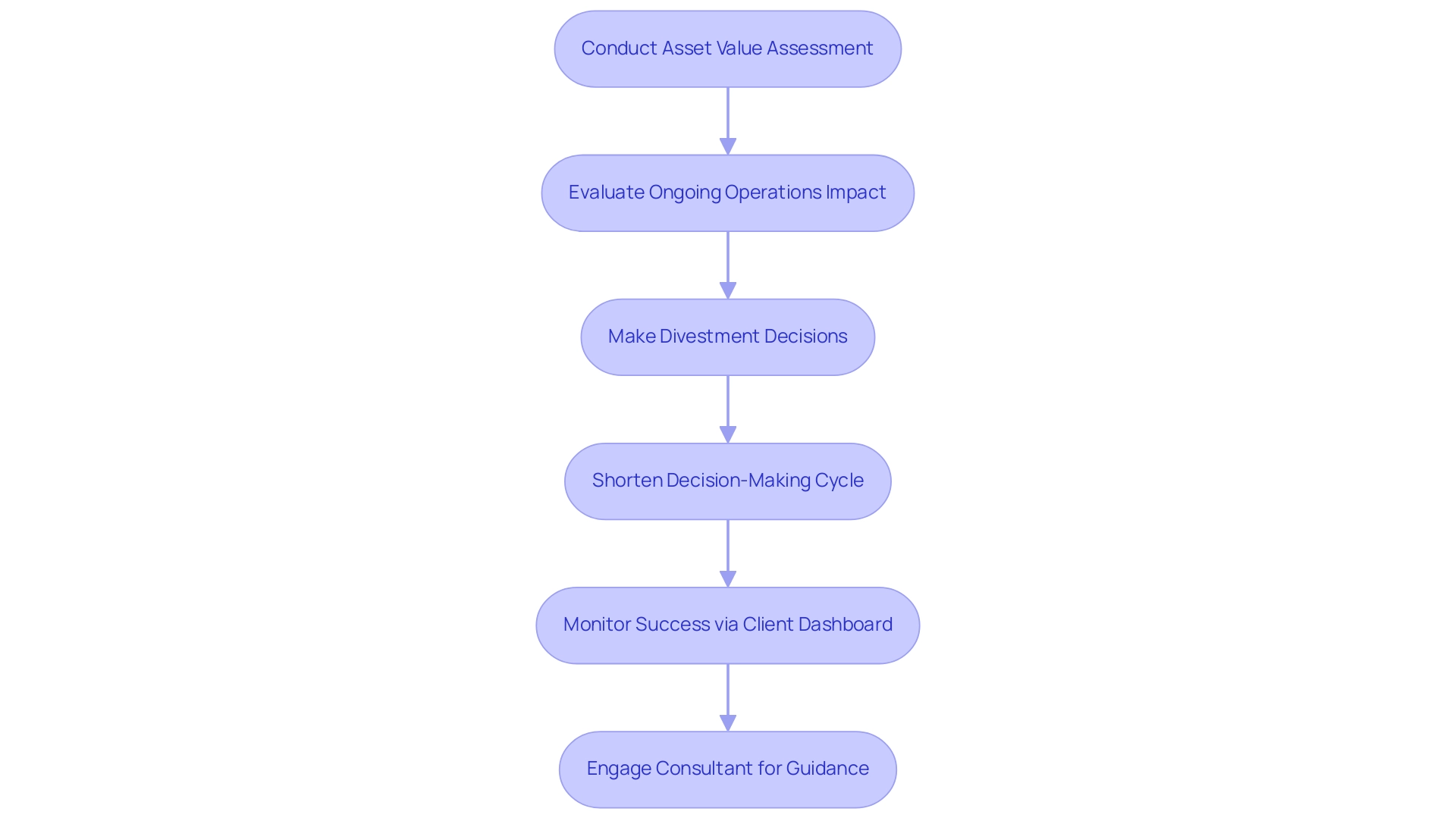

Selling Distressed Assets: Opportunities and Challenges

Selling is a strategic move that can yield immediate liquidity and alleviate financial pressures, especially in a challenging economic landscape. To maximize the effectiveness of this approach, it is crucial for organizations to conduct a thorough assessment of asset value while evaluating the potential impact on ongoing operations. For instance, a hospitality company may benefit from divesting underperforming properties to focus on core offerings, thereby streamlining operations and enhancing profitability.

While asset sales can generate short-term cash inflows, CFOs must carefully weigh the long-term implications, ensuring these decisions align with broader recovery strategies. Our team emphasizes a pragmatic approach, supporting a shortened decision-making cycle throughout the turnaround process to enable decisive action. We rigorously test every hypothesis related to asset sales and operational adjustments, measuring returns on investment to ensure maximum effectiveness.

Furthermore, we continually monitor the success of our strategies through our client dashboard, which provides real-time analytics, allowing us to update and adjust our approach as necessary. Engaging a consultant with expertise in distressed business solutions can provide invaluable guidance through this complex decision-making landscape, continuously leveraging real-time analytics to monitor organizational health. In the current economic environment, with high-yield bonds seeing losses of 2.2%, the urgency for strategic asset management is underscored.

Monitoring Treasury market liquidity is essential, as highlighted by Michael J. Fleming, head of Capital Markets Studies at the Federal Reserve Bank of New York. Additionally, the case study 'Opportunities in Private Credit' illustrates how this environment presents opportunities for private credit to provide rescue-financing capital, enabling fundamentally sound businesses to manage cash obligations and pursue growth initiatives effectively.

Conclusion

Recognizing and addressing business distress is not just a reactive measure; it is a crucial strategy for long-term success. Identifying warning signs early, such as declining sales and liquidity issues, empowers organizations to take proactive steps towards recovery. Engaging turnaround consultants and implementing a structured 'Test & Measure' approach can significantly enhance a company’s resilience and adaptability in challenging times.

Moreover, financial restructuring and operational improvements are essential components of a successful recovery strategy. By renegotiating debts, consolidating loans, and streamlining processes, businesses can stabilize their financial footing and position themselves for sustainable growth. The role of commercial finance brokers cannot be overstated, as they provide critical connections to funding sources that enable organizations to navigate their financial hurdles effectively.

Effective cash flow management stands as a cornerstone in these efforts, allowing businesses to forecast potential shortfalls and make informed decisions. By leveraging advanced analytics and optimizing accounts receivable processes, organizations can enhance liquidity and improve their overall financial health.

Ultimately, the journey through business distress is fraught with challenges, but it also presents opportunities for transformation. By embracing strategic asset management and engaging expert consultants, businesses can not only overcome immediate obstacles but also lay the groundwork for a more robust and successful future. Taking decisive action today is paramount for any organization aiming to thrive in an ever-evolving market landscape.

Frequently Asked Questions

What are the early warning signs of financial trouble in a company?

Early warning signs of financial trouble include declining sales, increasing debt, negative liquidity, and loss of key clients.

What indicators suggest a company is facing liquidity issues?

Delays in paying salaries, taxes, or invoices are clear indicators of liquidity issues, suggesting the company is trying to preserve its liquidity.

What are common causes of financial distress in businesses?

Common causes of financial distress often stem from poor management practices, shifts in market dynamics, and broader economic downturns.

How can companies proactively address early warning signs of financial trouble?

Companies can take proactive measures by enlisting the expertise of a turnaround consultant to assess their economic health and implement distressed business solutions, including developing a strategic recovery plan.

What is the 'Test & Measure' strategy mentioned in the article?

The 'Test & Measure' strategy involves rigorously testing hypotheses to ensure maximum return on invested capital, supported by real-time business analytics such as monitoring cash flow metrics and customer acquisition costs.

What does effective recovery require from a financial restructuring perspective?

Effective recovery requires a comprehensive monetary restructuring process, which may include renegotiating existing debts, consolidating loans, and attracting new investors.

How can operational improvements aid in financial recovery?

Operational improvements, such as streamlining processes and enhancing productivity, play a pivotal role in achieving financial recovery goals, for example, by adopting advanced inventory management systems to boost cash flow.

What is the current demand for distressed business solutions?

The demand for distressed business solutions is on the rise, particularly in sectors like health services, where providers seek to address balance sheet vulnerabilities amid evolving regulatory environments.

What were the statistics regarding Chapter 7 and Chapter 11 filings in 2018?

In 2018, there were 475,575 Chapter 7 filings and 7,095 Chapter 11 filings, highlighting the challenges in the restructuring landscape.

How can organizations stabilize their economic footing and position for growth?

By implementing strategic adjustments and distressed business solutions, organizations can stabilize their economic footing and position themselves for sustainable, long-term growth.